MaxDividends App

Portfolio George Soros portfolio stocks

Current Balance

1 000,00 USD

Capital Gains

+53 500,00 USD (+53,50%)

Daily Income

0,00 USD (0,00%)

1 a week

1 month

6 months

1 Y

3 Y

5 Y

All

12/13/2025 - 12/20/2025

For some assets, quotes may not update outside trading hours or on weekends

About Portfolio

Active Since: 29th January 2023

Portfolio Beta: -

Dividend Yield On Cost:

+0.91%

Annual Total Return:

+21 384.42%

Price Returns

6 months:

+37 825.31%

12 months:

+36 639.41%

All Time:

+61 865.71%

Annual Price Return:

+21 383.51%

Best Deal

Top Performer:

MicroStrategy Incorporated (MSTR)

First Bought:

29 Jan 2023

Price Return:

+537.95

%

Diversification

Your strategy’s breakdown by sectors, industries, and assets - this shows how you’re spreading your bets across the market.Sectors

Industries

Assets

Strategy Breakdown

Here’s the full picture of where your money’s working - every holding in your strategy, along with how much weight each one has.Total Strategy Value

1000 USD

Top Holdings (by % of Strategy)

Market Cap Breakdown

The big dogs. These are the $10 billion and up giants.

AMZN

Amazon.com, Inc

RIVN

Rivian Automoti...

DHI

D.R. Horton, In...

QQQ

Invesco QQQ Tru...

GOOG

Alphabet Inc

LPLA

LPL Financial H...

TMUS

T-Mobile US, In...

CRM

salesforce.com,...

NKE

NIKE, Inc

SE

Sea Ltd

IGSB

iShares 1-5 Yea...

SPY

SPDR S&P 500 ET...

INTU

Intuit Inc

MSTR

MicroStrategy I...

QCOM

QUALCOMM Incorp...

These are solid, well-established companies, usually worth between $2 billion and $10 billion. Big enough to weather storms but still with room to grow.

LBRDK

Liberty Broadba...

ARMK

Aramark Holding...

LCID

LCID

DISH

DISH Network Co...

SPSB

SPDR Portfolio...

FRSH

Freshworks Inc

Mid-size players with market caps between $300 million and $2 billion. They’re growing, but they can be a bit more volatile.

BHVN

Biohaven Pharma...

INDI

indie Semicondu...

BOWL

Bowlero Corp

FIGS

FIGS, Inc

Strategy Breakdown – By Sector

Here’s where your money’s working across different industries. A good mix of sectors helps smooth out risk - some pay steady dividends, others offer growth potential.Top Holdings in manufactured goods

-

Intel (MMM)23.03%

-

Texas instrumental (AMAT)7.11%

-

Tractor supply (CMI)8.25%

-

Pool (POOL)3.03%

-

ZM company (ROCK)5.24%

Your Asset Mix

Here’s the breakdown of what you ownMy Holdings

Top Positions in Your Strategy

Large Assets of Type

Company

AMZN

Amazon.com, IncLBRDK

Liberty Broadband Srs CRIVN

Rivian Automotive, Inc. Class A Common StockBHVN

Biohaven Pharmaceutical Holding Co LtdDHI

D.R. Horton, IncQQQ

Invesco QQQ TrustGOOG

Alphabet IncINDI

indie Semiconductor IncLPLA

LPL Financial Holdings IncTMUS

T-Mobile US, IncARMK

Aramark HoldingsCRM

salesforce.com, incNKE

NIKE, IncSE

Sea LtdIGSB

iShares 1-5 Year Investment Grade Corporate Bond ETFSPY

SPDR S&P 500 ETF TrustLCID

LCIDBOWL

Bowlero CorpDISH

DISH Network CorporationINTU

Intuit IncMSTR

MicroStrategy IncorporatedQCOM

QUALCOMM IncorporatedFIGS

FIGS, IncSPSB

SPDR Portfolio Short Term Corporate Bond ETFFRSH

Freshworks IncProfit Margin

Operating Margin ttm

ROA ttm

ROE ttm

Revenue/Share ttm

Enterprise Value / Ebitda

11.06

%

11.06

%

7.5

24.33

65.12

15.32

77.56

%

8.86

%

0.38

12.94

7.11

6.04

-61.34

%

-63.09

%

-14.47

-64.92

5.11

-1.96

-

-

-106.25

-

-

-2.19

10.47

%

12.47

%

8.16

14.32

111.02

10.45

-

-

-

-

-

-

32.23

%

30.51

%

16.28

35.45

31.71

20.51

-66.45

%

-69.15

%

-10.96

-34.9

1.13

-10.53

5.49

%

11.28

%

5.56

21.32

196

16.88

13.83

%

22.23

%

5.74

19.03

75.37

10.63

1.76

%

5.33

%

4.11

10.53

70.14

11.81

17.91

%

23.86

%

5.95

12.18

42.17

19.7

6.23

%

7.91

%

5.69

21.12

31.39

23.48

6.74

%

7.95

%

4.45

15.68

35.69

32.44

-

-

-

-

-

-

-

-

-

-

-

-

-214.1

%

-279.88

%

-22.89

-61.12

3.53

-2.12

-6.63

%

5.54

%

3.33

-

8.05

13.73

7.81

%

-1.13

%

1.05

7.19

29.34

7.92

21.19

%

15.7

%

9.78

21.99

69.47

29.96

1667.09

%

3023.4

%

16.75

25.59

1.83

5.46

12.51

%

26.24

%

14.71

23.34

40.41

12.68

3.03

%

6.35

%

3.25

4.32

3.55

47.65

-

-

-

-

-

-

-3.65

%

-3.47

%

-1.62

-2.98

2.74

-26.51

Inspired by this portfolio?

Try MaxDividends

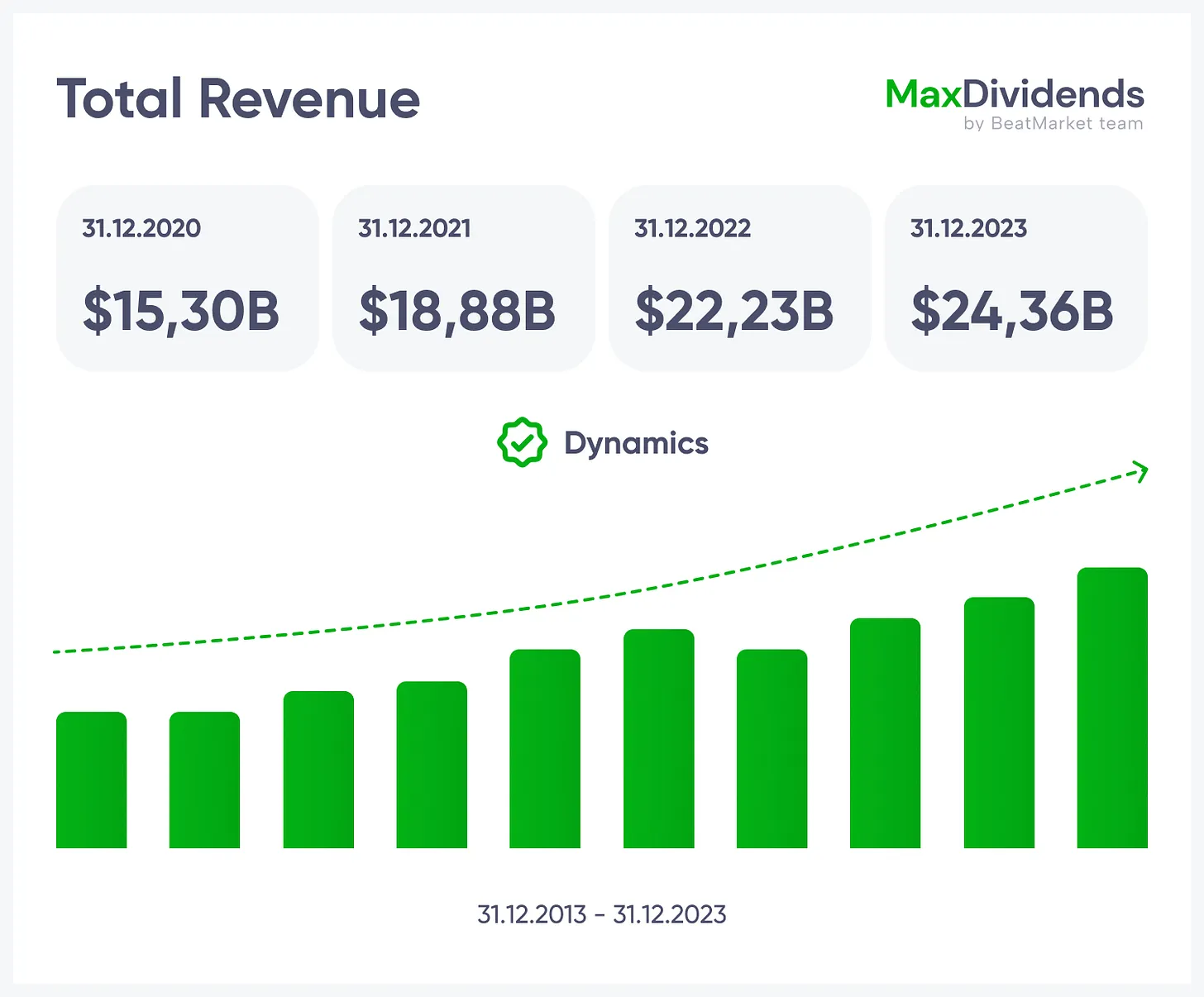

See the whole business at a glance — what it does, how it earns, and the value it brings.

See the whole business at a glance — what it does, how it earns, and the value it brings.

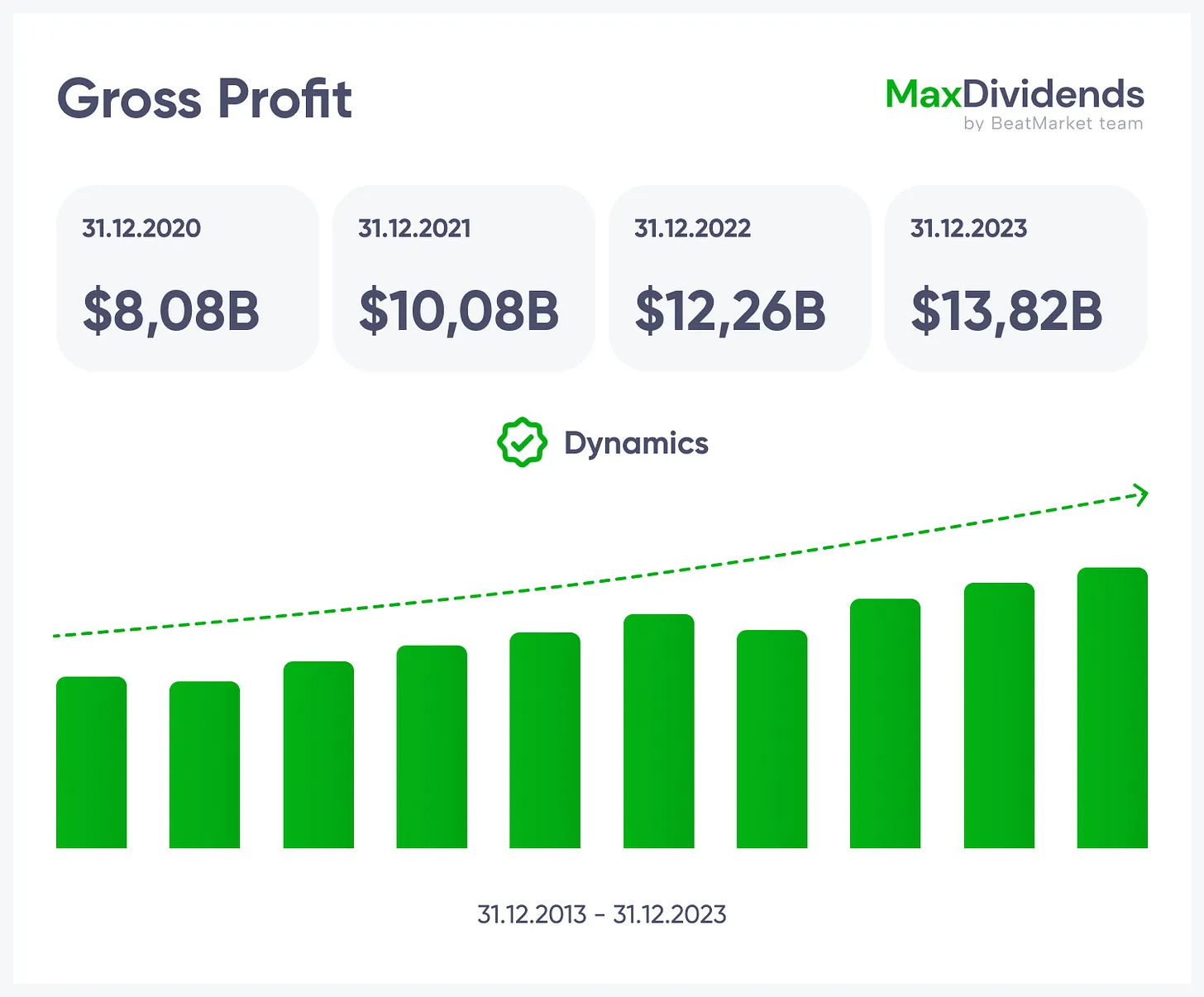

Growth trend, clear in one glance.

Growth trend, clear in one glance.

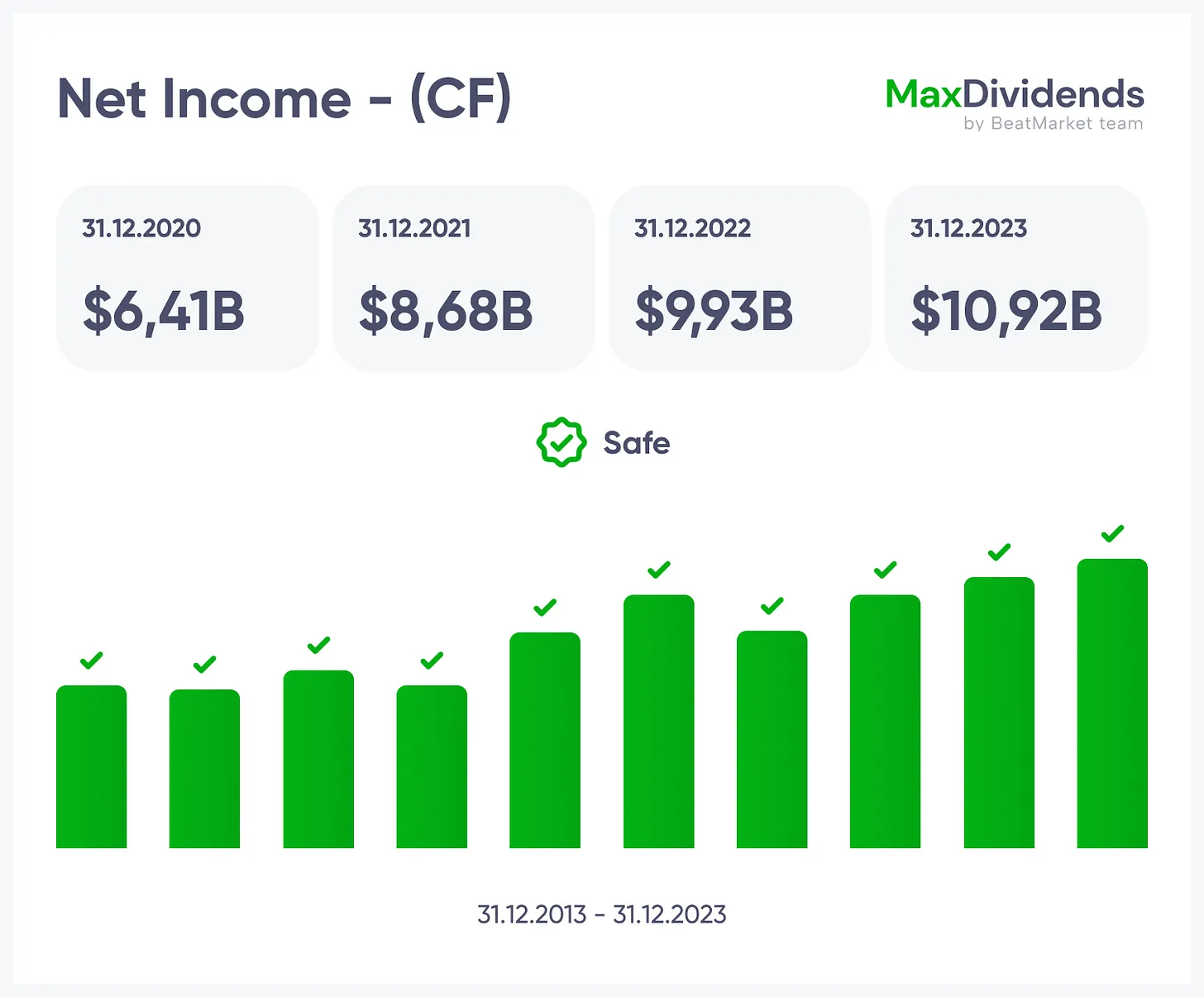

See if profits are real — instantly.

See if profits are real — instantly.

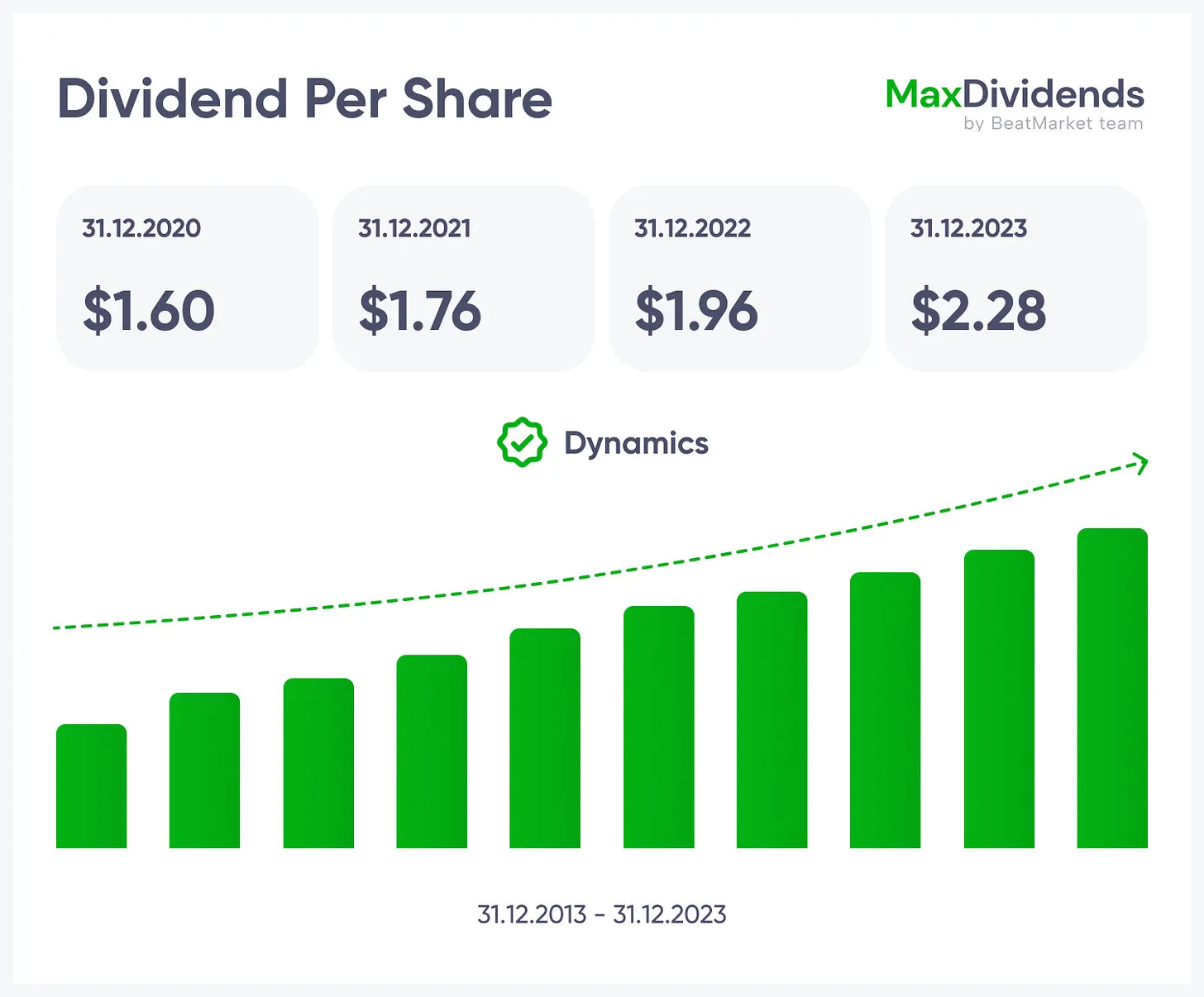

Bottom line made simple with MaxDividends.

Bottom line made simple with MaxDividends.

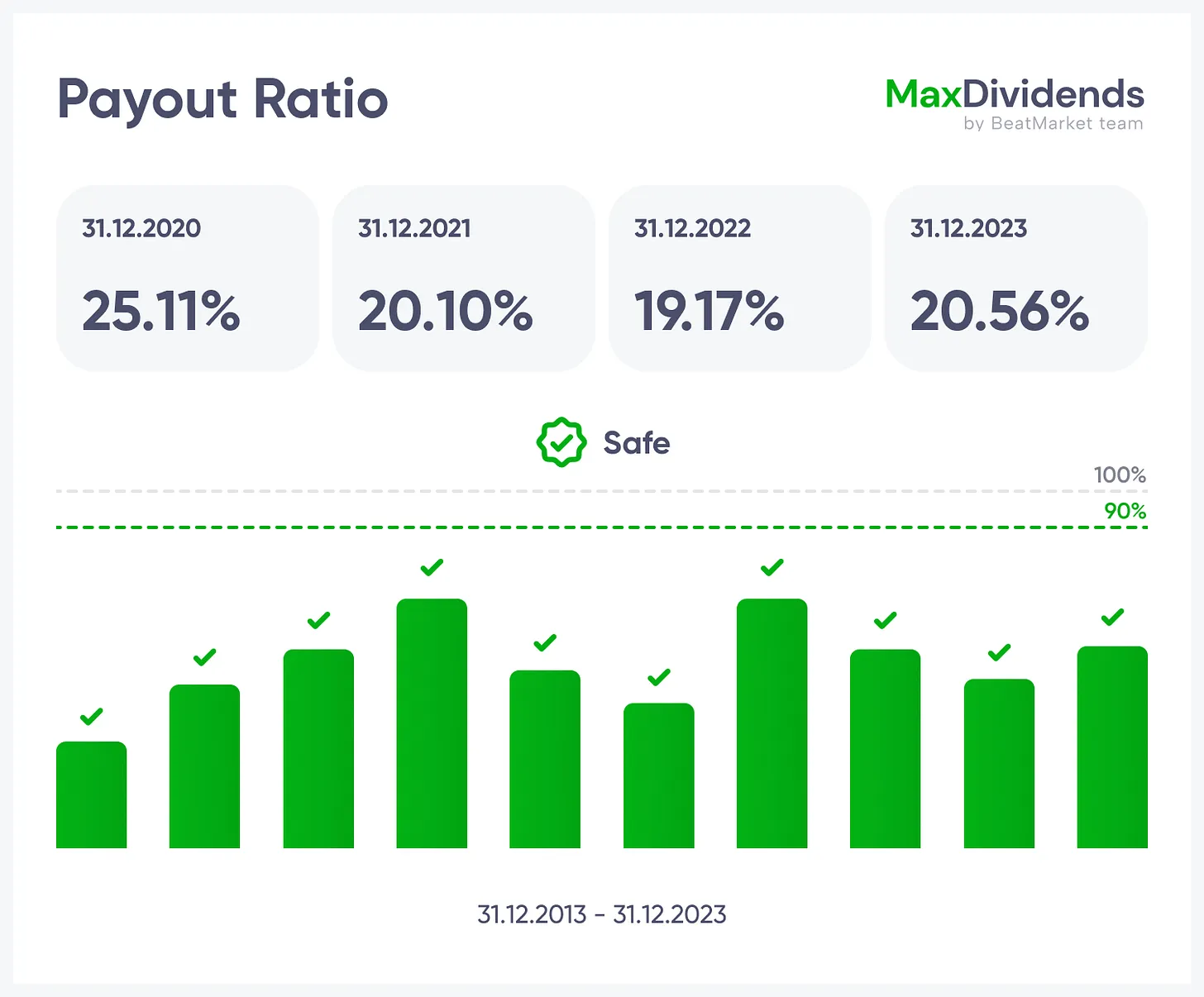

Debt risk checked for you, 24/7.

Debt risk checked for you, 24/7.

Dividend streaks and raises at your fingertips.

Dividend streaks and raises at your fingertips.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

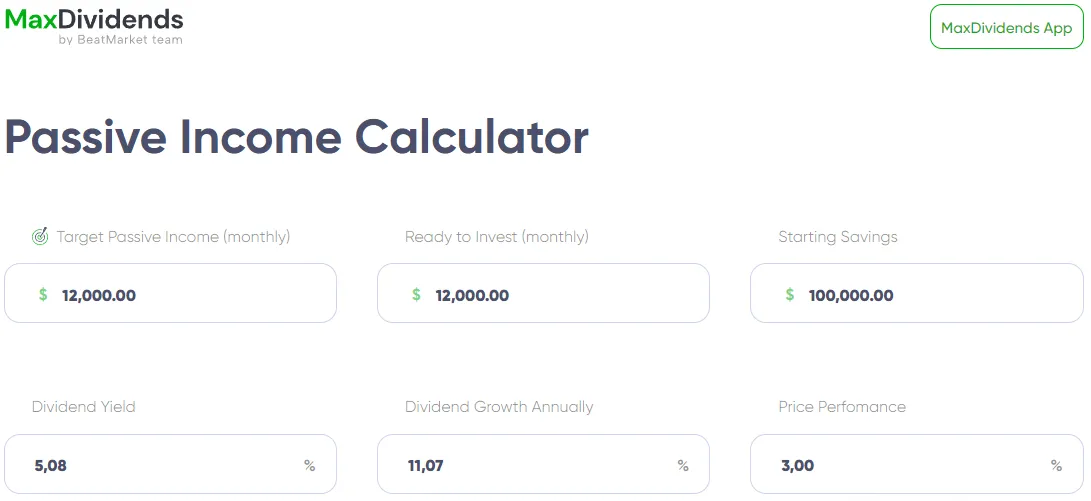

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

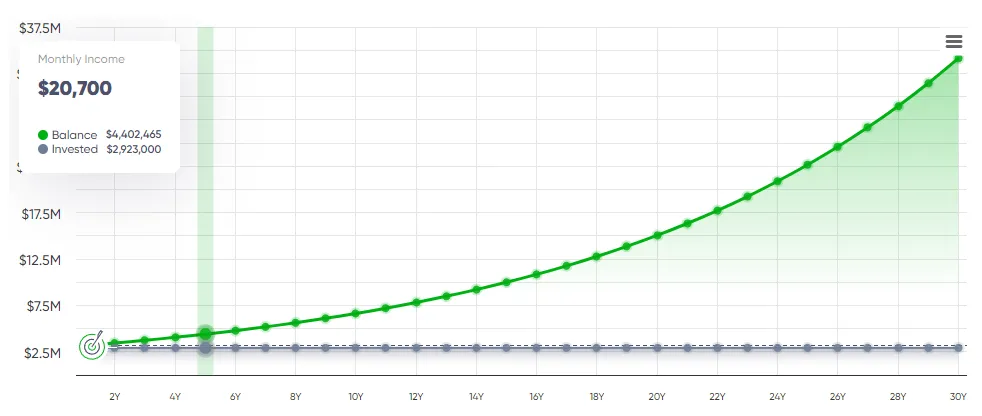

MaxDividends App: Passive Income Calculator, Income Forecast

MaxDividends App: Passive Income Calculator, Income Forecast

BeatStart

BeatStart