Précisez une action ou une cryptomonnaie dans la barre de recherche pour obtenir un récapitulatif

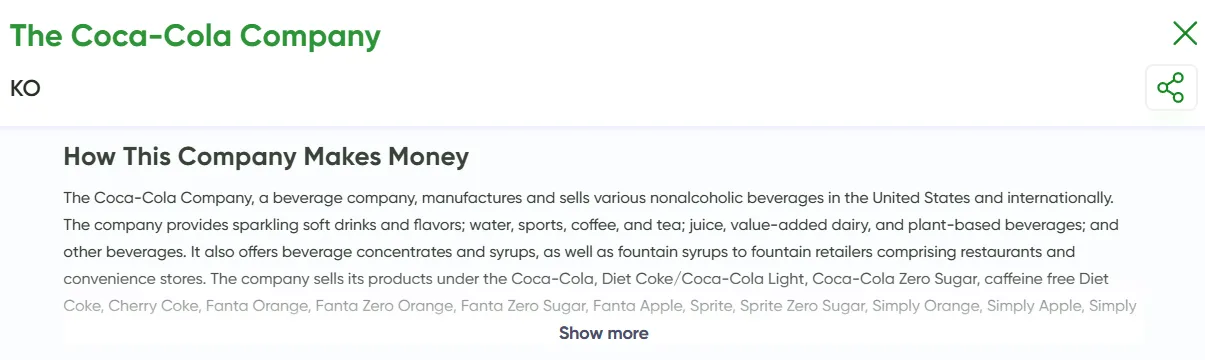

Comment Cette Entreprise Gagne de l'Argent

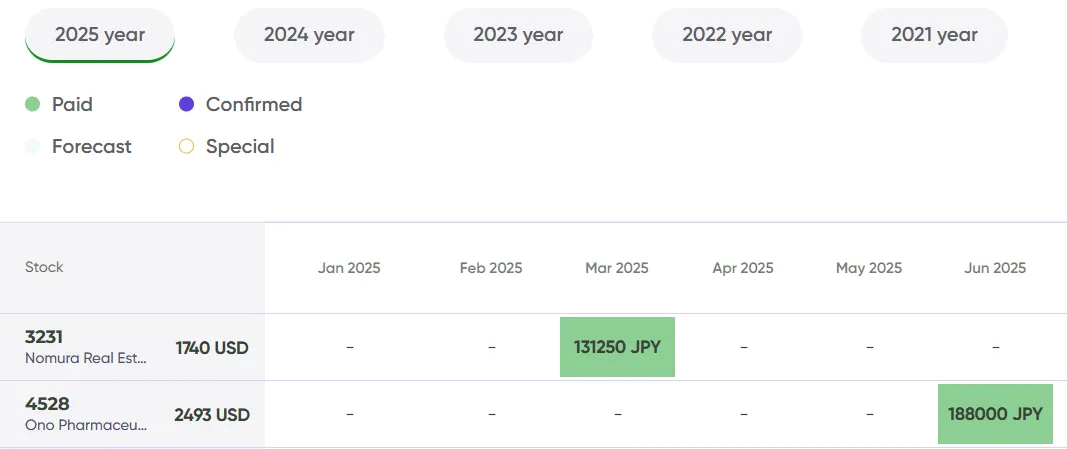

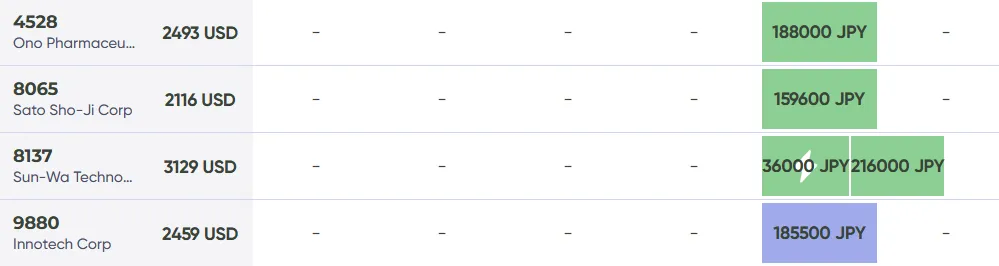

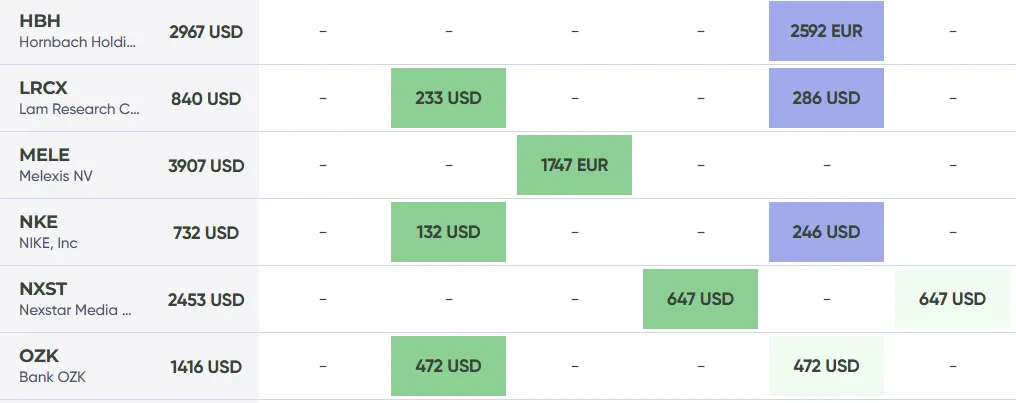

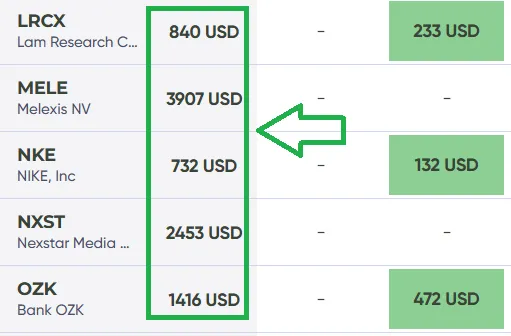

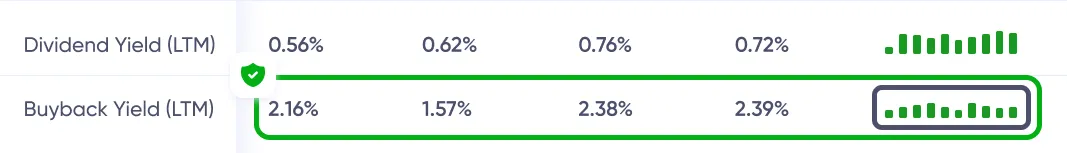

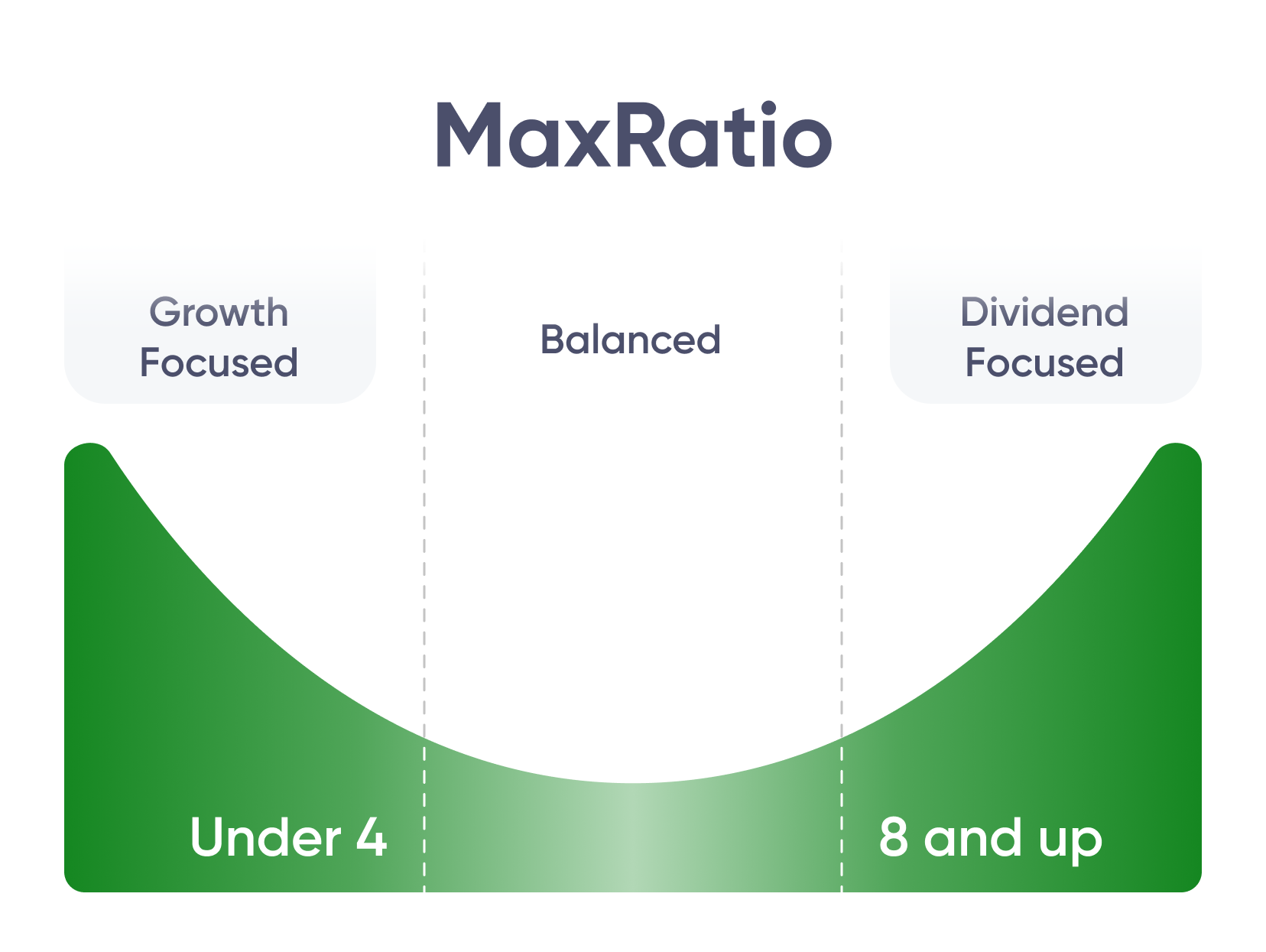

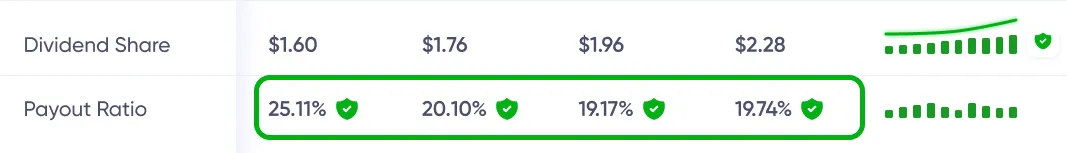

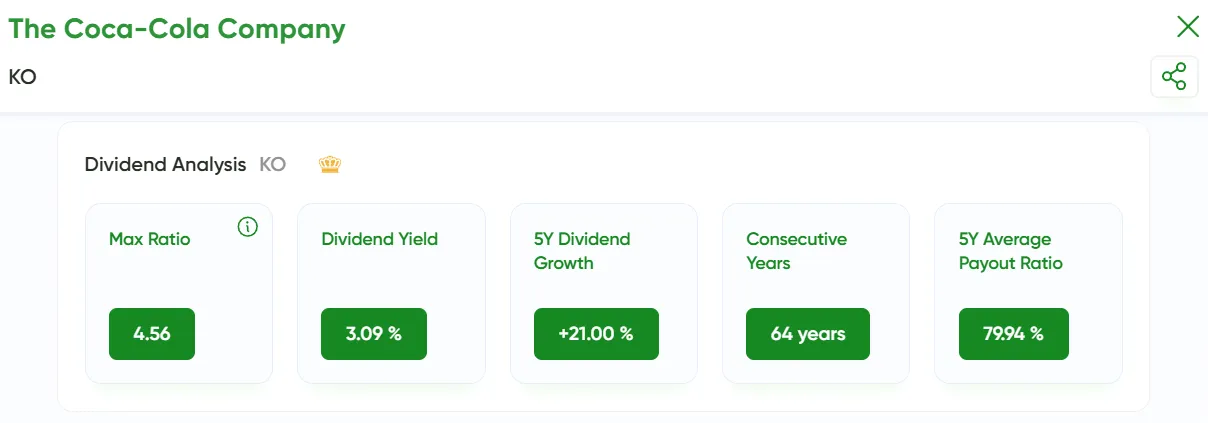

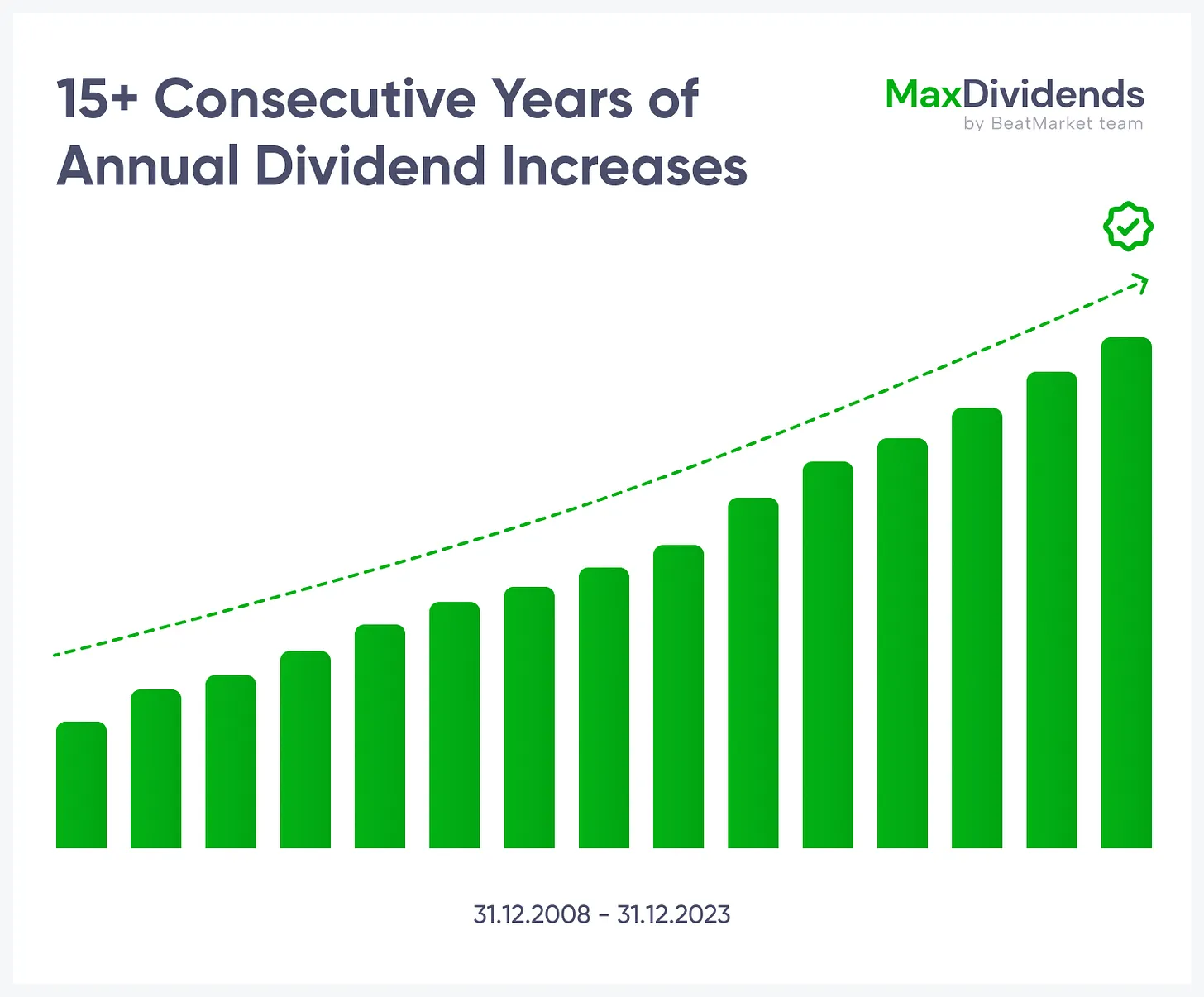

Analyse des dividendes 42H

Max Ratio

4.52Rendement du dividende

1.36 %Croissance des dividendes sur 5 ans

94.00 %Croissance continue

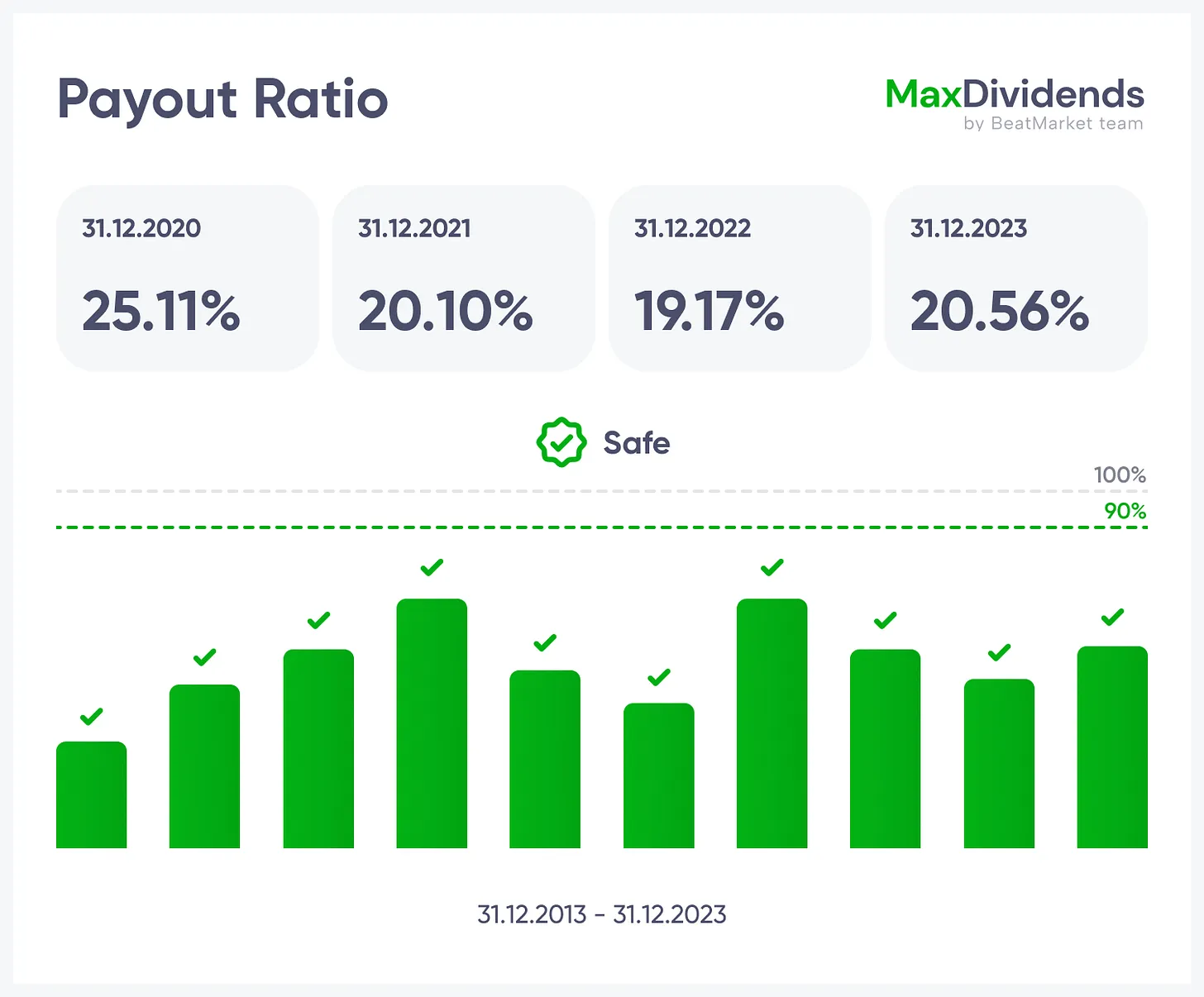

3 annéesRatio de distribution Moyenne sur 5 ans

21.69 %Historique des dividendes 42H

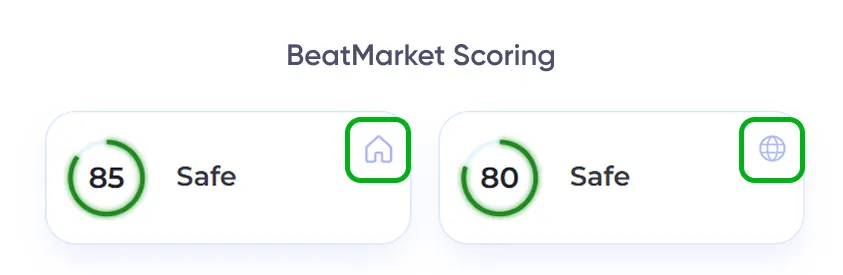

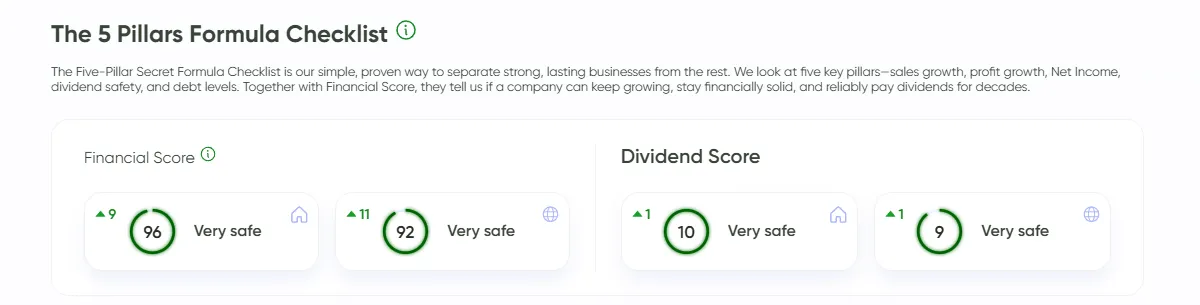

La Liste de Contrôle de la Formule à 5 Piliers

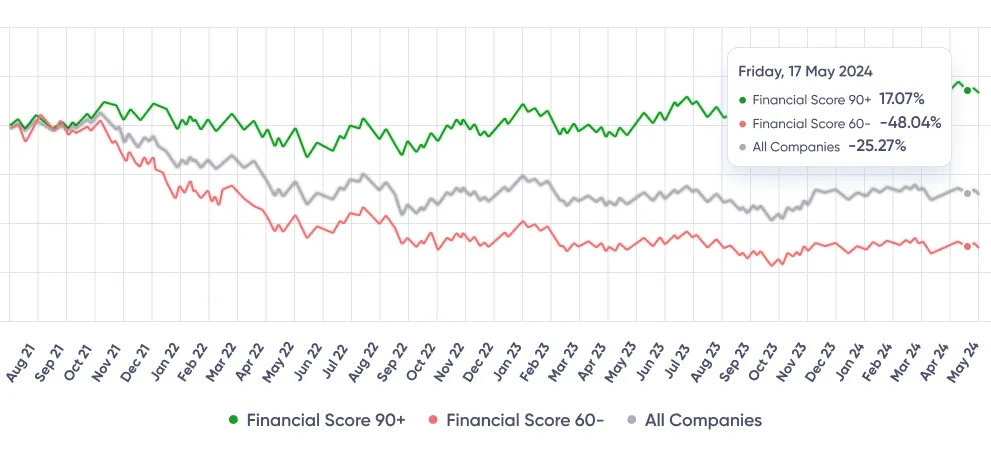

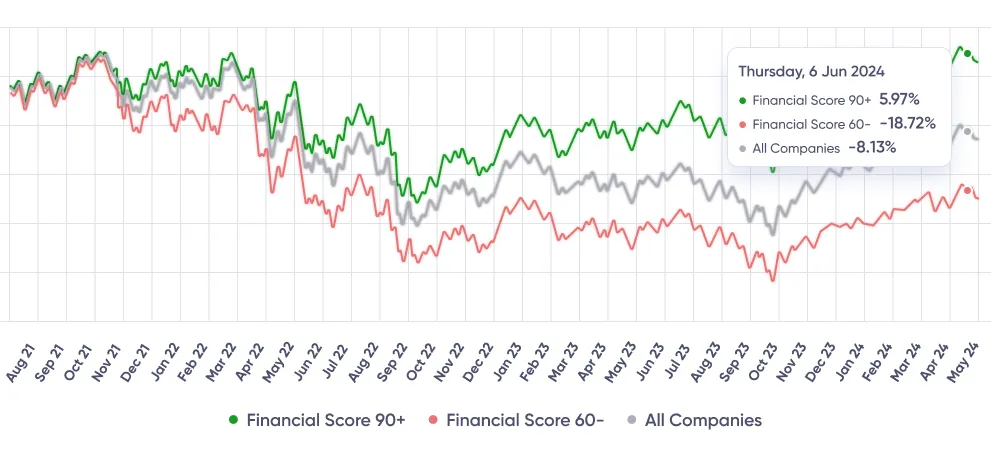

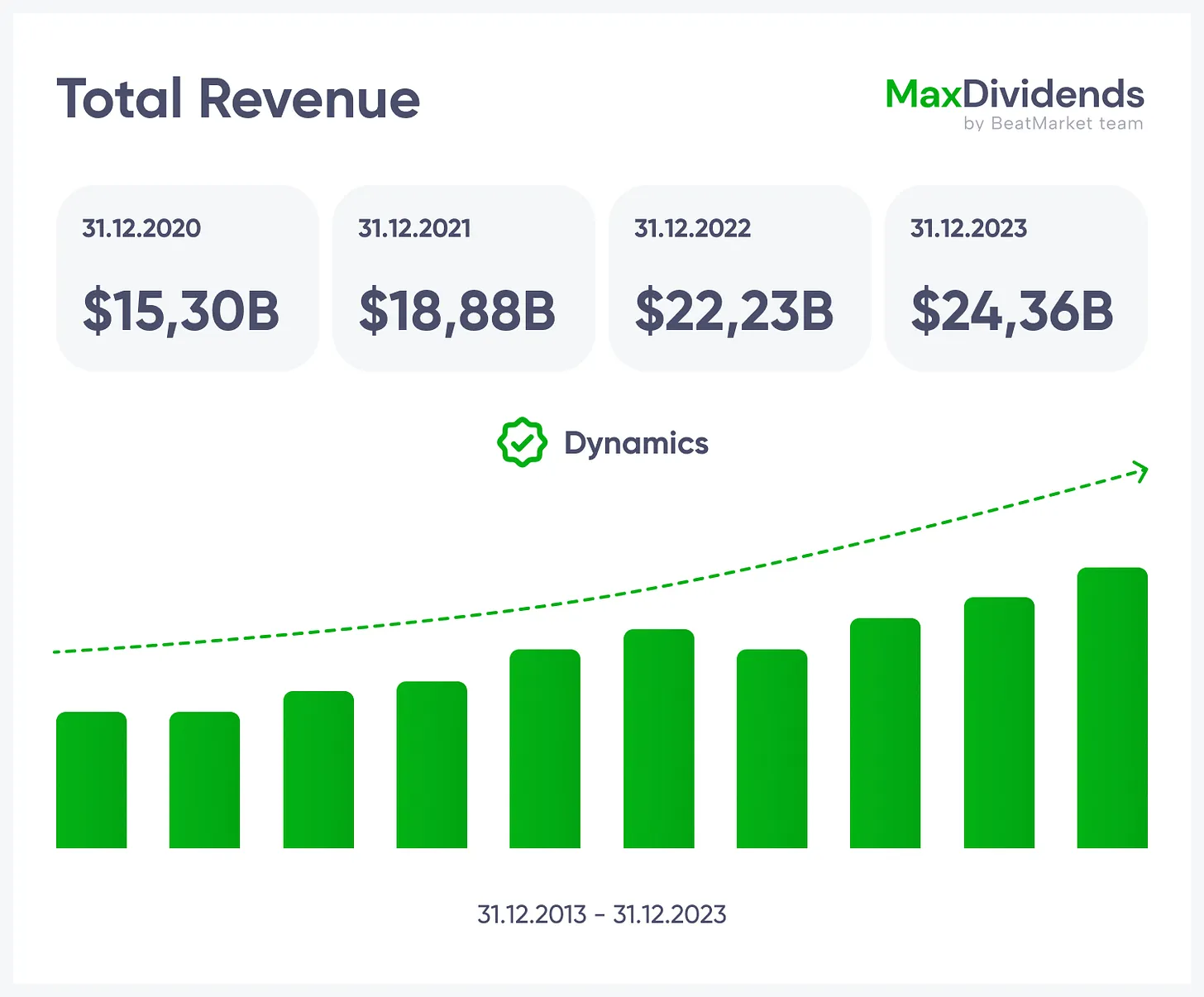

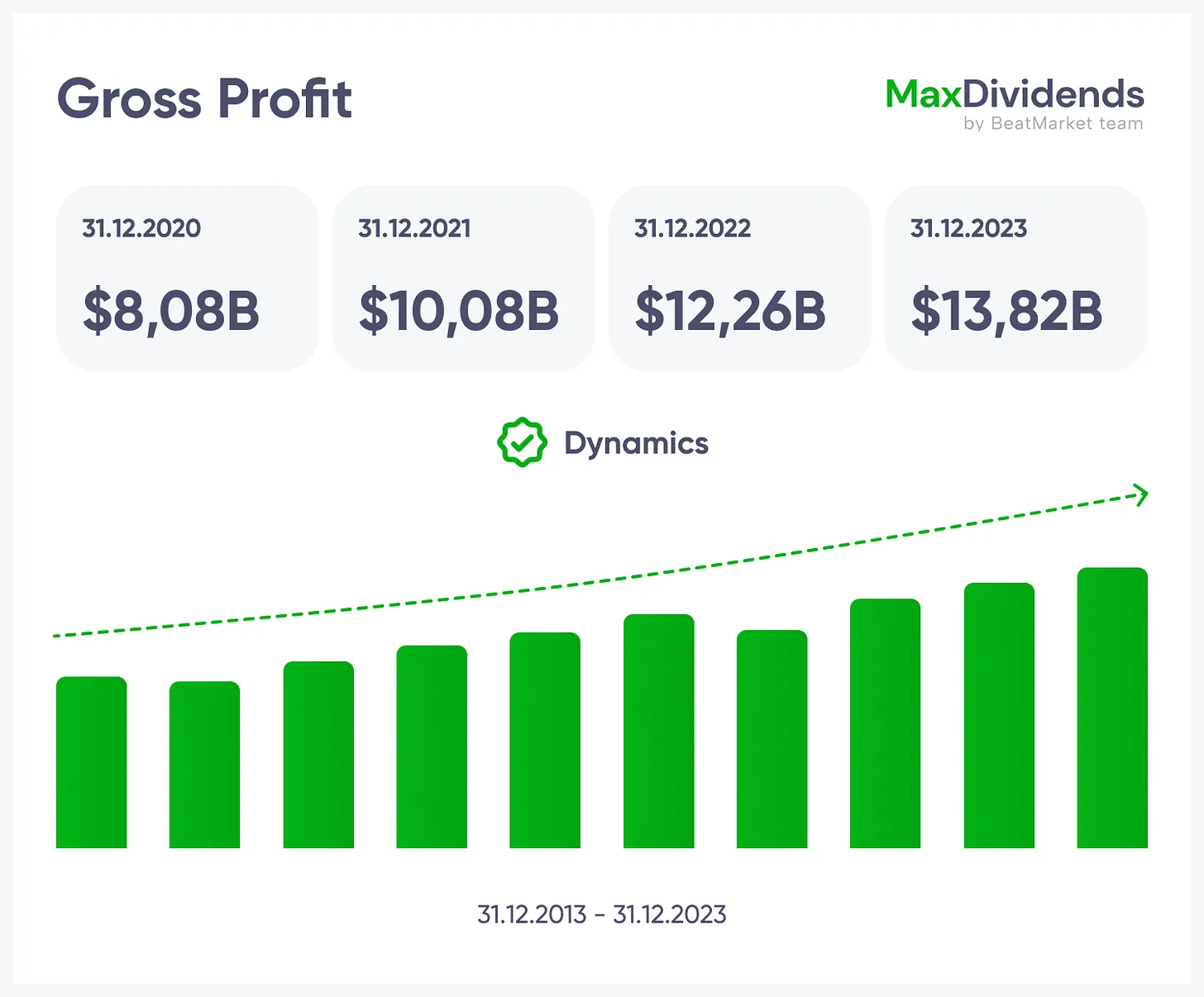

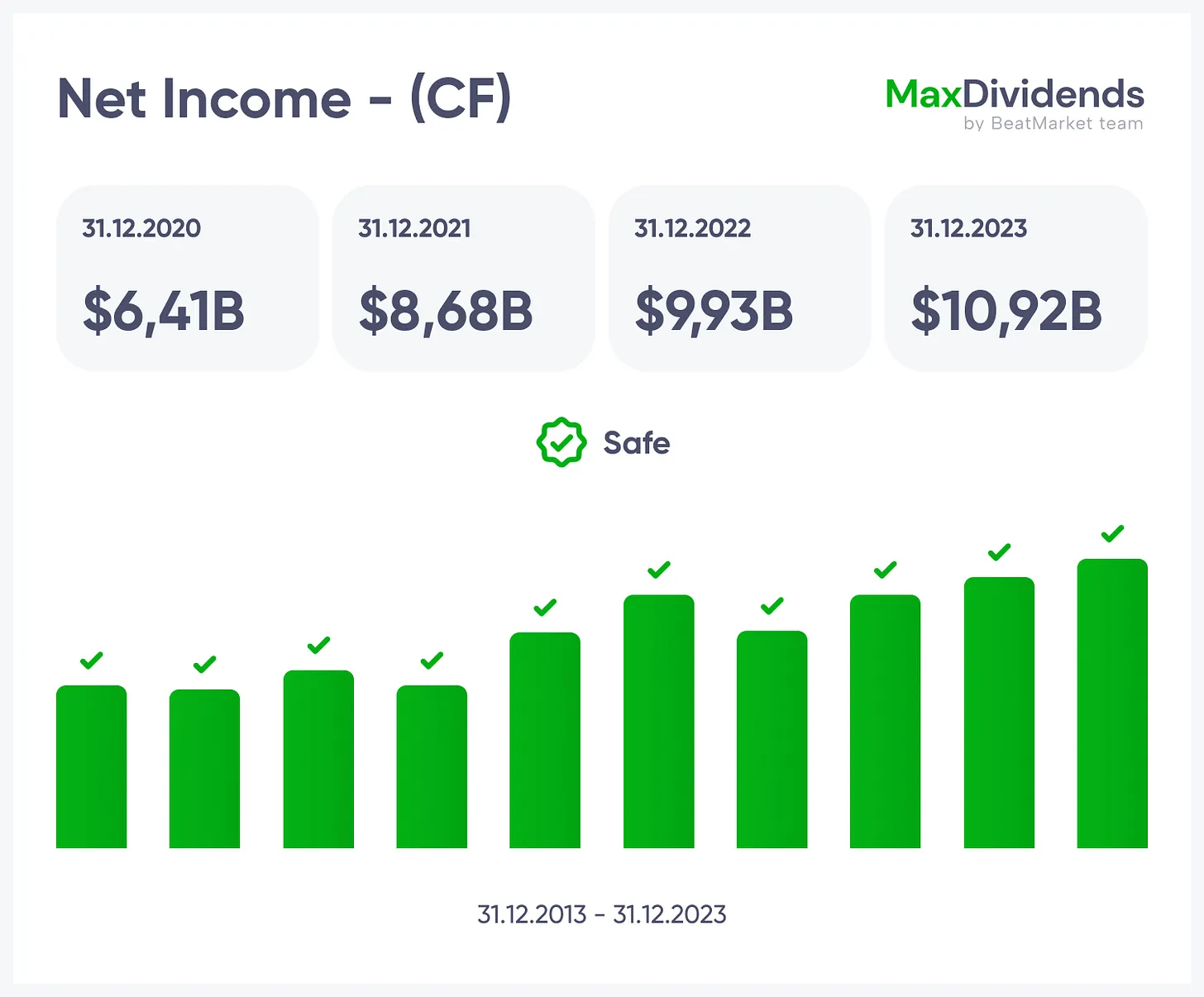

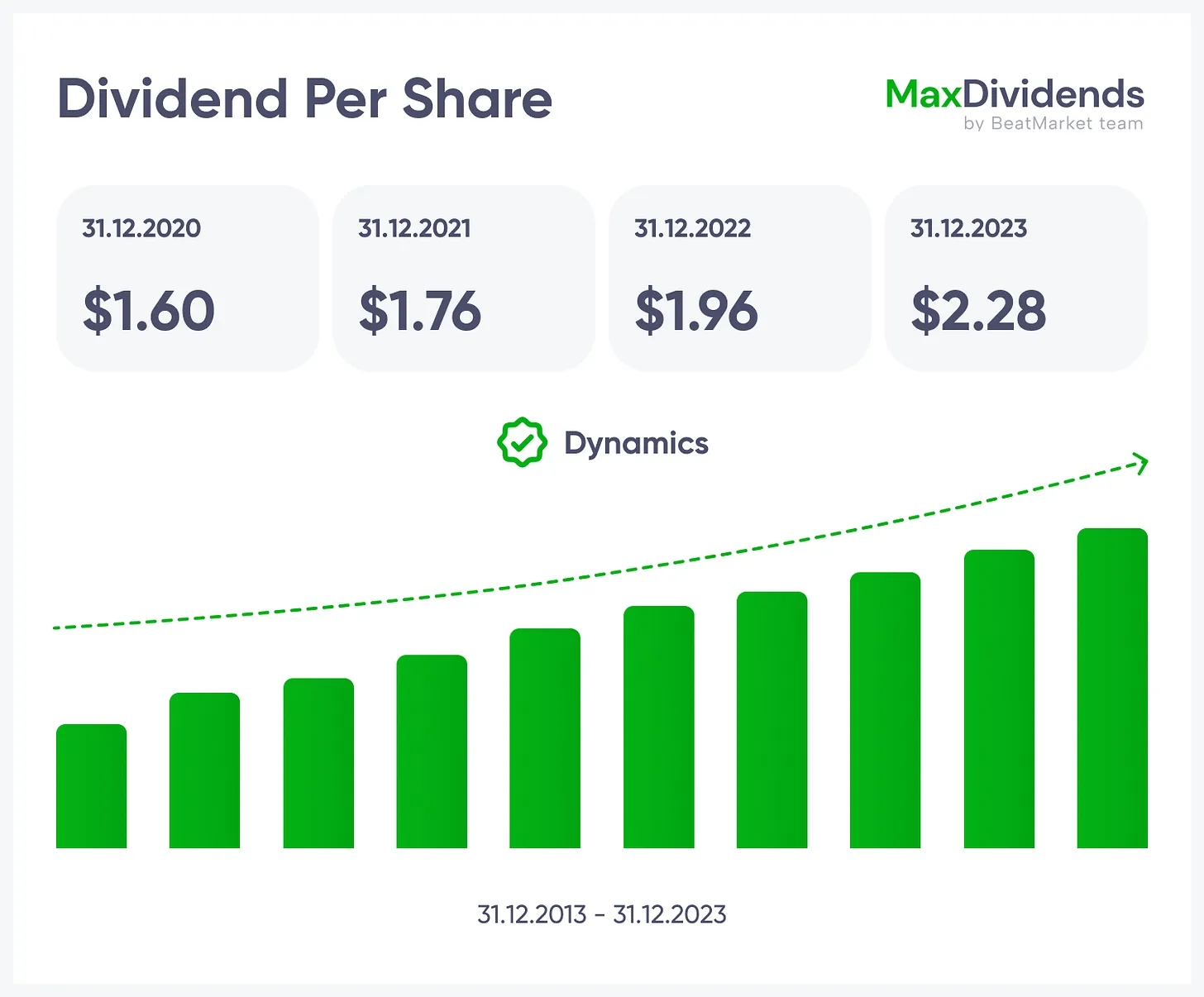

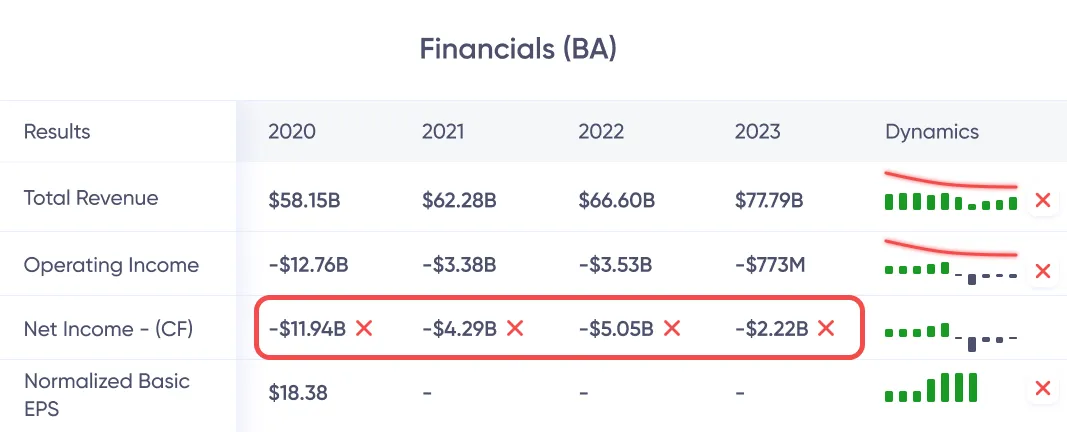

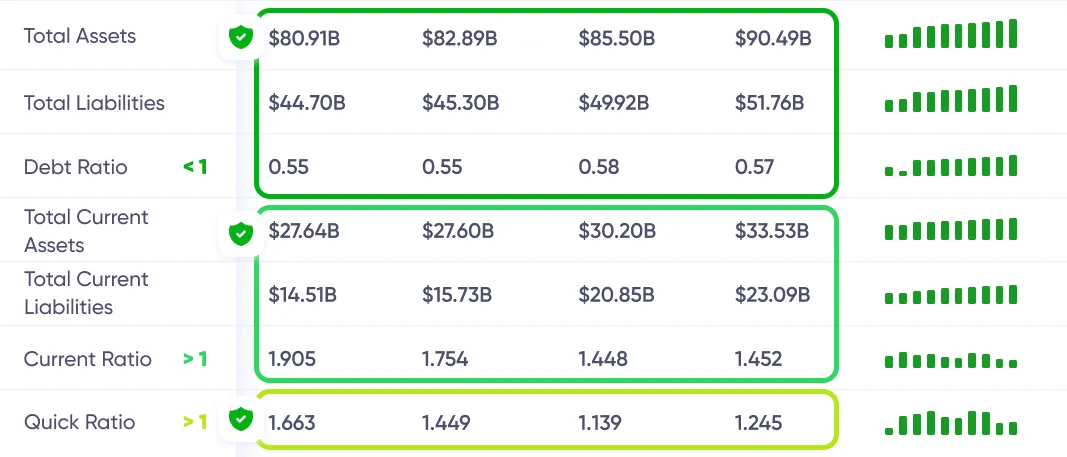

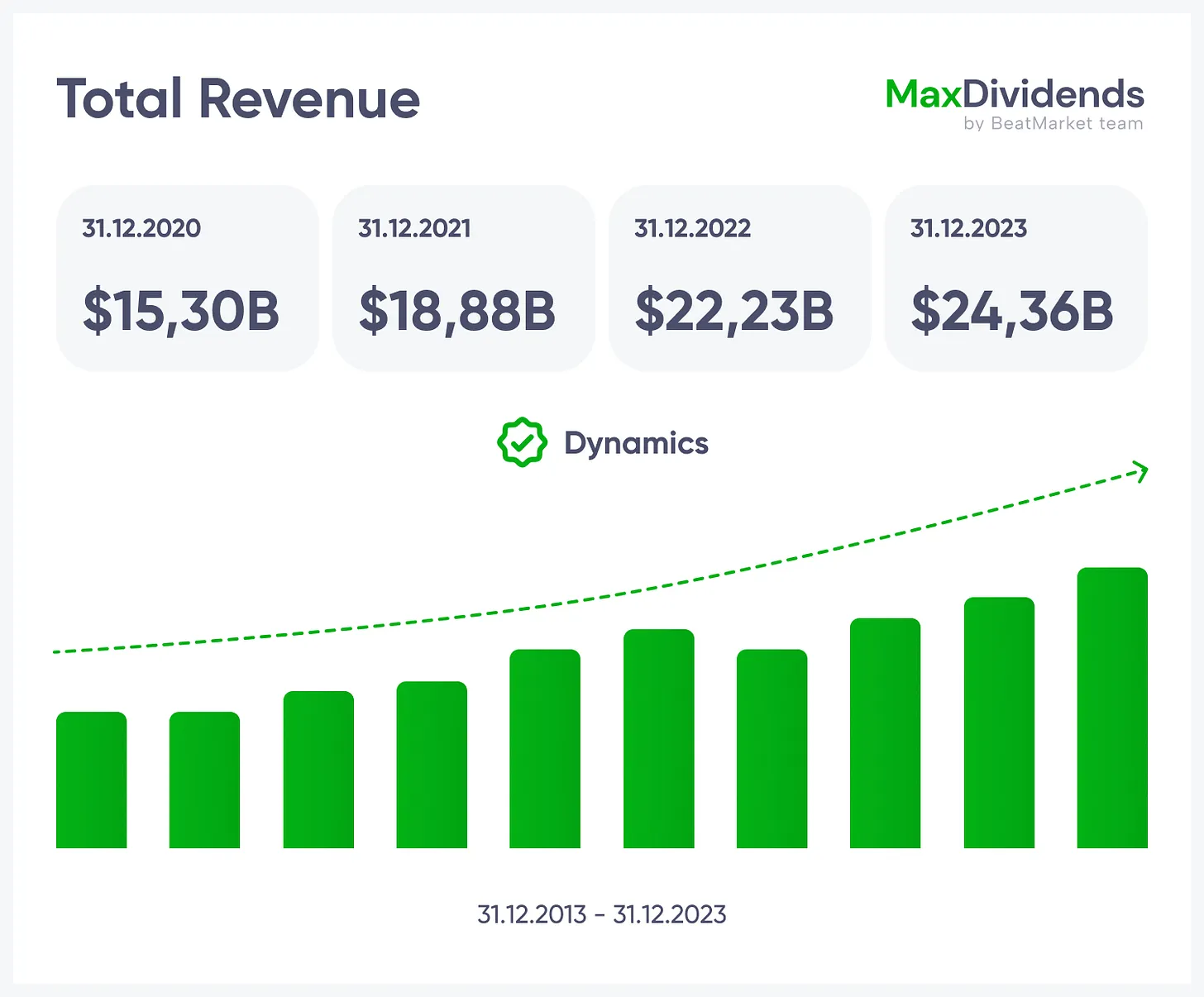

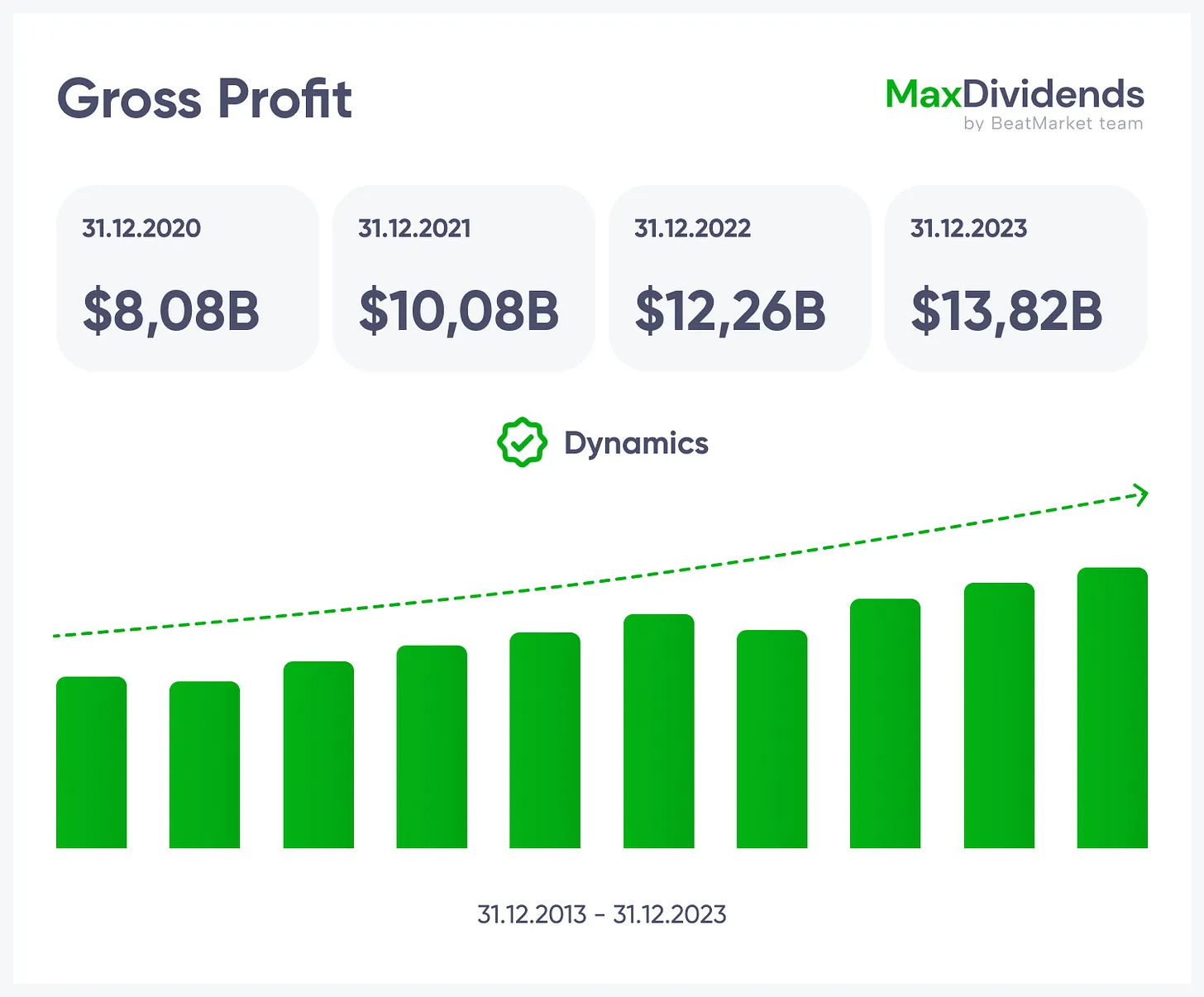

La Liste de Contrôle de la Formule Secrète à Cinq Piliers est notre moyen simple et éprouvé de séparer les entreprises solides et durables des autres. Nous examinons cinq piliers clés — la croissance des ventes, la croissance des bénéfices, le résultat net, la sécurité des dividendes et les niveaux d'endettement. Avec le Score Financier, ils nous indiquent si une entreprise peut continuer à croître, rester financièrement solide et verser des dividendes de manière fiable pendant des décennies.Revenu Total 42H

Bénéfice Brut / Marge Bénéficiaire 42H

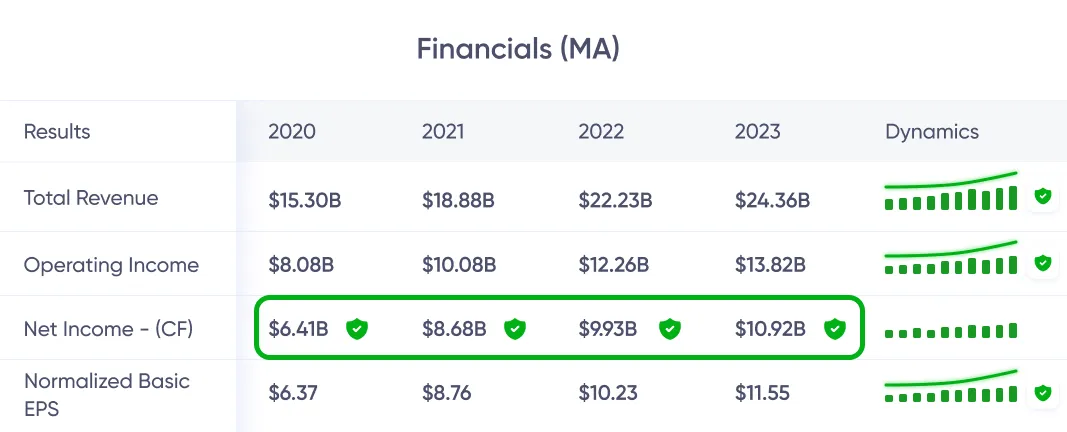

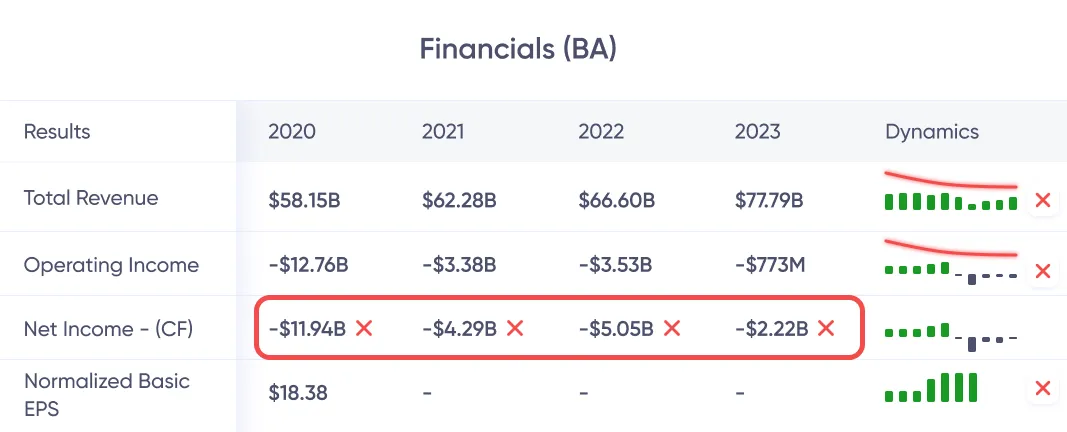

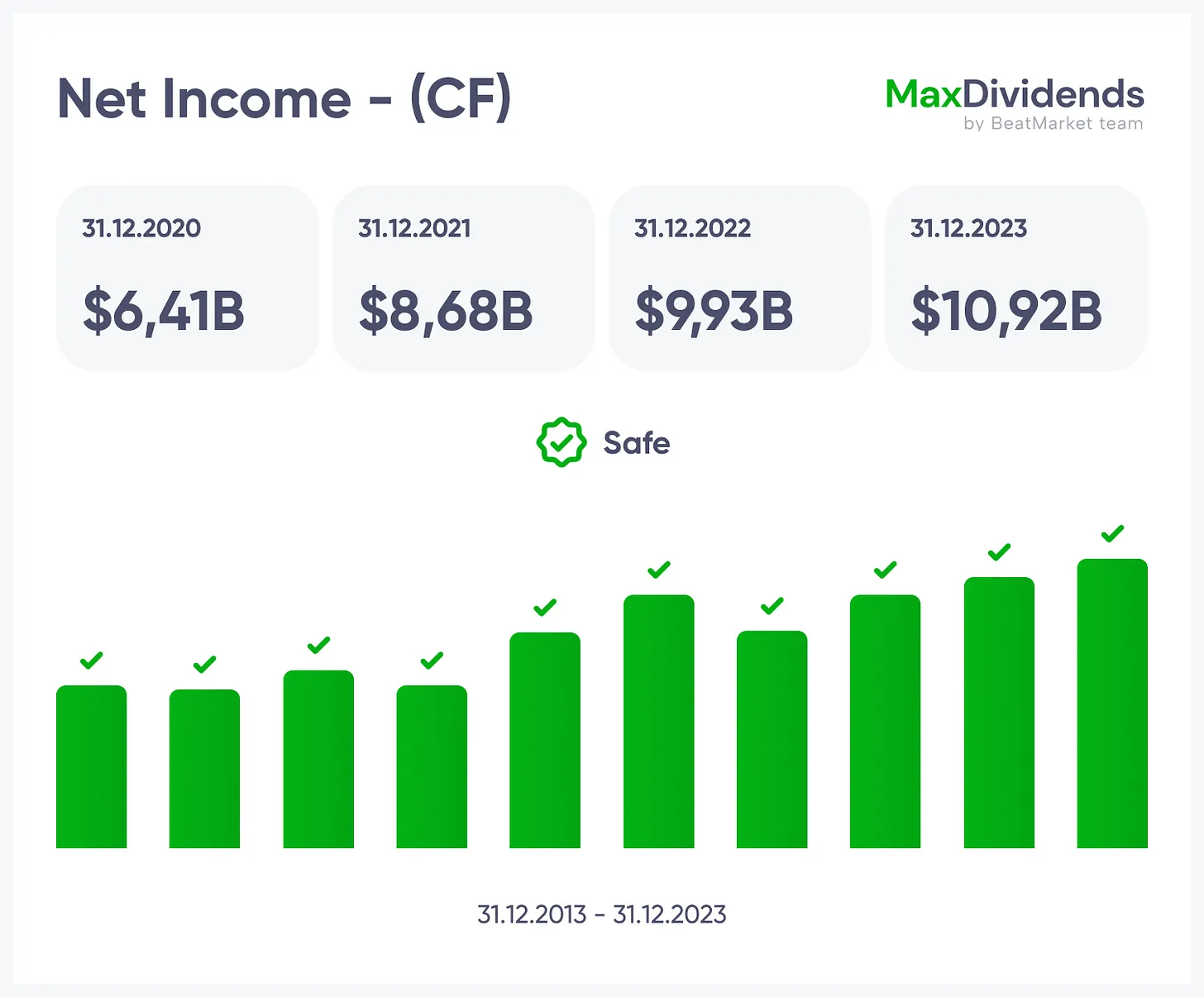

Revenu Net 42H

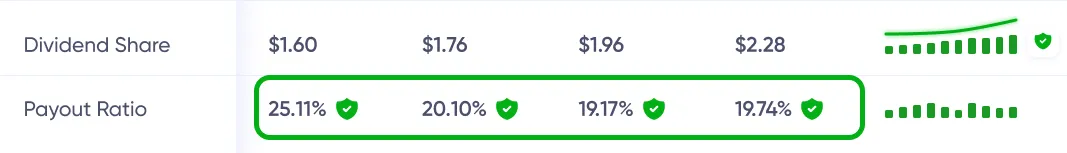

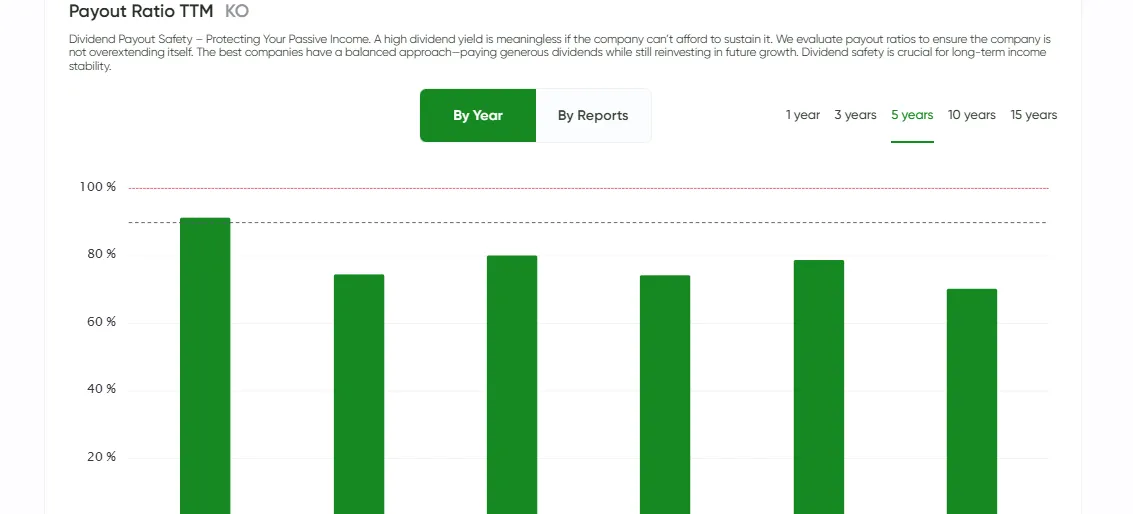

Ratio de Distribution 42H

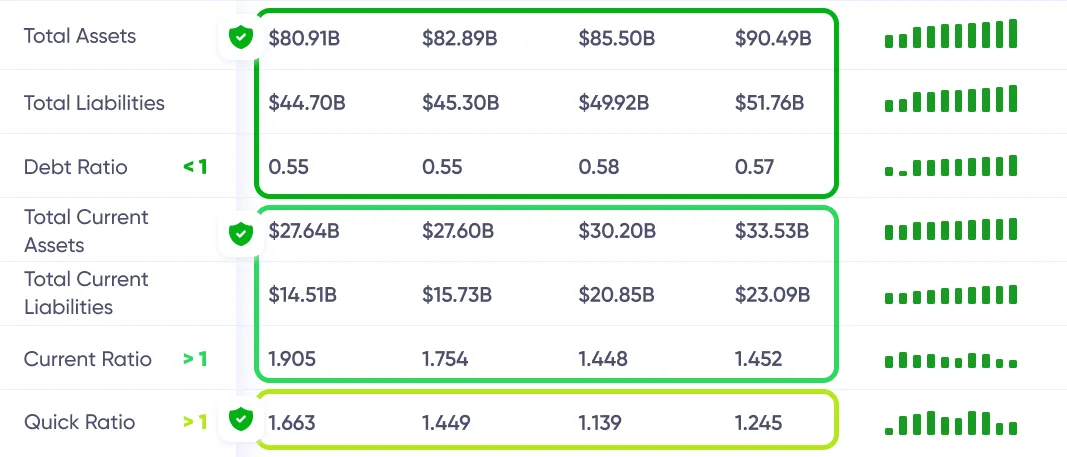

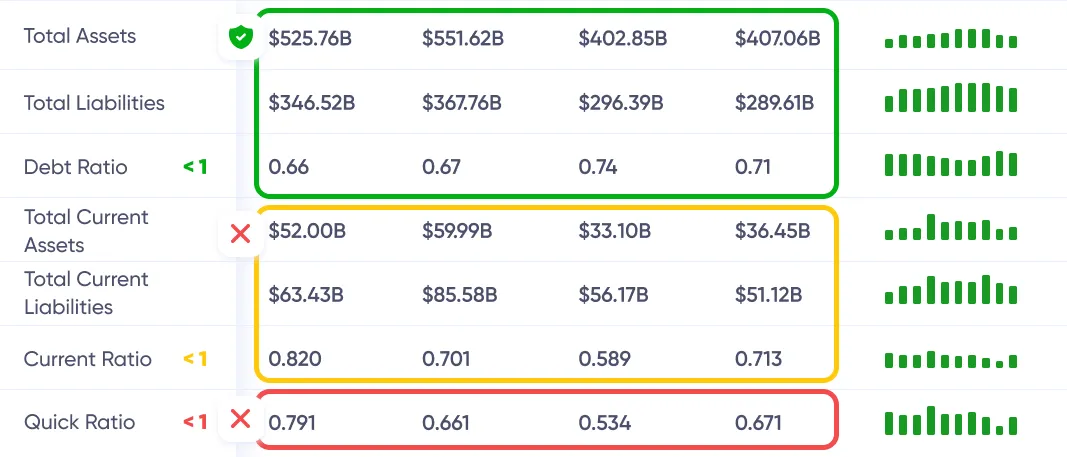

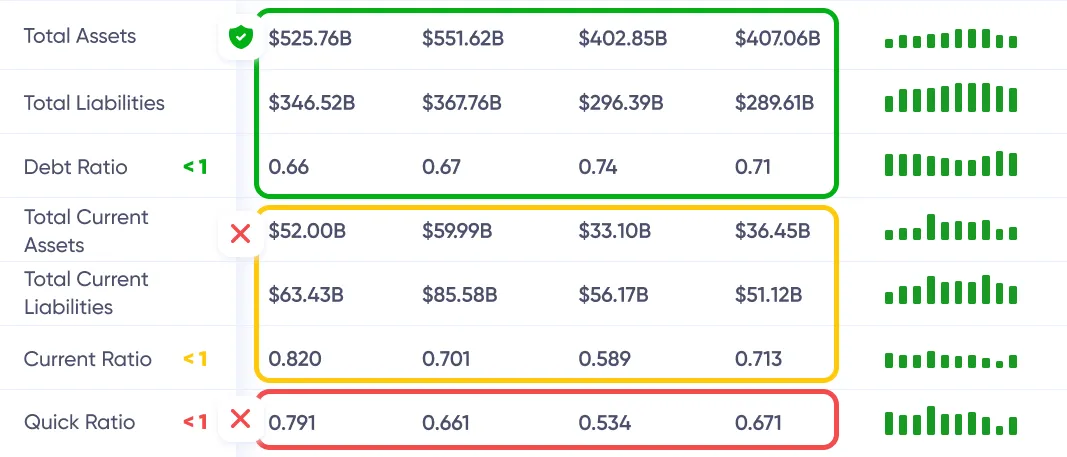

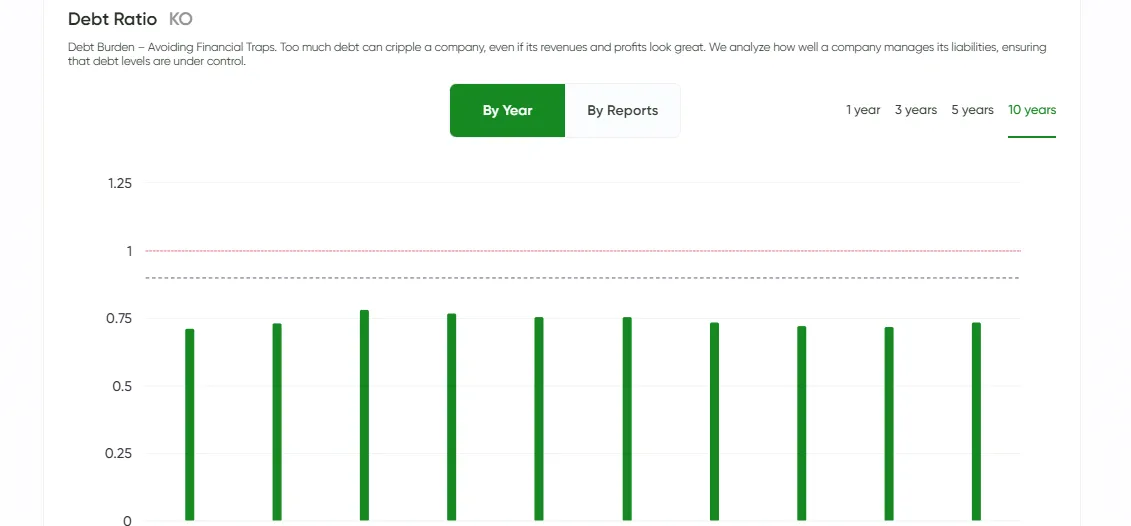

Ratio d'Endettement 42H

financières

Bank First National Corp 42H

| Résultats | 2019 | Dynamique |

Voyez l'entreprise entière en un coup d'œil — ce qu'elle fait, comment elle gagne de l'argent et la valeur qu'elle apporte.

Voyez l'entreprise entière en un coup d'œil — ce qu'elle fait, comment elle gagne de l'argent et la valeur qu'elle apporte.

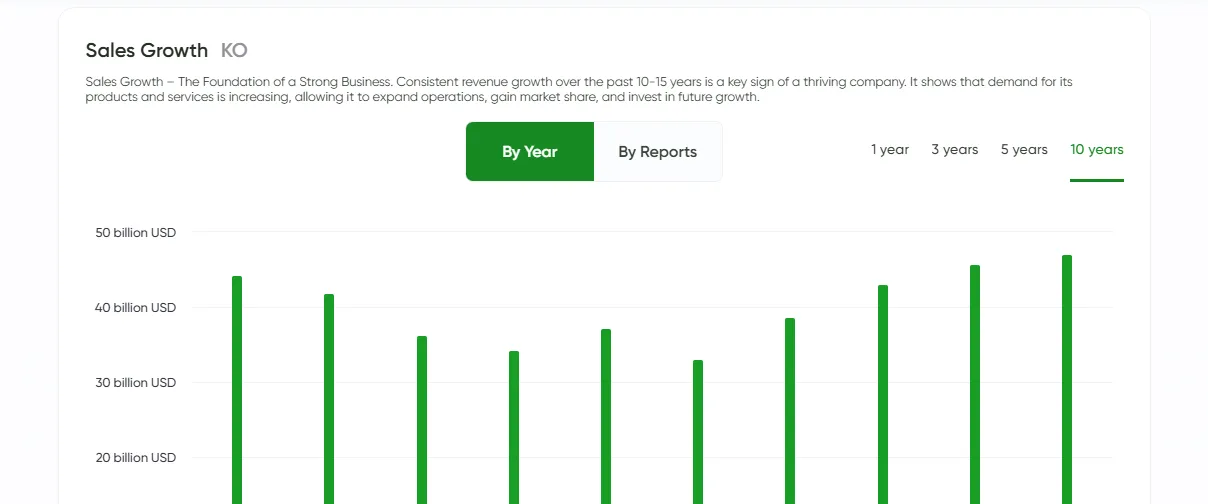

Tendance de croissance, claire en un coup d'œil.

Tendance de croissance, claire en un coup d'œil.

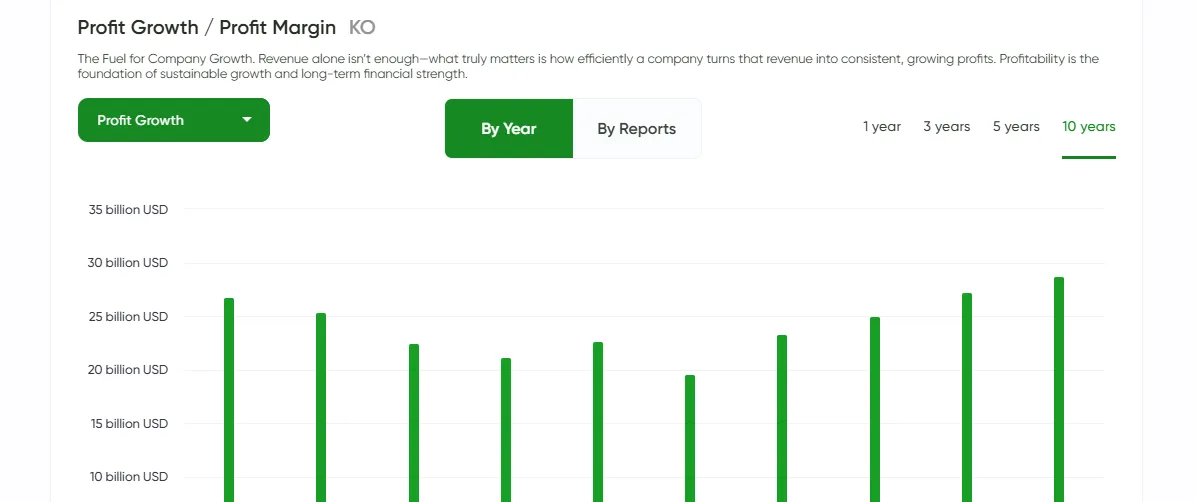

Voyez si les bénéfices sont réels — instantanément.

Voyez si les bénéfices sont réels — instantanément.

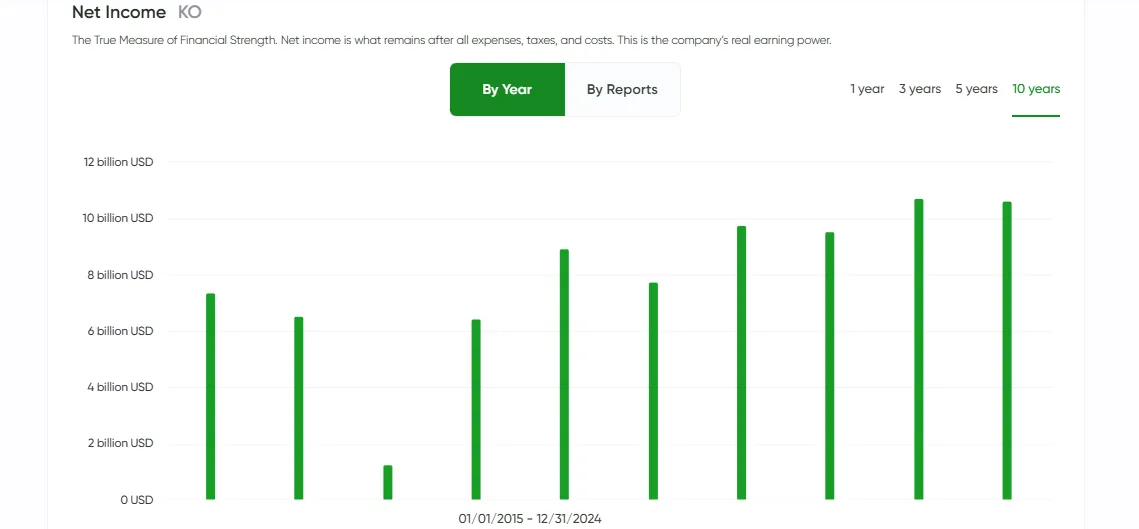

Le résultat net rendu simple avec MaxDividends.

Le résultat net rendu simple avec MaxDividends.

Risque de dette vérifié pour vous, 24h/24 et 7j/7.

Risque de dette vérifié pour vous, 24h/24 et 7j/7.

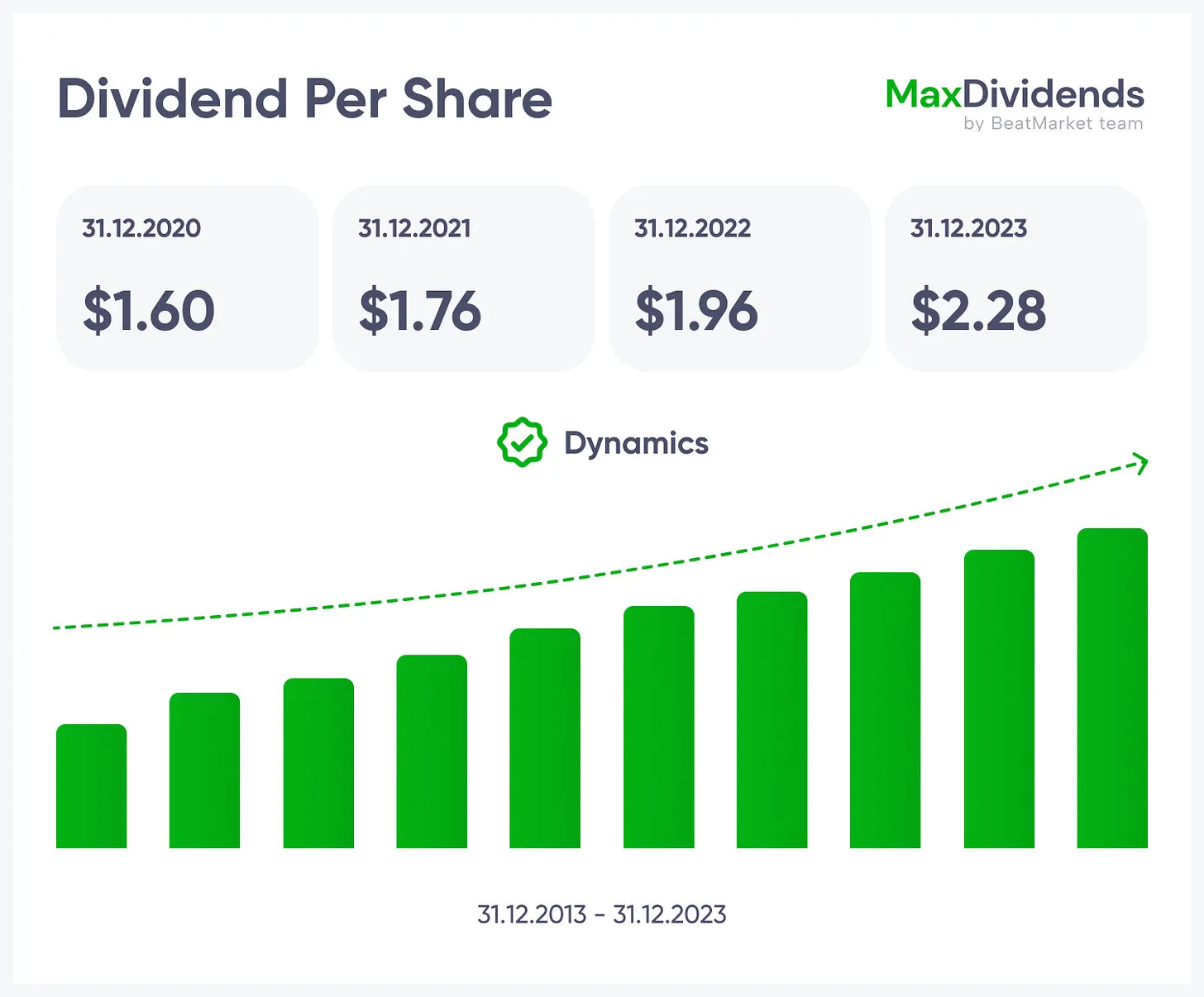

Séries et augmentations de dividendes à portée de main.

Séries et augmentations de dividendes à portée de main.

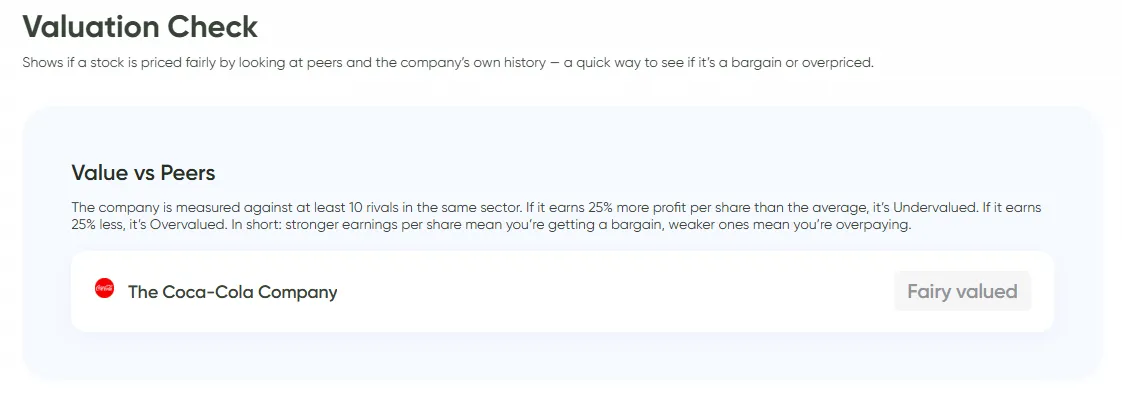

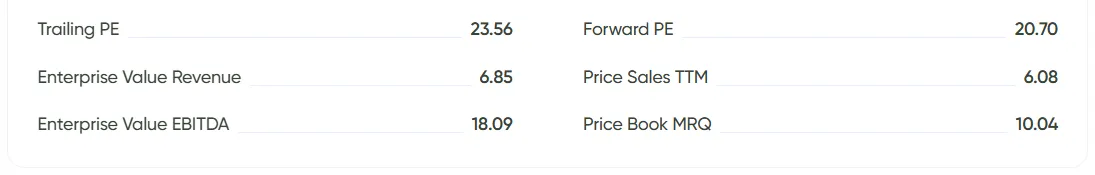

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

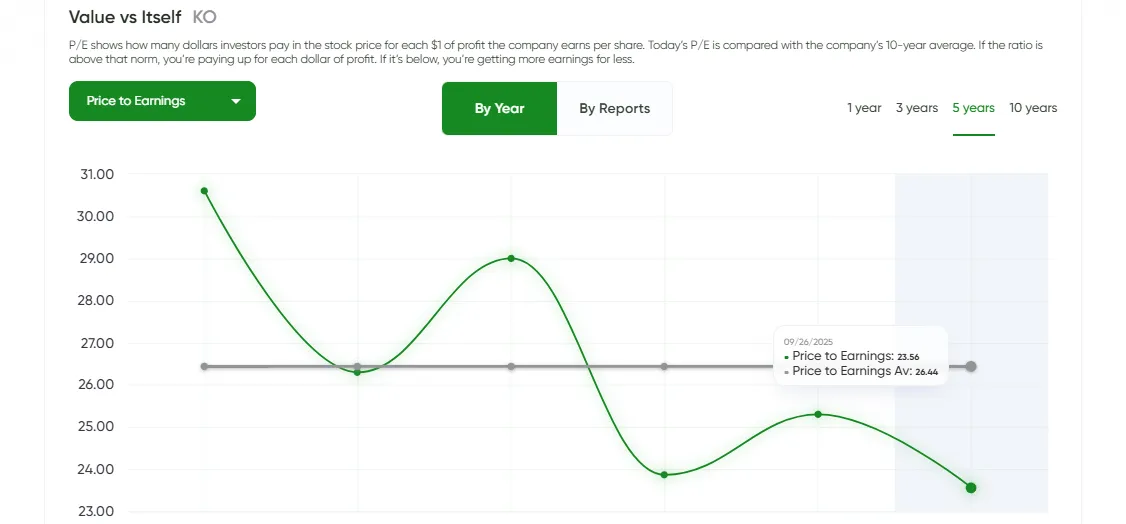

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

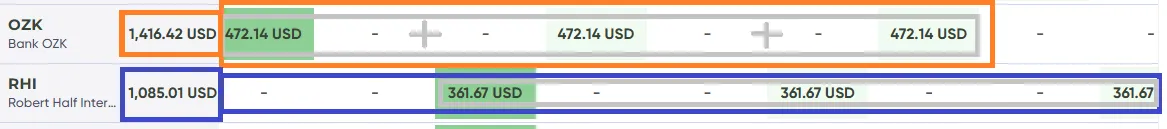

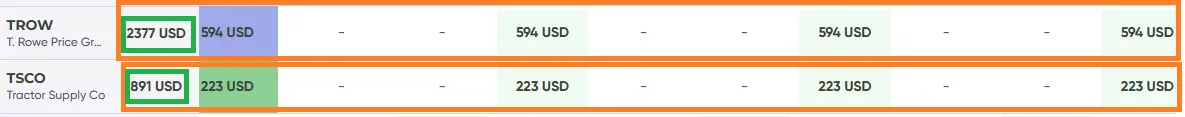

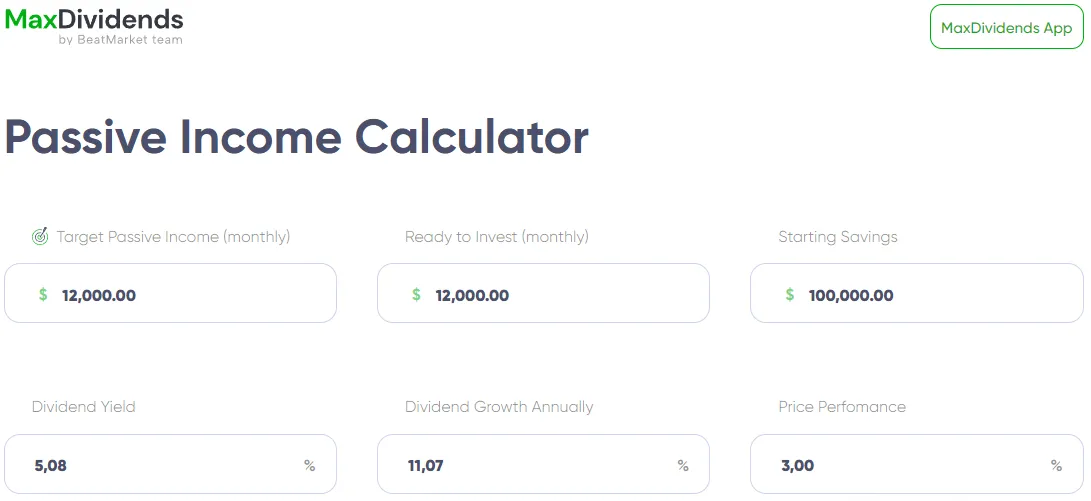

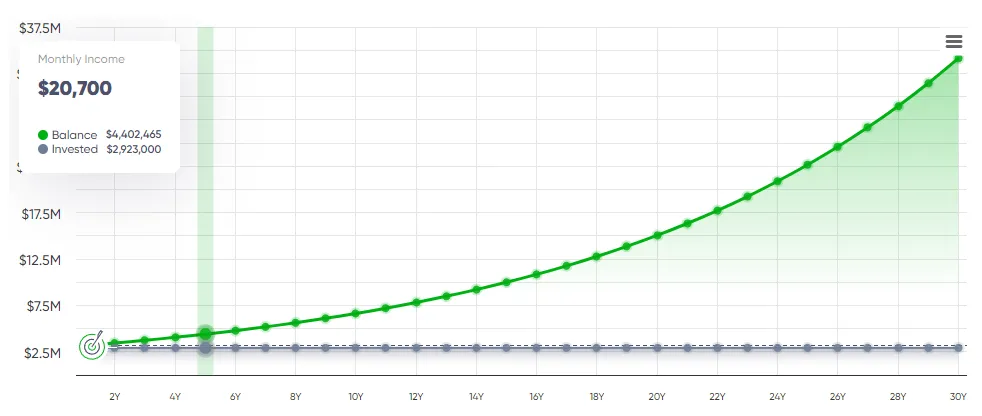

Application MaxDividends : Calculateur de Revenu Passif

Application MaxDividends : Calculateur de Revenu Passif

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

Application MaxDividends : Calculateur de Revenu Passif

Application MaxDividends : Calculateur de Revenu Passif

Application MaxDividends : Calculateur de Revenu Passif

Application MaxDividends : Calculateur de Revenu Passif

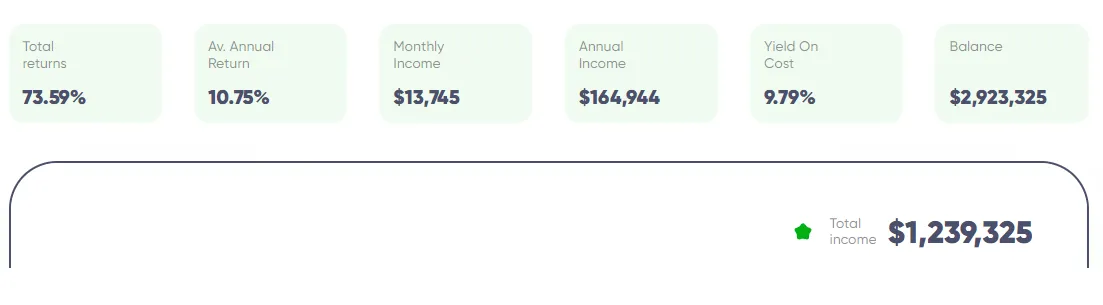

Application MaxDividends : Calculateur de Revenu Passif, Prévision de Revenu

Application MaxDividends : Calculateur de Revenu Passif, Prévision de Revenu

BeatStart

BeatStart