Précisez une action ou une cryptomonnaie dans la barre de recherche pour obtenir un récapitulatif

Comment Cette Entreprise Gagne de l'Argent

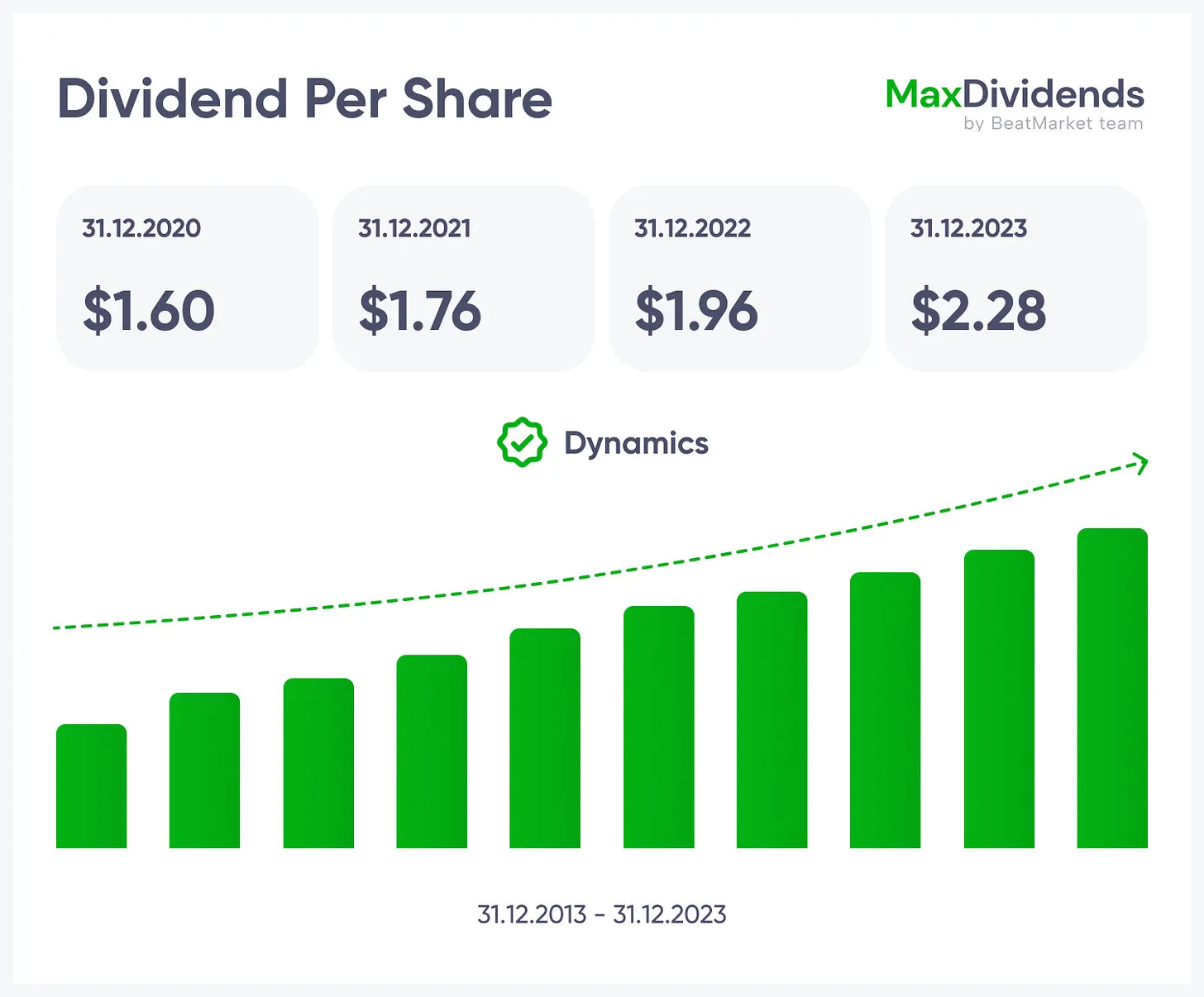

Analyse des dividendes OXLCG

Max Ratio

–Rendement du dividende

7.85 %Croissance des dividendes sur 5 ans

0.00 %Croissance continue

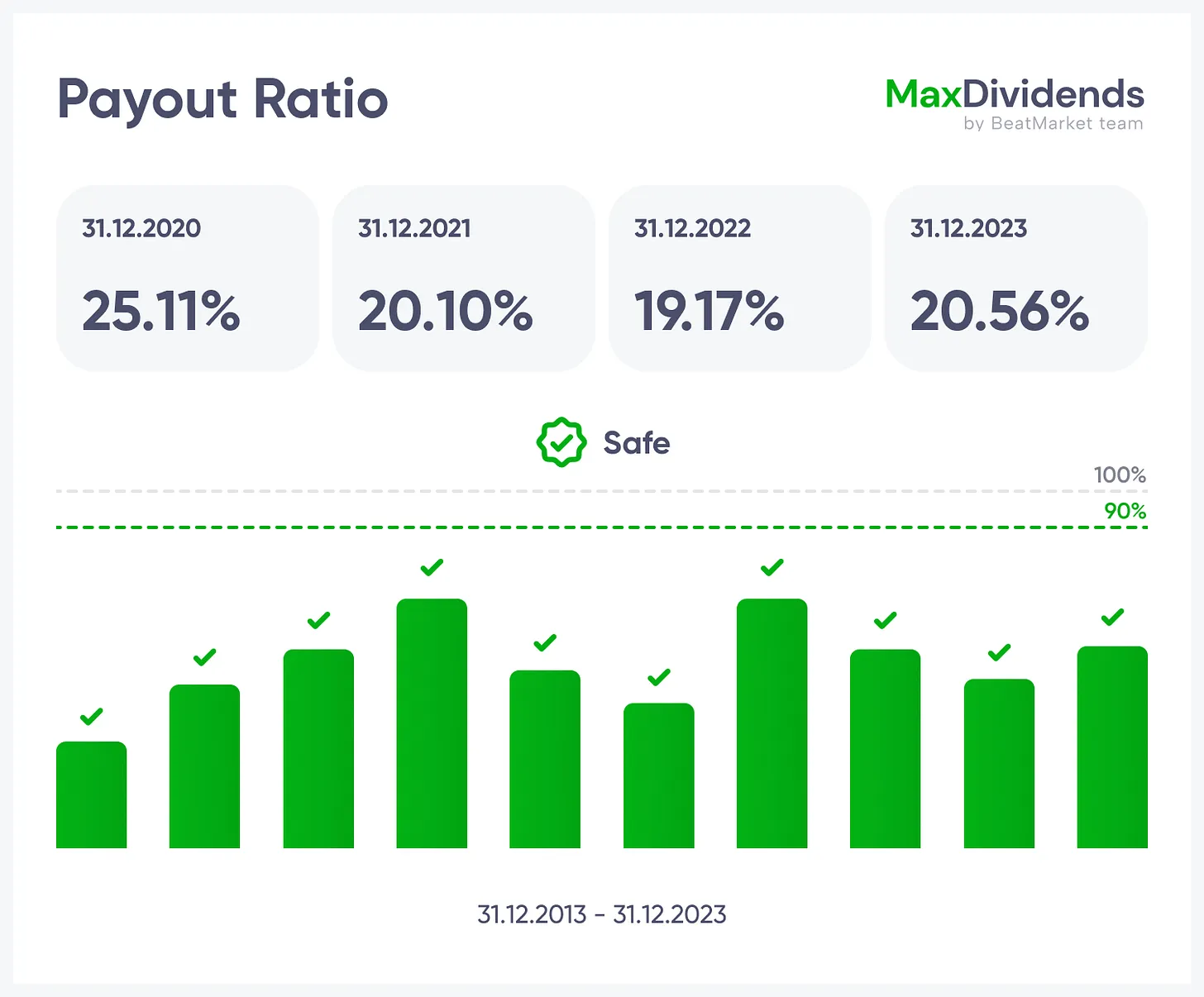

–Ratio de distribution Moyenne sur 5 ans

–Historique des dividendes OXLCG

La Liste de Contrôle de la Formule à 5 Piliers

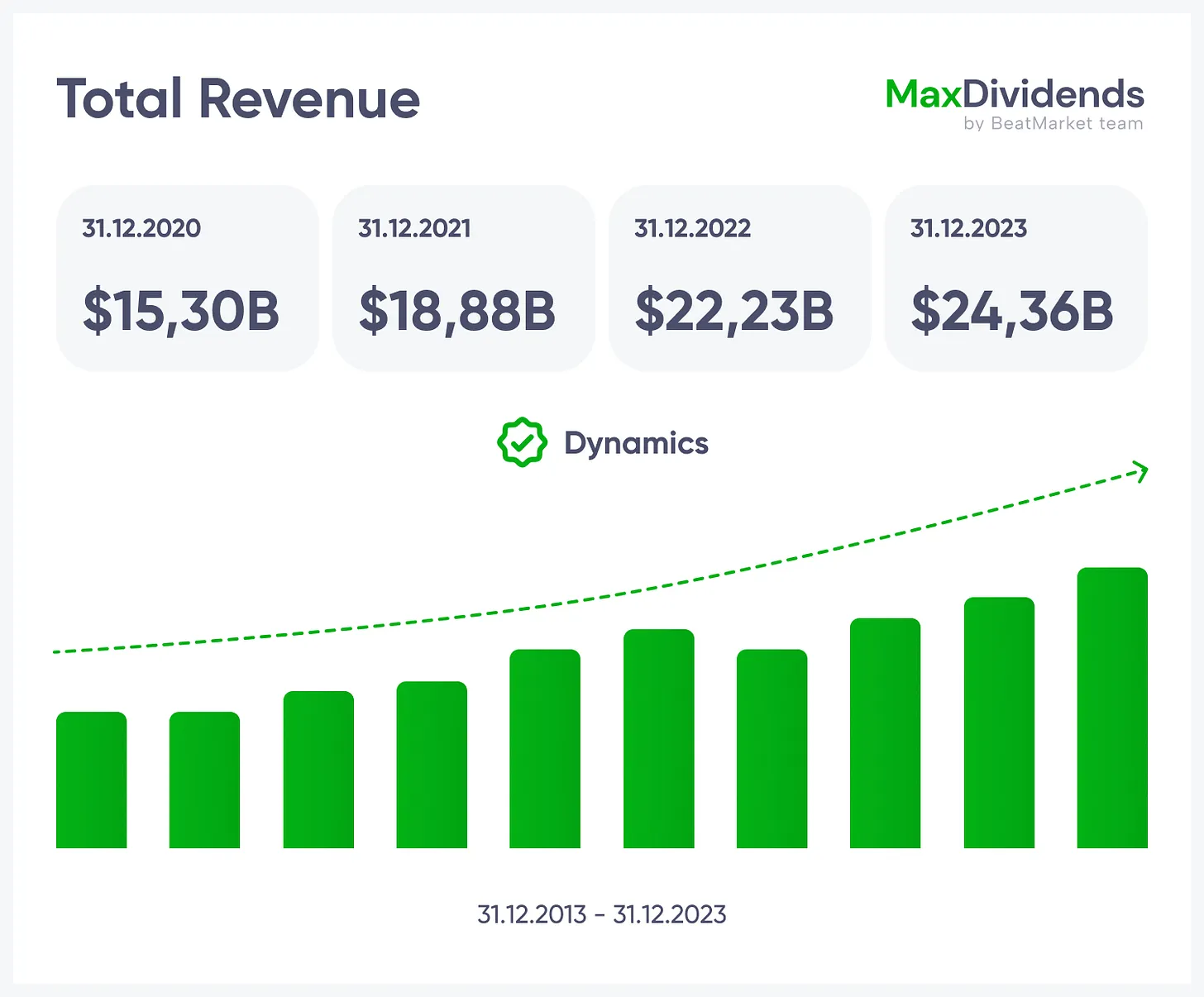

La Liste de Contrôle de la Formule Secrète à Cinq Piliers est notre moyen simple et éprouvé de séparer les entreprises solides et durables des autres. Nous examinons cinq piliers clés — la croissance des ventes, la croissance des bénéfices, le résultat net, la sécurité des dividendes et les niveaux d'endettement. Avec le Score Financier, ils nous indiquent si une entreprise peut continuer à croître, rester financièrement solide et verser des dividendes de manière fiable pendant des décennies.Revenu Total OXLCG

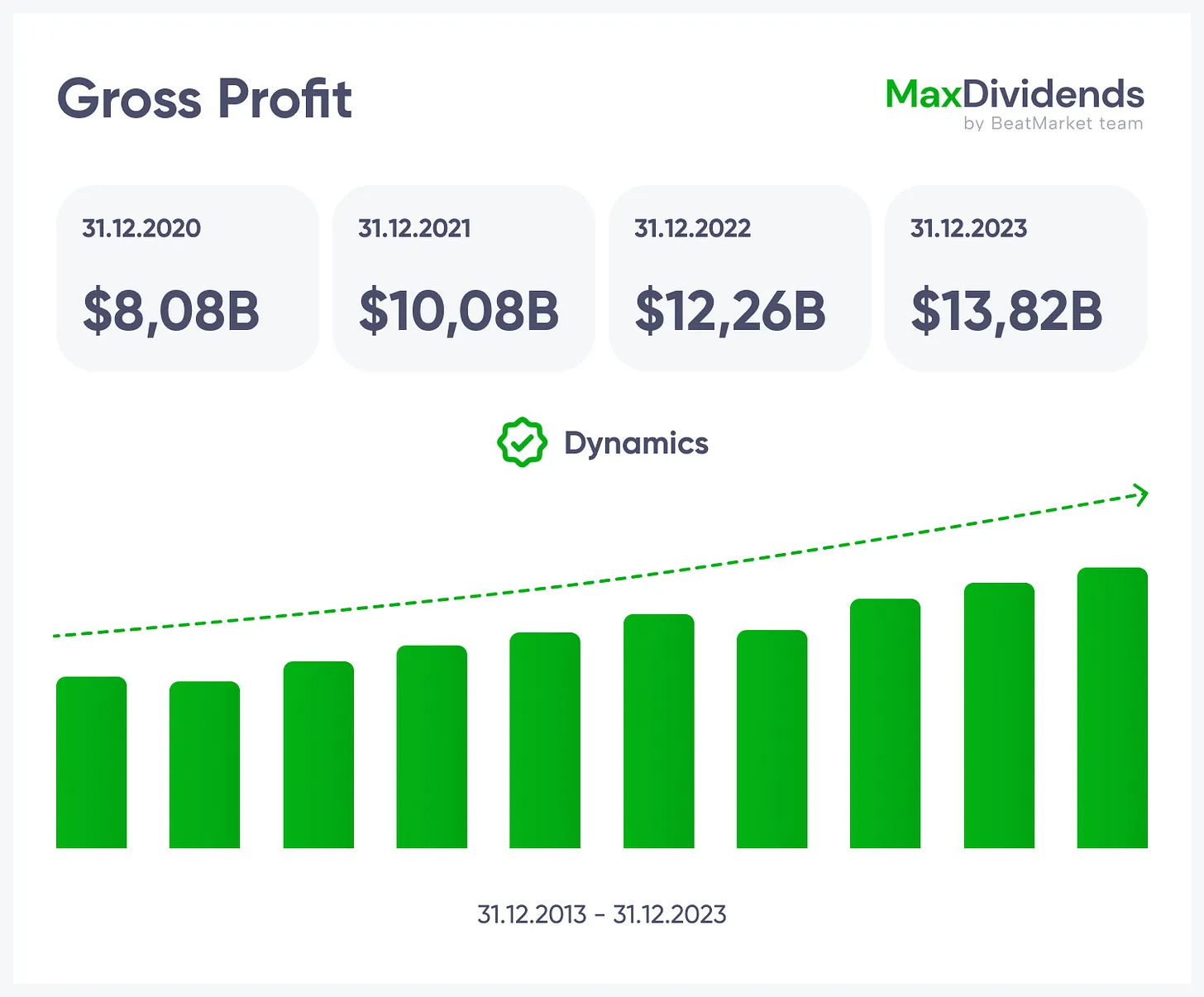

Bénéfice Brut / Marge Bénéficiaire OXLCG

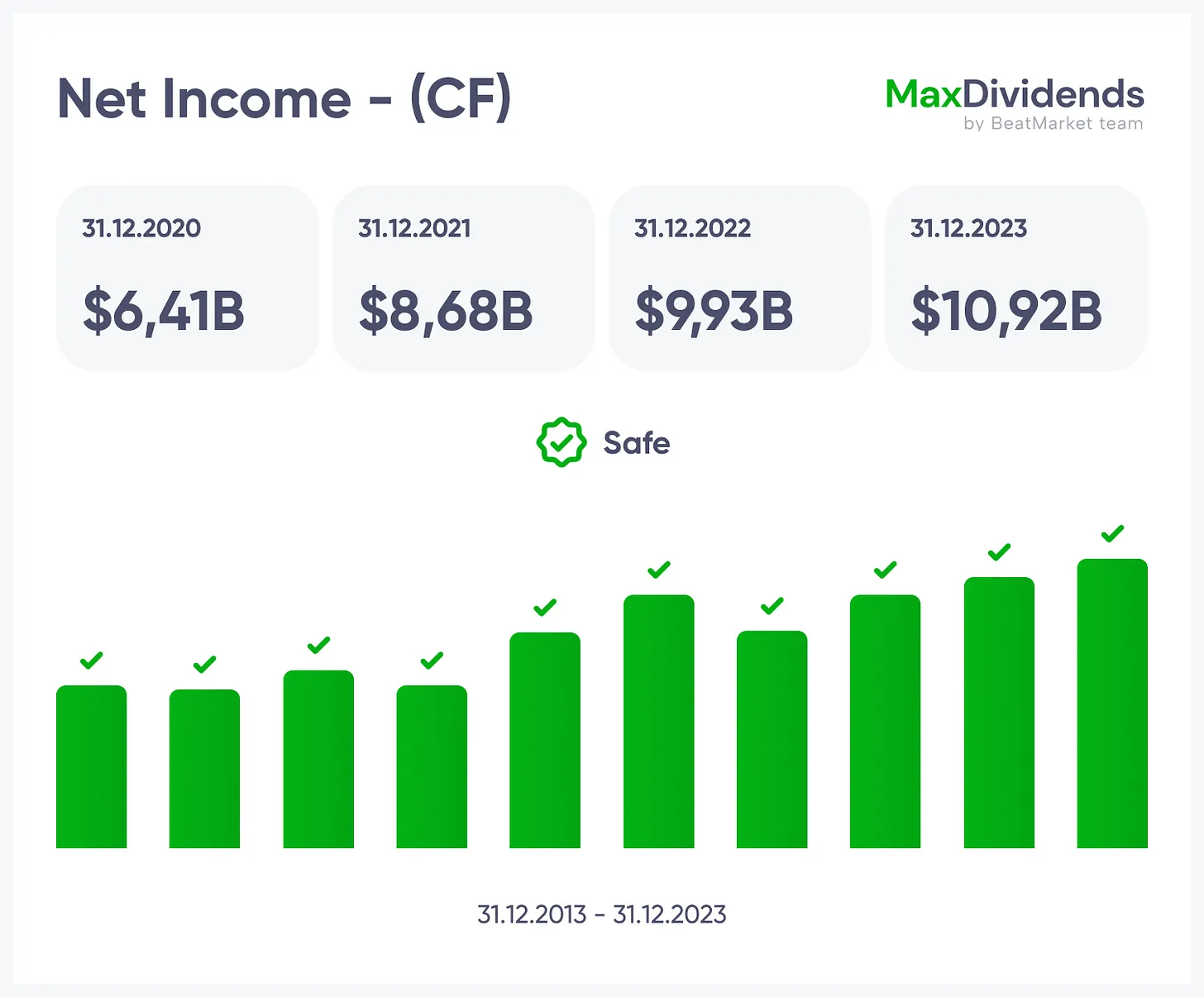

Revenu Net OXLCG

Ratio de Distribution OXLCG

Ratio d'Endettement OXLCG

financières

Oxford Lane Capital Corp. 7.95% Notes due 2032 OXLCG

| Résultats | 2019 | Dynamique |

Voyez l'entreprise entière en un coup d'œil — ce qu'elle fait, comment elle gagne de l'argent et la valeur qu'elle apporte.

Voyez l'entreprise entière en un coup d'œil — ce qu'elle fait, comment elle gagne de l'argent et la valeur qu'elle apporte.

Tendance de croissance, claire en un coup d'œil.

Tendance de croissance, claire en un coup d'œil.

Voyez si les bénéfices sont réels — instantanément.

Voyez si les bénéfices sont réels — instantanément.

Le résultat net rendu simple avec MaxDividends.

Le résultat net rendu simple avec MaxDividends.

Risque de dette vérifié pour vous, 24h/24 et 7j/7.

Risque de dette vérifié pour vous, 24h/24 et 7j/7.

Séries et augmentations de dividendes à portée de main.

Séries et augmentations de dividendes à portée de main.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

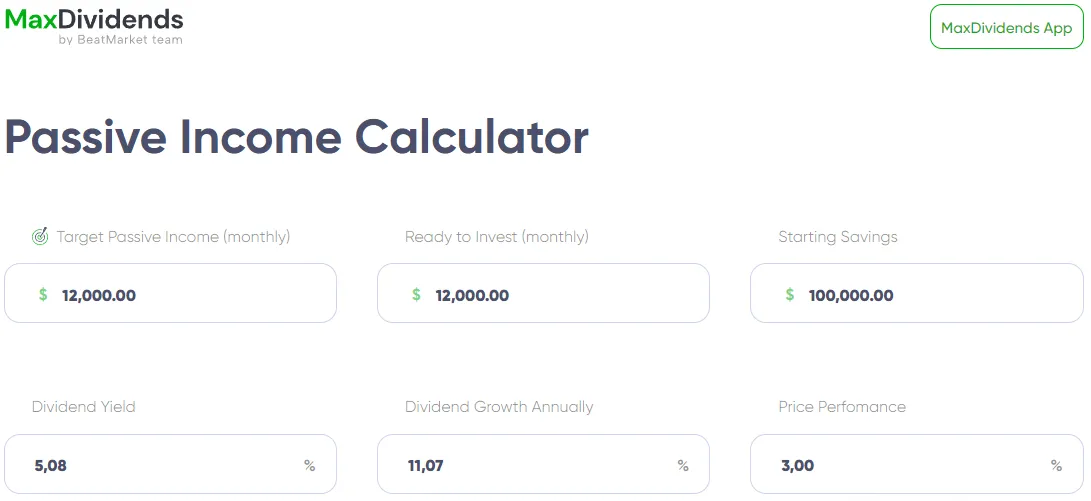

Application MaxDividends : Calculateur de Revenu Passif

Application MaxDividends : Calculateur de Revenu Passif

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

Application MaxDividends : Calculateur de Revenu Passif

Application MaxDividends : Calculateur de Revenu Passif

Application MaxDividends : Calculateur de Revenu Passif

Application MaxDividends : Calculateur de Revenu Passif

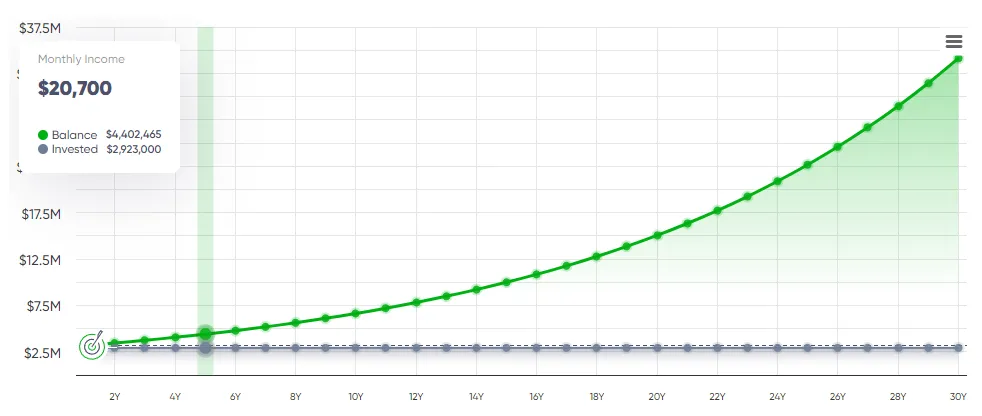

Application MaxDividends : Calculateur de Revenu Passif, Prévision de Revenu

Application MaxDividends : Calculateur de Revenu Passif, Prévision de Revenu

BeatStart

BeatStart