MaxDividends App

Portfolio Max's Dividend Focused

Current Balance

1 690 767,47 USD

Capital Gains

+366 083,89 USD (+16,52%)

Dividend Income

6 049.55 USD

72 594.57 USD

+4.96%

90 091.88 USD

About Portfolio

Price Returns

Best Deal

Diversification

Your strategy’s breakdown by sectors, industries, and assets - this shows how you’re spreading your bets across the market.Sectors

Industries

Assets

Strategy Breakdown

Here’s the full picture of where your money’s working - every holding in your strategy, along with how much weight each one has.Total Strategy Value

Top Holdings (by % of Strategy)

Market Cap Breakdown

The big dogs. These are the $10 billion and up giants.

These are solid, well-established companies, usually worth between $2 billion and $10 billion. Big enough to weather storms but still with room to grow.

Mid-size players with market caps between $300 million and $2 billion. They’re growing, but they can be a bit more volatile.

The scrappy up-and-comers. These companies are usually worth under $300 million. More risk, but if you catch a winner, the payoff can be big.

Strategy Breakdown – By Sector

Here’s where your money’s working across different industries. A good mix of sectors helps smooth out risk - some pay steady dividends, others offer growth potential.Top Holdings in manufactured goods

-

Intel (MMM)23.03%

-

Texas instrumental (AMAT)7.11%

-

Tractor supply (CMI)8.25%

-

Pool (POOL)3.03%

-

ZM company (ROCK)5.24%

Your Asset Mix

Here’s the breakdown of what you ownMy Holdings

Top Positions in Your Strategy

Large Assets of Type

Company

BNR

Brenntag SEFPE

Fuchs Petrolub SETXN

Texas Instruments IncorporatedTSCO

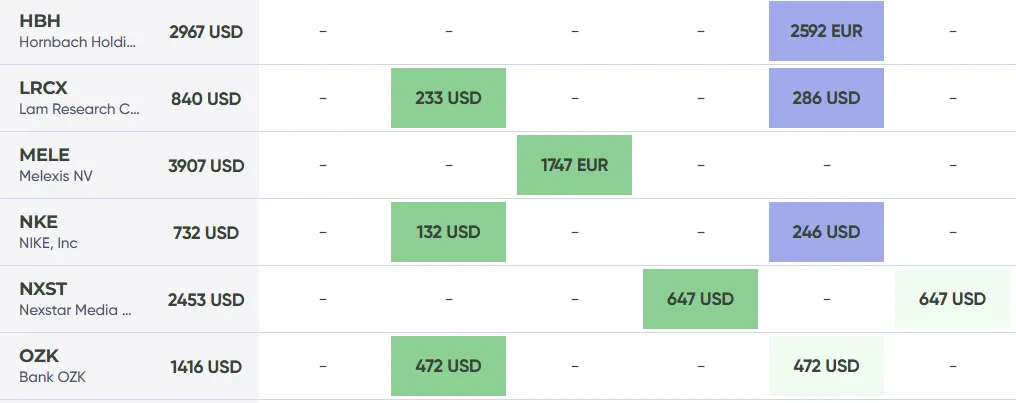

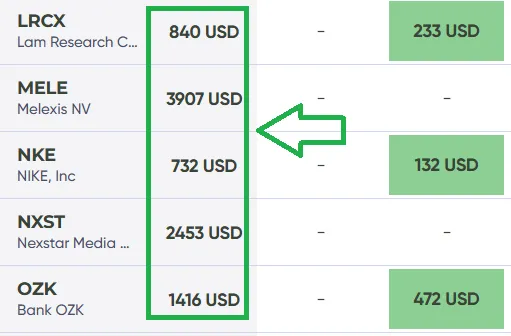

Tractor Supply CoNKE

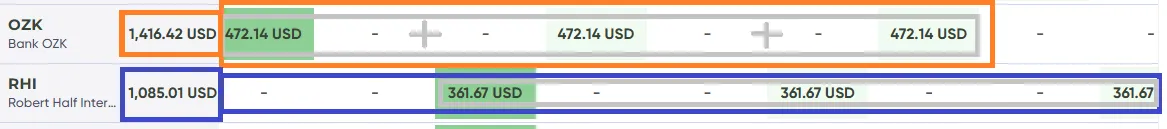

NIKE, IncRHI

Robert Half International IncTROW

T. Rowe Price Group, IncSWKS

Skyworks Solutions, IncBBY

Best Buy Co., IncRUI

Rubis SCAWAC

Wacker Neuson SEDOM

Dom Development S.A.UPS

United Parcel Service, IncCTC-A

Canadian Tire Corporation LimitedAKE

Arkema SAMELE

Melexis NVABS

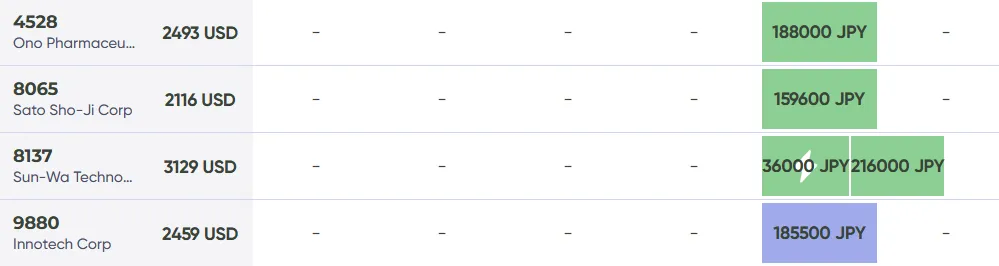

Asseco Business Solutions S.A.9880

Innotech Corp8137

Sun-Wa Technos CorpUVV

Universal CorporationNXST

Nexstar Media Group, IncAMB

Ambra SATEP

Teleperformance SEADM

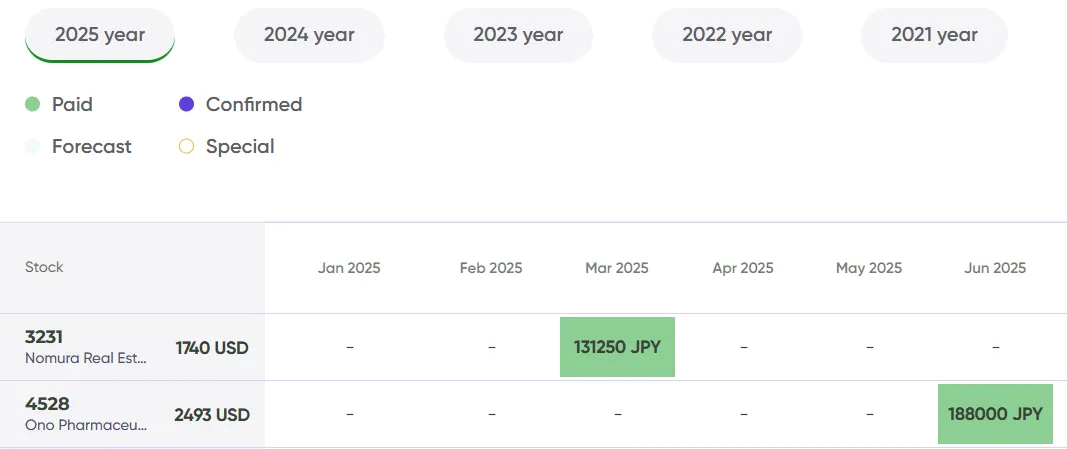

Archer Daniels Midland Company4528

Ono Pharmaceutical Ltd3231

Nomura Real Estate Holding IncHBH

Hornbach Holding VZO O.N.8065

Sato Sho-Ji CorpOZK

Bank OZK5911

Yokogawa Bridge Holdings CorpKFRC

Kforce Inc.CGO

Cogeco Inc.SCVL

Shoe Carnival IncGSY

goeasy LtdNVO

Novo Nordisk A/STGT

Target CorporationProfit Margin

Operating Margin ttm

ROA ttm

ROE ttm

Revenue/Share ttm

Enterprise Value / Ebitda

Inspired by this portfolio?

Try MaxDividends

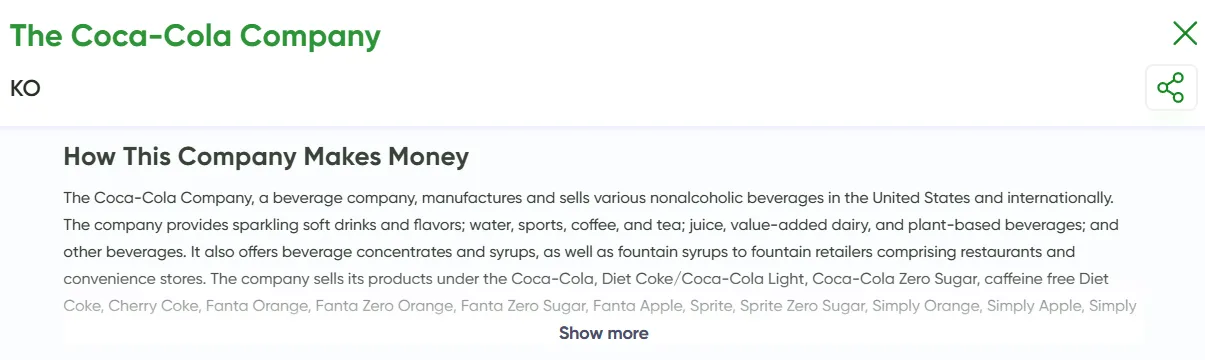

See the whole business at a glance — what it does, how it earns, and the value it brings.

See the whole business at a glance — what it does, how it earns, and the value it brings.

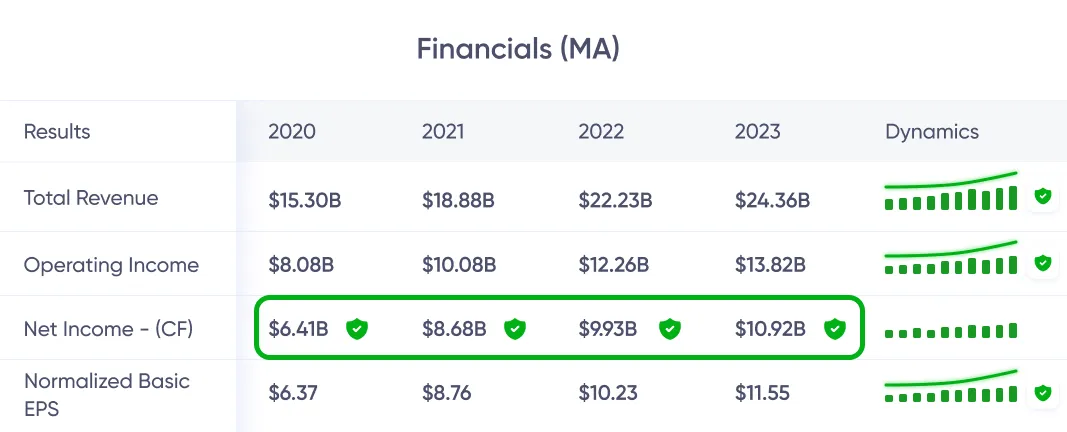

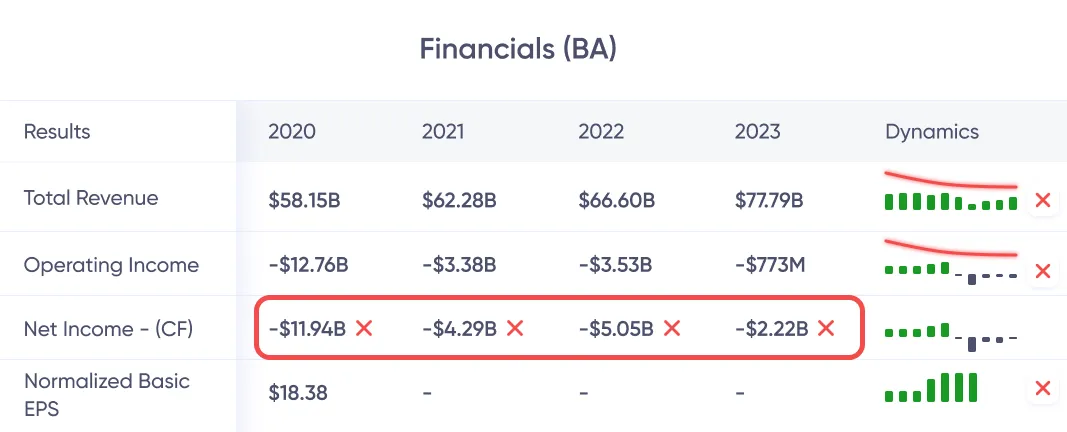

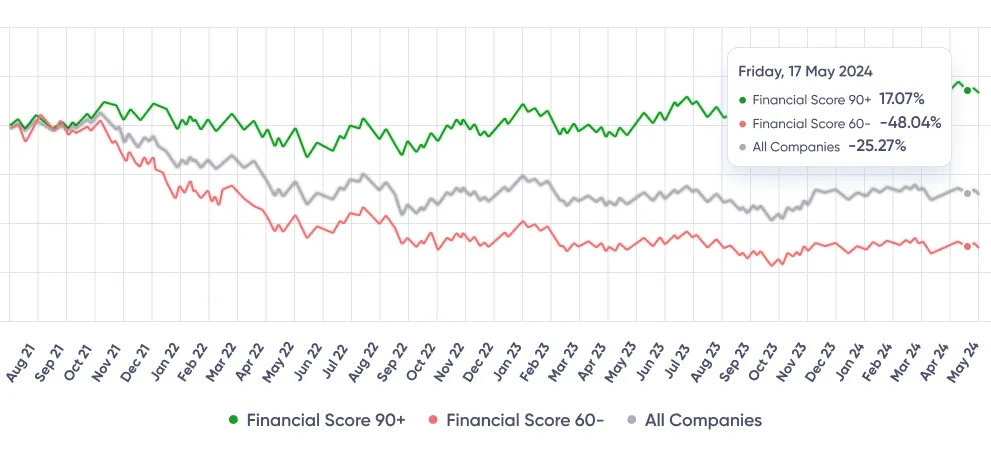

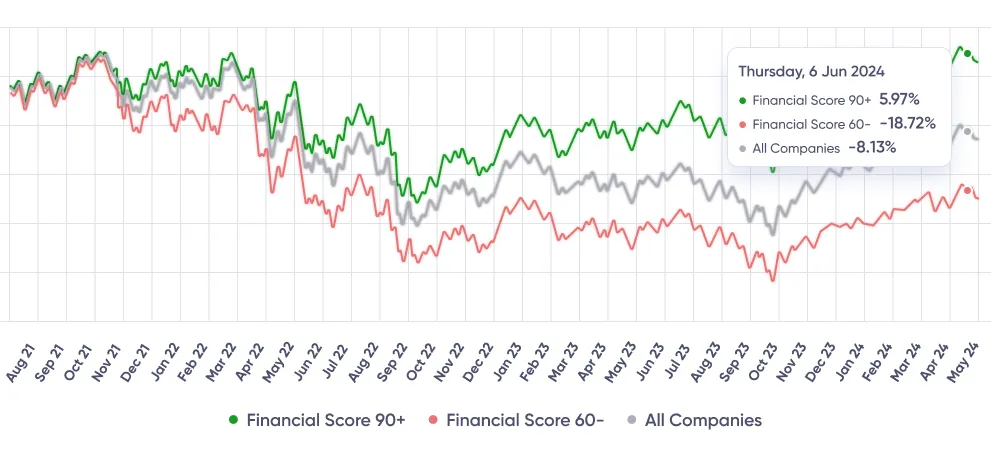

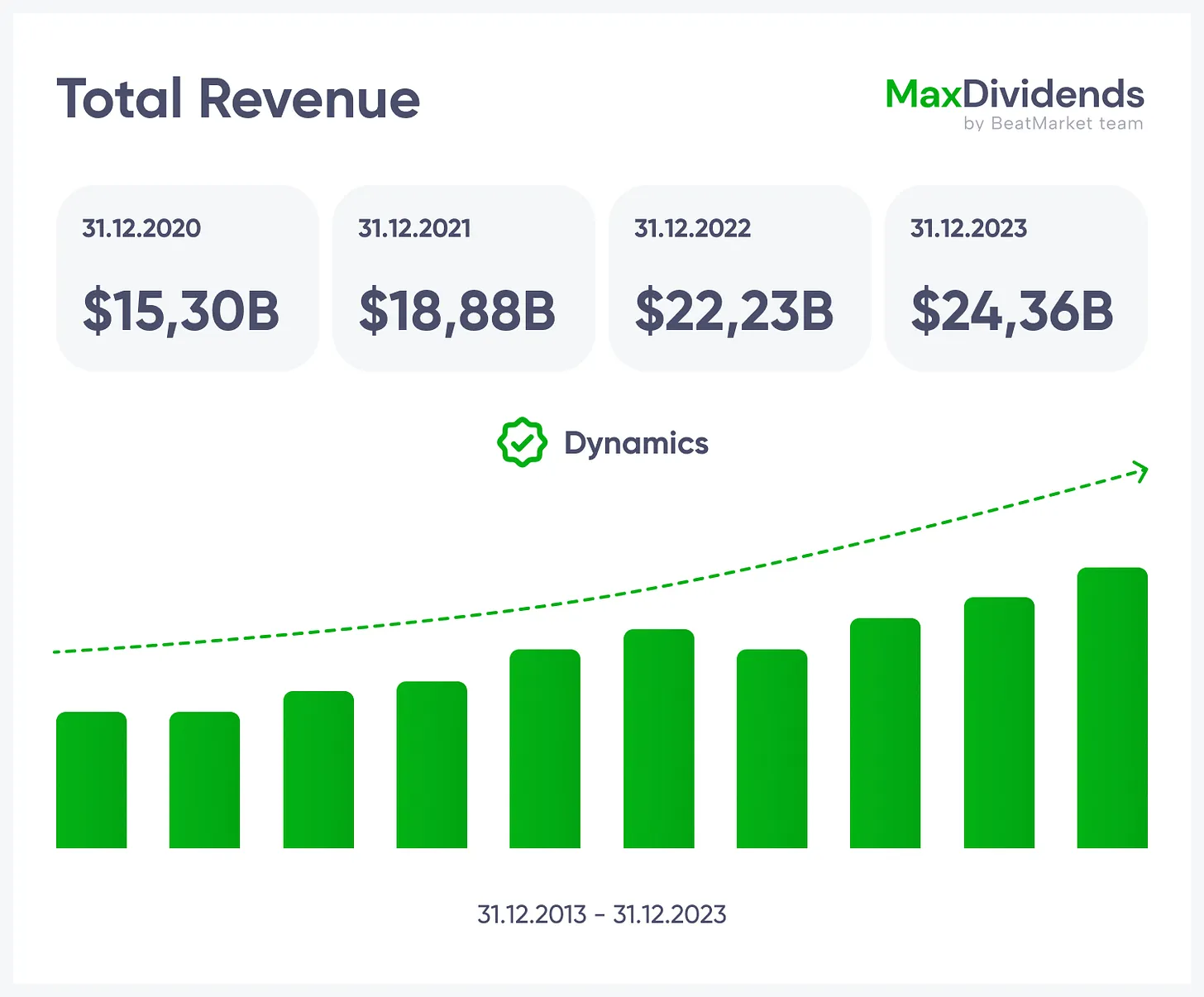

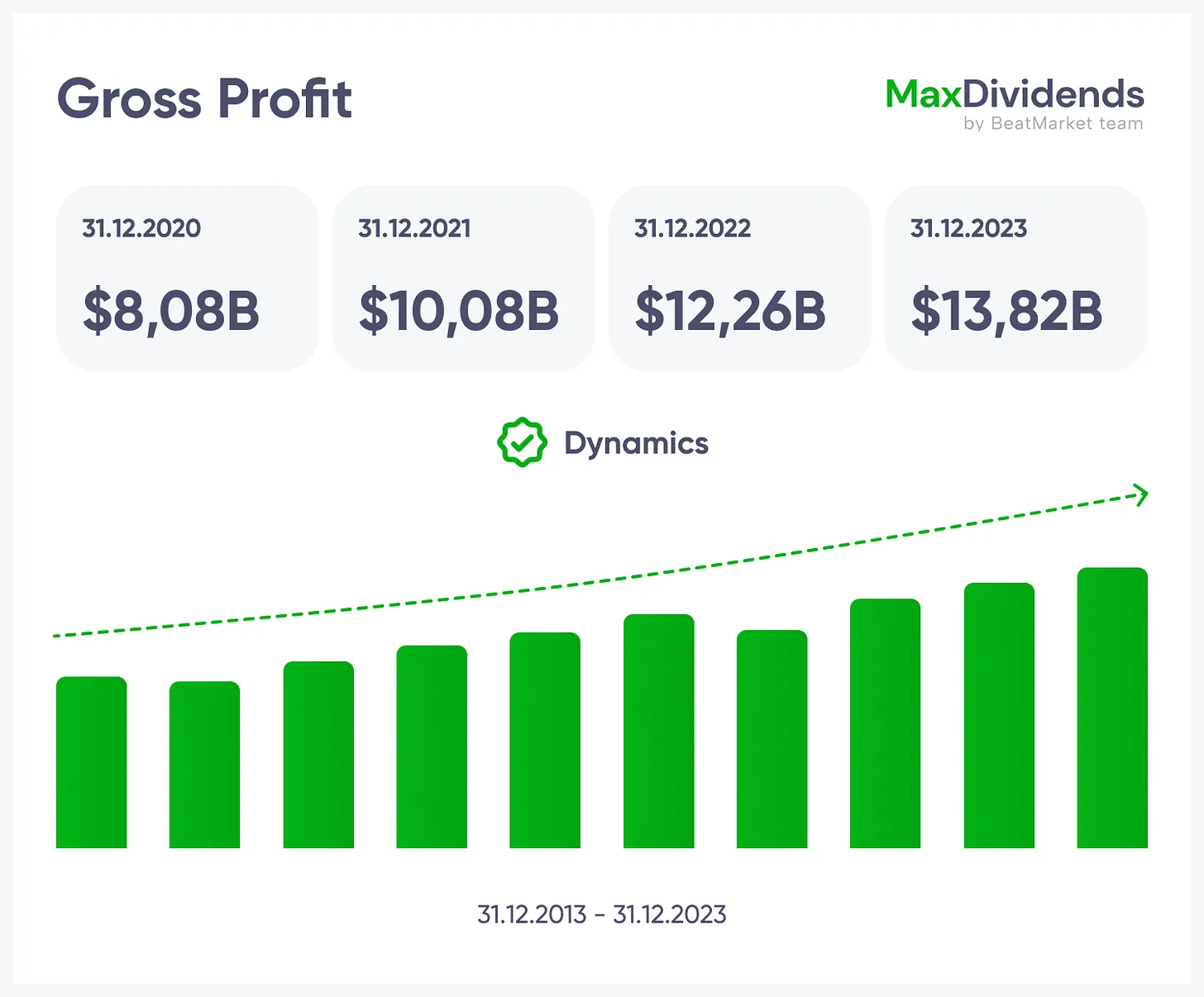

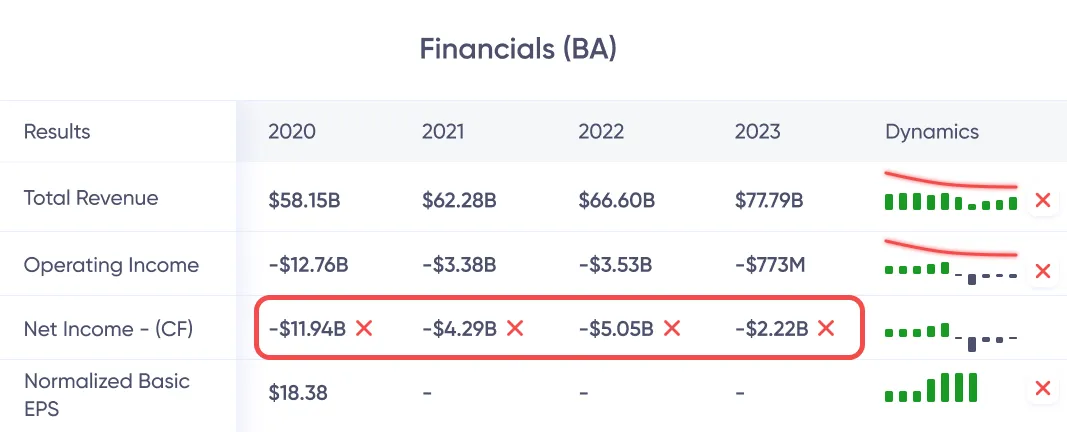

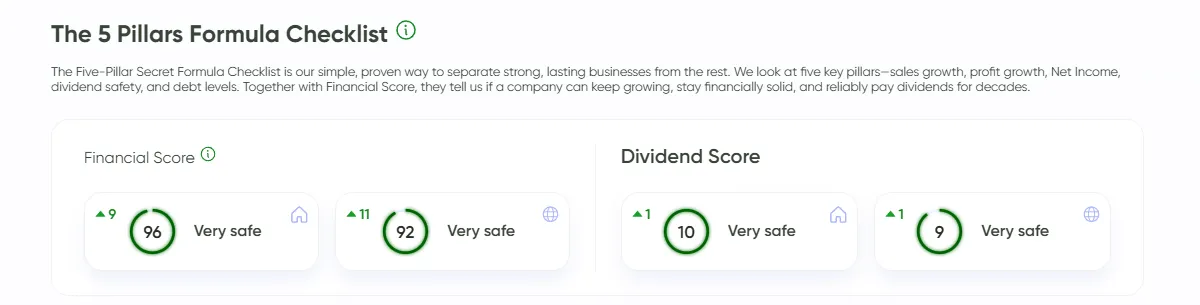

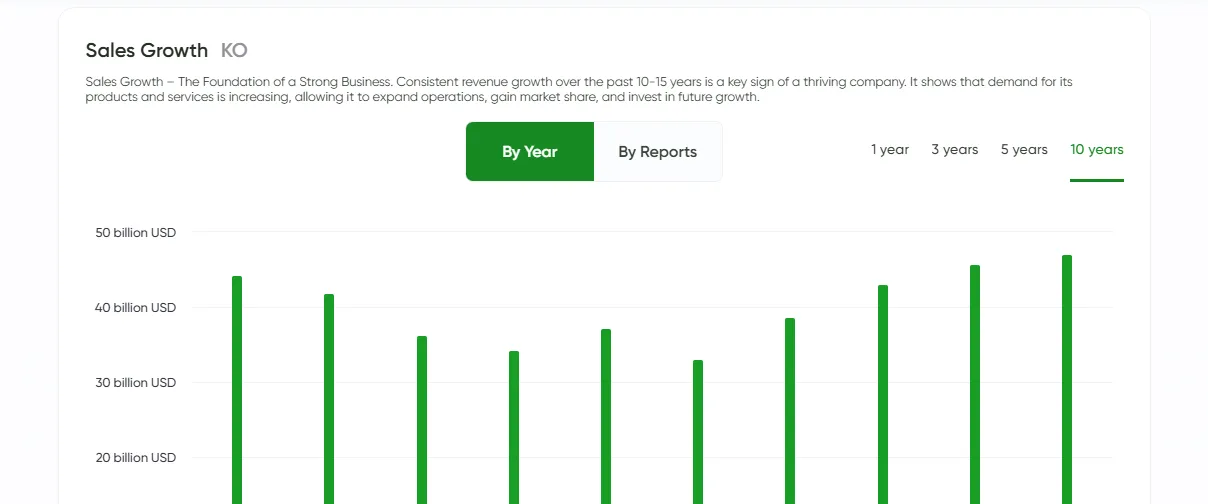

Growth trend, clear in one glance.

Growth trend, clear in one glance.

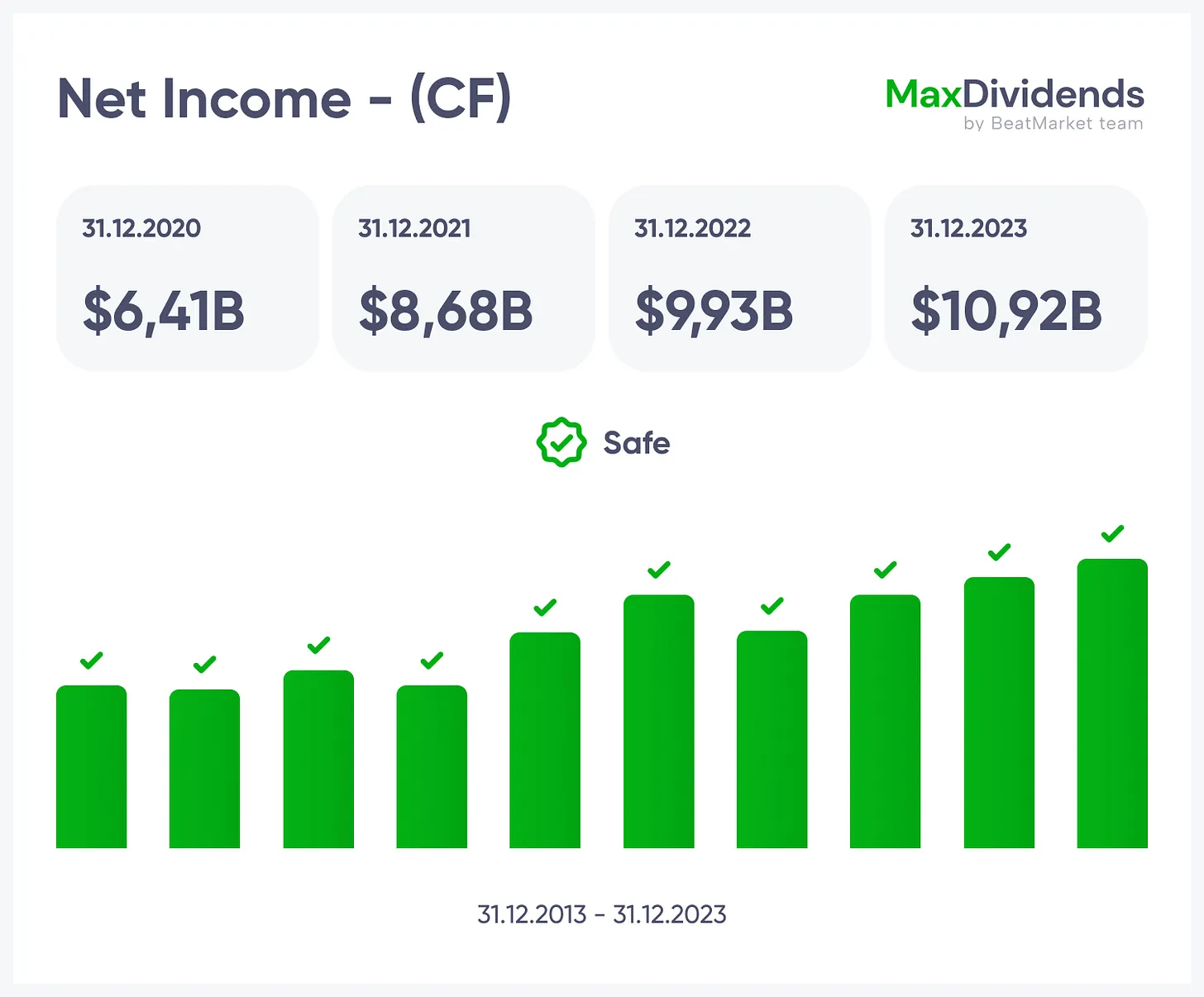

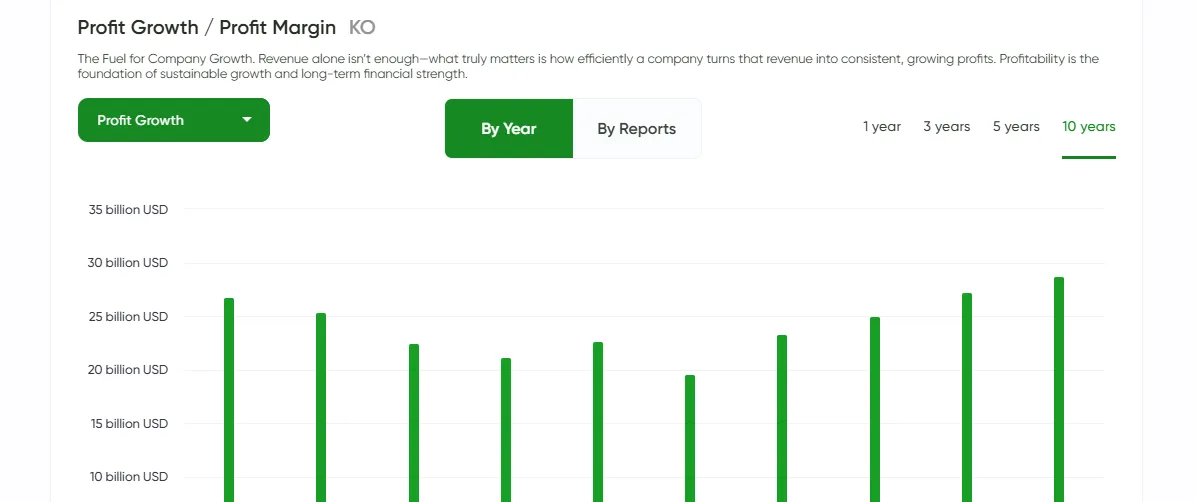

See if profits are real — instantly.

See if profits are real — instantly.

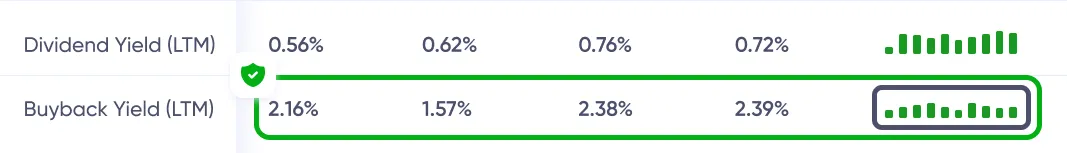

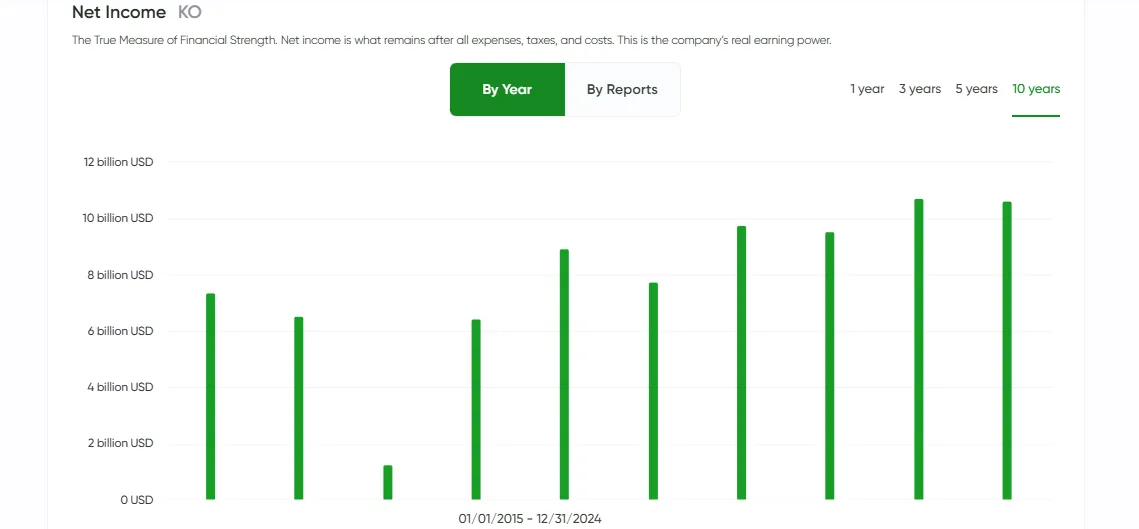

Bottom line made simple with MaxDividends.

Bottom line made simple with MaxDividends.

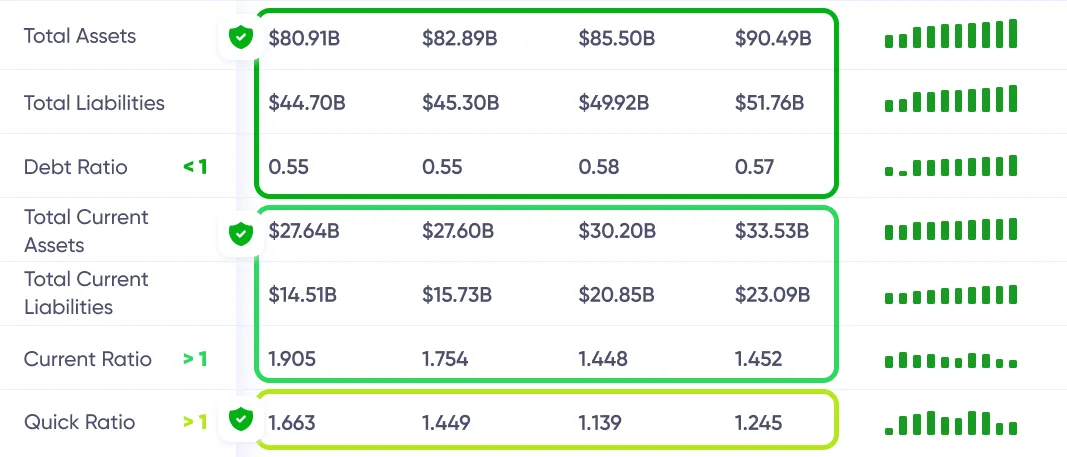

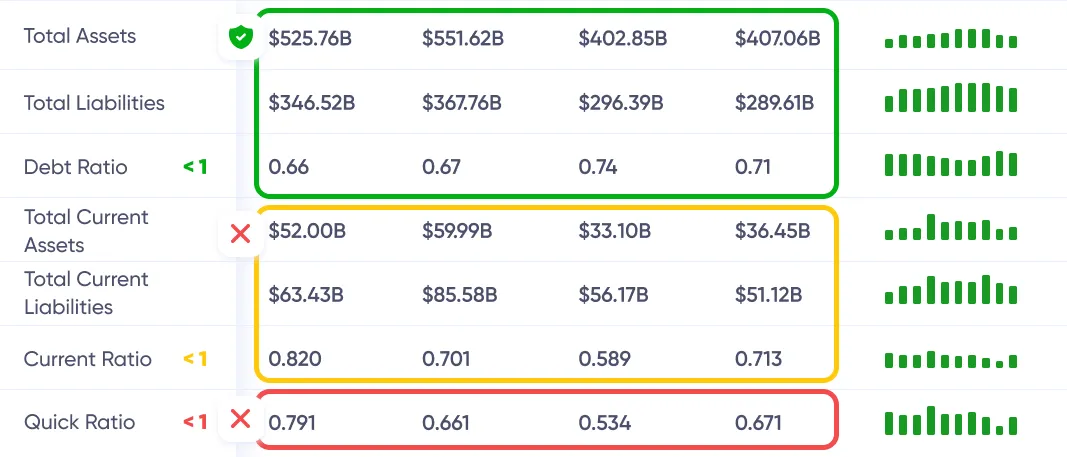

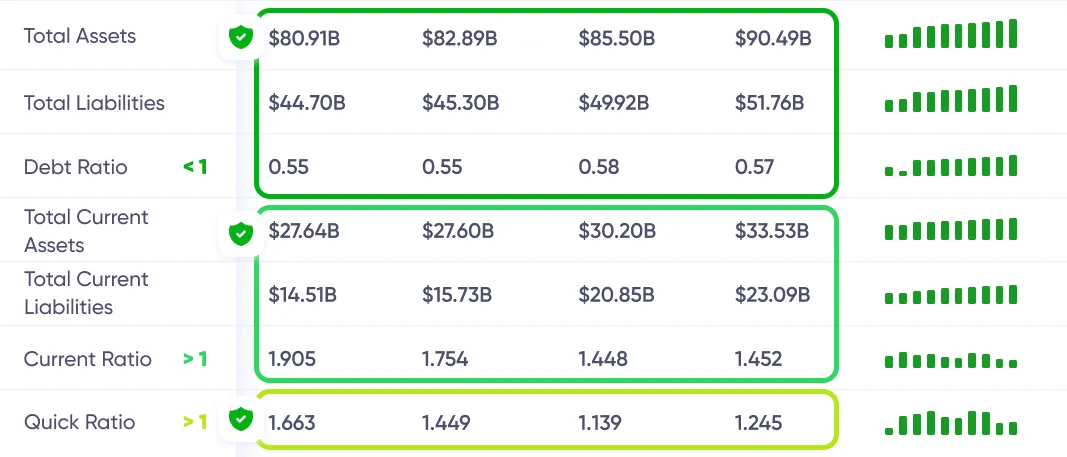

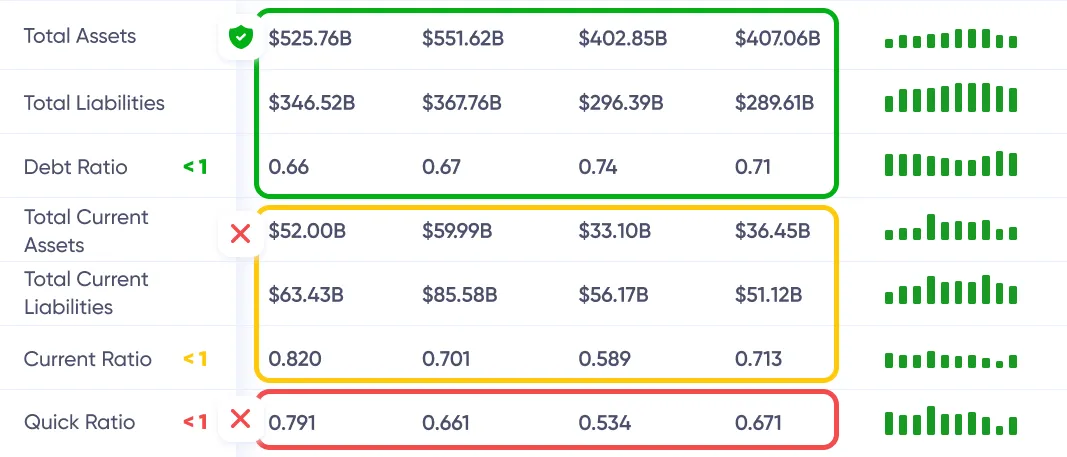

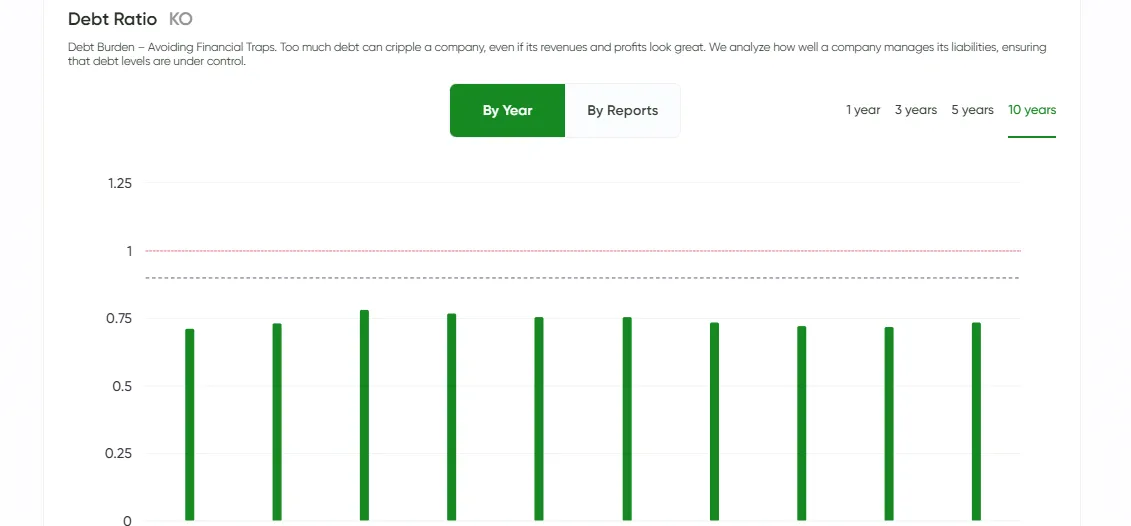

Debt risk checked for you, 24/7.

Debt risk checked for you, 24/7.

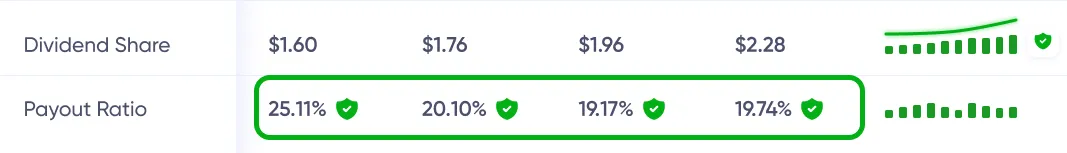

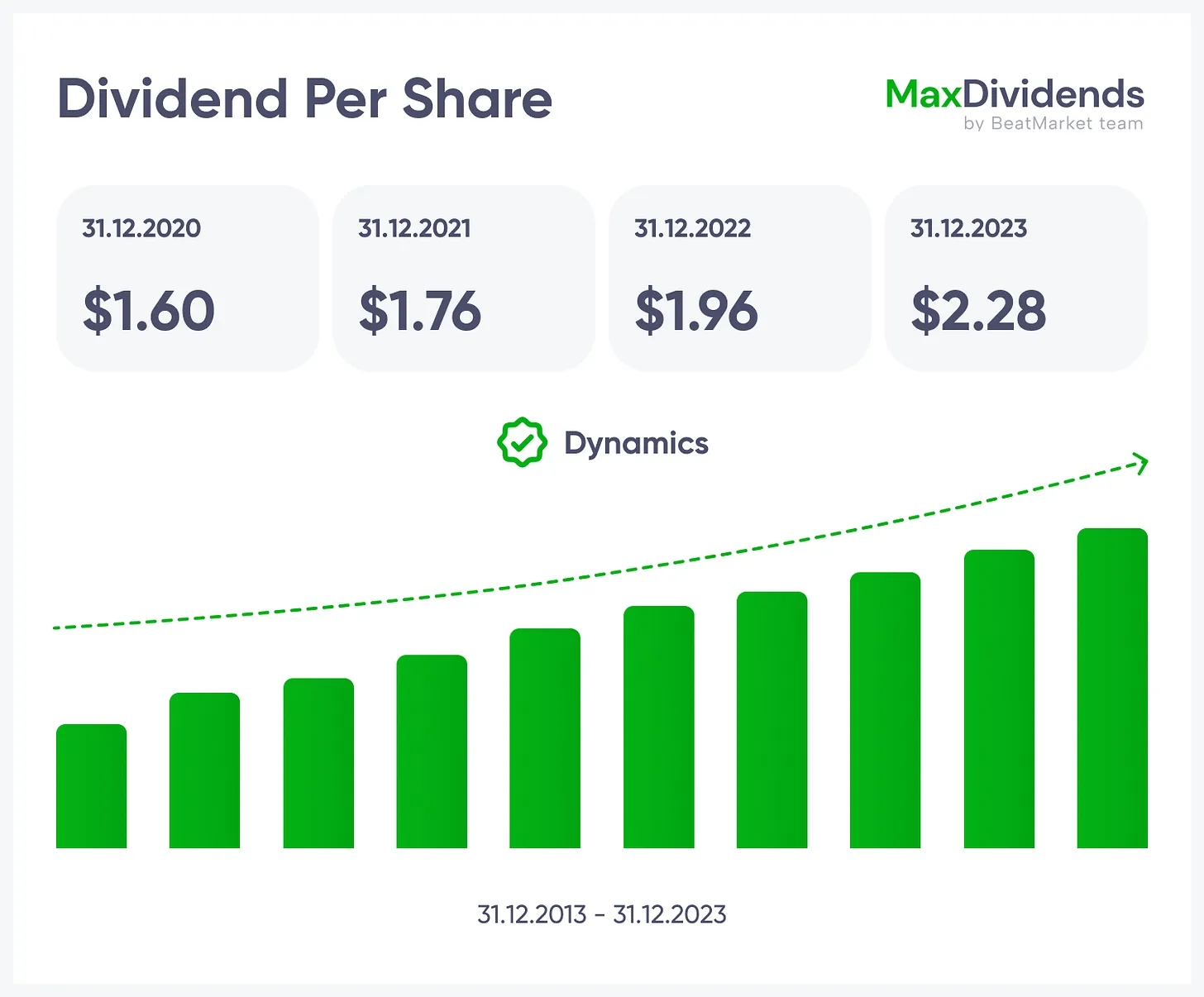

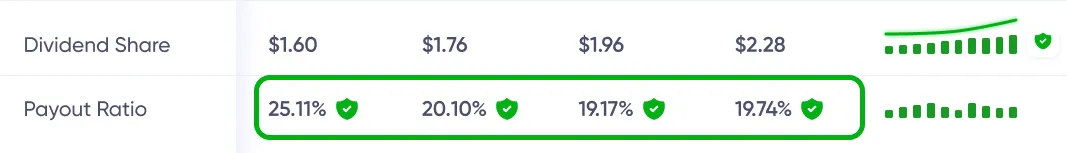

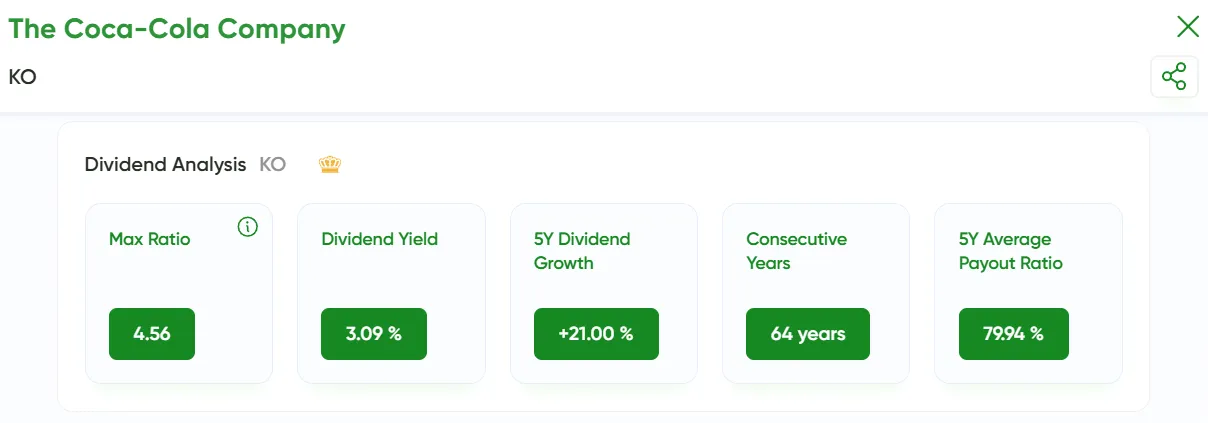

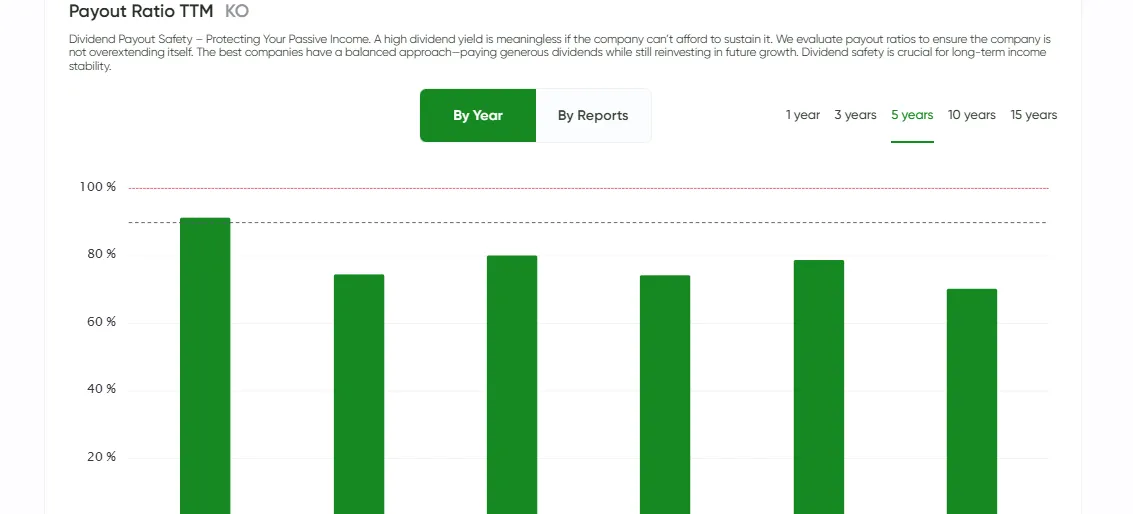

Dividend streaks and raises at your fingertips.

Dividend streaks and raises at your fingertips.

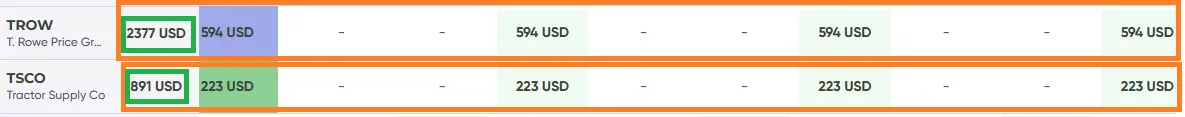

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

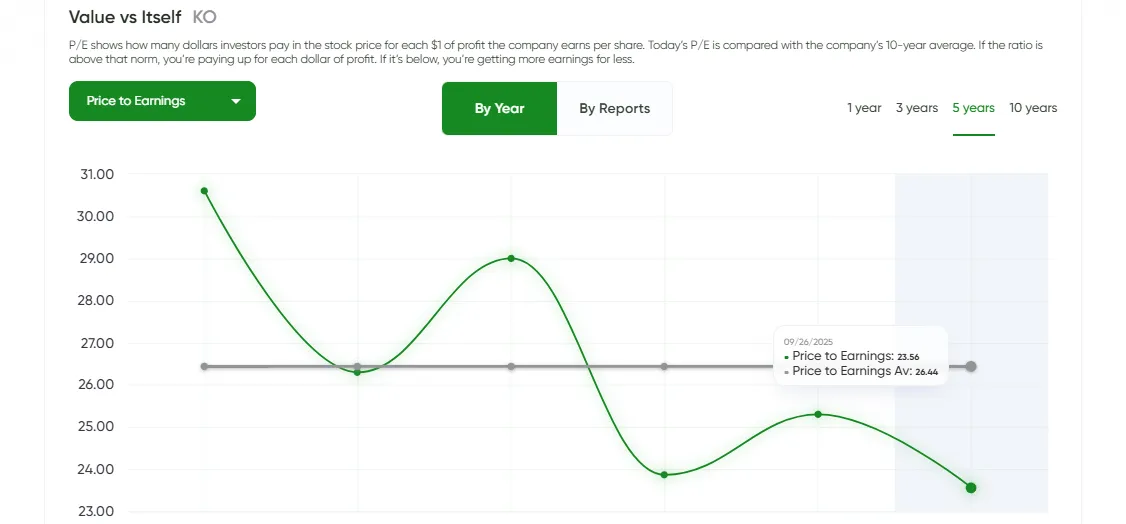

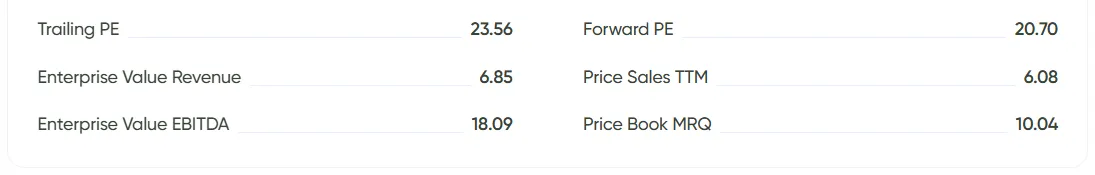

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

BeatStart

BeatStart