MaxDividends App

Portfolio UK Dividend Eagles Porfolio

Current Balance

6 632,63 GBP

Capital Gains

-82,42 GBP (-1,23%)

Dividend Income

23.30 GBP

279.64 GBP

+3.11%

81.37 GBP

About Portfolio

Price Returns

Best Deal

Diversification

Your strategy’s breakdown by sectors, industries, and assets - this shows how you’re spreading your bets across the market.Sectors

Industries

Assets

Strategy Breakdown

Here’s the full picture of where your money’s working - every holding in your strategy, along with how much weight each one has.Total Strategy Value

Top Holdings (by % of Strategy)

Market Cap Breakdown

Mid-size players with market caps between $300 million and $2 billion. They’re growing, but they can be a bit more volatile.

The scrappy up-and-comers. These companies are usually worth under $300 million. More risk, but if you catch a winner, the payoff can be big.

Strategy Breakdown – By Sector

Here’s where your money’s working across different industries. A good mix of sectors helps smooth out risk - some pay steady dividends, others offer growth potential.Top Holdings in manufactured goods

-

Intel (MMM)23.03%

-

Texas instrumental (AMAT)7.11%

-

Tractor supply (CMI)8.25%

-

Pool (POOL)3.03%

-

ZM company (ROCK)5.24%

Your Asset Mix

Here’s the breakdown of what you ownMy Holdings

Top Positions in Your Strategy

Large Assets of Type

Company

AHT

Ashtead Group PLCLTHM

James Latham plcMPE

M.P.Evans GroupSAFE

Safestore Holdings PlcTEP

Telecom Plus PLCBRK

Brooks Macdonald GroupHIK

Hikma Pharmaceuticals PLCMGNS

Morgan Sindall Group PLCDWHA

Dewhurst plcIII

3I Group PLCTET

Treatt PLCVSVS

Vesuvius PLCMACF

Macfarlane Group PLCBNZL

Bunzl PLCCWK

Cranswick PLCHILS

Hill & Smith Holdings PLCProfit Margin

Operating Margin ttm

ROA ttm

ROE ttm

Revenue/Share ttm

Enterprise Value / Ebitda

Inspired by this portfolio?

Try MaxDividends

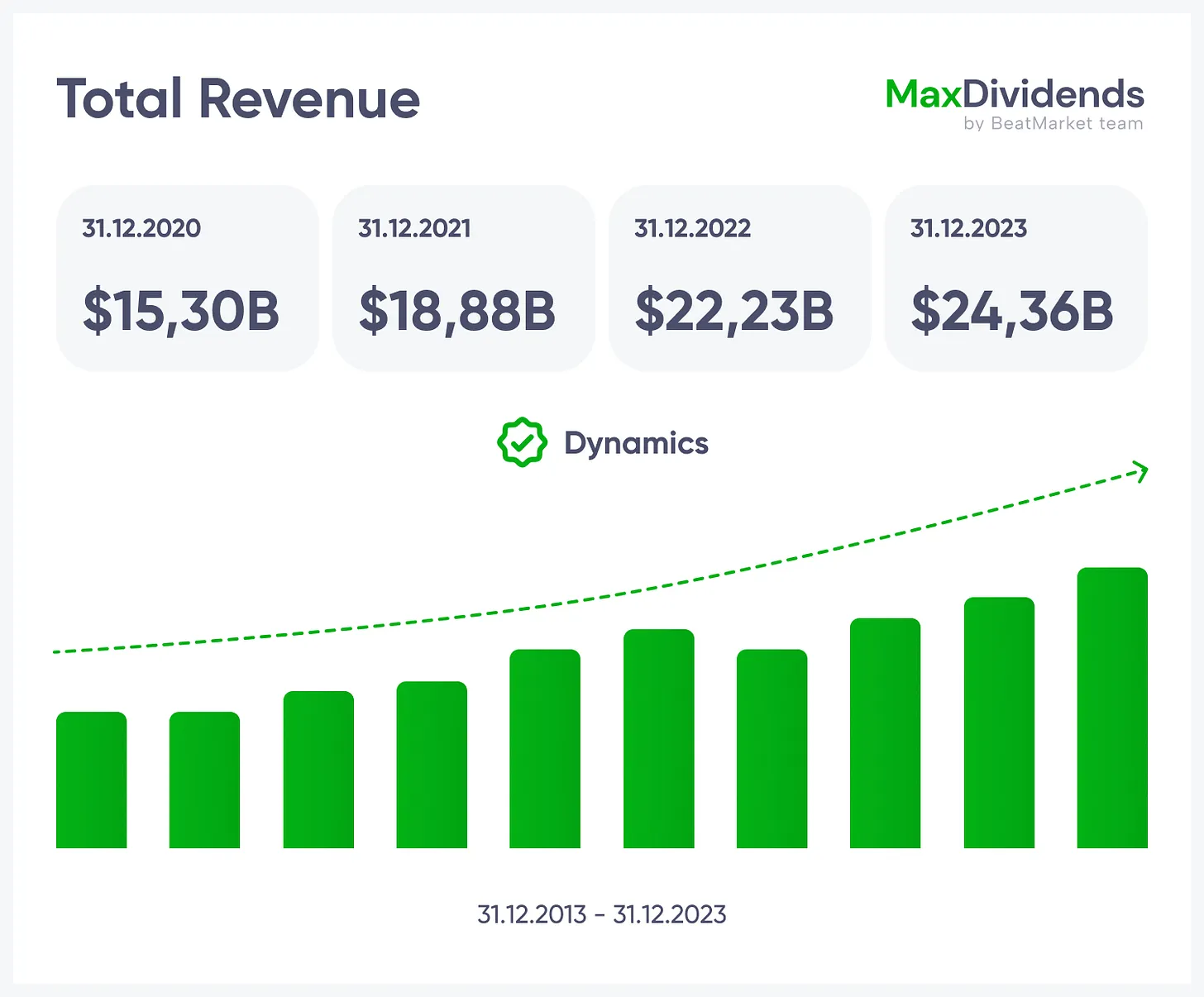

See the whole business at a glance — what it does, how it earns, and the value it brings.

See the whole business at a glance — what it does, how it earns, and the value it brings.

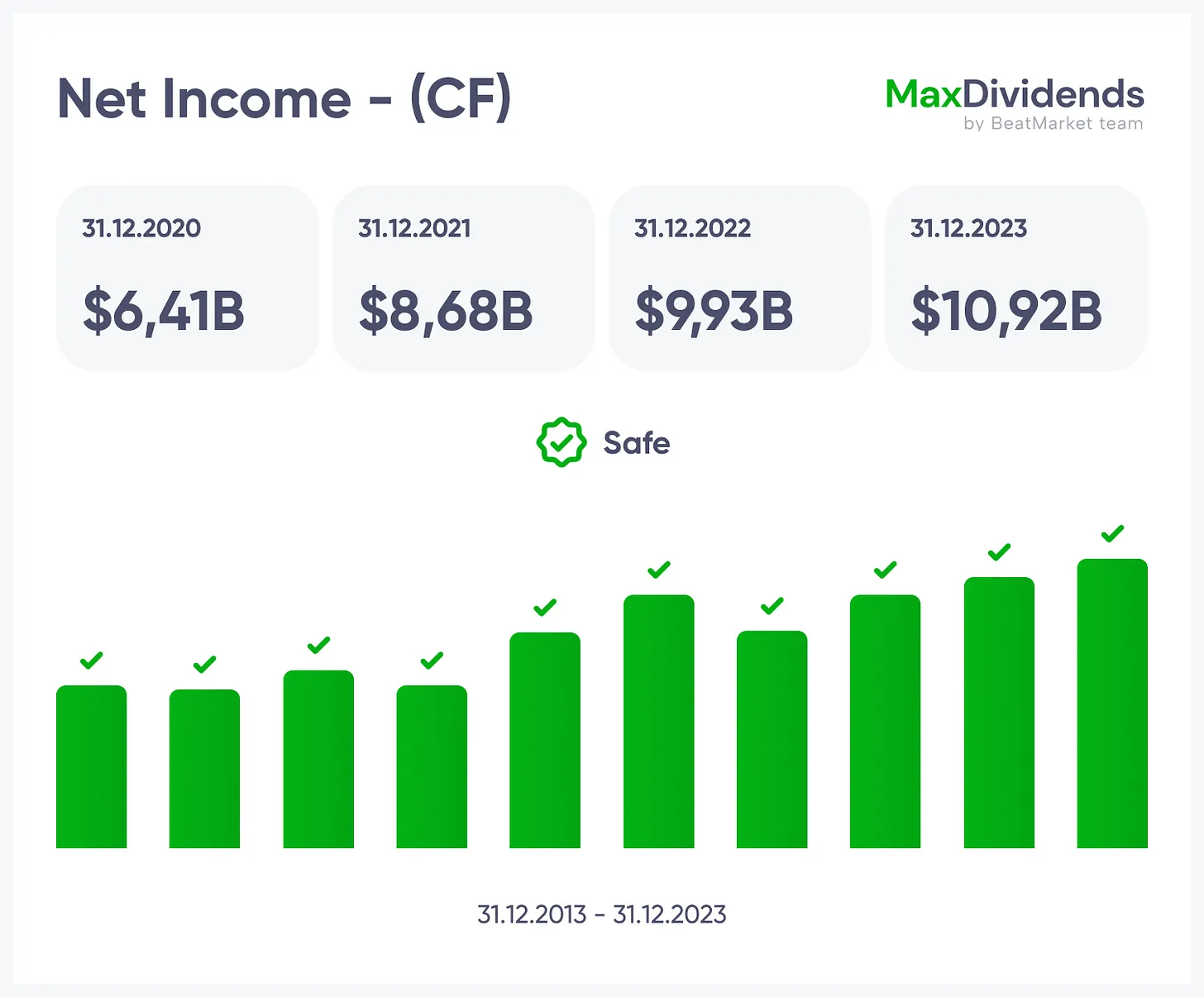

Growth trend, clear in one glance.

Growth trend, clear in one glance.

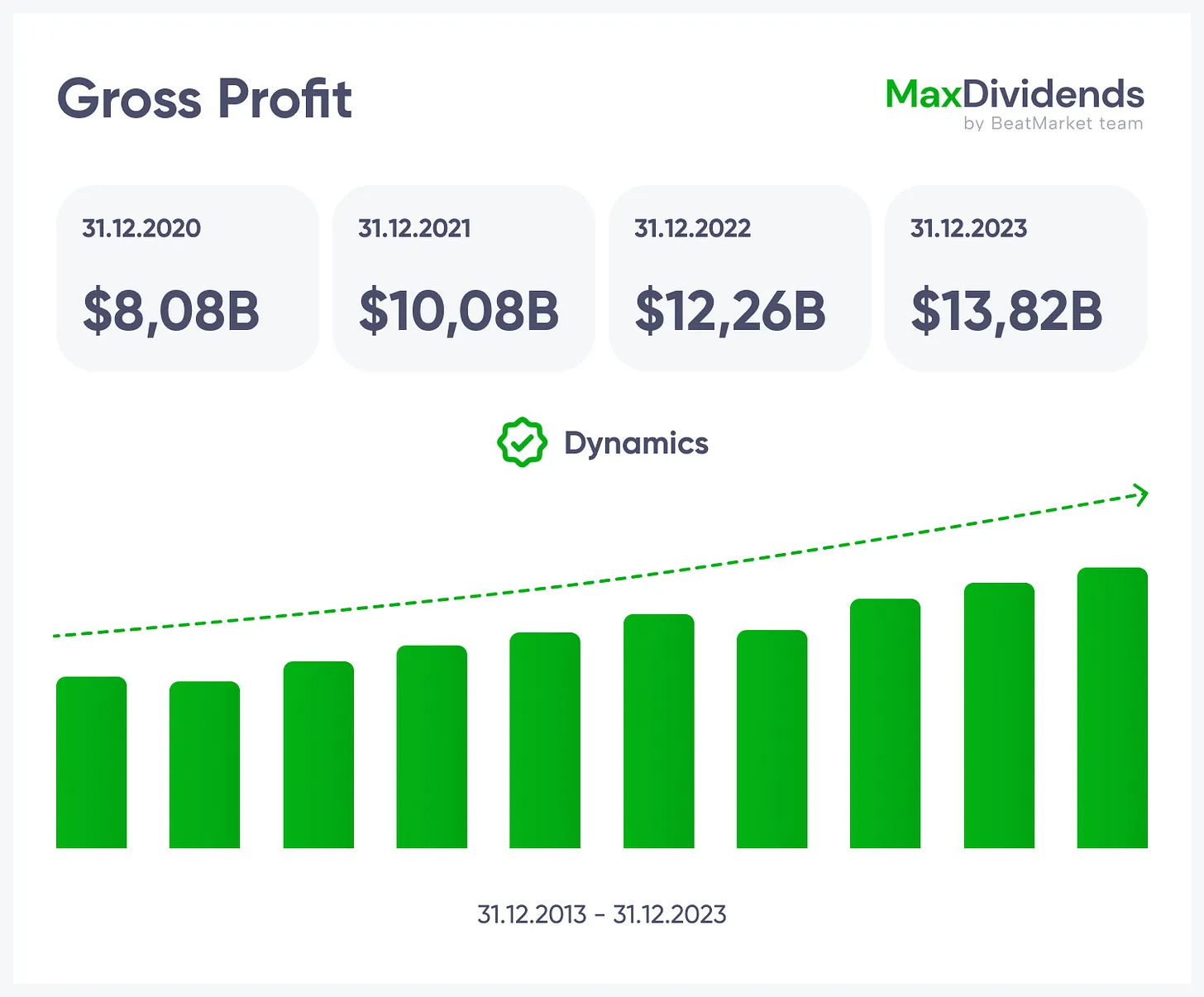

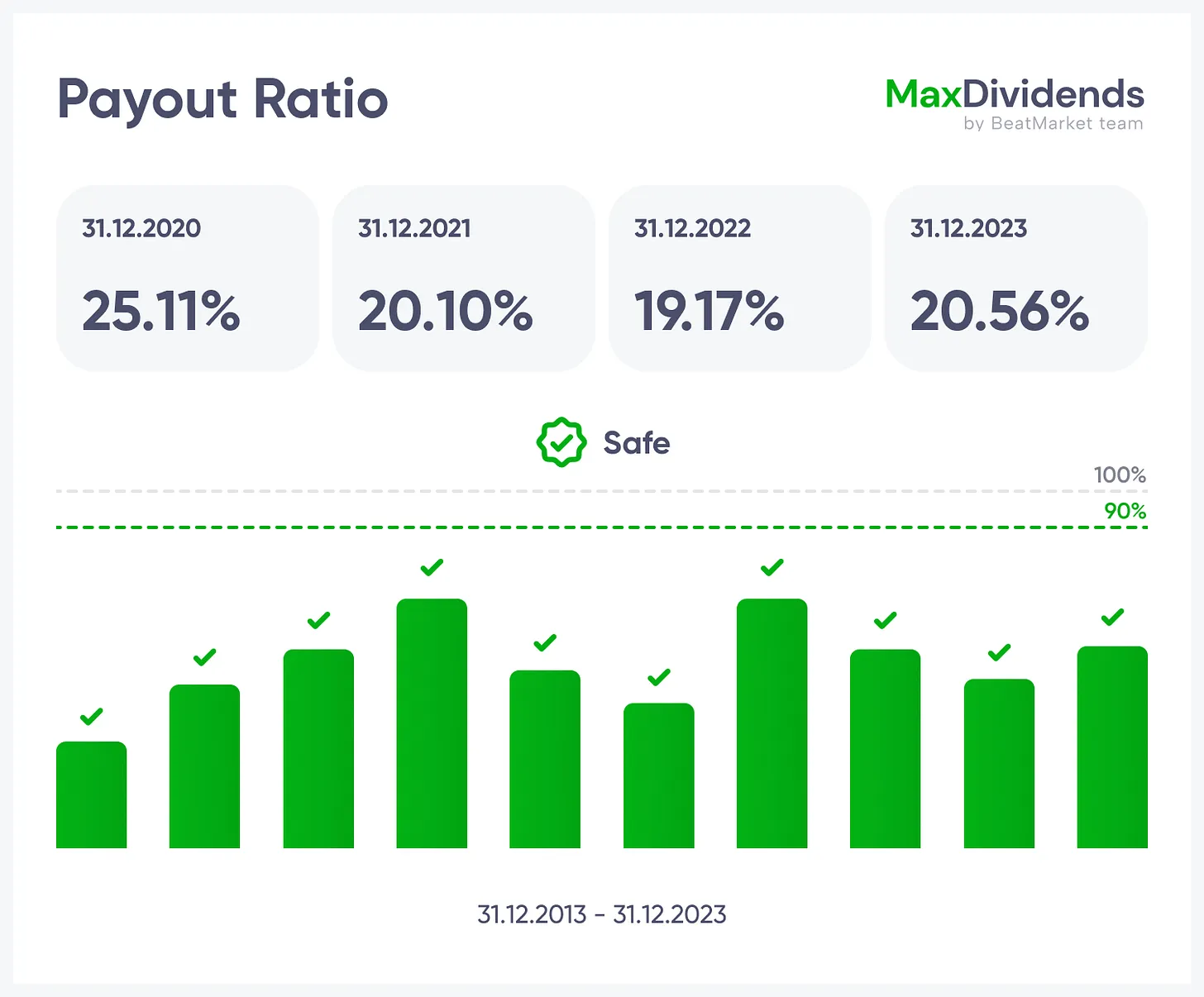

See if profits are real — instantly.

See if profits are real — instantly.

Bottom line made simple with MaxDividends.

Bottom line made simple with MaxDividends.

Debt risk checked for you, 24/7.

Debt risk checked for you, 24/7.

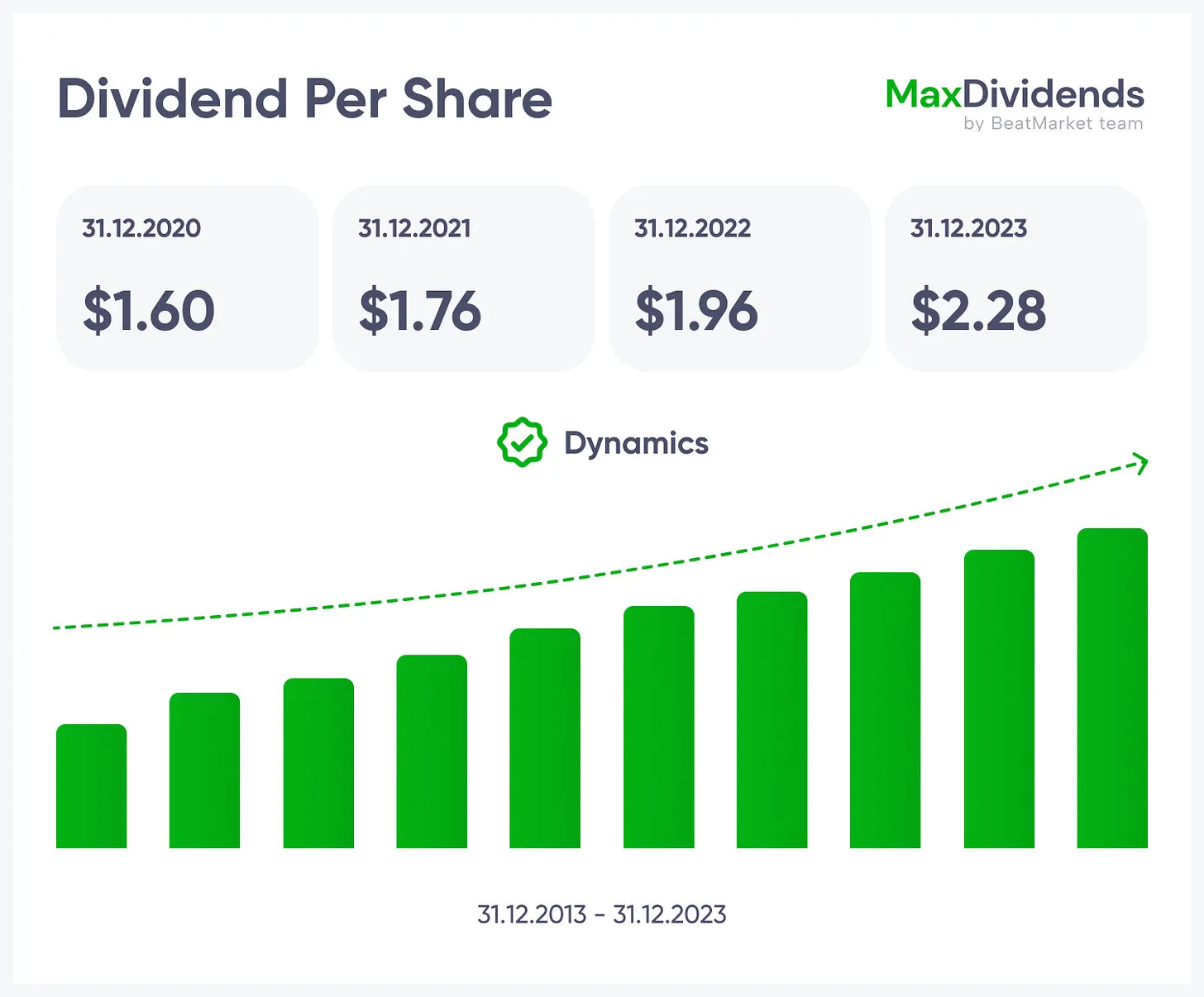

Dividend streaks and raises at your fingertips.

Dividend streaks and raises at your fingertips.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

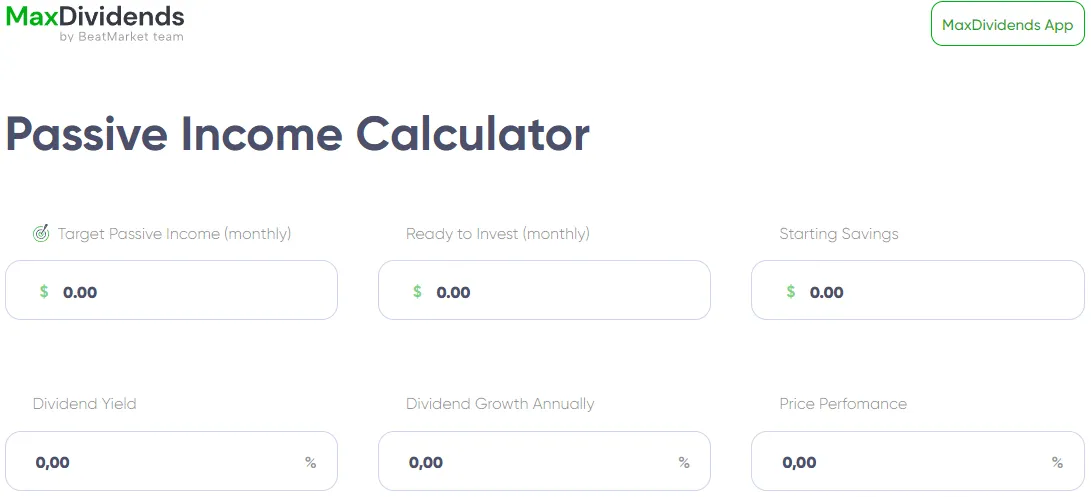

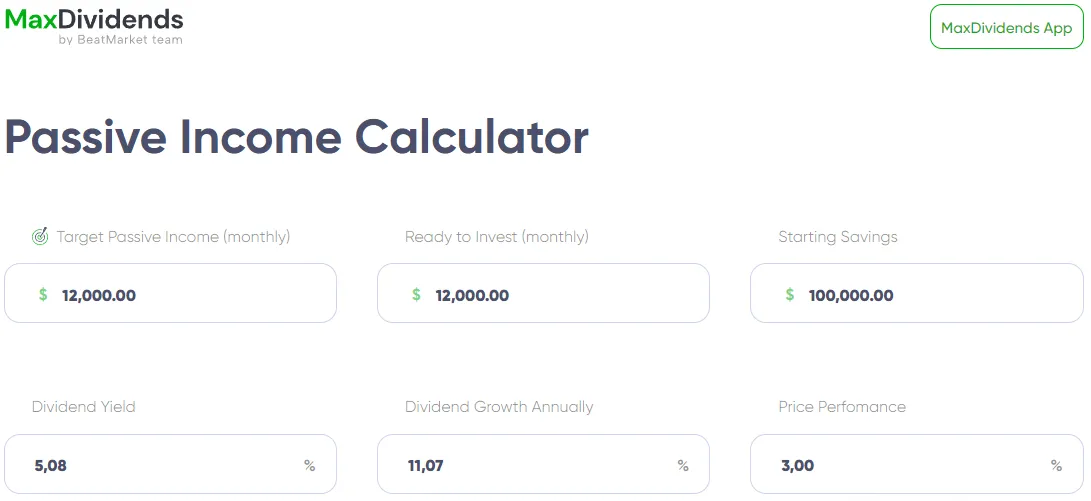

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

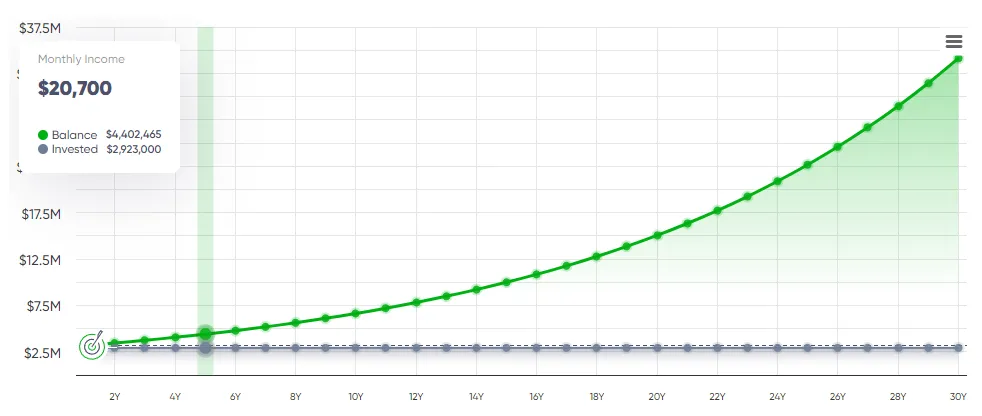

MaxDividends App: Passive Income Calculator, Income Forecast

MaxDividends App: Passive Income Calculator, Income Forecast

BeatStart

BeatStart