Especifique uma ação ou criptomoeda na barra de pesquisa para obter um resumo

Como Esta Empresa Ganha Dinheiro

Análise de Dividendos TCU

Max Ratio

–Rendimento de dividendos

4.76 %Crescimento de dividendos em 5 anos

0.00 %Crescimento contínuo

1 anoTaxa de pagamento em média de 5 anos

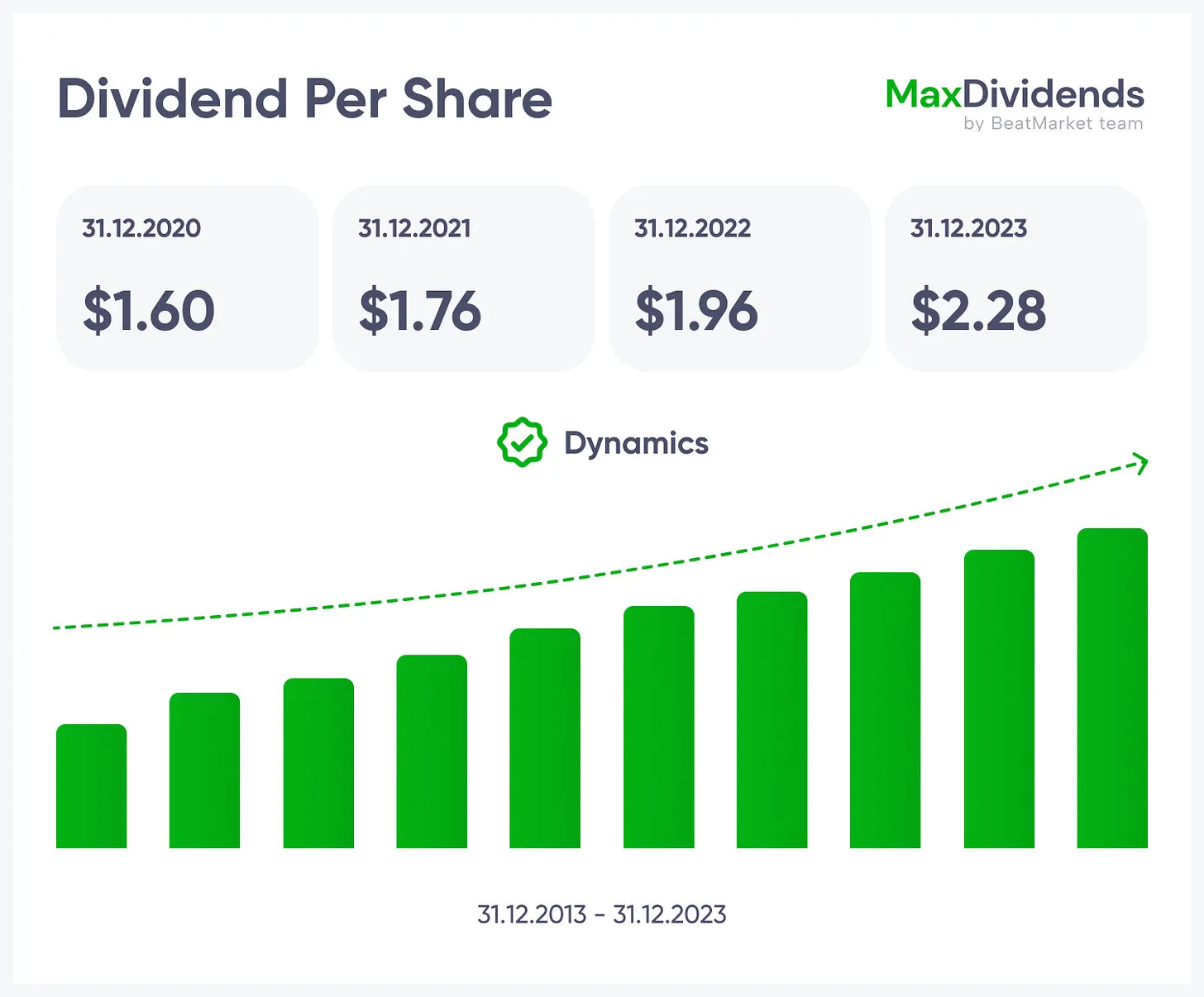

76.19 %Histórico de Dividendos TCU

A Lista de Verificação da Fórmula dos 5 Pilares

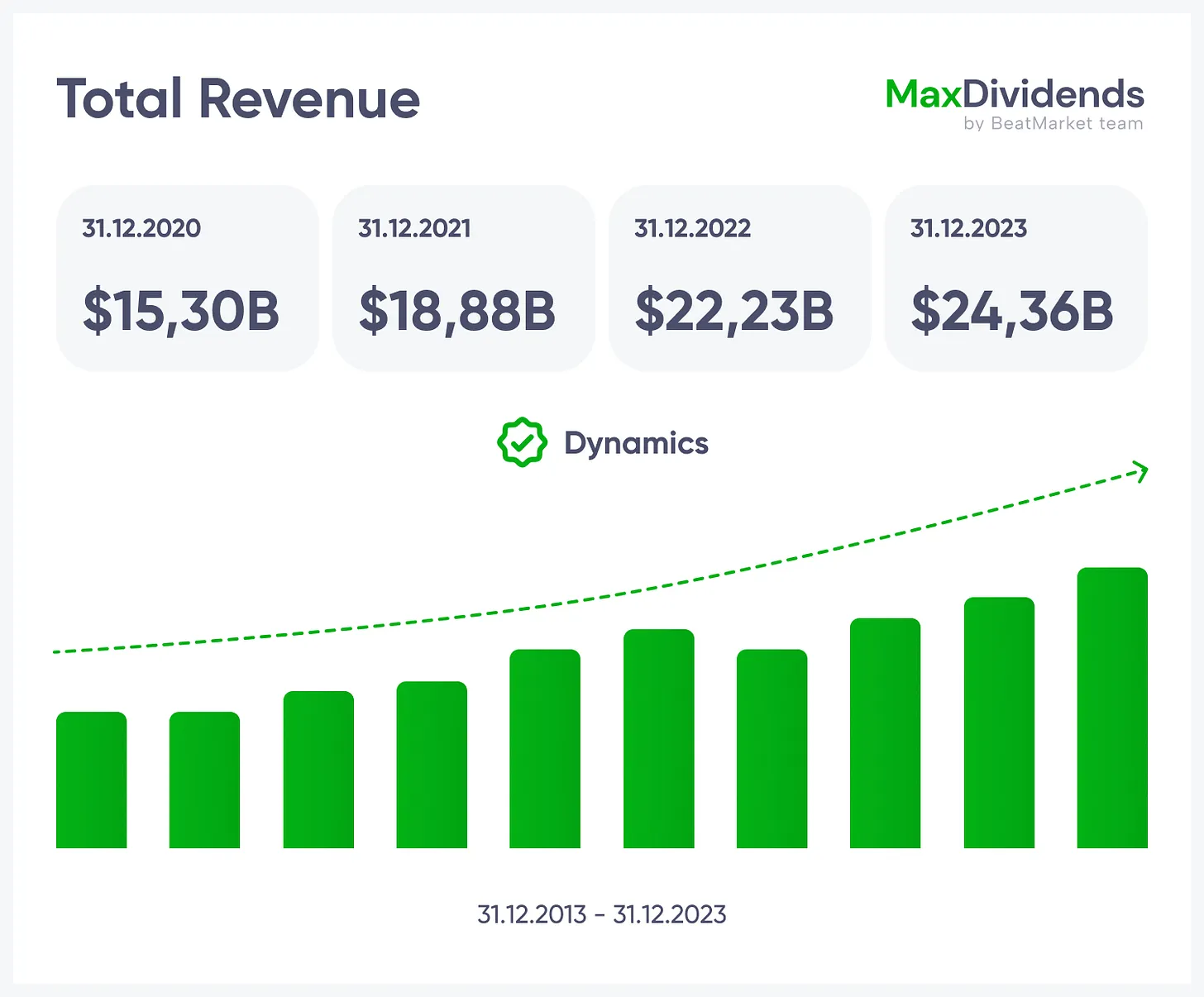

A Lista de Verificação da Fórmula Secreta dos Cinco Pilares é nossa maneira simples e comprovada de separar negócios fortes e duradouros do resto. Analisamos cinco pilares-chave—crescimento de vendas, crescimento de lucros, Lucro Líquido, segurança de dividendos e níveis de dívida. Juntamente com a Pontuação Financeira, eles nos dizem se uma empresa pode continuar crescendo, permanecer financeiramente sólida e pagar dividendos com confiabilidade por décadas.Receita Total TCU

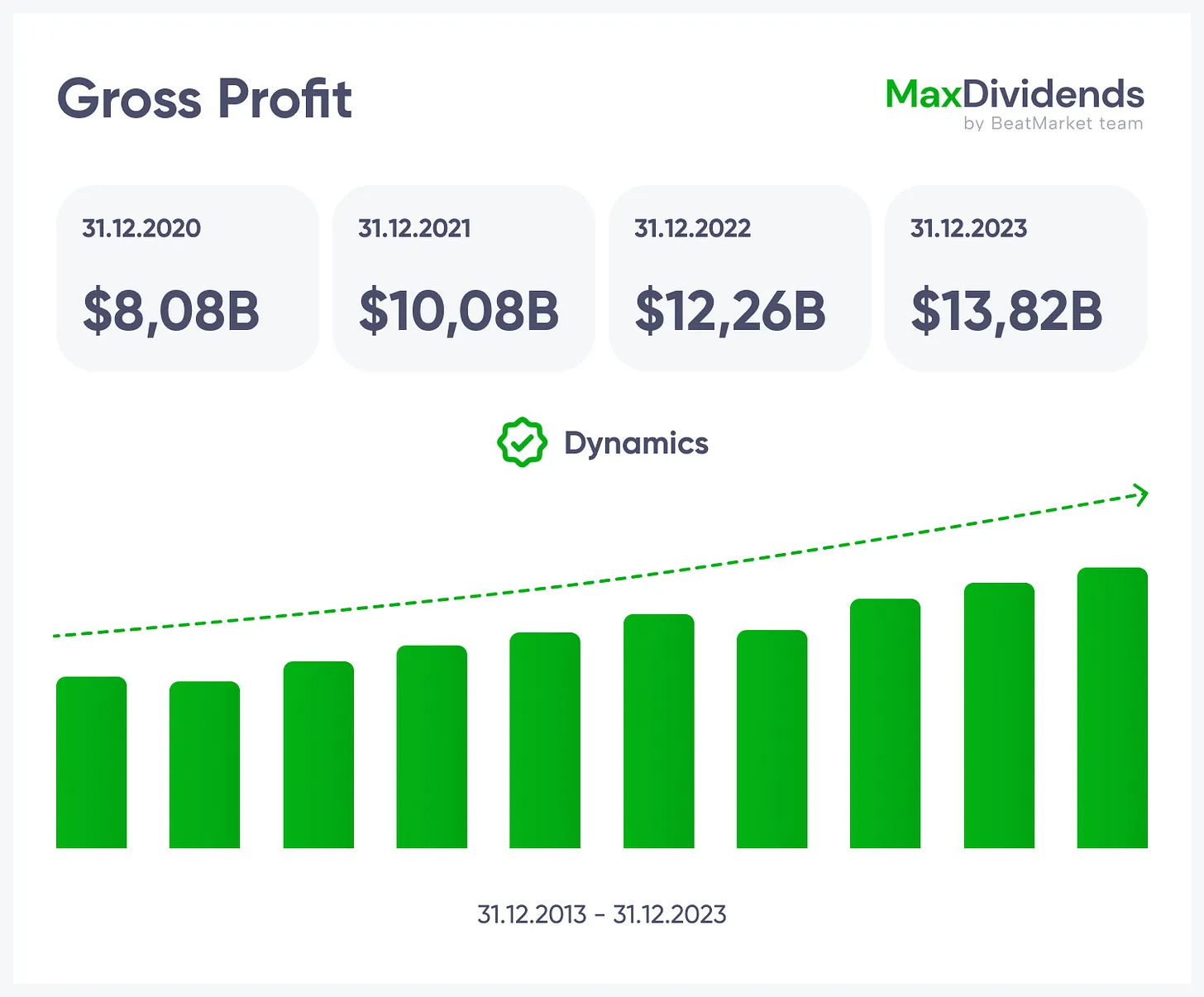

Lucro Bruto / Margem de Lucro TCU

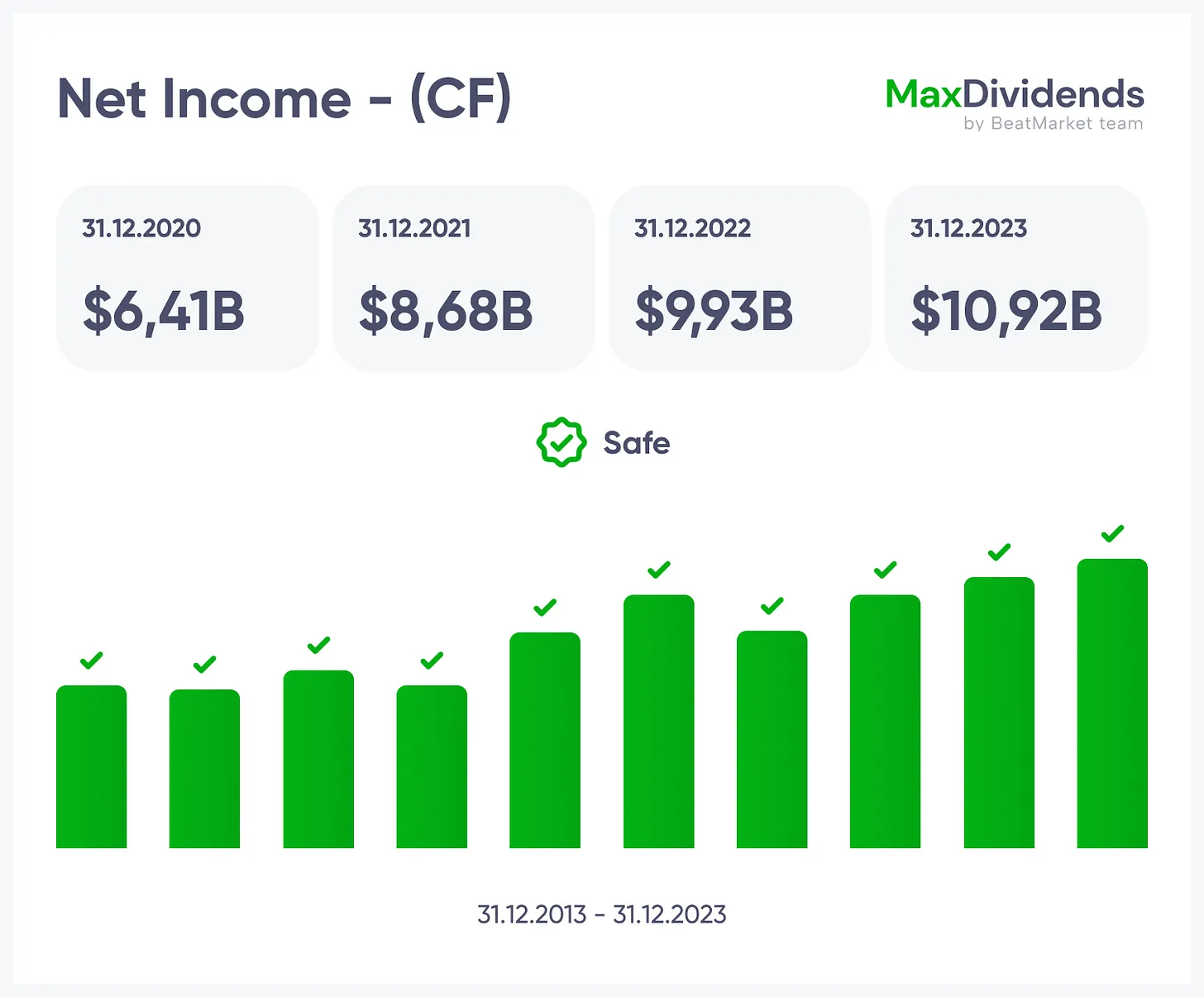

Lucro Líquido TCU

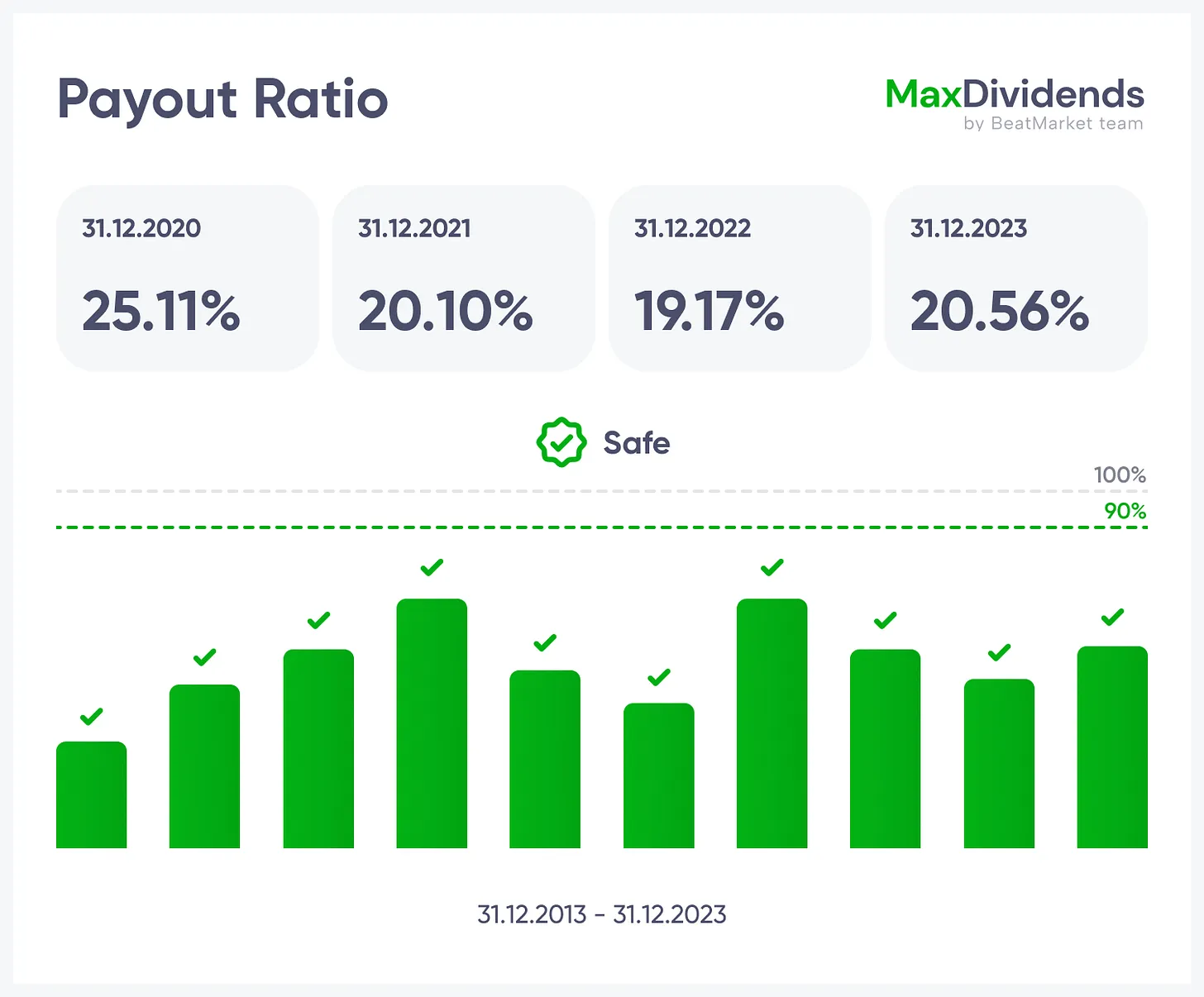

Rácio de Distribuição TCU

Rácio de Endividamento TCU

Relatório

CREDIT BUREAU ASIA LIMITED TCU

Acompanhe as principais métricas de cada ação em um só lugar, sem complicações

Inscreva-se no premium| Resultados | 2019 | Dinâmica |

Veja o negócio inteiro de relance—o que ele faz, como ganha e o valor que traz.

Veja o negócio inteiro de relance—o que ele faz, como ganha e o valor que traz.

Tendência de crescimento, clara em uma olhadela.

Tendência de crescimento, clara em uma olhadela.

Veja se os lucros são reais—instantaneamente.

Veja se os lucros são reais—instantaneamente.

Resultado final simplificado com o MaxDividends.

Resultado final simplificado com o MaxDividends.

Risco de dívida verificado para você, 24/7.

Risco de dívida verificado para você, 24/7.

Sequências e aumentos de dividendos na ponta dos dedos.

Sequências e aumentos de dividendos na ponta dos dedos.

Compare a empresa com rivais. Se ela ganha mais por ação, está subvalorizada. Se menos, superfaturada.

Compare a empresa com rivais. Se ela ganha mais por ação, está subvalorizada. Se menos, superfaturada.

Compare o P/L de hoje com seu próprio histórico de 10 anos. Acima da média = caro. Abaixo = pechincha.

Compare o P/L de hoje com seu próprio histórico de 10 anos. Acima da média = caro. Abaixo = pechincha.

Veja se a ação negocia abaixo de seus ativos. Isso é comprar o negócio com uma margem de segurança embutida.

Veja se a ação negocia abaixo de seus ativos. Isso é comprar o negócio com uma margem de segurança embutida.

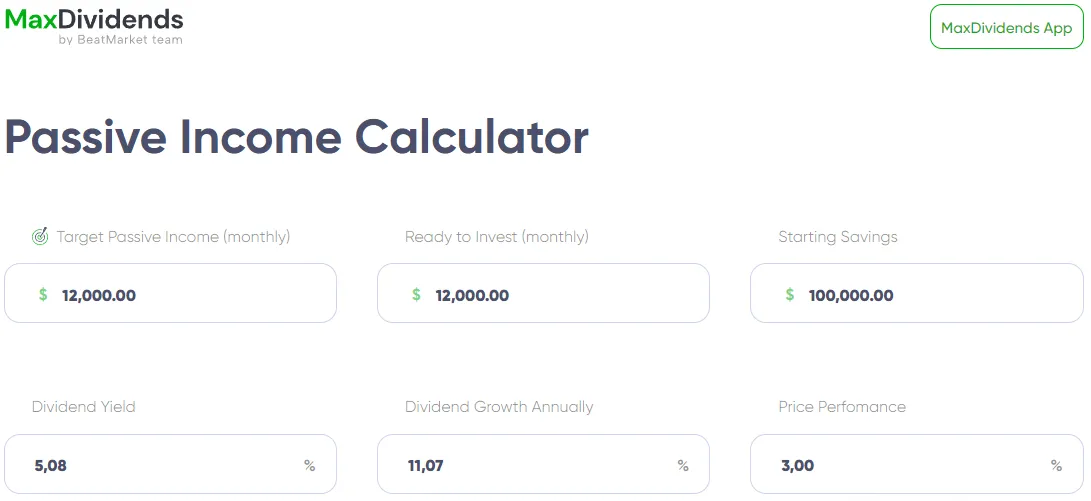

Aplicativo MaxDividends: Calculadora de Renda Passiva

Aplicativo MaxDividends: Calculadora de Renda Passiva

Insira esses valores, clique em calcular e boom—você tem seu roteiro.

Insira esses valores, clique em calcular e boom—você tem seu roteiro.

Aplicativo MaxDividends: Calculadora de Renda Passiva

Aplicativo MaxDividends: Calculadora de Renda Passiva

Aplicativo MaxDividends: Calculadora de Renda Passiva

Aplicativo MaxDividends: Calculadora de Renda Passiva

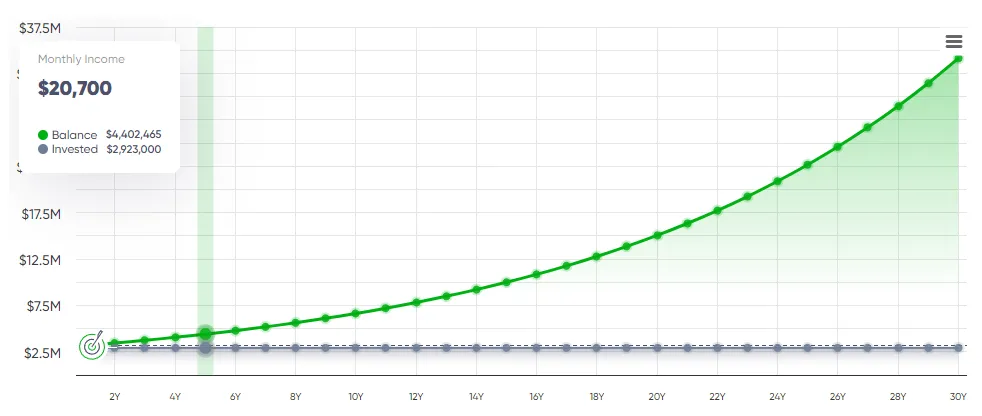

Aplicativo MaxDividends: Calculadora de Renda Passiva, Previsão de Renda

Aplicativo MaxDividends: Calculadora de Renda Passiva, Previsão de Renda

BeatStart

BeatStart