ציין מניה או מטבע קריפטוגרפי בשורת החיפוש כדי לקבל סיכום

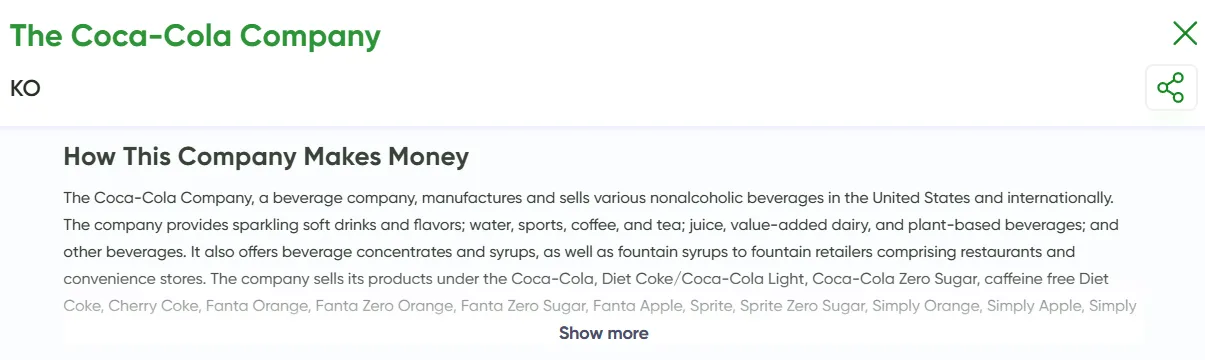

איך החברה הזו מרוויחה כסף

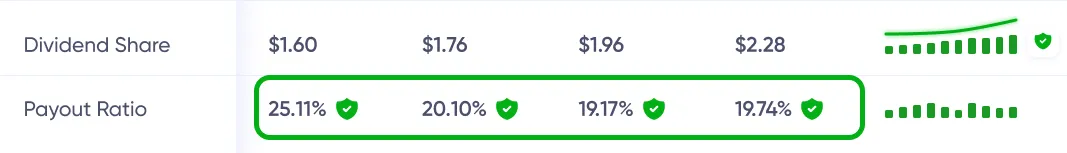

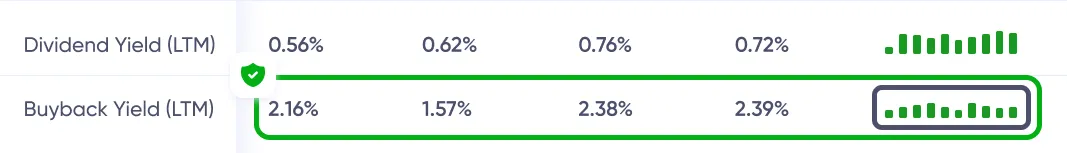

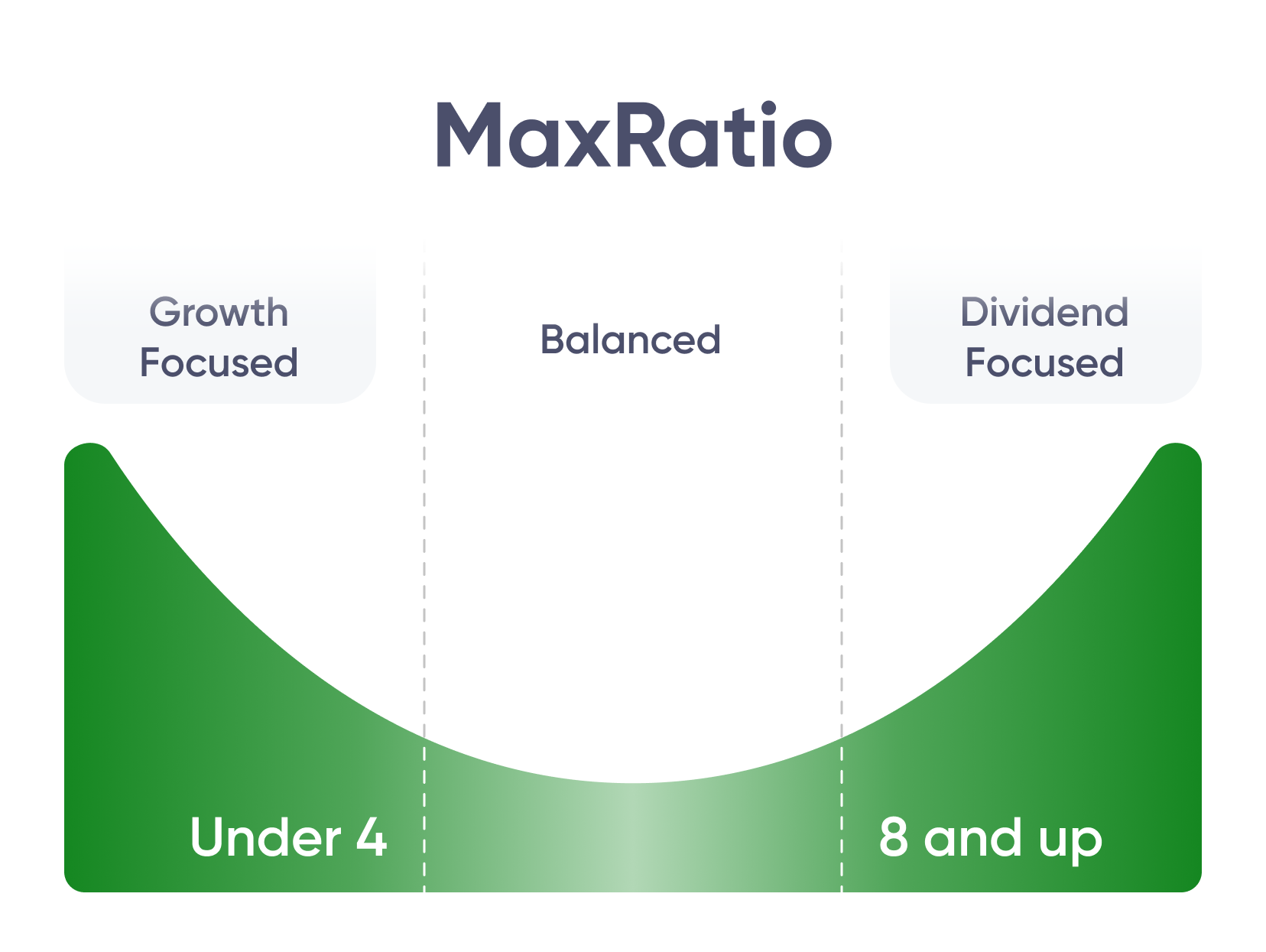

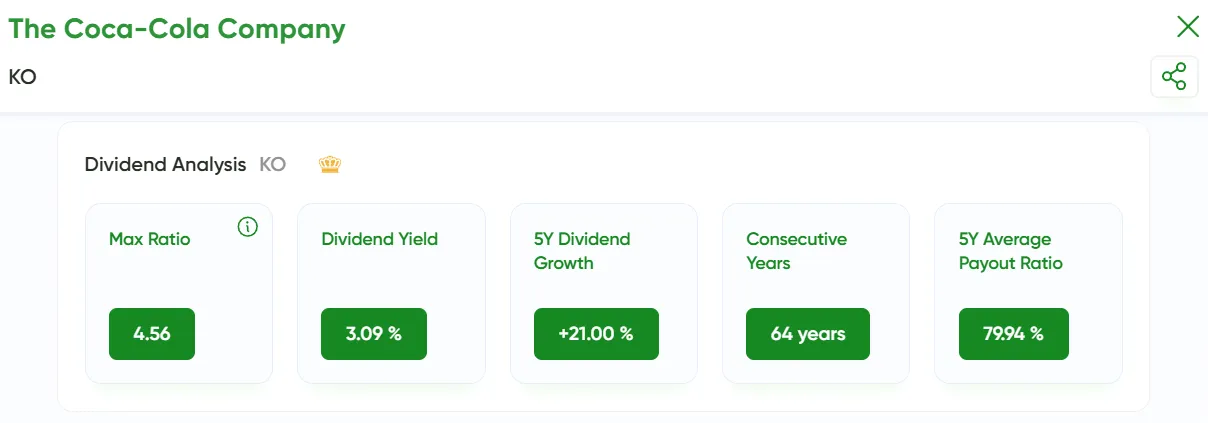

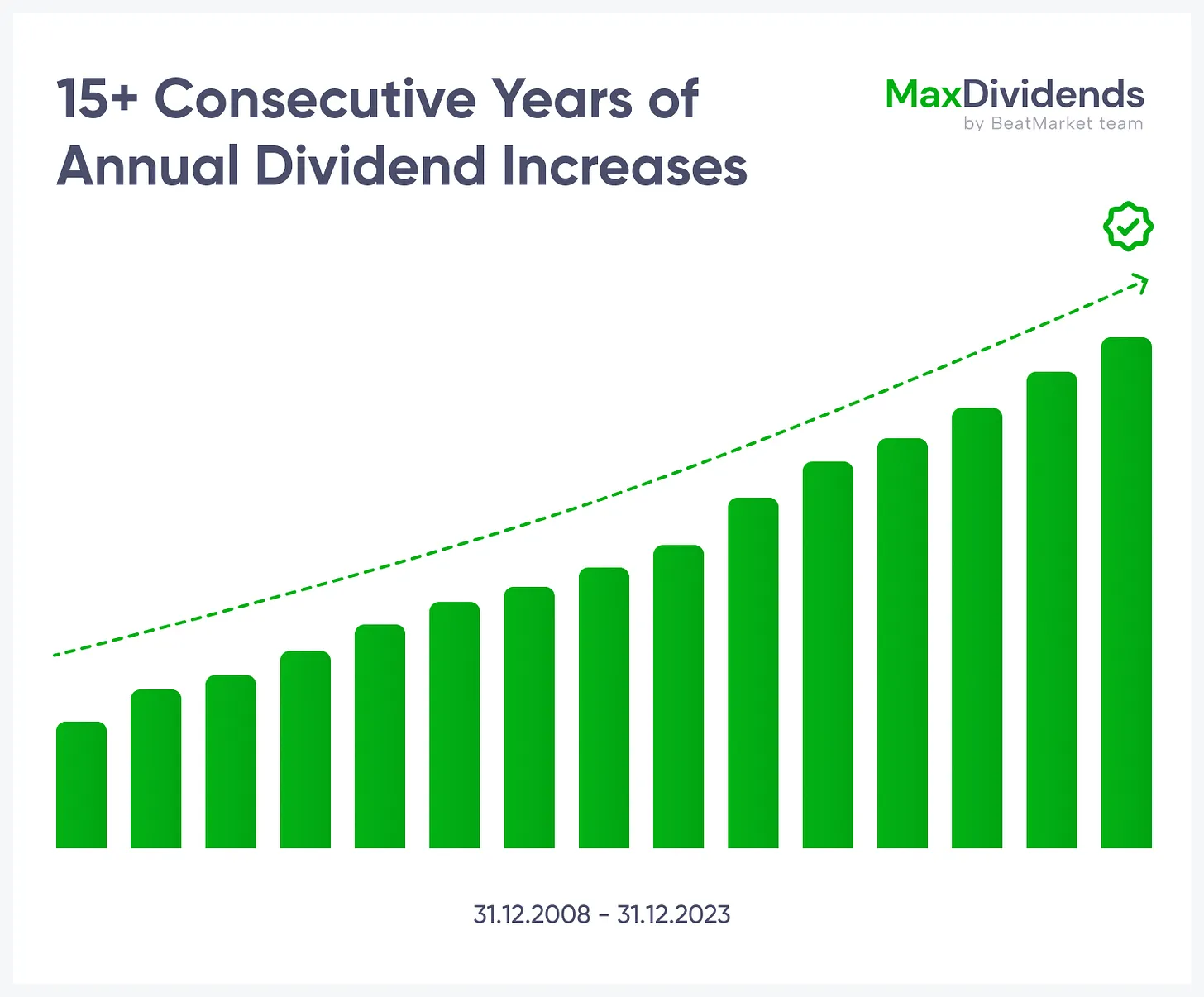

ניתוח דיבידנדים BRS

Max Ratio

–תשואת דיבידנד

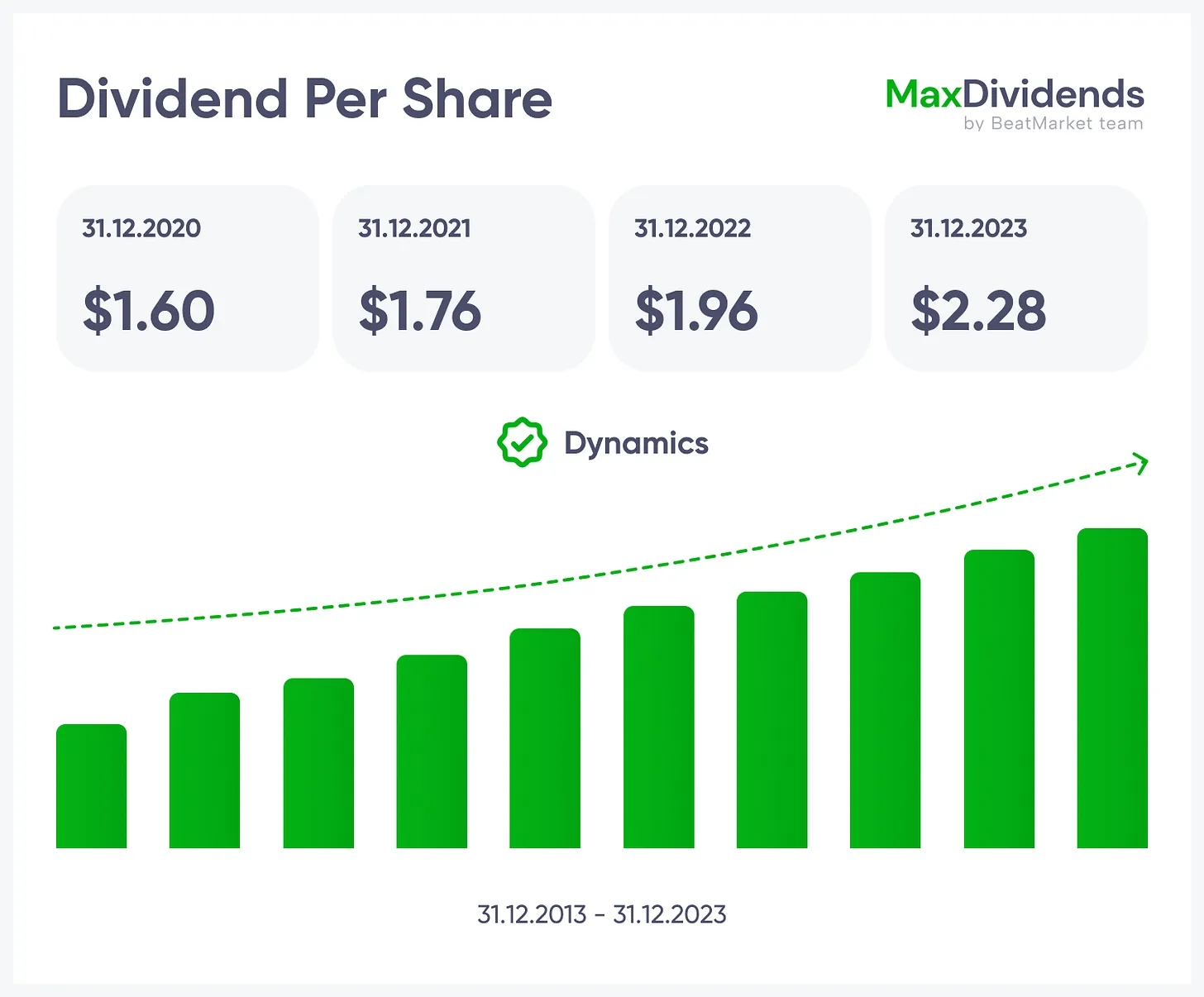

13.39 %גידול דיבידנד במשך 5 שנים

0.00 %צמיחה מתמשכת

–יחס תשלום ממוצע של 5 שנים

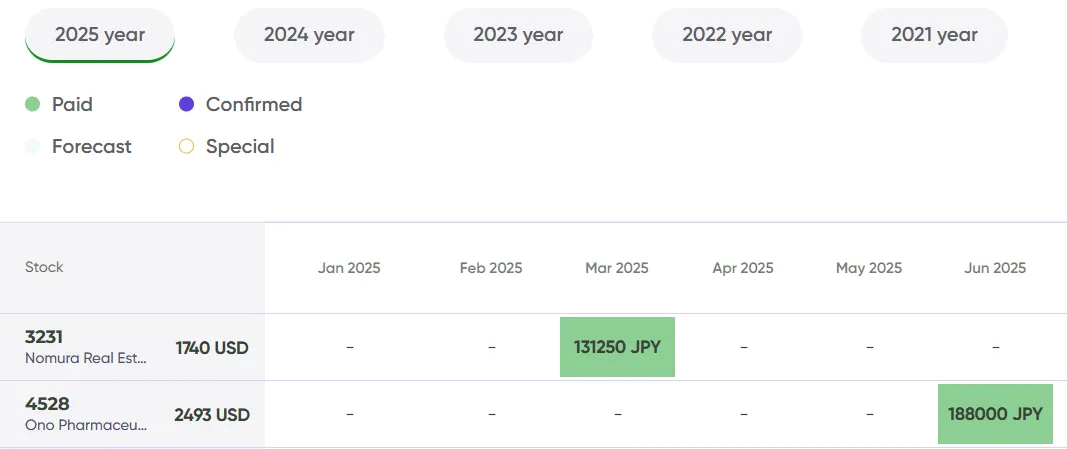

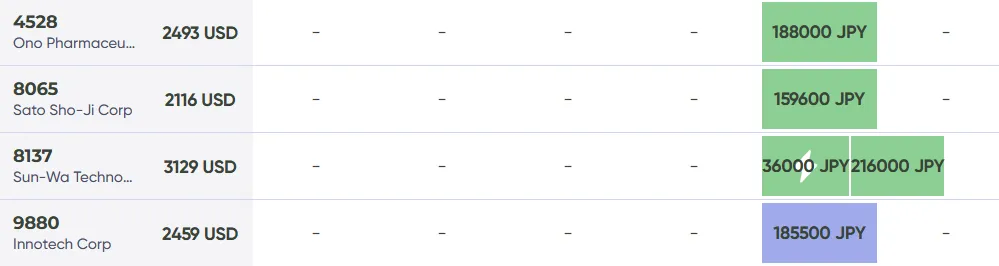

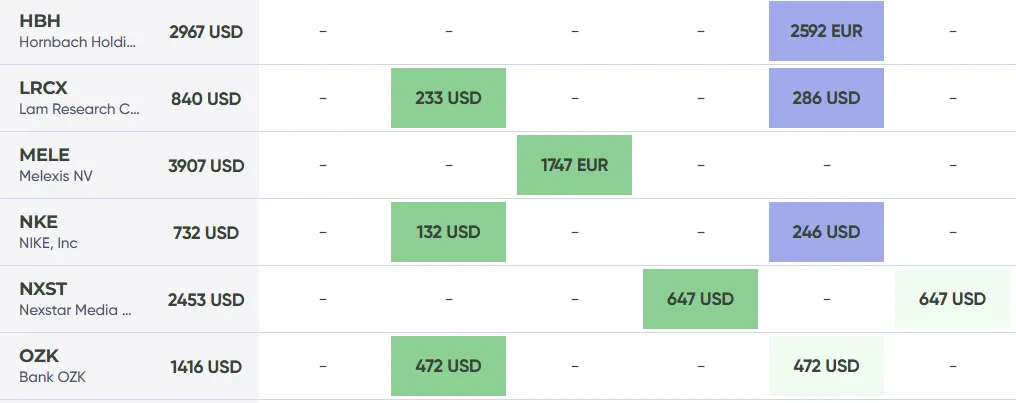

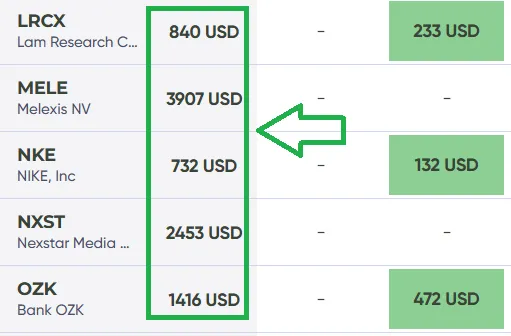

75.44 %היסטוריית דיבידנדים BRS

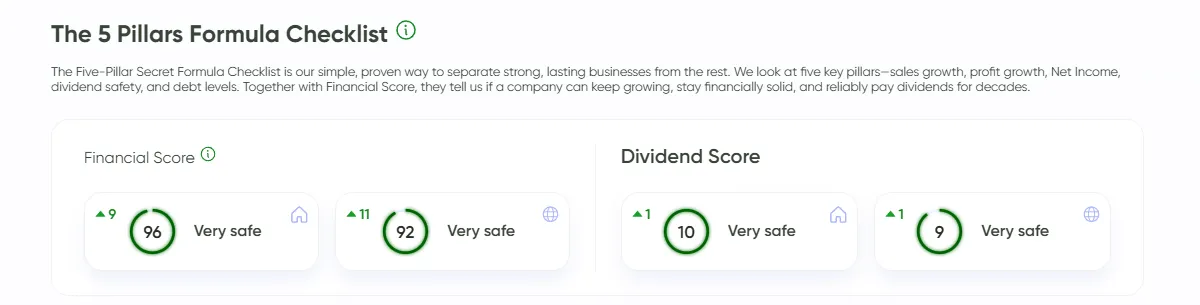

רשימת בדיקה של נוסחת חמשת העמודים

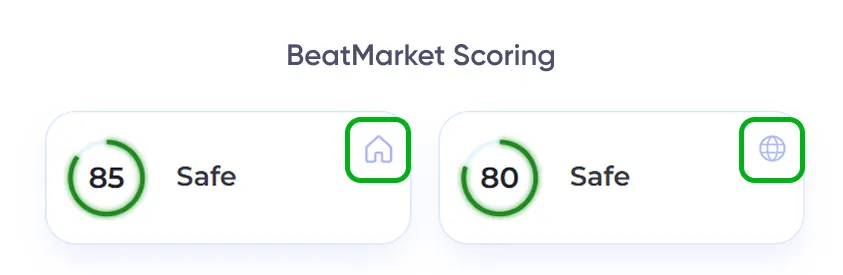

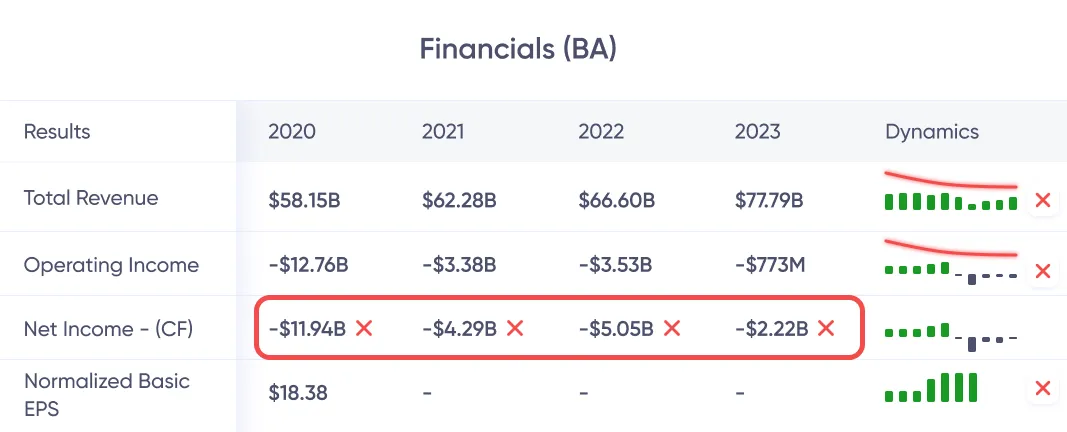

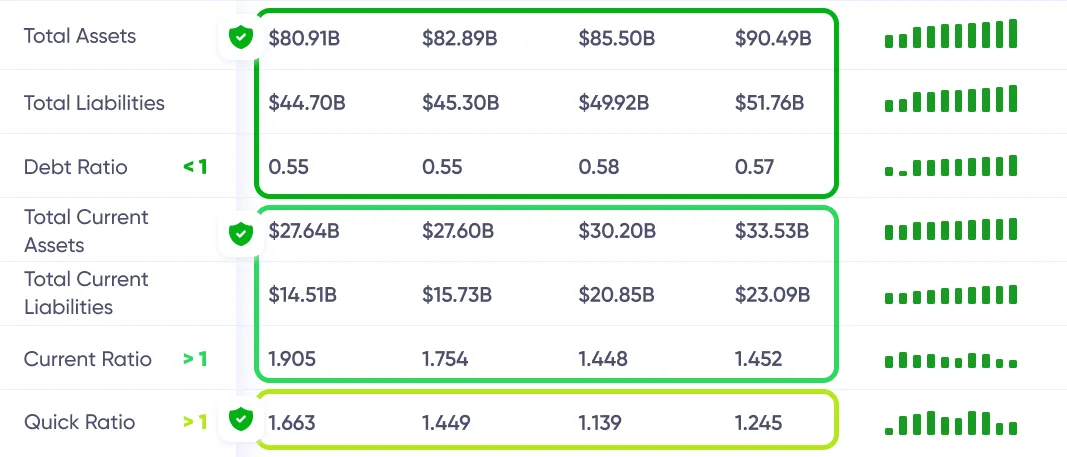

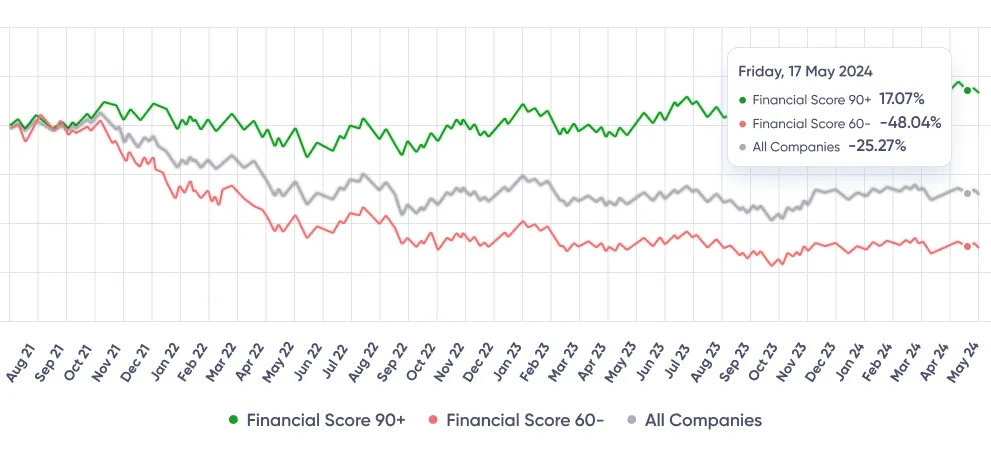

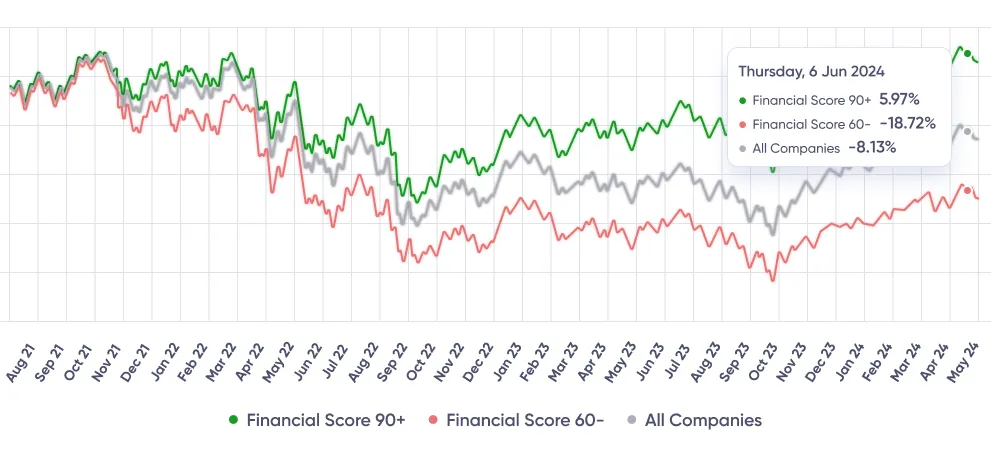

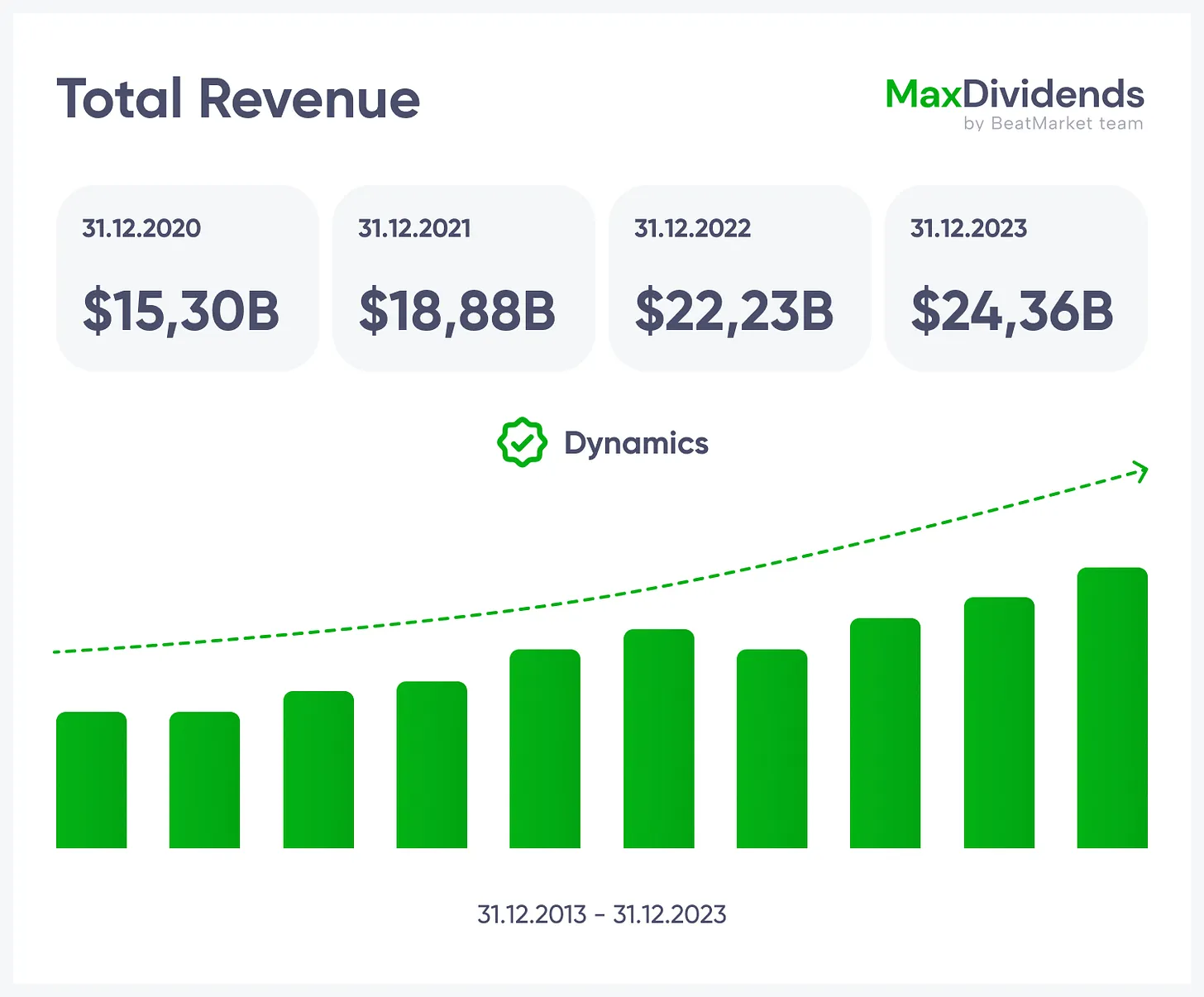

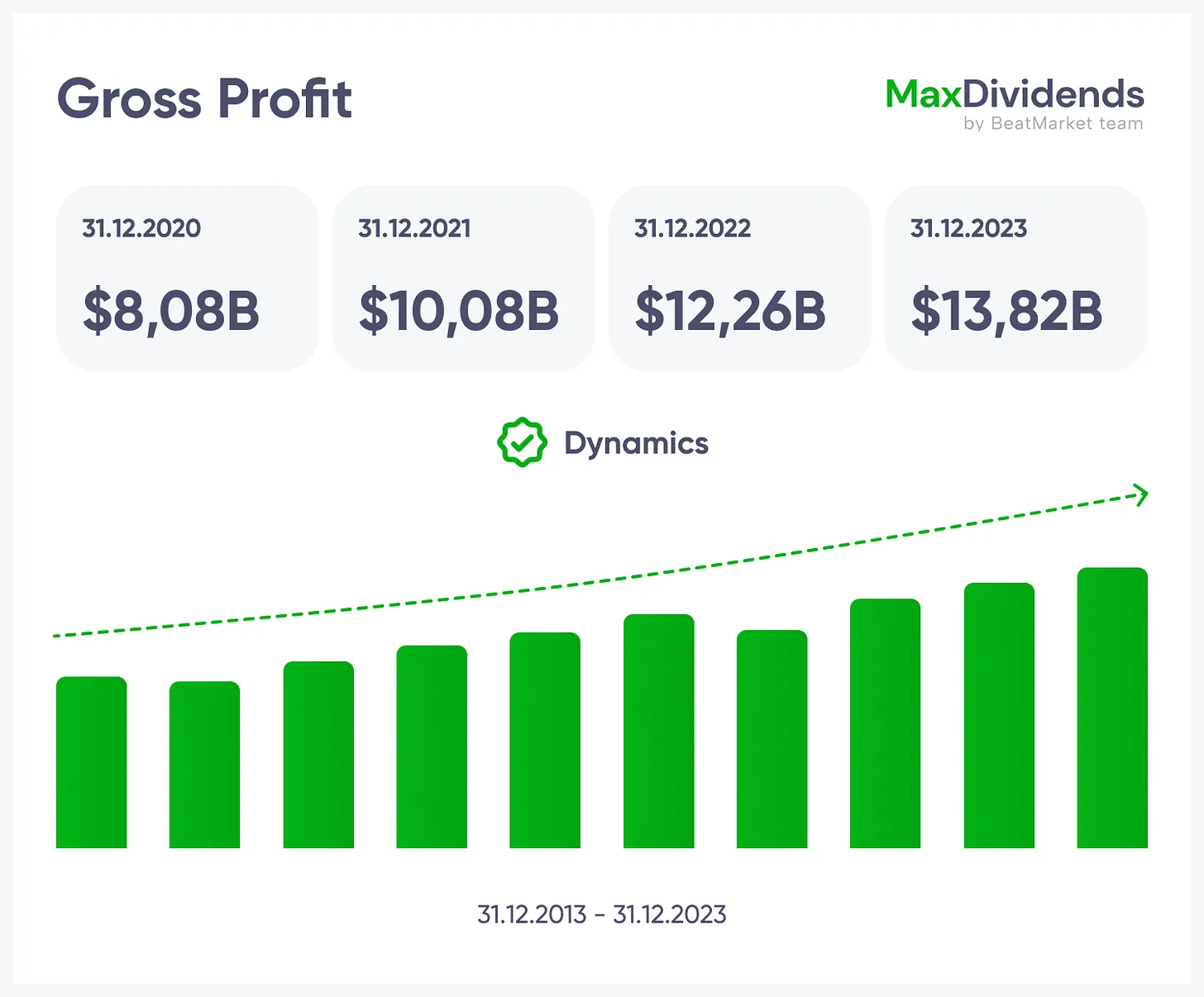

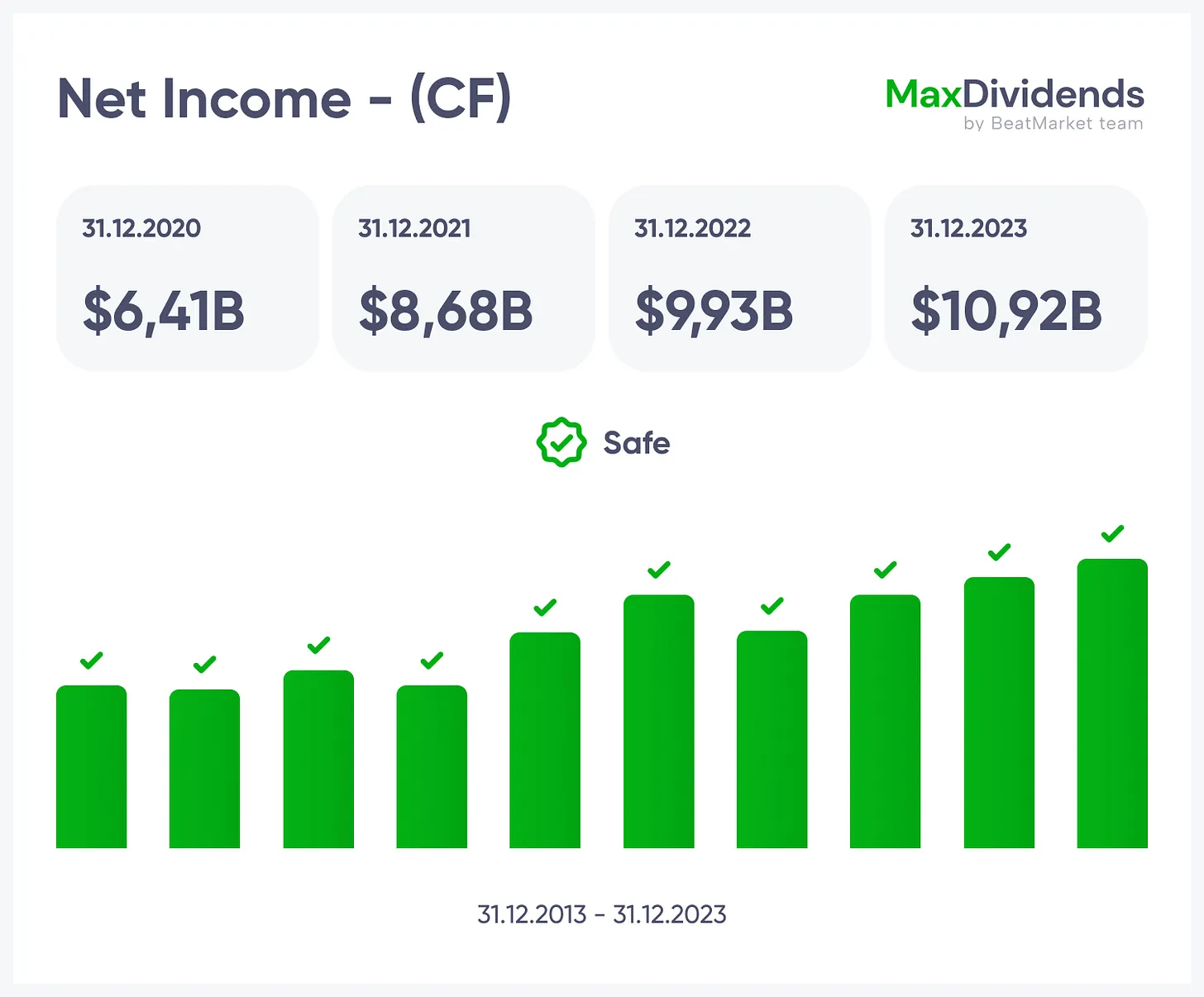

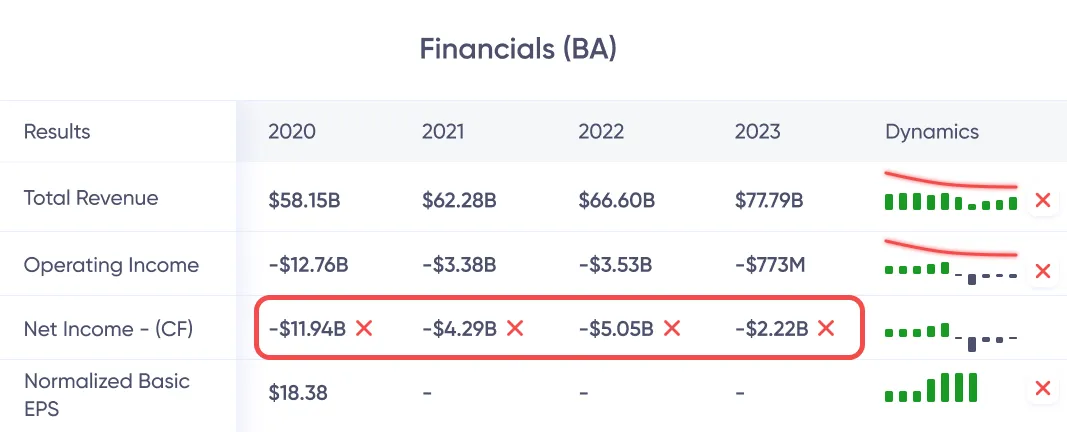

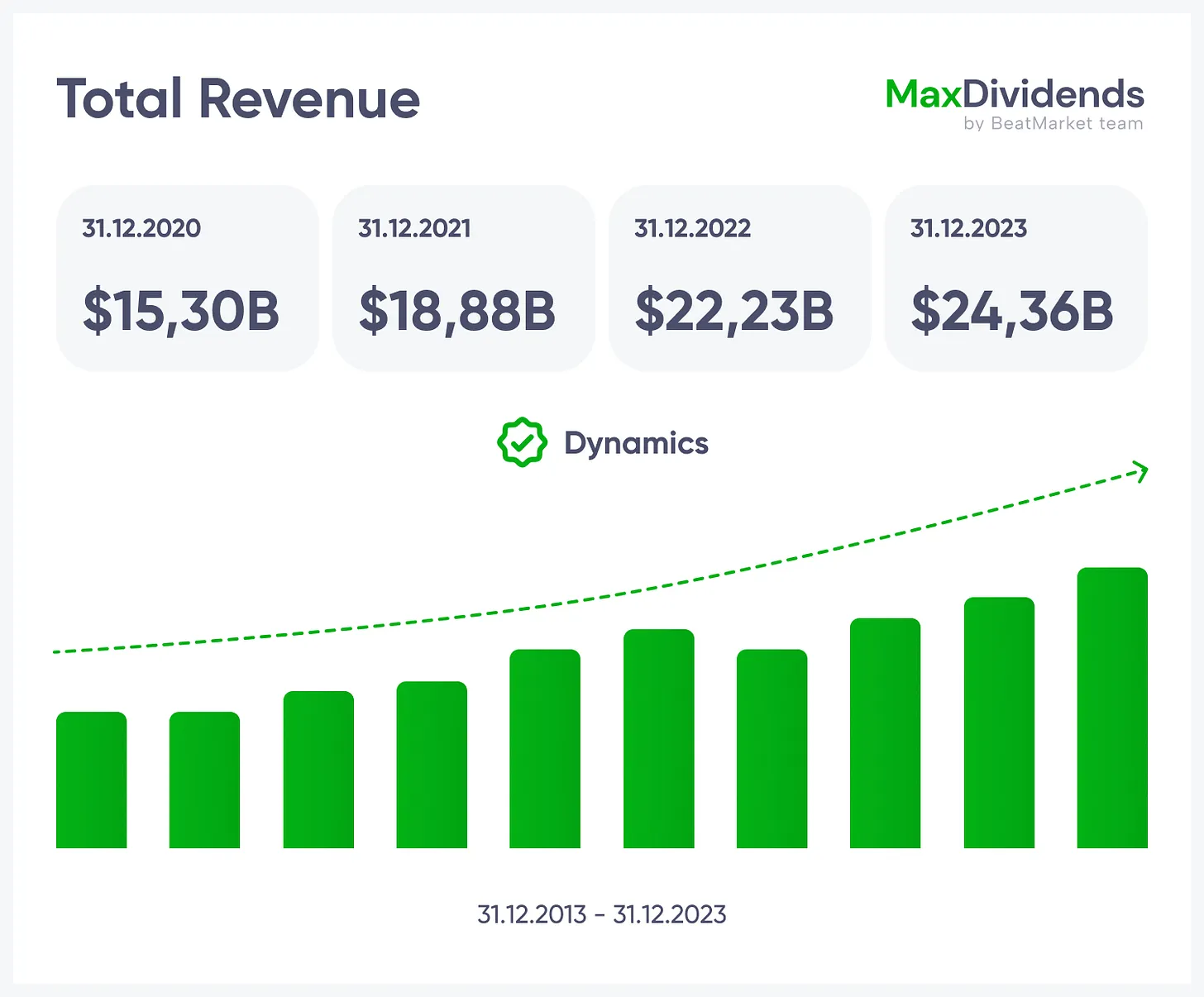

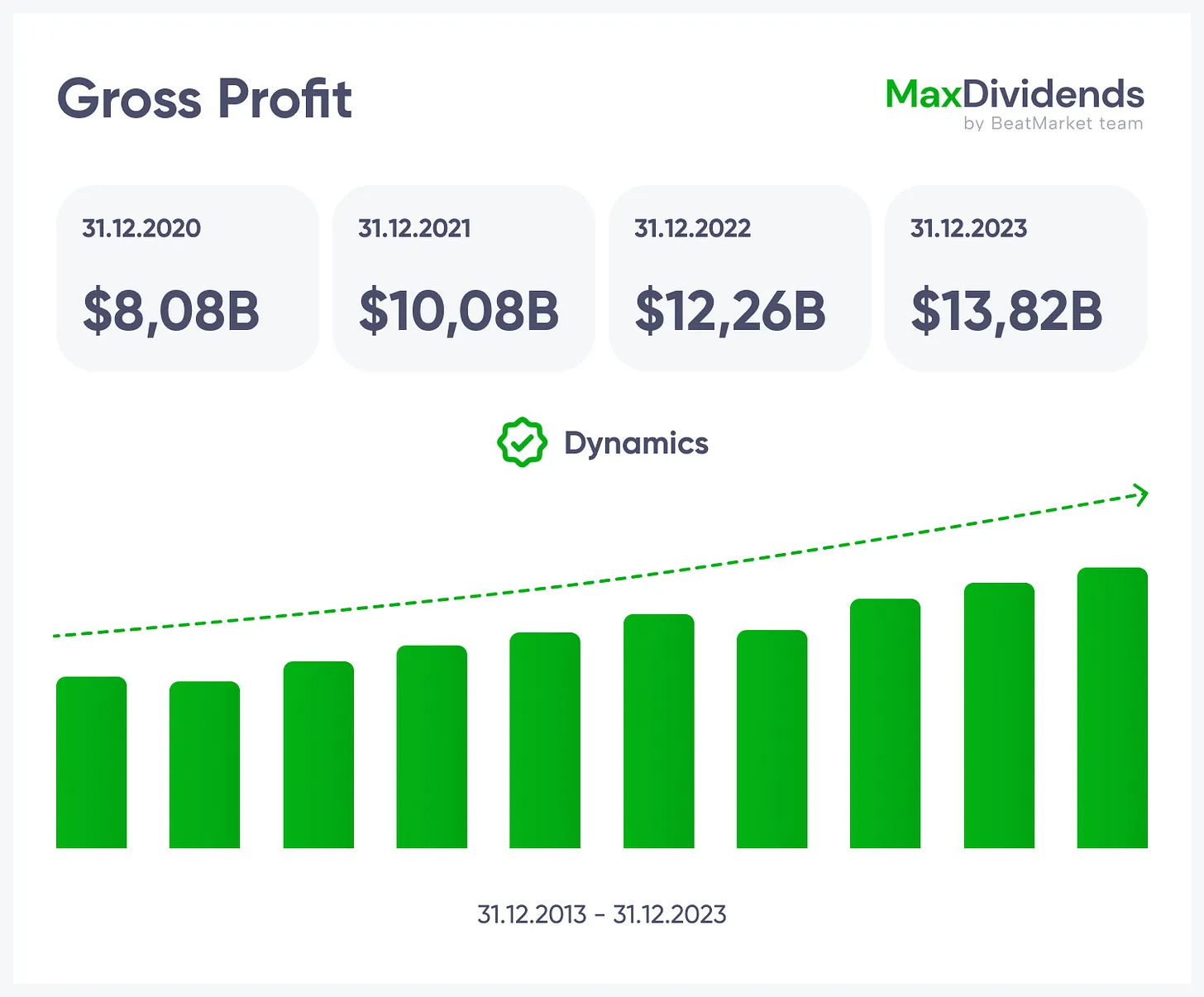

רשימת הבדיקה של נוסחת חמשת העמודים היא הדרך הפשוטה והמוכחת שלנו להבדיל בין עסקים חזקים ובני קיימא לבין השאר. אנו בוחנים חמישה עמודים עיקריים — צמיחת מכירות, צמיחת רווחים, רווח נקי, בטיחות דיבידנד ורמות חוב. יחד עם הציון הפיננסי, הם מראים אם החברה יכולה להמשיך לצמוח, להישאר יציבה מבחינה פיננסית ולשלם דיבידנדים באופן מהימן במשך עשרות שנים.הכנסה כוללת BRS

רווח גולמי / רווחיות BRS

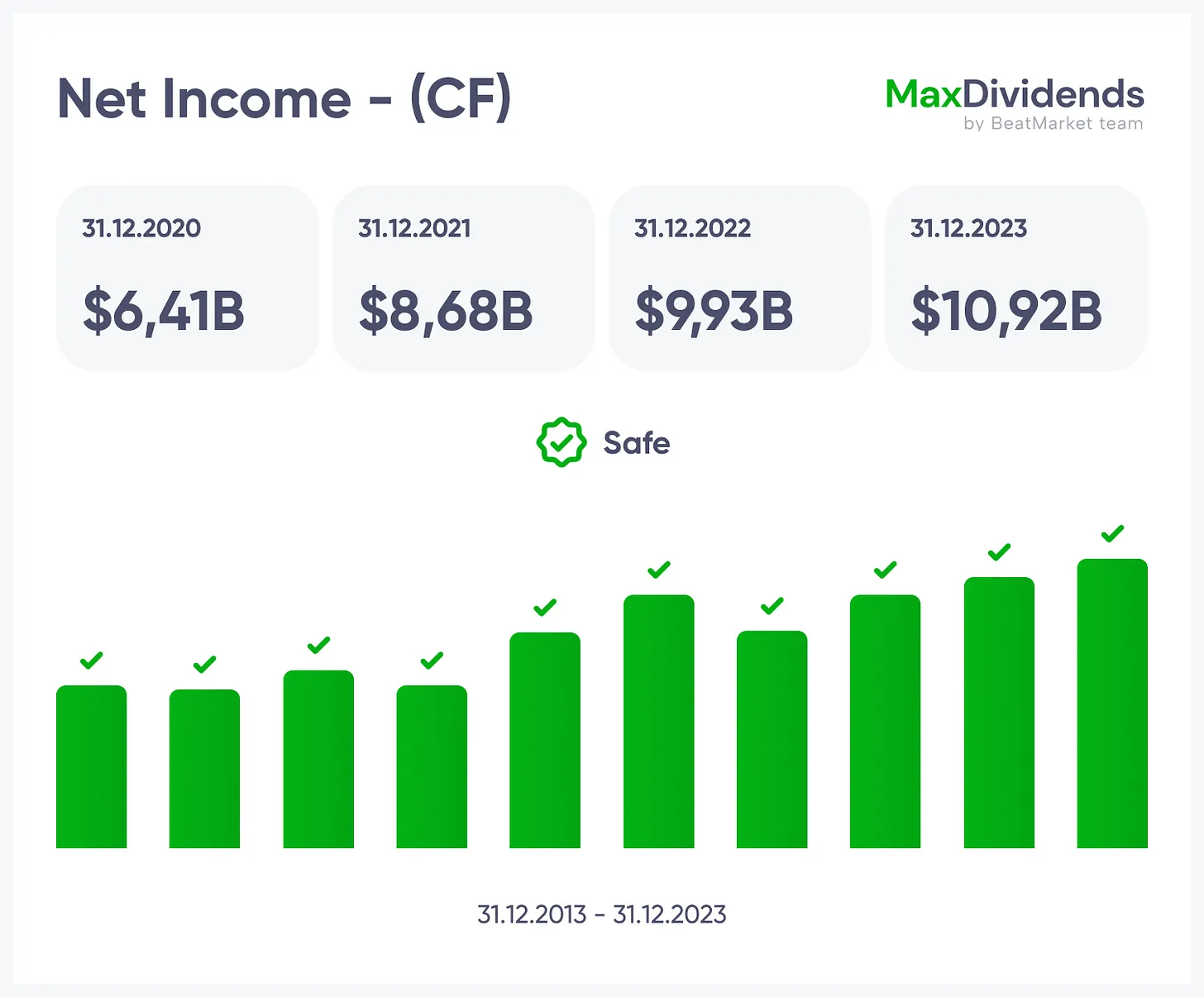

רווח נקי BRS

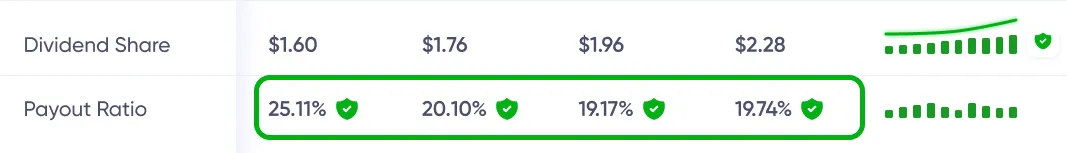

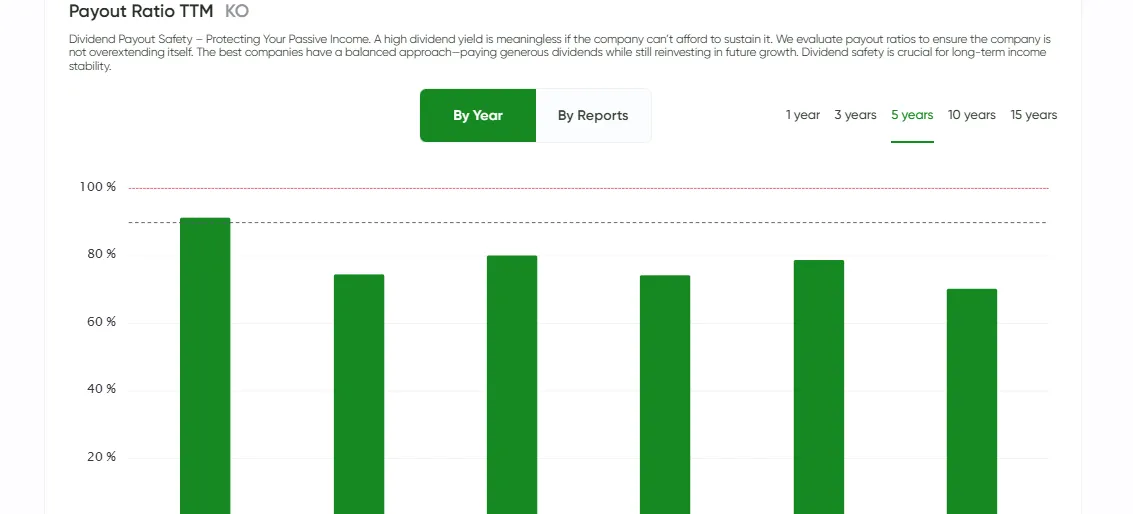

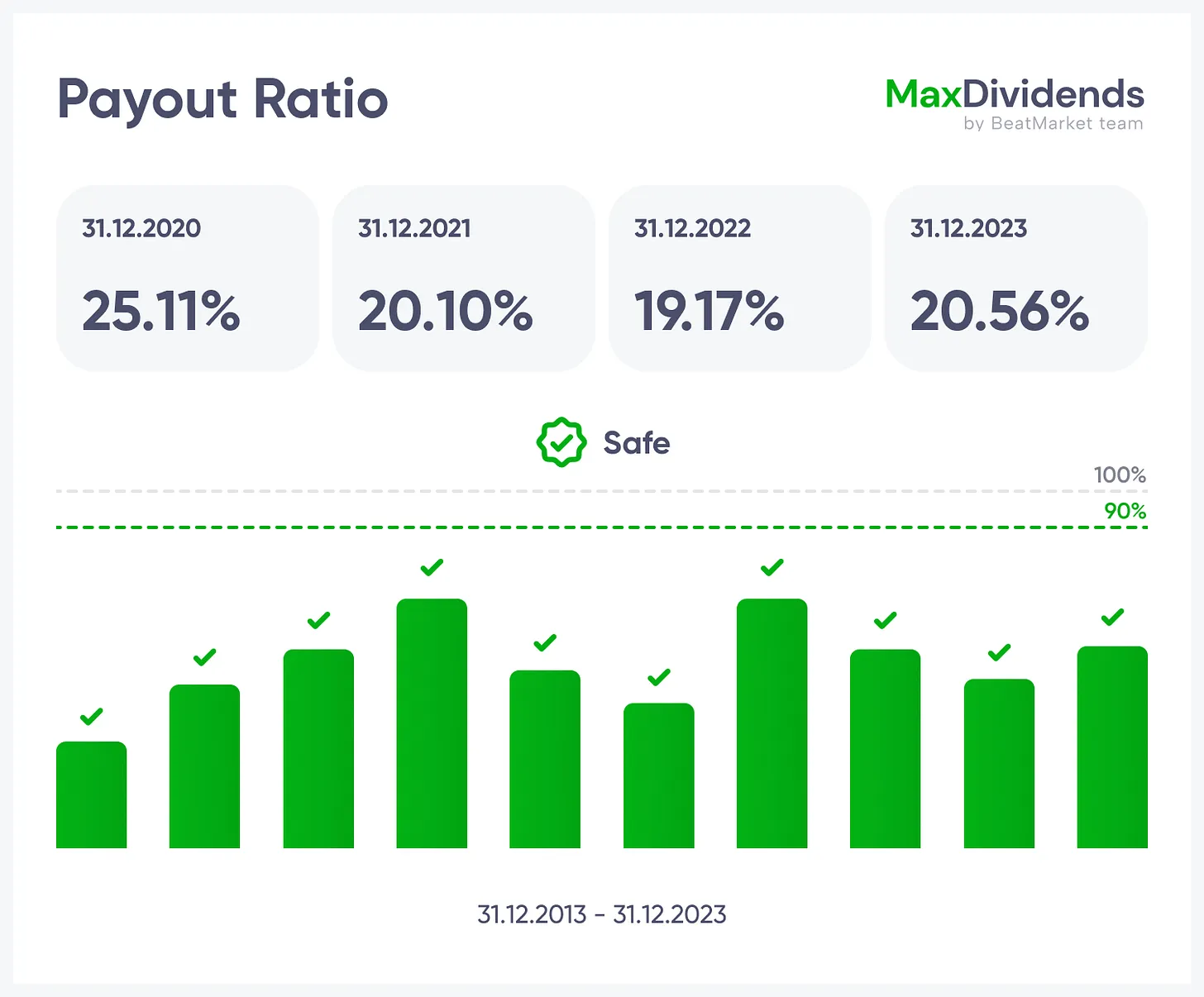

יחס תשלום BRS

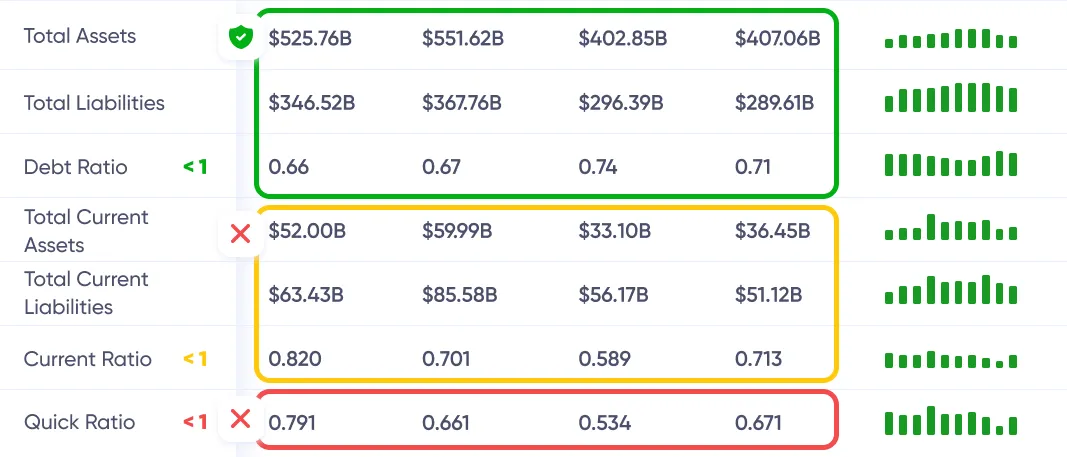

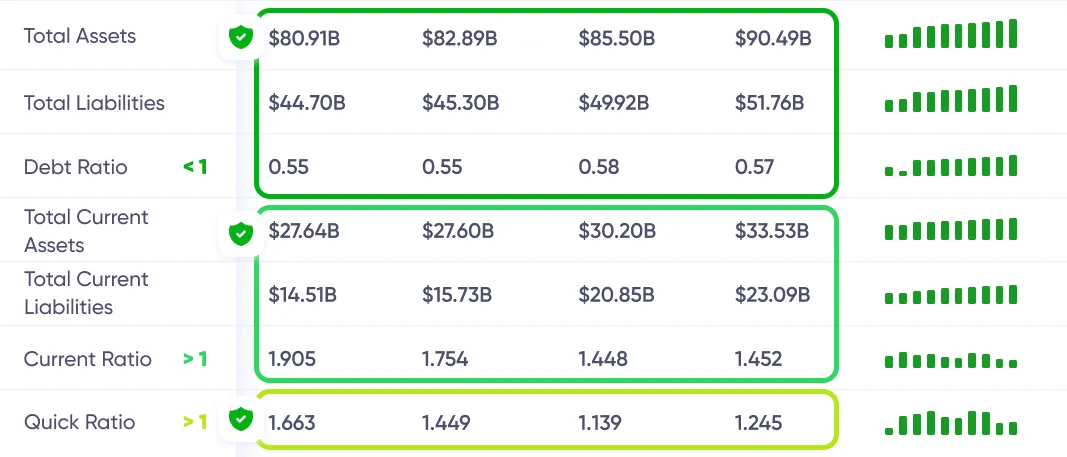

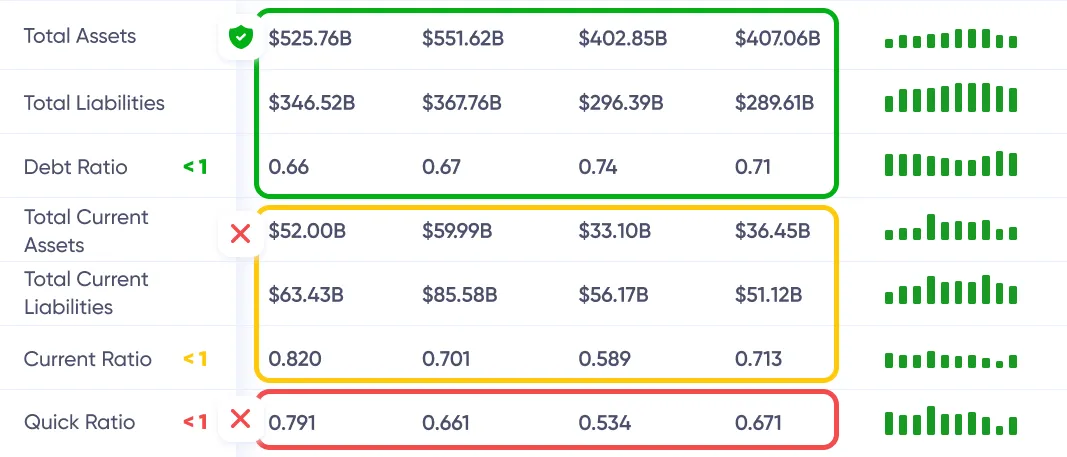

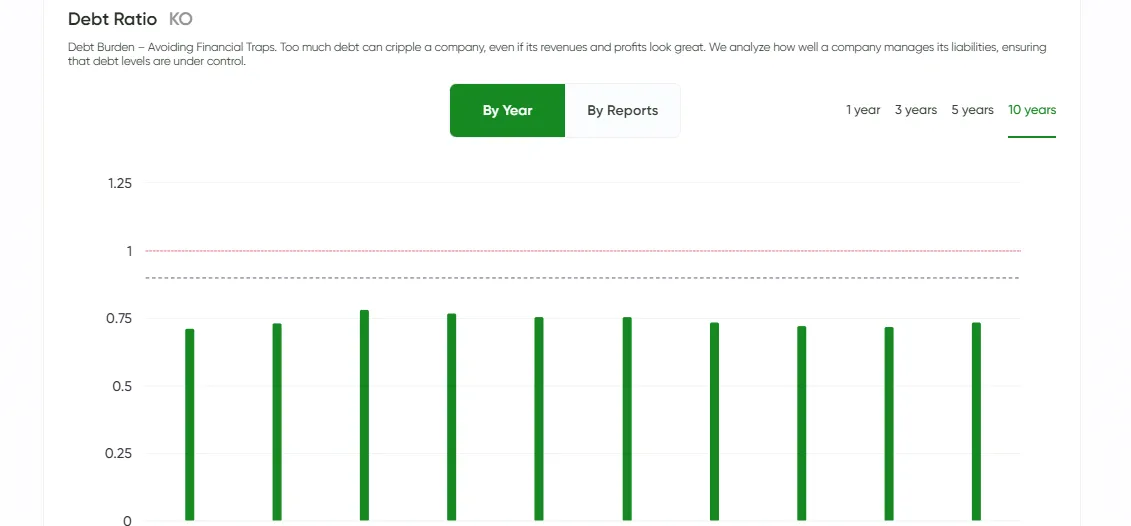

יחס חוב BRS

פיננסיים

Boryszew SA BRS

| תוצאות | 2019 | דינמיקה |

ראה את העסק כולו במבט אחד — מה הוא עושה, איך הוא מרוויח, ואיזה ערך הוא מביא.

ראה את העסק כולו במבט אחד — מה הוא עושה, איך הוא מרוויח, ואיזה ערך הוא מביא.

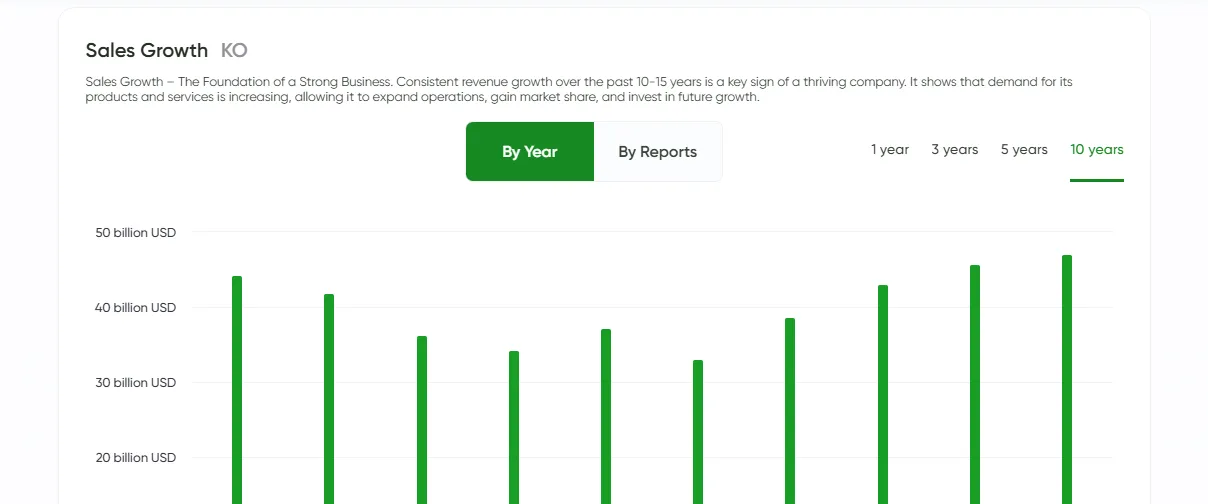

מגמת צמיחה, ברורה במבט אחד.

מגמת צמיחה, ברורה במבט אחד.

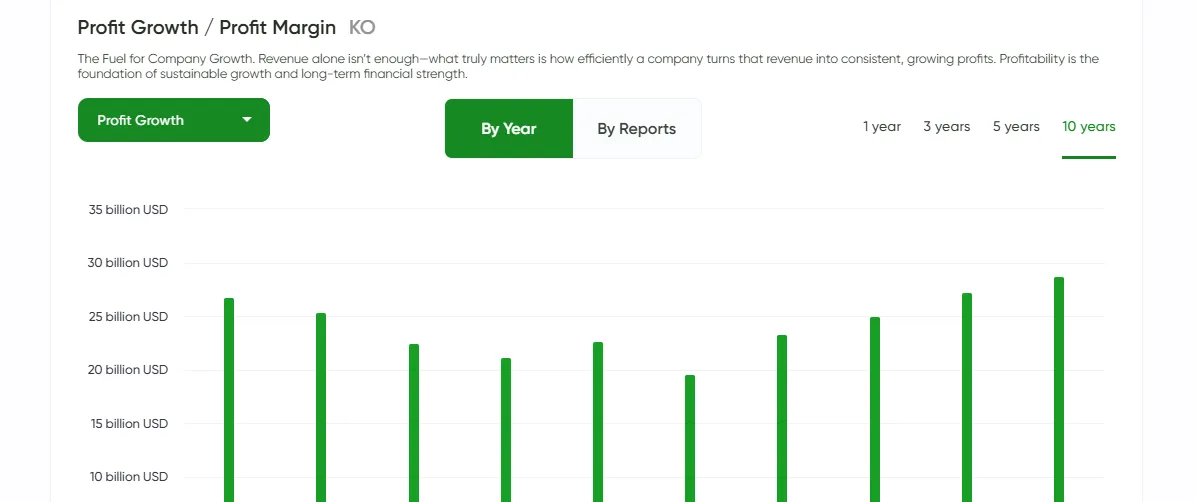

ראה אם הרווחים אמיתיים — מיד.

ראה אם הרווחים אמיתיים — מיד.

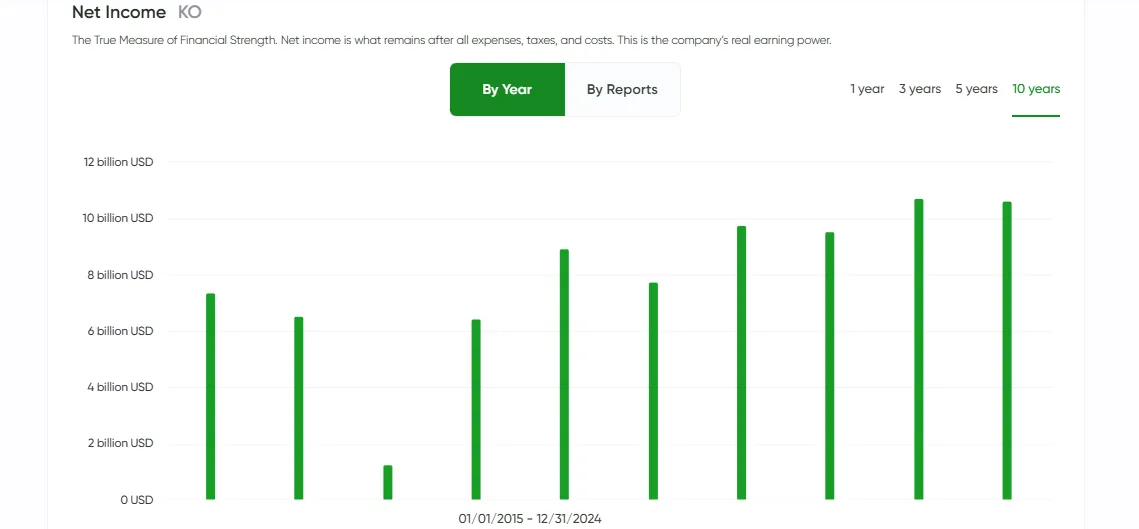

השורה התחתונה הופכת לפשוטה עם MaxDividends.

השורה התחתונה הופכת לפשוטה עם MaxDividends.

סיכון החוב נבדק עבורך, 24/7.

סיכון החוב נבדק עבורך, 24/7.

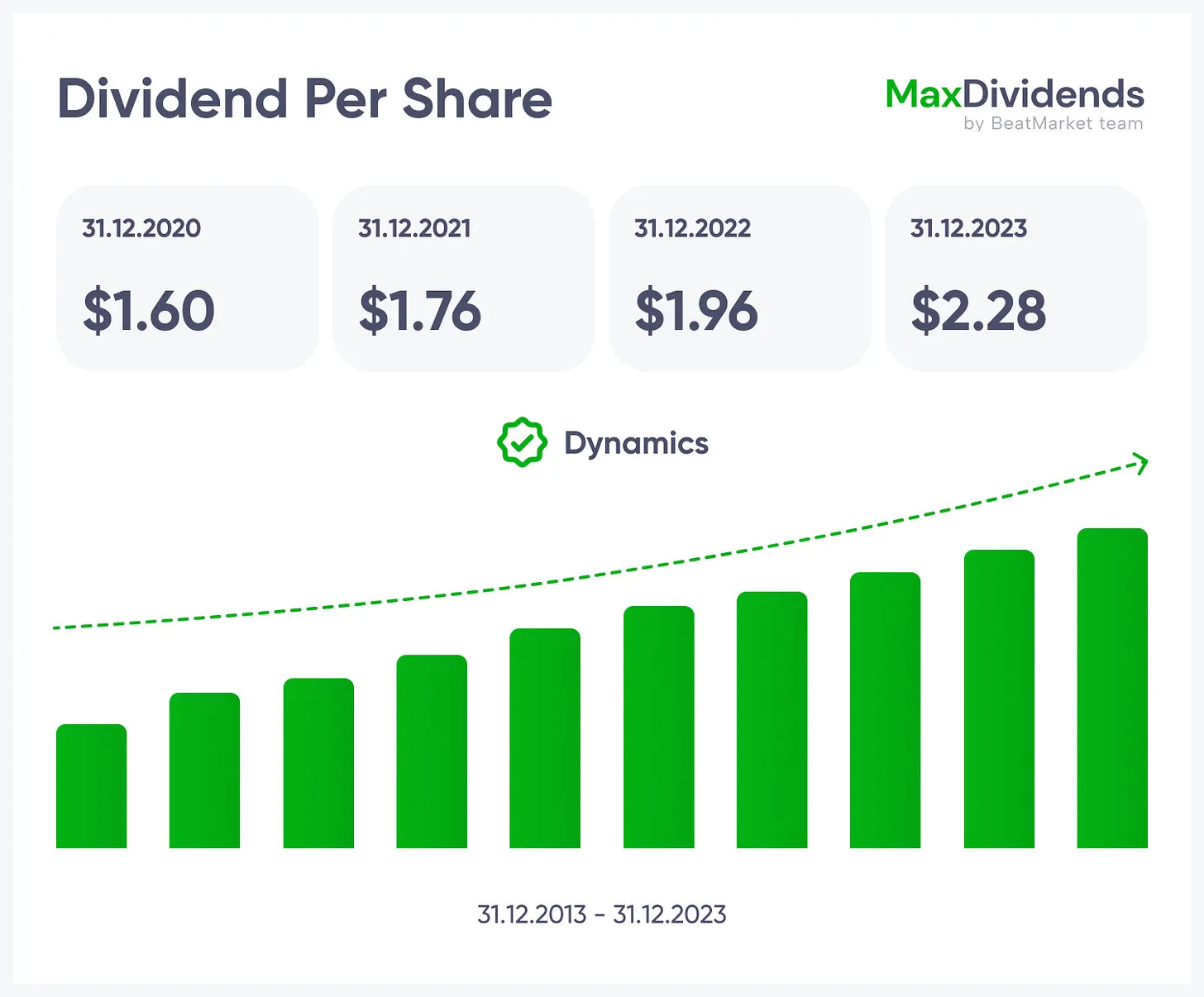

רצפי דיבידנד והעלאות בהישג ידך.

רצפי דיבידנד והעלאות בהישג ידך.

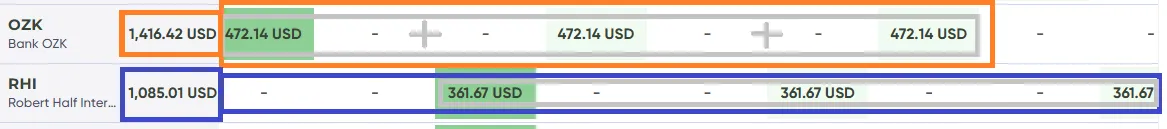

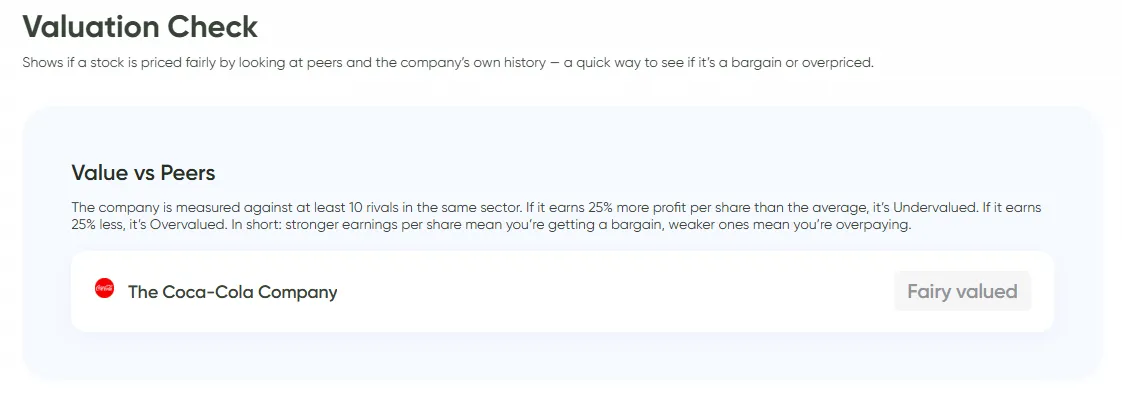

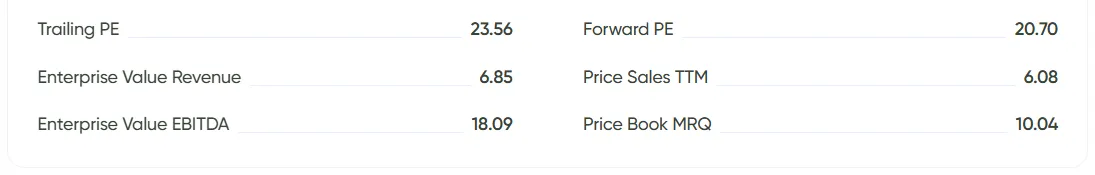

השווה את החברה מול מתחרים. אם היא מרוויחה יותר למניה — היא מוערכת פחות מדי. אם פחות — מוערכת יתר.

השווה את החברה מול מתחרים. אם היא מרוויחה יותר למניה — היא מוערכת פחות מדי. אם פחות — מוערכת יתר.

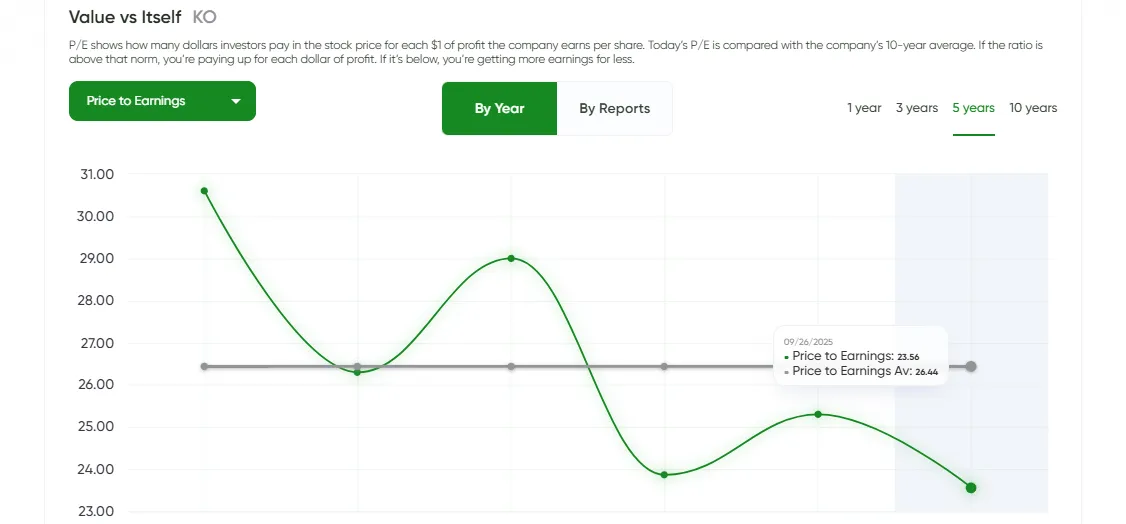

השווה את P/E של היום מול ההיסטוריה של 10 השנים האחרונות. מעל הממוצע = יקר. מתחת = מציאה.

השווה את P/E של היום מול ההיסטוריה של 10 השנים האחרונות. מעל הממוצע = יקר. מתחת = מציאה.

ראה אם המניה נסחרת מתחת לנכסיה. זו רכישת העסק עם מרווח בטחון מובנה.

ראה אם המניה נסחרת מתחת לנכסיה. זו רכישת העסק עם מרווח בטחון מובנה.

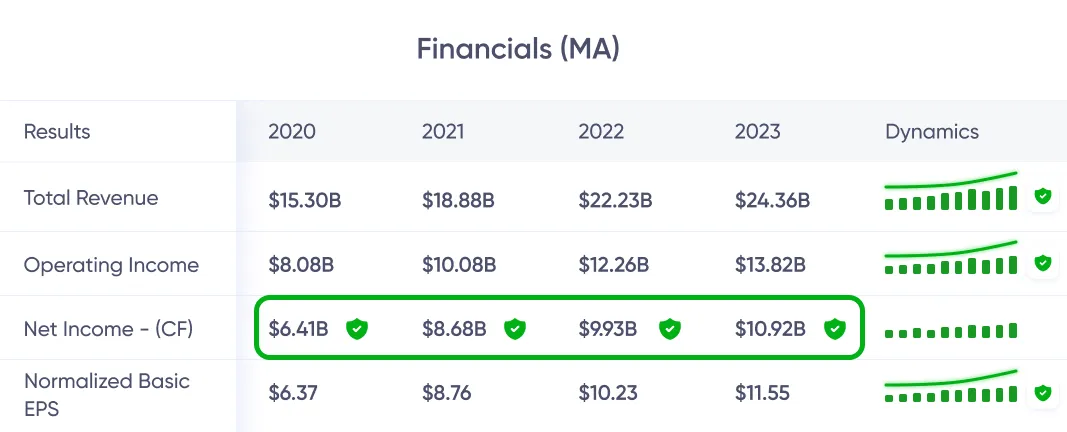

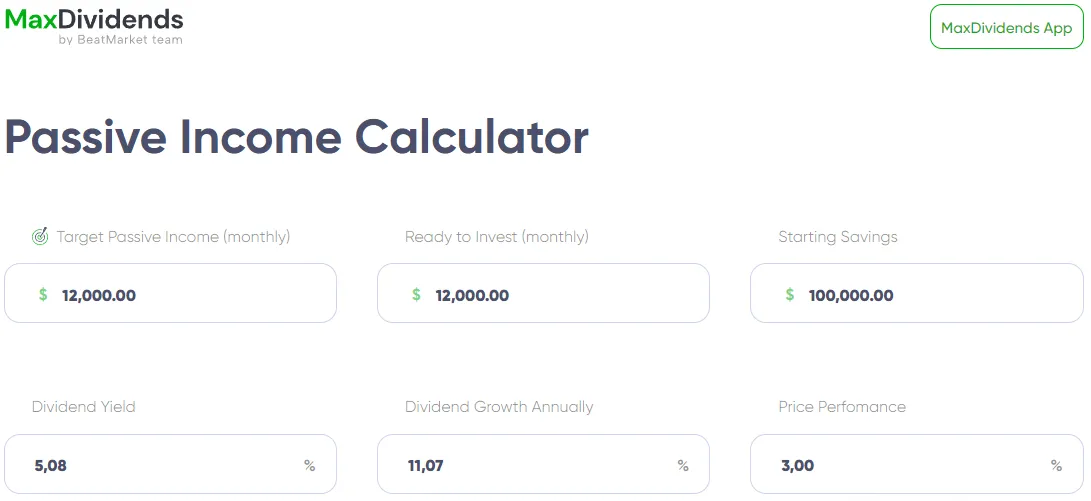

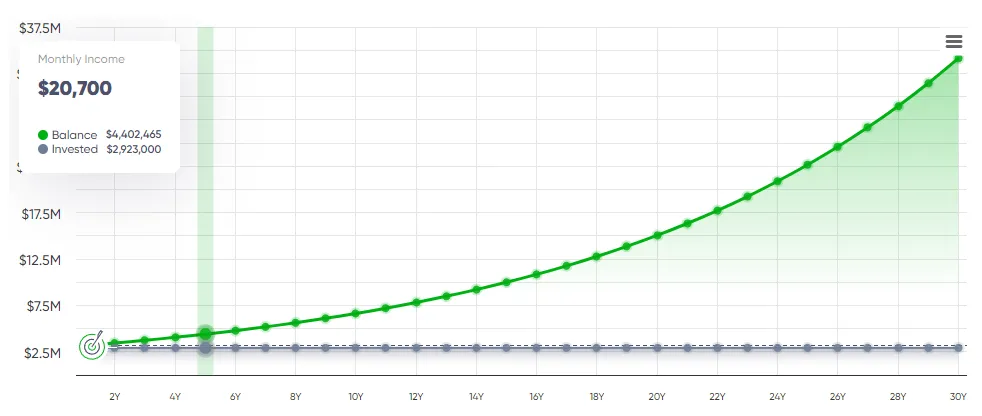

אפליקציית MaxDividends: מחשבון הכנסה פסיבית

אפליקציית MaxDividends: מחשבון הכנסה פסיבית

הזן את הערכים האלה, לחץ על חשב, ובום — יש לך את מפת הדרכים שלך.

הזן את הערכים האלה, לחץ על חשב, ובום — יש לך את מפת הדרכים שלך.

אפליקציית MaxDividends: מחשבון הכנסה פסיבית

אפליקציית MaxDividends: מחשבון הכנסה פסיבית

אפליקציית MaxDividends: מחשבון הכנסה פסיבית

אפליקציית MaxDividends: מחשבון הכנסה פסיבית

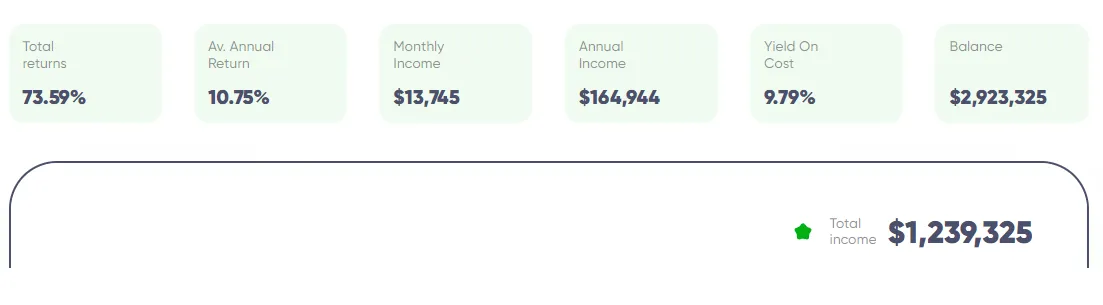

אפליקציית MaxDividends: מחשבון הכנסה פסיבית, תחזית הכנסה

אפליקציית MaxDividends: מחשבון הכנסה פסיבית, תחזית הכנסה

BeatStart

BeatStart