Especifique uma ação ou criptomoeda na barra de pesquisa para obter um resumo

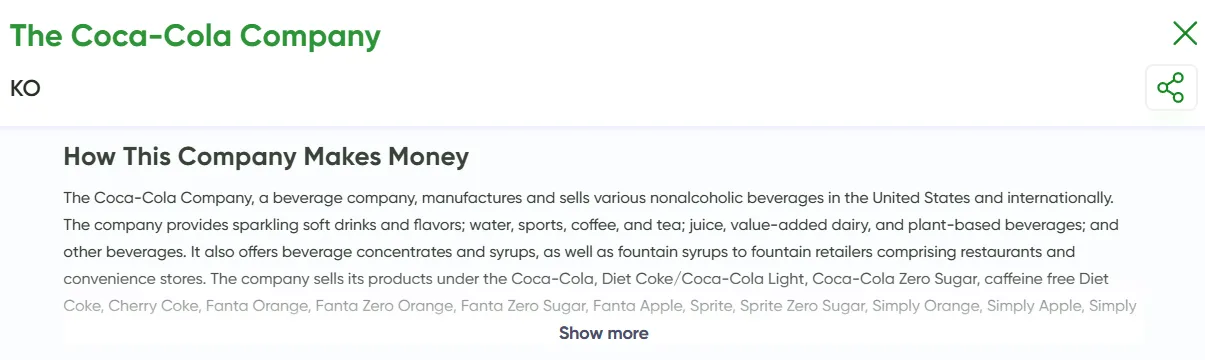

Como Esta Empresa Ganha Dinheiro

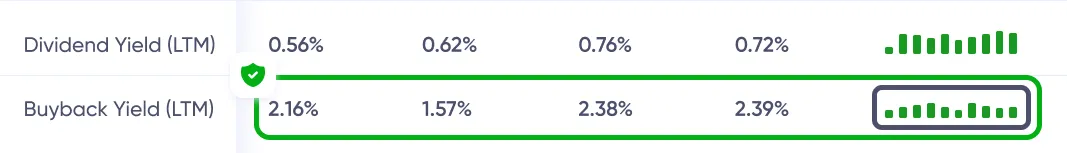

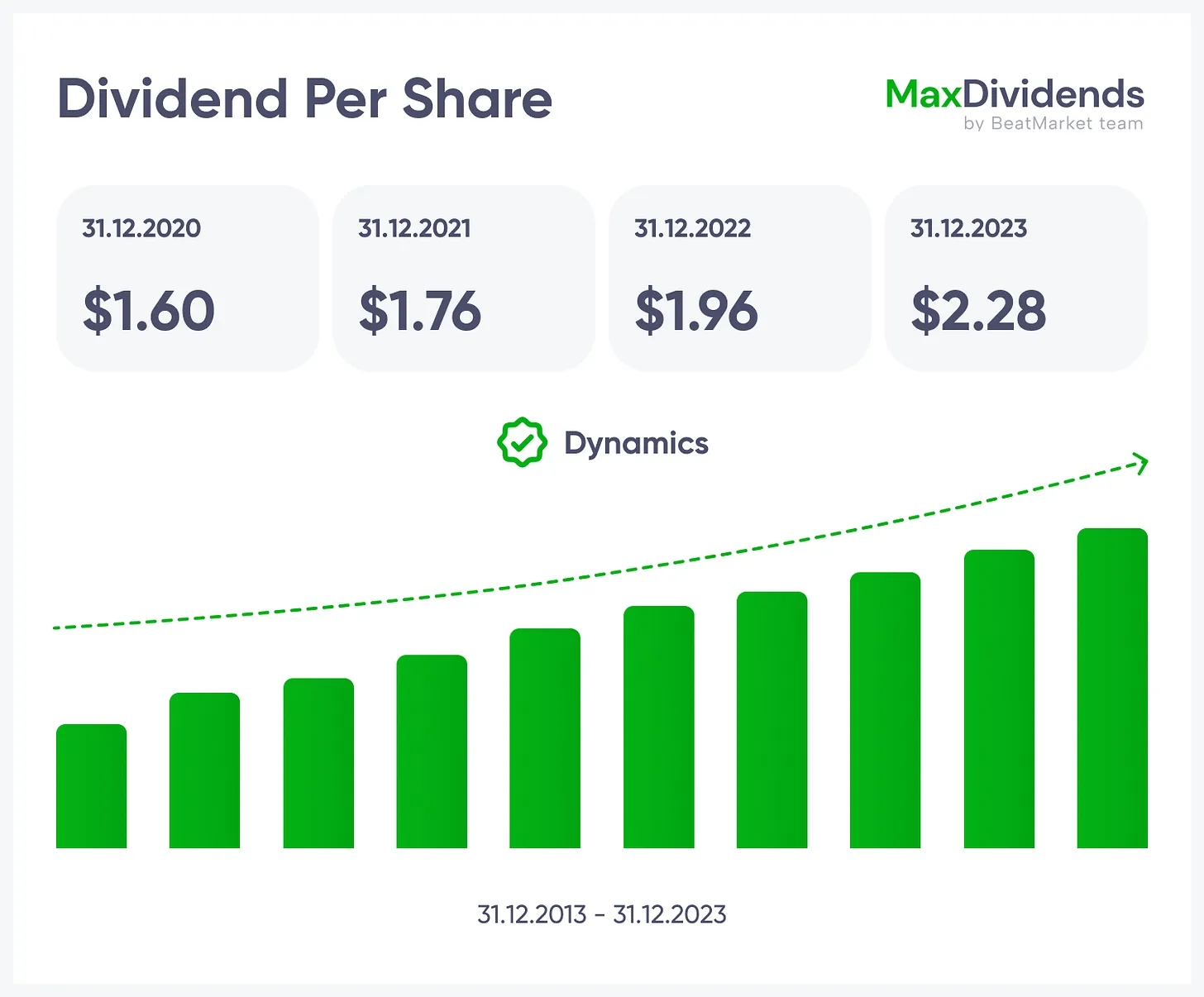

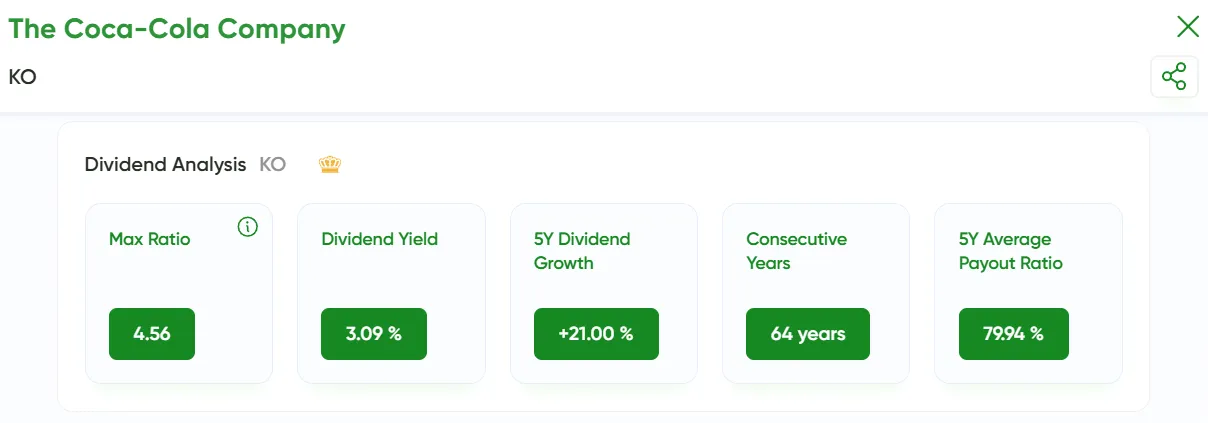

Análise de Dividendos M46

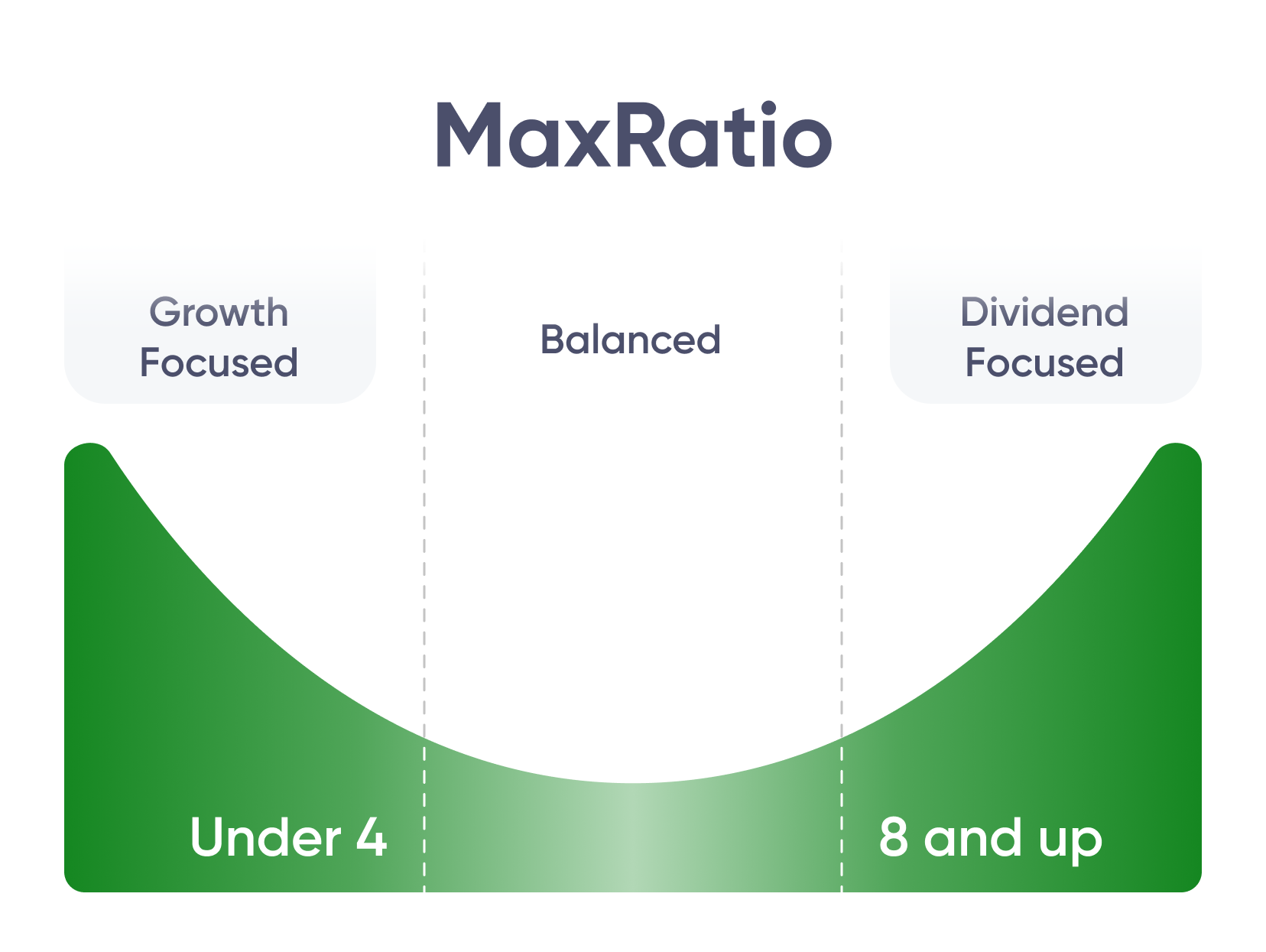

Max Ratio

–Rendimento de dividendos

5.37 %Crescimento de dividendos em 5 anos

0.00 %Crescimento contínuo

1 anoTaxa de pagamento em média de 5 anos

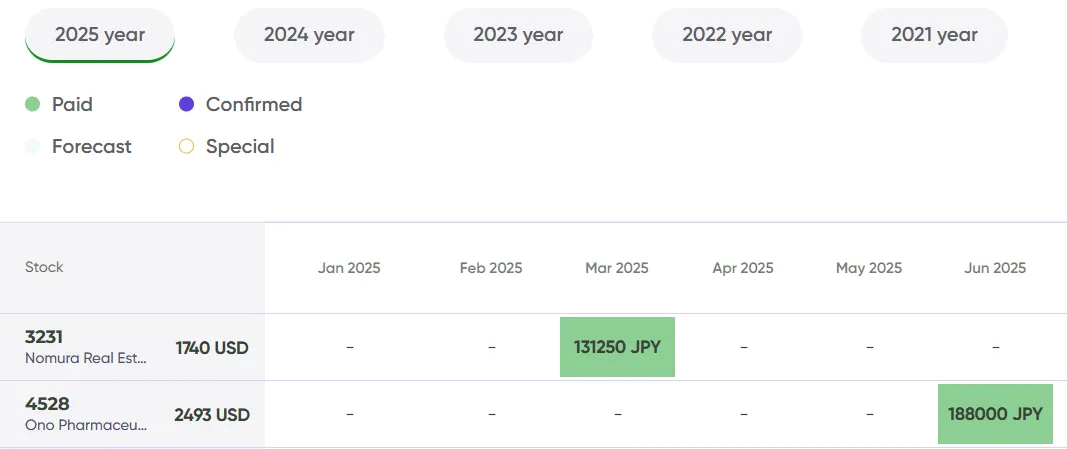

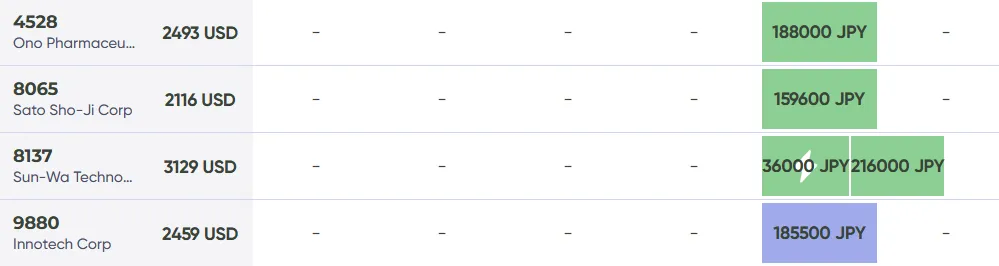

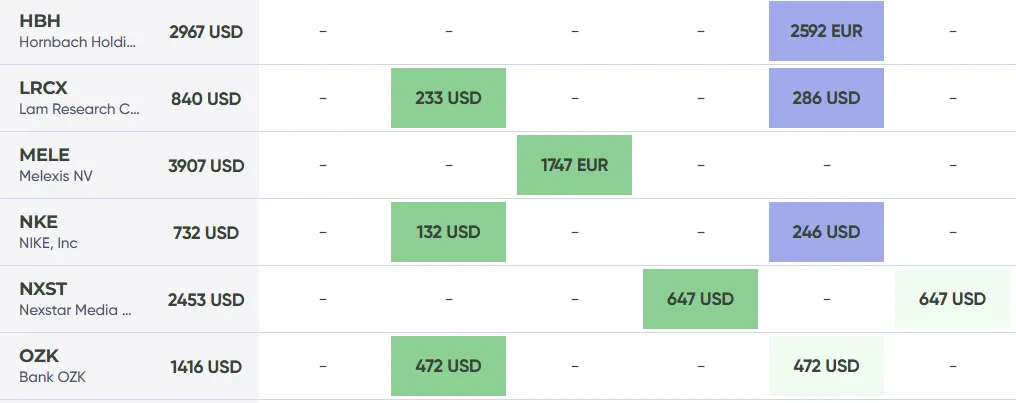

31.70 %Histórico de Dividendos M46

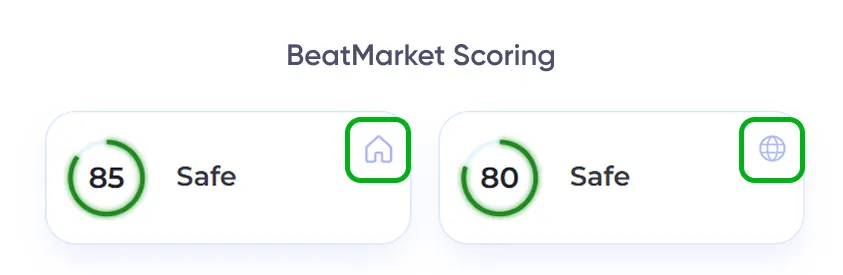

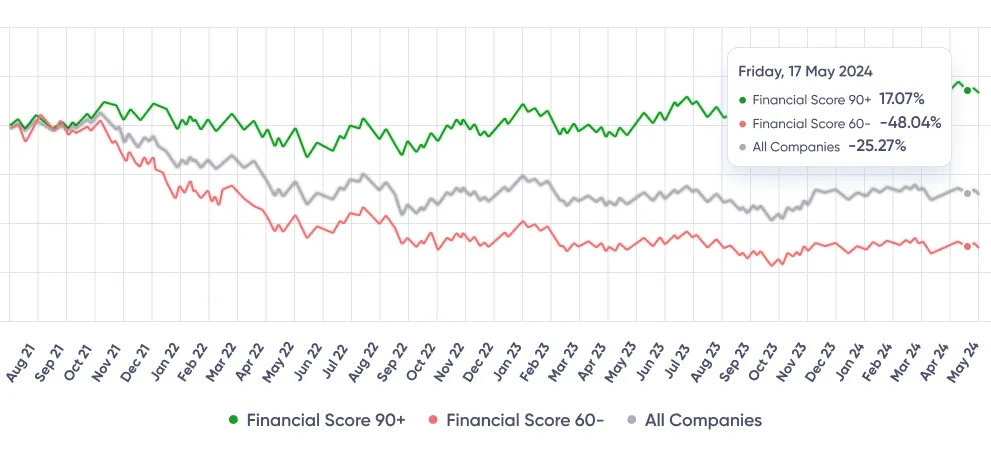

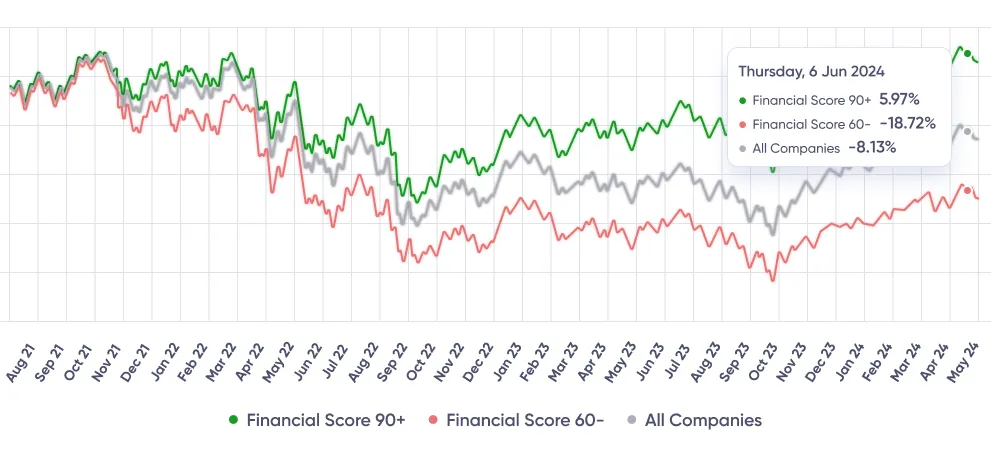

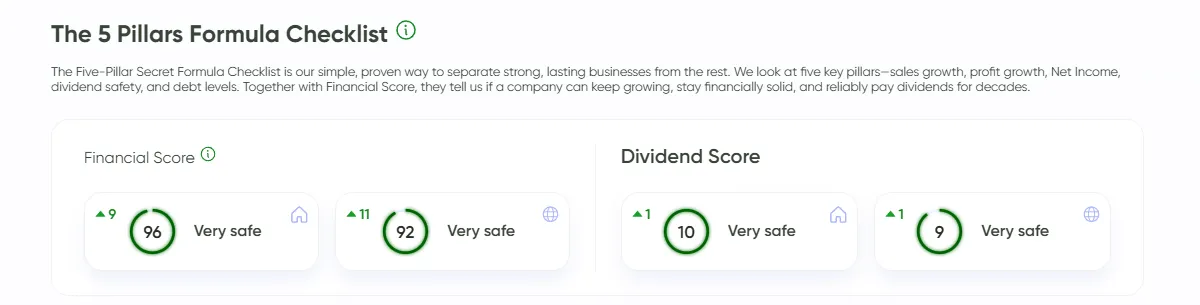

A Lista de Verificação da Fórmula dos 5 Pilares

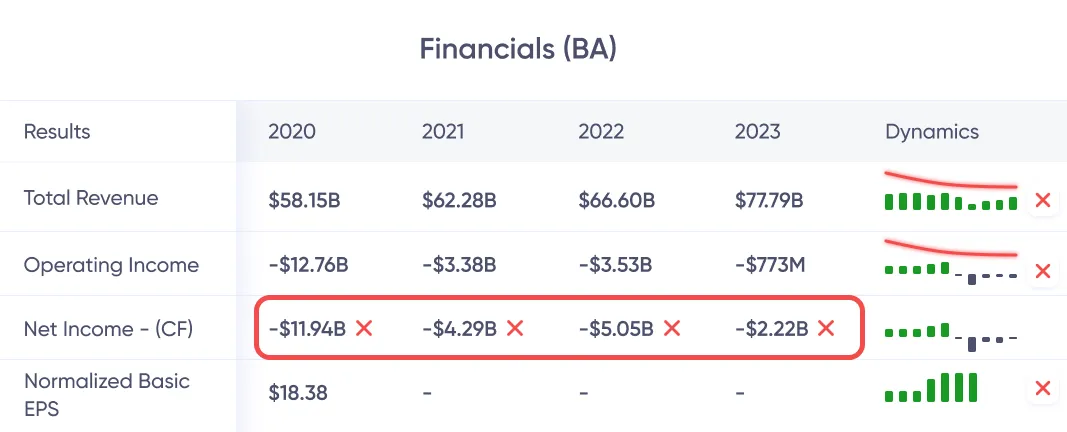

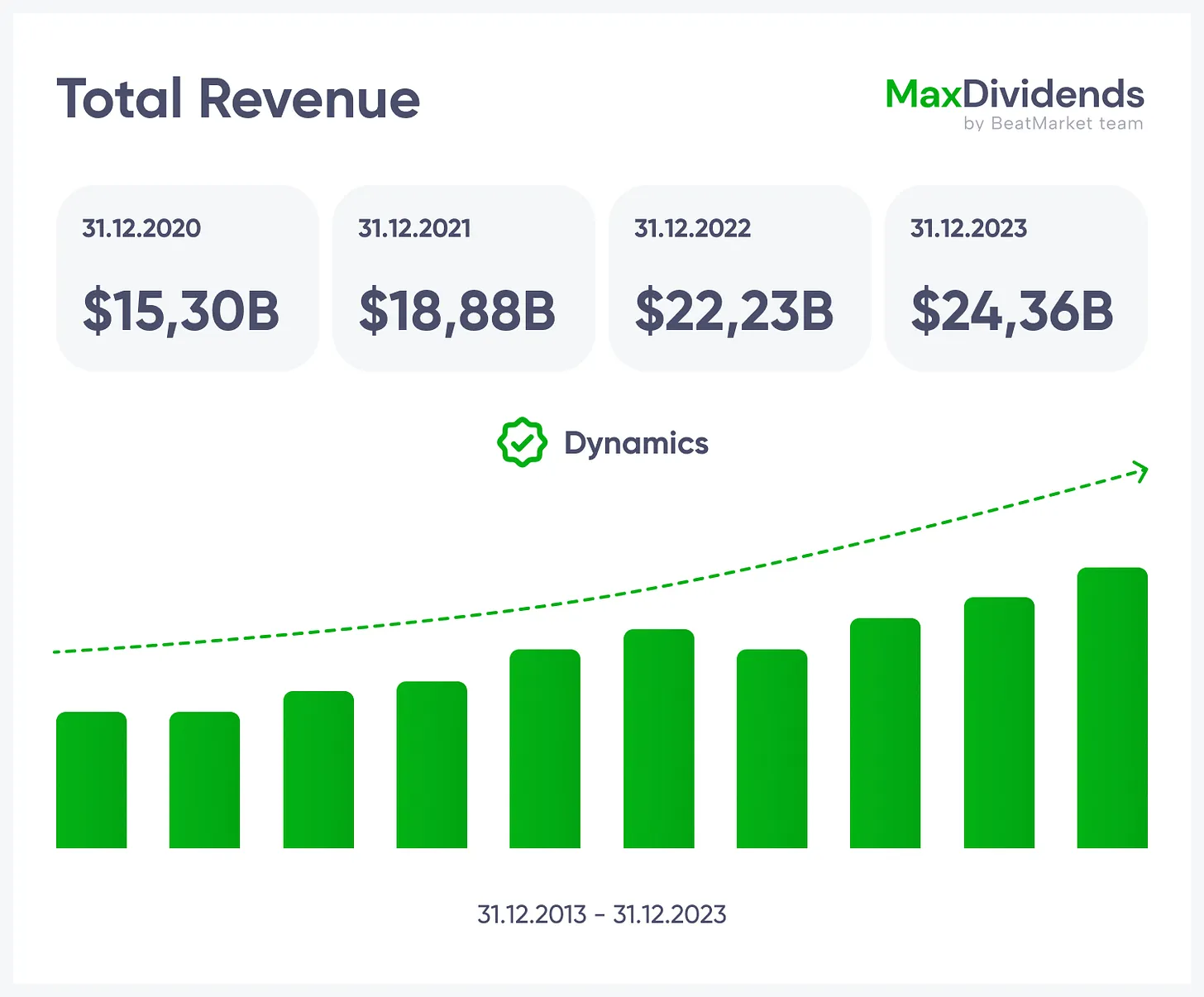

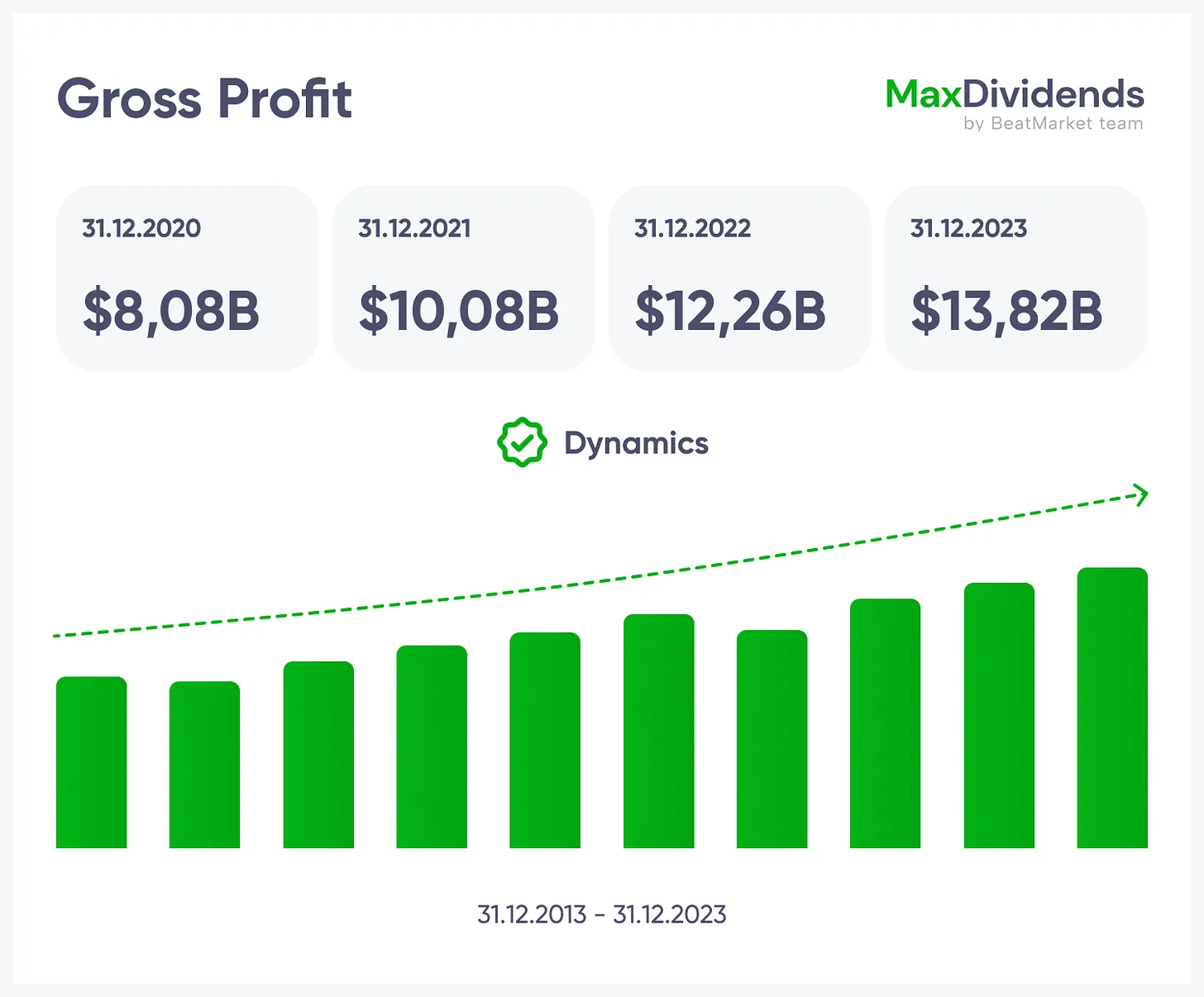

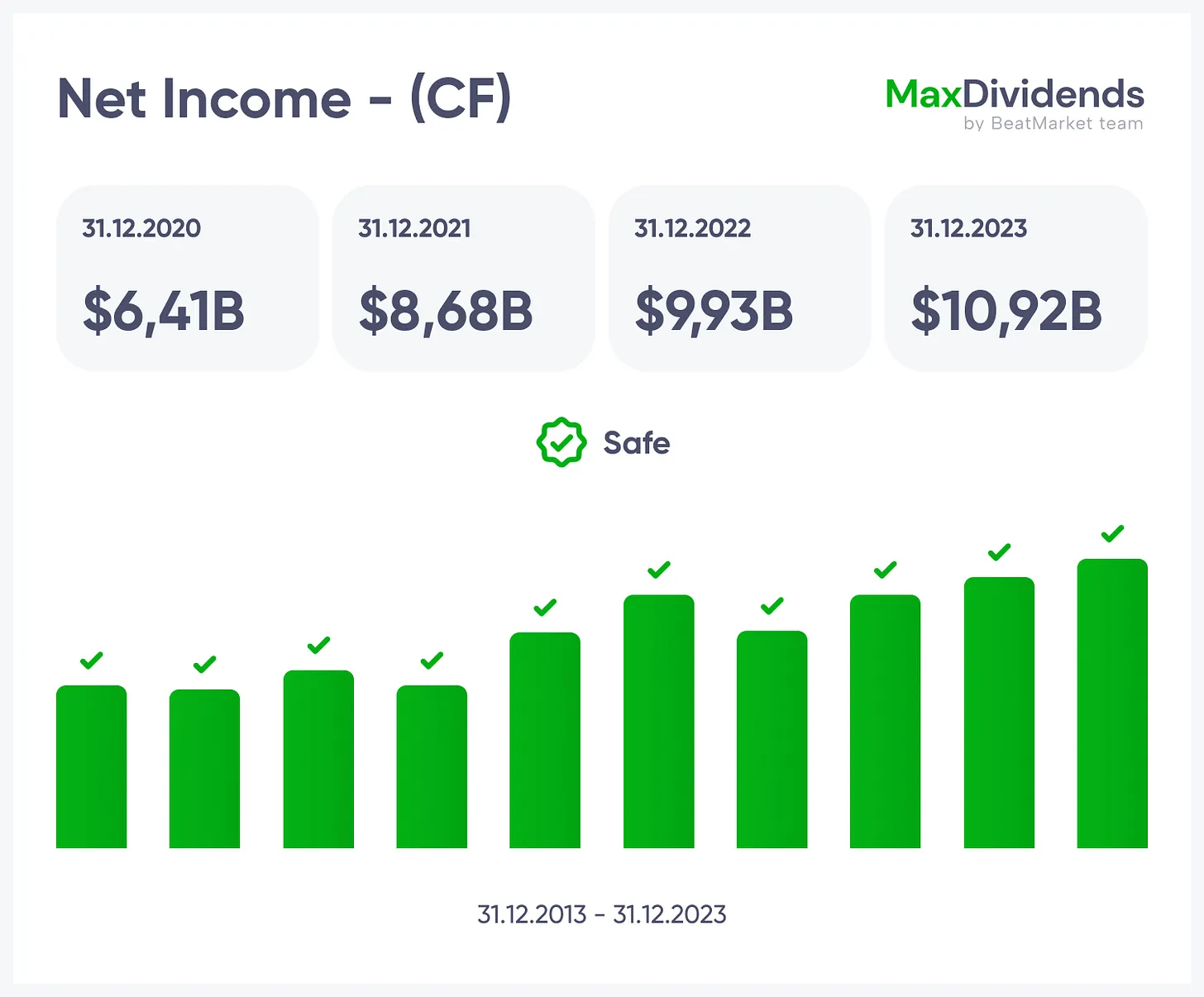

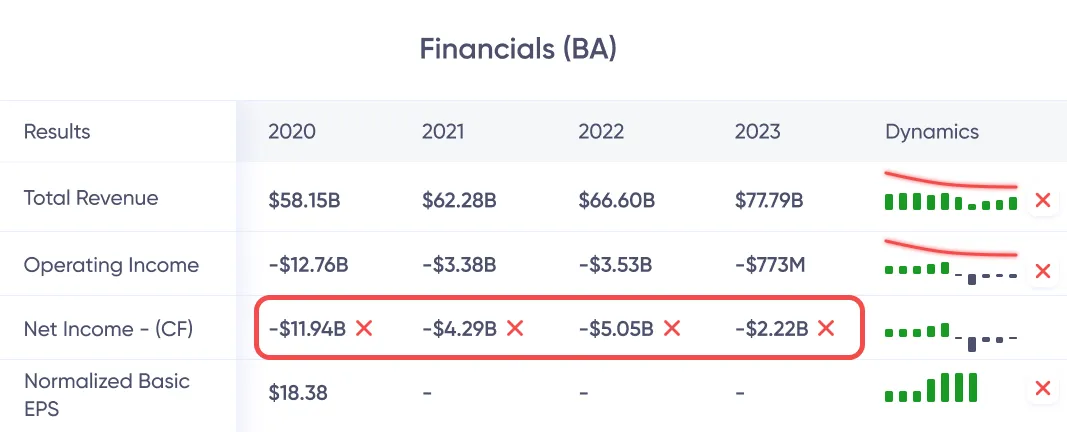

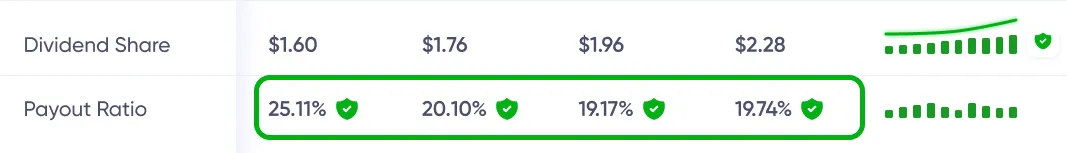

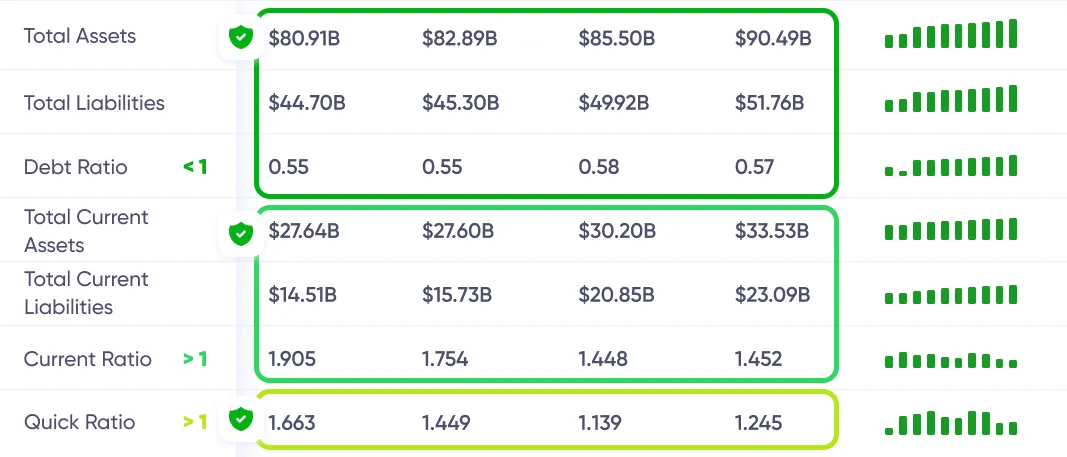

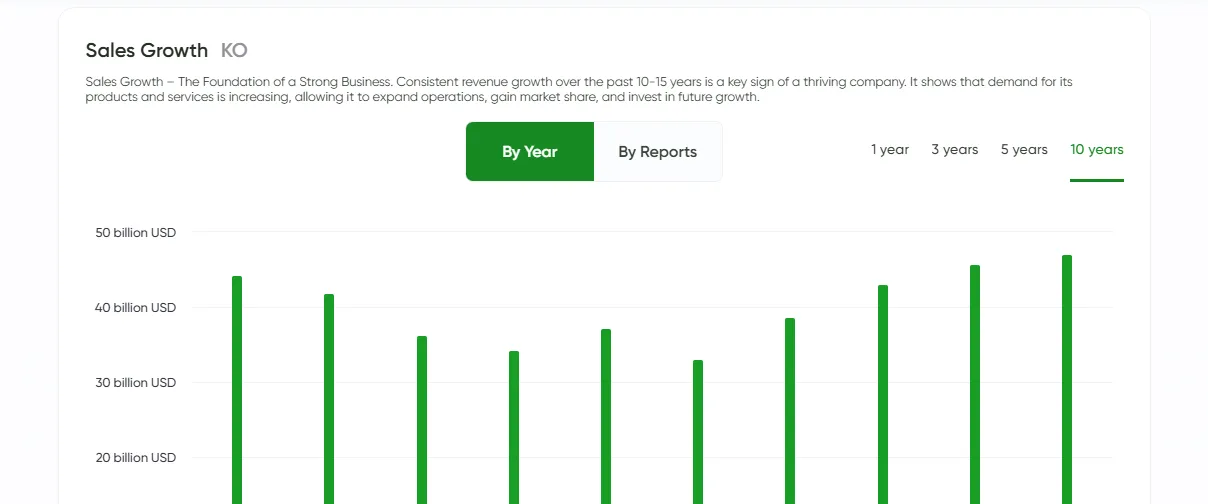

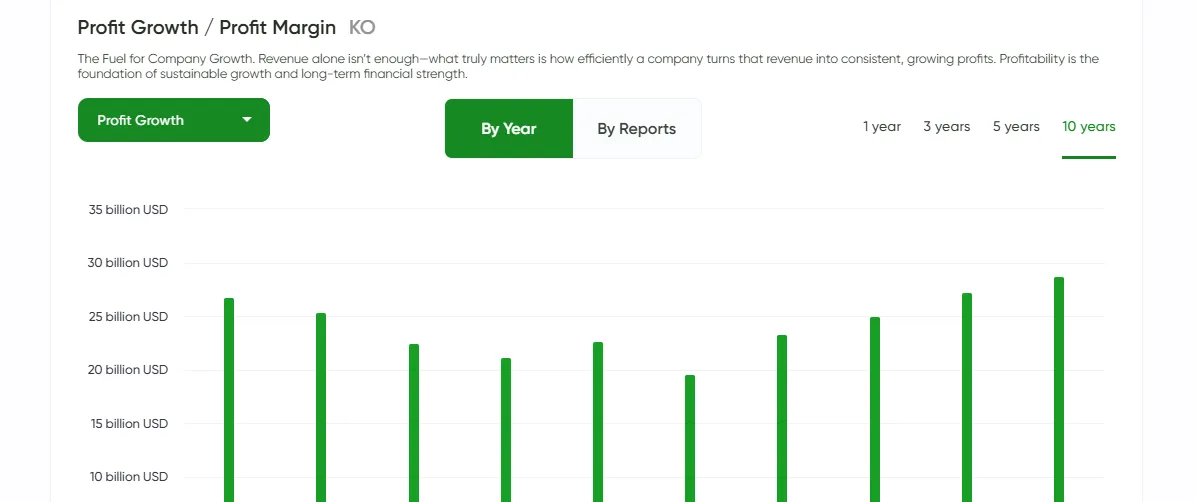

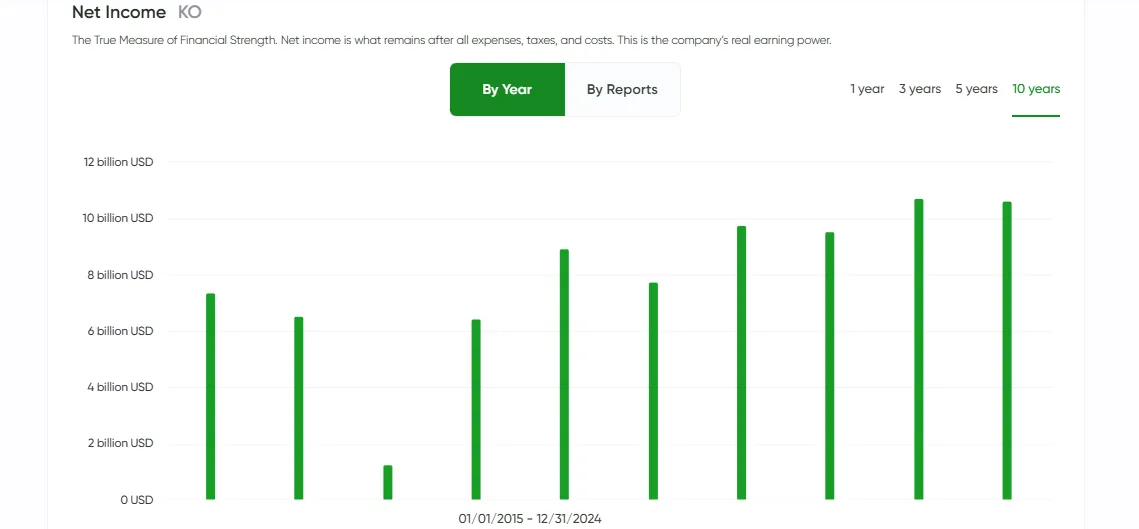

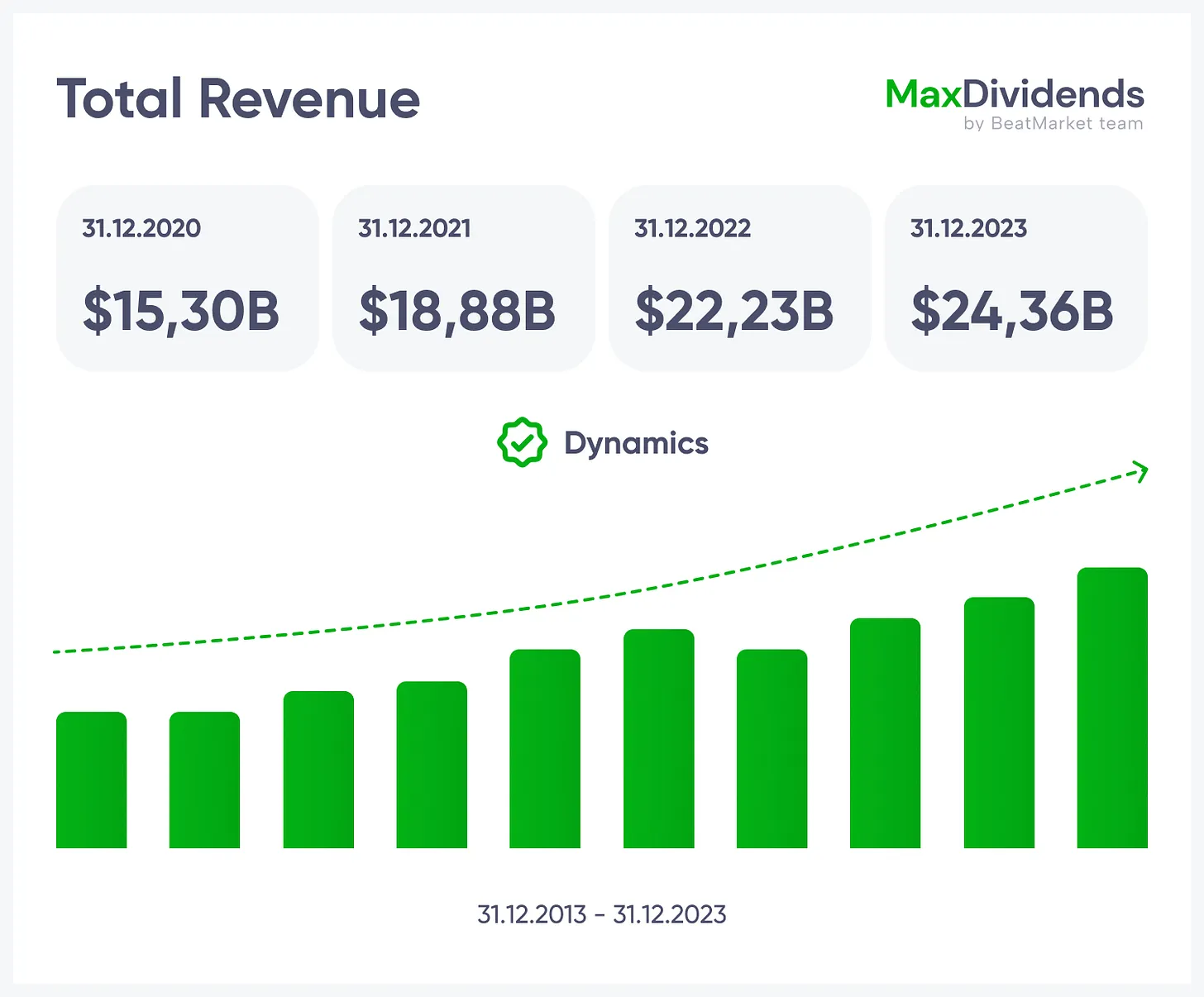

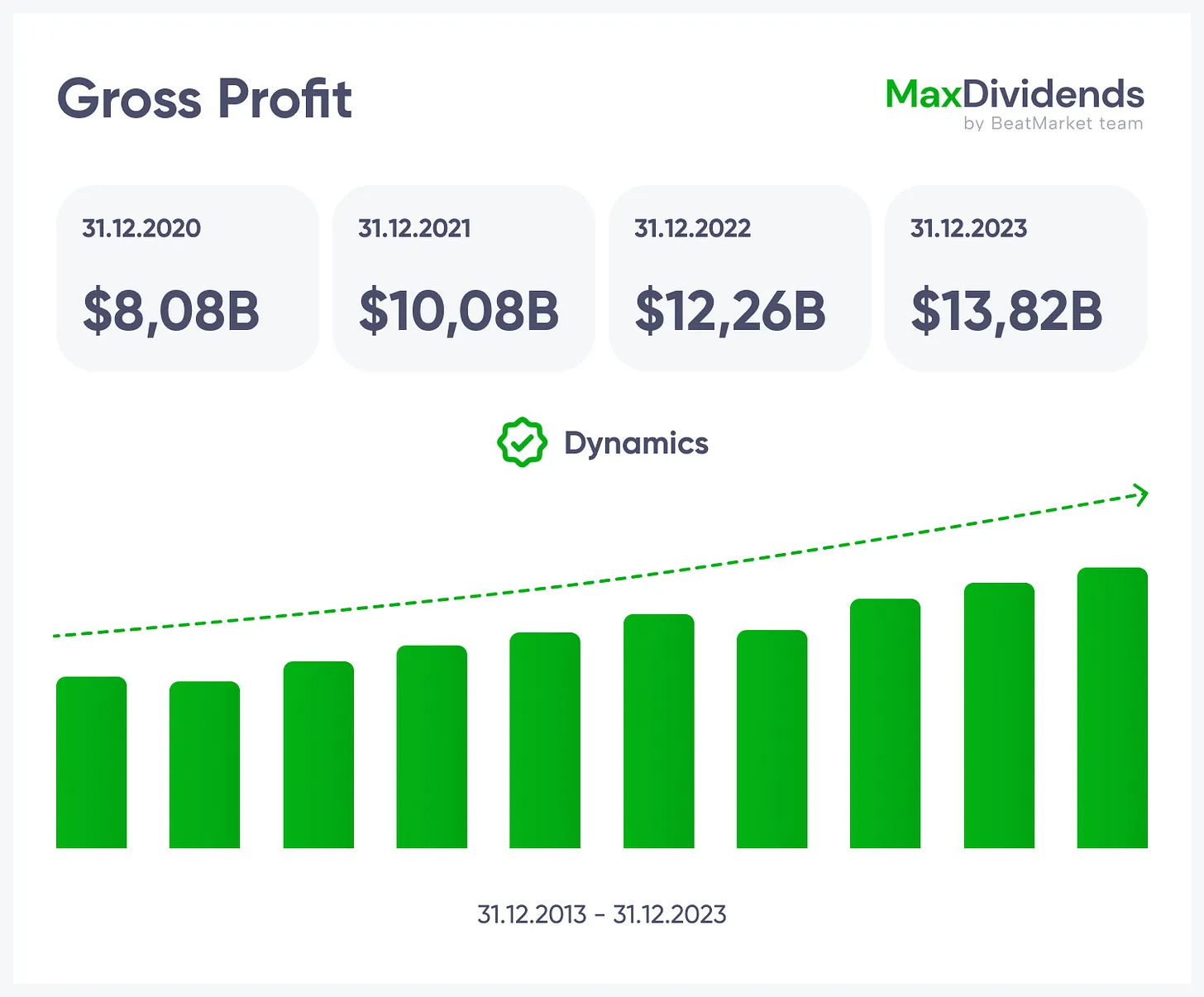

A Lista de Verificação da Fórmula Secreta dos Cinco Pilares é nossa maneira simples e comprovada de separar negócios fortes e duradouros do resto. Analisamos cinco pilares-chave—crescimento de vendas, crescimento de lucros, Lucro Líquido, segurança de dividendos e níveis de dívida. Juntamente com a Pontuação Financeira, eles nos dizem se uma empresa pode continuar crescendo, permanecer financeiramente sólida e pagar dividendos com confiabilidade por décadas.Receita Total M46

Lucro Bruto / Margem de Lucro M46

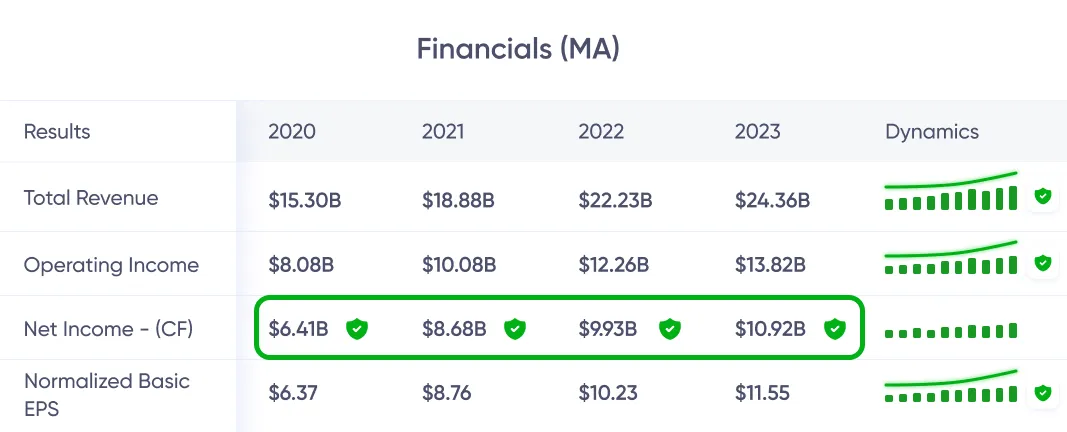

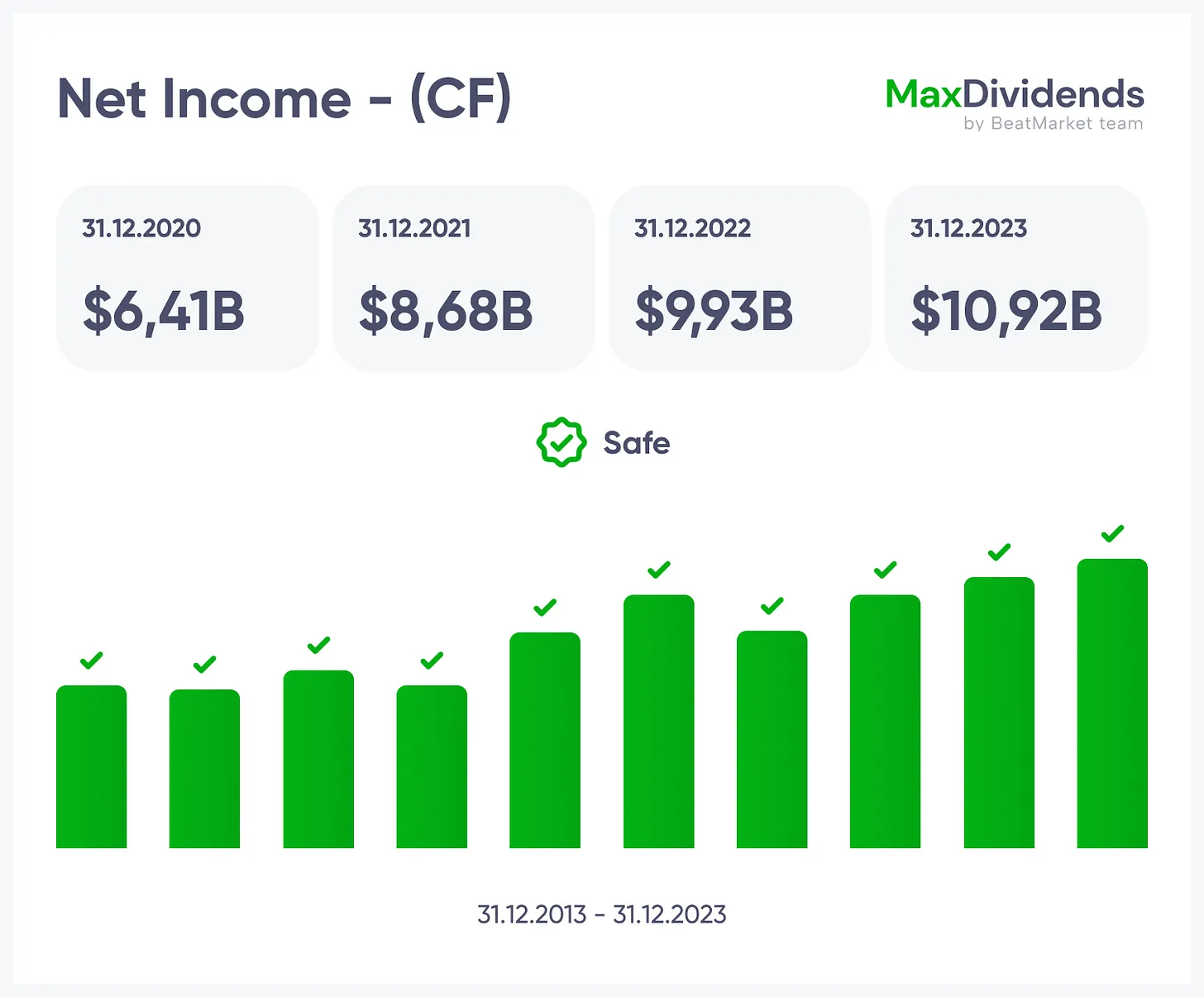

Lucro Líquido M46

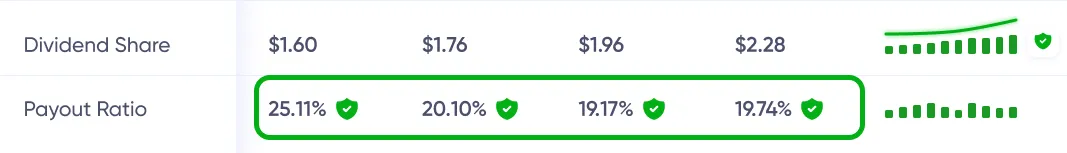

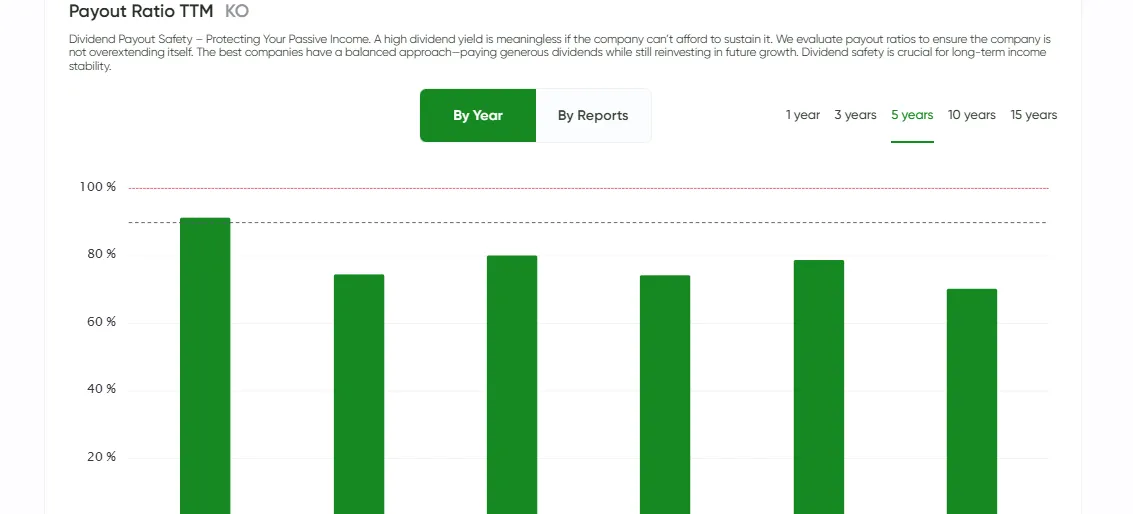

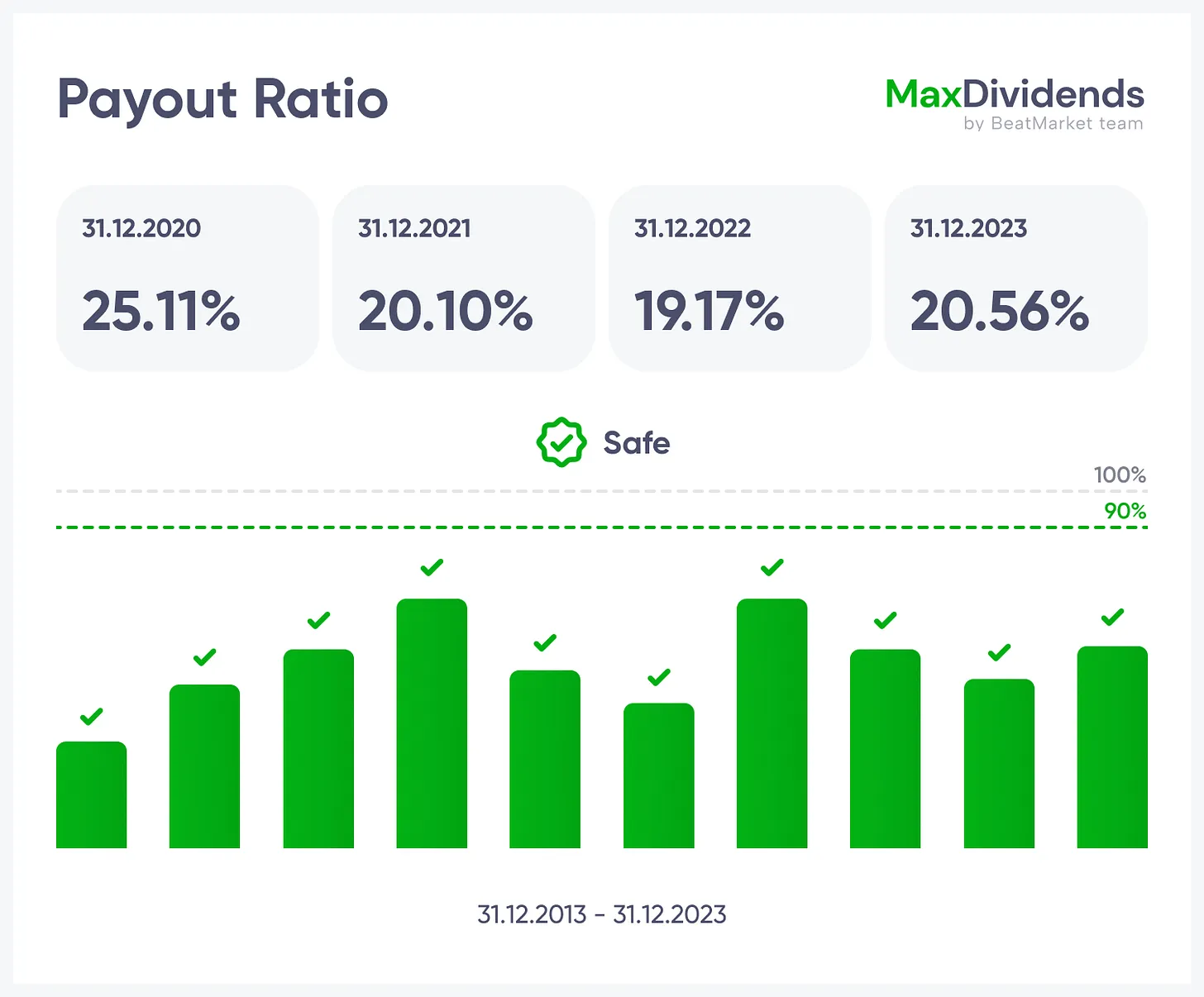

Rácio de Distribuição M46

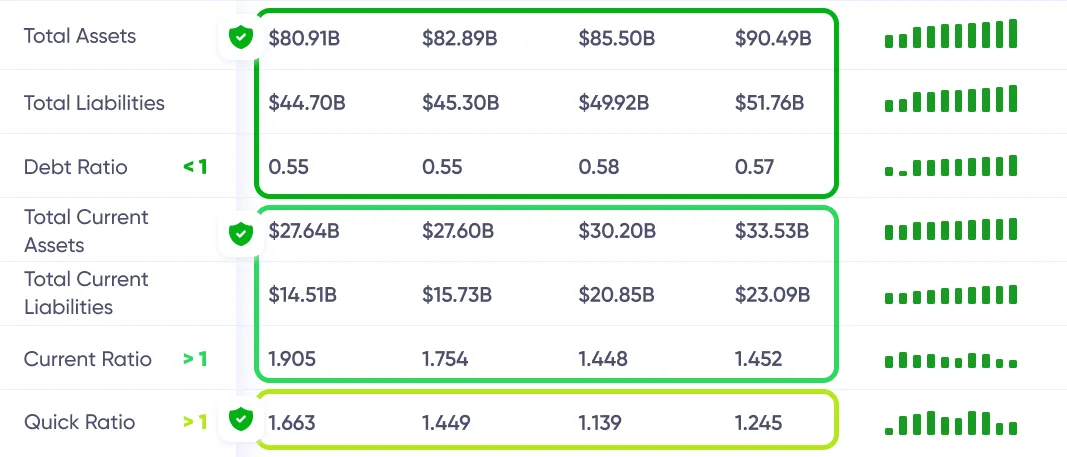

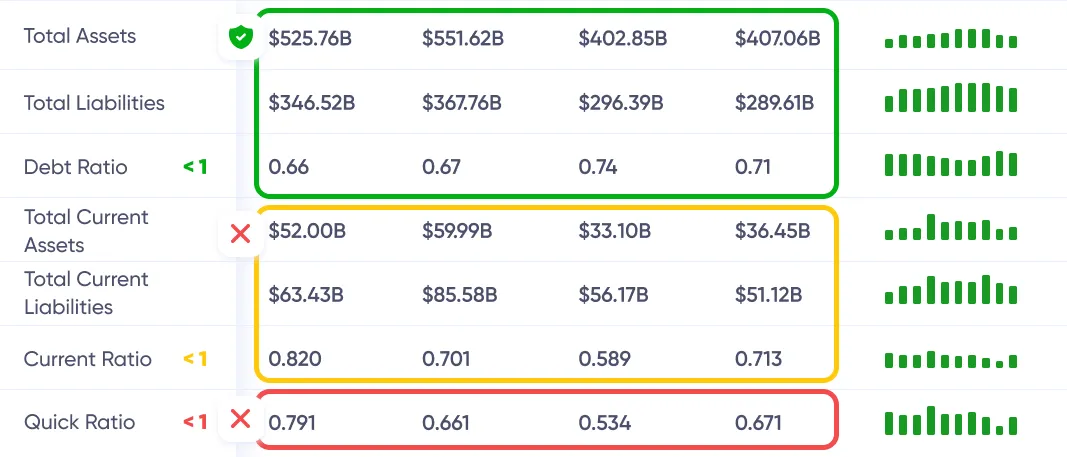

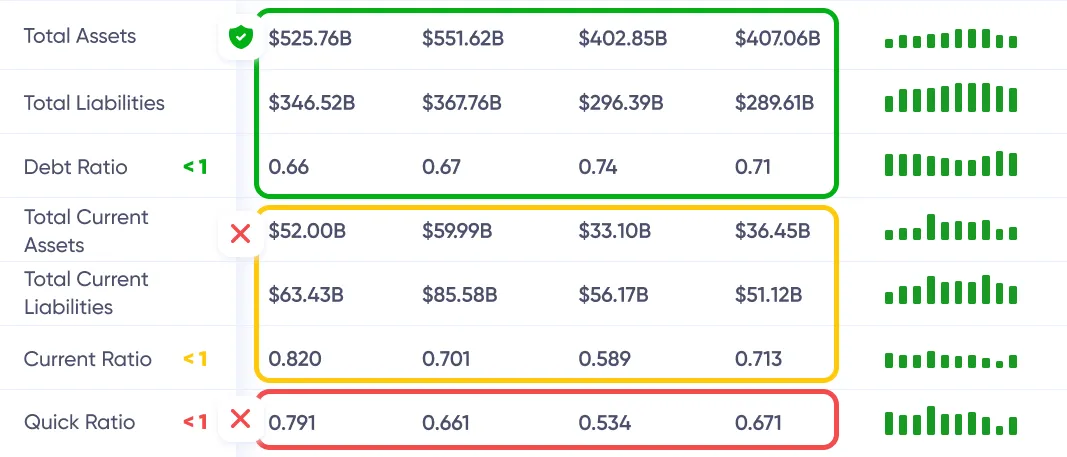

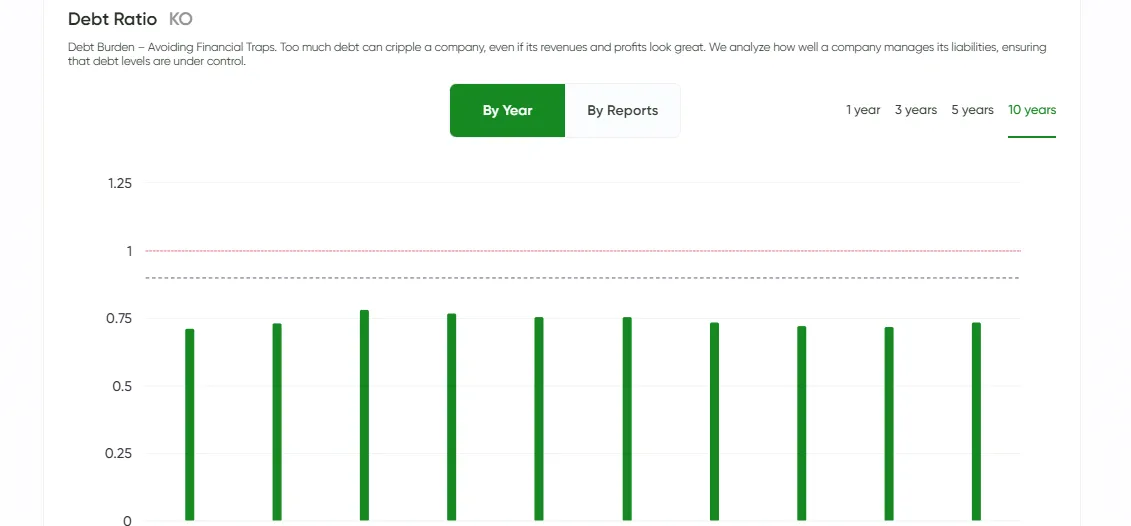

Rácio de Endividamento M46

Relatório

Alleima AB (publ) M46

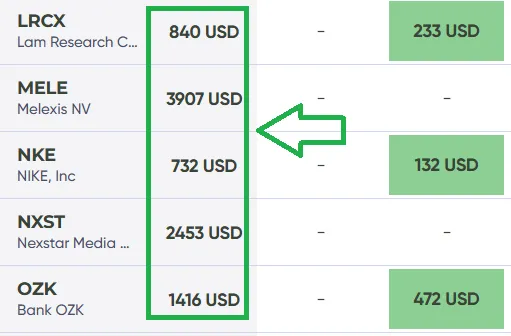

Acompanhe as principais métricas de cada ação em um só lugar, sem complicações

Inscreva-se no premium| Resultados | 2019 | Dinâmica |

Veja o negócio inteiro de relance—o que ele faz, como ganha e o valor que traz.

Veja o negócio inteiro de relance—o que ele faz, como ganha e o valor que traz.

Tendência de crescimento, clara em uma olhadela.

Tendência de crescimento, clara em uma olhadela.

Veja se os lucros são reais—instantaneamente.

Veja se os lucros são reais—instantaneamente.

Resultado final simplificado com o MaxDividends.

Resultado final simplificado com o MaxDividends.

Risco de dívida verificado para você, 24/7.

Risco de dívida verificado para você, 24/7.

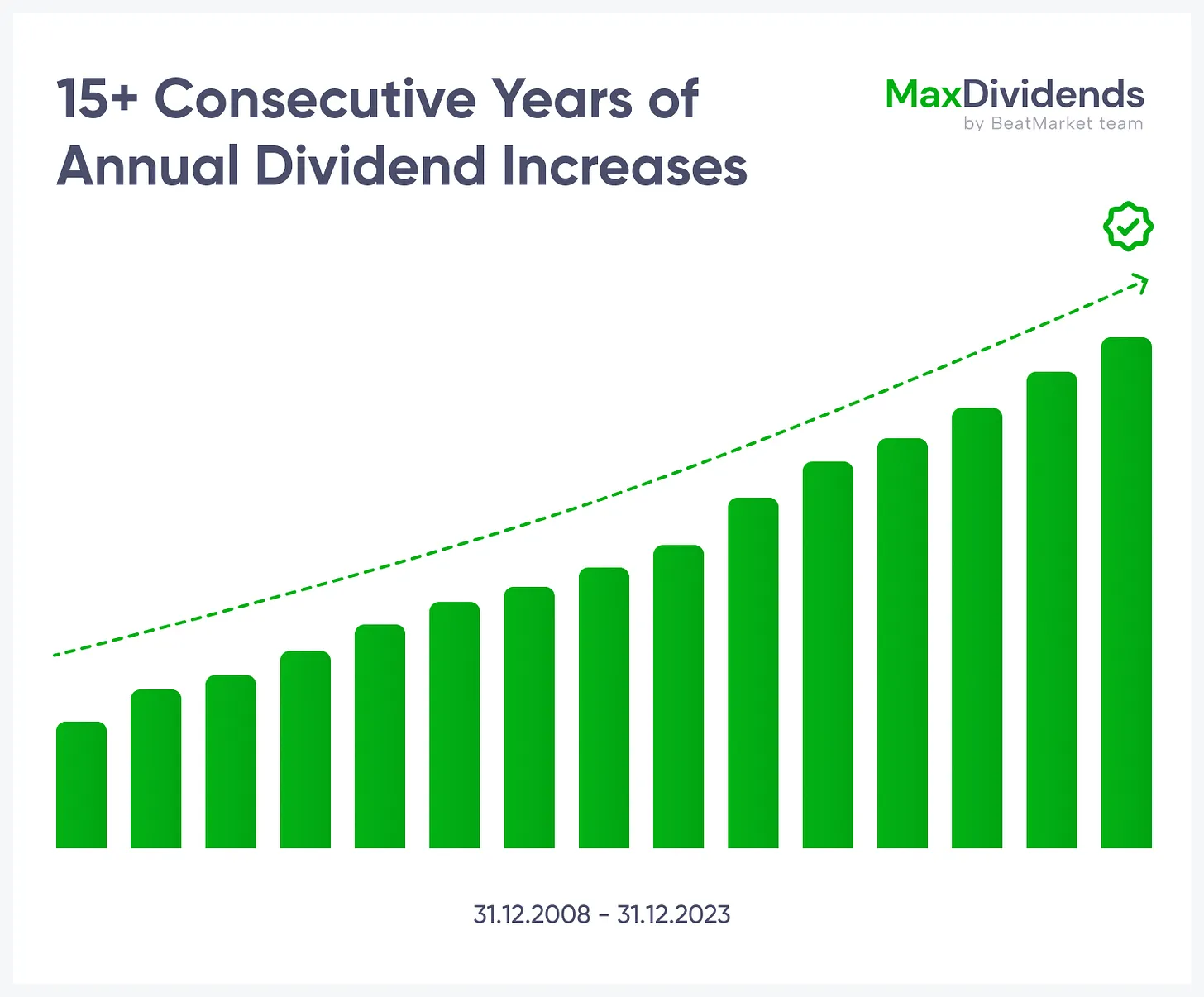

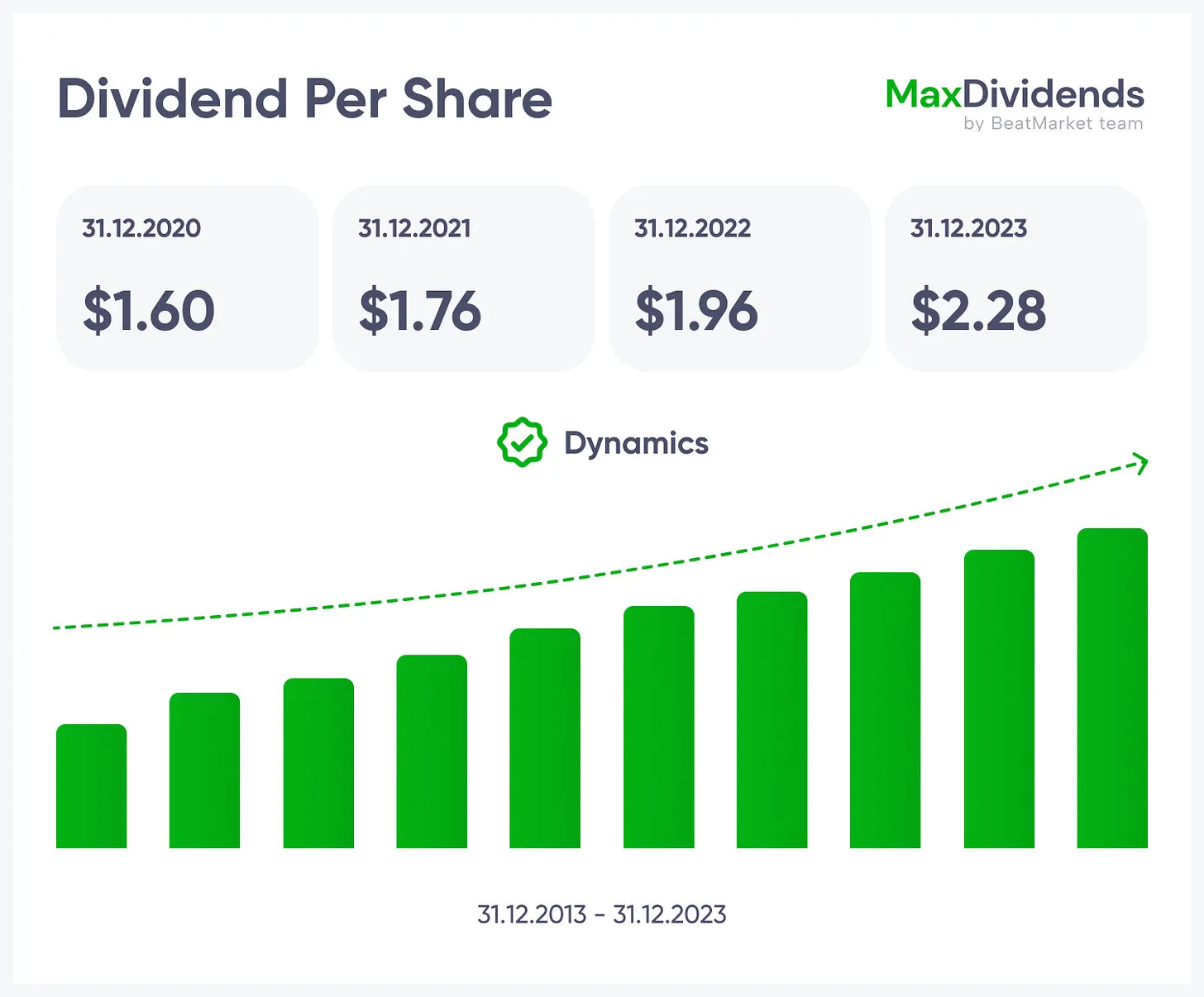

Sequências e aumentos de dividendos na ponta dos dedos.

Sequências e aumentos de dividendos na ponta dos dedos.

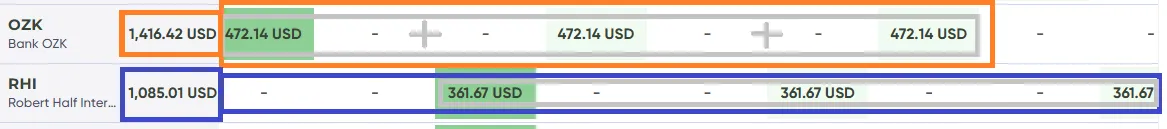

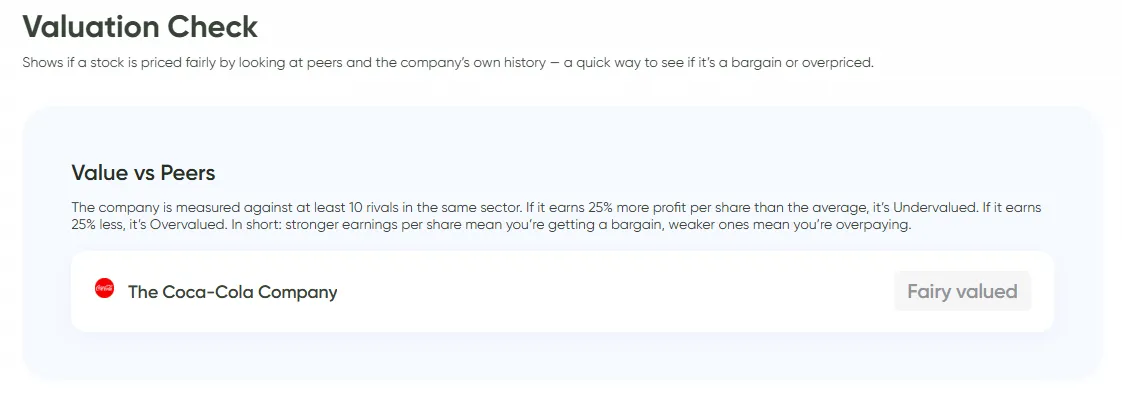

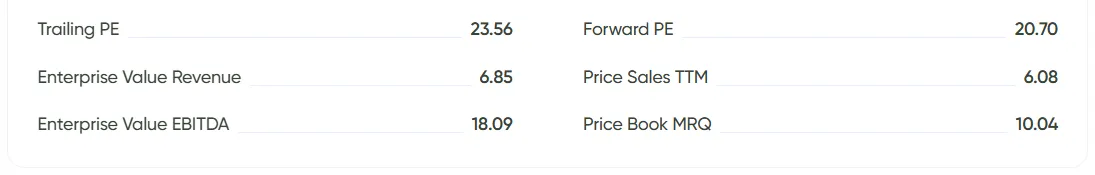

Compare a empresa com rivais. Se ela ganha mais por ação, está subvalorizada. Se menos, superfaturada.

Compare a empresa com rivais. Se ela ganha mais por ação, está subvalorizada. Se menos, superfaturada.

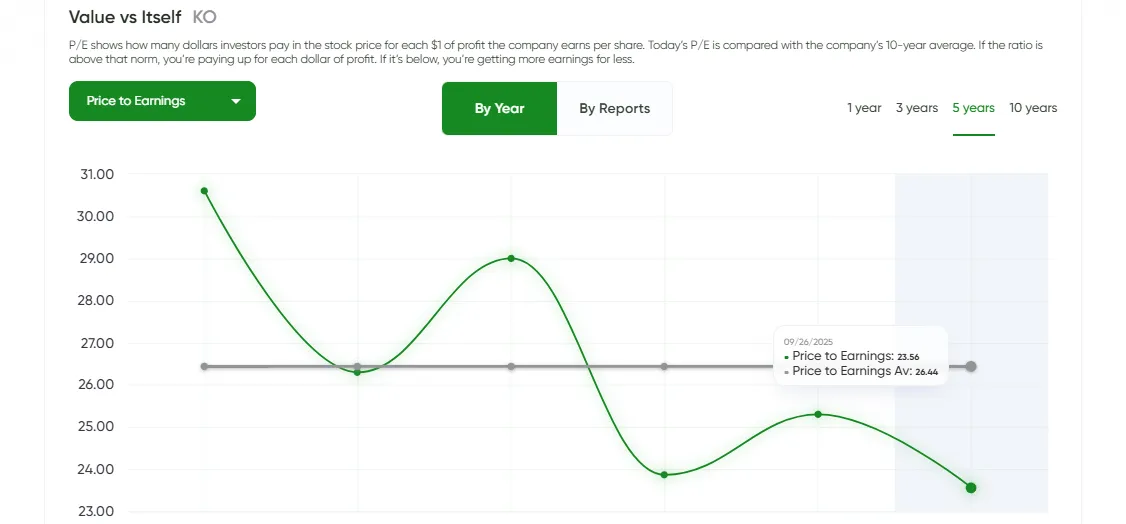

Compare o P/L de hoje com seu próprio histórico de 10 anos. Acima da média = caro. Abaixo = pechincha.

Compare o P/L de hoje com seu próprio histórico de 10 anos. Acima da média = caro. Abaixo = pechincha.

Veja se a ação negocia abaixo de seus ativos. Isso é comprar o negócio com uma margem de segurança embutida.

Veja se a ação negocia abaixo de seus ativos. Isso é comprar o negócio com uma margem de segurança embutida.

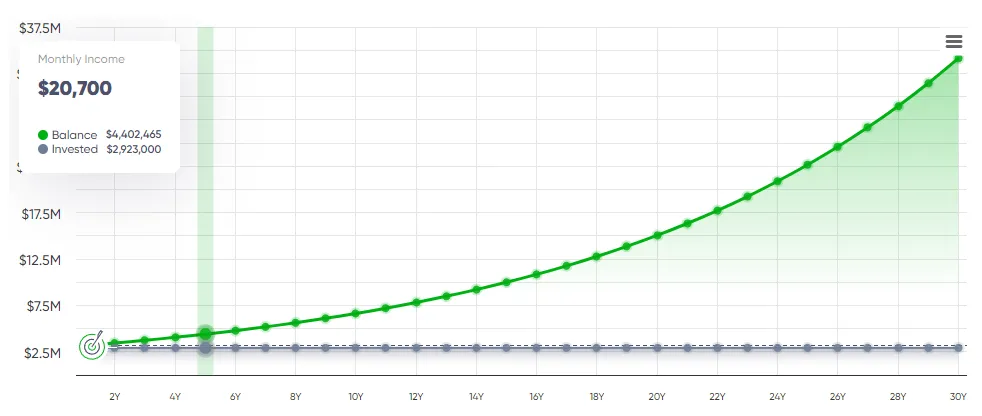

Aplicativo MaxDividends: Calculadora de Renda Passiva

Aplicativo MaxDividends: Calculadora de Renda Passiva

Insira esses valores, clique em calcular e boom—você tem seu roteiro.

Insira esses valores, clique em calcular e boom—você tem seu roteiro.

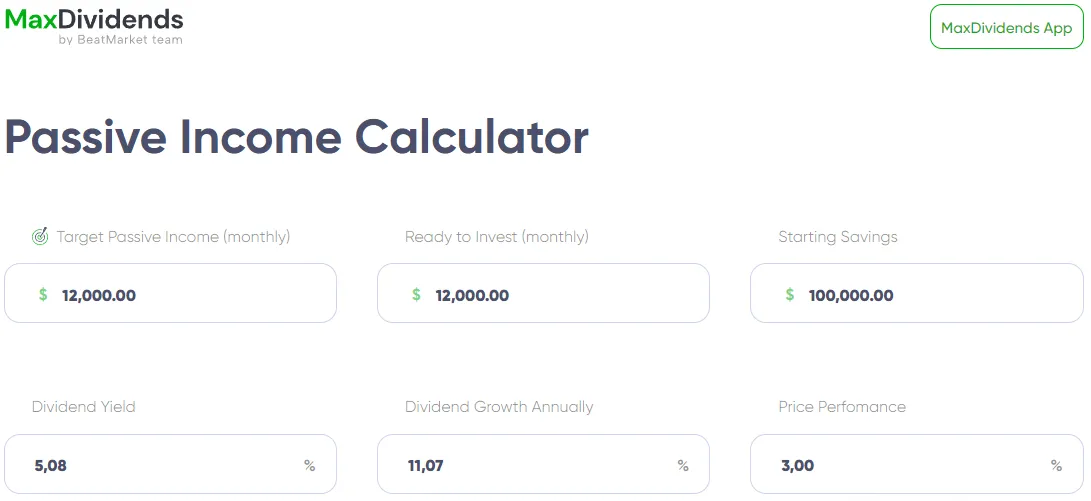

Aplicativo MaxDividends: Calculadora de Renda Passiva

Aplicativo MaxDividends: Calculadora de Renda Passiva

Aplicativo MaxDividends: Calculadora de Renda Passiva

Aplicativo MaxDividends: Calculadora de Renda Passiva

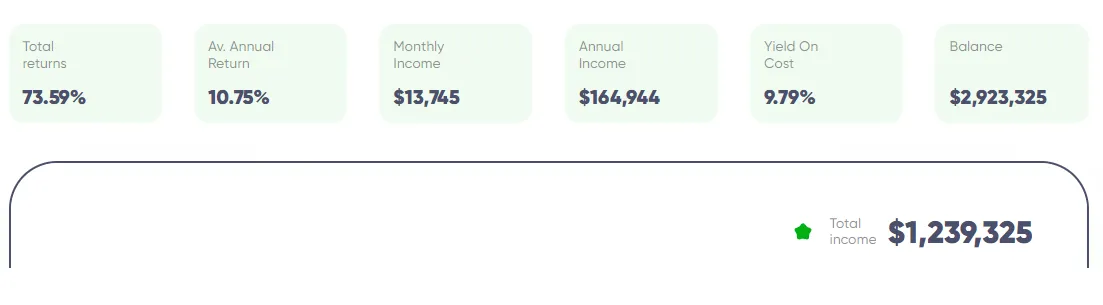

Aplicativo MaxDividends: Calculadora de Renda Passiva, Previsão de Renda

Aplicativo MaxDividends: Calculadora de Renda Passiva, Previsão de Renda

BeatStart

BeatStart