MaxDividends App

Portfólio Max's Dividend Focused

Conta corrente

1 688 775,68 USD

Renda total

+364 092,09 USD (+16,43%)

Renda regular

6 049.55 USD

72 594.57 USD

+4.96%

90 091.88 USD

Sobre o portfólio

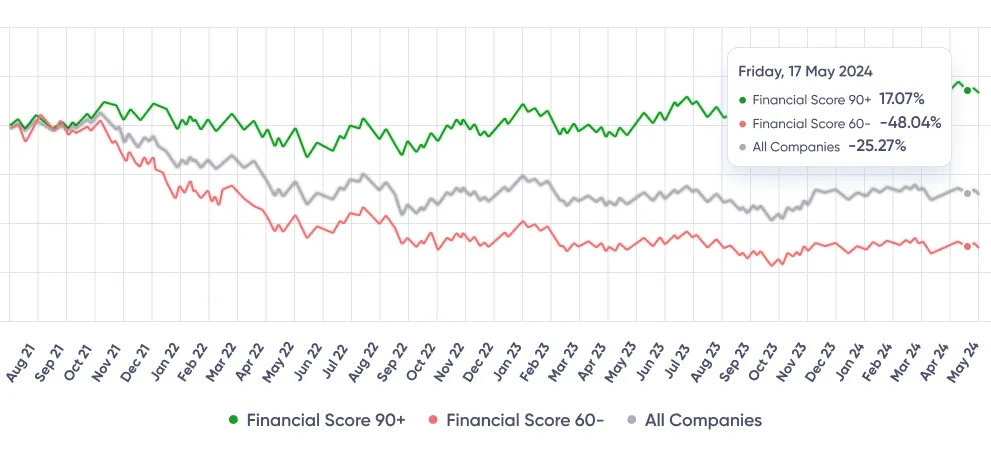

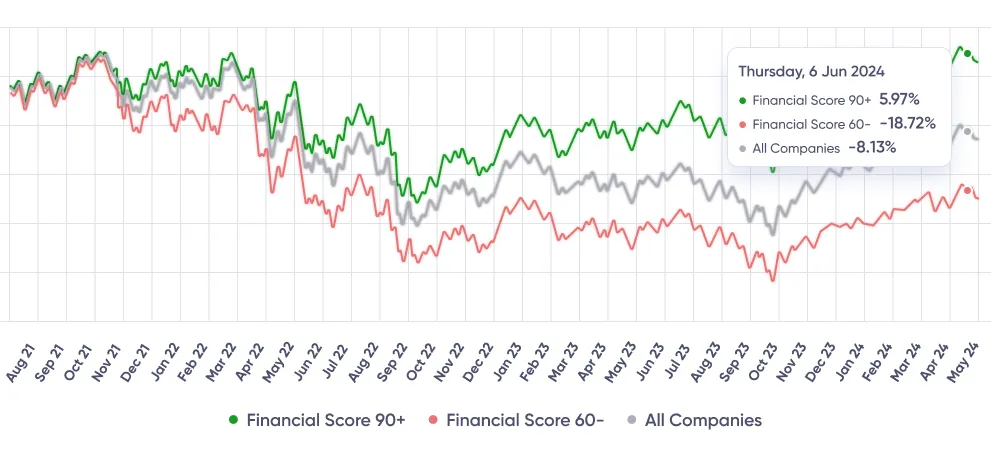

retorno de portfólio

Melhor negócio

Organizar

Your strategy’s breakdown by sectors, industries, and assets - this shows how you’re spreading your bets across the market.Setores

Indústrias

Ativos

Estrutura do portfólio

Вот полная картина того, как работают ваши деньги — каждый актив в вашей стратегии, а также вес каждого из них.Total Strategy Value

Top Holdings (by % of Strategy)

Distribuição de ativos por capitalização

Os grandes. São os gigantes com 10 mil milhões de dólares ou mais.

São empresas sólidas e bem estabelecidas, geralmente com um valor entre os 2 mil milhões e os 10 mil milhões de dólares. Grandes o suficiente para resistir a tempestades, mas ainda com espaço para crescer.

Empresas de média dimensão com capitalização bolsista entre US$ 300 milhões e US$ 2 mil milhões. Estão a crescer, mas podem ser um pouco mais voláteis.

As promissoras e ambiciosas. Estas empresas valem geralmente menos de 300 milhões de dólares. Mais risco, mas se encontrar uma vencedora, o retorno pode ser grande.

Ativos classificados por setor

Here’s where your money’s working across different industries. A good mix of sectors helps smooth out risk - some pay steady dividends, others offer growth potential.Grandes propriedades bens manufaturados

-

Intel (MMM)23.03%

-

Texas instrumental (AMAT)7.11%

-

Tractor supply (CMI)8.25%

-

Pool (POOL)3.03%

-

ZM company (ROCK)5.24%

Colocação de ativos

Here’s the breakdown of what you ownMeus ativos

Лучшие позиции в вашей стратегии

Grandes ativos do tipo

Empresa

BNR

Brenntag SEFPE

Fuchs Petrolub SETXN

Texas Instruments IncorporatedTSCO

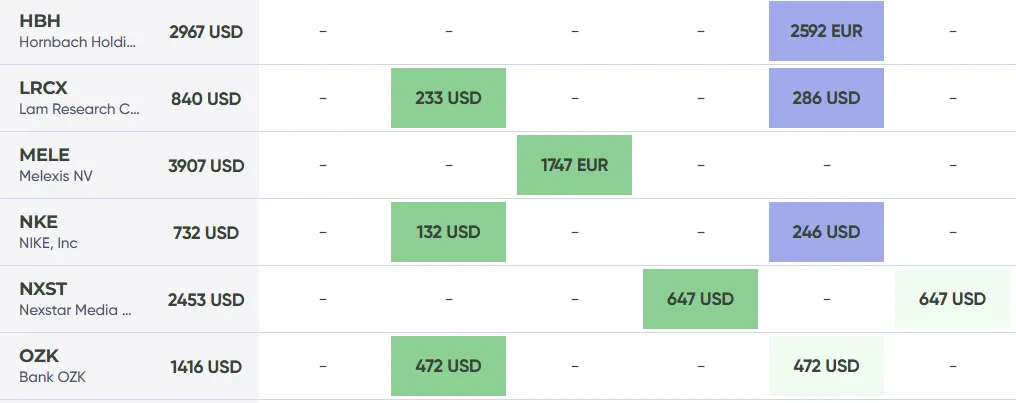

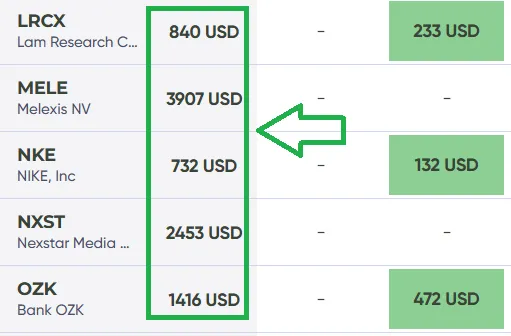

Tractor Supply CoNKE

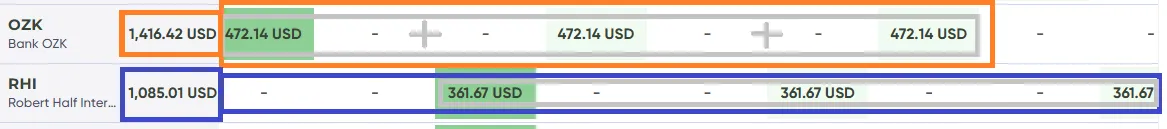

NIKE, IncRHI

Robert Half International IncTROW

T. Rowe Price Group, IncSWKS

Skyworks Solutions, IncBBY

Best Buy Co., IncRUI

Rubis SCAWAC

Wacker Neuson SEDOM

Dom Development S.A.UPS

United Parcel Service, IncCTC-A

Canadian Tire Corporation LimitedAKE

Arkema SAMELE

Melexis NVABS

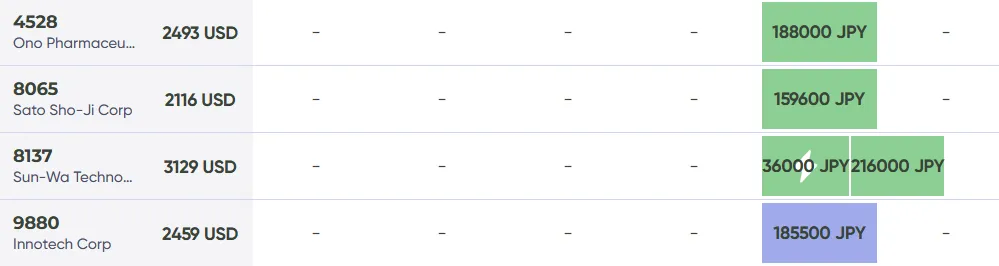

Asseco Business Solutions S.A.9880

Innotech Corp8137

Sun-Wa Technos CorpUVV

Universal CorporationNXST

Nexstar Media Group, IncAMB

Ambra SATEP

Teleperformance SEADM

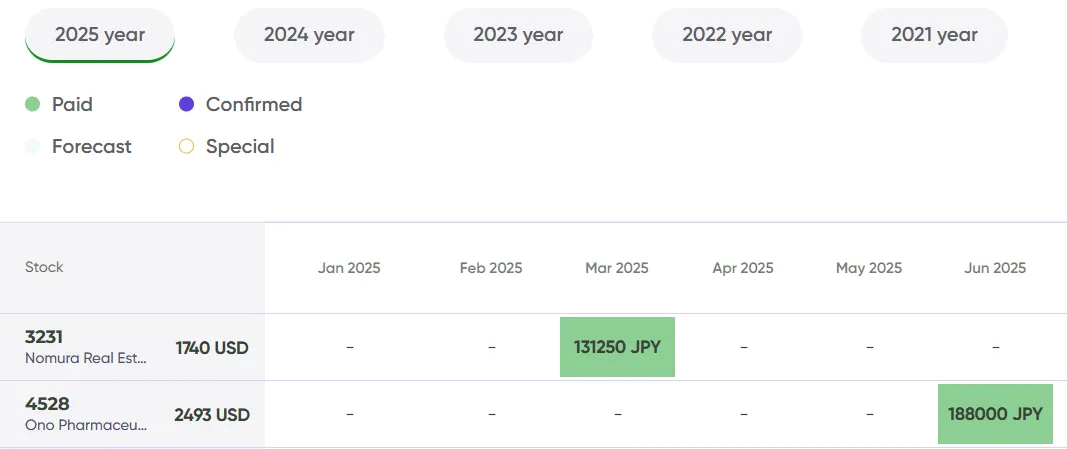

Archer Daniels Midland Company4528

Ono Pharmaceutical Ltd3231

Nomura Real Estate Holding IncHBH

Hornbach Holding VZO O.N.8065

Sato Sho-Ji CorpOZK

Bank OZK5911

Yokogawa Bridge Holdings CorpKFRC

Kforce Inc.CGO

Cogeco Inc.SCVL

Shoe Carnival IncGSY

goeasy LtdNVO

Novo Nordisk A/STGT

Target CorporationMargem de lucro

Margem operacional ttm

ROA ttm

ROE ttm

Receita/ação ttm

Valor da empresa / Ebitda

Inspired by this portfolio?

Try MaxDividends

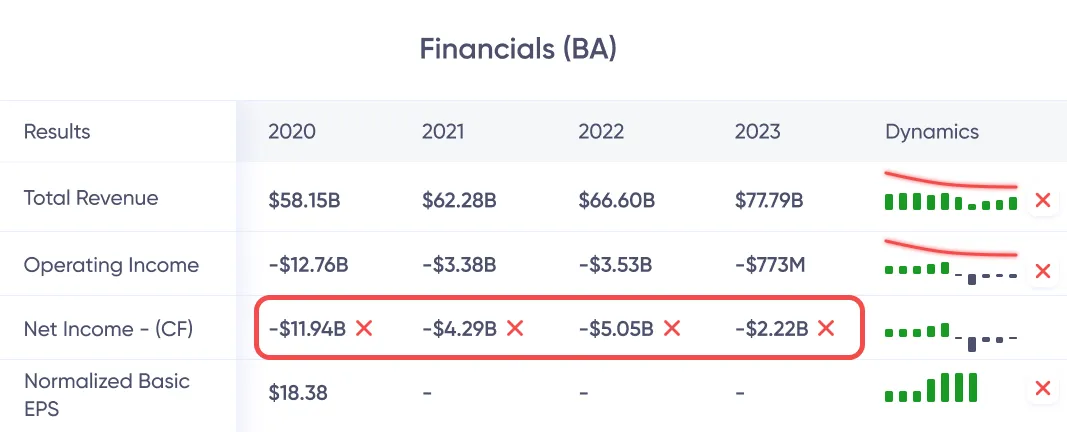

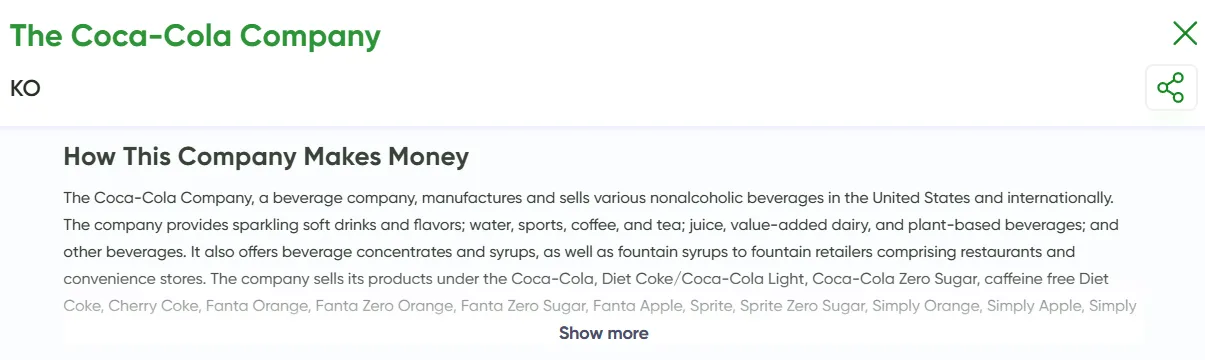

Veja o negócio inteiro de relance—o que ele faz, como ganha e o valor que traz.

Veja o negócio inteiro de relance—o que ele faz, como ganha e o valor que traz.

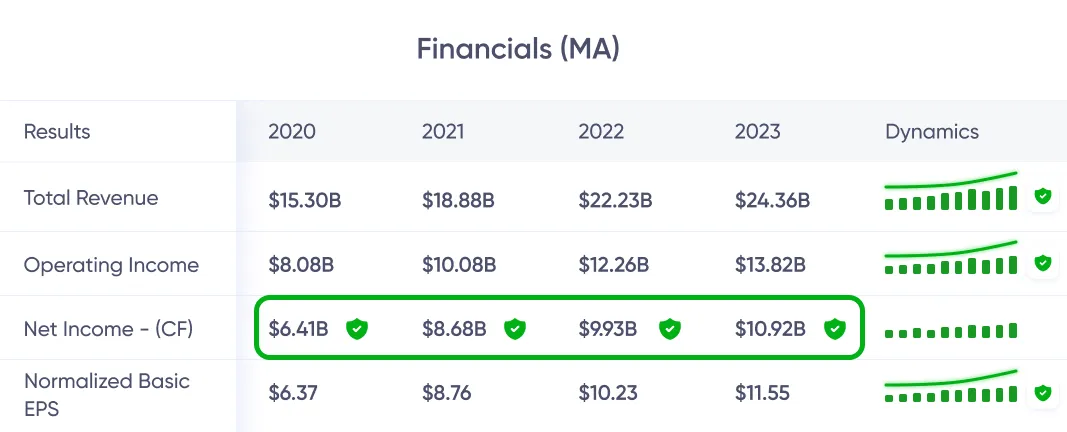

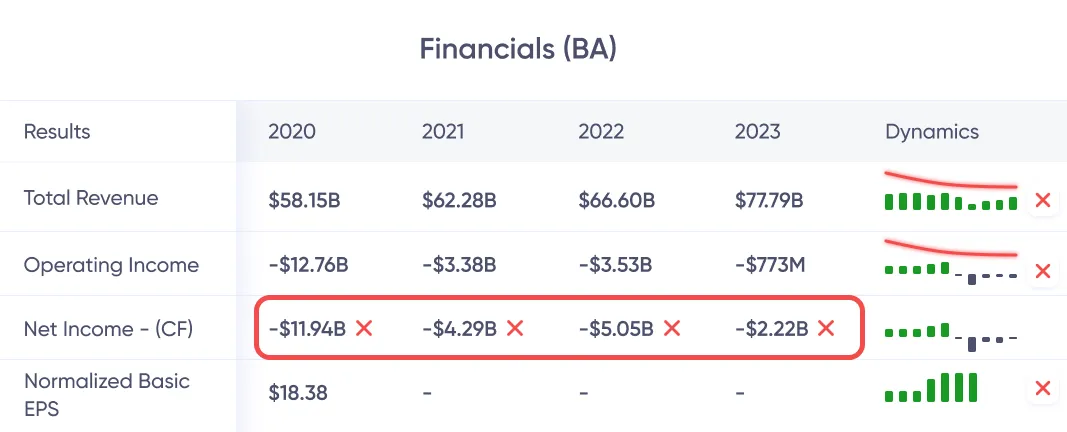

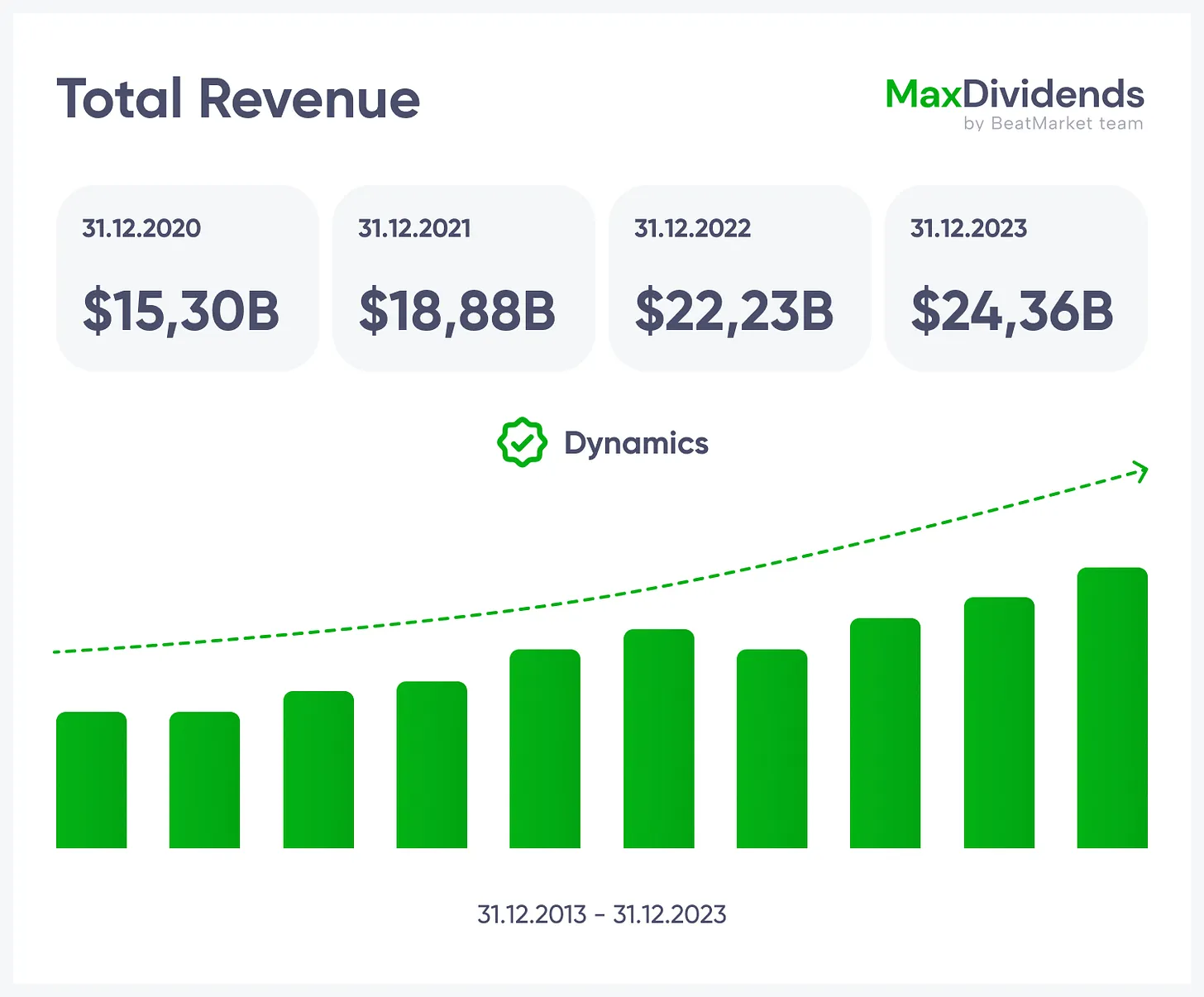

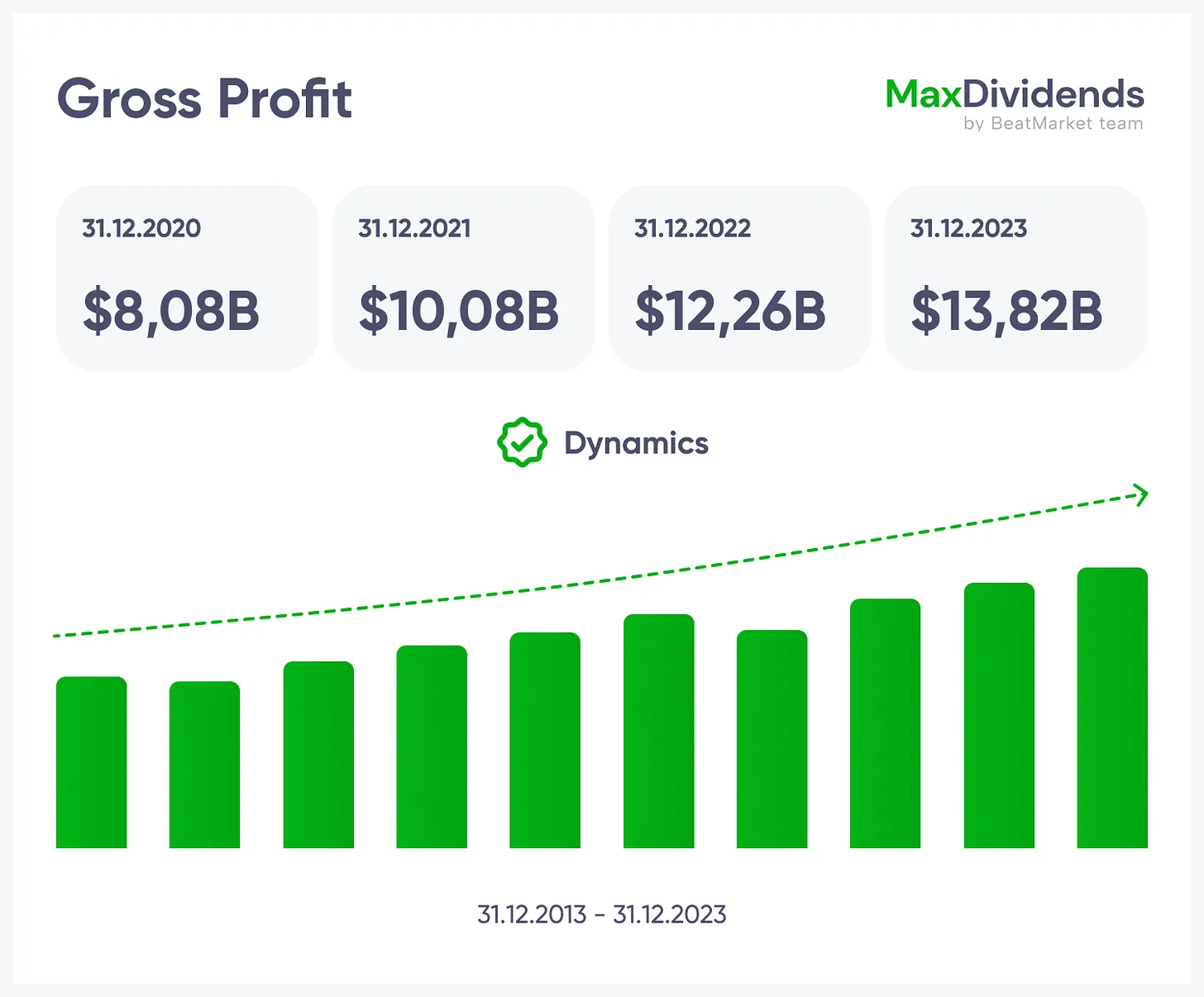

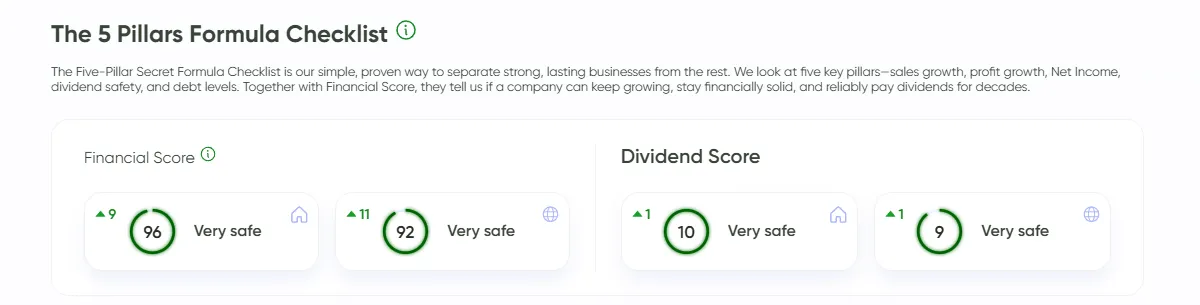

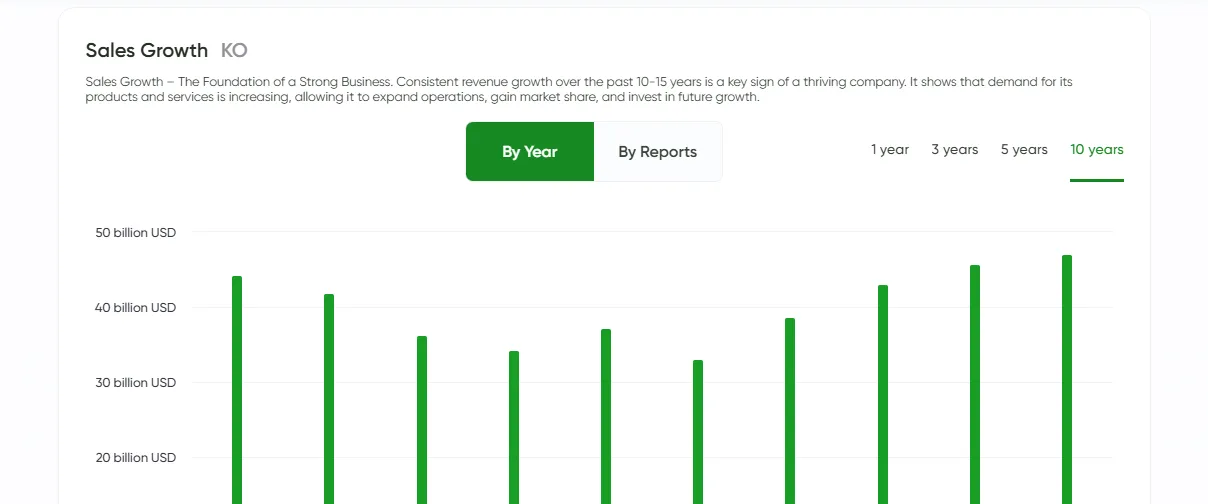

Tendência de crescimento, clara em uma olhadela.

Tendência de crescimento, clara em uma olhadela.

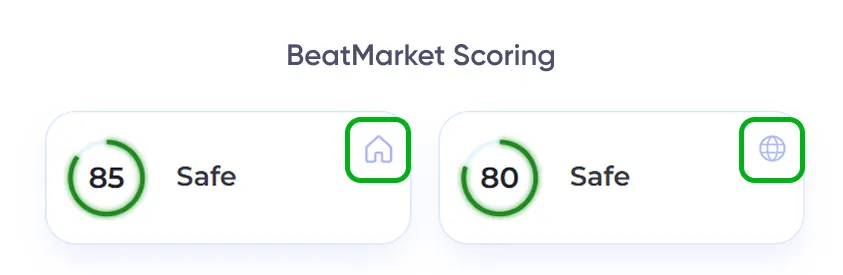

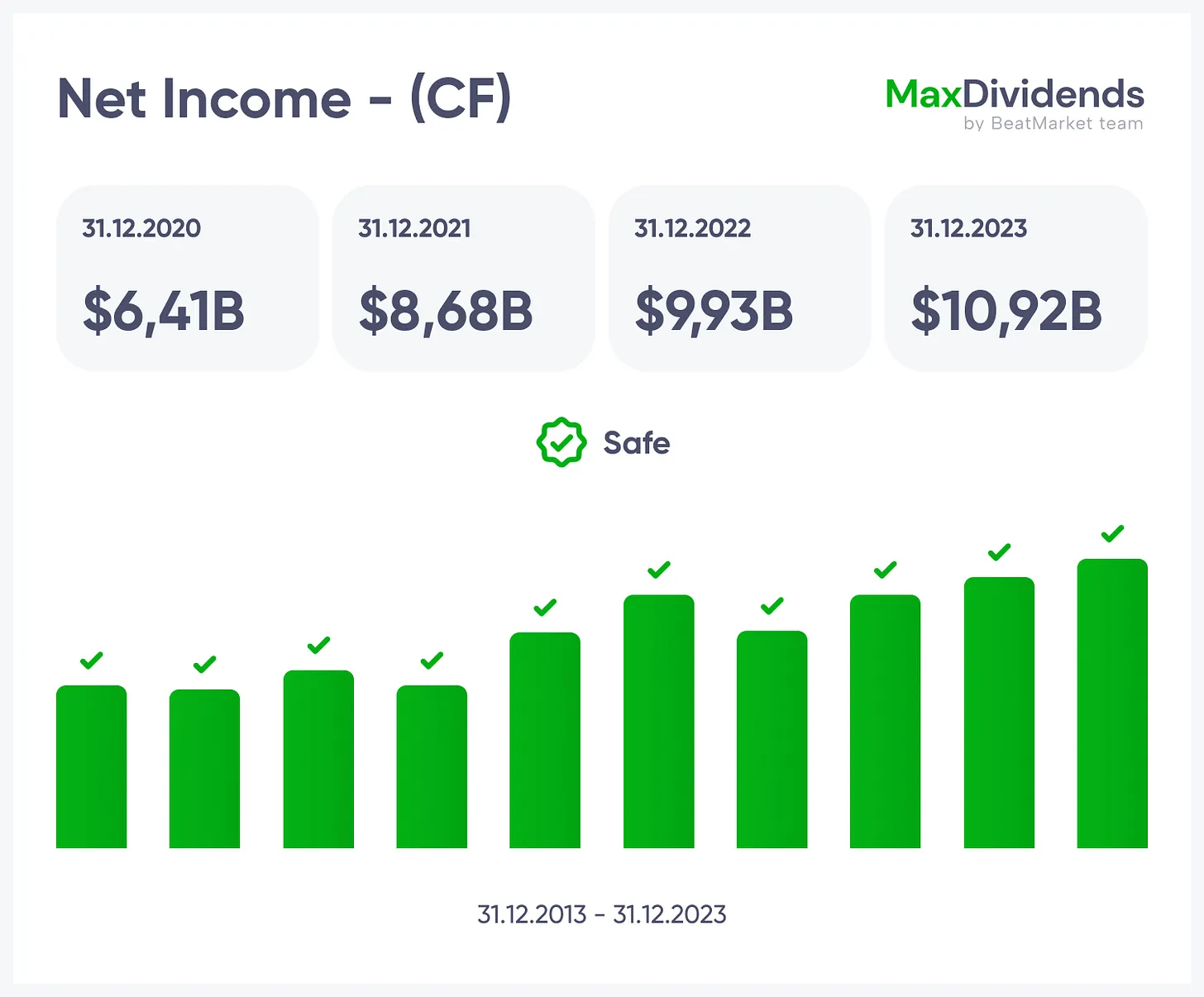

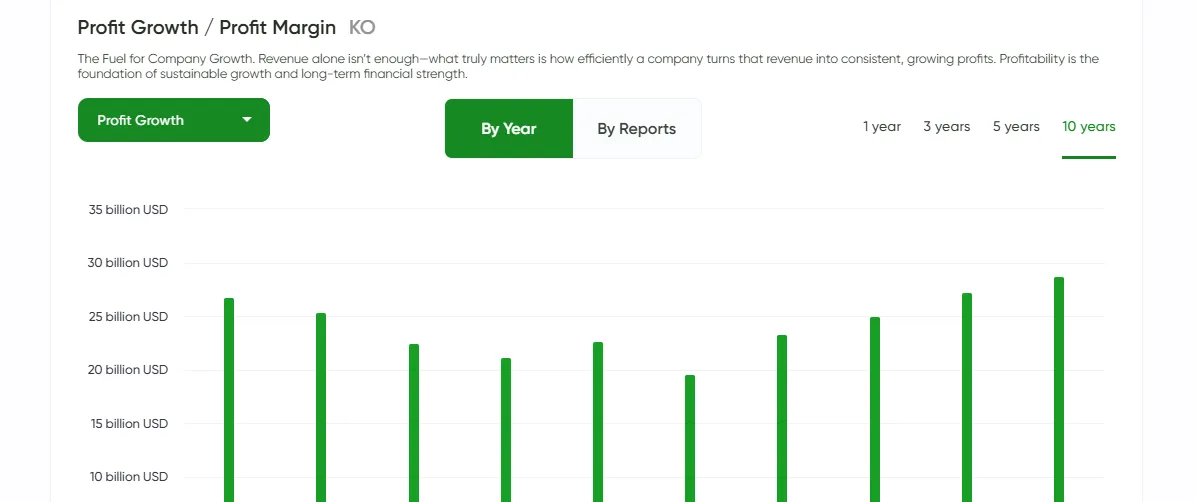

Veja se os lucros são reais—instantaneamente.

Veja se os lucros são reais—instantaneamente.

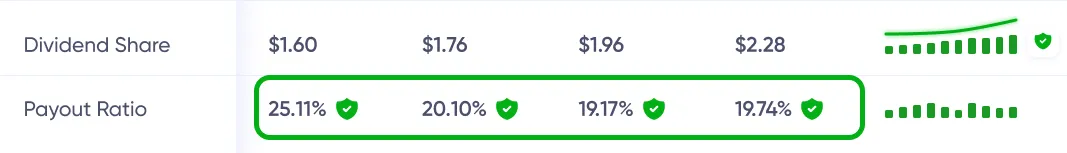

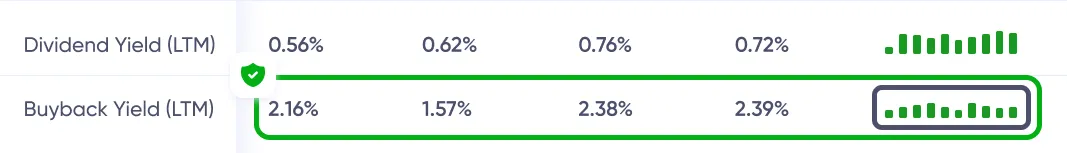

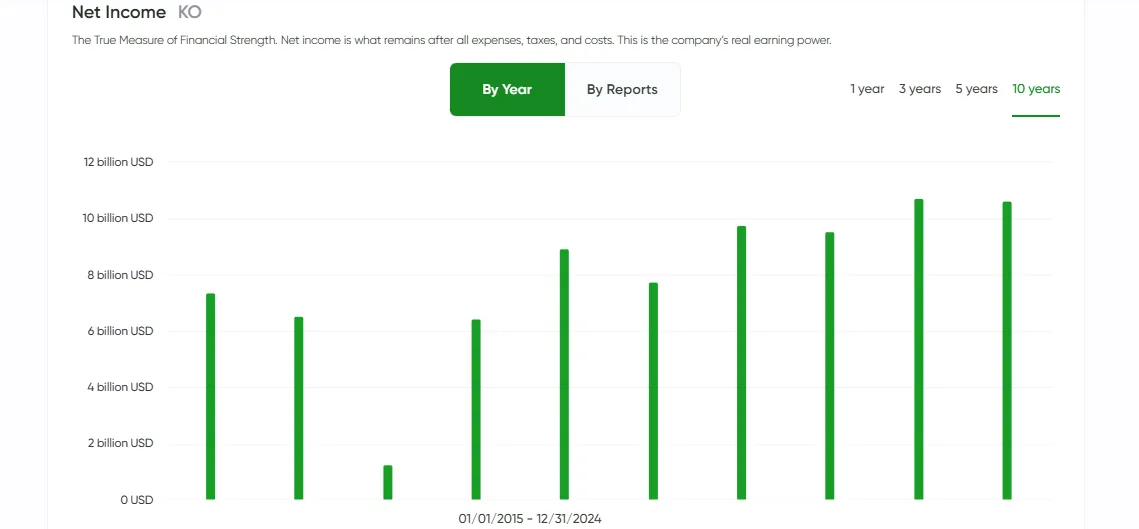

Resultado final simplificado com o MaxDividends.

Resultado final simplificado com o MaxDividends.

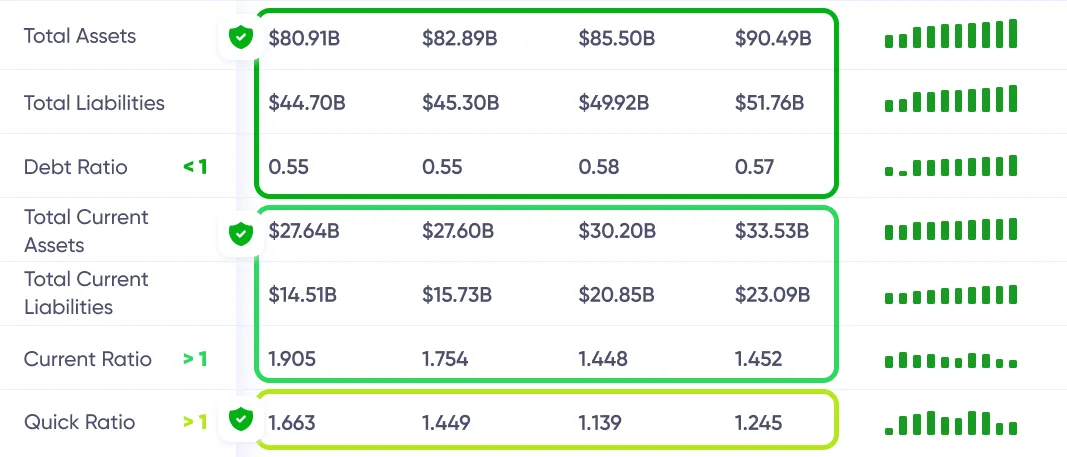

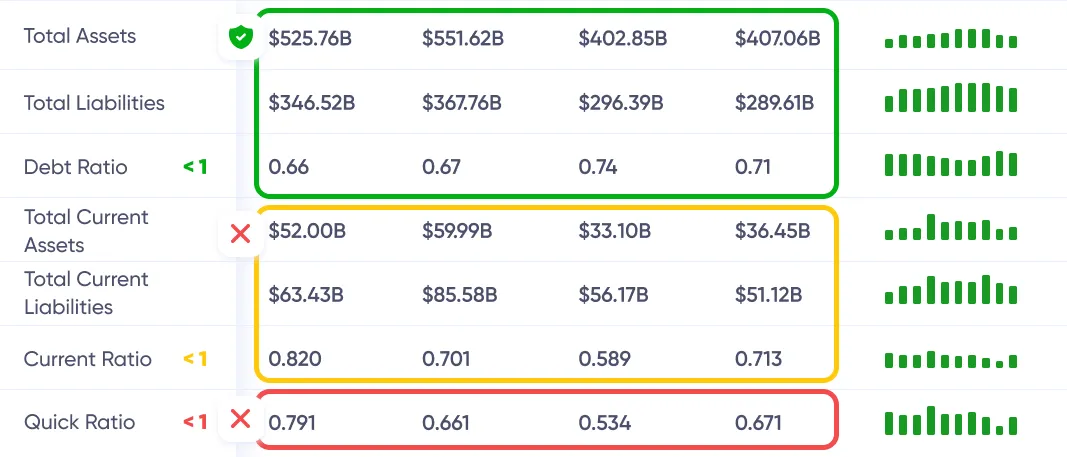

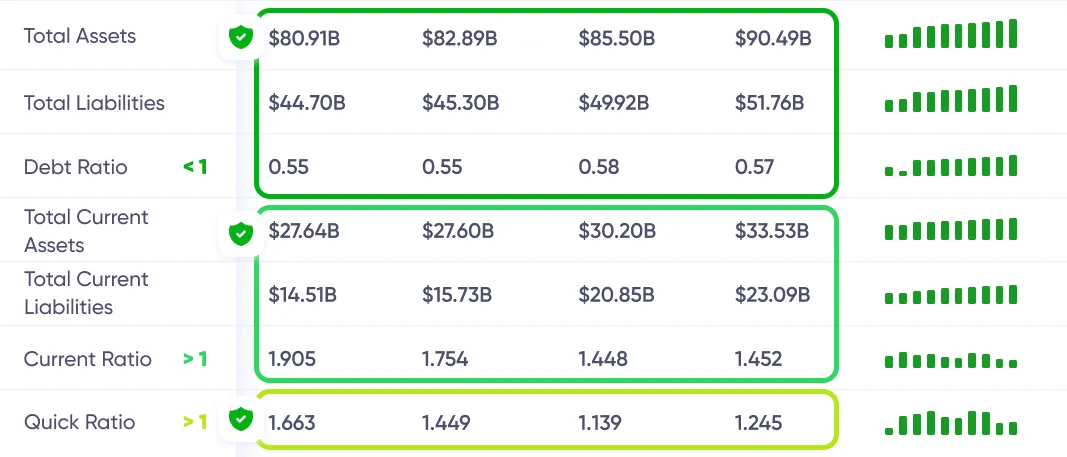

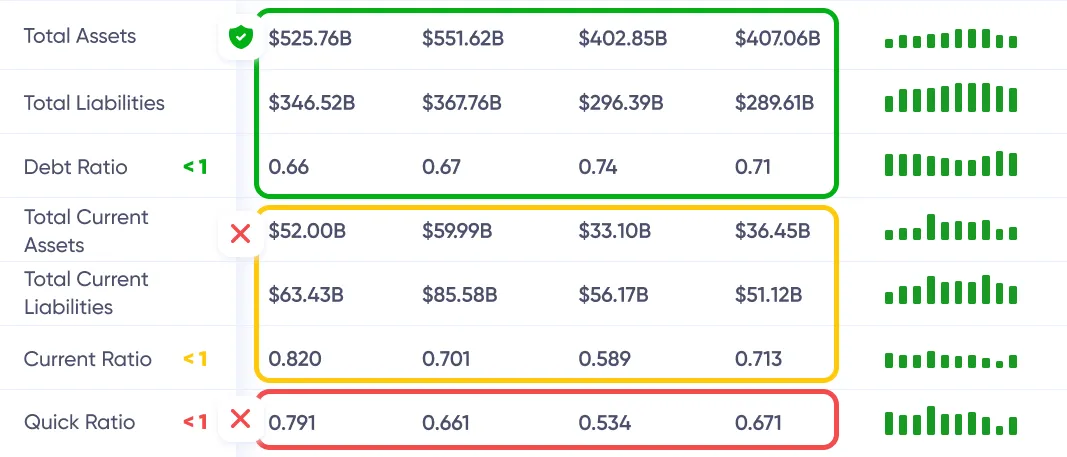

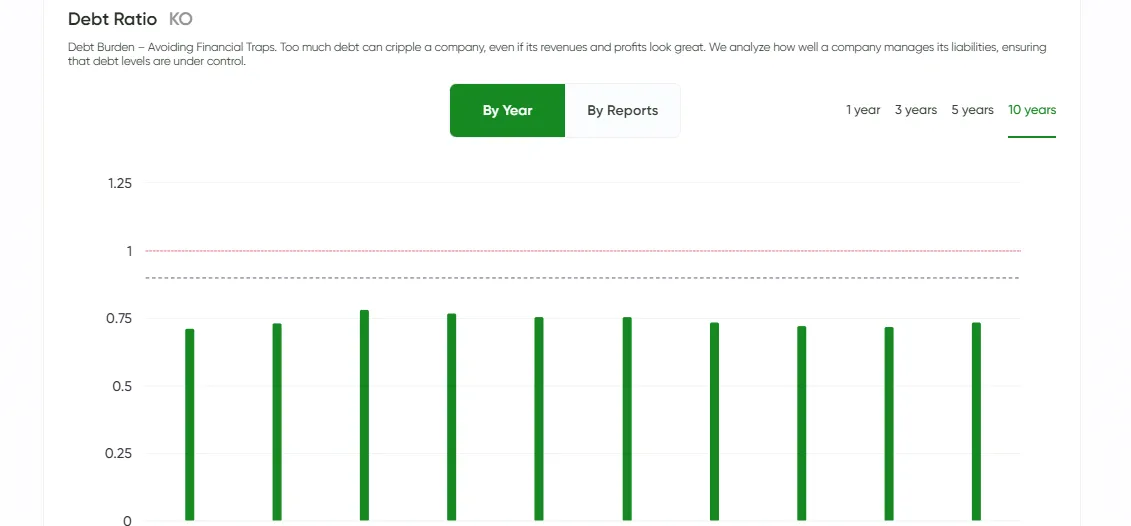

Risco de dívida verificado para você, 24/7.

Risco de dívida verificado para você, 24/7.

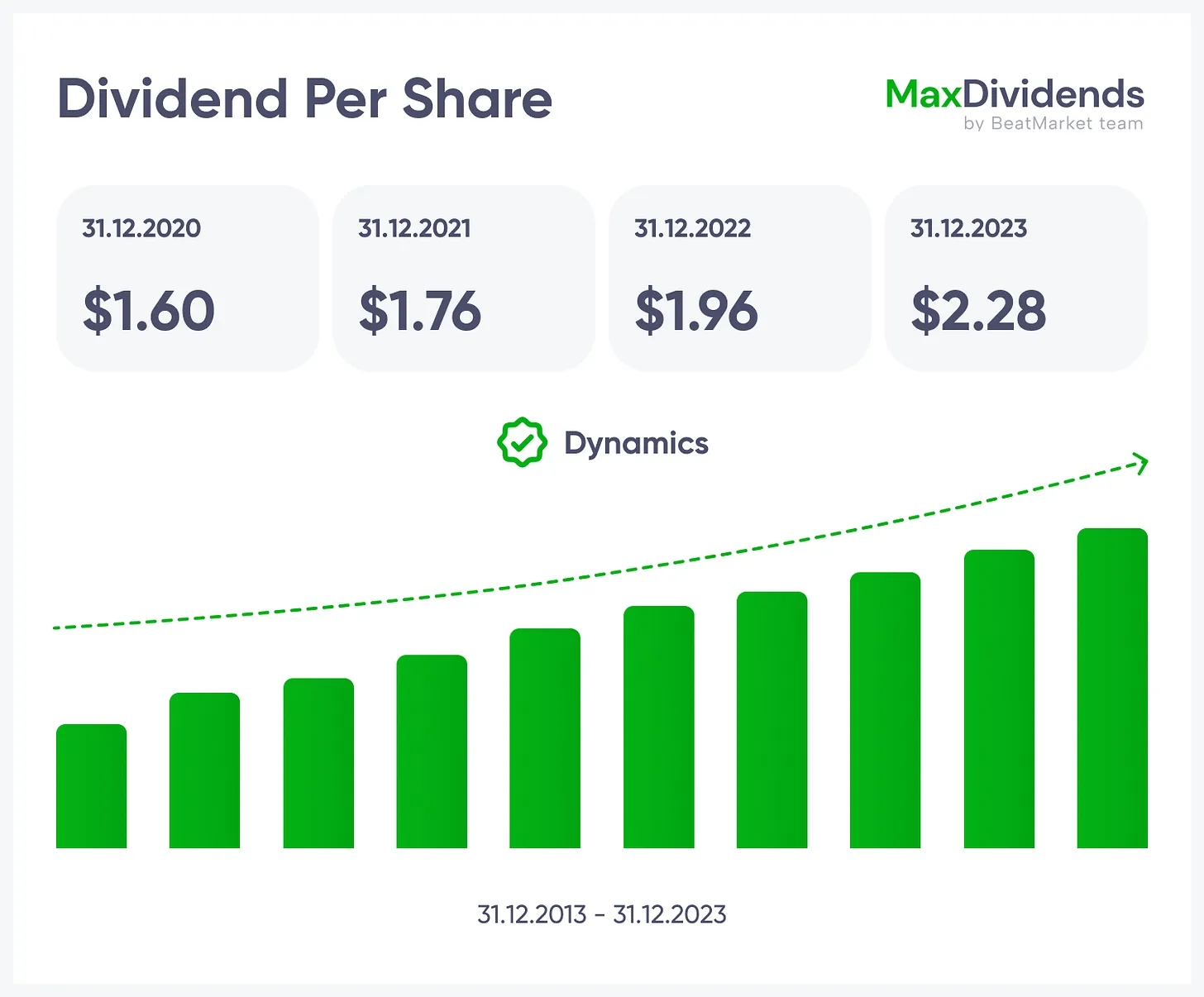

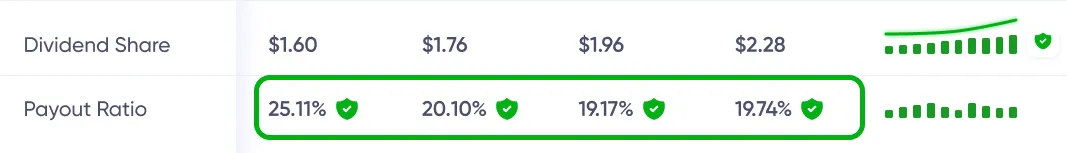

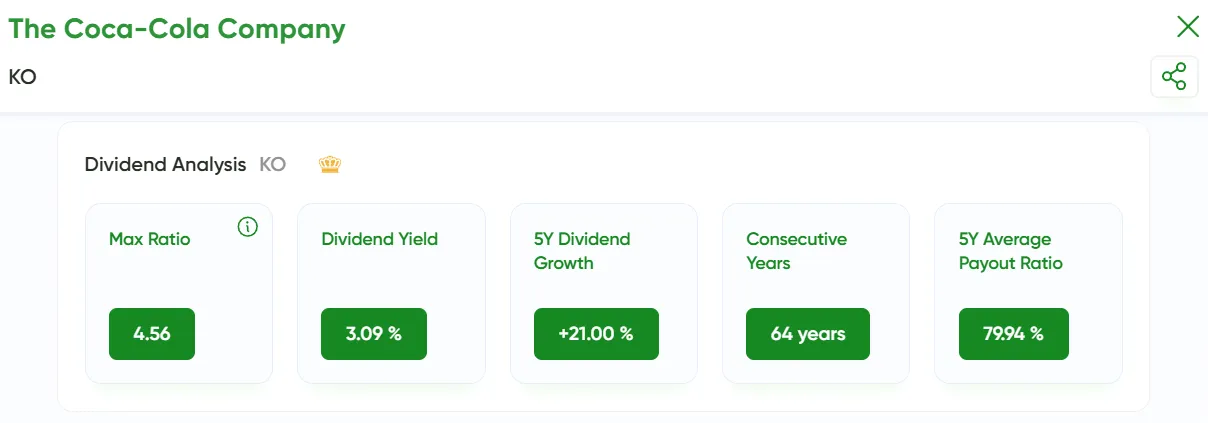

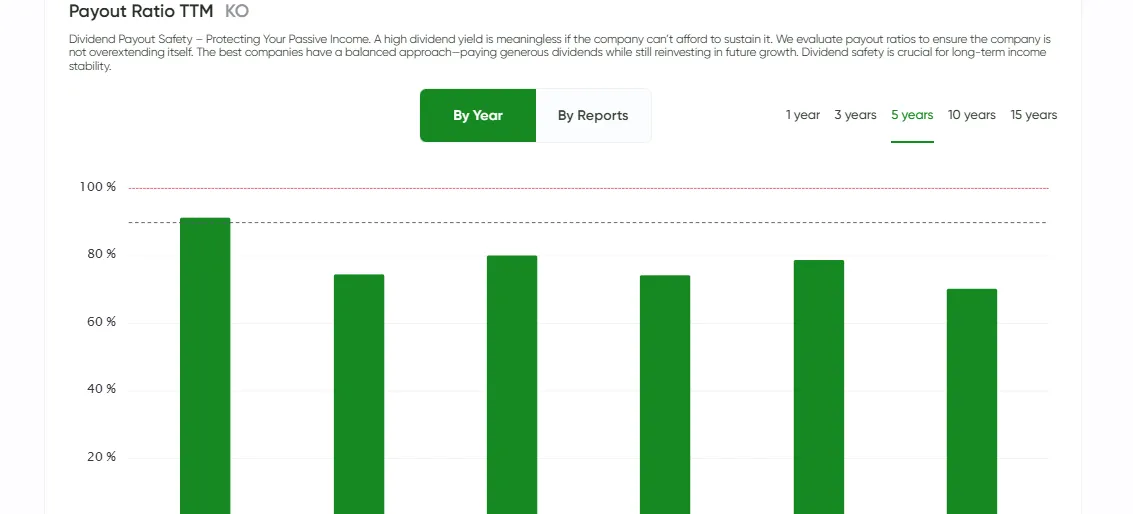

Sequências e aumentos de dividendos na ponta dos dedos.

Sequências e aumentos de dividendos na ponta dos dedos.

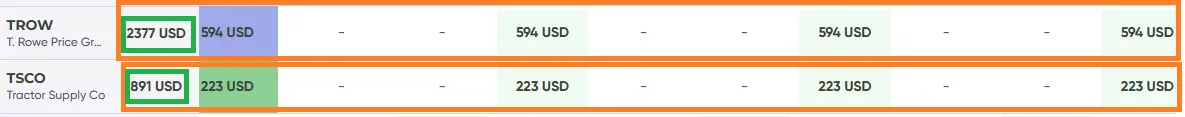

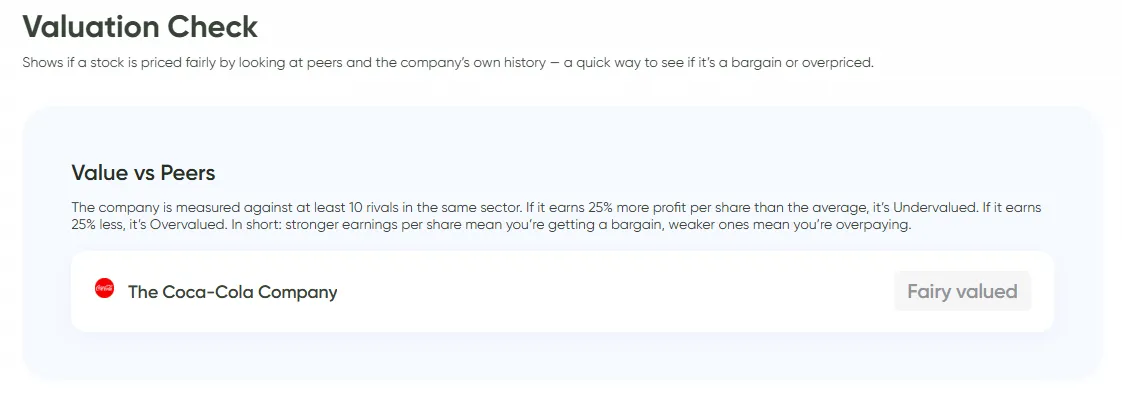

Compare a empresa com rivais. Se ela ganha mais por ação, está subvalorizada. Se menos, superfaturada.

Compare a empresa com rivais. Se ela ganha mais por ação, está subvalorizada. Se menos, superfaturada.

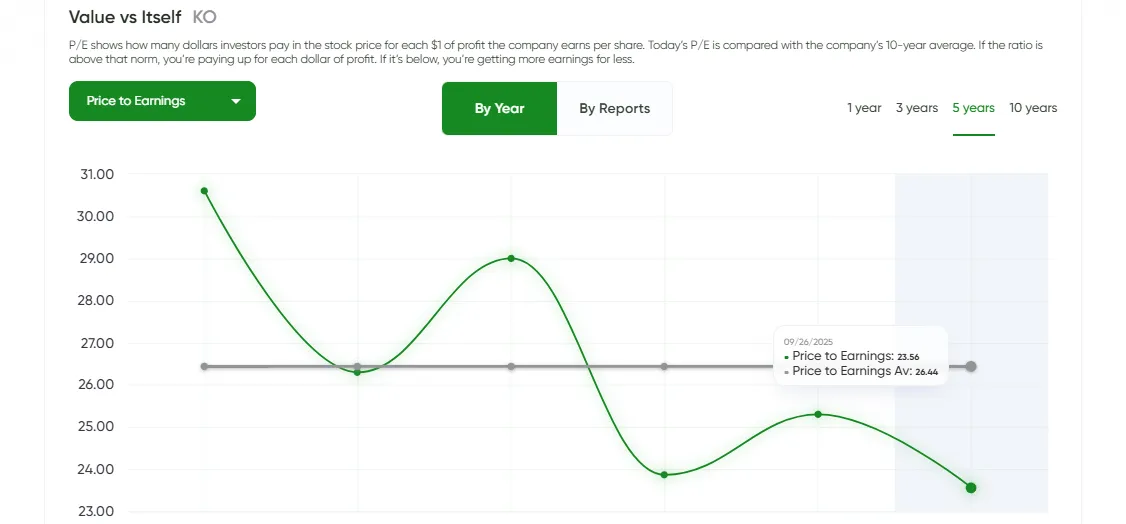

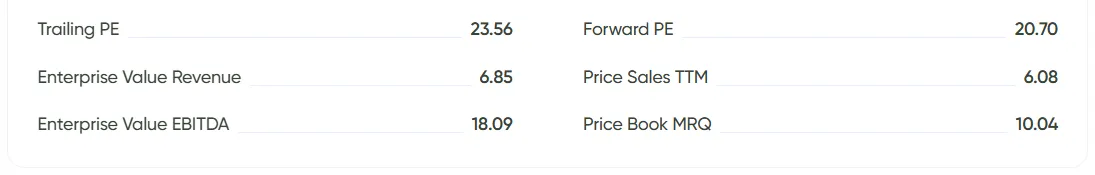

Compare o P/L de hoje com seu próprio histórico de 10 anos. Acima da média = caro. Abaixo = pechincha.

Compare o P/L de hoje com seu próprio histórico de 10 anos. Acima da média = caro. Abaixo = pechincha.

Veja se a ação negocia abaixo de seus ativos. Isso é comprar o negócio com uma margem de segurança embutida.

Veja se a ação negocia abaixo de seus ativos. Isso é comprar o negócio com uma margem de segurança embutida.

BeatStart

BeatStart