Introduzca una acción o criptomoneda en el cuadro de búsqueda para obtener un resumen

Cómo Esta Empresa Gana Dinero

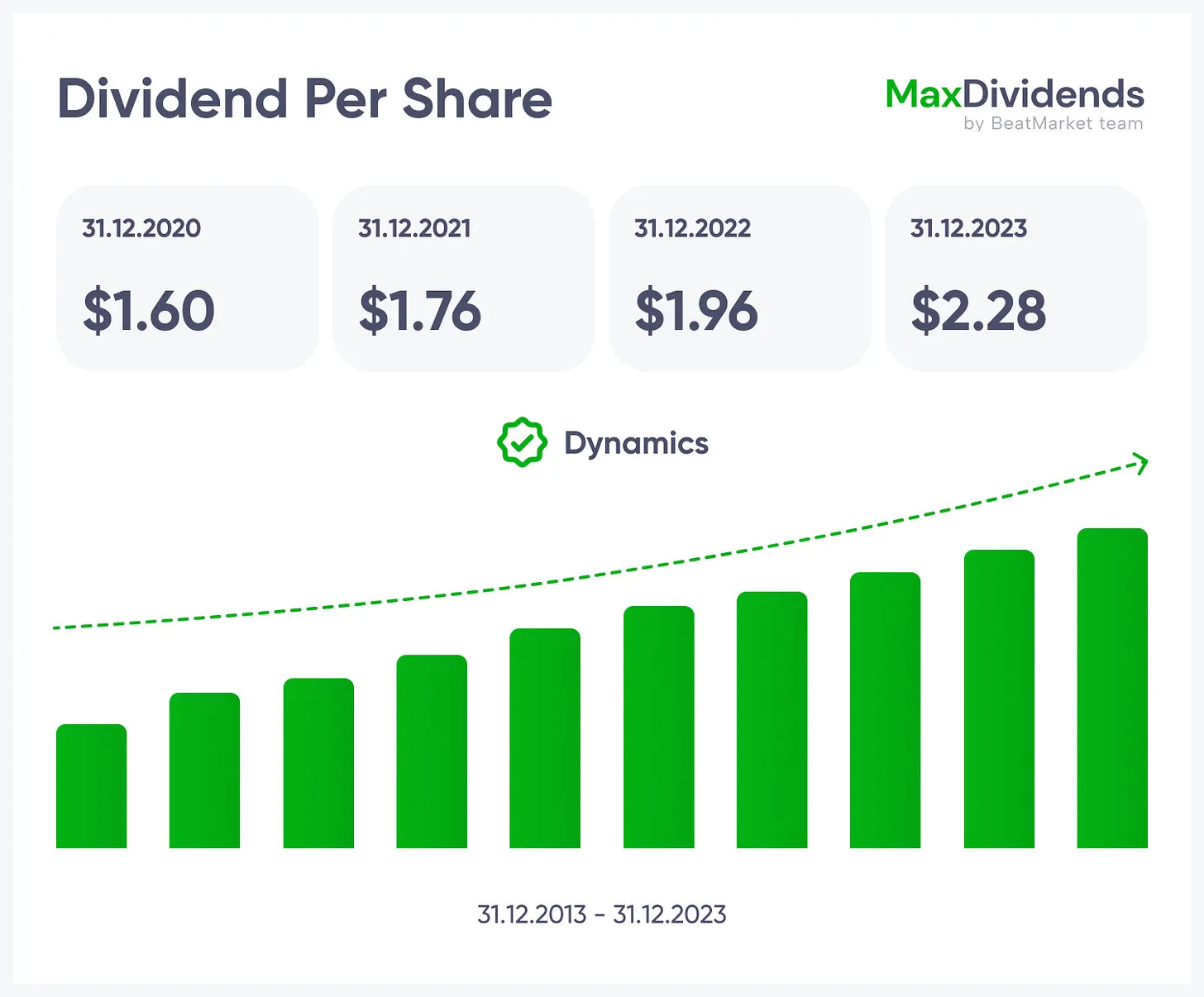

Análisis de dividendos BALAMINES

Max Ratio

11.63Rentabilidad por dividendo

1.97 %Aumento del dividendo durante 5 años

293.00 %Crecimiento continuo

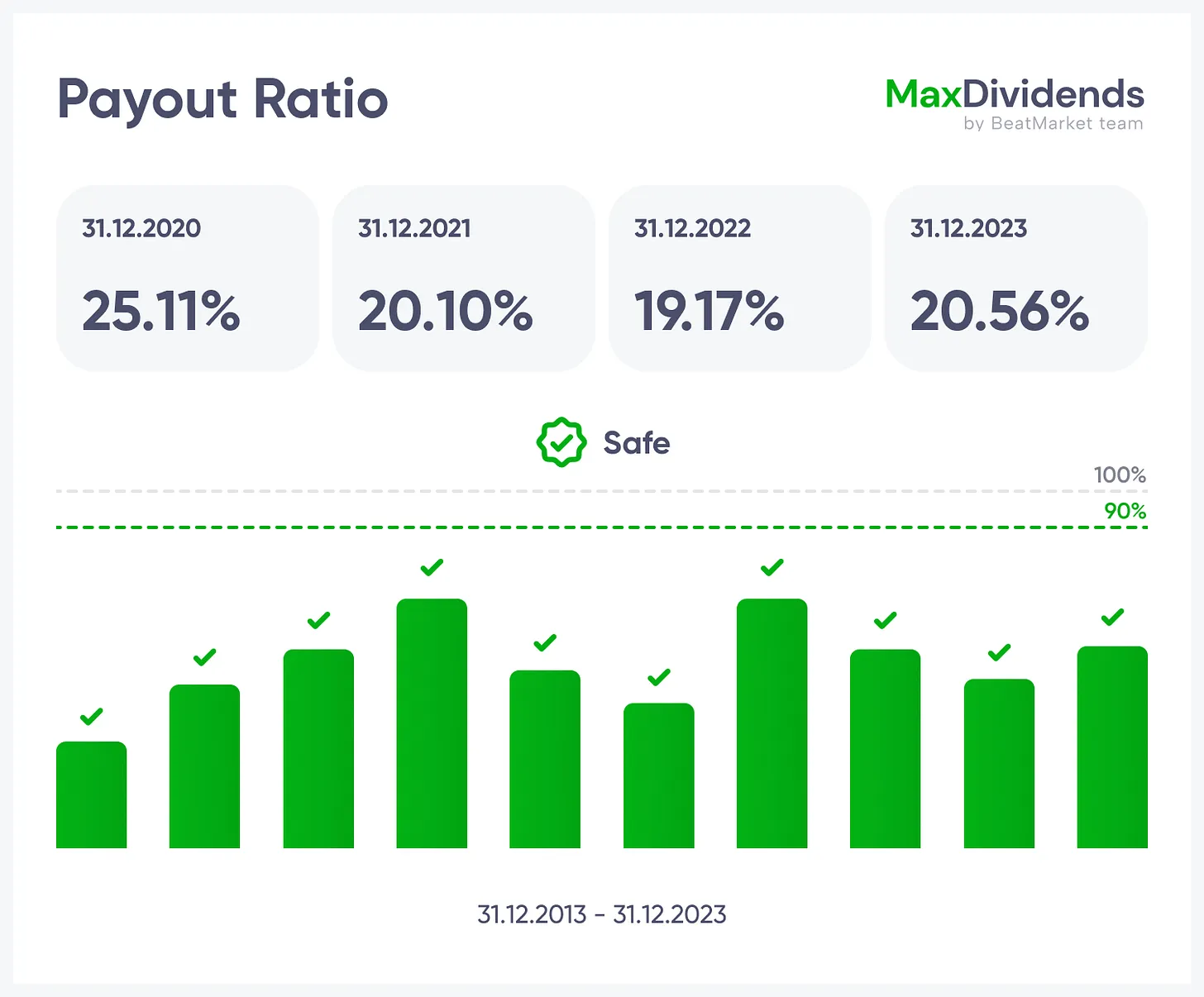

1 AñoRatio de pago medio en 5 años

10.65 %Tendencia del payout BALAMINES

La Lista de Verificación de la Fórmula de los 5 Pilares

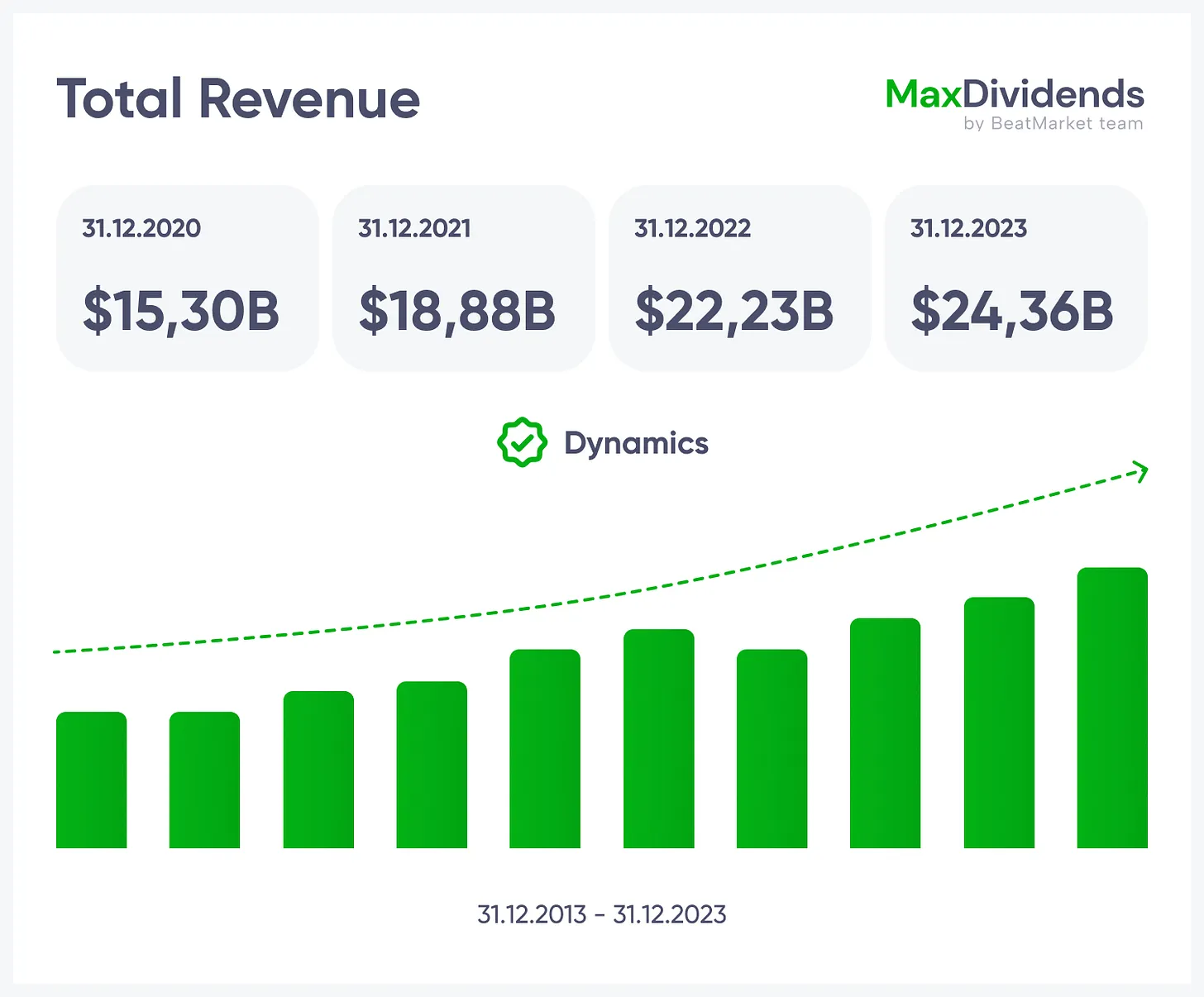

La Lista de Verificación de la Fórmula Secreta de los Cinco Pilares es nuestra forma simple y probada de separar negocios fuertes y duraderos del resto. Observamos cinco pilares clave—crecimiento de ventas, crecimiento de ganancias, Ingreso Neto, seguridad de dividendos y niveles de deuda. Junto con la Puntuación Financiera, nos dicen si una empresa puede seguir creciendo, mantenerse financieramente sólida y pagar dividendos de manera confiable durante décadas.Ingresos Totales BALAMINES

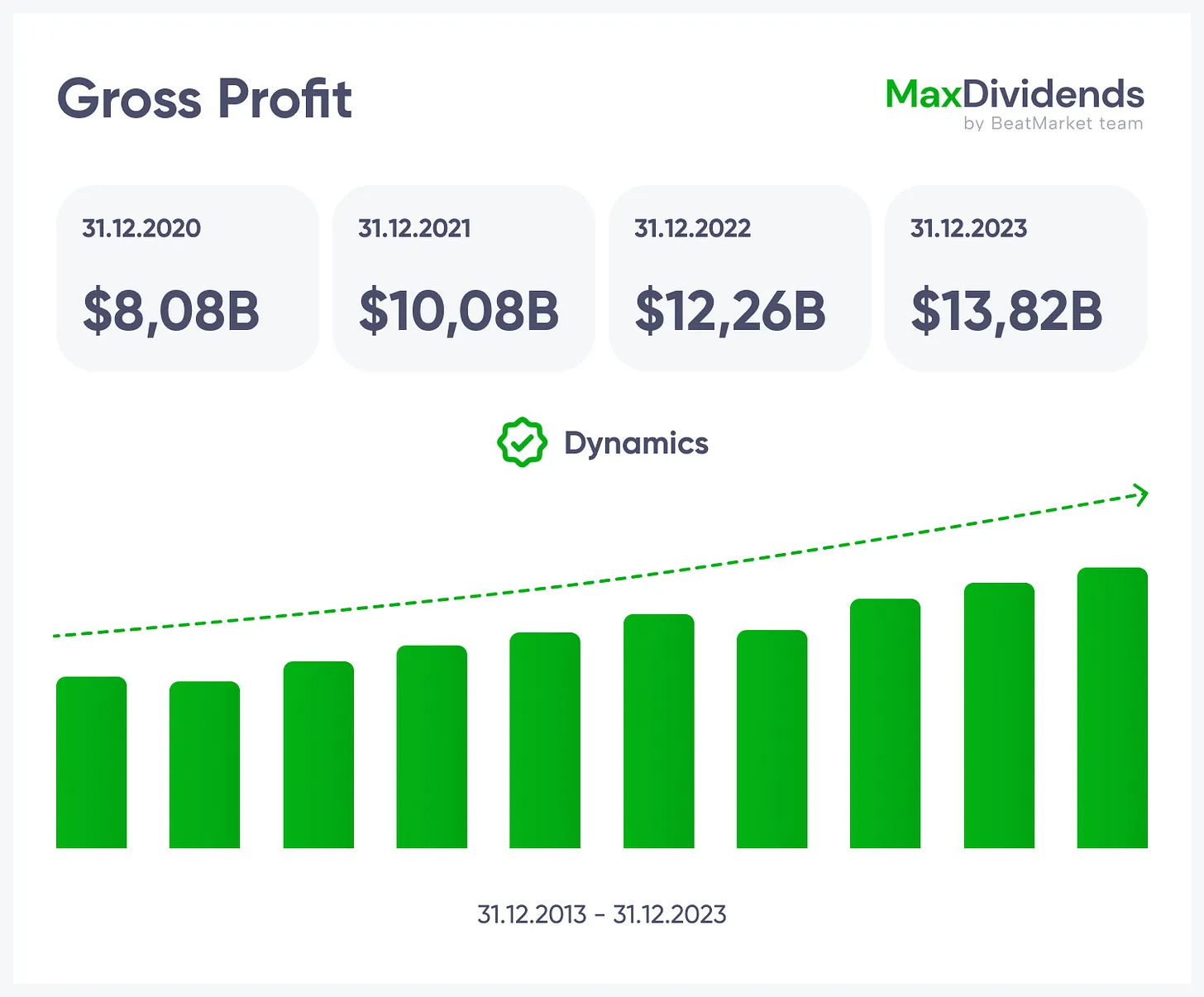

Beneficio Bruto / Margen de Beneficio BALAMINES

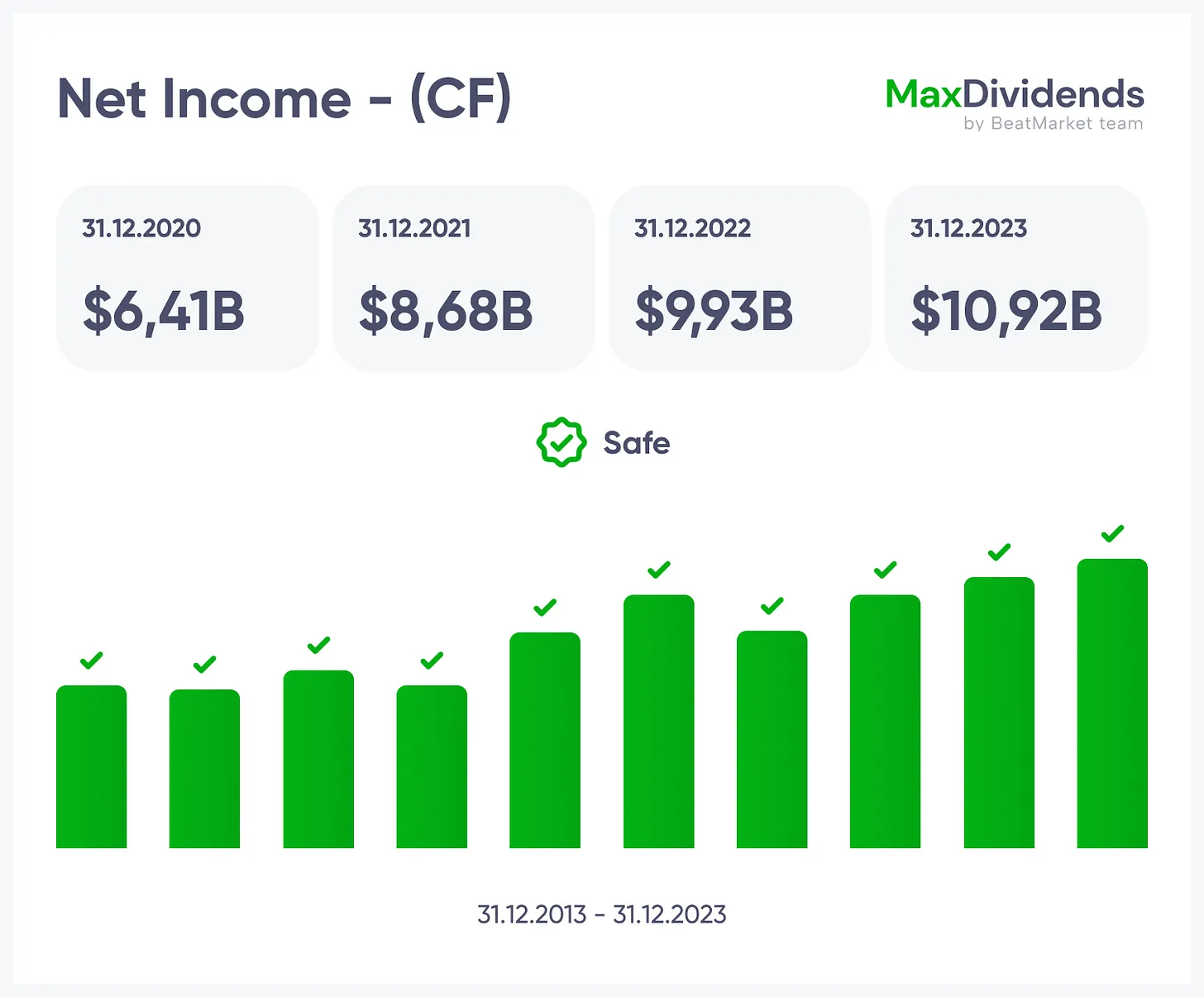

Ingresos Netos BALAMINES

Relación de Pago BALAMINES

Relación de Deuda BALAMINES

Finanzas

Balaji Amines Limited BALAMINES

Realice un seguimiento de las métricas clave de cada acción en un solo lugar y sin complicaciones

Hazte premium| Resultados | 2019 | Dinámica |

Vea todo el negocio de un vistazo — qué hace, cómo gana y el valor que aporta.

Vea todo el negocio de un vistazo — qué hace, cómo gana y el valor que aporta.

Tendencia de crecimiento, clara de un vistazo.

Tendencia de crecimiento, clara de un vistazo.

Vea si las ganancias son reales — instantáneamente.

Vea si las ganancias son reales — instantáneamente.

Resultado final simplificado con MaxDividends.

Resultado final simplificado con MaxDividends.

Riesgo de deuda verificado por usted, 24/7.

Riesgo de deuda verificado por usted, 24/7.

Rachas y aumentos de dividendos al alcance de su mano.

Rachas y aumentos de dividendos al alcance de su mano.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

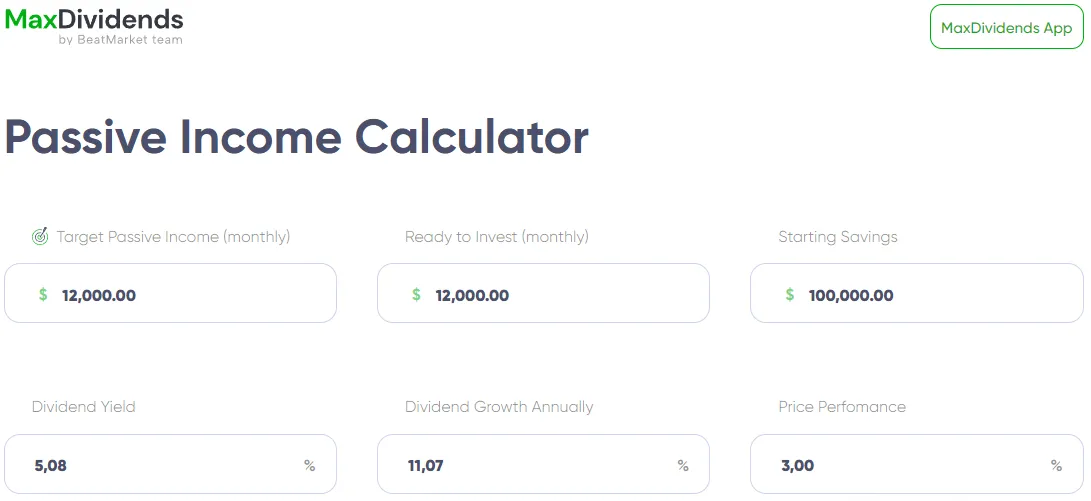

App MaxDividends: Calculadora de Ingresos Pasivos

App MaxDividends: Calculadora de Ingresos Pasivos

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

App MaxDividends: Calculadora de Ingresos Pasivos

App MaxDividends: Calculadora de Ingresos Pasivos

App MaxDividends: Calculadora de Ingresos Pasivos

App MaxDividends: Calculadora de Ingresos Pasivos

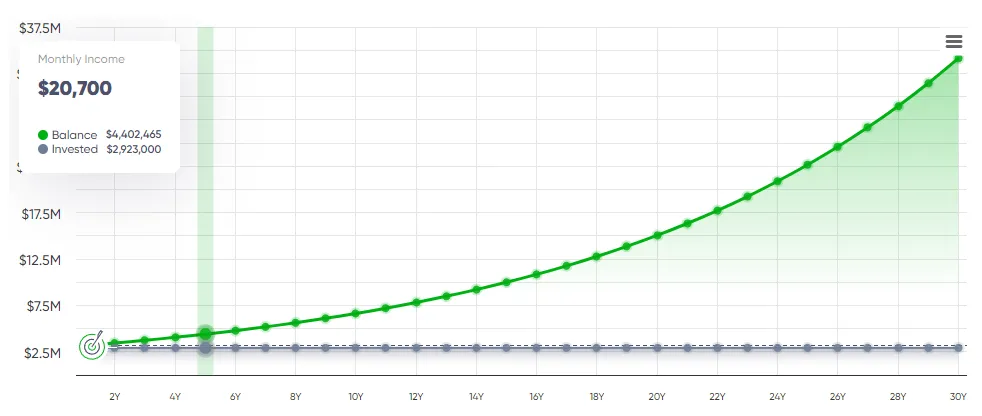

App MaxDividends: Calculadora de Ingresos Pasivos, Pronóstico de Ingresos

App MaxDividends: Calculadora de Ingresos Pasivos, Pronóstico de Ingresos

BeatStart

BeatStart