Lido Staked Polkadot

STDOTPrice Chart

Lido DOT Liquid Staking Protocol, built on the Polkadot chain, allows their users to earn staking rewards on the Polkadot chain without locking DOT or maintaining staking infrastructure. Lido on Polkadot make DOTs liquid while staking. It ensures maximized yield and availability of staking and makes leverage options possible while being decentralized and secure. Users can deposit DOT to the Lido smart contract and receive stDOT tokens in return. Unlike DOT staked directly on the Polkadot network, the stDOT token is free from the limitations associated with the lack of liquidity and can be transferred at any time. The stDOT token balance corresponds to the amount of the Polkadot chain DOT that a holder can withdraw. That becomes possible because of permissionless validator node selection and dynamic reallocation algorithms along with slashing hedging deployed on Moonbeam parachain and empowered by XC-20 cross-chain token standard.

See the whole business at a glance — what it does, how it earns, and the value it brings.

See the whole business at a glance — what it does, how it earns, and the value it brings.

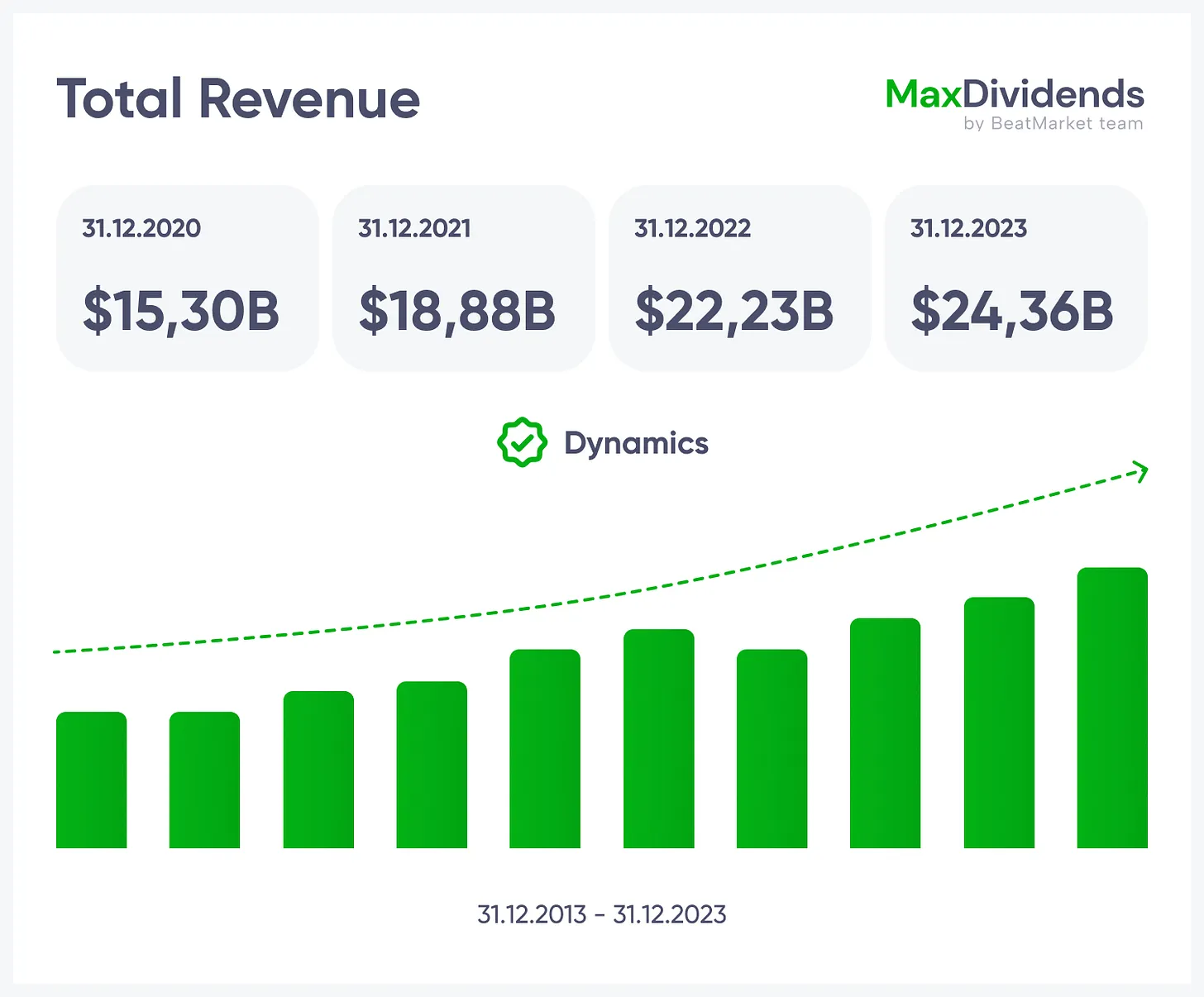

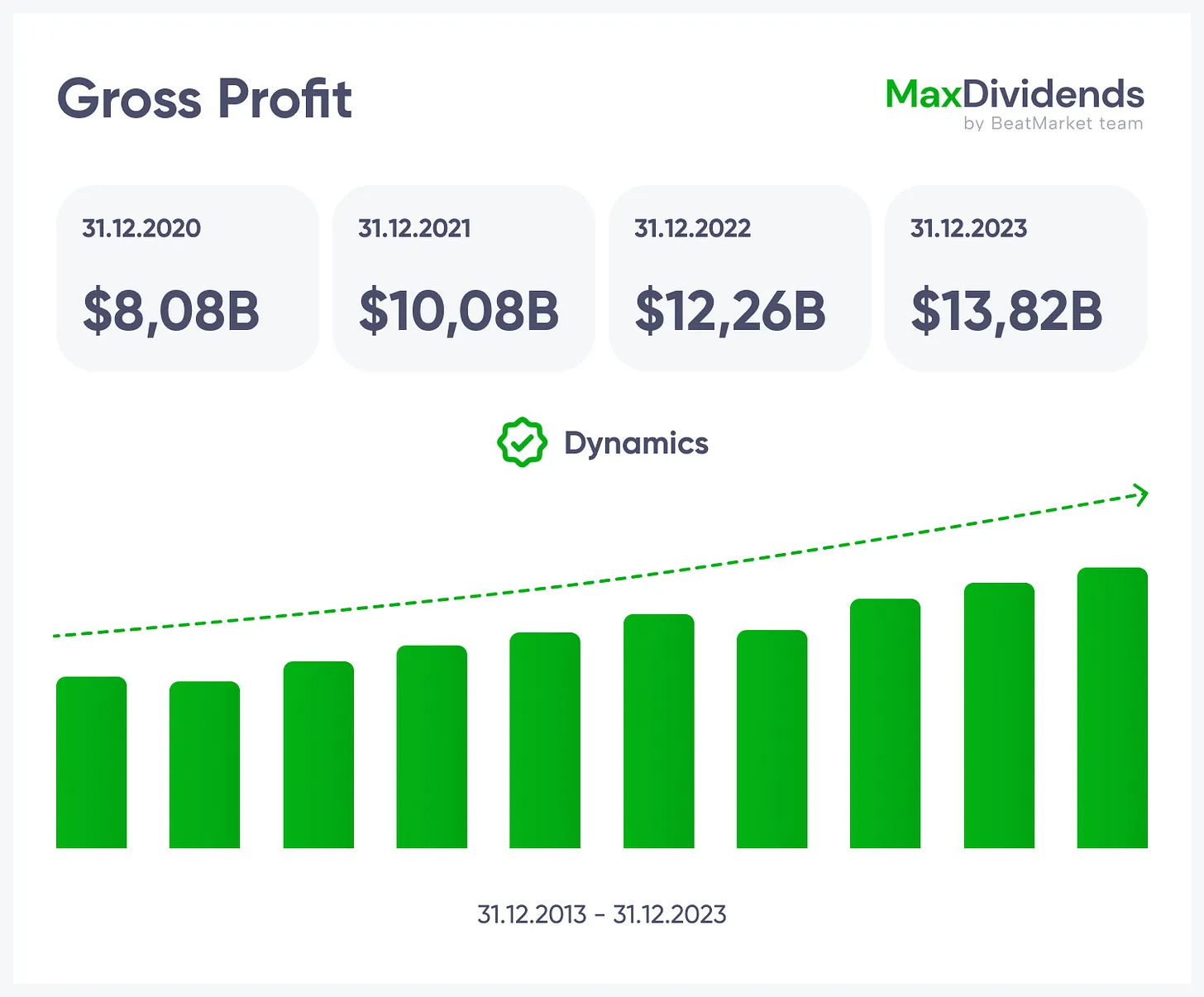

Growth trend, clear in one glance.

Growth trend, clear in one glance.

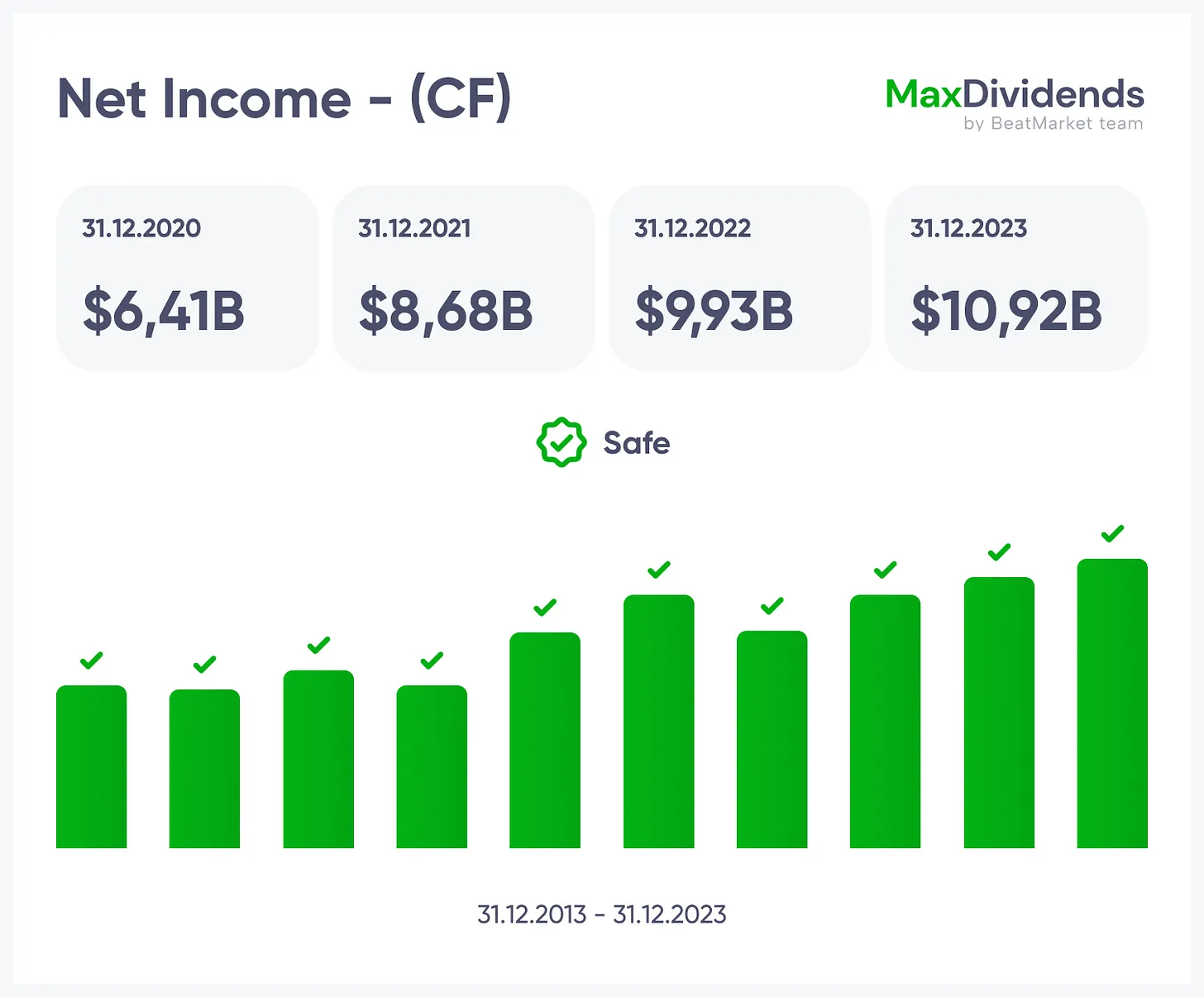

See if profits are real — instantly.

See if profits are real — instantly.

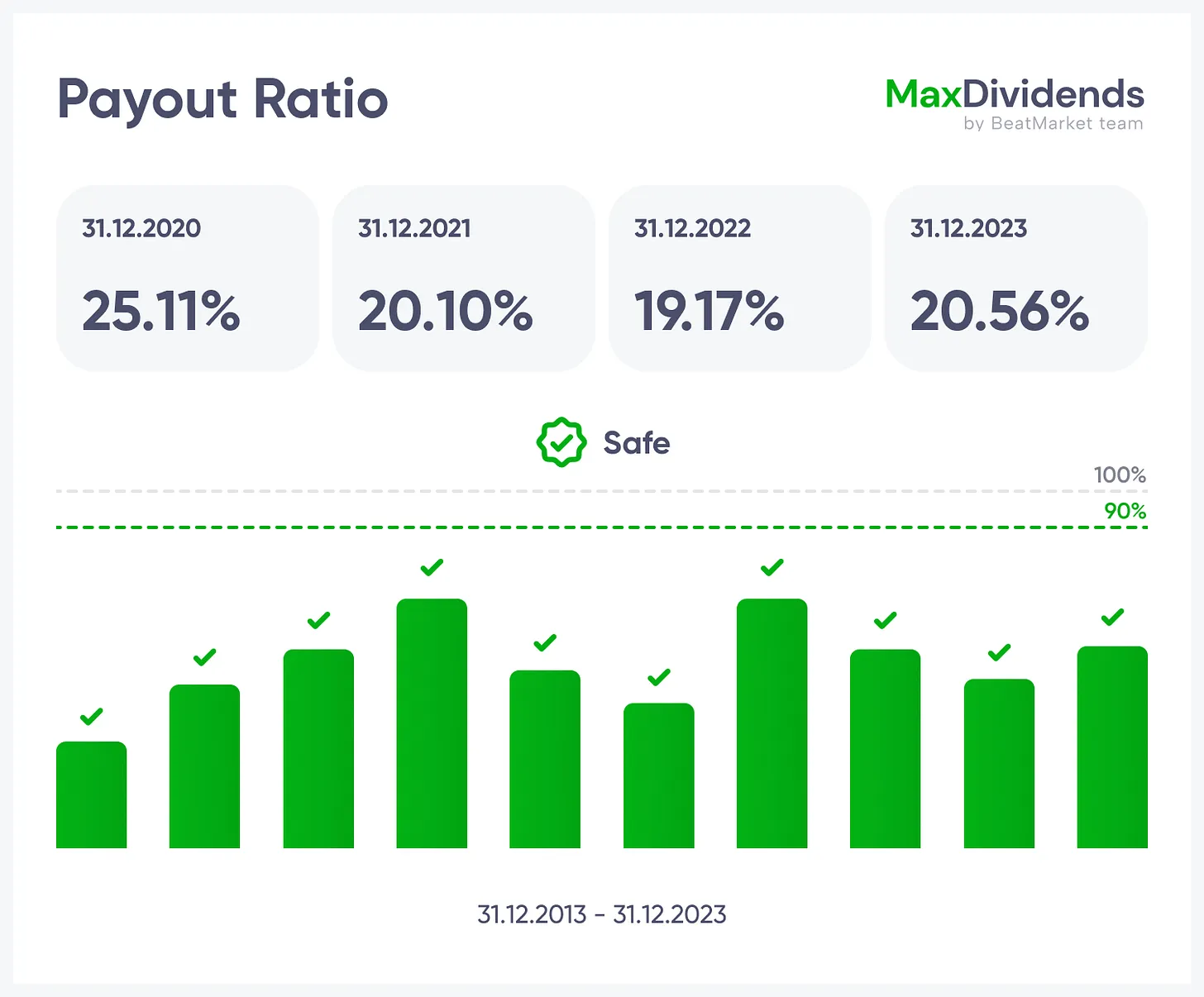

Bottom line made simple with MaxDividends.

Bottom line made simple with MaxDividends.

Debt risk checked for you, 24/7.

Debt risk checked for you, 24/7.

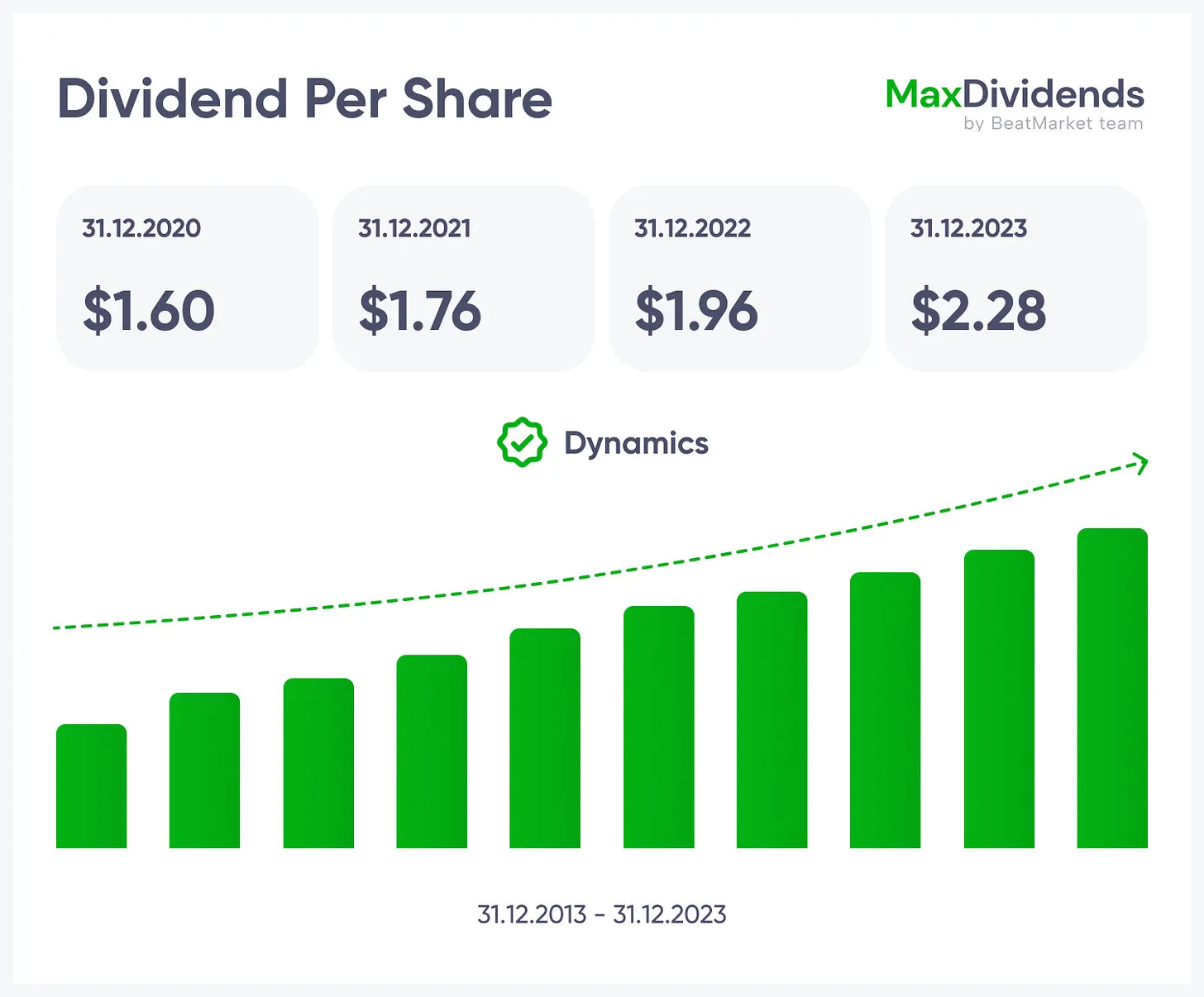

Dividend streaks and raises at your fingertips.

Dividend streaks and raises at your fingertips.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

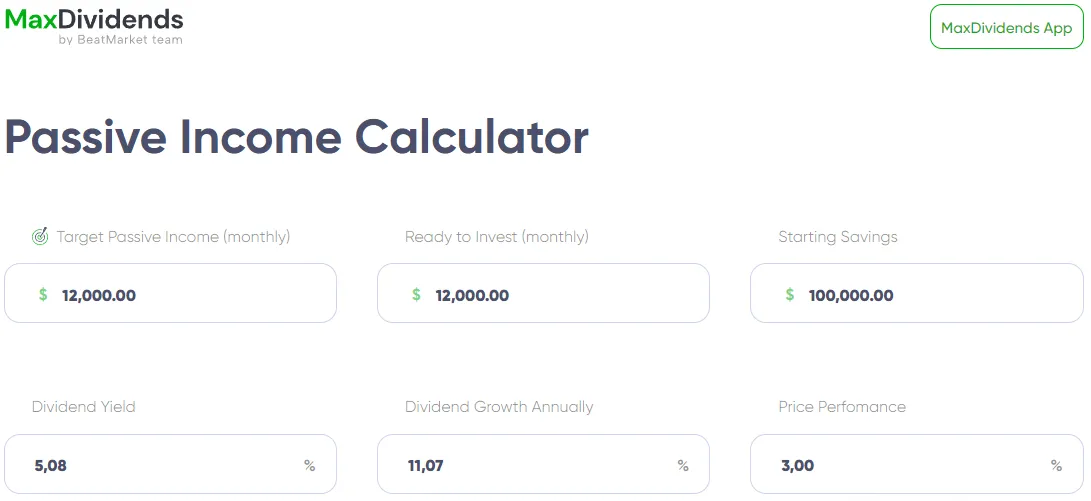

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

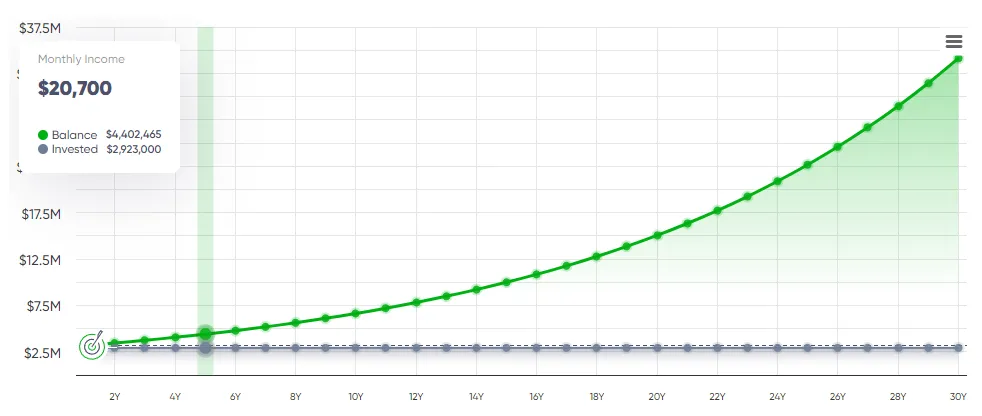

MaxDividends App: Passive Income Calculator, Income Forecast

MaxDividends App: Passive Income Calculator, Income Forecast

BeatStart

BeatStart