Kirjoita osake tai kryptovaluutta hakupalkkiin saadaksesi yhteenvedon

Kuinka tämä yritys ansaitsee rahaa

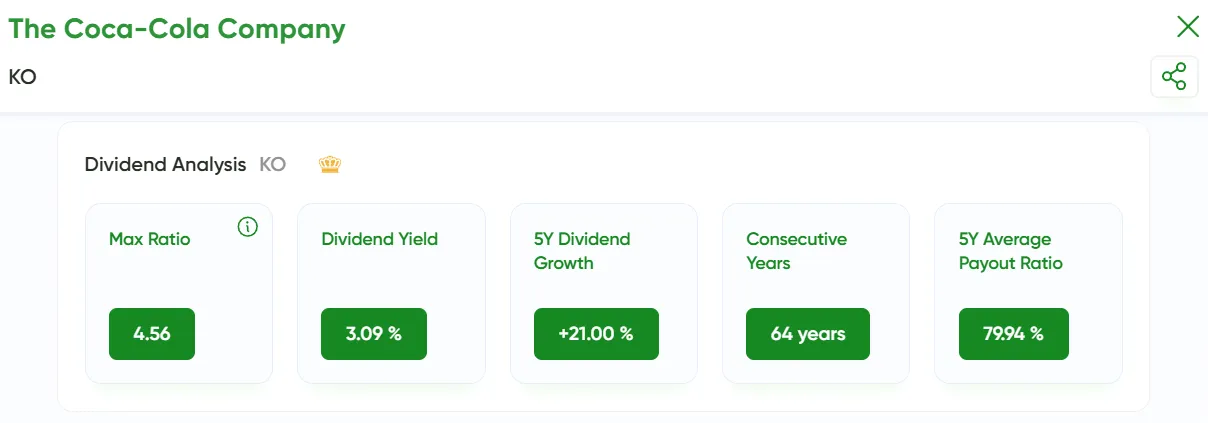

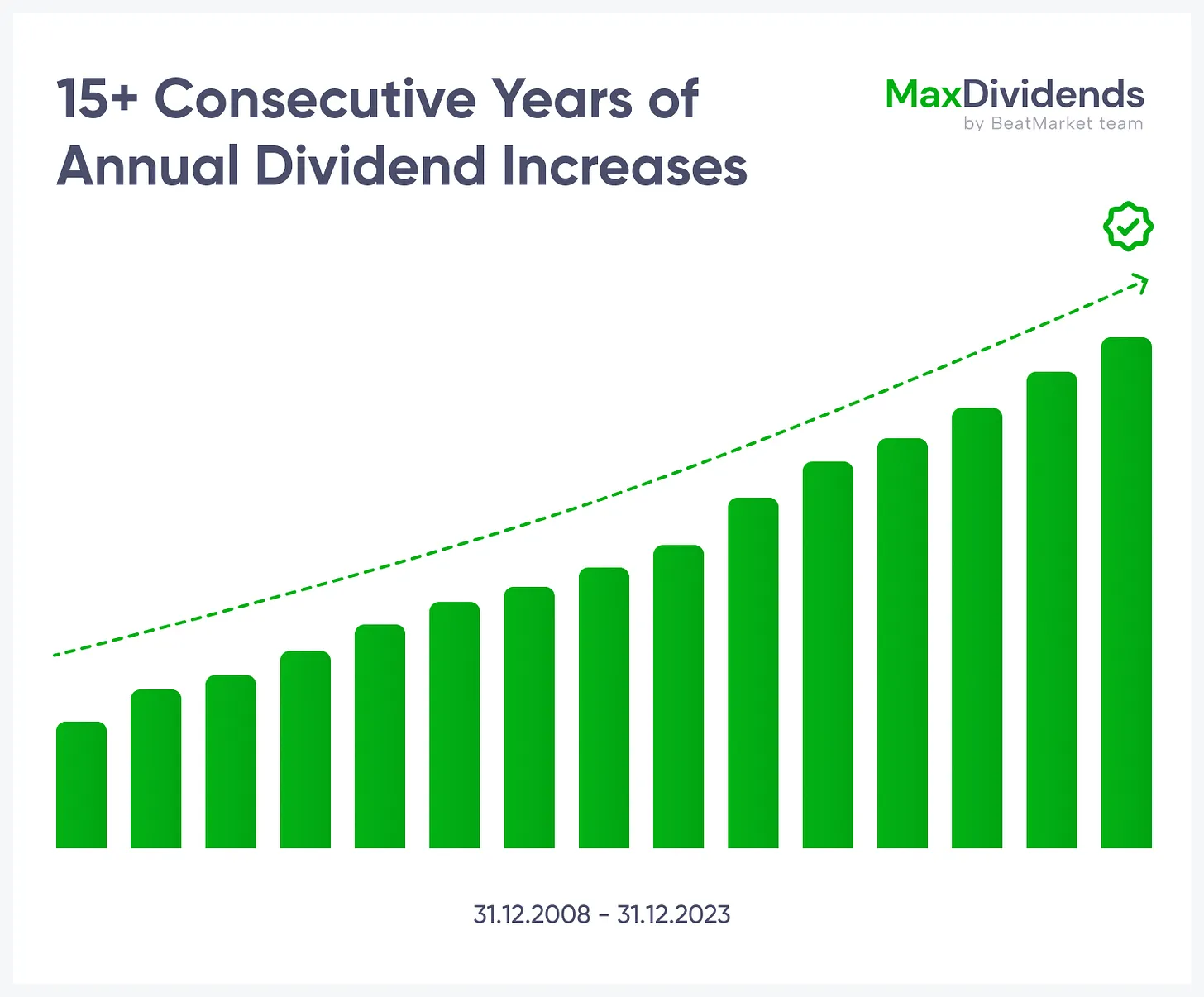

Osinkoanalytiikka 1NX

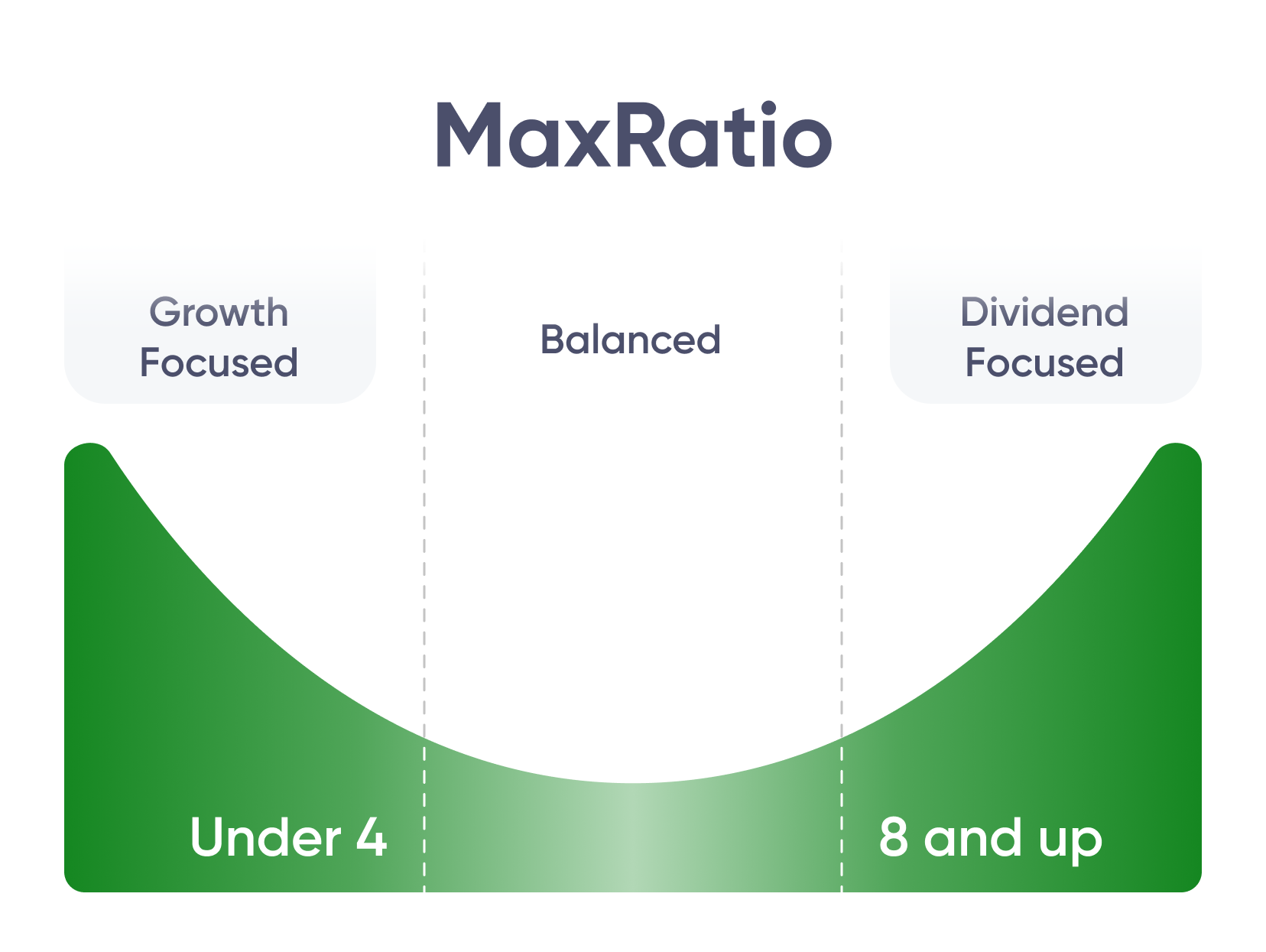

Max Ratio

–Osinkotuotto

13.43 %Osinkojen kasvu 5 vuoden aikana

20.00 %Jatkuva kasvu

–Maksusuhde 5 vuoden keskiarvo

38.32 %Osinkohistoria 1NX

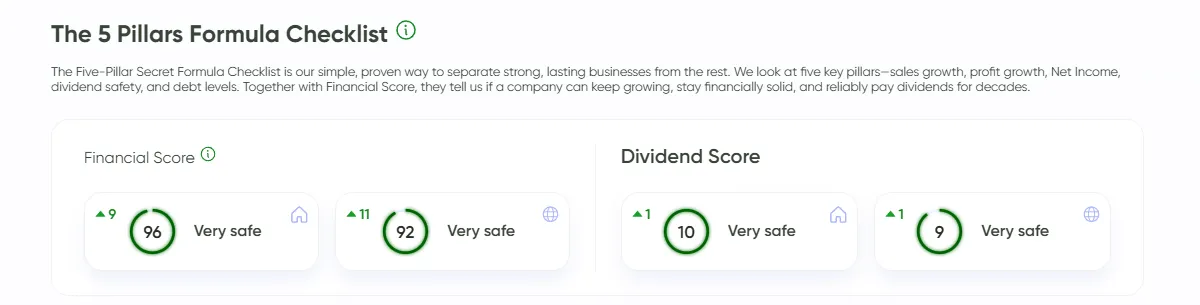

The 5 Pillars Formula -tarkistuslista

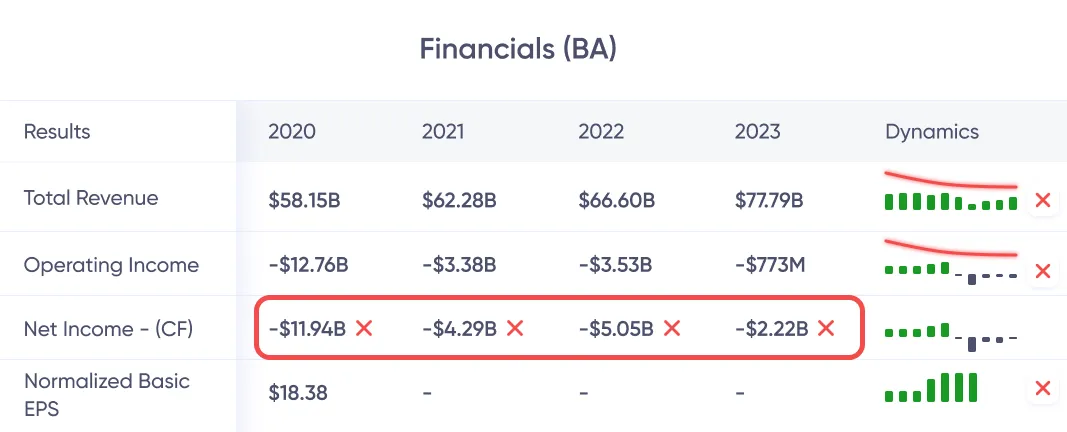

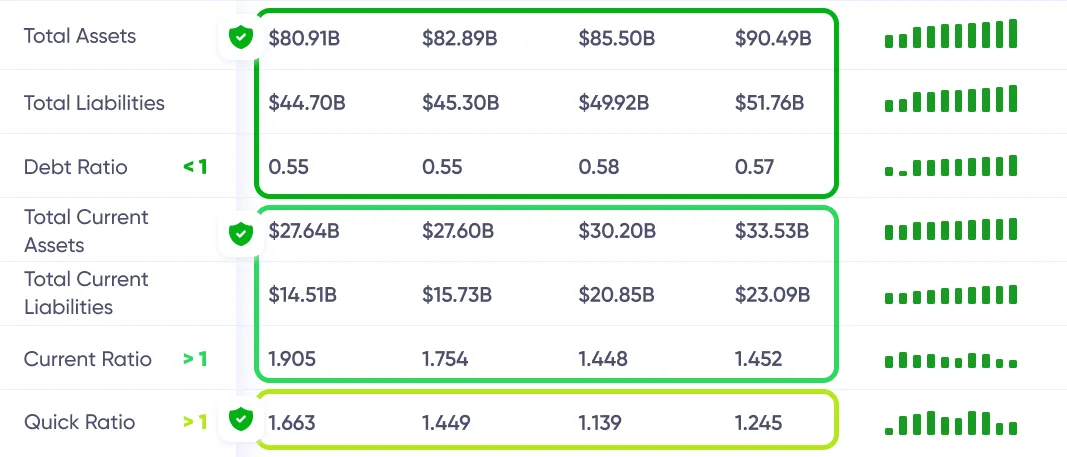

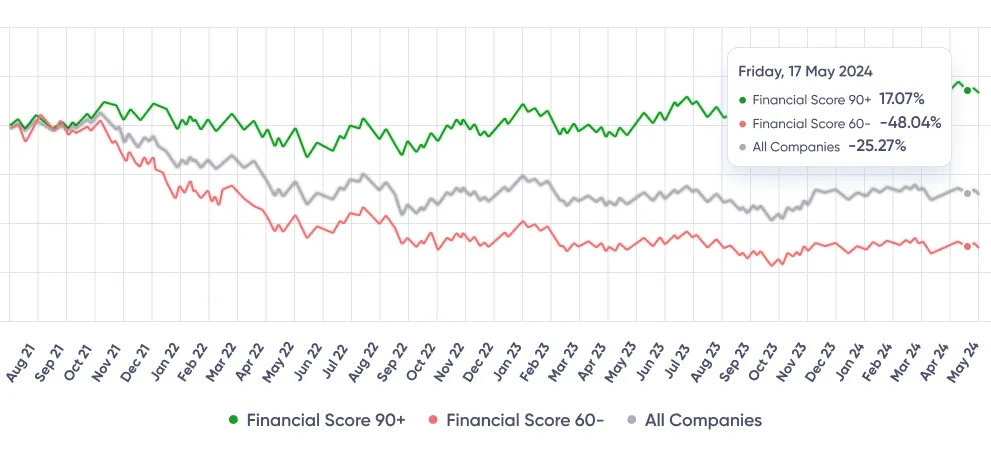

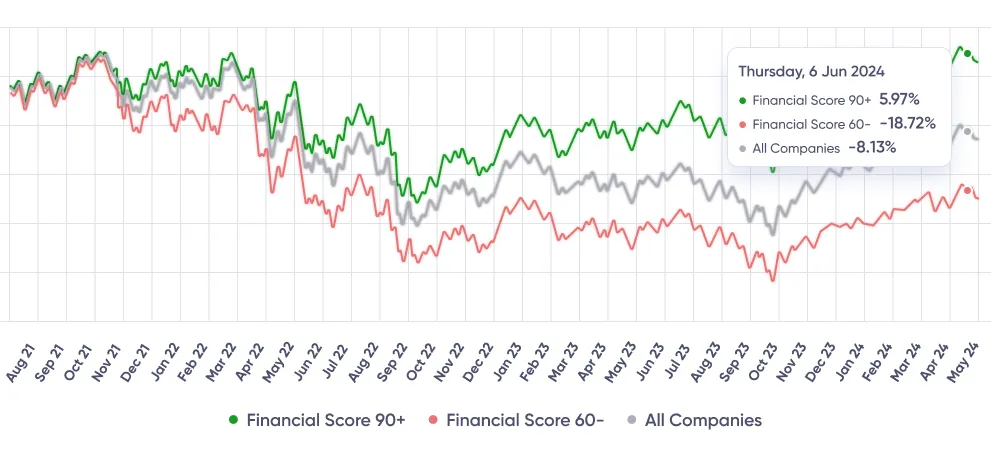

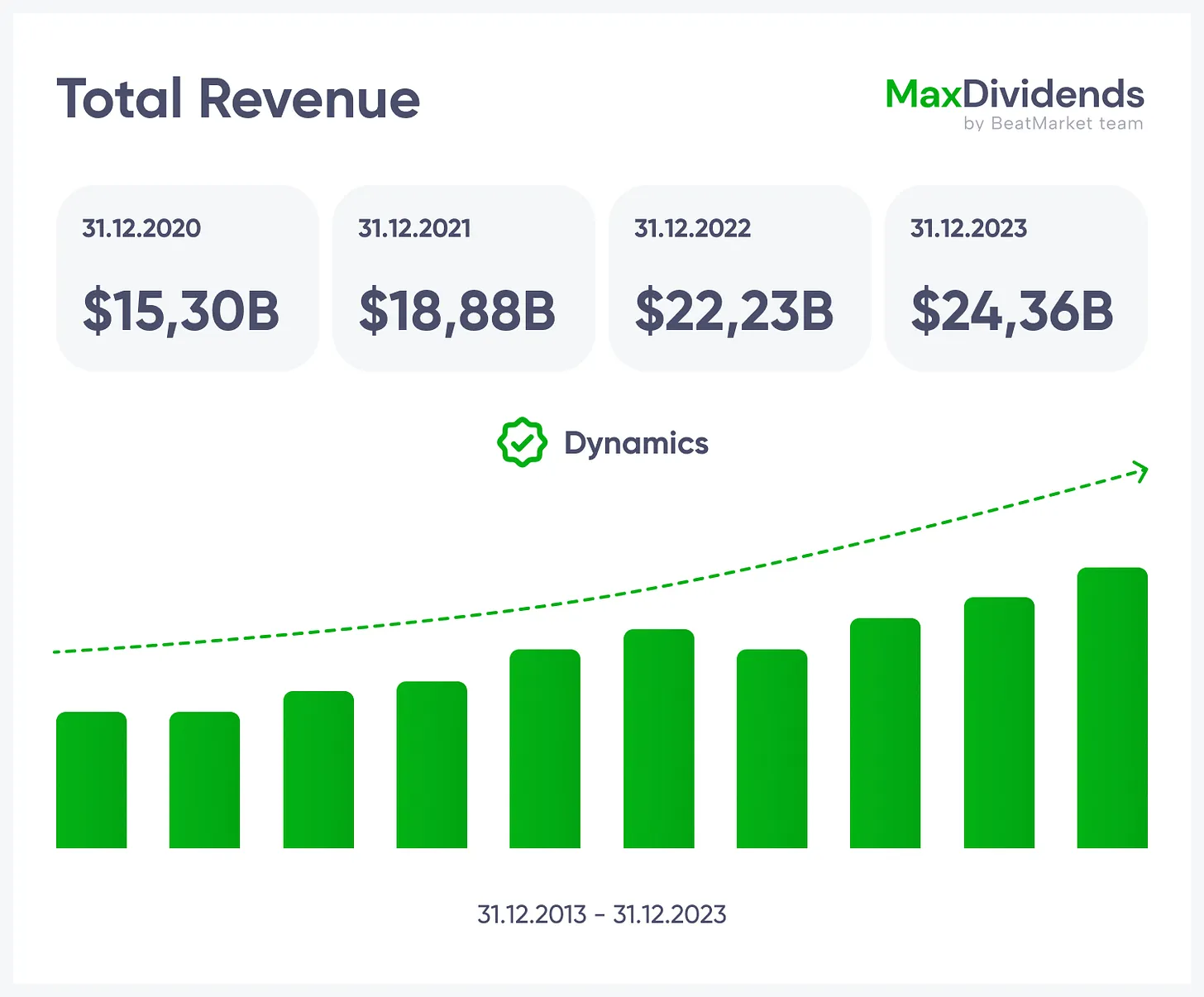

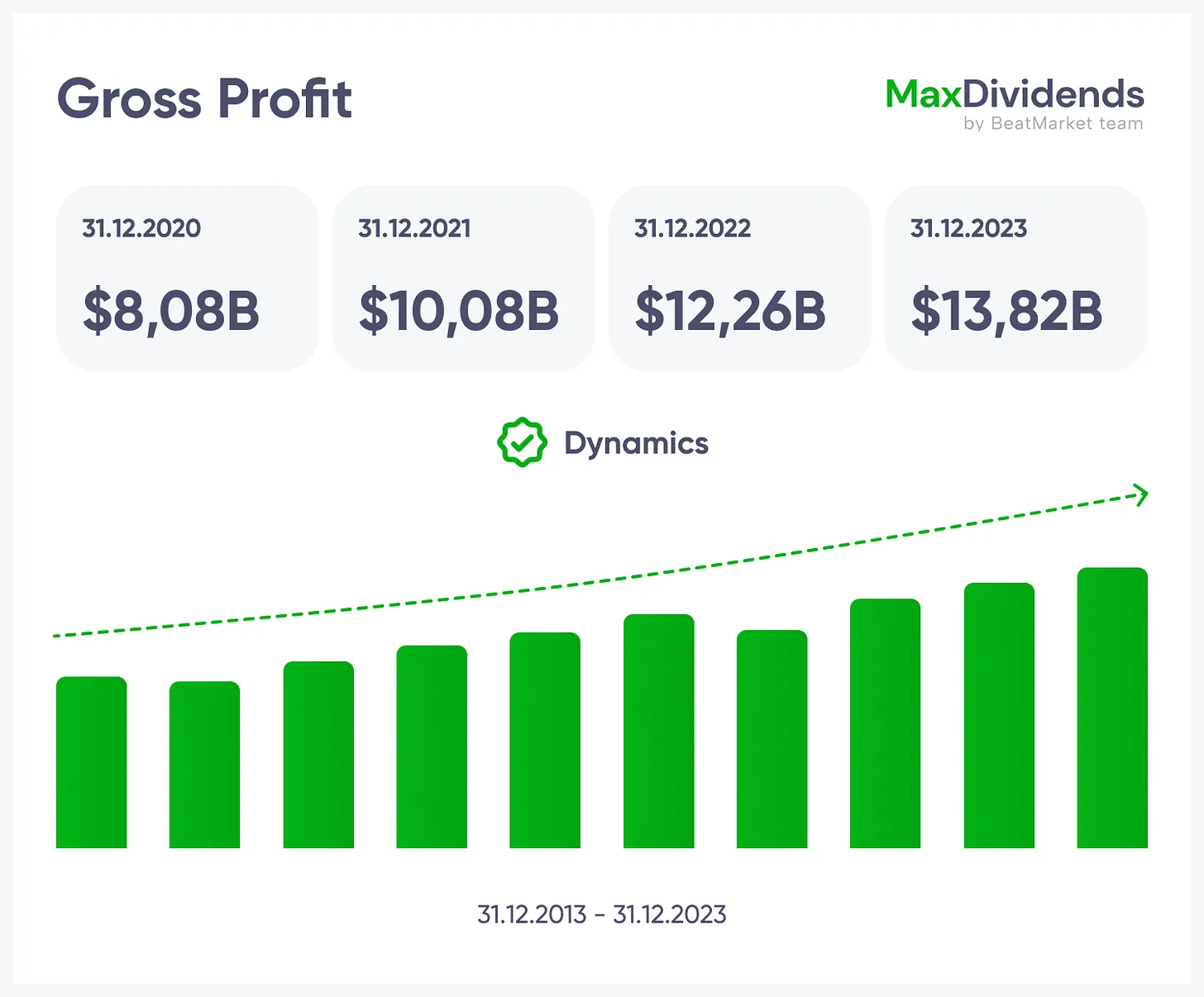

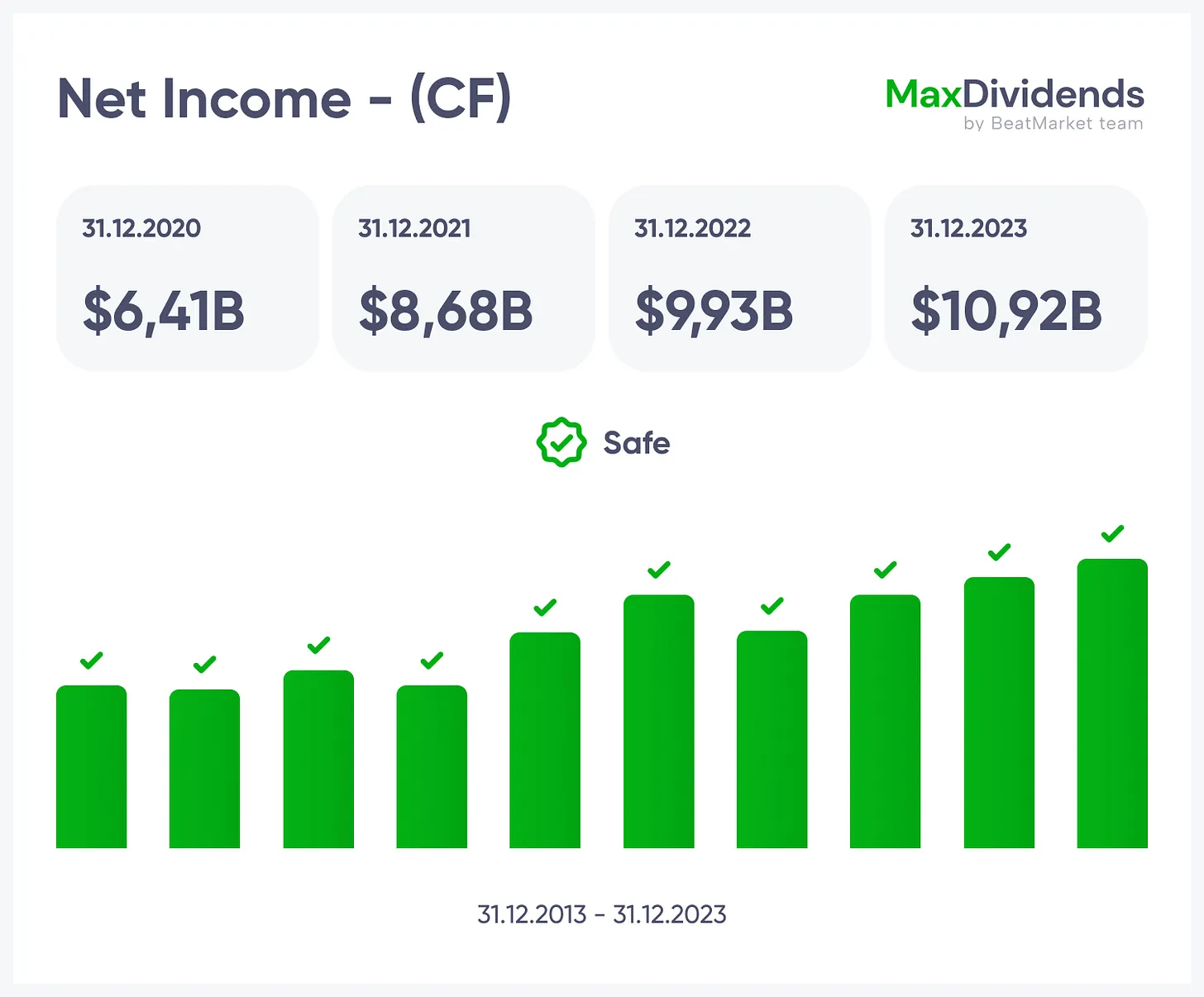

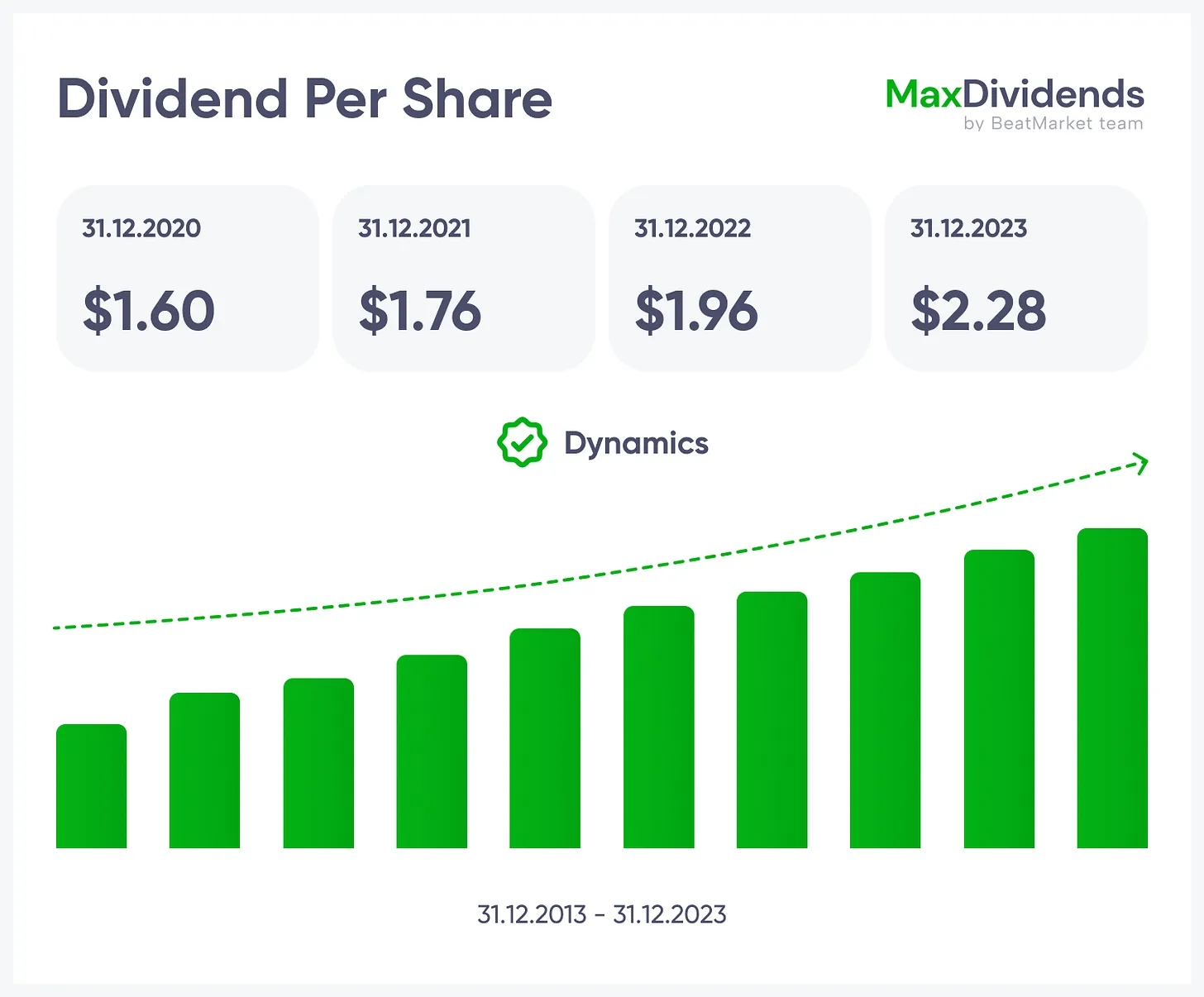

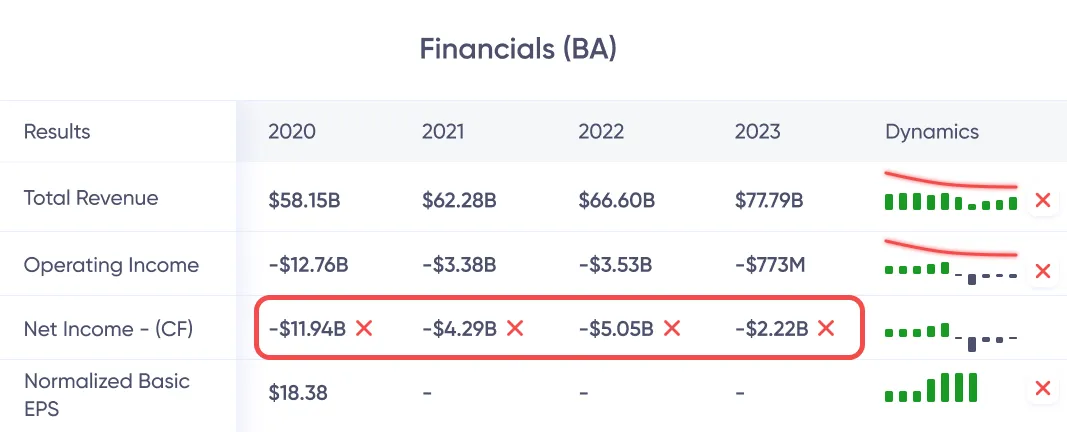

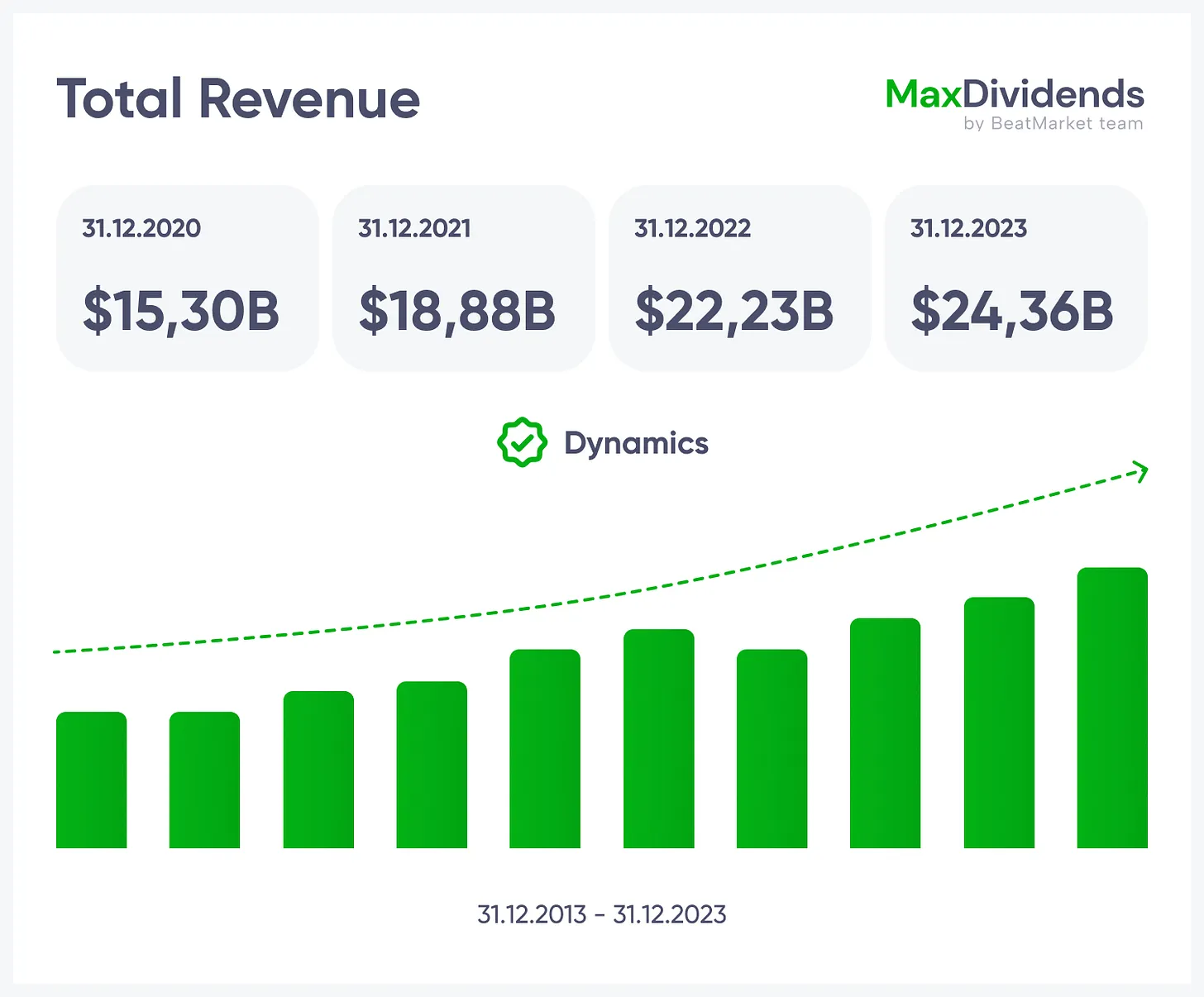

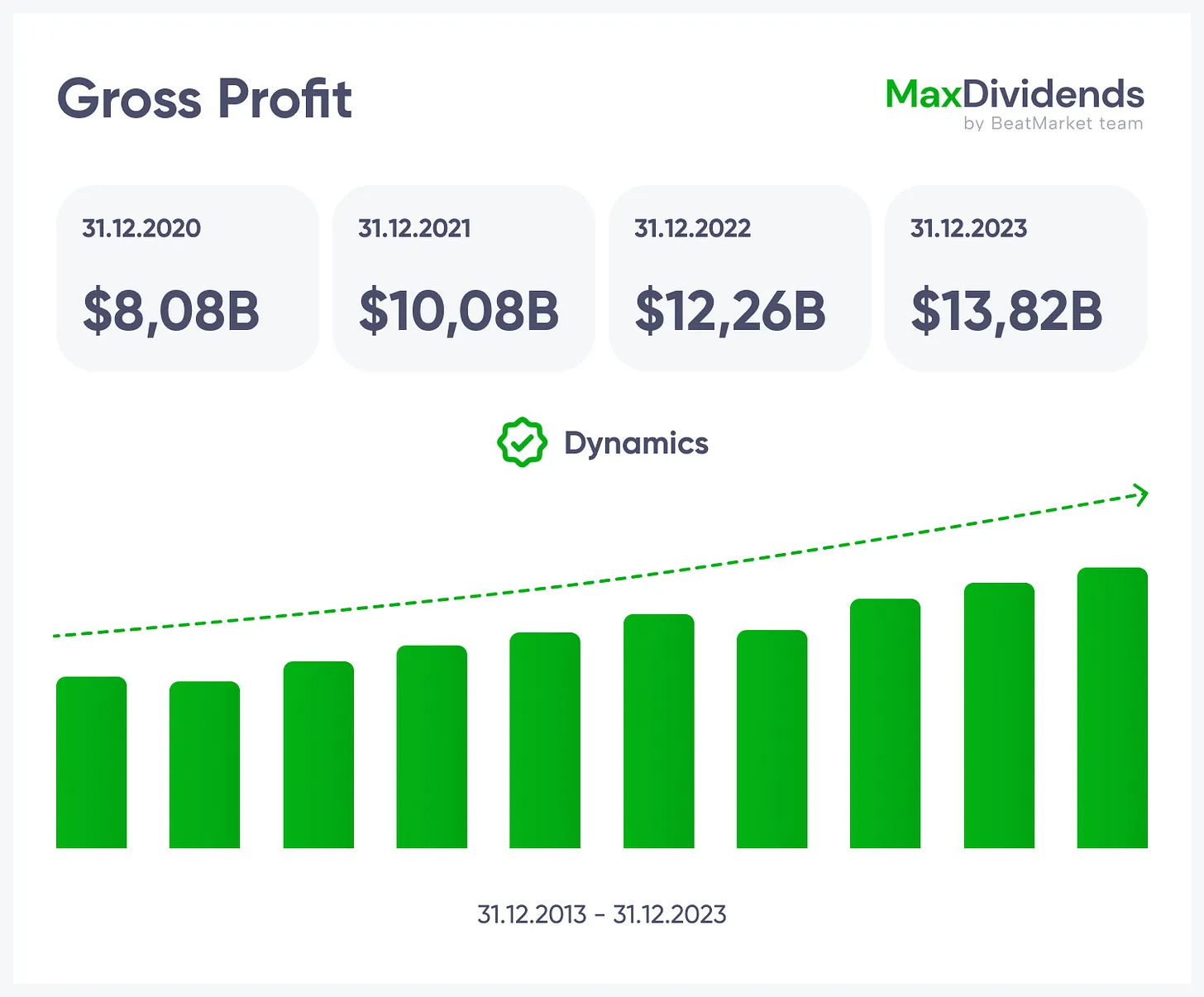

Viiden pilarin salainen kaavatarkistuslista on yksinkertainen, todistettu tapa erottaa vahvat, kestävät yritykset muista. Tarkastelemme viittä keskeistä pilaria — myynnin kasvu, tuloksen kasvu, nettotulos, osinkoturvallisuus ja velkatasot. Yhdessä Financial Scoren kanssa ne kertovat, voiko yritys jatkaa kasvua, pysyä taloudellisesti vakaana ja maksaa osinkoja luotettavasti vuosikymmeniä.Kokonaistulot 1NX

Bruttovoitto / Käyttökate 1NX

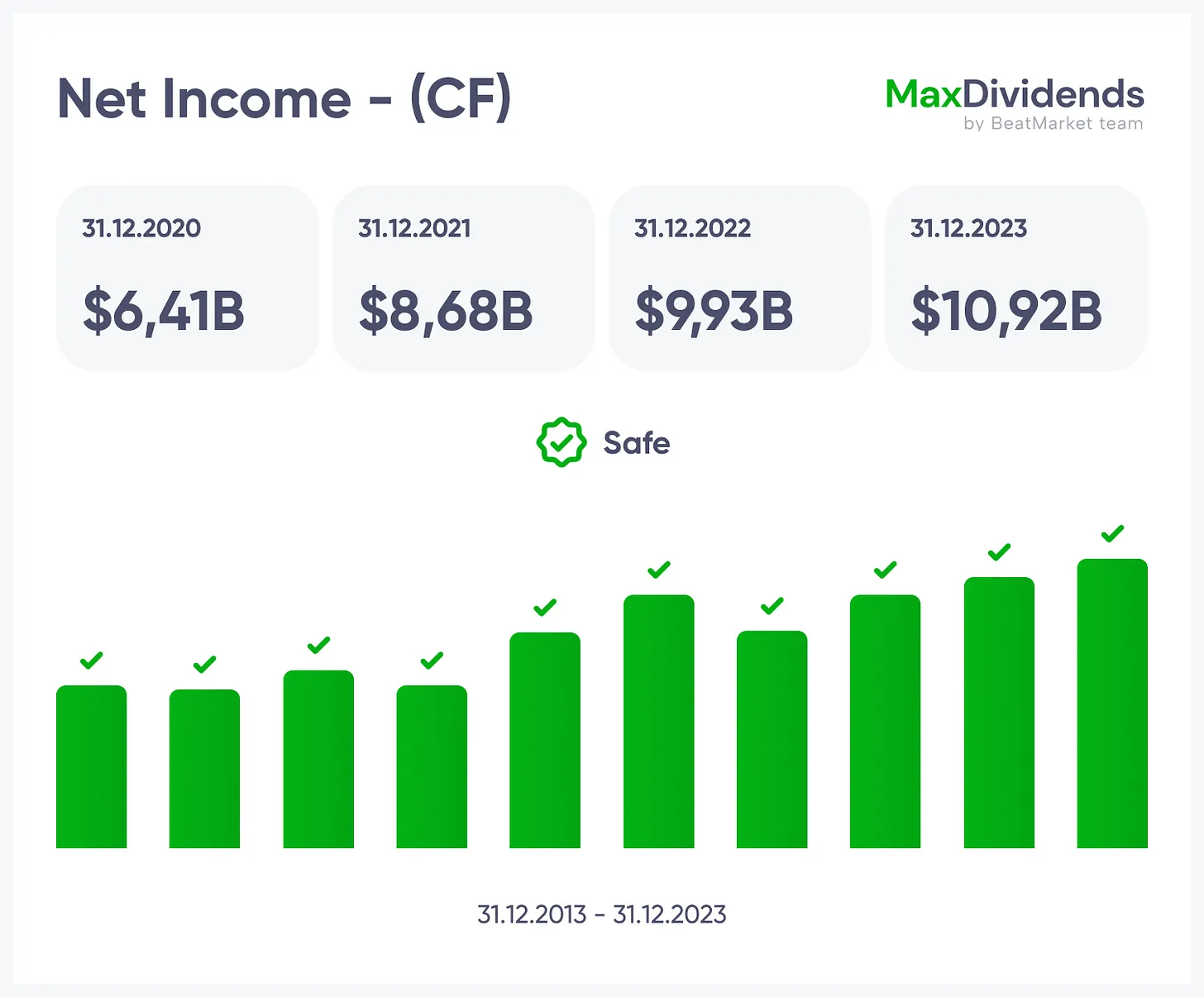

Nettotulos 1NX

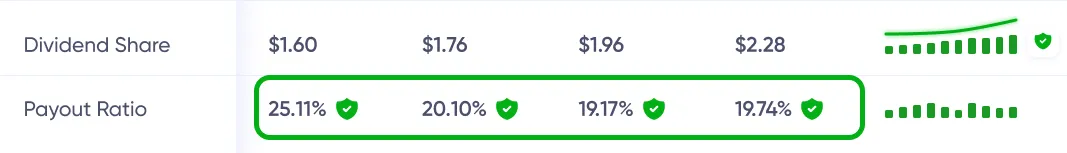

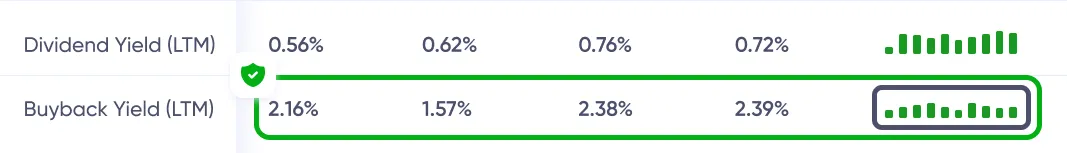

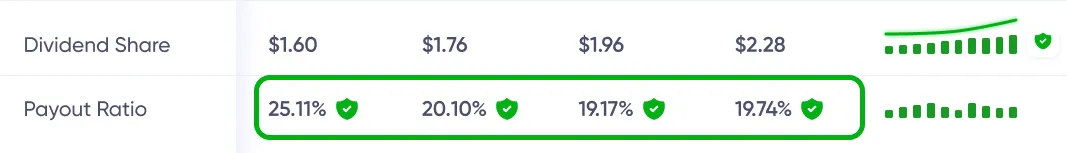

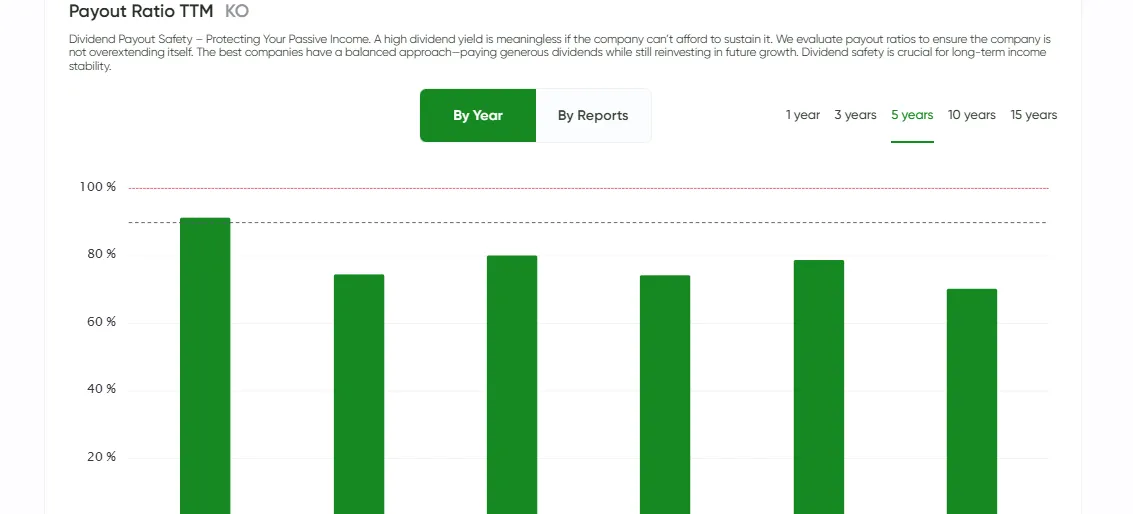

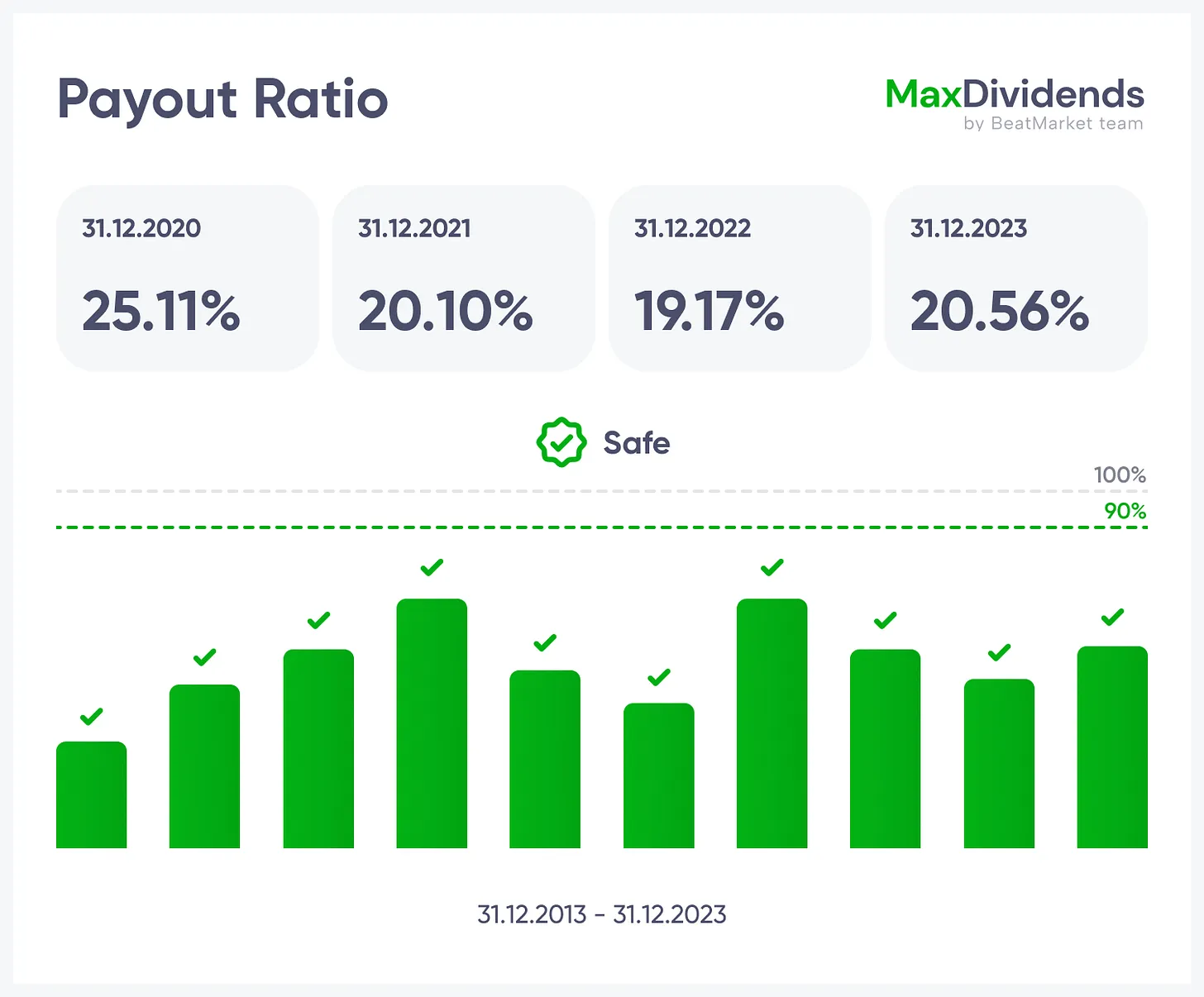

Maksusuhde 1NX

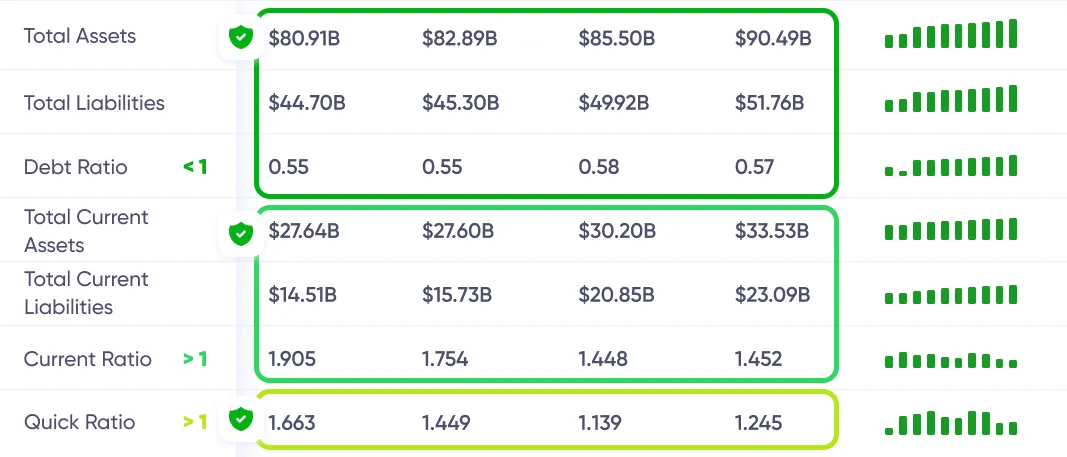

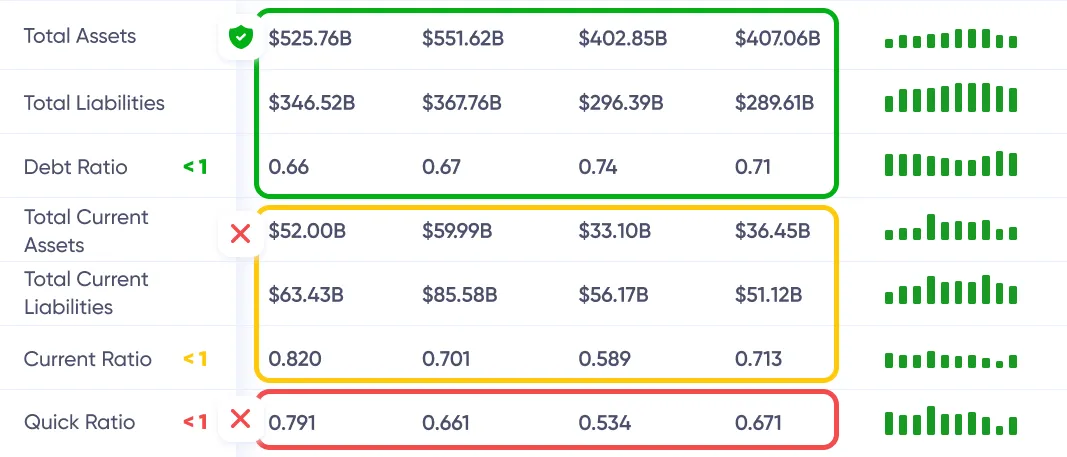

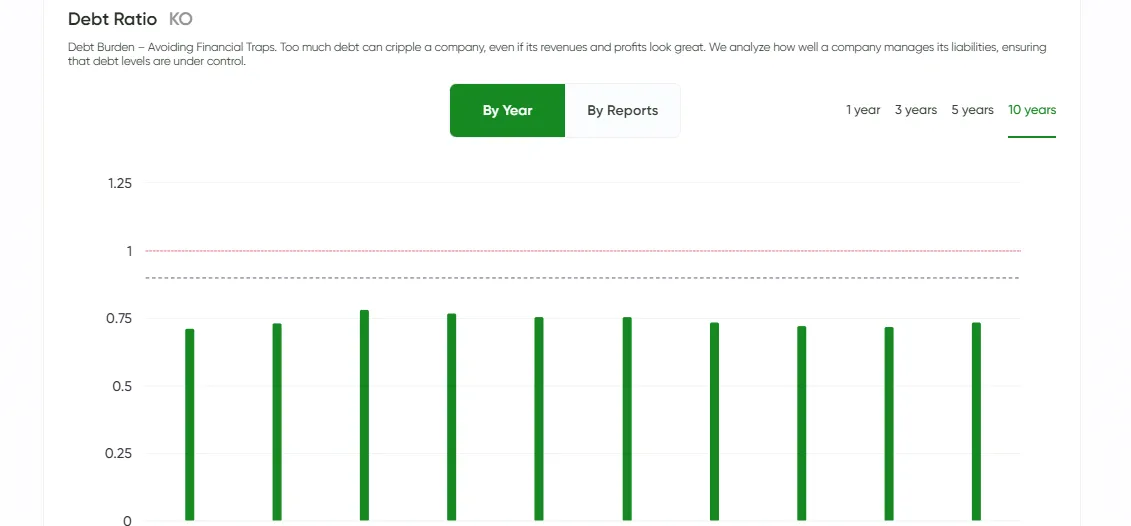

Velkasuhde 1NX

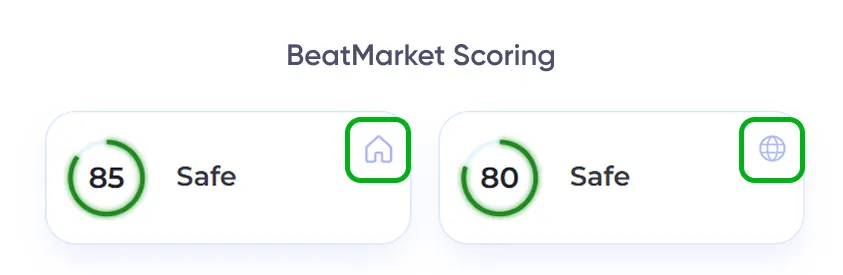

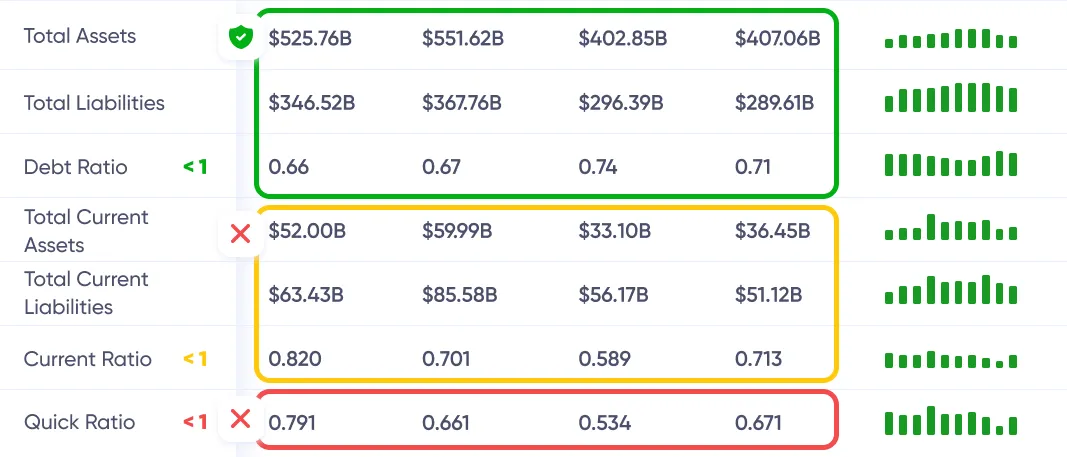

Talousasiat

Stomil Sanok SA 1NX

| Tuloksia | 2019 | Dynamiikka |

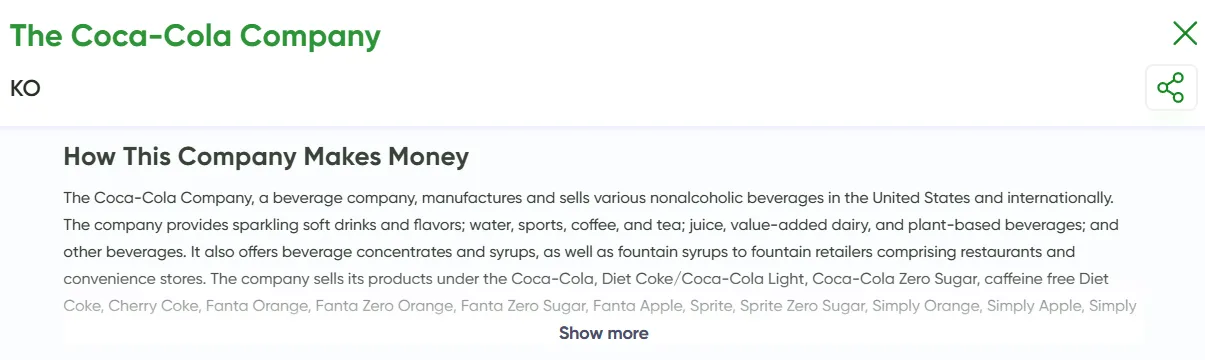

Näe koko liiketoiminta yhdellä silmäyksellä — mitä se tekee, kuinka se ansaitsee ja minkä arvon se tuo.

Näe koko liiketoiminta yhdellä silmäyksellä — mitä se tekee, kuinka se ansaitsee ja minkä arvon se tuo.

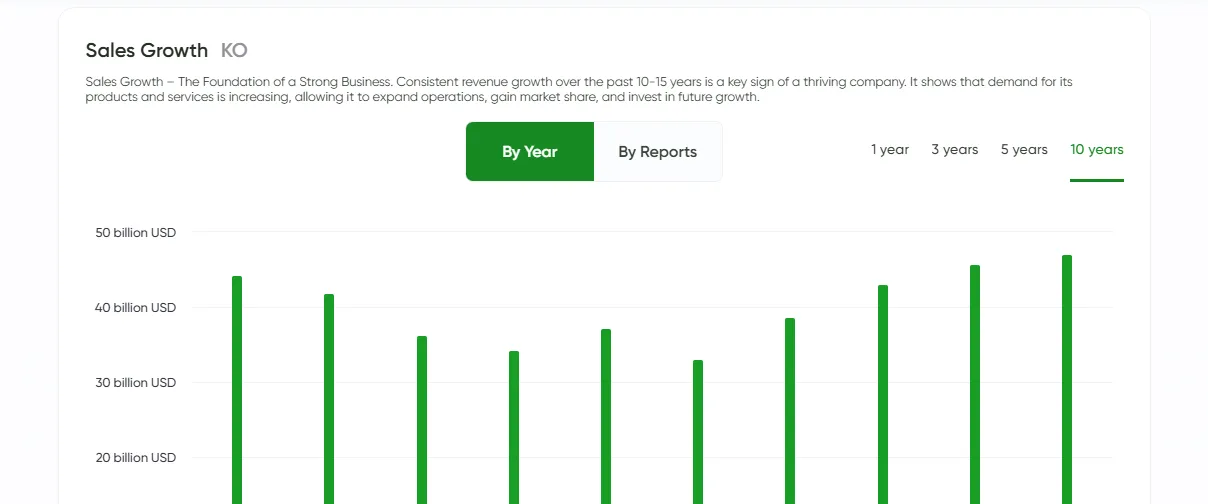

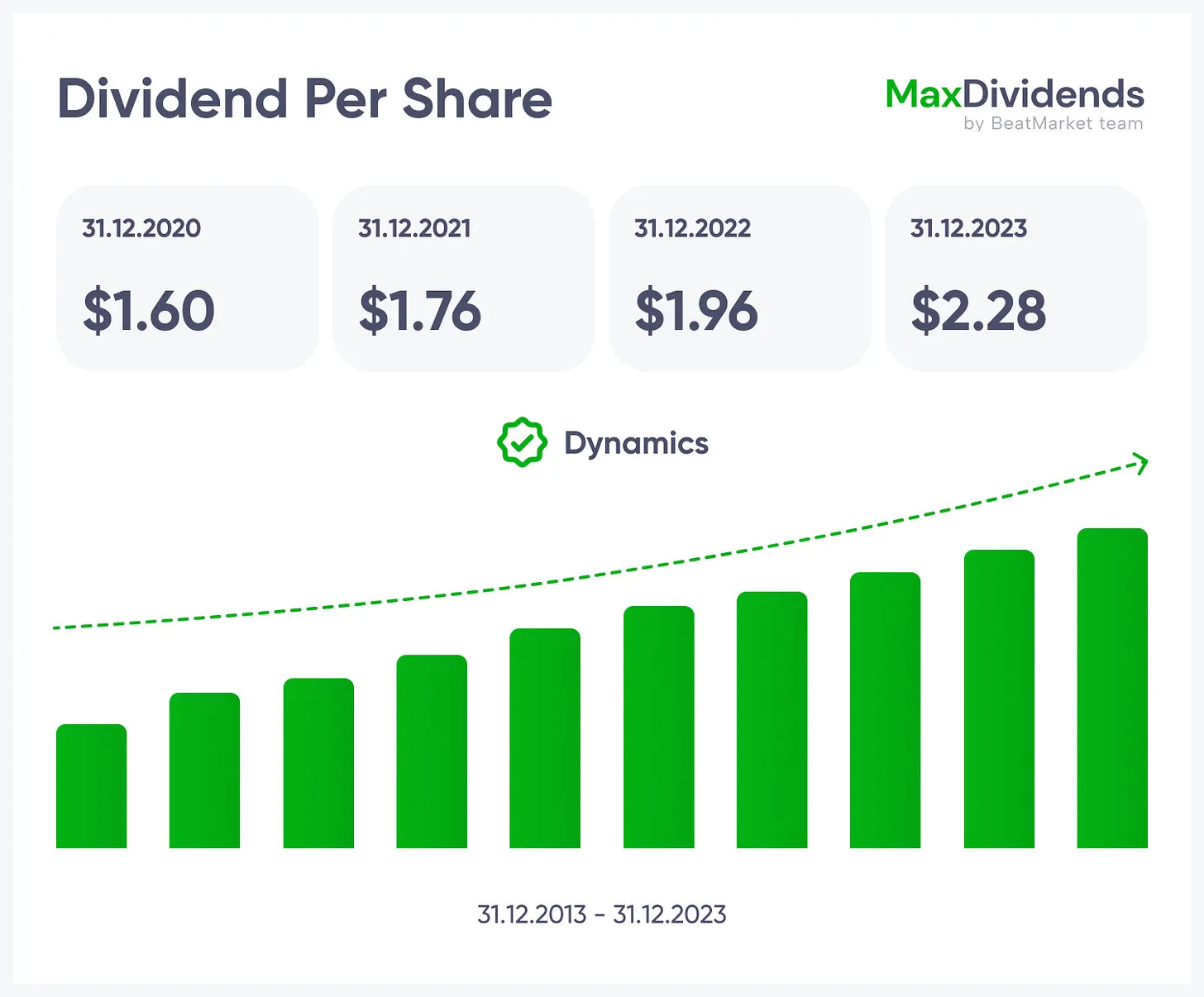

Kasvutrendi, selvä yhdellä silmäyksellä.

Kasvutrendi, selvä yhdellä silmäyksellä.

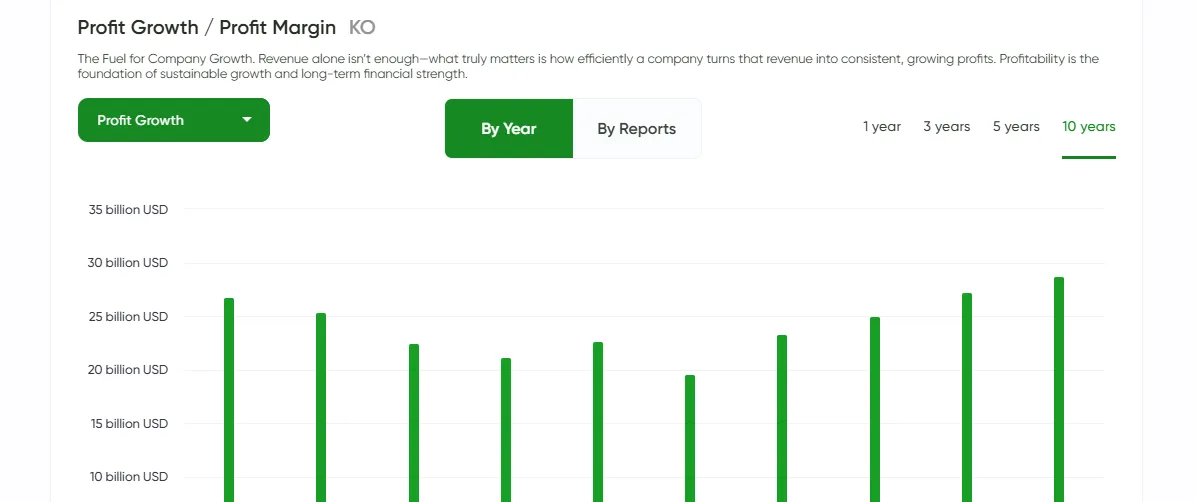

Näe, ovatko tulokset todellisia — välittömästi.

Näe, ovatko tulokset todellisia — välittömästi.

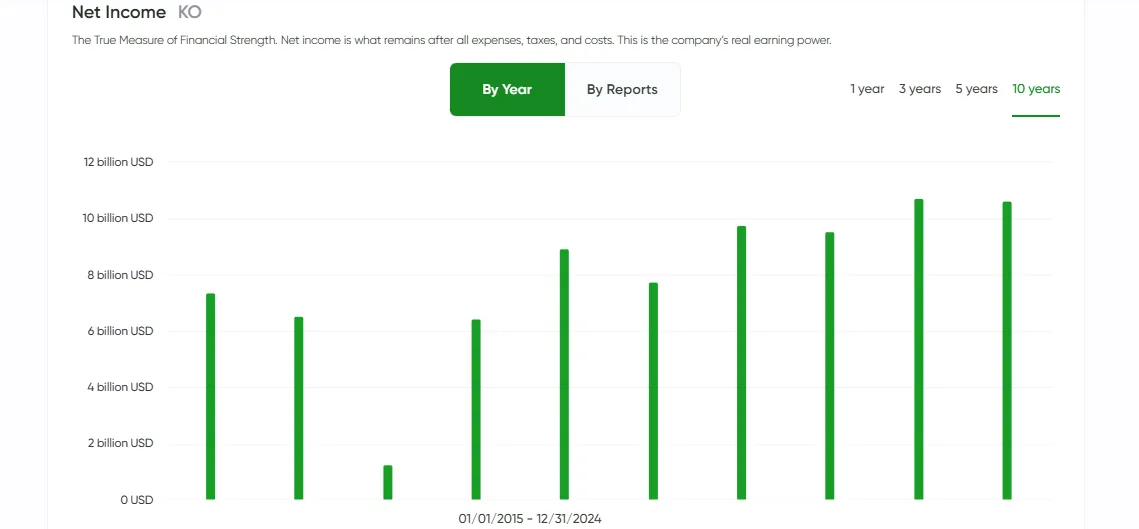

Bottom line tehty yksinkertaiseksi MaxDividendsillä.

Bottom line tehty yksinkertaiseksi MaxDividendsillä.

Velkariski tarkistettu puolestasi, 24/7.

Velkariski tarkistettu puolestasi, 24/7.

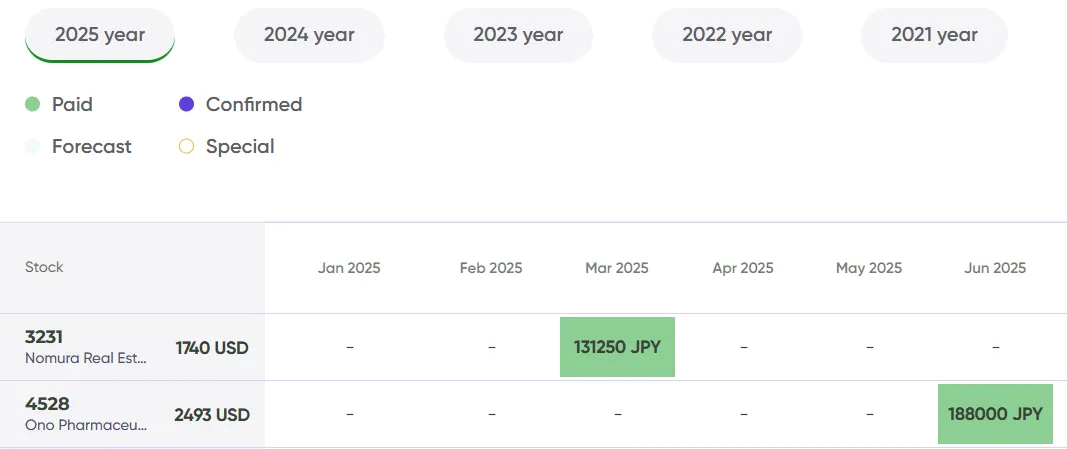

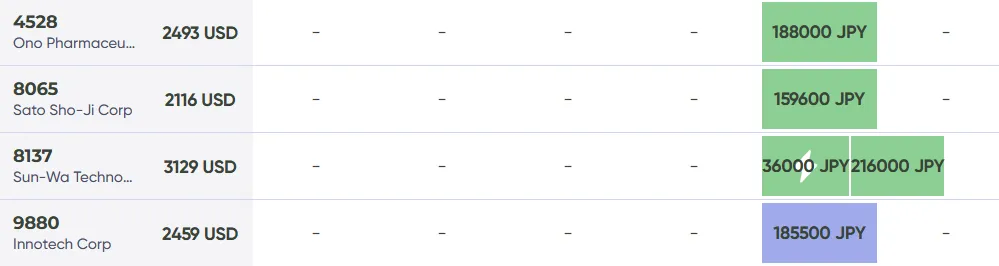

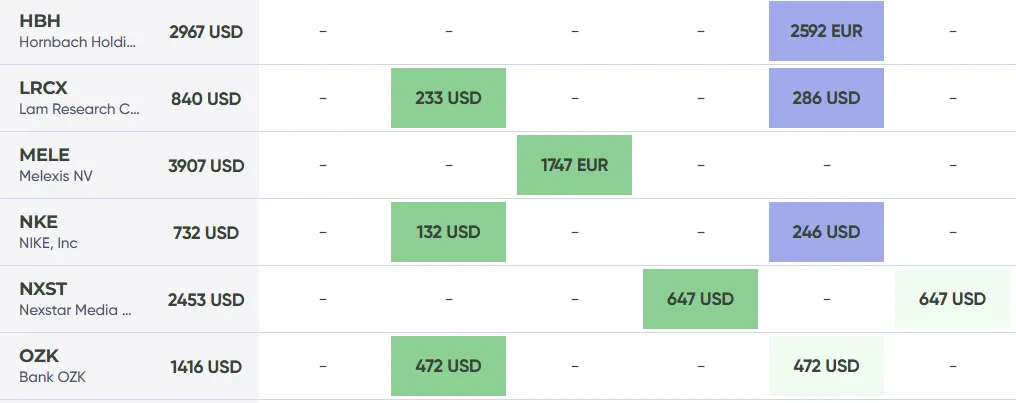

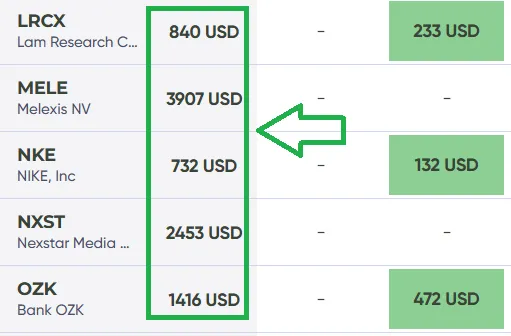

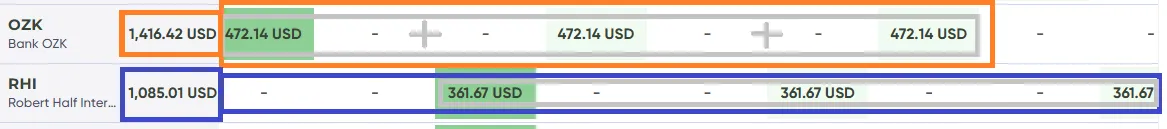

Osinkoputket ja -korotukset käytettävissäsi.

Osinkoputket ja -korotukset käytettävissäsi.

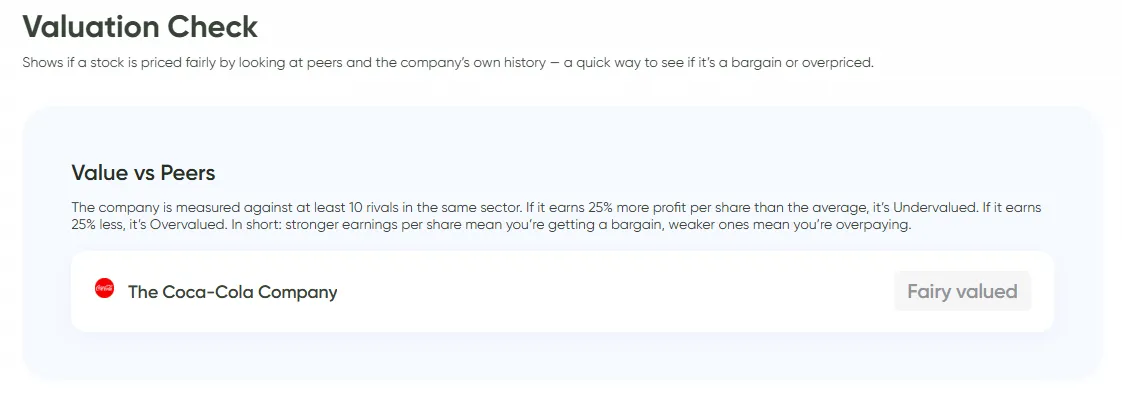

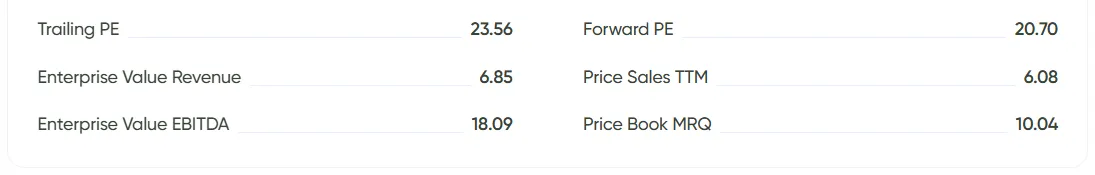

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

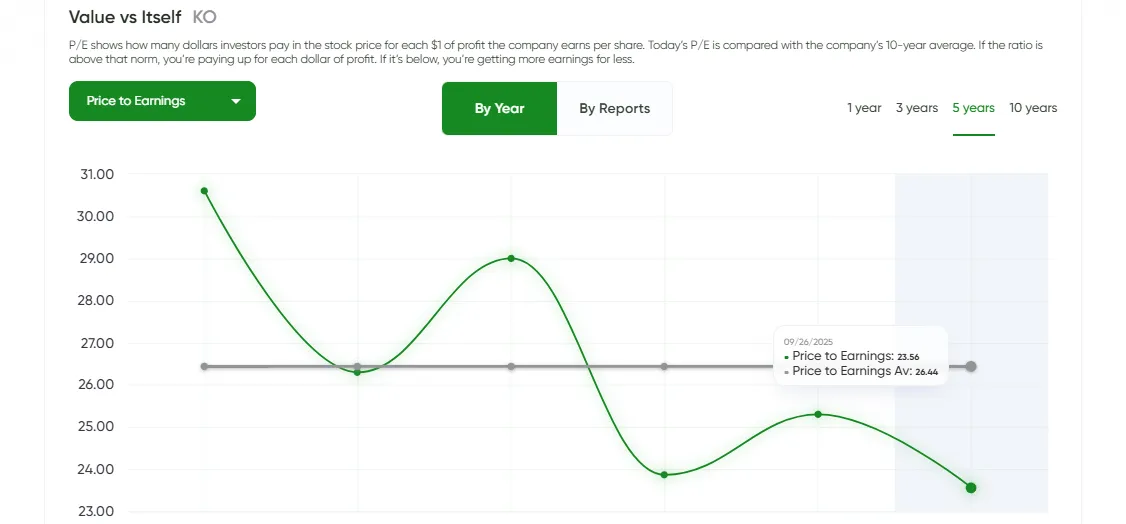

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

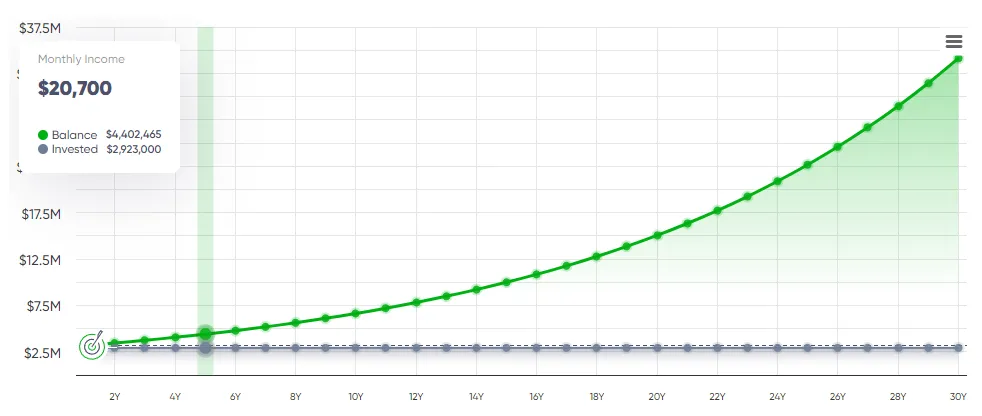

MaxDividends-sovellus: Passiivisen tulon laskuri

MaxDividends-sovellus: Passiivisen tulon laskuri

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

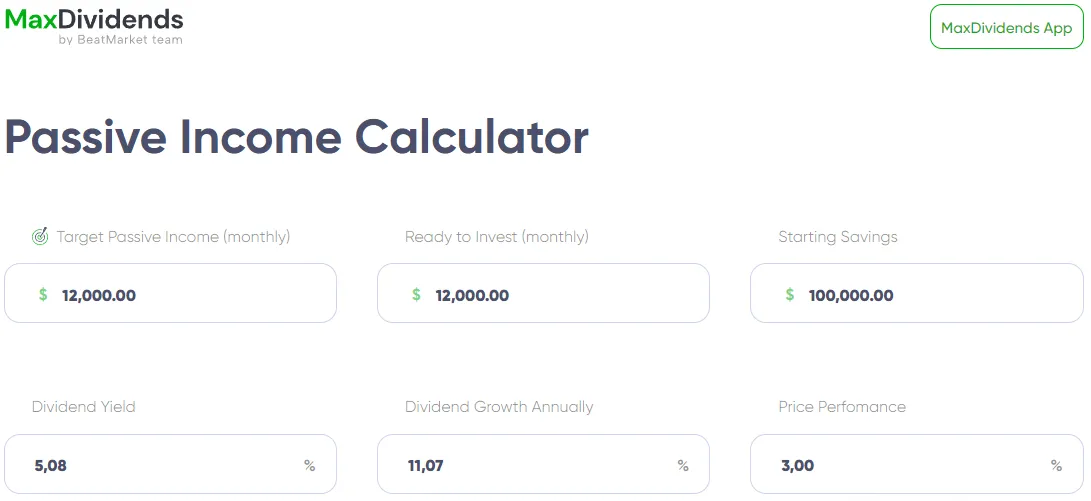

MaxDividends-sovellus: Passiivisen tulon laskuri

MaxDividends-sovellus: Passiivisen tulon laskuri

MaxDividends-sovellus: Passiivisen tulon laskuri

MaxDividends-sovellus: Passiivisen tulon laskuri

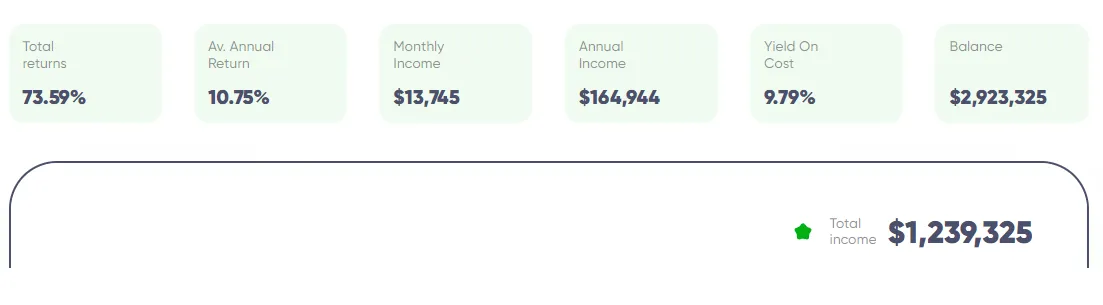

MaxDividends-sovellus: Passiivisen tulon laskuri, Tulon ennuste

MaxDividends-sovellus: Passiivisen tulon laskuri, Tulon ennuste

BeatStart

BeatStart