Galileo Protocol

LEOXPrice Chart

Galileo Protocol is a Multichain, peer-to-peer community platform created with QRC-20 token and QRC-721 tokenisation technology. Our platform lets brands, owners, and customers discover, browse, purchase, and create NFTs tied to physical assets. We call these pNFTs. The term pNFTs refers to ‘physical Non-Fungible Tokens’, tokenised physical assets. These can apply to almost anything where ownership is essential, like real estate, luxury watches, and cars. The pNFT is a digital representation of the physical object to which it is linked, a digital twin. It provides all the advantages of a conventional NFT (unique, traceable, immutable, and secure) while abstracting much of the complexity involved in trading a physical asset. Galileo's pNFTs provide a valuable tool for buyers and sellers to establish the authenticity of the underlying asset. The Galileo protocol will allow most people and businesses to tokenise real-world assets into NFTs. These NFTs are obtainable with fiat or cryptocurrencies, such as $USDC, $LEOX, $QNT, and more. Galileo Protocol offers a plethora of services under its umbrella, including: - An open source marketplace - Cheaper and faster transactions - Currency and pNFT transfer - A wide variety of pNFTs to collect - Redemption and escrow system - Fiat & Crypto payment options - Defi lending protocol The $LEOX token will serve as a utility token within the Galileo ecosystem. The $LEOX utility token functions as a digital currency you can use on the Internet when dealing with physical assets. $LEOX will also enable critical functions, including serving as a medium of exchange for platform services, milestone rewards, transaction fees, and governance rights.

See the whole business at a glance — what it does, how it earns, and the value it brings.

See the whole business at a glance — what it does, how it earns, and the value it brings.

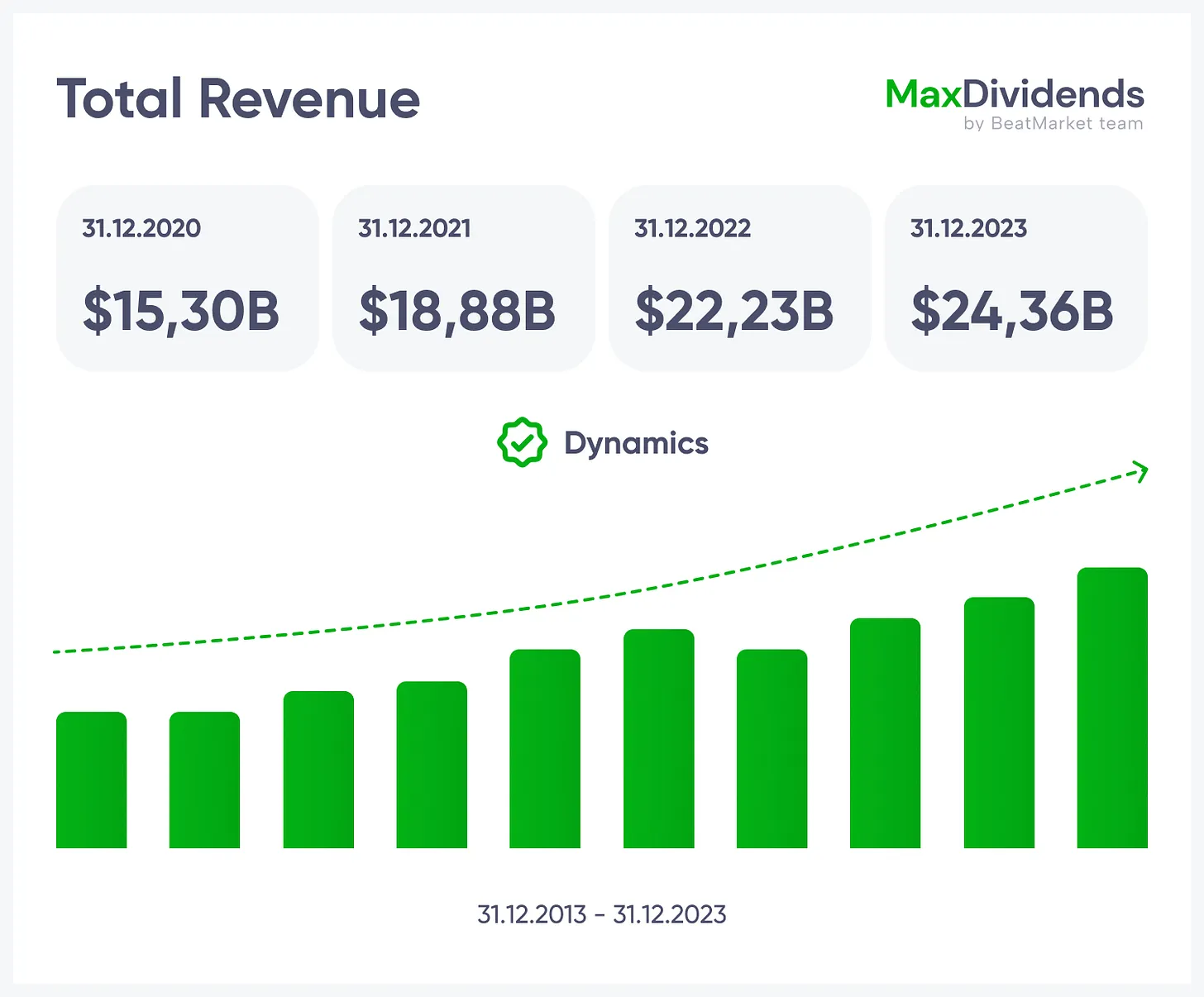

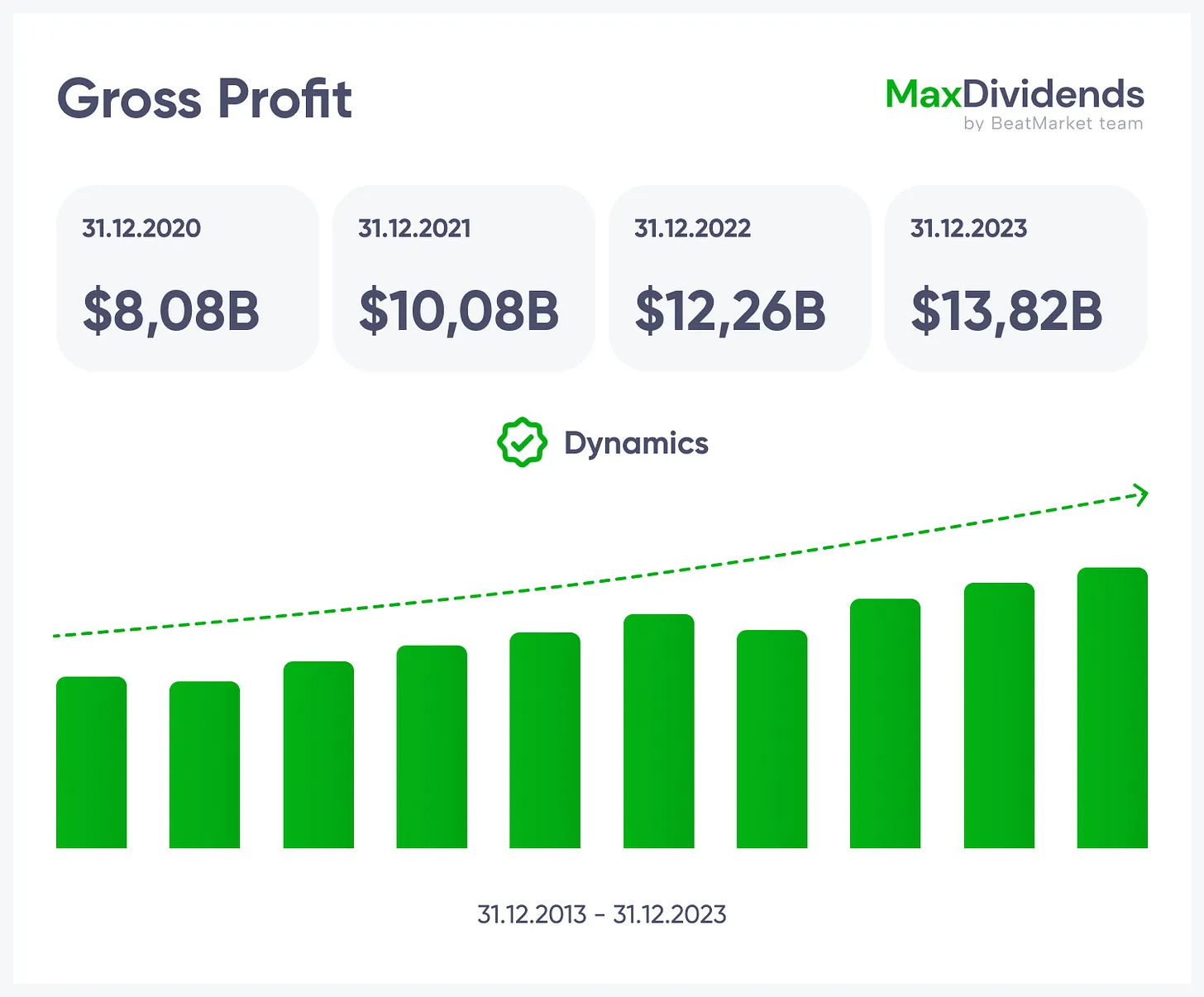

Growth trend, clear in one glance.

Growth trend, clear in one glance.

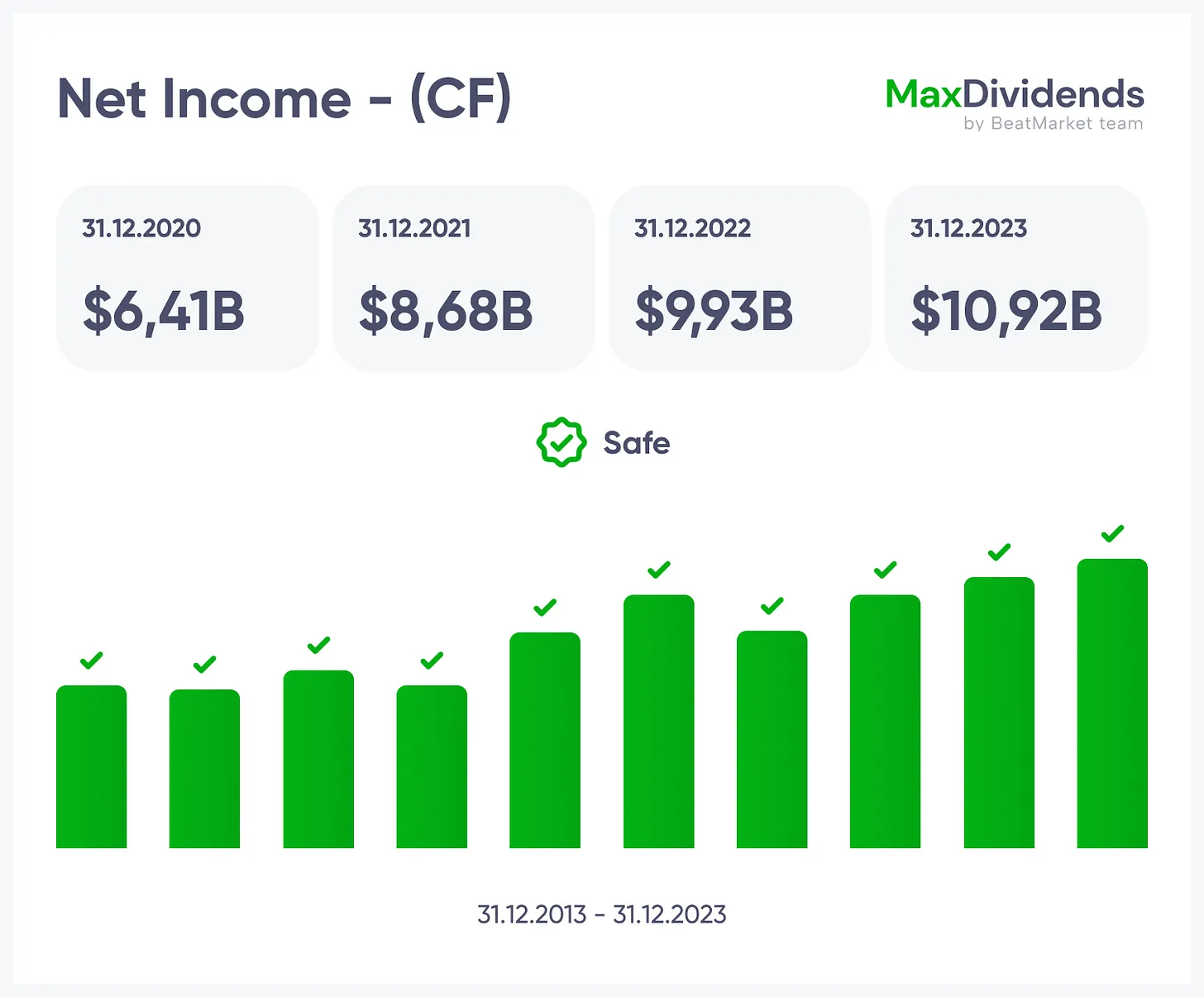

See if profits are real — instantly.

See if profits are real — instantly.

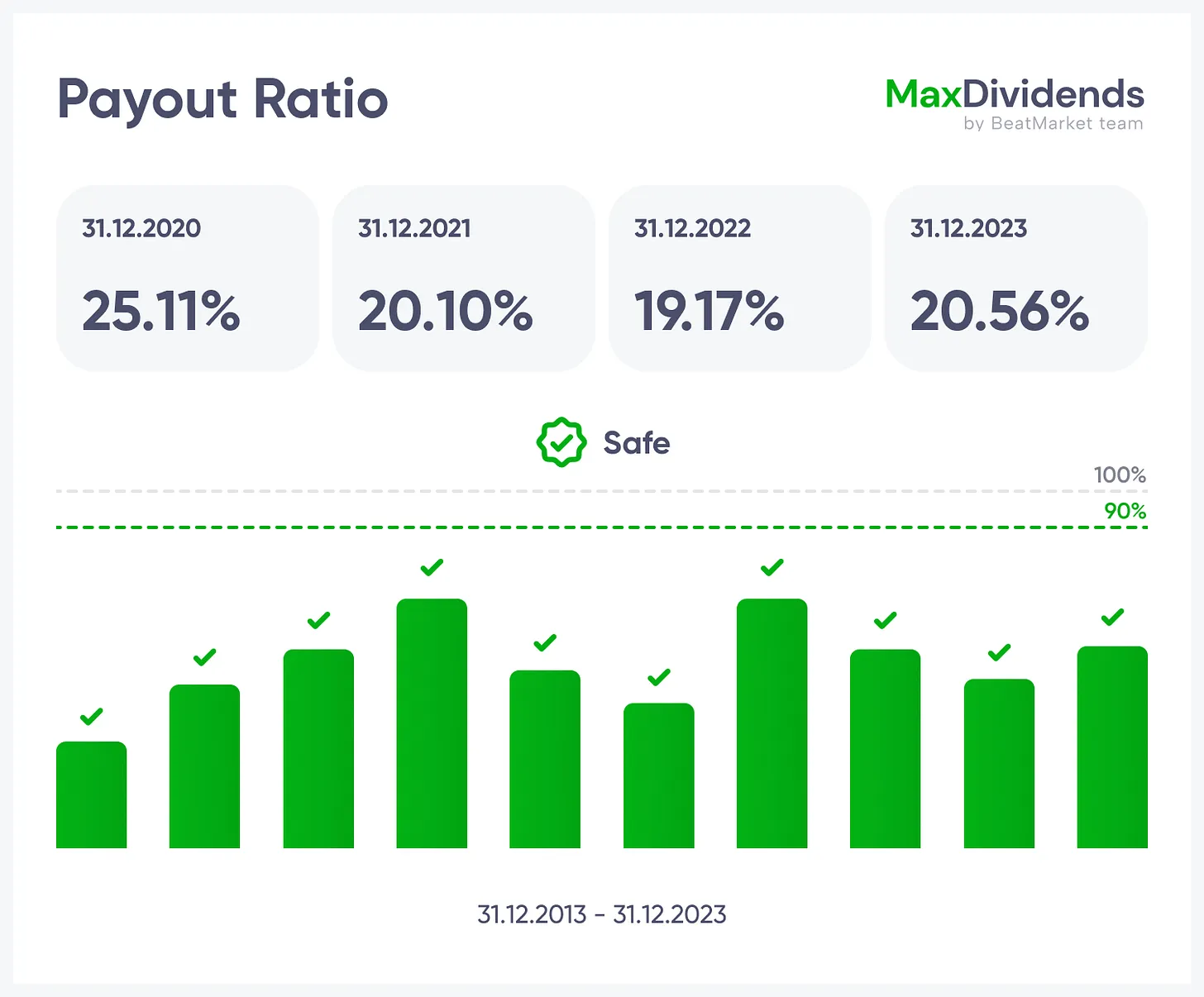

Bottom line made simple with MaxDividends.

Bottom line made simple with MaxDividends.

Debt risk checked for you, 24/7.

Debt risk checked for you, 24/7.

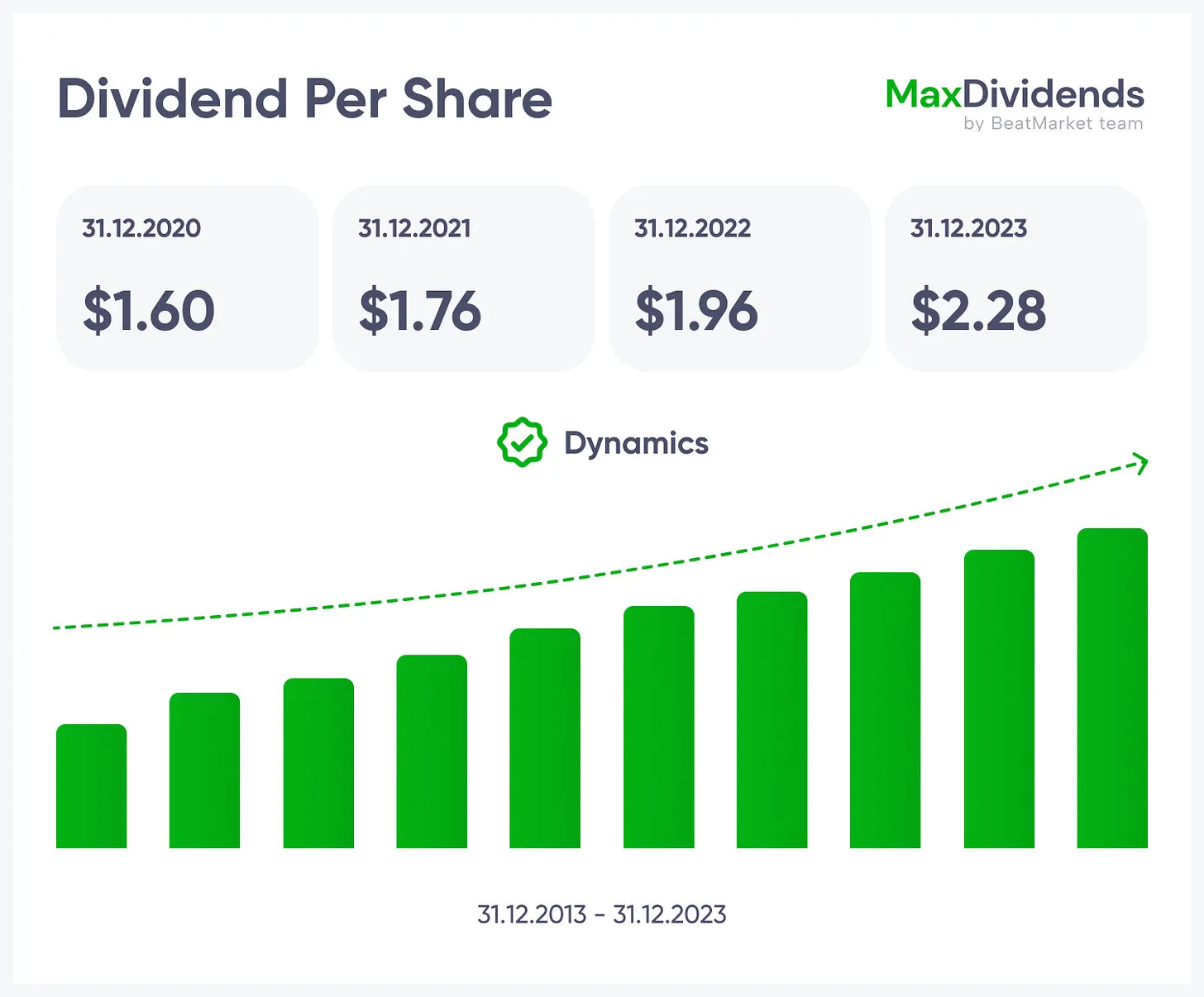

Dividend streaks and raises at your fingertips.

Dividend streaks and raises at your fingertips.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

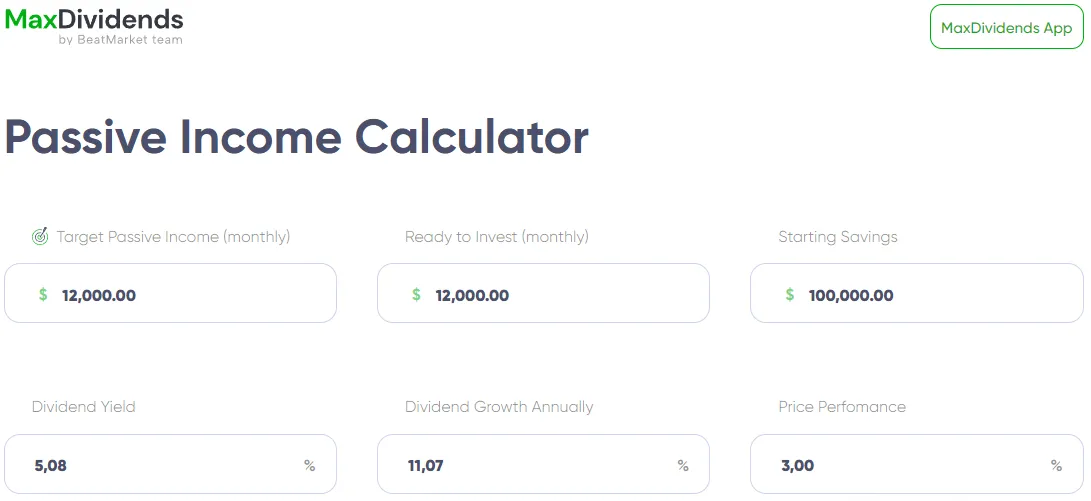

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

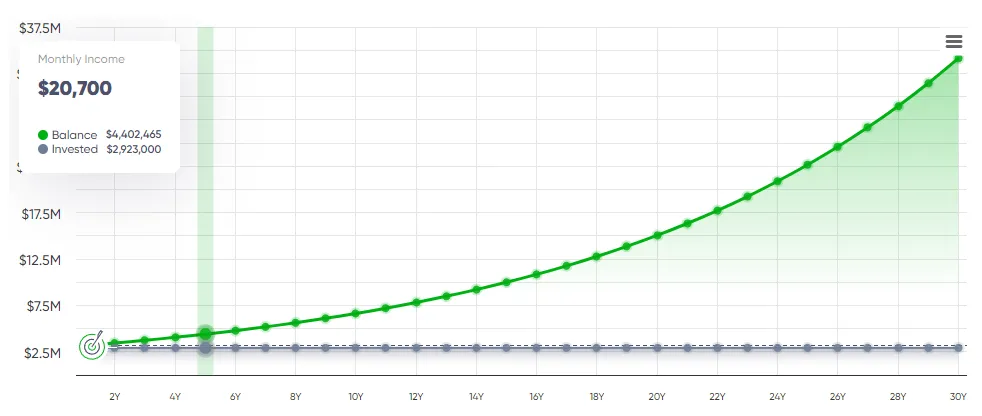

MaxDividends App: Passive Income Calculator, Income Forecast

MaxDividends App: Passive Income Calculator, Income Forecast

BeatStart

BeatStart