SAWA Crypto

SAWAPrice Chart

The SAWA project was launched in early 2022 by a team from Turkey. SAWA aims to develop decentralized fundraising for technology companies. The project already has a working product, this is SawaStarter, which can already be tested. Gradually, SAWA will develop into an ecosystem of decentralized products based on smart contracts, which will include its own OTC solution, DEX exchange, NFT trading platform. SAWA also launched its own utility token, which will provide token holders with early access to projects to be listed on the SawaStarter launch pad, the opportunity to participate in the distribution of platform profits among them, and guarantee the safety of OTC transactions for Purchase and Sale of equity with collateral through the SAWA token. The token will generate non-inflationary returns through staking and farming, by creating liquidity pools for DEXSAWA. The commission income from transactions on DEXSAWA will be distributed in the form of dividends among SAWA token holders. All SAWA holders have the opportunity to vote and participate in the governance of the DAO platform. Another utility model where the SAWA token will be used to pay for SAWA expert access for those who want to publish and monetize their experience. At the very beginning, access will be free to attract more users. The SAWA token also provides for staking, which allows platform users to increase their share in the rating system. 32% of total tokens supply is reserved for staking and farming rewards, regarding that amount is limited so when it gets over satking reward would be paid only from SAWA net income. The rates are determined by token holders voting. As voting power as well as received dividend volume depends on the quantity of SAWA tokens held by users - staking is a good chance to earn more tokens to earn more dividends and to get more votes to participate in SAWA growth and development.

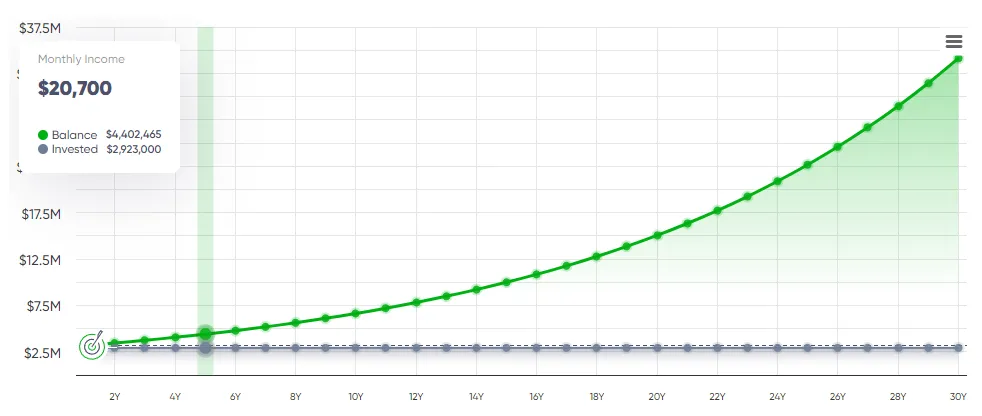

See the whole business at a glance — what it does, how it earns, and the value it brings.

See the whole business at a glance — what it does, how it earns, and the value it brings.

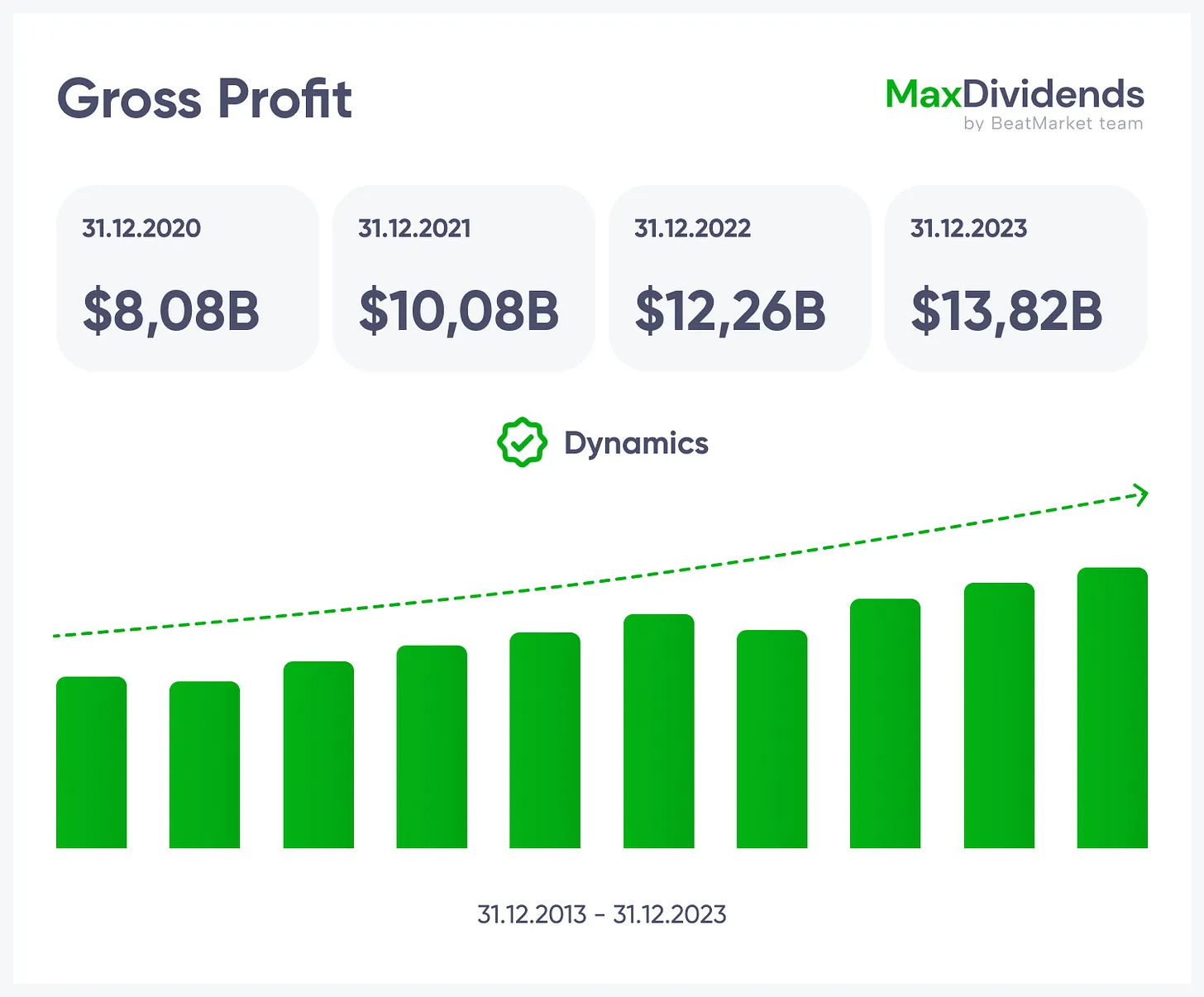

Growth trend, clear in one glance.

Growth trend, clear in one glance.

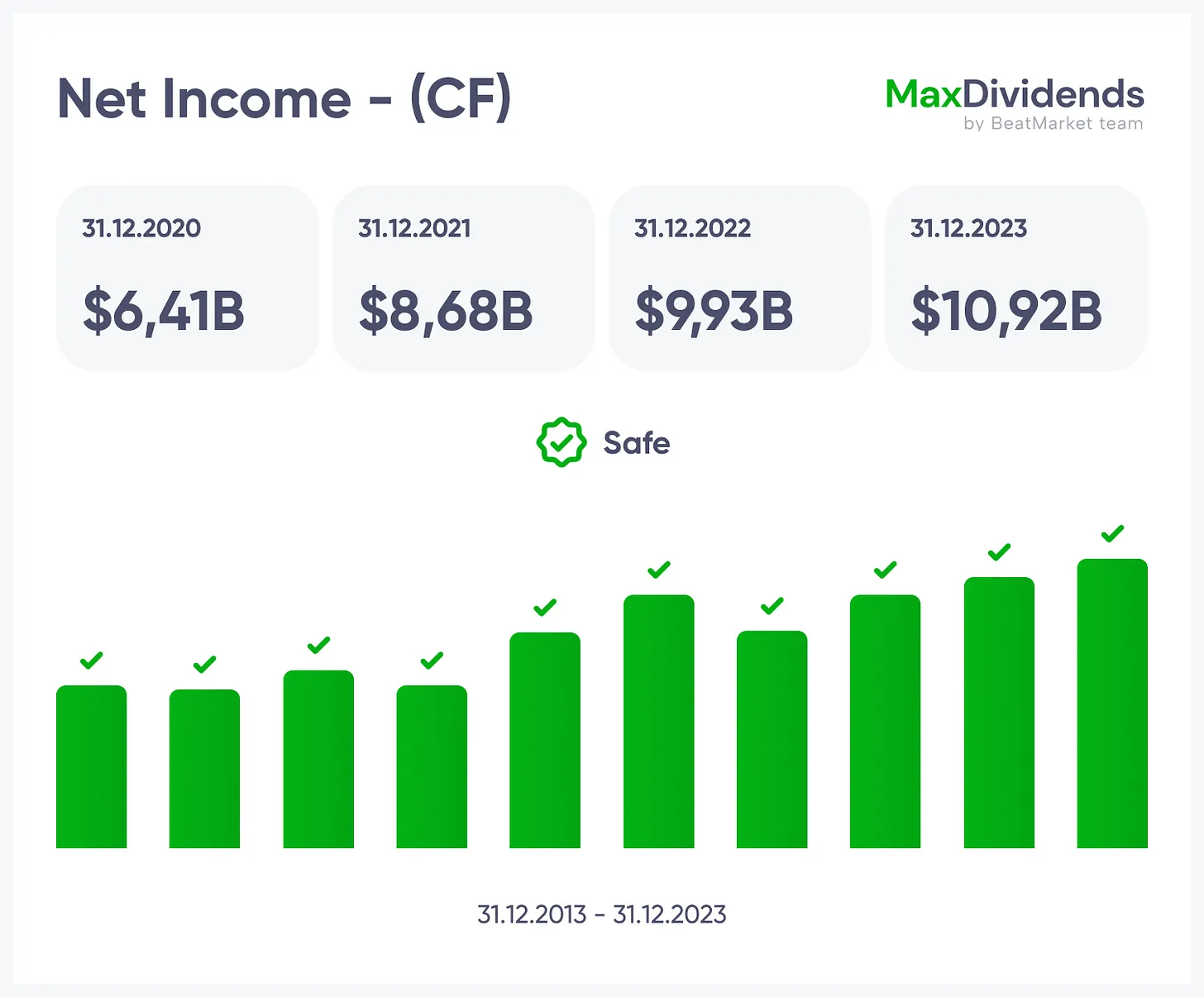

See if profits are real — instantly.

See if profits are real — instantly.

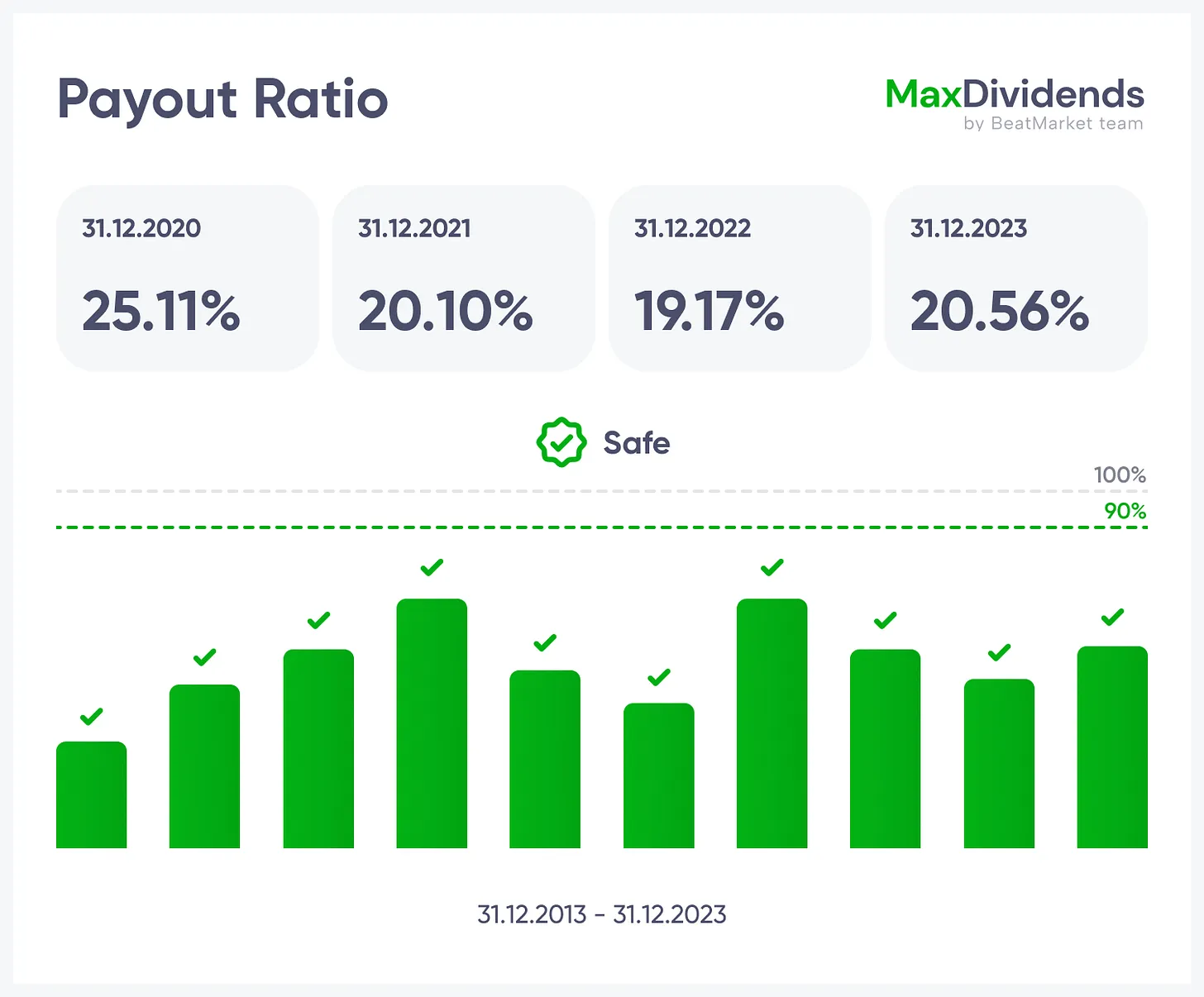

Bottom line made simple with MaxDividends.

Bottom line made simple with MaxDividends.

Debt risk checked for you, 24/7.

Debt risk checked for you, 24/7.

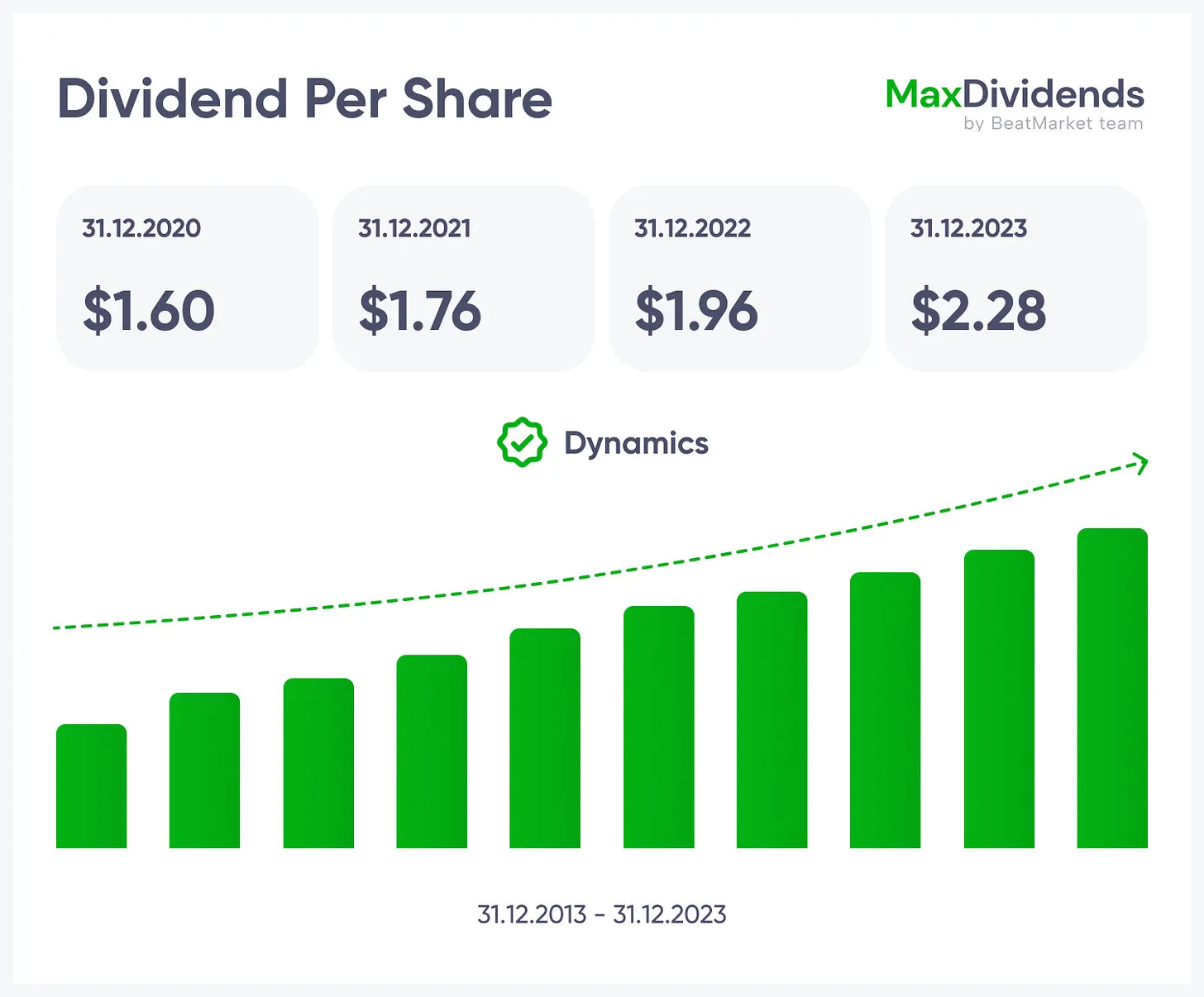

Dividend streaks and raises at your fingertips.

Dividend streaks and raises at your fingertips.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Stack the company against rivals. If it earns more per share, it's undervalued. If less, overpriced.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

Compare today's P/E with its own 10-year history. Above average = expensive. Below = bargain.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

See if the stock trades below its assets. That's buying the business with built-in margin of safety.

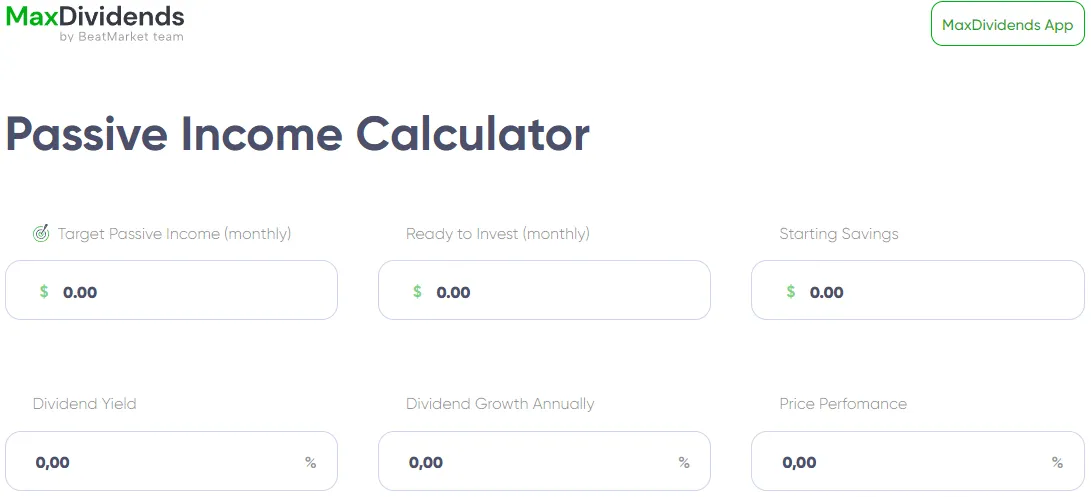

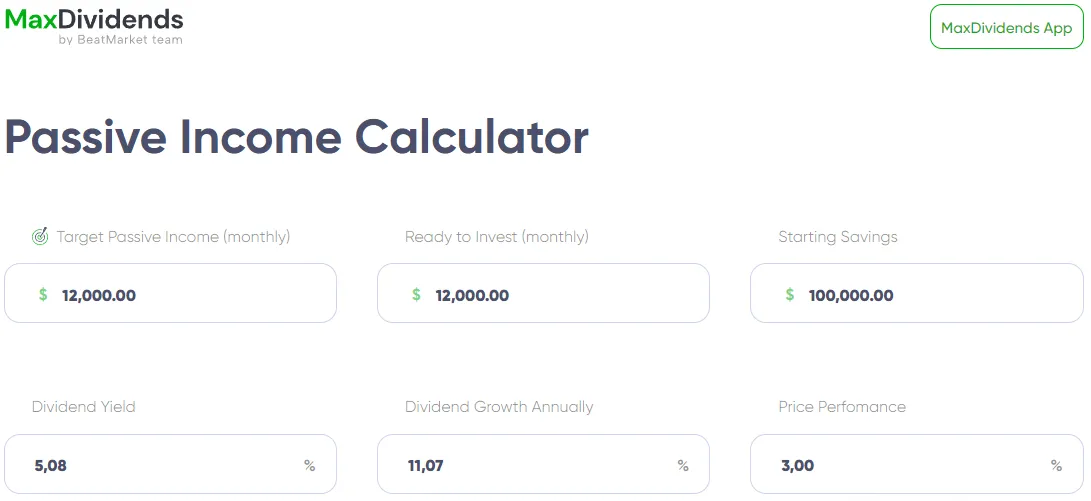

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

Plug in those values, hit calculate, and boom—you've got your roadmap.

Plug in those values, hit calculate, and boom—you've got your roadmap.

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator

MaxDividends App: Passive Income Calculator, Income Forecast

MaxDividends App: Passive Income Calculator, Income Forecast

BeatStart

BeatStart