Stake DAO CRV

SDCRVPrice Chart

Stake DAO created a liquid locker for the CRV token, the governance token of Curve, called sdCRV. As sdCRV is a liquid form of veCRV, users have the possibility to deposit and stake directly on Stake DAO or buy on the secondary market, using the sdCRV/CRV pool. TL;DR: Liquid Lockers unlock the following from lockable tokens: Maximised yield Exit liquidity (convert back to underlying governance token) Governance power (no vote-lock) Bribing (sell your votes) Cross-chain accessibility (to come) Boost your voting power (using veSDT) What are Liquid Lockers ? Stake DAO Liquid Lockers allow DeFi users to unlock power from lockable tokens (e.g. ANGLE, FXS, CRV) without having to compromise on yield, voting power, or liquidity. With Stake DAO Liquid Lockers, anyone that supplies assets receives the maximum yield boost while retaining full voting rights and benefits of their token's native protocol, as well as the ability to boost voting rights, on-sell them, and exit their position back to the underlying token.

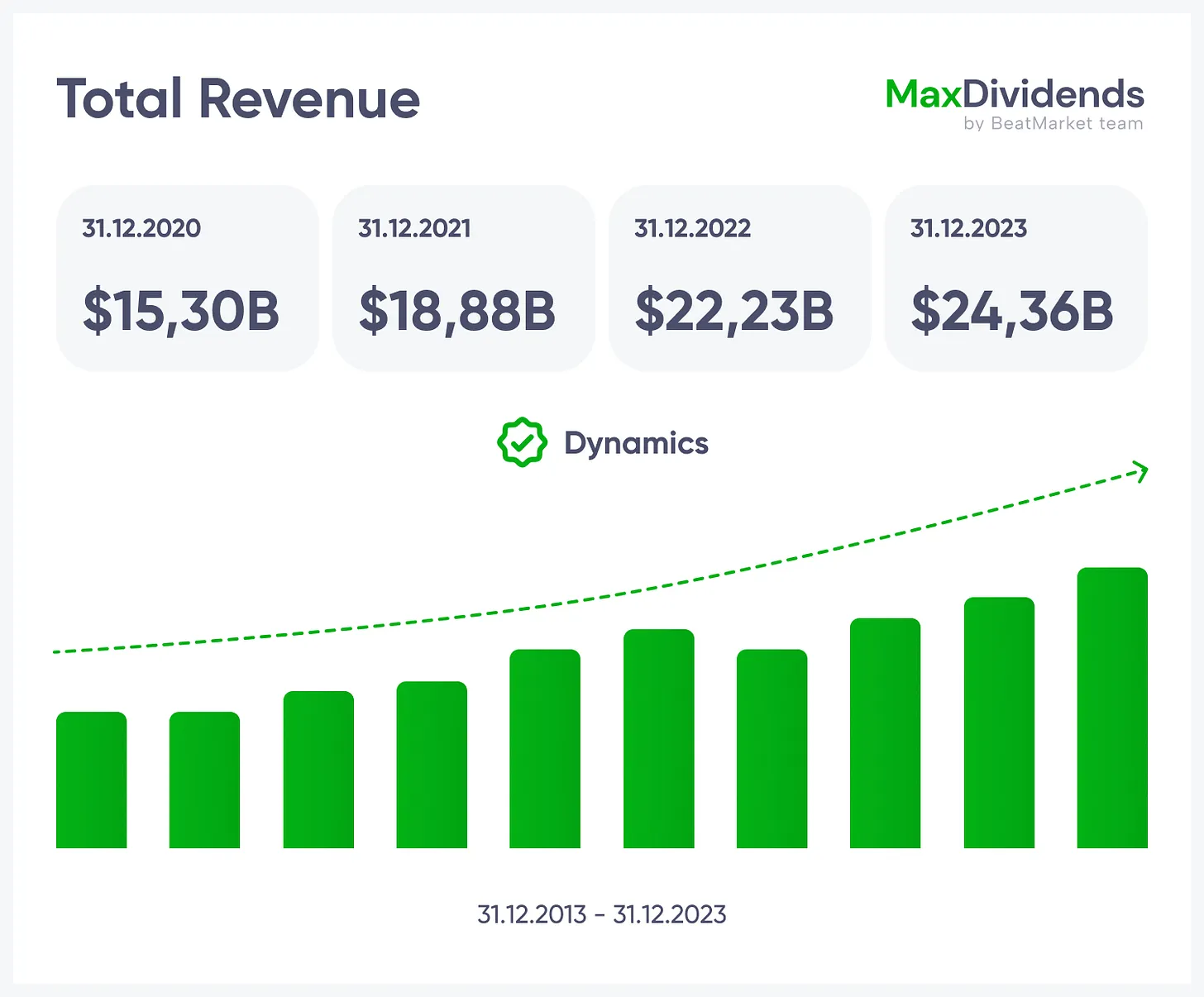

See the whole business at a glance — what it does, how it earns, and the value it brings.

See the whole business at a glance — what it does, how it earns, and the value it brings.

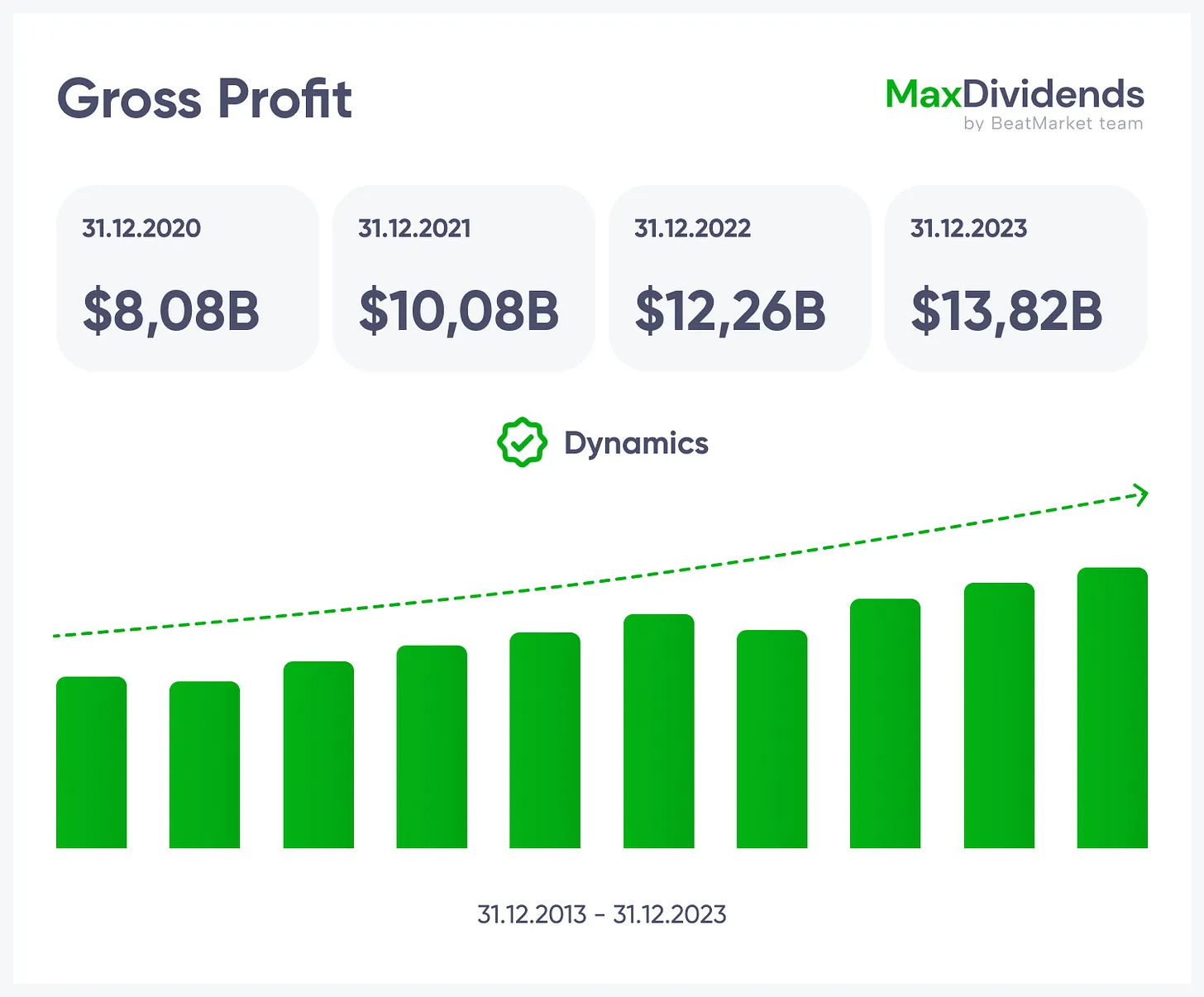

Growth trend, clear in one glance.

Growth trend, clear in one glance.

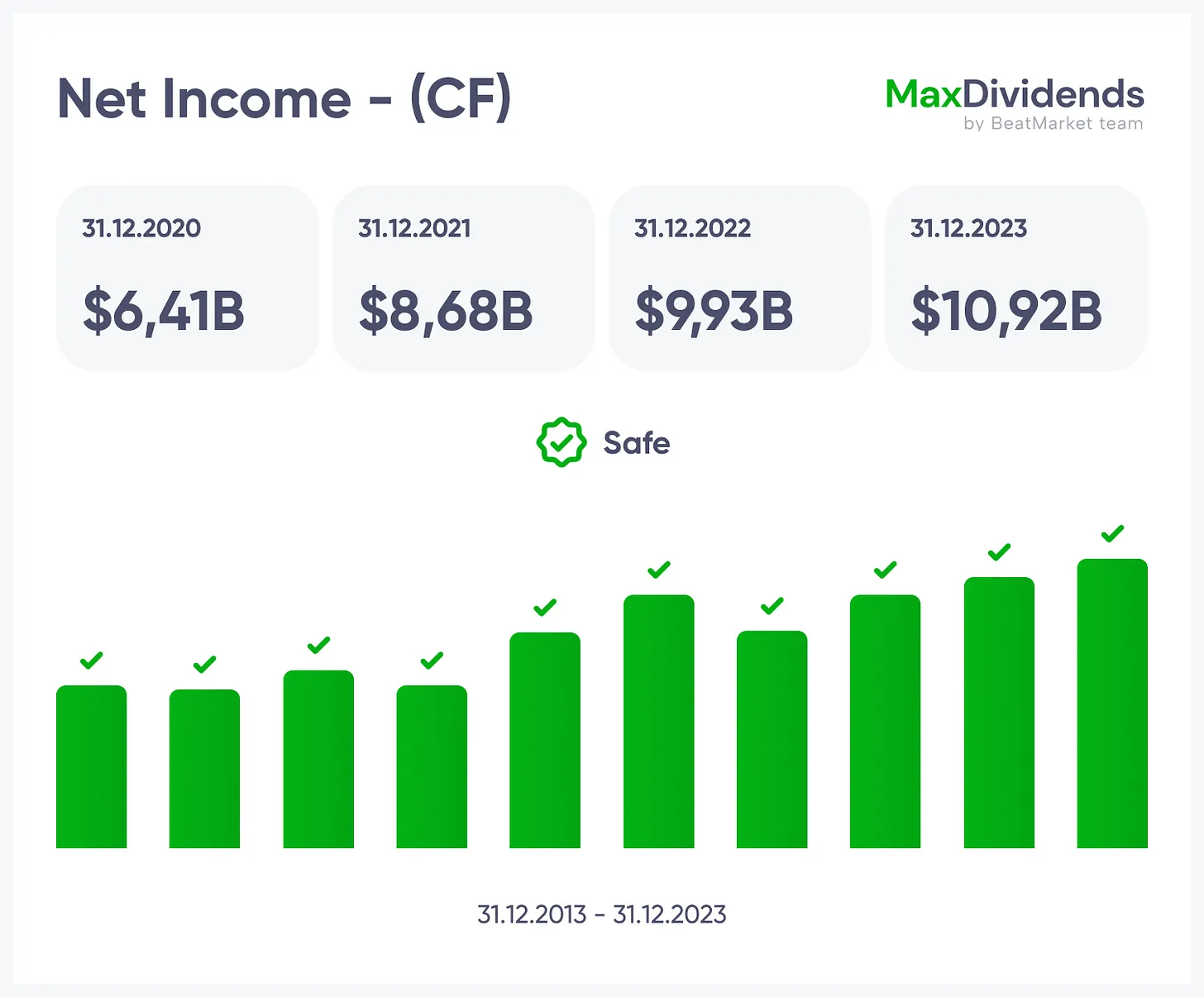

See if profits are real — instantly.

See if profits are real — instantly.

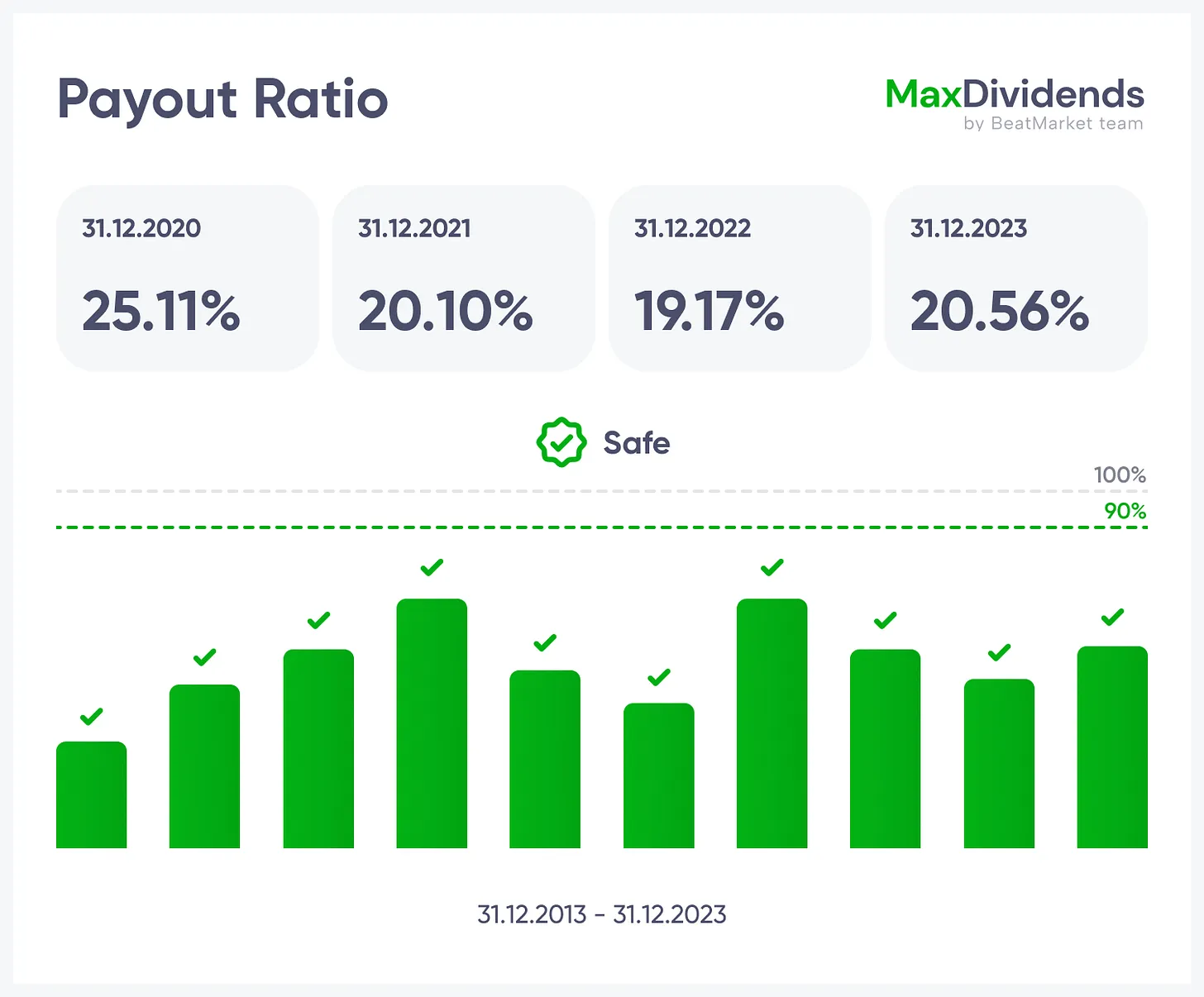

Bottom line made simple with MaxDividends.

Bottom line made simple with MaxDividends.

Debt risk checked for you, 24/7.

Debt risk checked for you, 24/7.

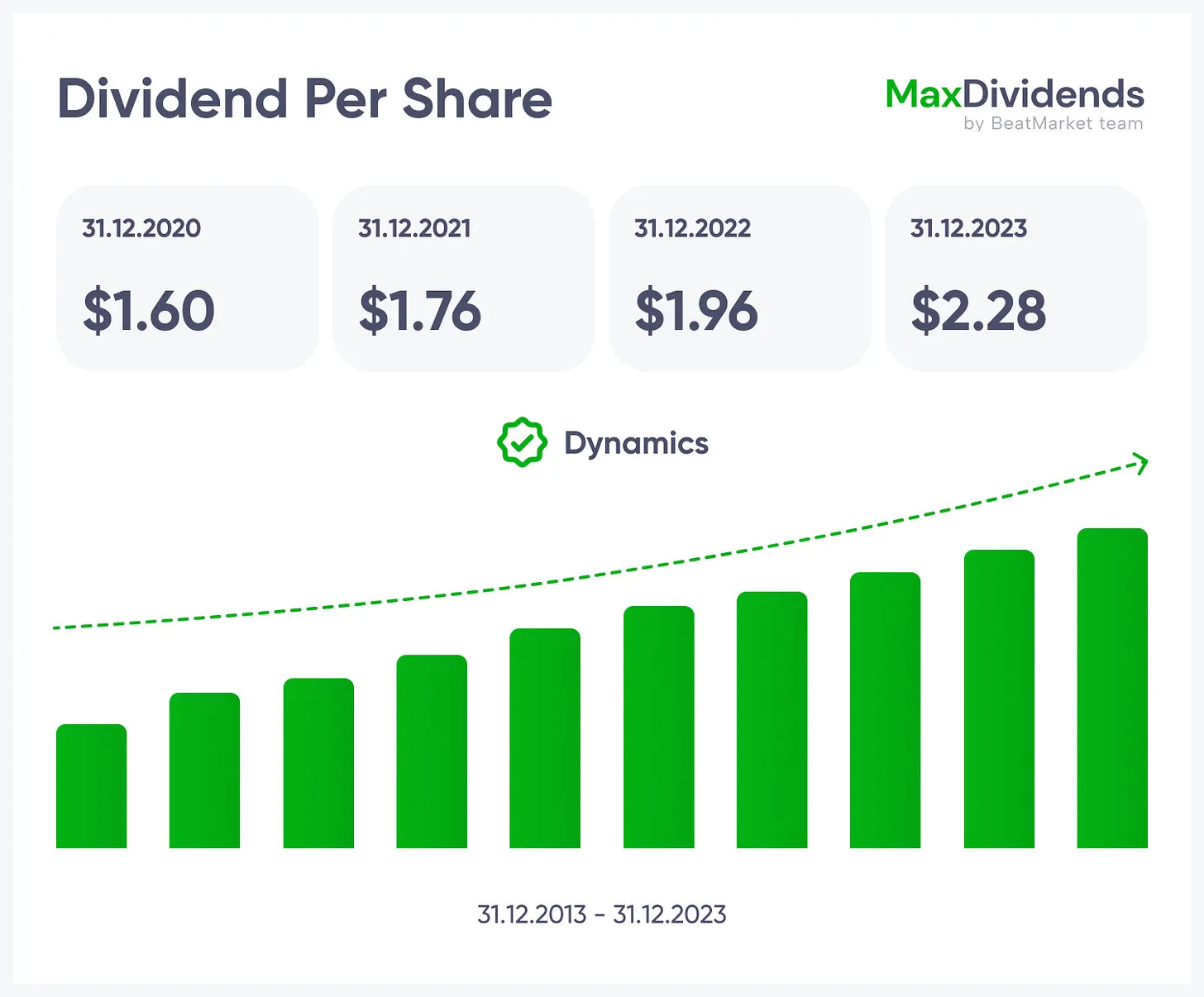

Dividend streaks and raises at your fingertips.

Dividend streaks and raises at your fingertips.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

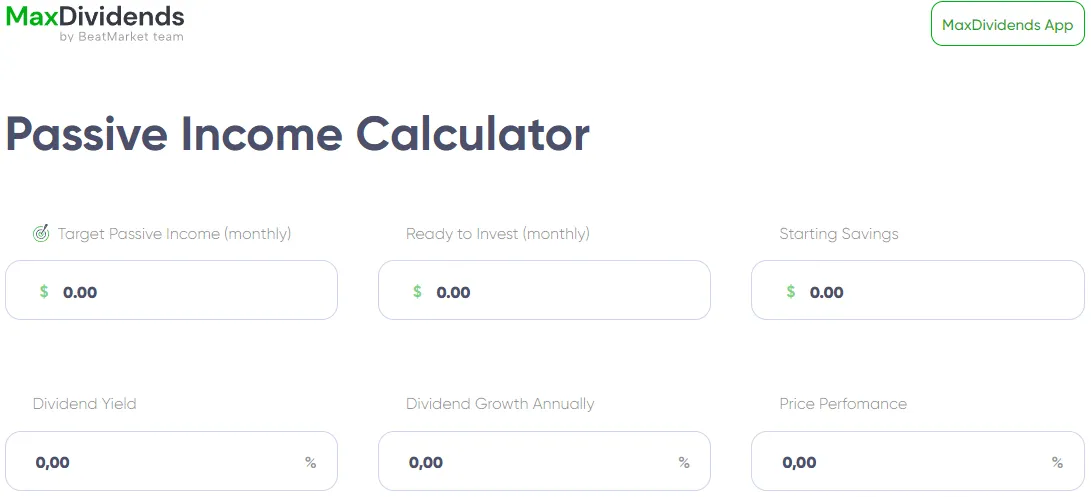

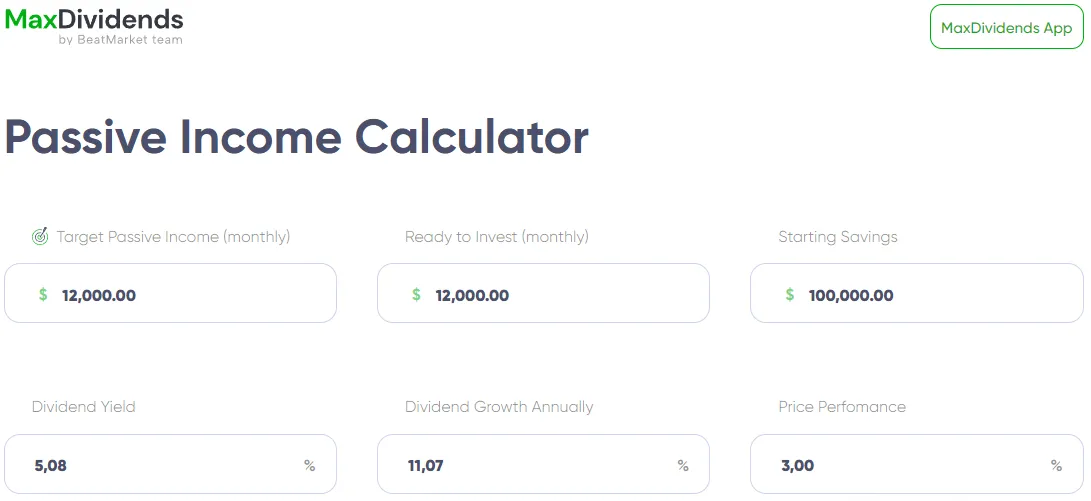

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

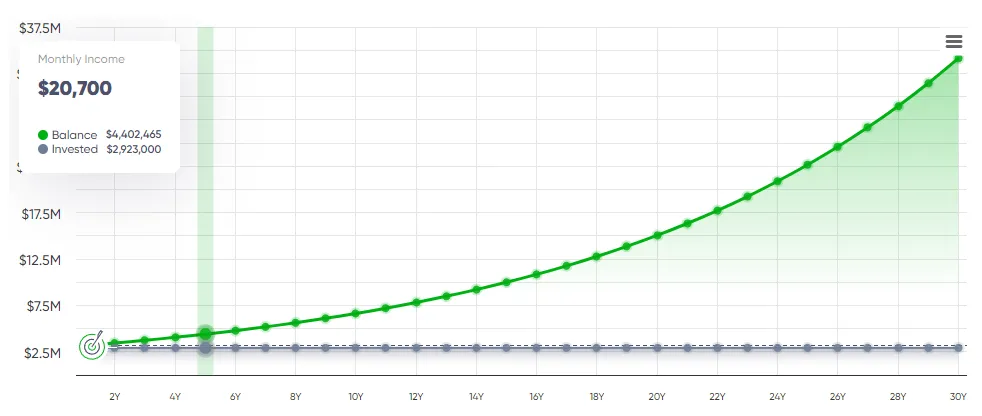

MaxDividends App: Passive Income Calculator, Income Forecast

MaxDividends App: Passive Income Calculator, Income Forecast

BeatStart

BeatStart