Geben Sie eine Aktie oder eine Kryptowährung in der Suchleiste an, um eine Zusammenfassung zu erhalten

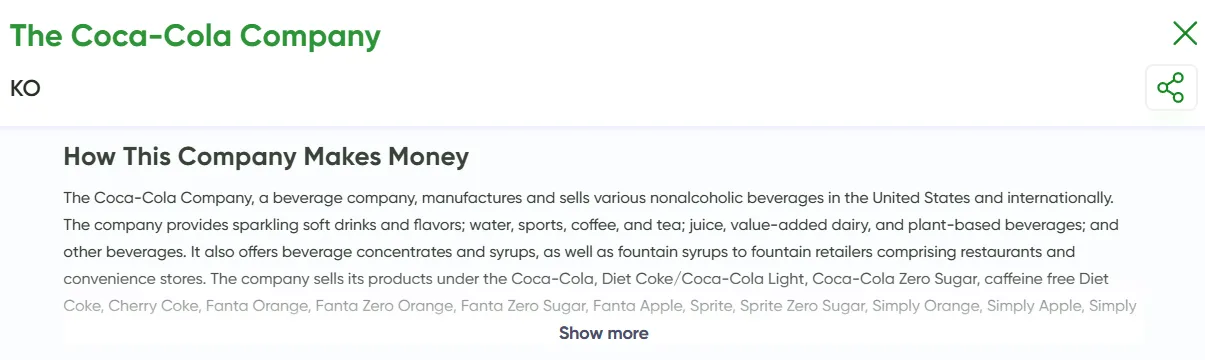

Wie dieses Unternehmen Geld verdient

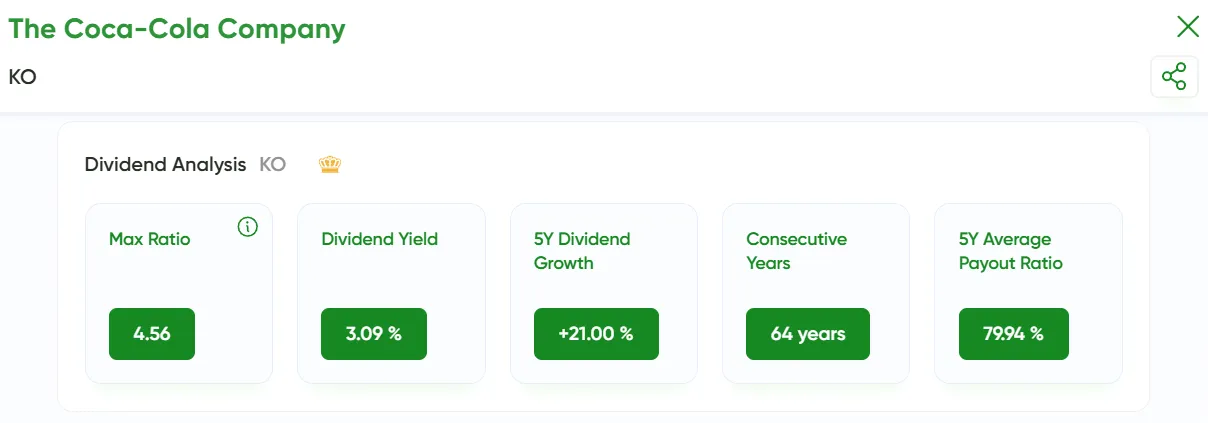

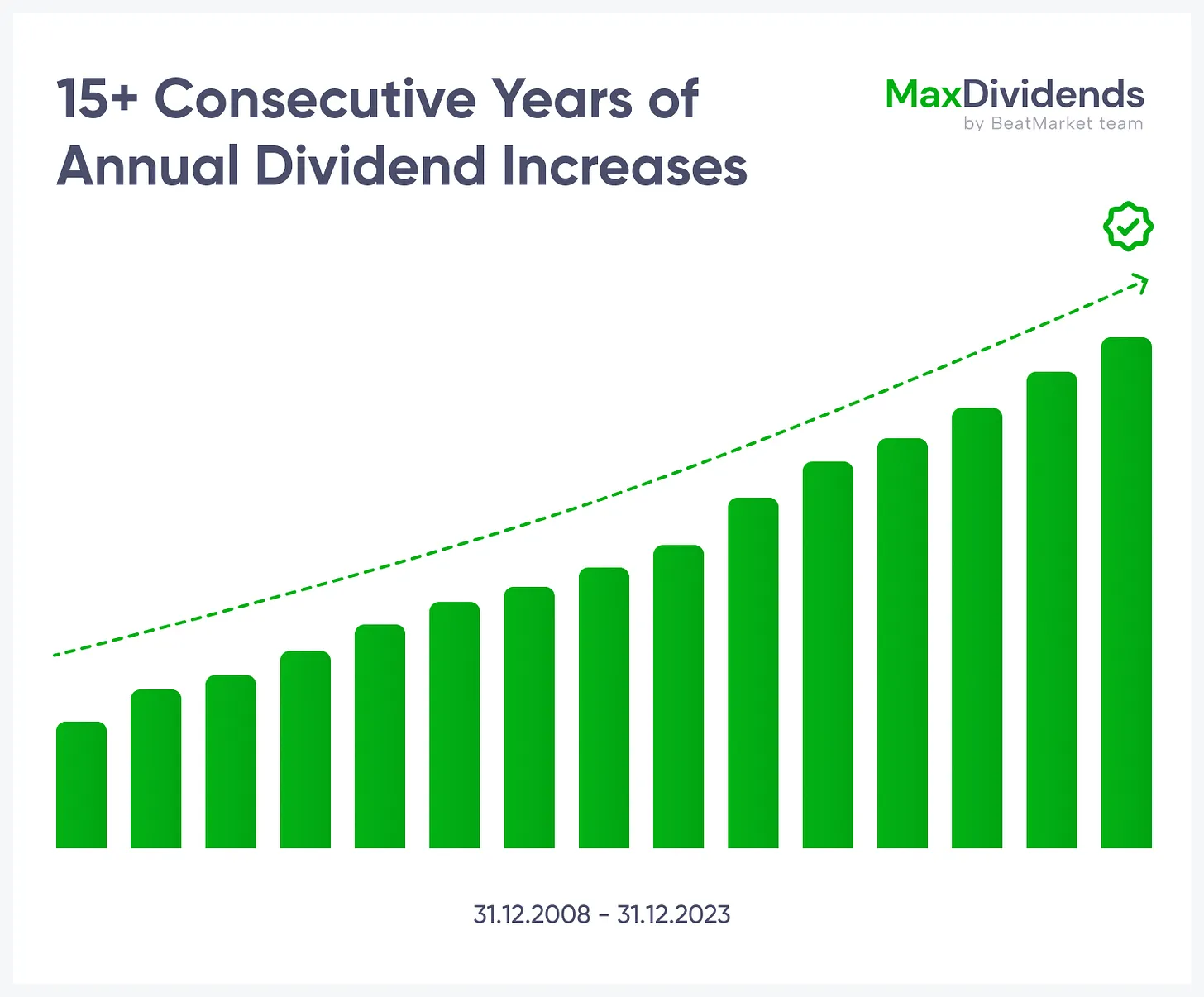

Dividenden-Analyse VSTTILLERS

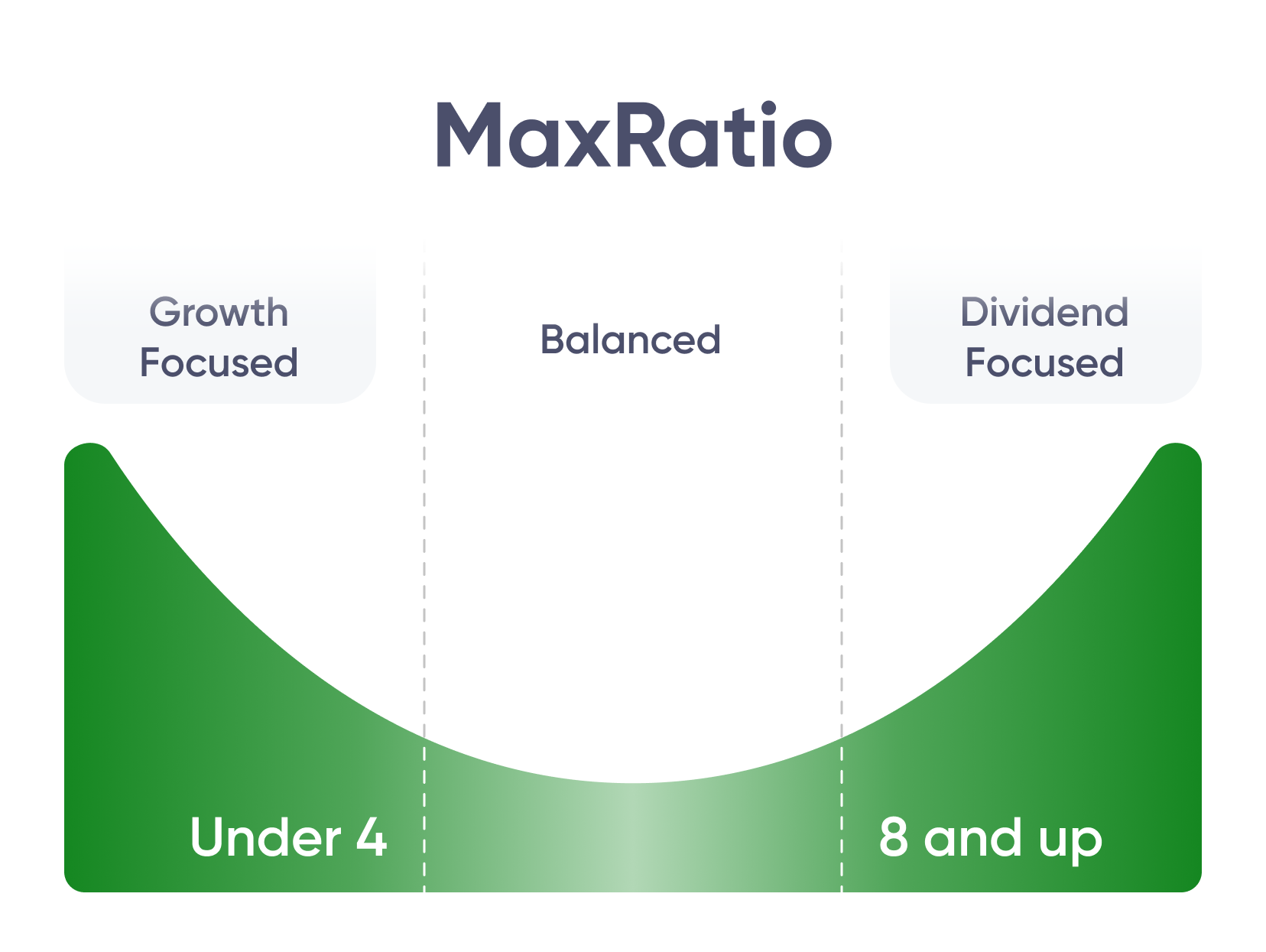

Max Ratio

0.51Dividendenrendite

0.69 %Dividendenwachstum über 5 Jahre

33.00 %Kontinuierliches Wachstum

–Ausschüttungsquote 5-Jahres-Durchschnitt

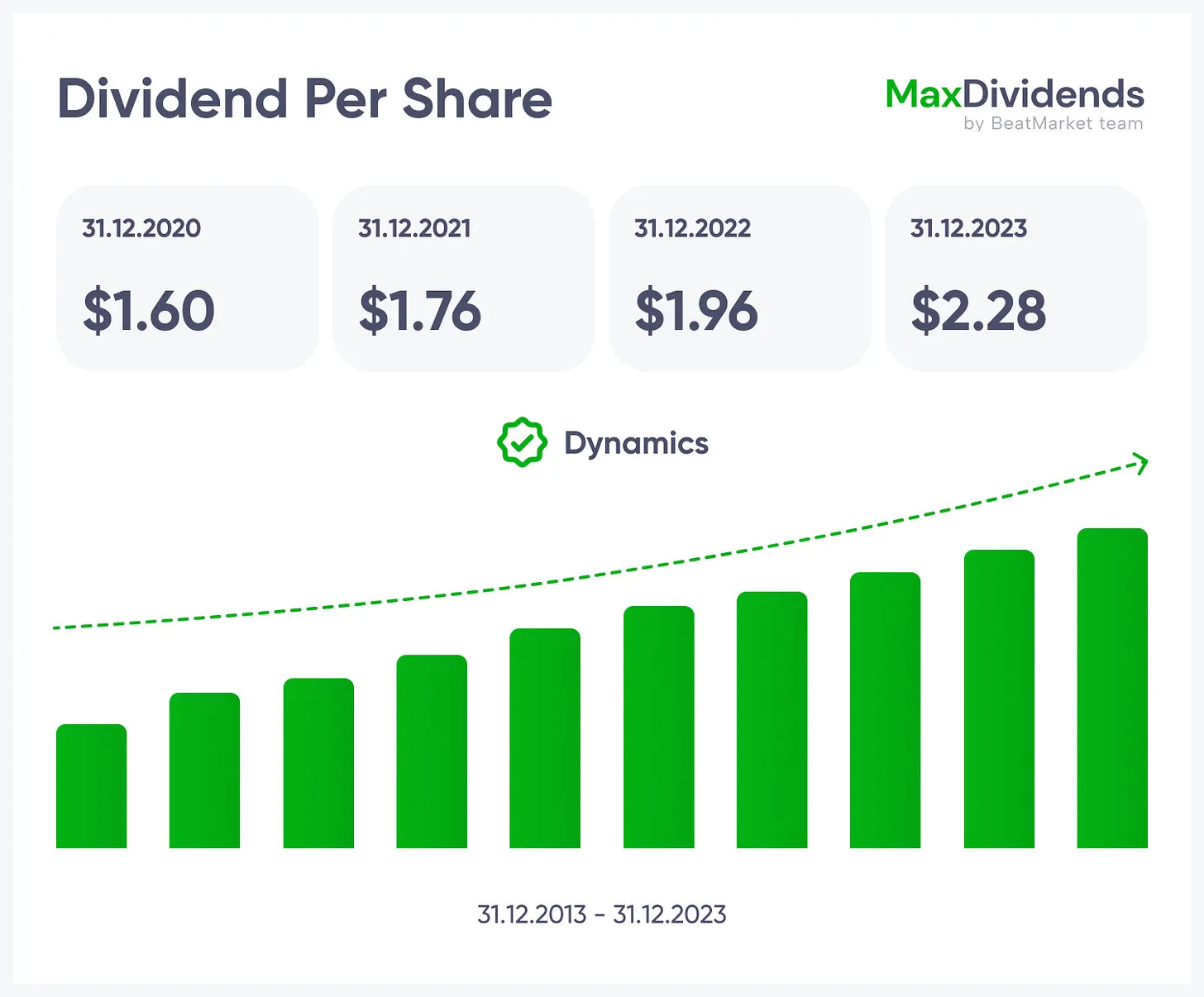

29.21 %Verlauf der Dividende VSTTILLERS

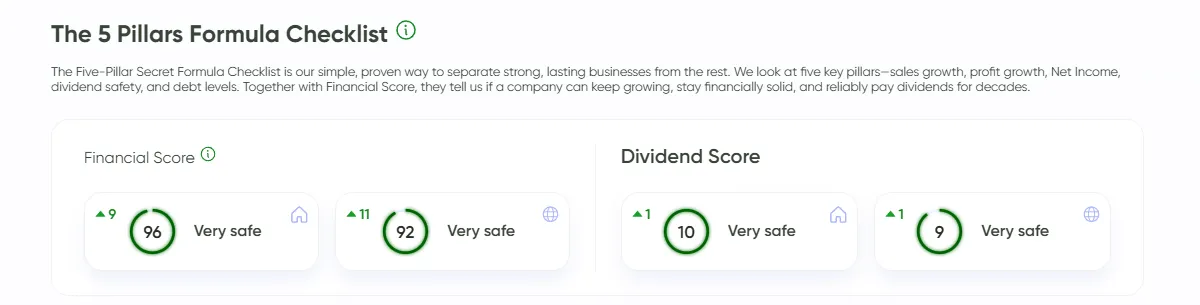

Die 5-Säulen-Formel-Checkliste

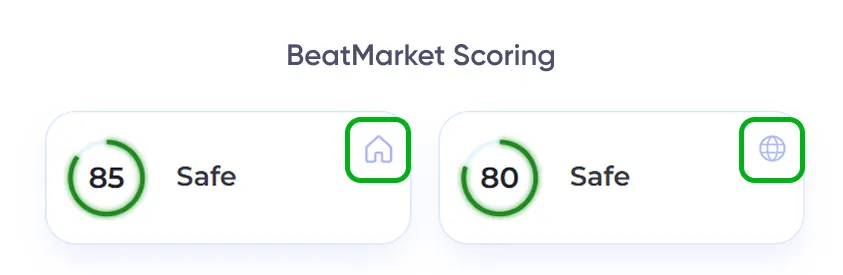

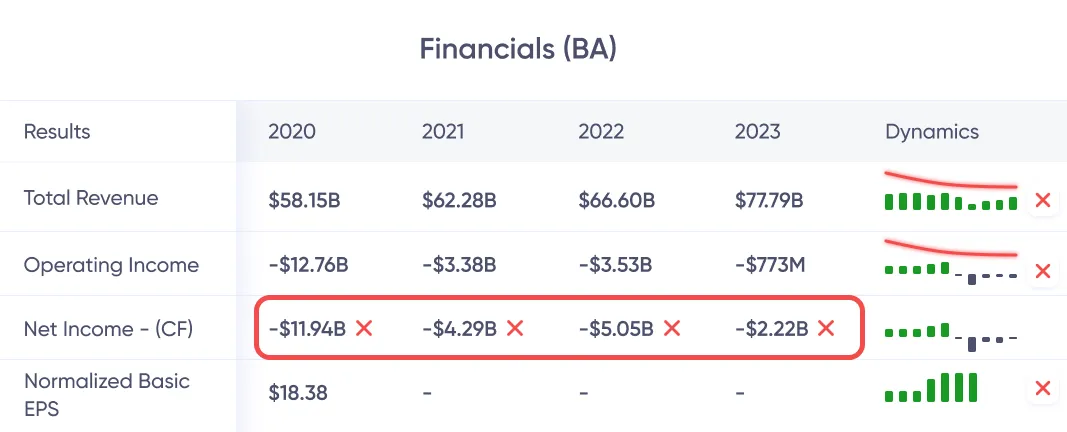

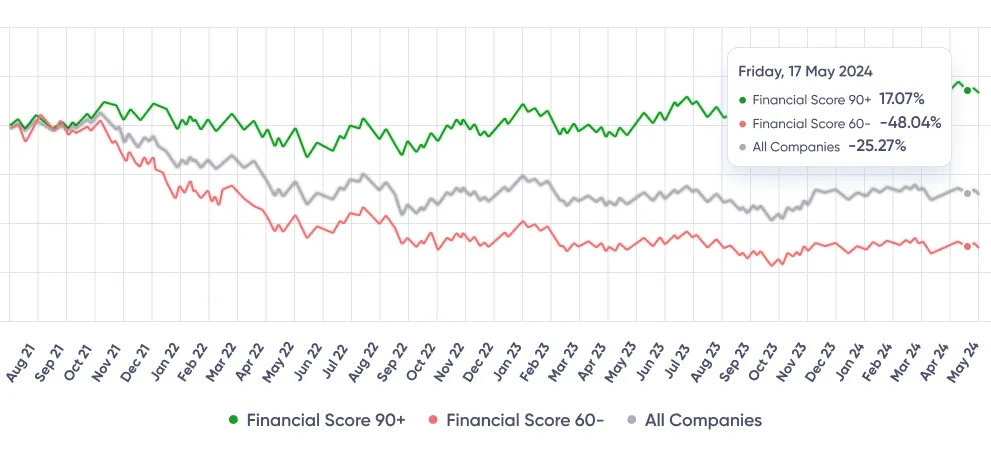

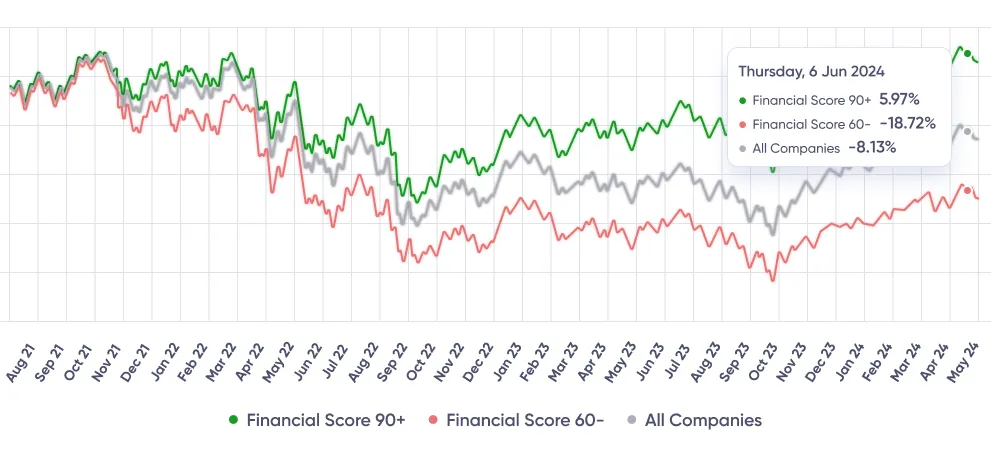

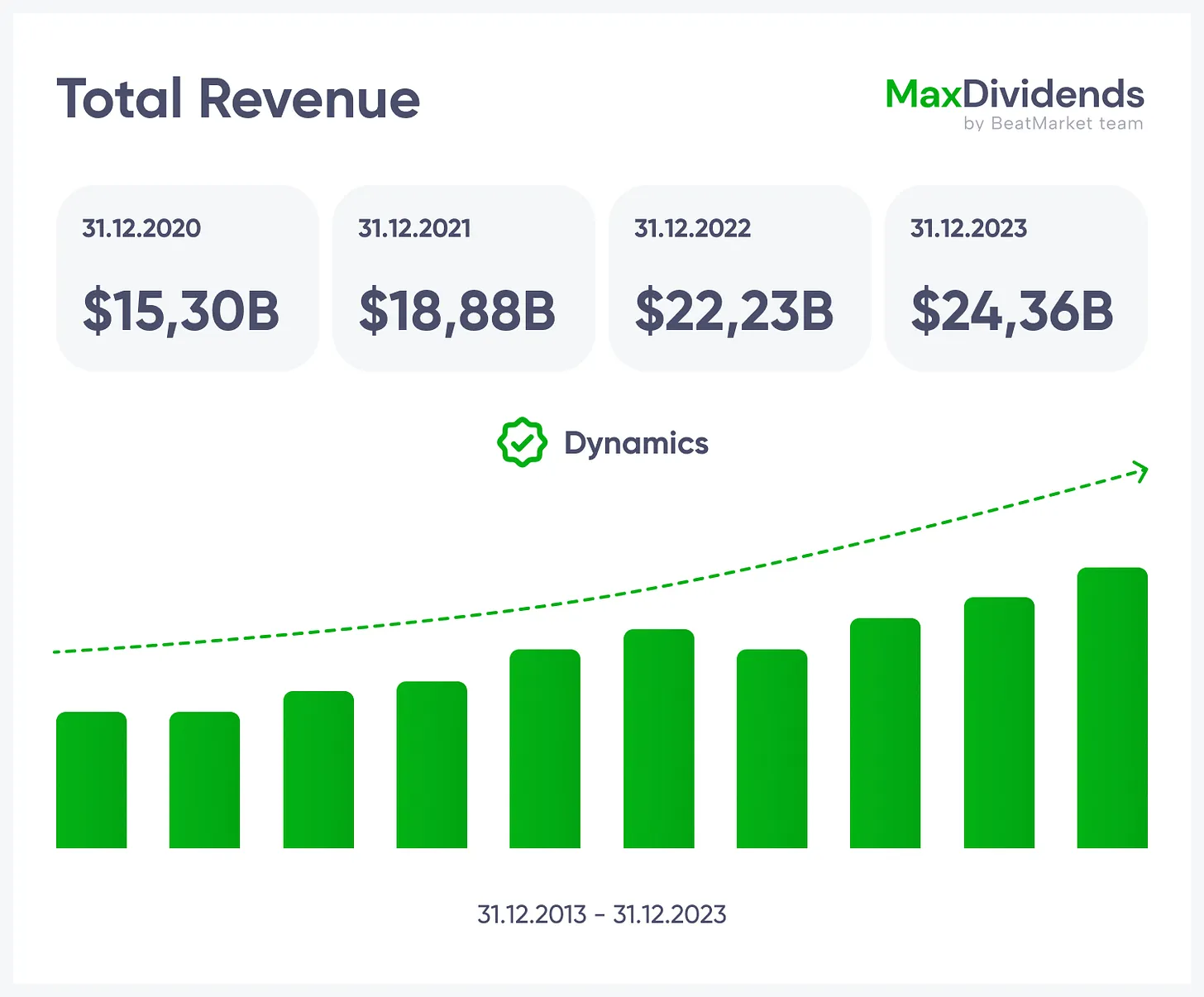

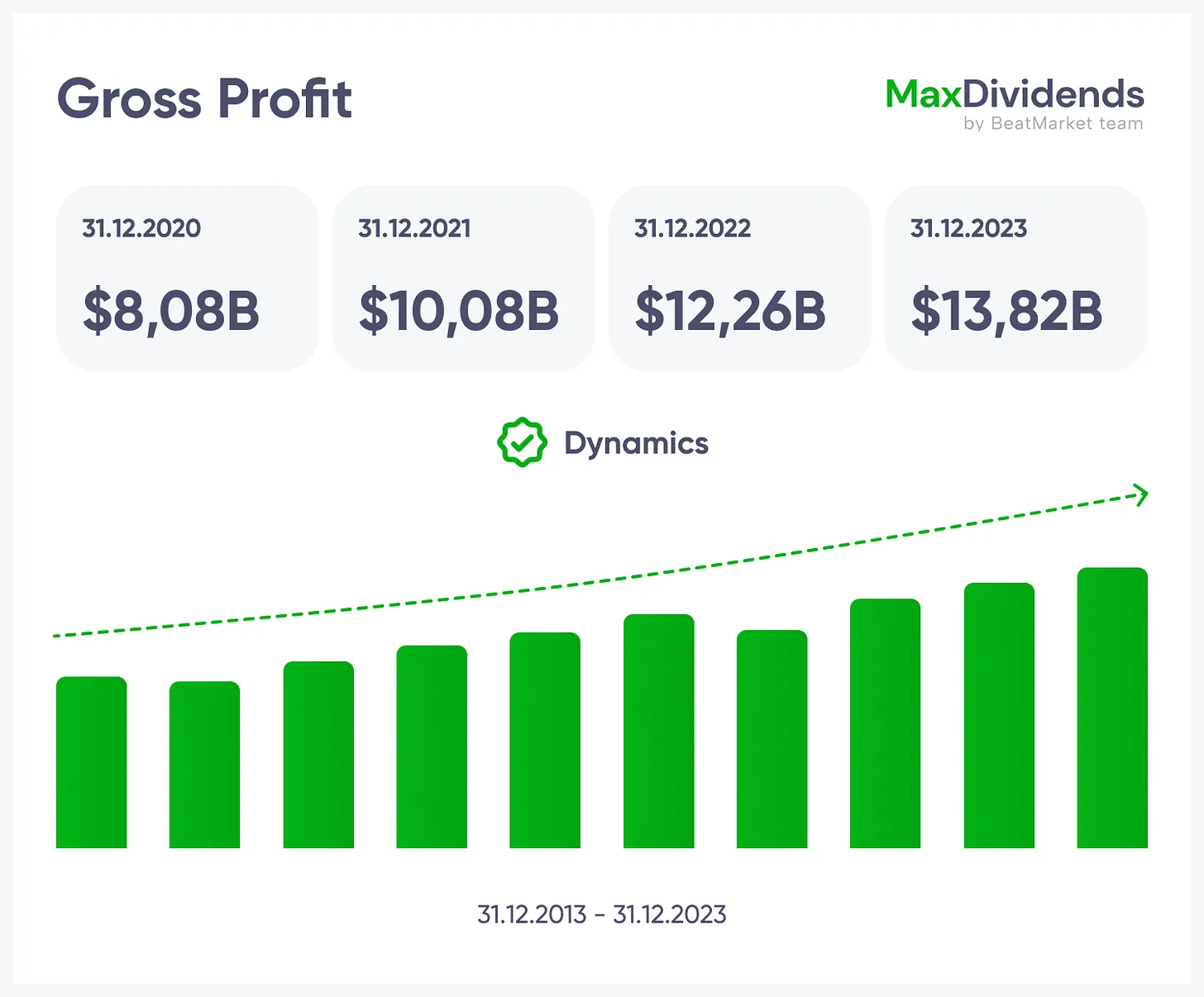

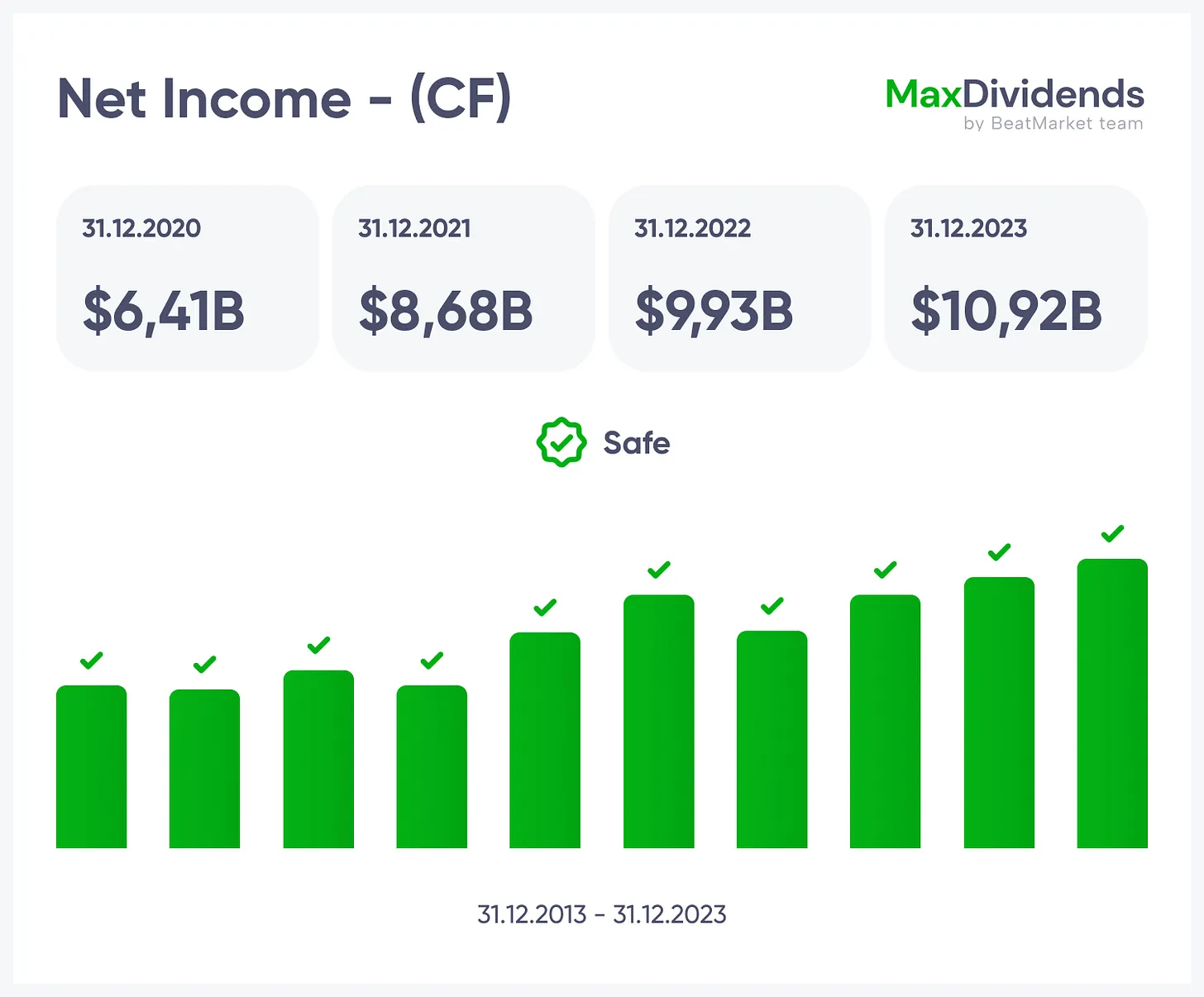

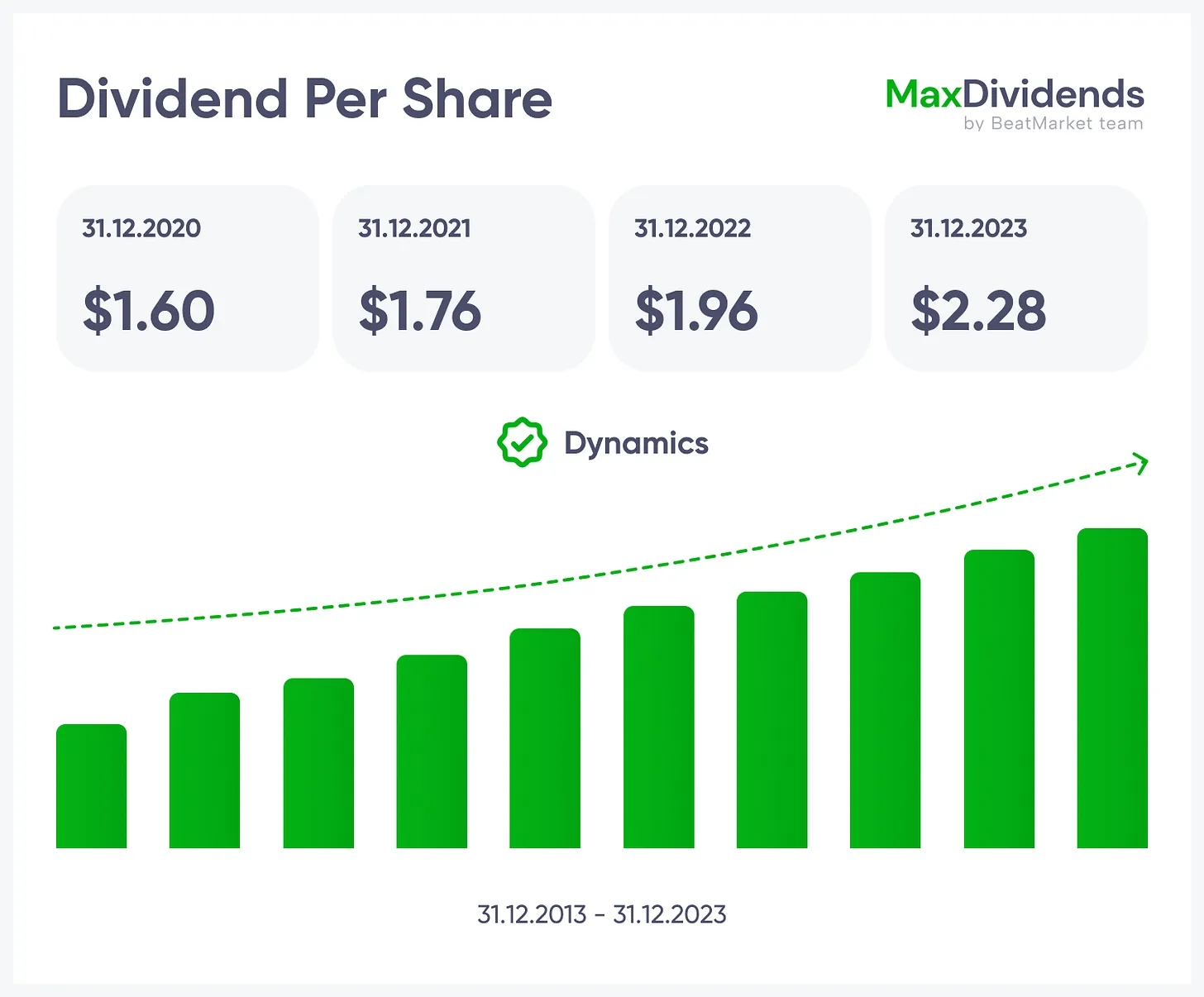

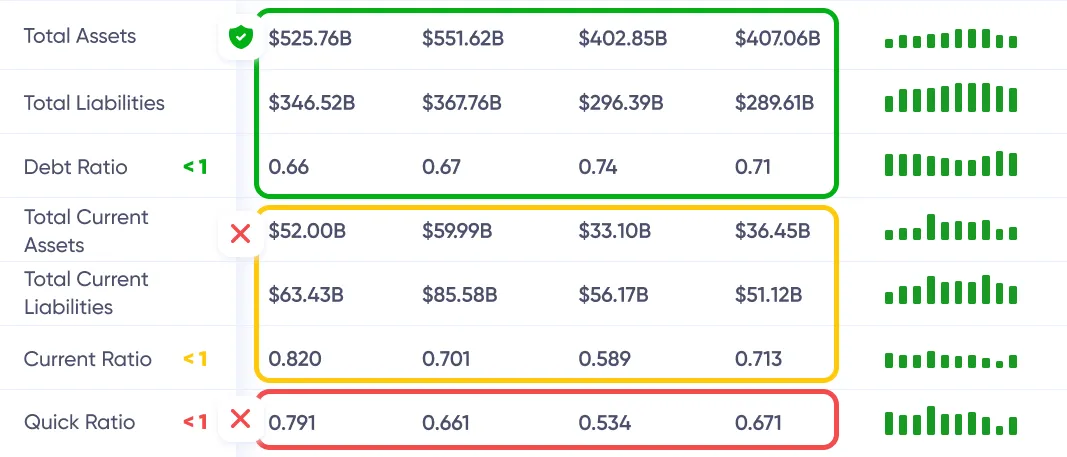

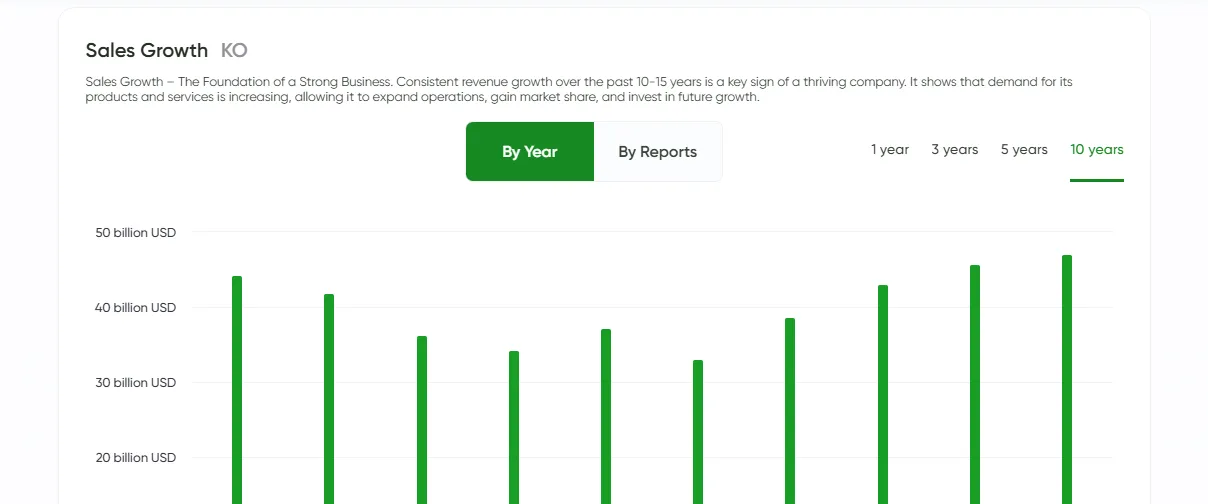

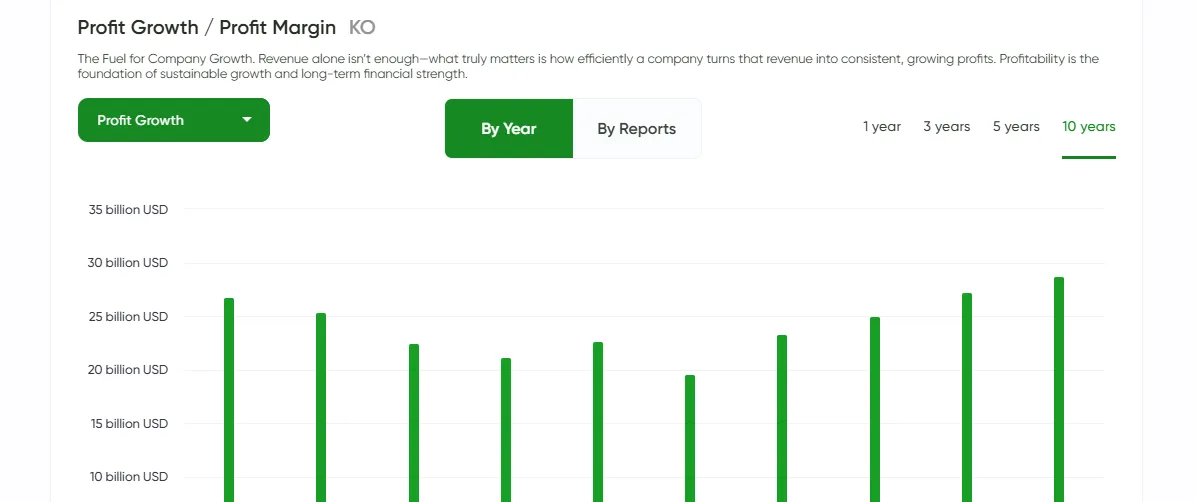

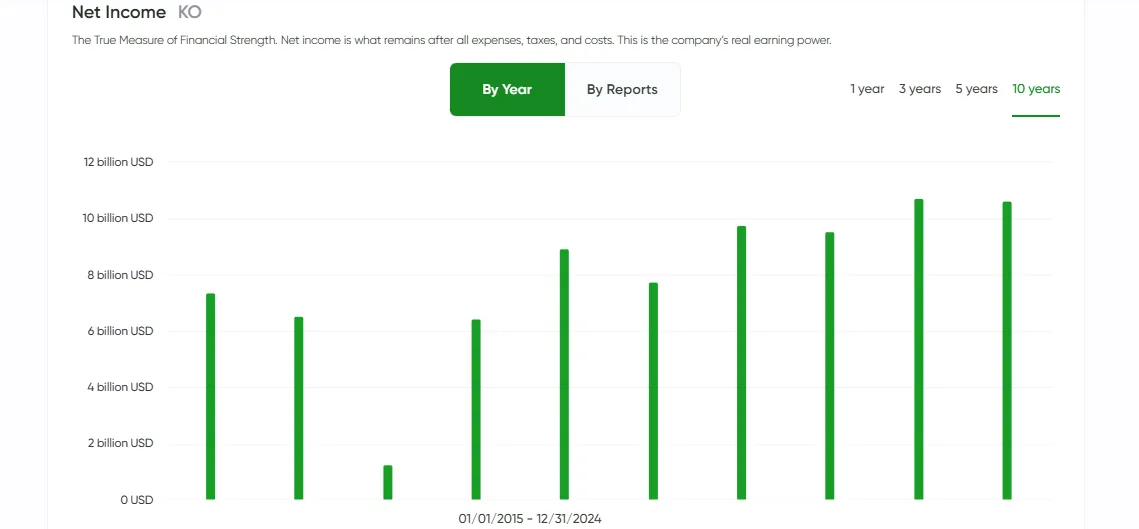

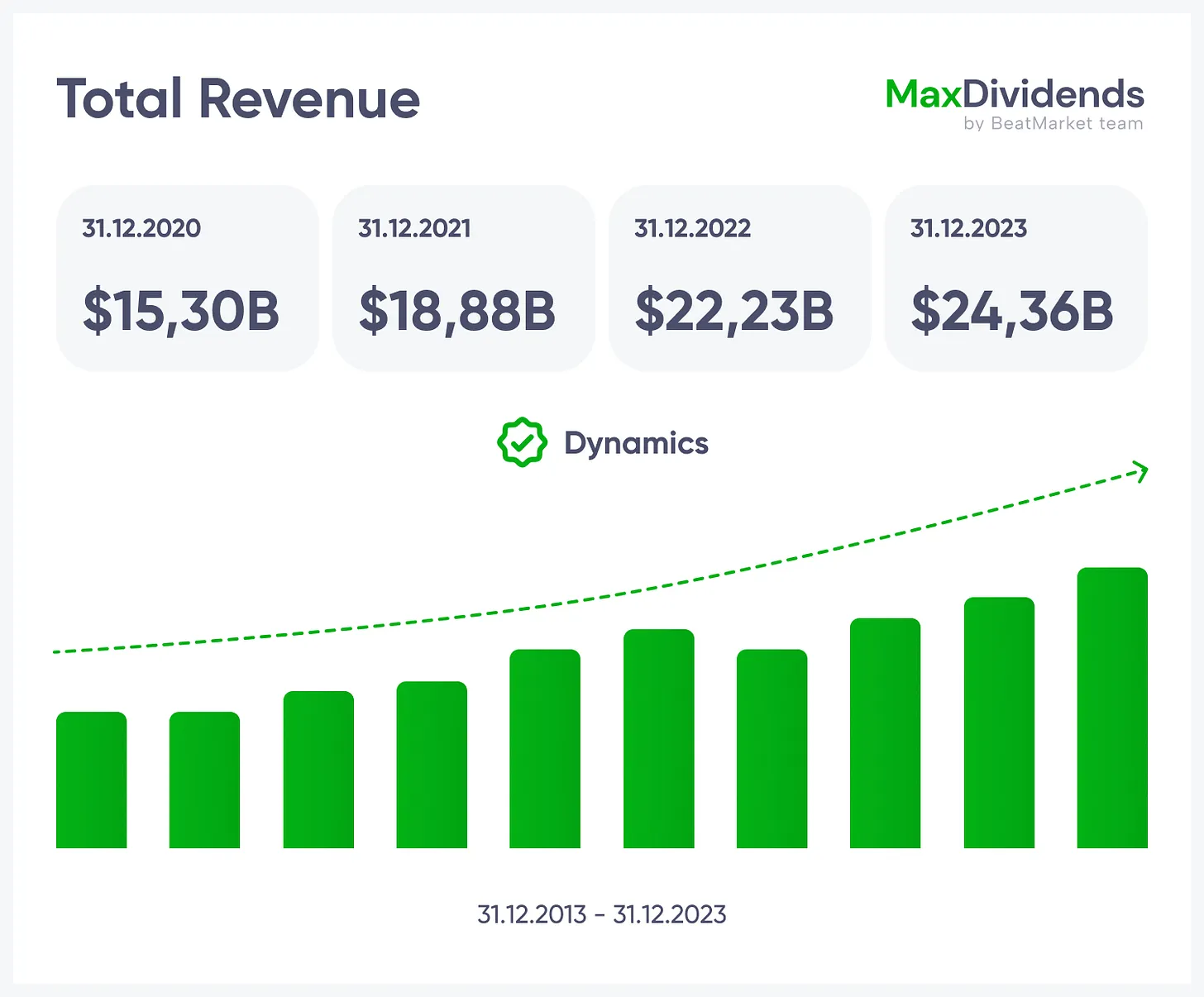

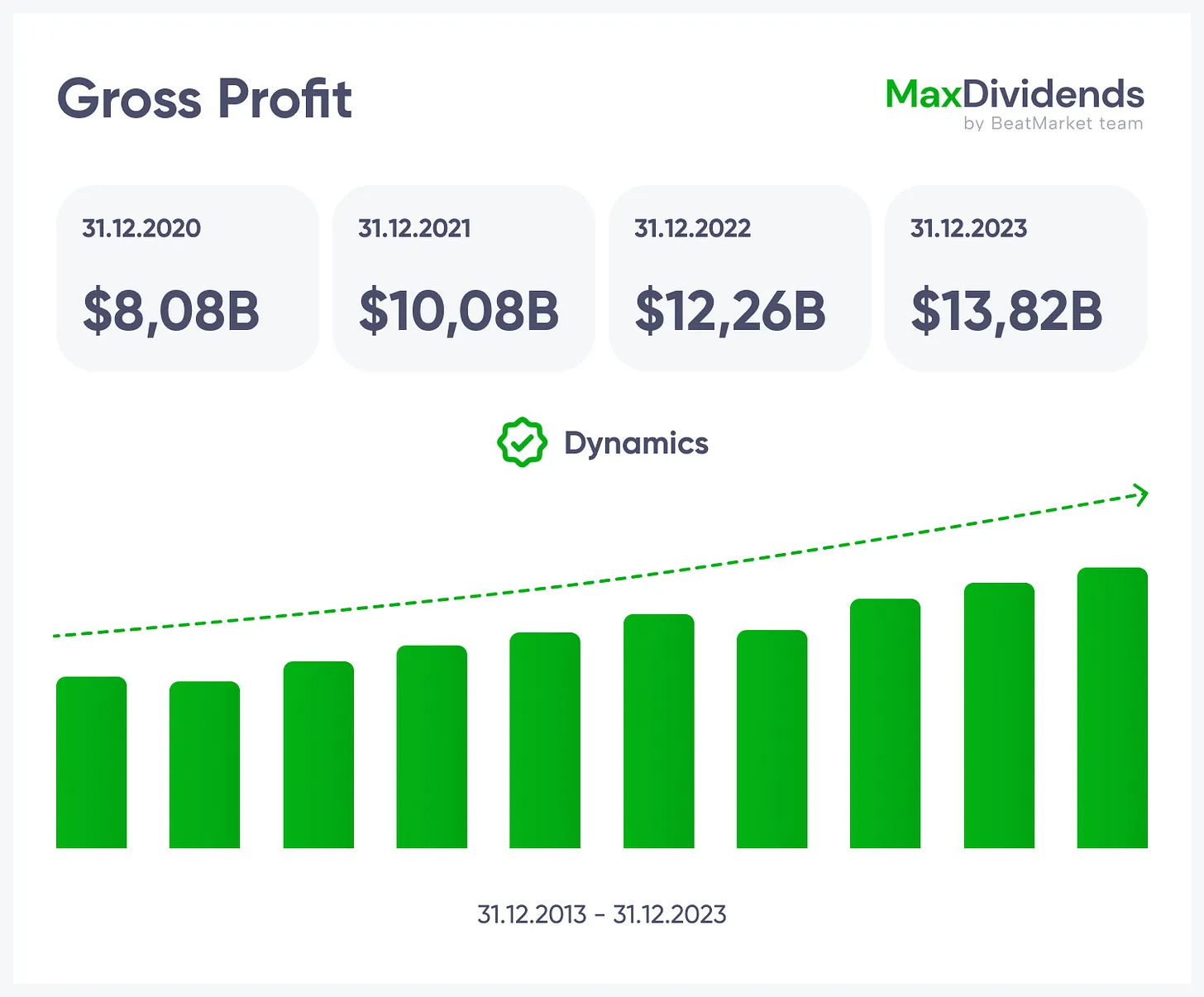

Die Fünf-Säulen-Geheimformel-Checkliste ist unsere einfache, bewährte Methode, um starke, dauerhafte Unternehmen vom Rest zu trennen. Wir betrachten fünf Schlüsselsäulen – Umsatzwachstum, Gewinnwachstum, Nettoeinkommen, Dividenden-Sicherheit und Schuldenstände. Zusammen mit dem Financial Score sagen sie uns, ob ein Unternehmen weiter wachsen, finanziell solide bleiben und zuverlässig Dividenden für Jahrzehnte zahlen kann.Gesamtumsatz VSTTILLERS

Bruttogewinn / Gewinnspanne VSTTILLERS

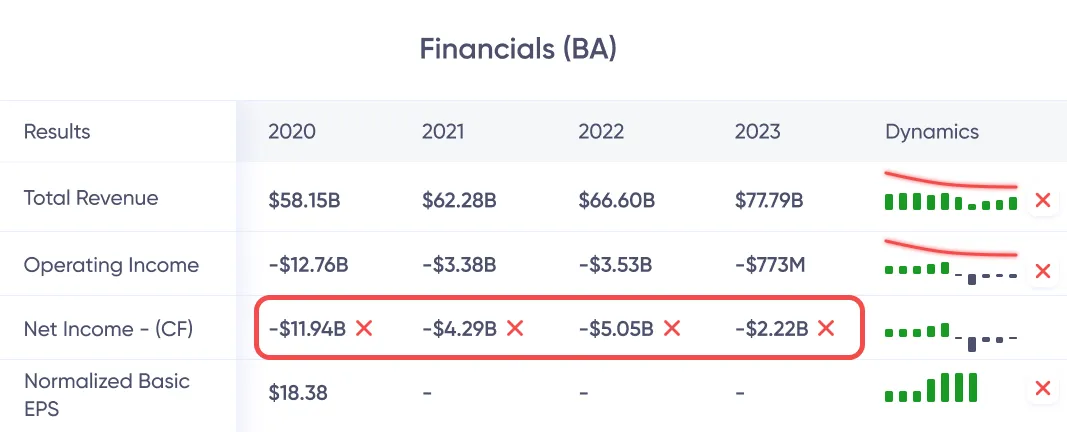

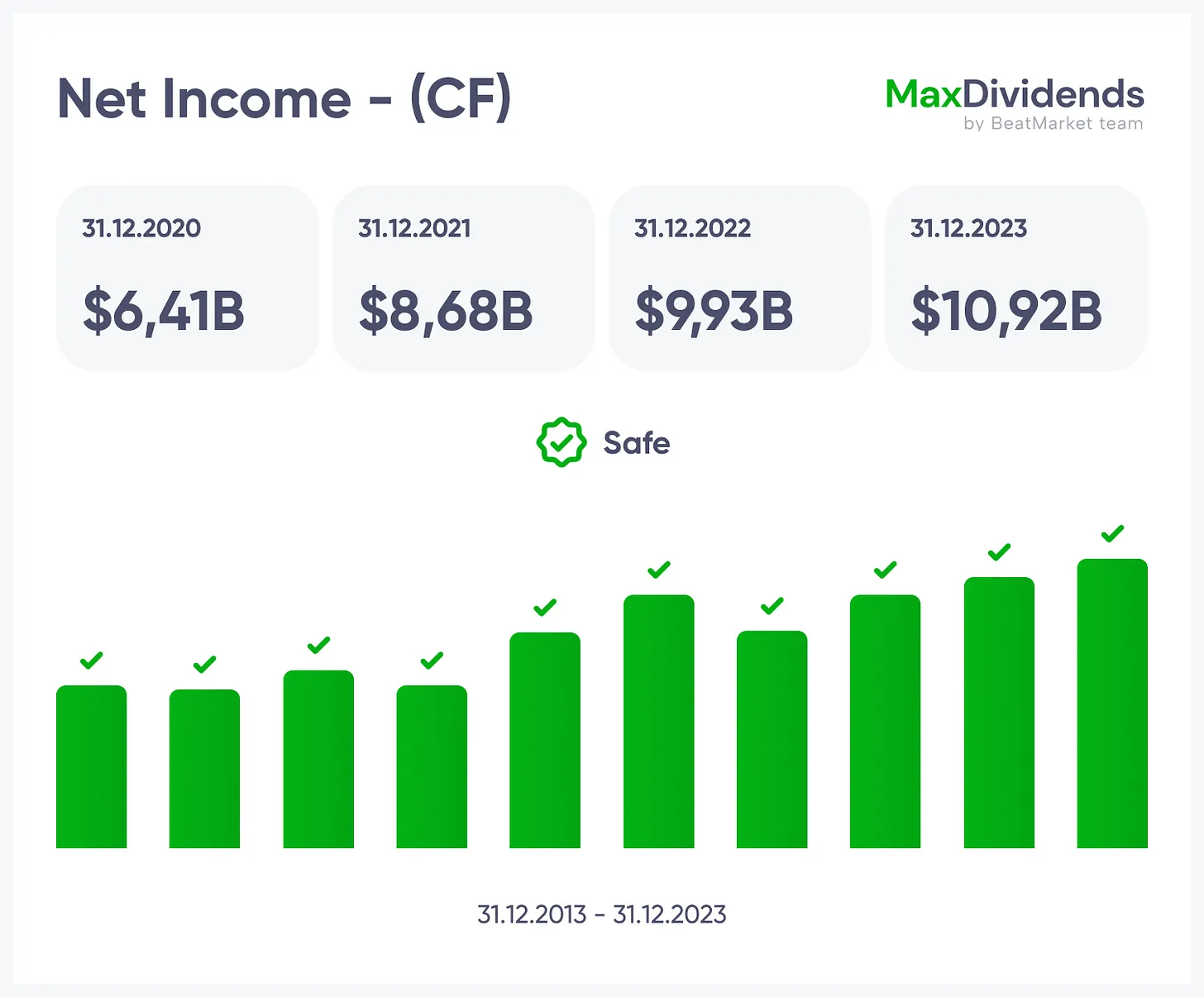

Nettogewinn VSTTILLERS

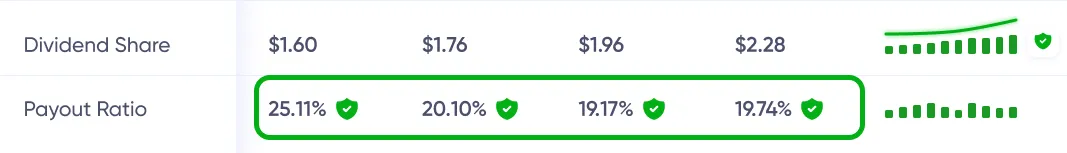

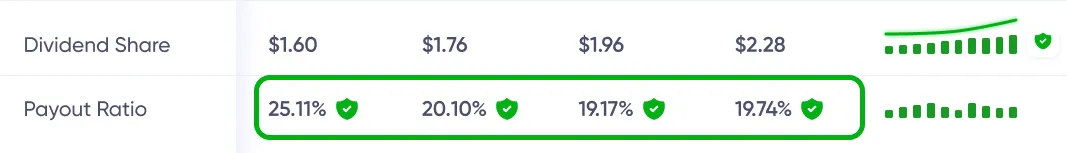

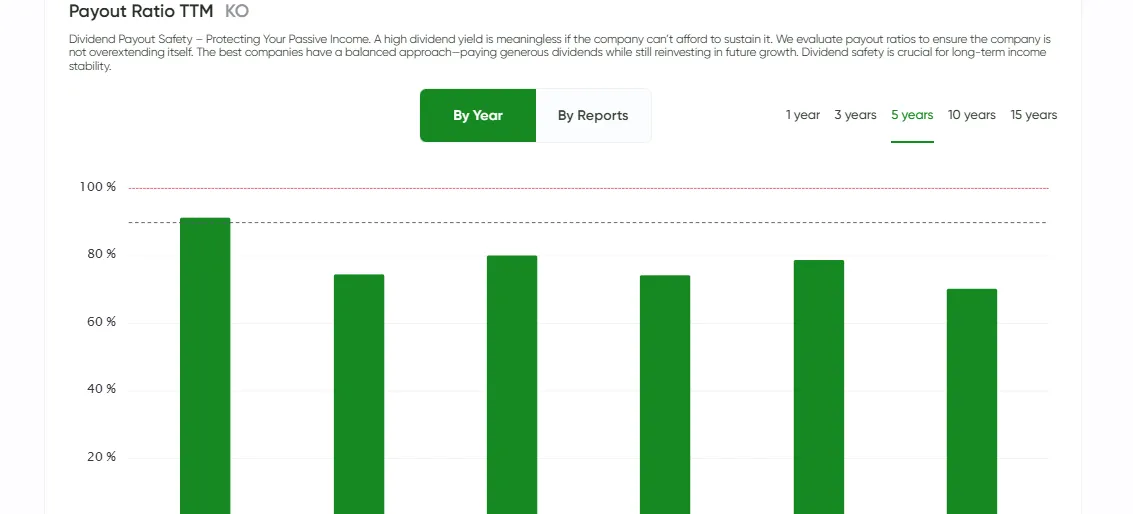

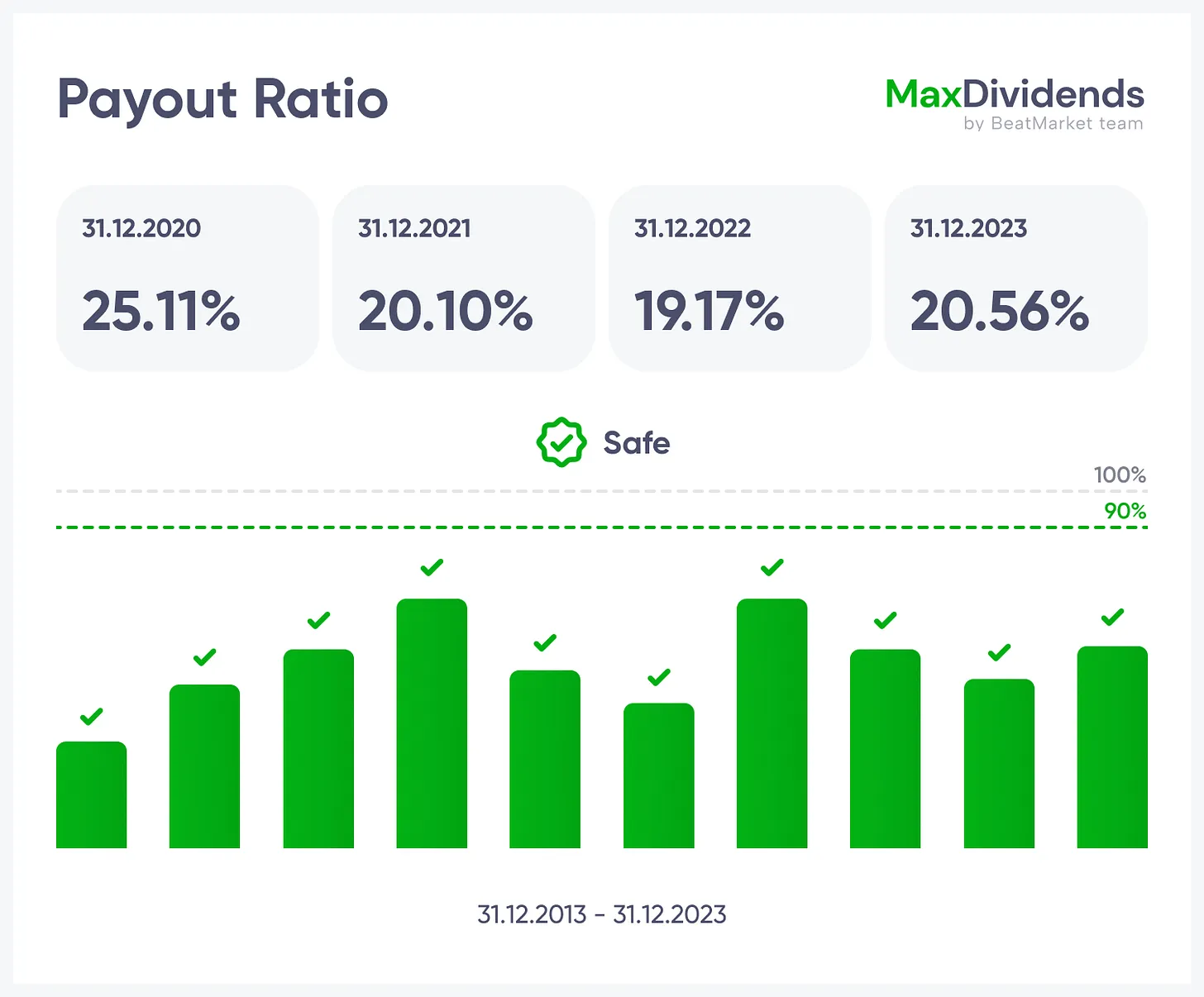

Auszahlungsquote VSTTILLERS

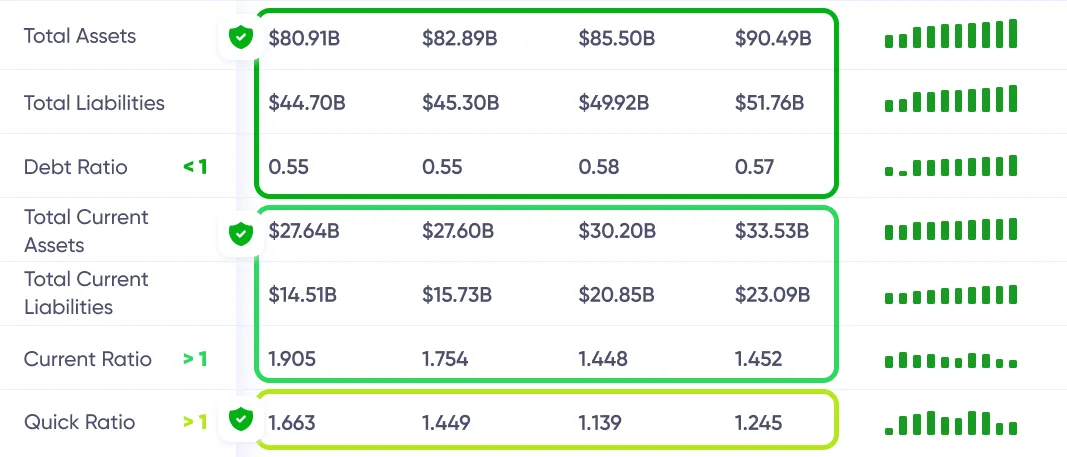

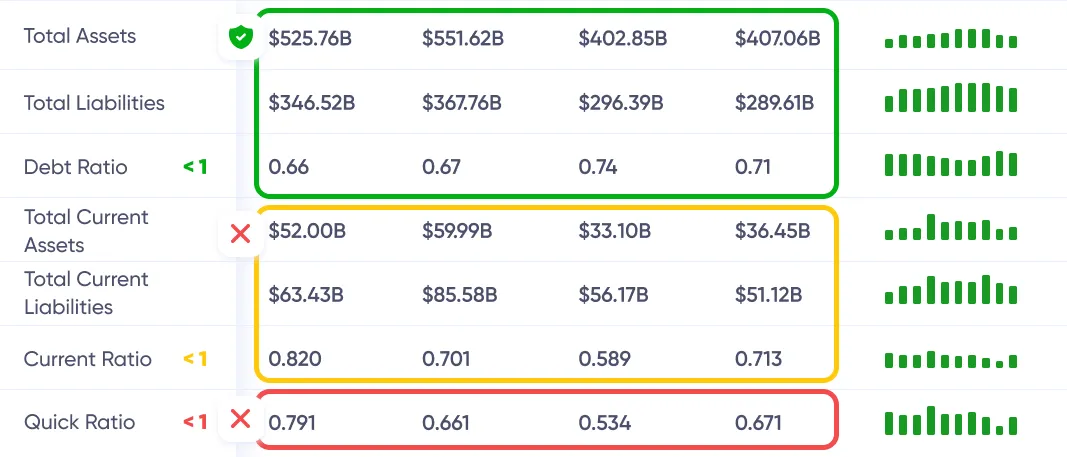

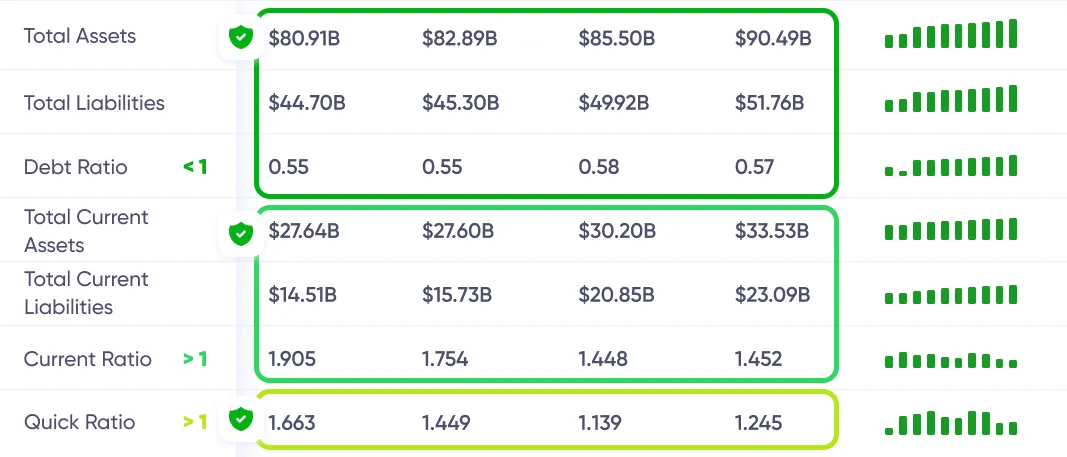

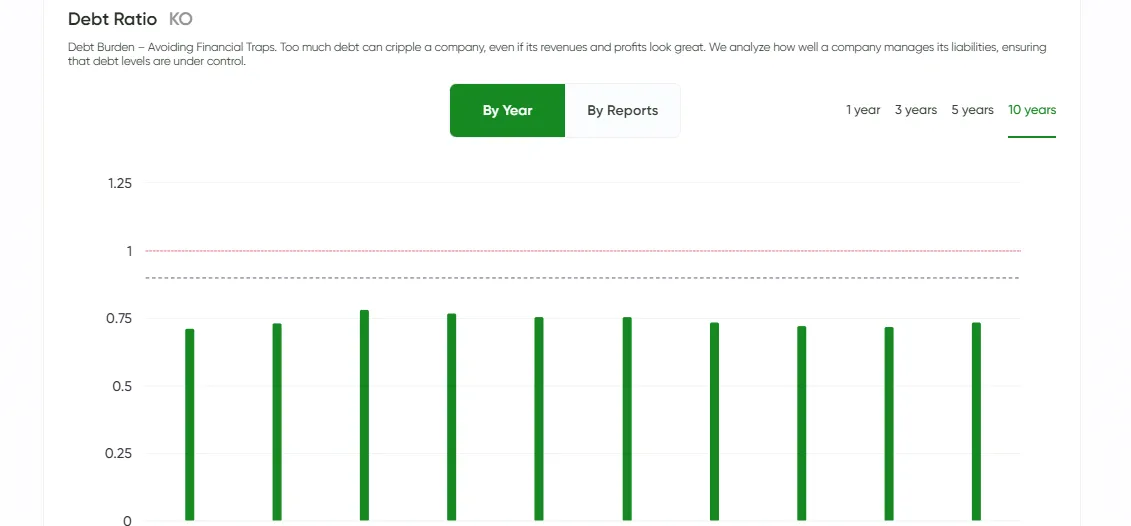

Verschuldungsgrad VSTTILLERS

Finanzen

V.S.T Tillers Tractors Limited VSTTILLERS

| Ergebnisse | 2019 | Dynamik |

Sehen Sie das gesamte Geschäft auf einen Blick – was es tut, wie es verdient und welchen Wert es bringt.

Sehen Sie das gesamte Geschäft auf einen Blick – was es tut, wie es verdient und welchen Wert es bringt.

Wachstumstrend, auf einen Blick klar.

Wachstumstrend, auf einen Blick klar.

Sehen Sie, ob die Gewinne real sind – sofort.

Sehen Sie, ob die Gewinne real sind – sofort.

Das Endergebnis wird mit MaxDividends einfach.

Das Endergebnis wird mit MaxDividends einfach.

Schuldenrisiko für Sie geprüft, 24/7.

Schuldenrisiko für Sie geprüft, 24/7.

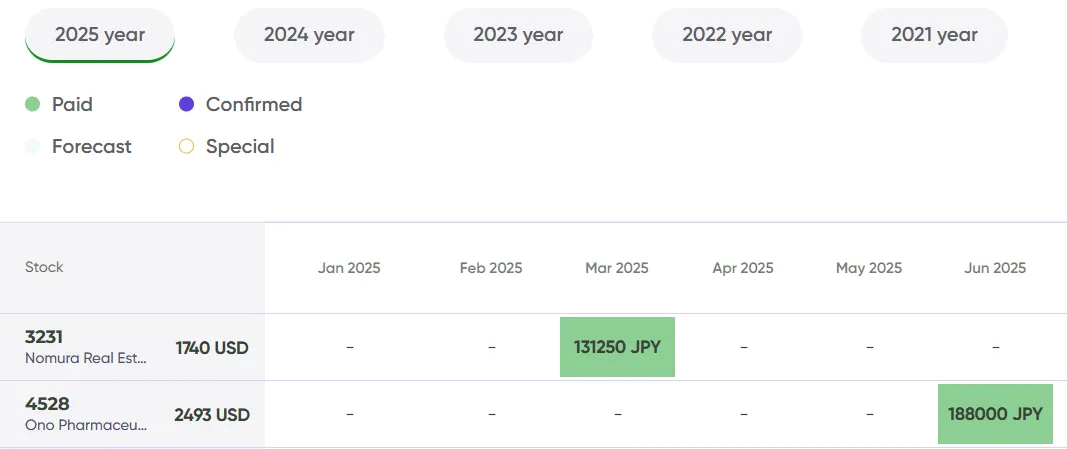

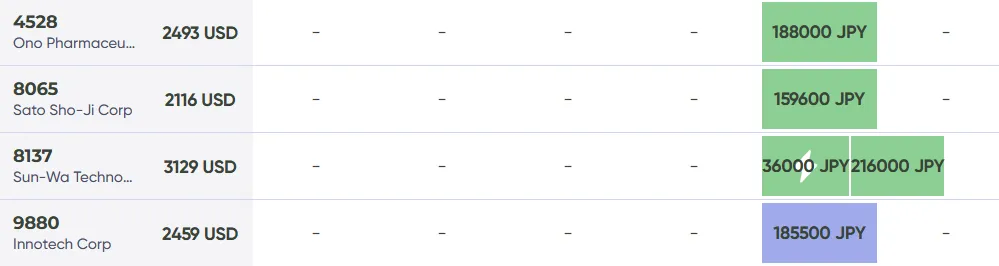

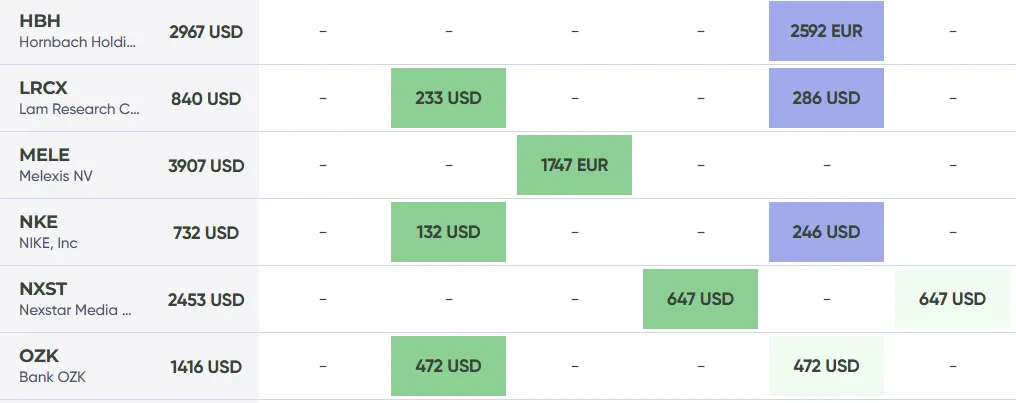

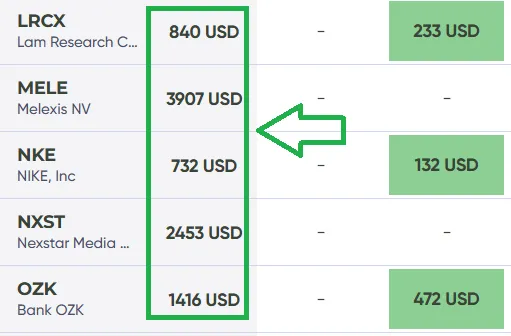

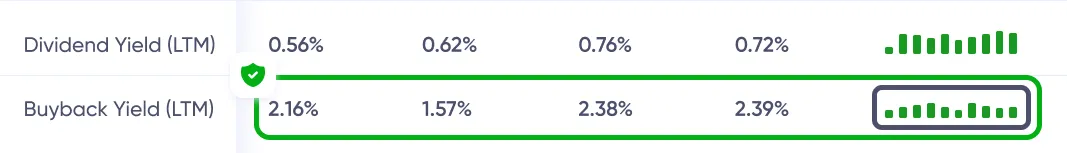

Dividenden-Serien und -Erhöhungen griffbereit.

Dividenden-Serien und -Erhöhungen griffbereit.

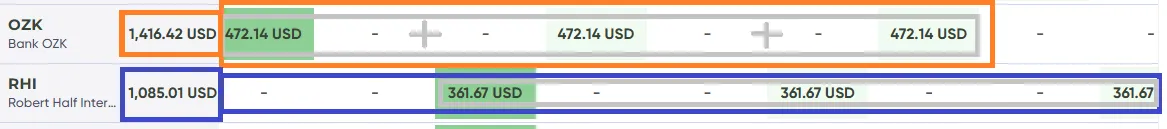

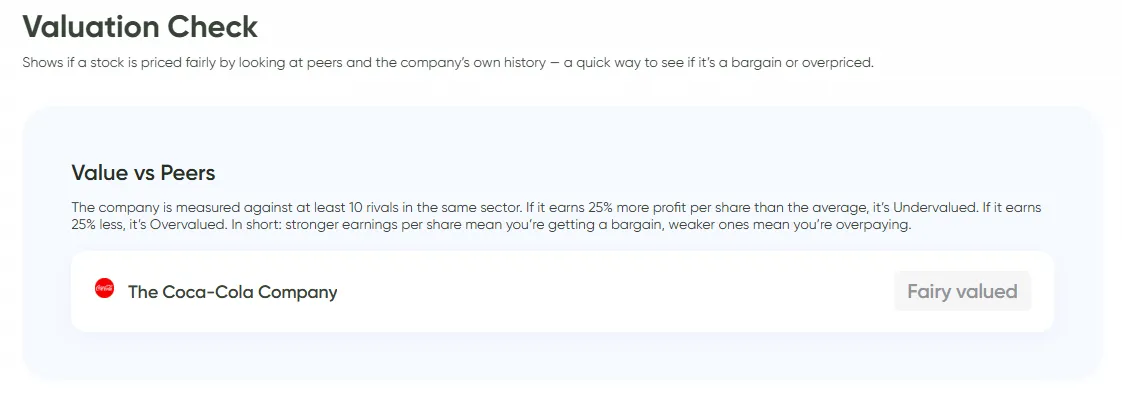

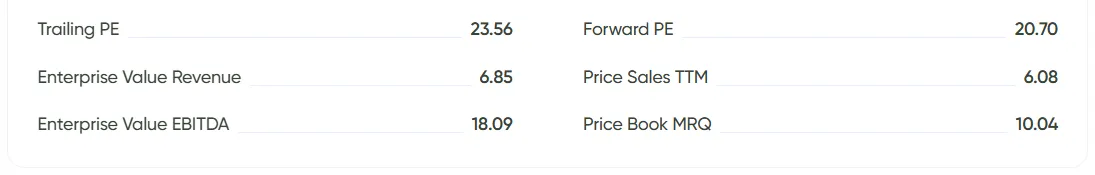

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

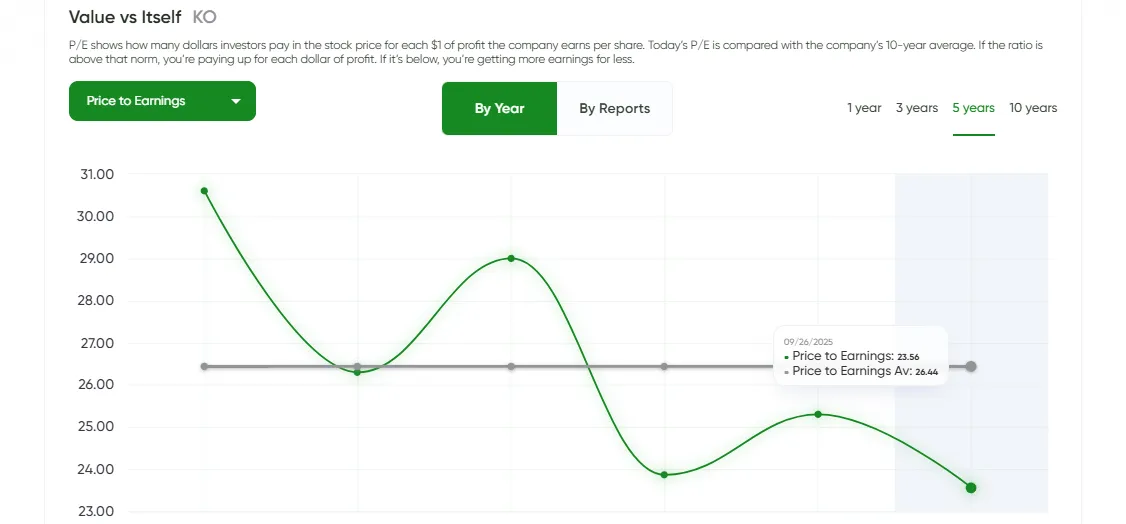

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

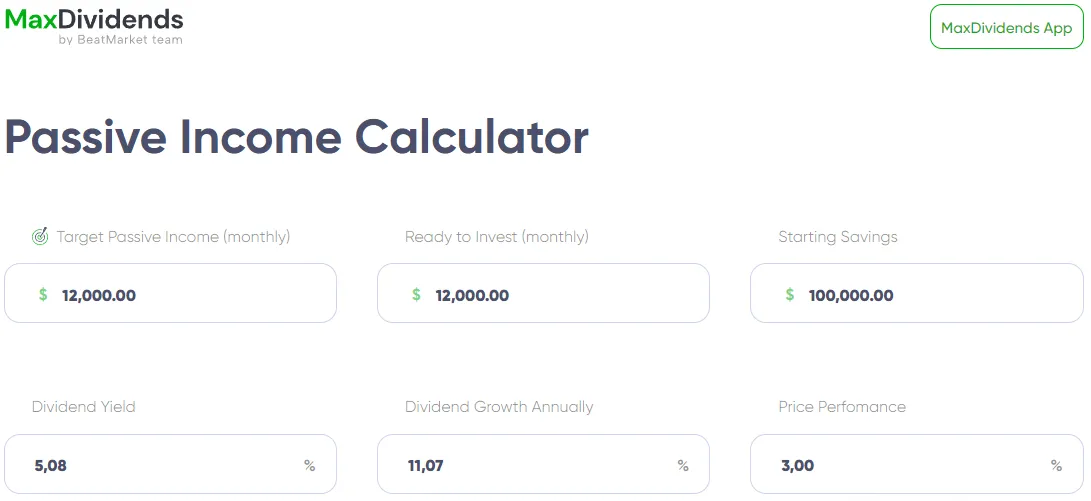

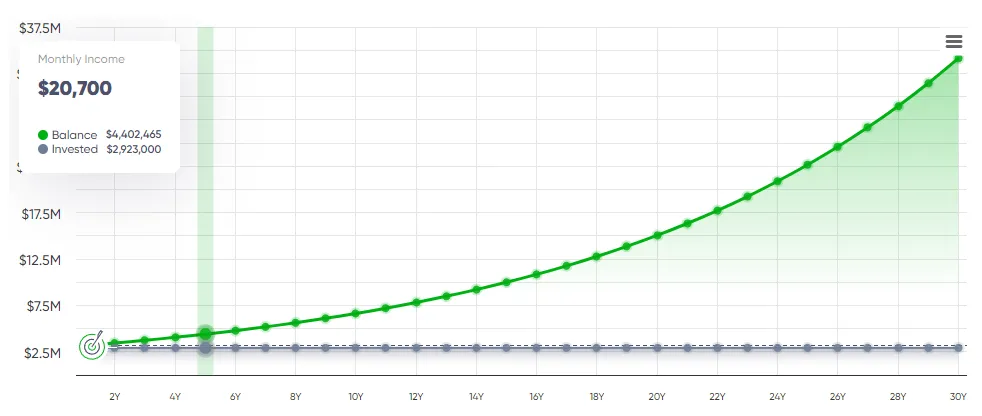

MaxDividends App: Passiver Einkommensrechner

MaxDividends App: Passiver Einkommensrechner

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

MaxDividends App: Passiver Einkommensrechner

MaxDividends App: Passiver Einkommensrechner

MaxDividends App: Passiver Einkommensrechner

MaxDividends App: Passiver Einkommensrechner

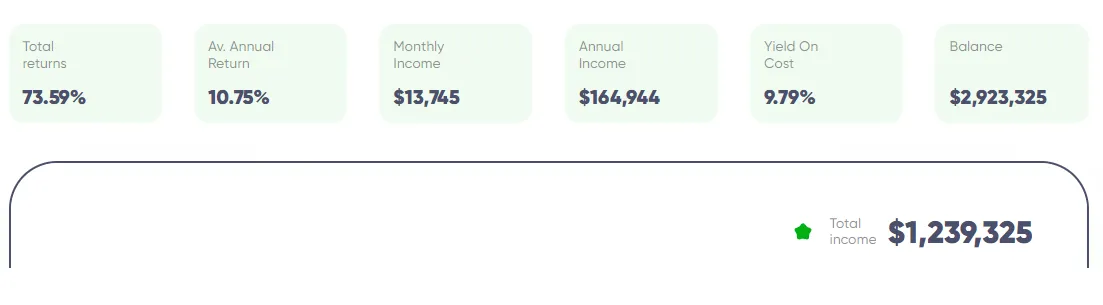

MaxDividends App: Passiver Einkommensrechner, Einkommensprognose

MaxDividends App: Passiver Einkommensrechner, Einkommensprognose

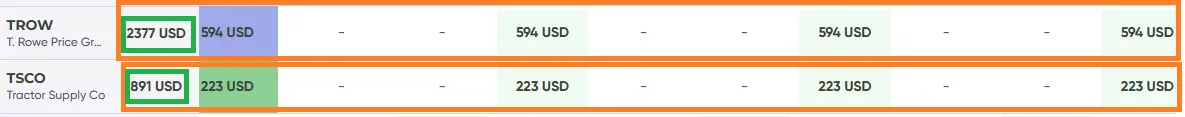

BeatStart

BeatStart