Analytic

Portfolio Tim’s Portfolio

Current Balance

2 499,18 USD

Capital Gains

+290,01 USD (+13,13%)

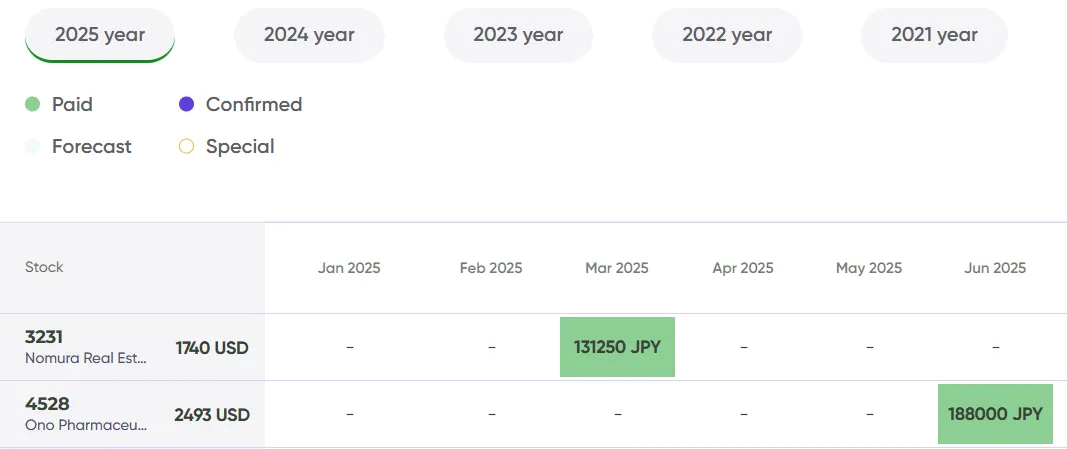

Dividend Income

2.27 USD

27.18 USD

+1.17%

25.30 USD

About Portfolio

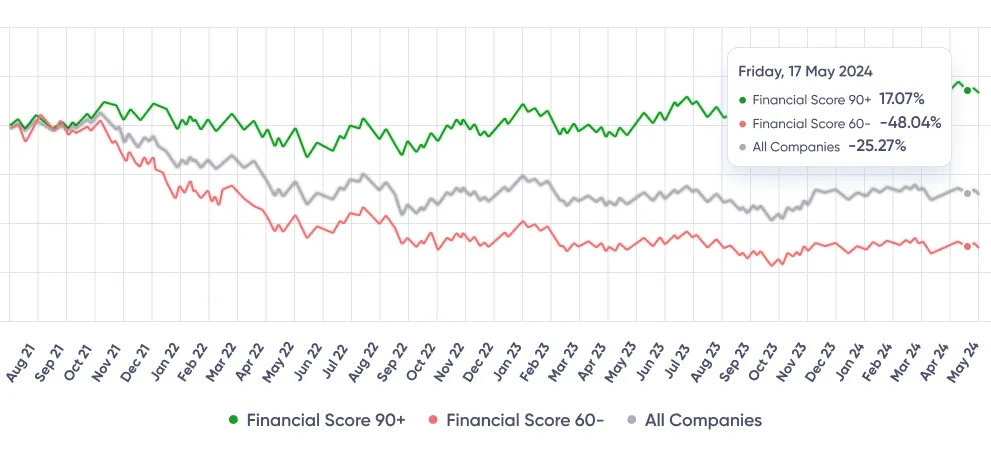

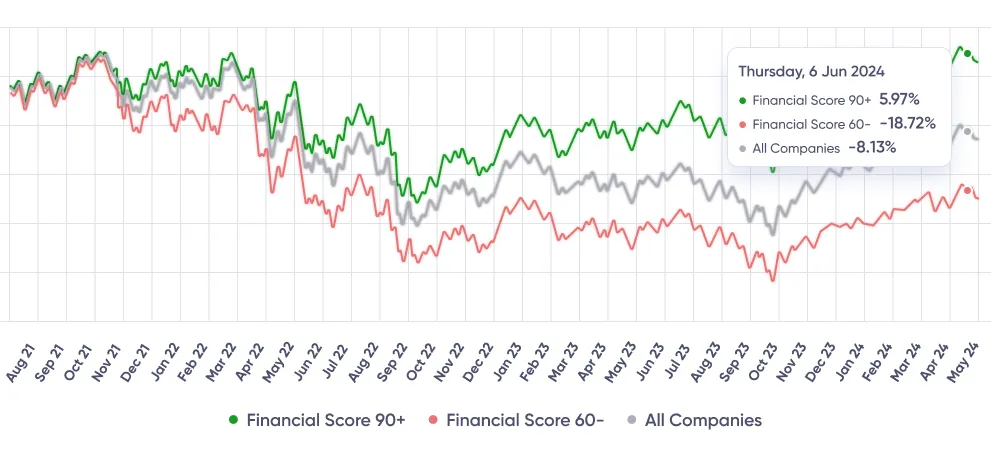

Price Returns

Best Deal

Diversification

Your strategy’s breakdown by sectors, industries, and assets - this shows how you’re spreading your bets across the market.Sectors

Industries

Assets

Strategy Breakdown

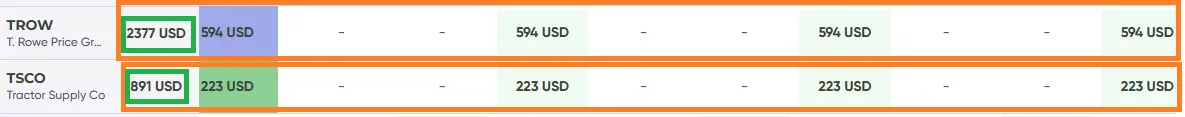

Here’s the full picture of where your money’s working - every holding in your strategy, along with how much weight each one has.Total Strategy Value

Top Holdings (by % of Strategy)

Market Cap Breakdown

The big dogs. These are the $10 billion and up giants.

These are solid, well-established companies, usually worth between $2 billion and $10 billion. Big enough to weather storms but still with room to grow.

Mid-size players with market caps between $300 million and $2 billion. They’re growing, but they can be a bit more volatile.

Strategy Breakdown – By Sector

Here’s where your money’s working across different industries. A good mix of sectors helps smooth out risk - some pay steady dividends, others offer growth potential.Top Holdings in manufactured goods

-

Intel (MMM)23.03%

-

Texas instrumental (AMAT)7.11%

-

Tractor supply (CMI)8.25%

-

Pool (POOL)3.03%

-

ZM company (ROCK)5.24%

Your Asset Mix

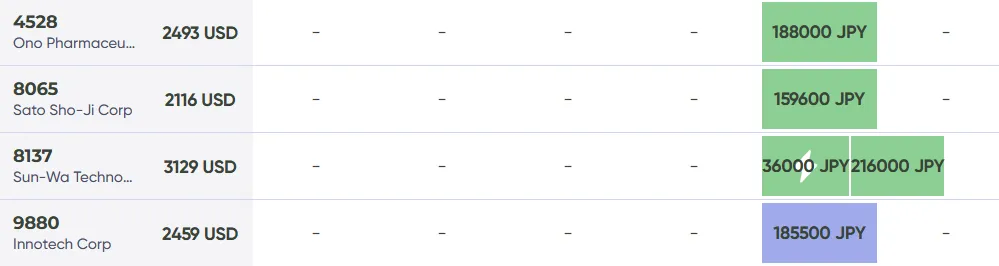

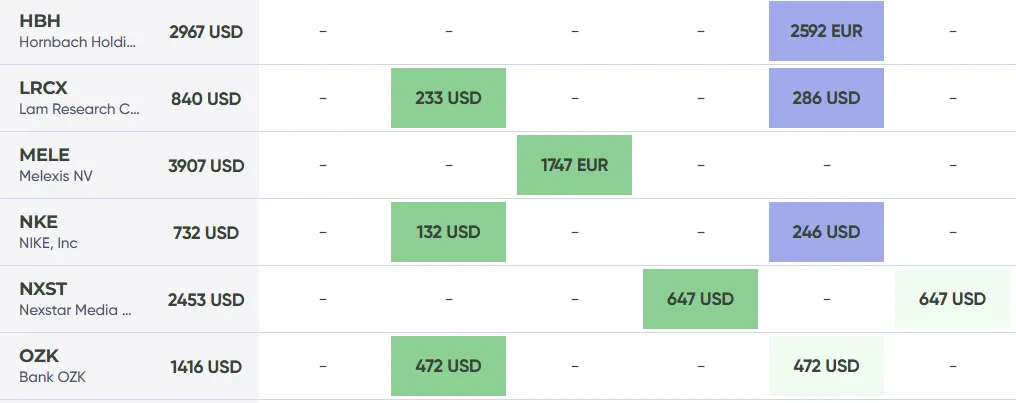

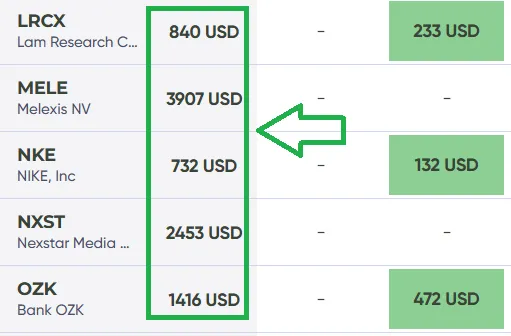

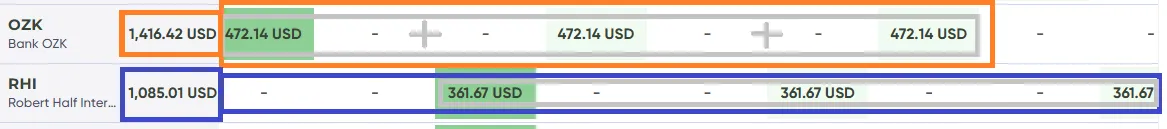

Here’s the breakdown of what you ownMy Holdings

Top Positions in Your Strategy

Large Assets of Type

Company

POWI

Power Integrations IncTTC

Toro CoLMAT

LeMaitre Vascular IncRHI

Robert Half International IncDCI

Donaldson Company, IncAPH

Amphenol CorporationMGPI

MGP Ingredients IncLRCX

Lam Research CorporationFSS

Federal Signal CorporationEXPO

Exponent IncFELE

Franklin Electric Co., IncMSFT

Microsoft CorpBRC

Brady CorporationRMD

ResMed IncLECO

Lincoln Electric Holdings, IncProfit Margin

Operating Margin ttm

ROA ttm

ROE ttm

Revenue/Share ttm

Enterprise Value / Ebitda

Inspired by this portfolio?

Try MaxDividends

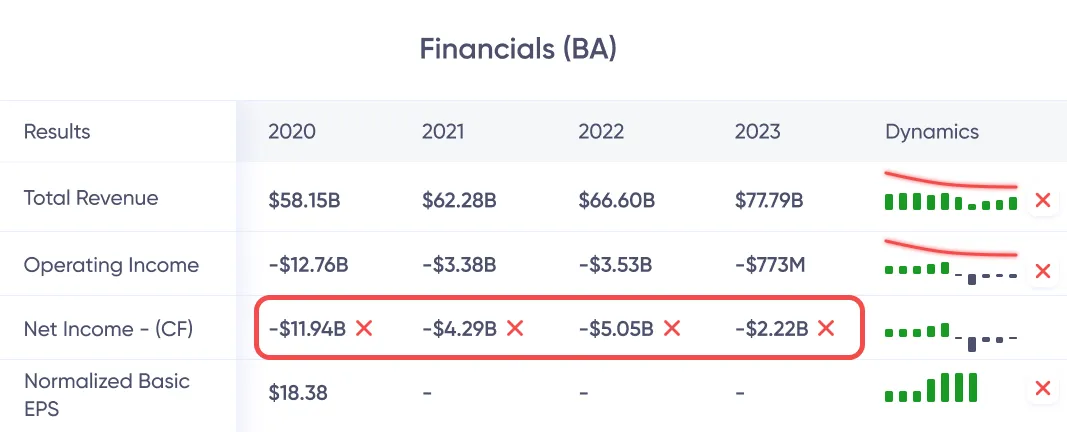

See the whole business at a glance — what it does, how it earns, and the value it brings.

See the whole business at a glance — what it does, how it earns, and the value it brings.

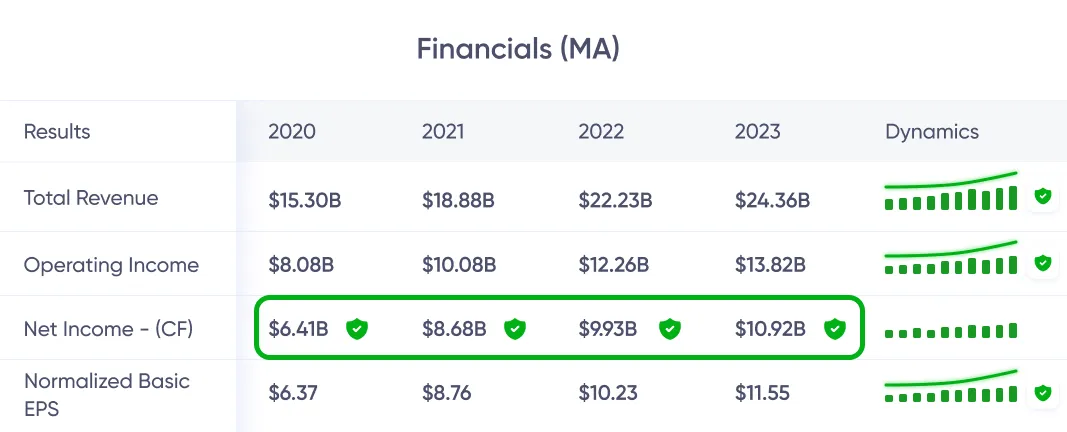

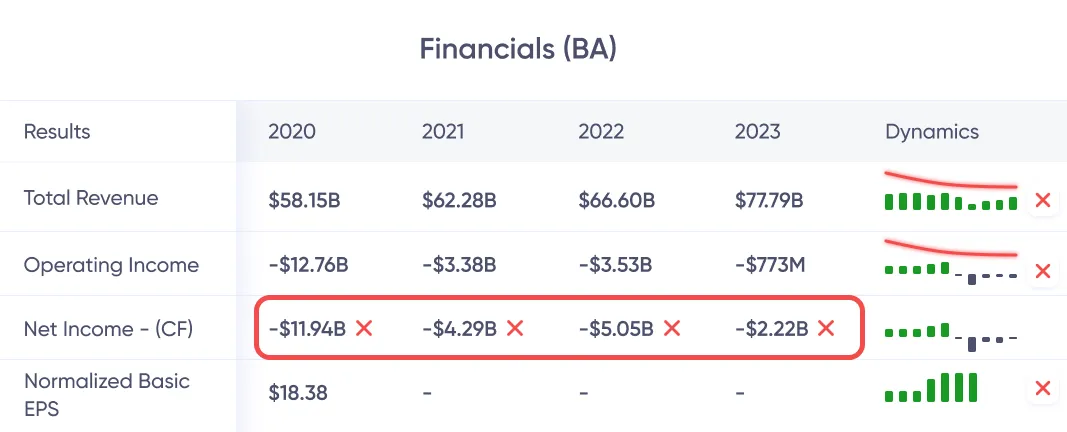

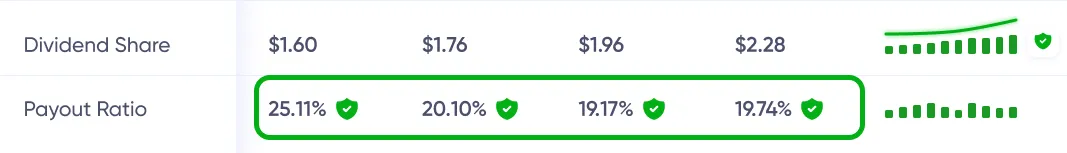

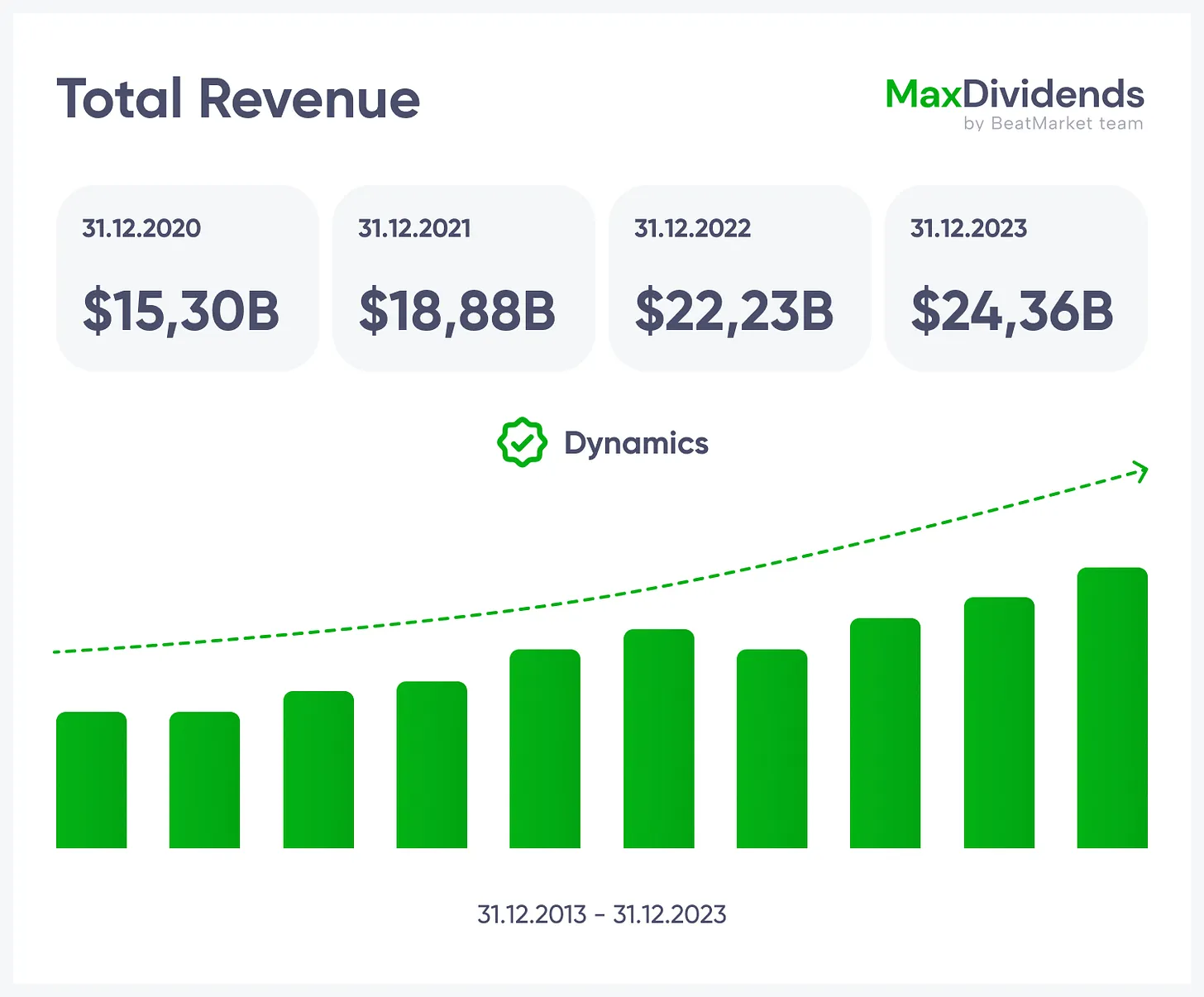

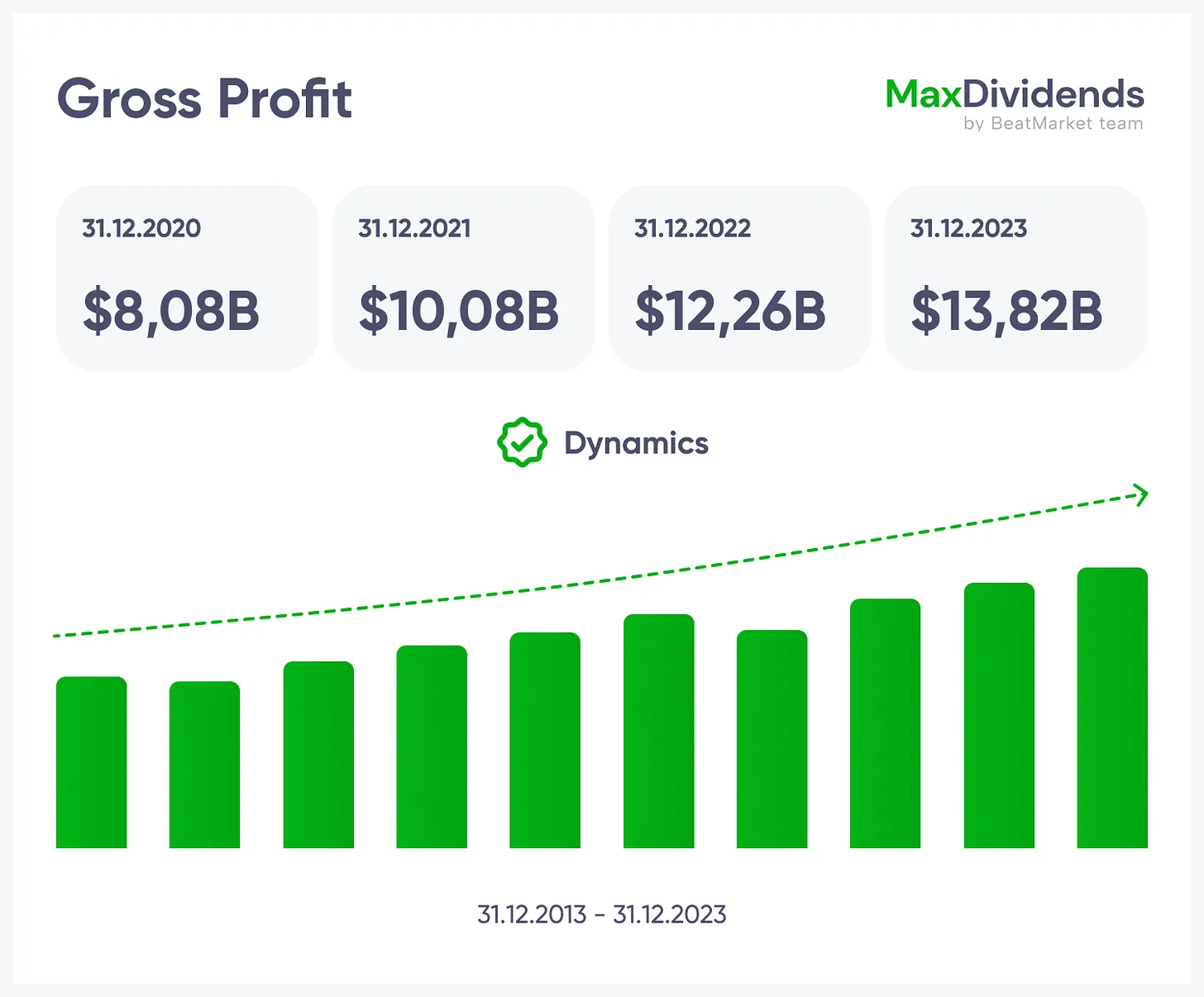

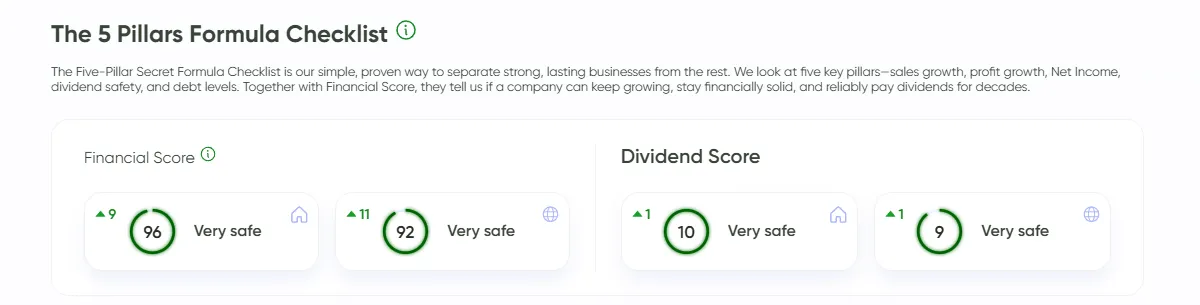

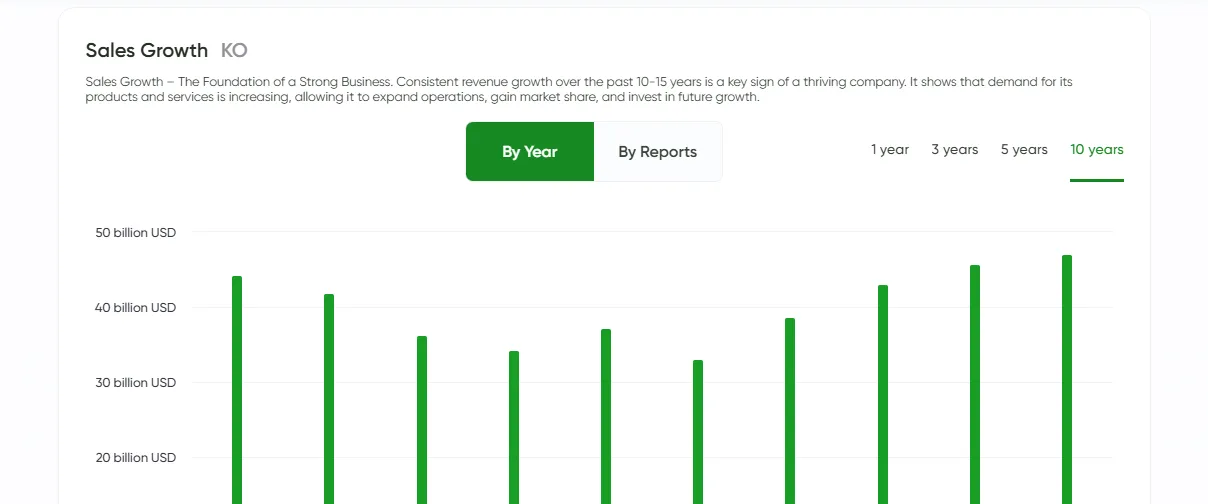

Growth trend, clear in one glance.

Growth trend, clear in one glance.

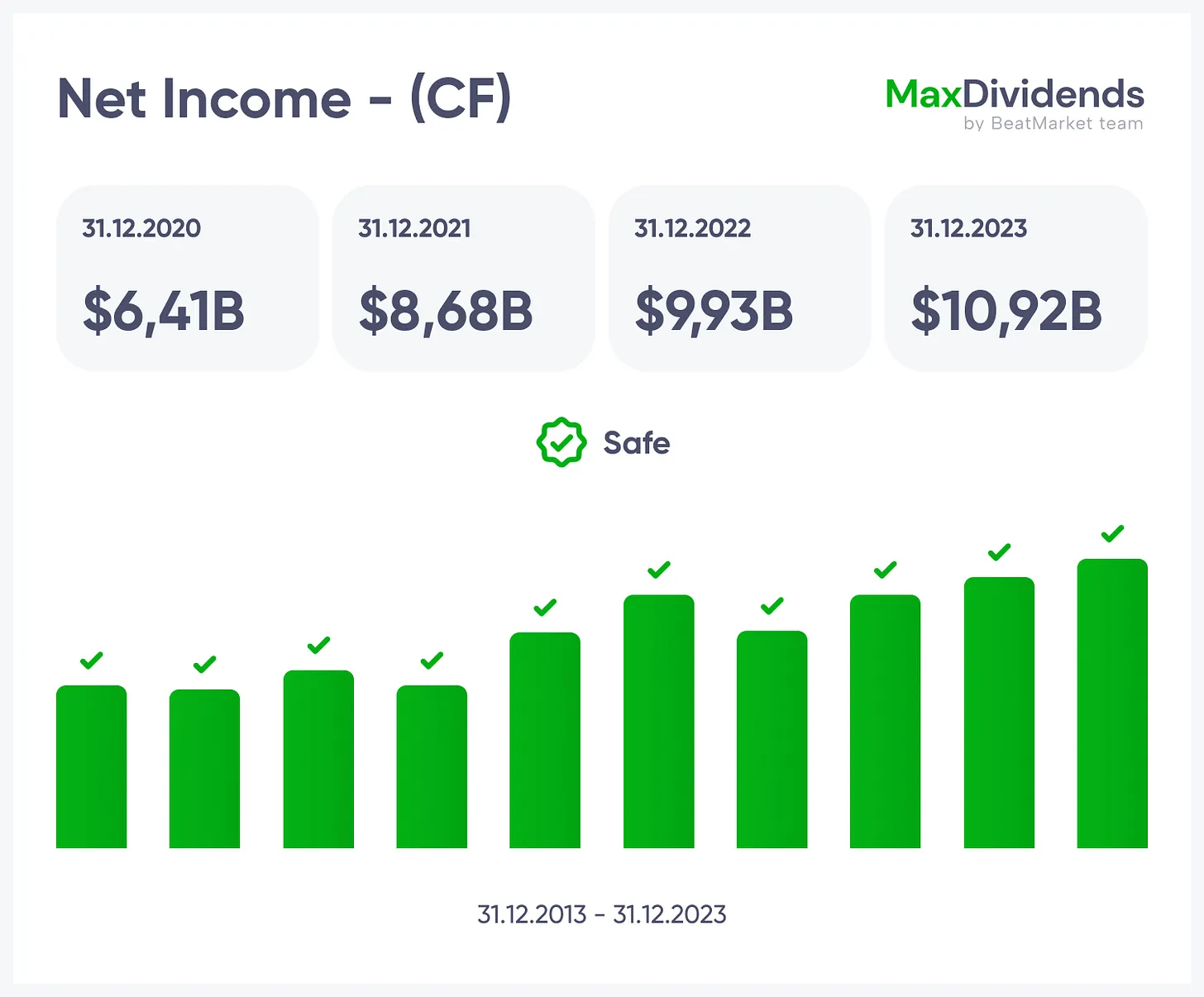

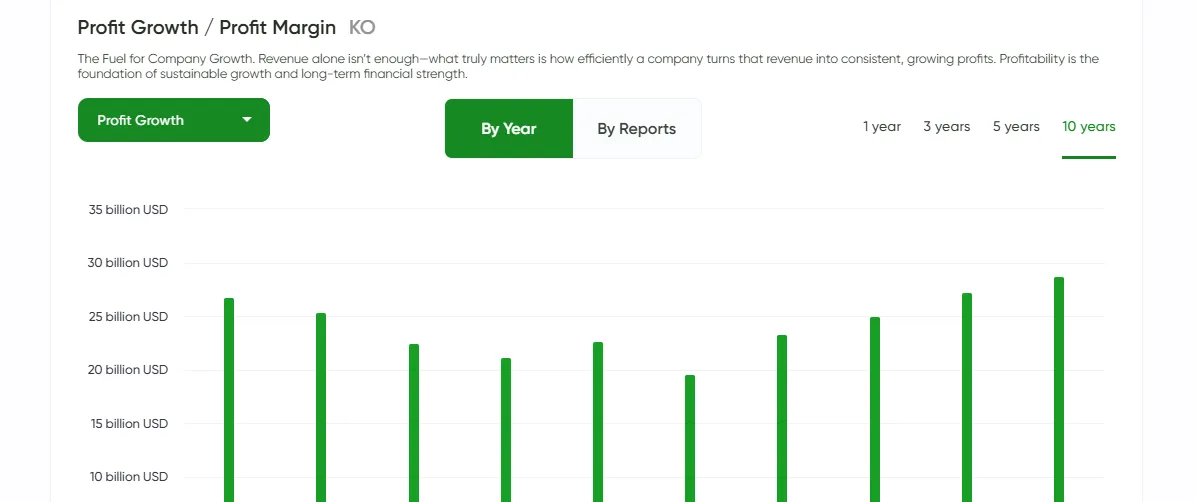

See if profits are real — instantly.

See if profits are real — instantly.

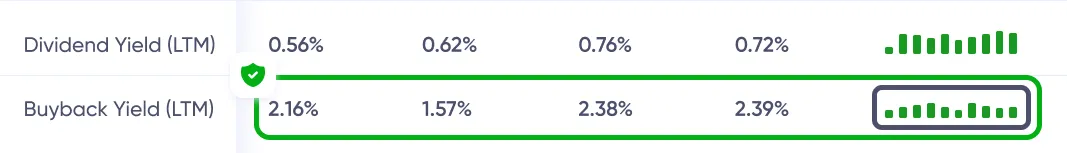

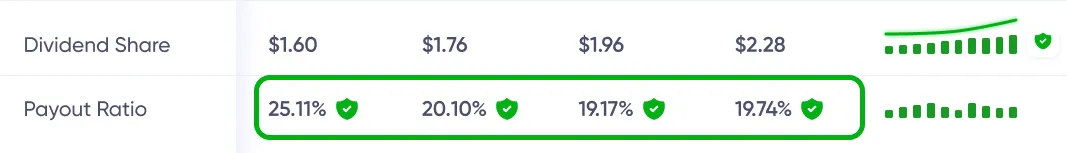

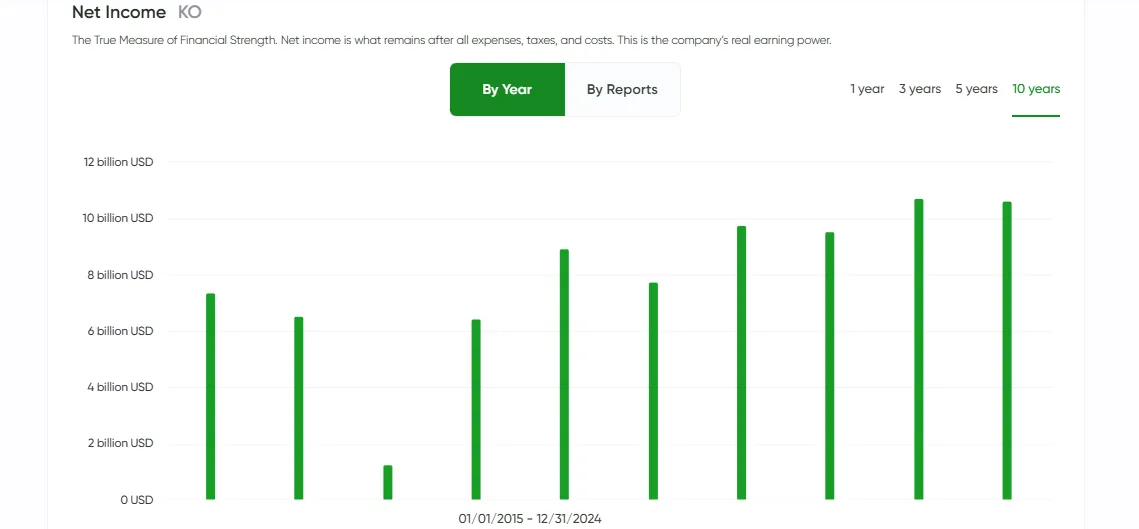

Bottom line made simple with MaxDividends.

Bottom line made simple with MaxDividends.

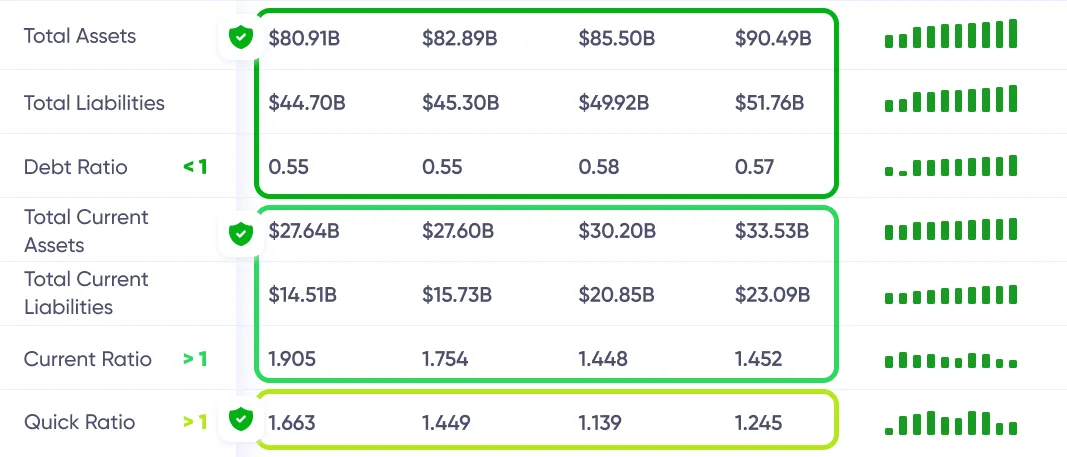

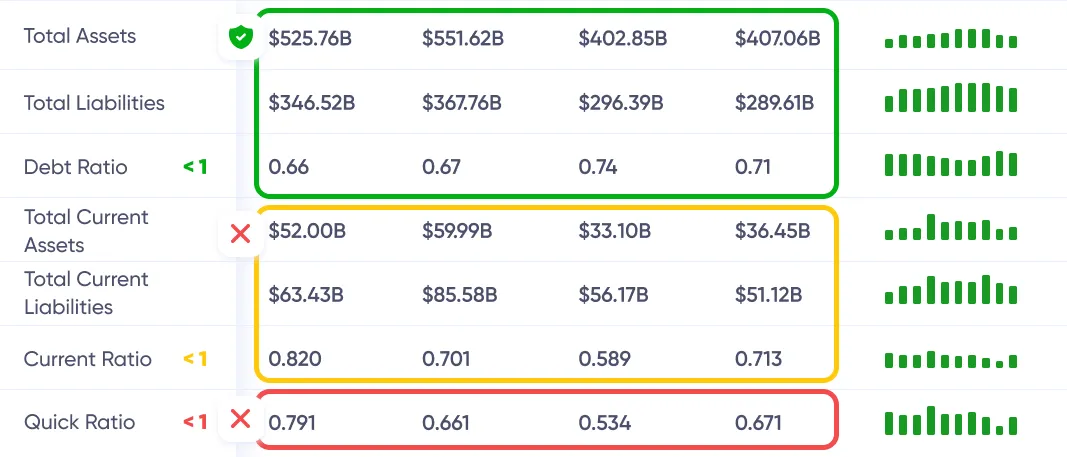

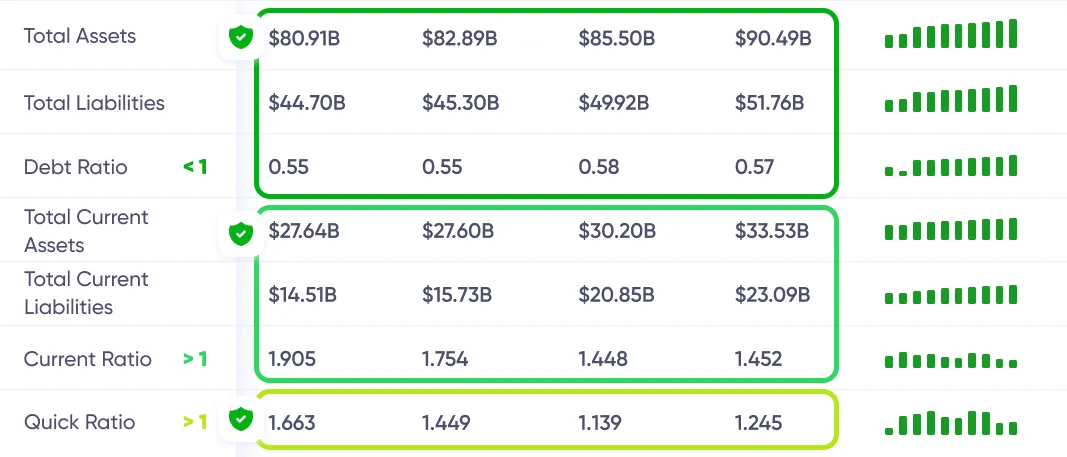

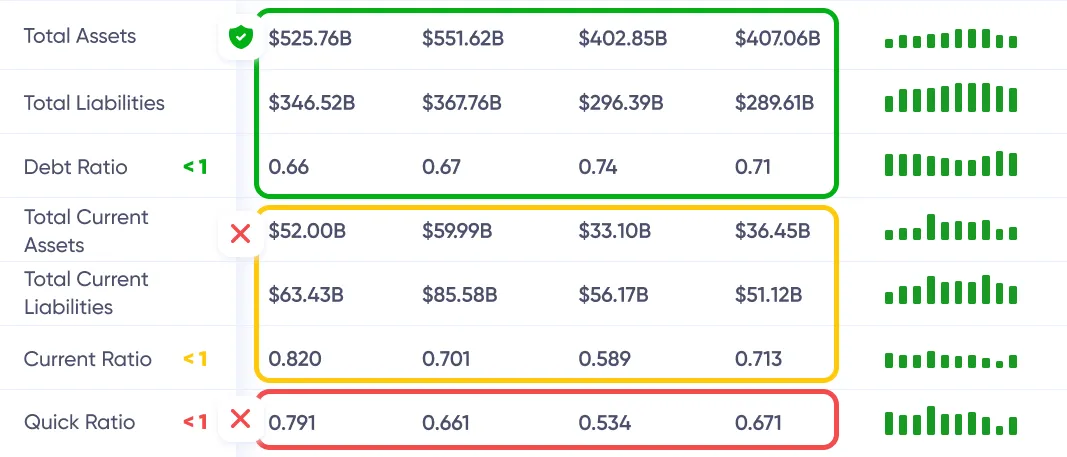

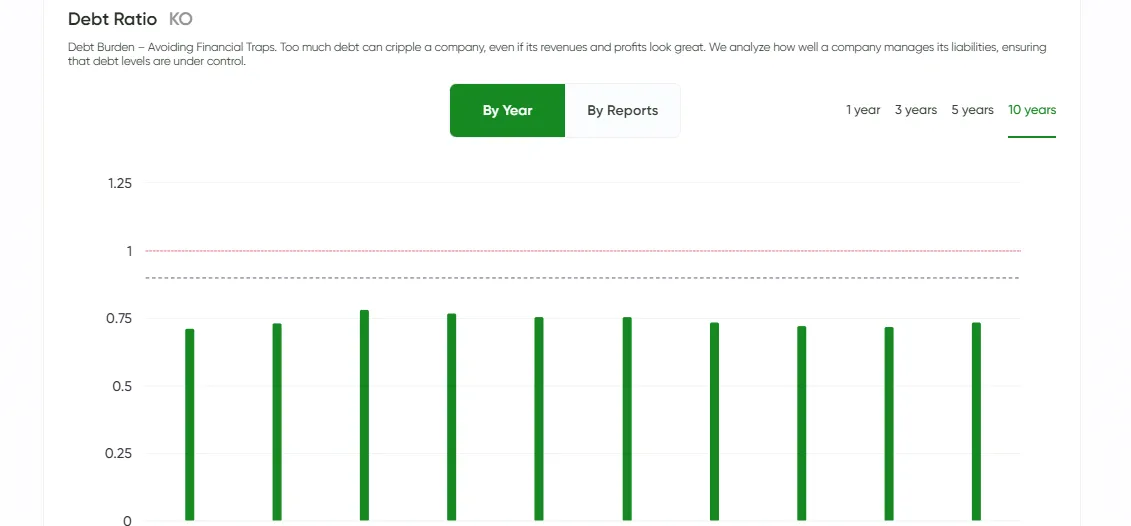

Debt risk checked for you, 24/7.

Debt risk checked for you, 24/7.

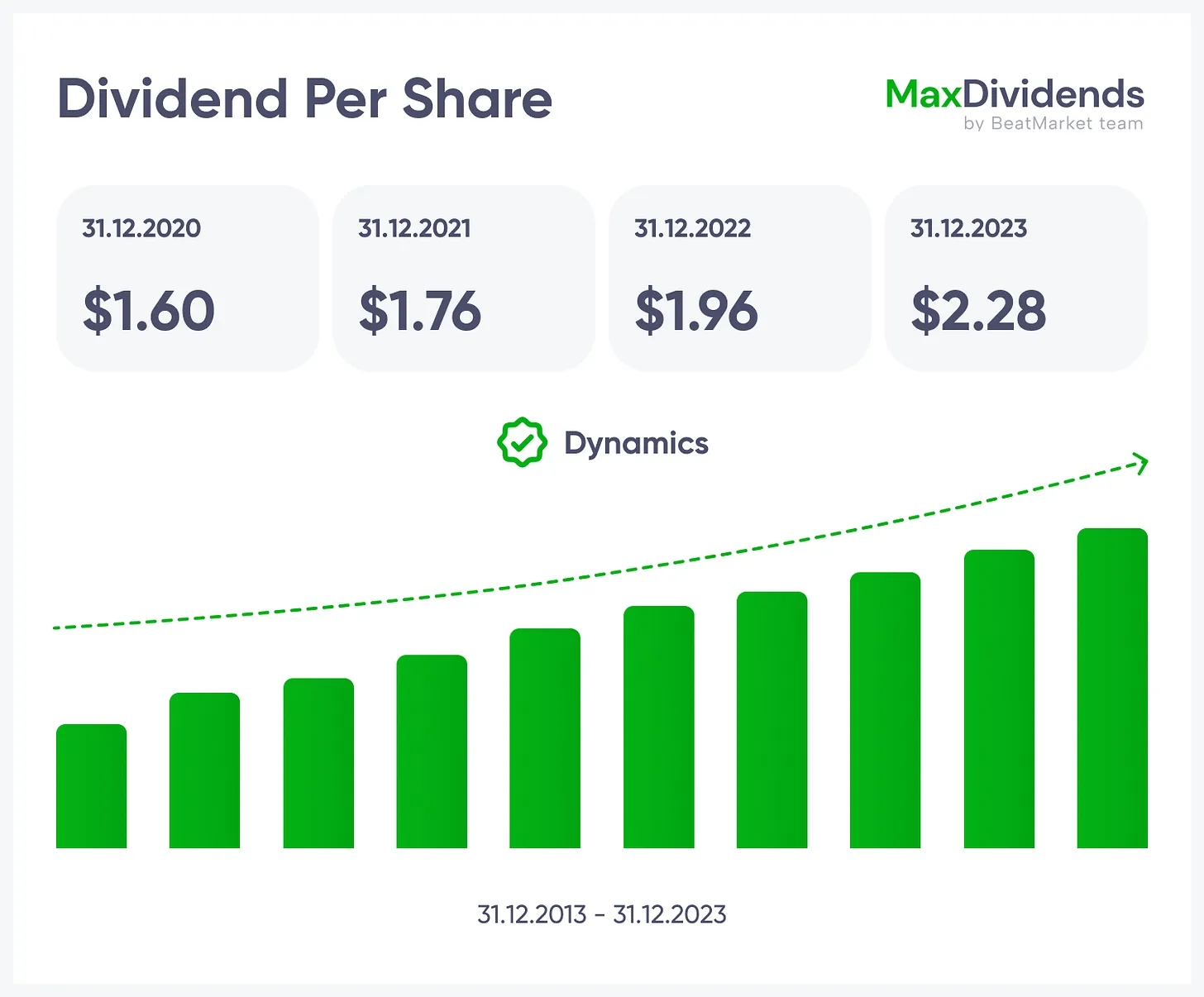

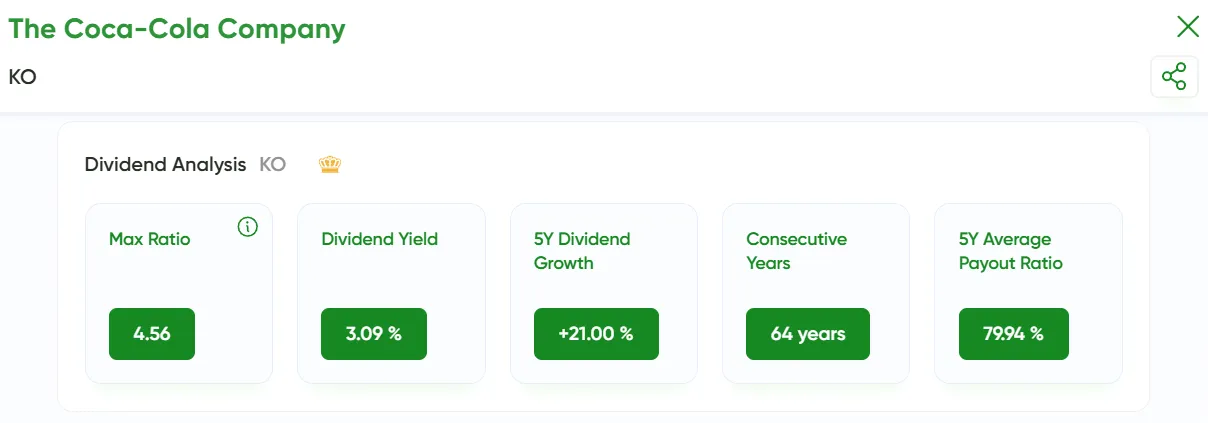

Dividend streaks and raises at your fingertips.

Dividend streaks and raises at your fingertips.

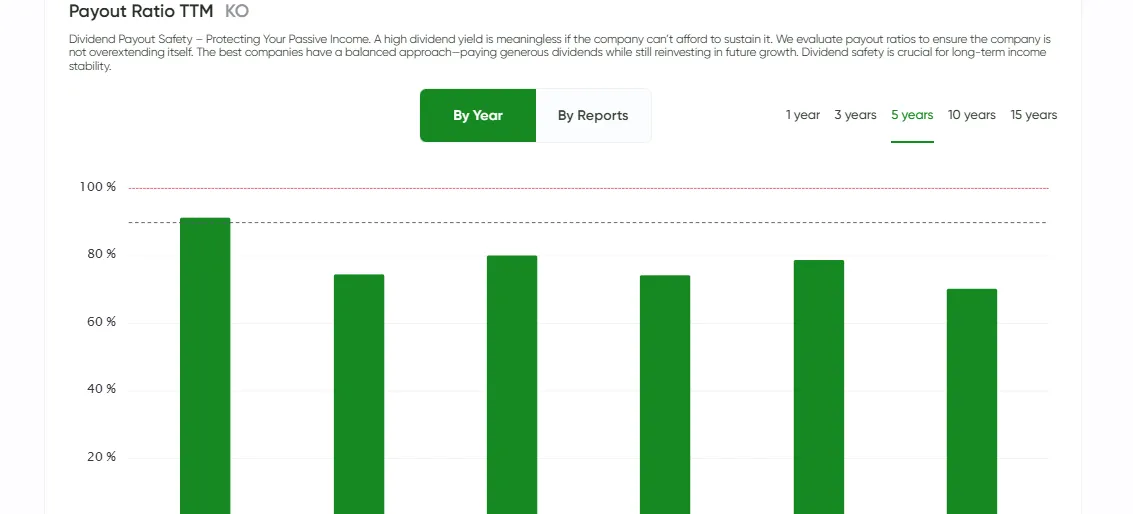

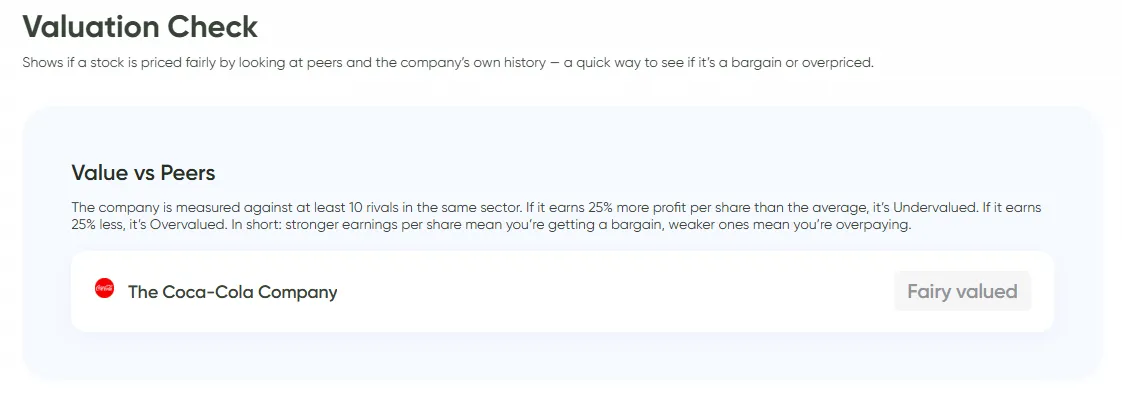

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

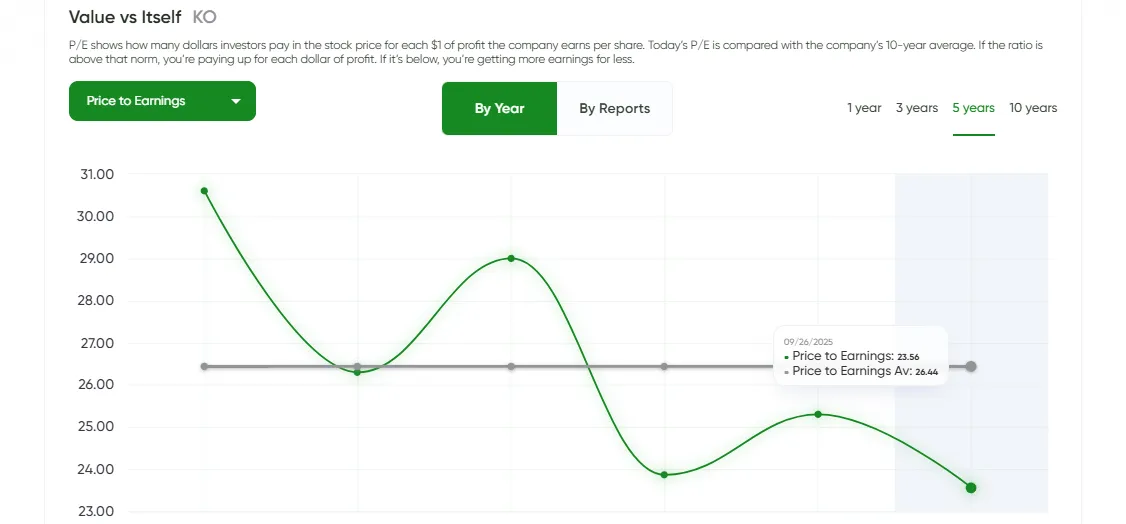

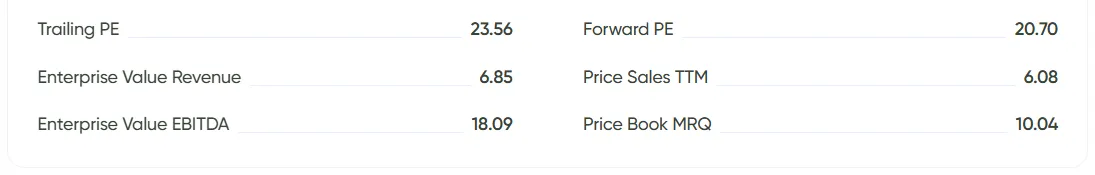

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

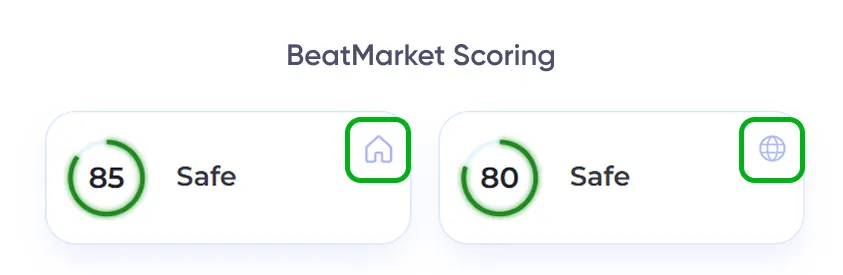

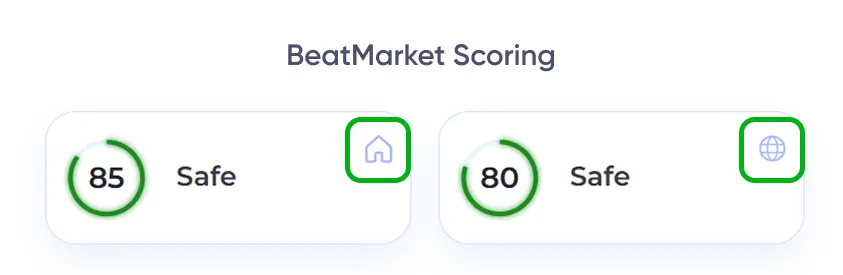

BeatStart

BeatStart