MaxDividends App

Portfolio Warren Buffett portfolio stocks

Current Balance

1 000,00 USD

Capital Gains

+37 190,00 USD (+37,19%)

Daily Income

0,00 USD (0,00%)

1 a week

1 month

6 months

1 Y

3 Y

5 Y

All

12/12/2025 - 12/19/2025

About Portfolio

Active Since: 12th December 2022

Portfolio Beta: 0.74

Dividend Yield On Cost:

+0.71%

Annual Total Return:

+13.53%

Price Returns

6 months:

+1.45%

12 months:

+12.52%

All Time:

+37.19%

Annual Price Return:

+12.82%

Best Deal

Top Performer:

Amazon.com, Inc (AMZN)

First Bought:

25 Jan 2023

Price Return:

+135.42

%

Diversification

Your strategy’s breakdown by sectors, industries, and assets - this shows how you’re spreading your bets across the market.Sectors

Industries

Assets

Strategy Breakdown

Here’s the full picture of where your money’s working - every holding in your strategy, along with how much weight each one has.Total Strategy Value

1000 USD

Top Holdings (by % of Strategy)

Market Cap Breakdown

The big dogs. These are the $10 billion and up giants.

AAPL

Apple Inc

AMZN

Amazon.com, Inc

ATVI

Activision Bliz...

CHTR

Charter Communi...

VRSN

VeriSign Inc

ALLY

Ally Financial...

AON

Aon PLC

C

Citigroup Inc

CVX

Chevron Corpora...

GM

General Motors...

KR

The Kroger Co

MA

Mastercard Inco...

MCK

McKesson Corpor...

MKL

Markel Corporat...

OXY

Occidental Petr...

USB

U.S. Bancorp

V

VISA Inc.

These are solid, well-established companies, usually worth between $2 billion and $10 billion. Big enough to weather storms but still with room to grow.

LSXMK

Liberty Media C...

CE

Celanese Corpor...

DVA

DaVita Inc

STOR

STORE Capital C...

PARA

PREMARA FINANCI...

The scrappy up-and-comers. These companies are usually worth under $300 million. More risk, but if you catch a winner, the payoff can be big.

HP

Helmerich & Pay...

Strategy Breakdown – By Sector

Here’s where your money’s working across different industries. A good mix of sectors helps smooth out risk - some pay steady dividends, others offer growth potential.Top Holdings in manufactured goods

-

Intel (MMM)23.03%

-

Texas instrumental (AMAT)7.11%

-

Tractor supply (CMI)8.25%

-

Pool (POOL)3.03%

-

ZM company (ROCK)5.24%

Your Asset Mix

Here’s the breakdown of what you ownMy Holdings

Top Positions in Your Strategy

Large Assets of Type

Company

AAPL

Apple IncAMZN

Amazon.com, IncATVI

Activision Blizzard Inc.CHTR

Charter Communications, IncLSXMK

Liberty Media Corp SiriusXM CVRSN

VeriSign IncALLY

Ally Financial IncAON

Aon PLCC

Citigroup IncCE

Celanese CorporationCVX

Chevron CorporationDVA

DaVita IncGM

General Motors CompanyHP

Helmerich & Payne, IncKR

The Kroger CoMA

Mastercard IncorporatedMCK

McKesson CorporationMKL

Markel CorporationOXY

Occidental Petroleum CorporationSTOR

STORE Capital CorporationUSB

U.S. BancorpV

VISA Inc.PARA

PREMARA FINANCIALProfit Margin

Operating Margin ttm

ROA ttm

ROE ttm

Revenue/Share ttm

Enterprise Value / Ebitda

26.92

%

31.65

%

22.96

171.42

27.84

28.05

11.06

%

11.06

%

7.5

24.33

65.12

15.4

24.88

%

27.37

%

5.2

11.1

11.11

22.05

9.29

%

23.86

%

5.55

31.33

396.69

5.83

9.42

%

19.52

%

3.94

8.28

27.43

6.9

49.86

%

67.84

%

47.98

-

17.26

20.45

8.83

%

25.94

%

0.33

4.25

23.19

-

15.96

%

20.37

%

5.59

37.69

78.76

17.56

19.49

%

30.61

%

0.58

7

40.51

-

-31.81

%

9.05

%

2.34

-50.51

88.7

66.29

6.77

%

9.85

%

4.05

7.32

105.17

8.01

5.8

%

14.83

%

7.01

61.62

172.46

7.68

1.63

%

5.67

%

2.01

4.44

189.95

9.47

-11.29

%

-12.49

%

-7.13

-18.85

0.15

9.25

0.54

%

3.1

%

5.19

8

220.48

10.95

45.28

%

59.8

%

23.05

184.86

34.59

26.61

1.04

%

1.37

%

4.78

-

3096.75

17.42

12.83

%

23.12

%

2.89

11.76

1272.52

-

8.17

%

17.72

%

3.3

5.96

27.61

5.54

36.46

%

56.91

%

3.14

6.14

3.17

17.52

27.63

%

39.49

%

1.04

11.72

16.69

-

50.15

%

65.75

%

17.26

52.07

20.61

25.85

-0.05

%

10.26

%

3.04

0.09

42.89

17.44

Inspired by this portfolio?

Try MaxDividends

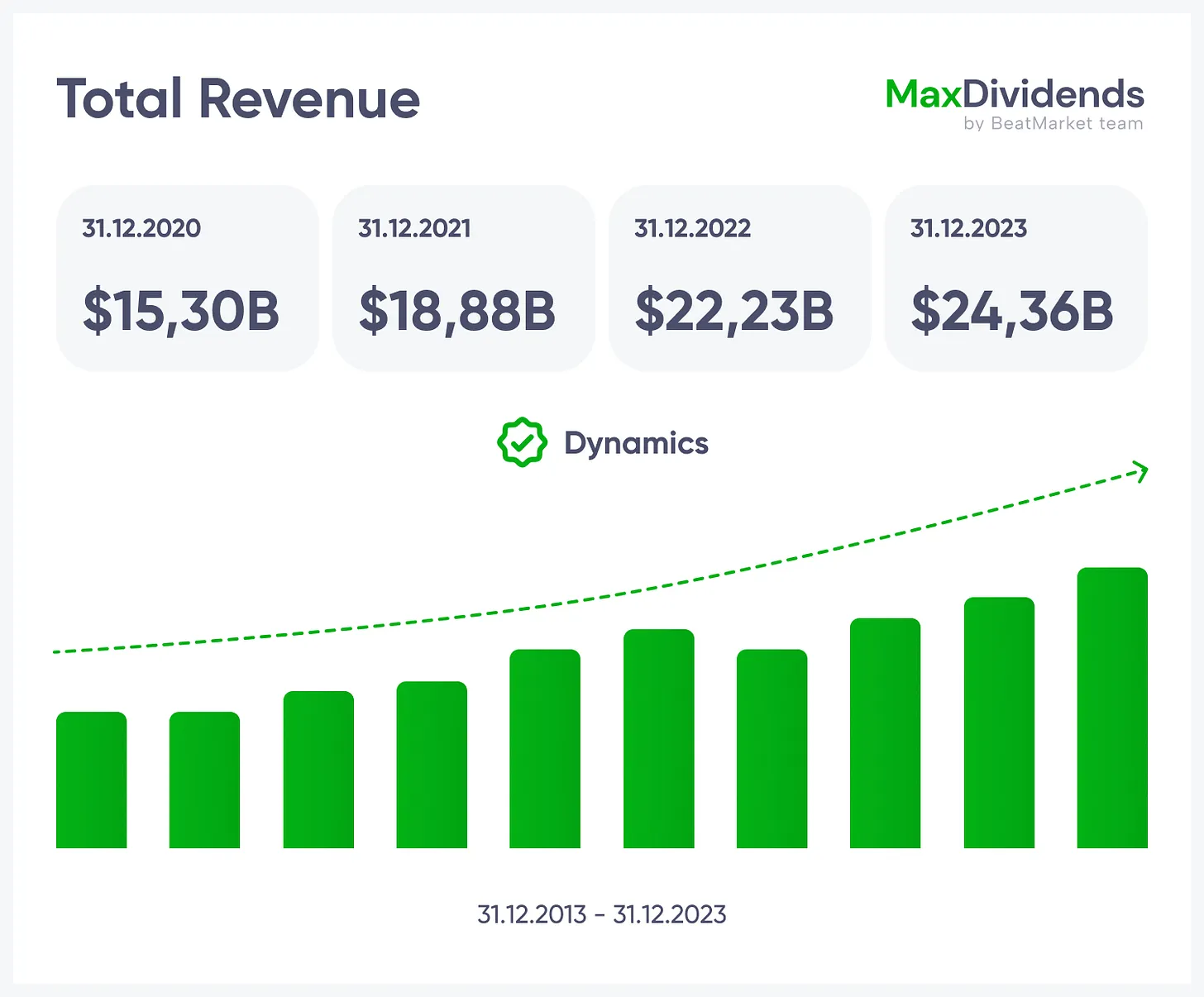

See the whole business at a glance — what it does, how it earns, and the value it brings.

See the whole business at a glance — what it does, how it earns, and the value it brings.

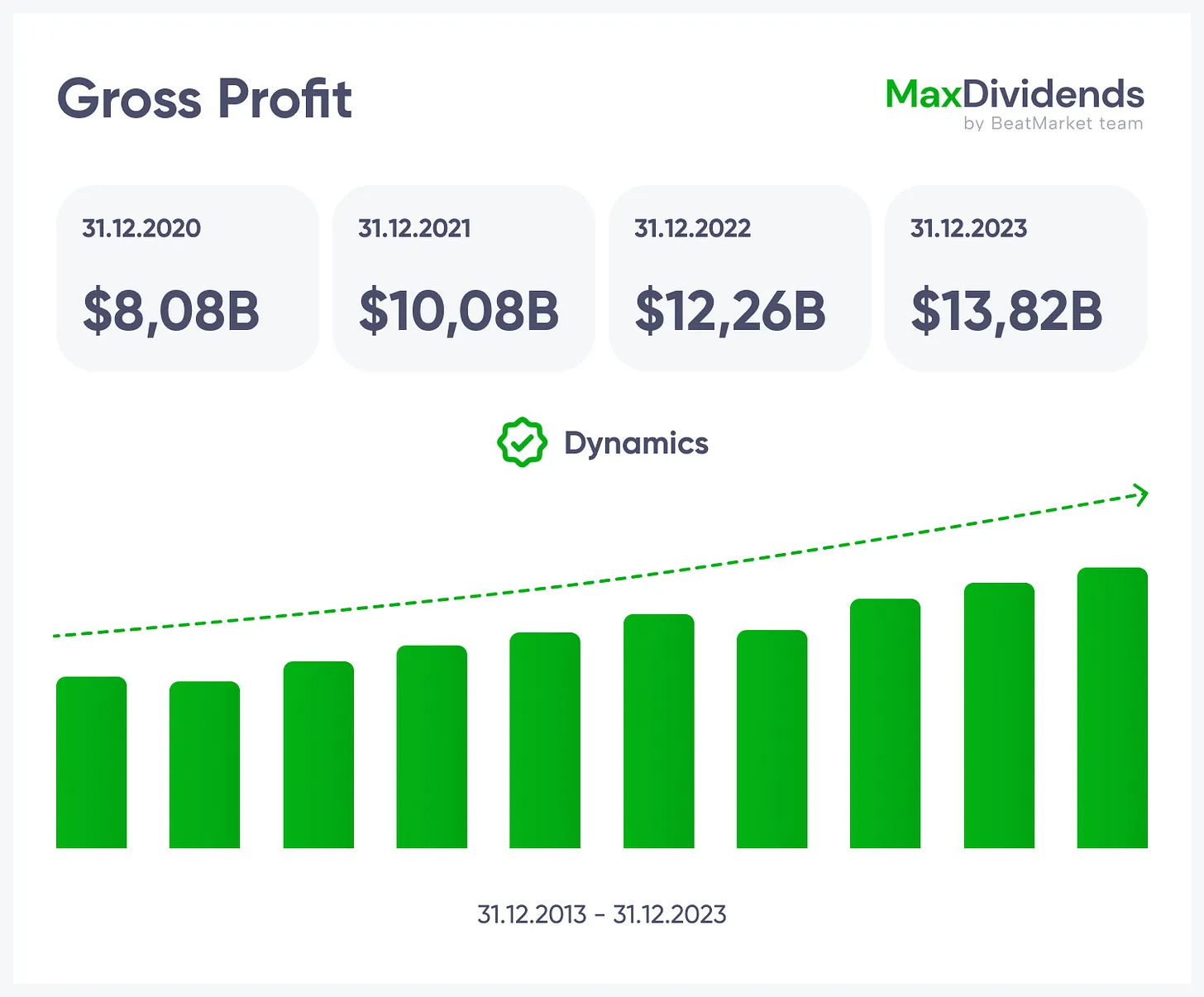

Growth trend, clear in one glance.

Growth trend, clear in one glance.

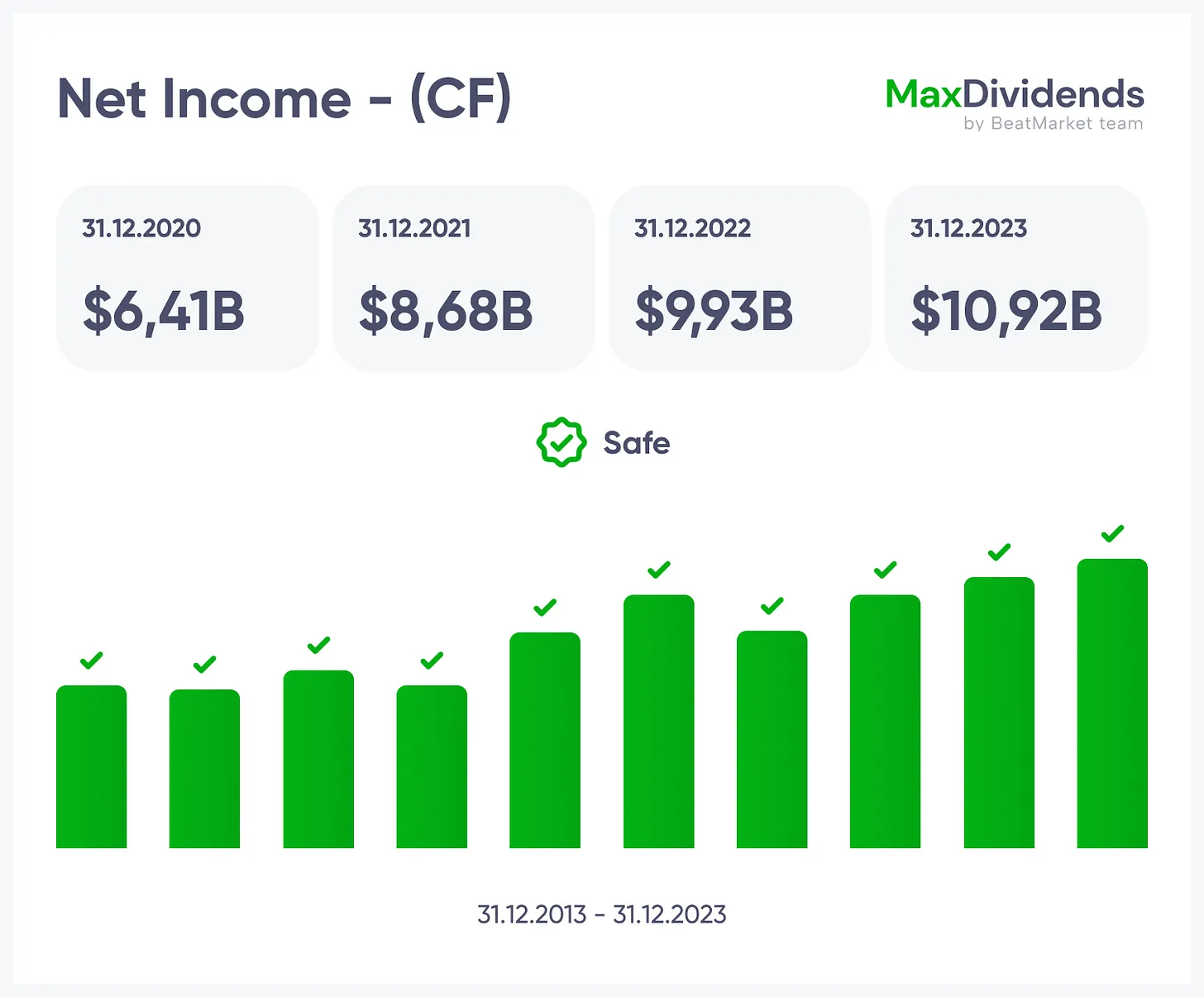

See if profits are real — instantly.

See if profits are real — instantly.

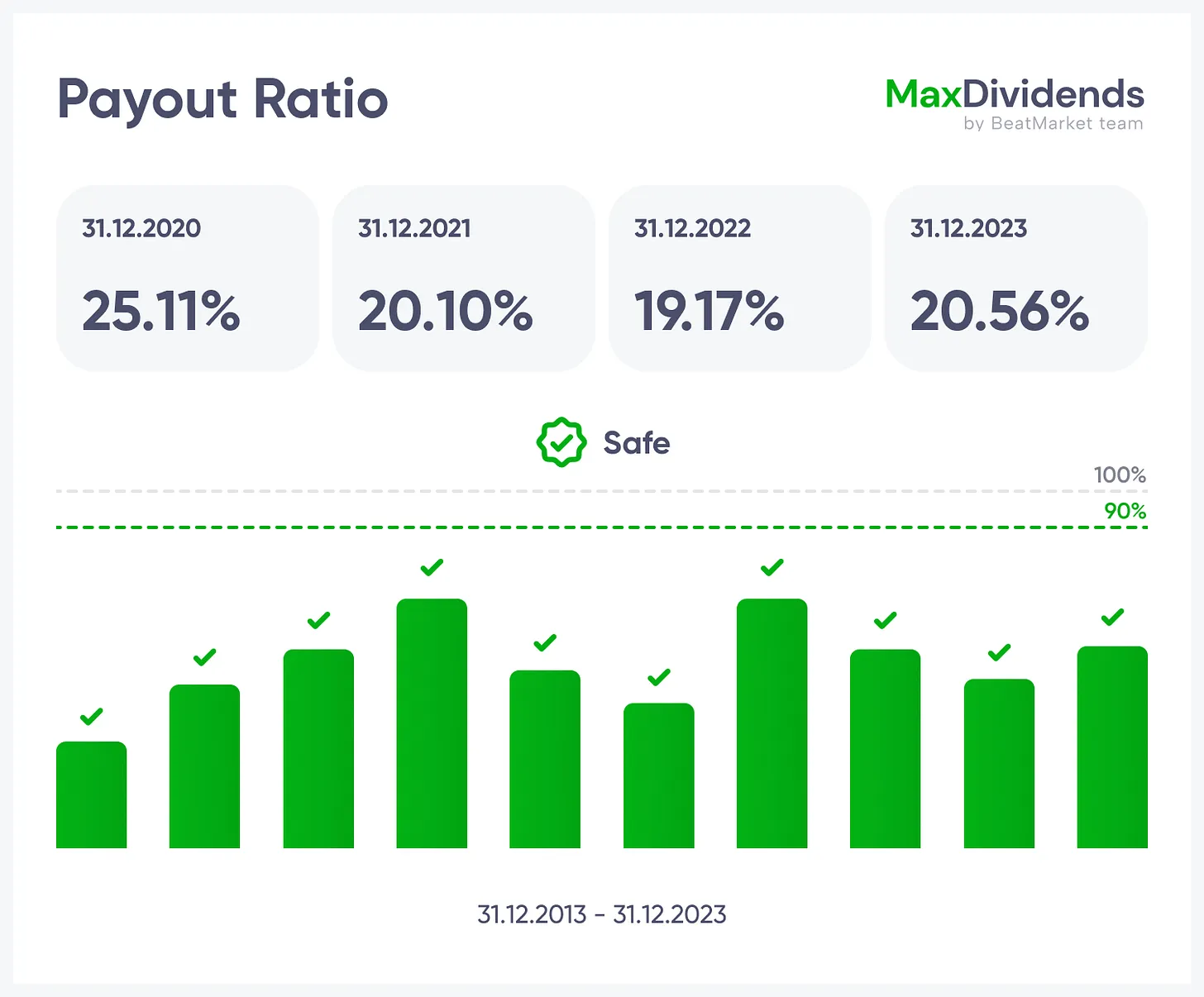

Bottom line made simple with MaxDividends.

Bottom line made simple with MaxDividends.

Debt risk checked for you, 24/7.

Debt risk checked for you, 24/7.

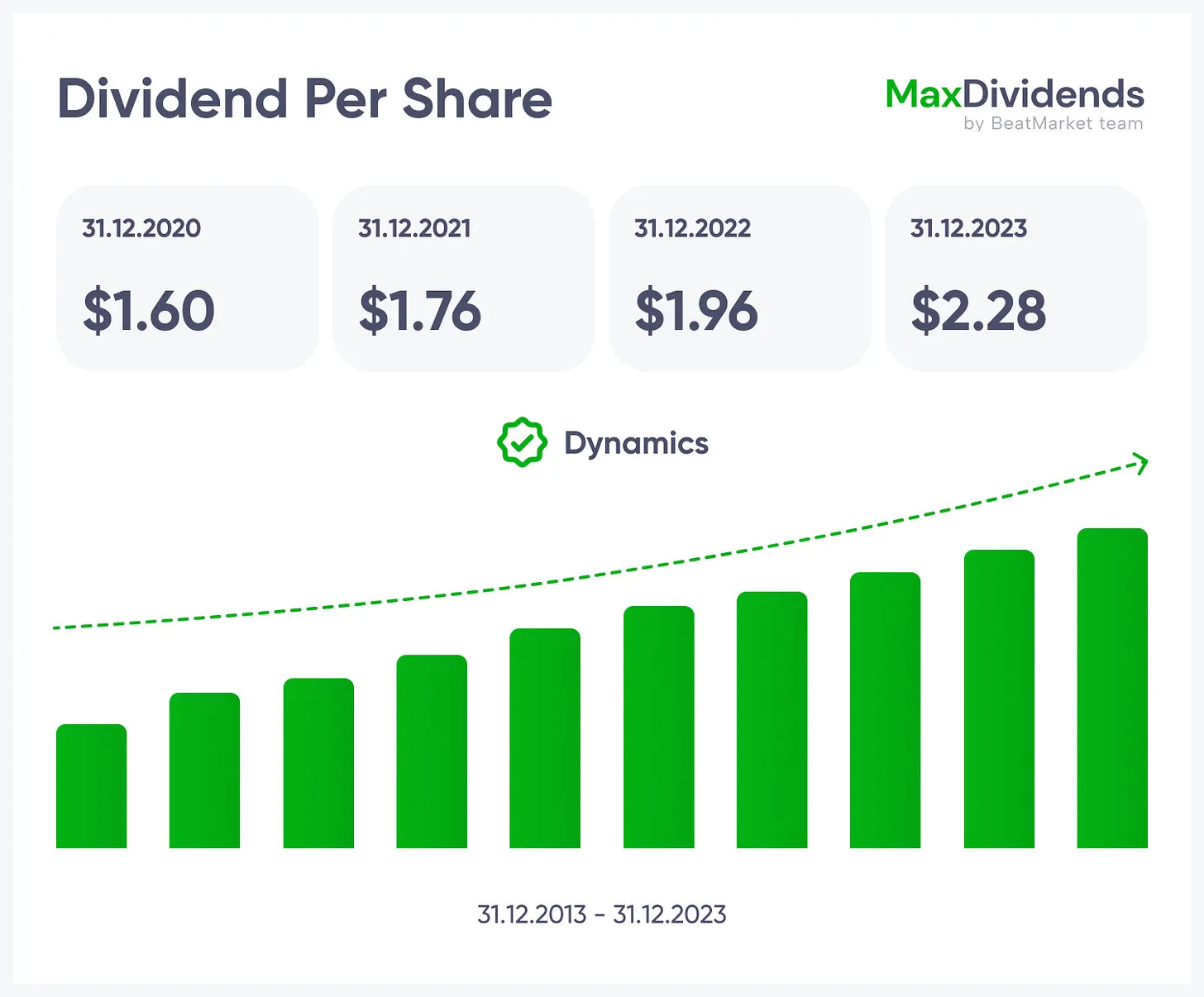

Dividend streaks and raises at your fingertips.

Dividend streaks and raises at your fingertips.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

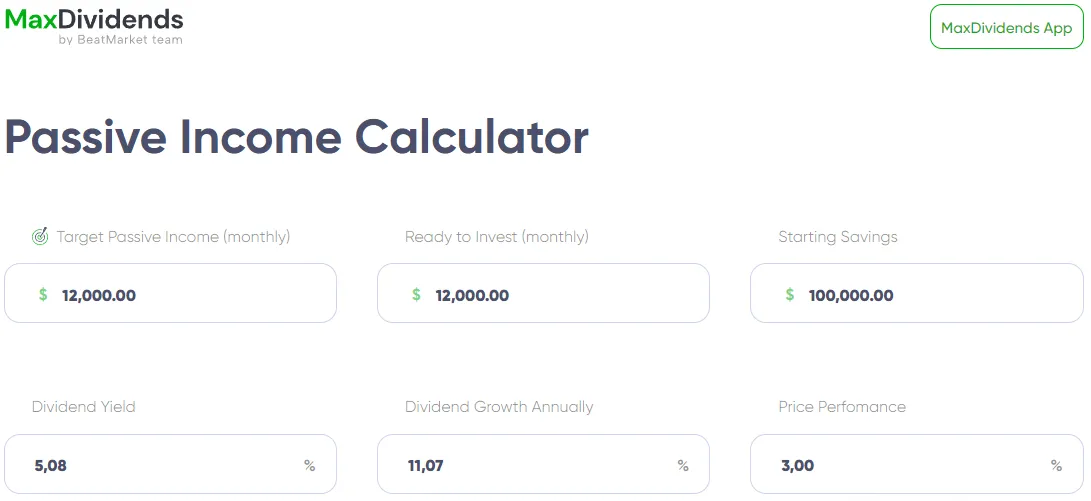

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

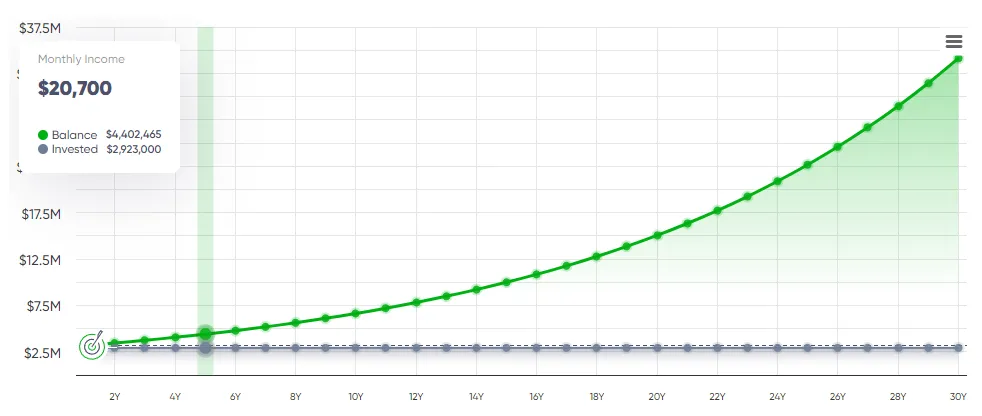

MaxDividends App: Passive Income Calculator, Income Forecast

MaxDividends App: Passive Income Calculator, Income Forecast

BeatStart

BeatStart