The key feature of silver as an investment asset is the real value of silver. Silver is primarily a physical commodity. That makes it impossible for its value to fall to zero. Therefore, it also makes it a proper instrument for inflation protection.

Gold has similar qualities. But silver has a few differences from the most popular of the precious metals:

Traditionally, both silver and gold are considered "true" money. Both metals have an inverse correlation to the U.S. dollar. But in times of economic turmoil, the outlook for silver prices is negative. Investors seek shelter in gold with the Gold/silver ratio rising. Silver begins to overtake "its competitor" during periods of production recovery.

It is worth adding this asset to your portfolio for those who:

This precious metal is a good asset to diversify a large portfolio. However, it is improper for holding an emergency fund.

Investments in physical silver provide no passive income. As an alternative, you can consider buying stocks of mining companies, such as First Majestic Silver (AG).

These kinds of assets pay dividends. Besides, they are unlikely to suffer in the event of a crisis like the dot-com bubble.

The price of silver is largely determined by the balance of supply and demand. But market expectations of a recession are making serious adjustments. The best time to invest in this metal is during periods of economic growth.

The 2008 crisis was deflationary in nature. Silver was getting cheaper, as well as other assets. From the beginning of March to November its quotations fell by more than half. They fell to $9 per ounce.

-26.90%Between April and May, silver traded around an all-time high of $49. This short-term peak was due to expectations of high inflation rates. Concerns related to the downgrade of the US credit rating played an important role.

+55.73%Amid panic in March, the price fell to $11.77. But already by August, the silver market reached the maximum for 7 years. Quotes reached $29.14 per ounce. This was due to the growing demand for the metal amid falling supply. Because of the pandemic, 101 mines were closed. The volume of mining has decreased dramatically.

+47.44%Silver price demonstrates positive dynamics. There is every reason to believe that this situation will not change in the coming days. The current moment is proper for building up positions in the metal regardless of the investment horizon.

Silver price forecasting can be based on technical analysis. For this purpose, popular tools and indicators are used. For example:

The technical analysis tools listed are among the simplest for beginner investors. However, they can provide fairly reliable forecasts.

All technical analysis indicators share a common drawback: they only consider past data. As a result, some signals may turn out to be false. Fundamental factors and significant news can lead to abrupt changes in trends.

The data on popular indicators and tools are given below. You can adjust your trading strategy based on them.

Buy: 16.67%

Sell: 0%

Neutral: 83.33%

Buy: 100%

Sell: 0%

Neutral: 0%

| Header | Sell | Neutral | Buy | Action |

| Moving Averages |

0% |

0% |

100% |

Strong Buy |

| Oscillators |

0% |

83.33% |

16.67% |

Buy |

| Name | Value | Action |

| RSI(14) |

67.63 |

Neutral |

| Stochastic %K (14, 3, 3) |

28.29 |

Neutral |

| Stochastic RSI Fast (3, 3, 14, 14) |

28.29 |

Neutral |

| Williams Percent Range (14) |

-46.7 |

Buy |

| CCI(20) |

82.68 |

Neutral |

| Ultimate Oscillator (7, 14, 28) |

57.82 |

Neutral |

| Period | Simple | Exponential |

| MA10 |

78.48 |

79.33 |

| MA20 |

64.17 |

68.36 |

| MA30 |

55.92 |

61.35 |

| MA50 |

47.05 |

52.87 |

| MA100 |

38.43 |

42.82 |

| MA200 |

30.44 |

34.77 |

| Pivot | Classic | Fibonacci | Camarilla | Woodie | Demark |

| Middle | 61.638333333333 | 61.638333333333 | 61.638333333333 | 64.2205 | 67.168 |

| S3 | - | 6.2203333333333 | 57.57905 | - | - |

| S2 | 6.2203333333333 | 27.390009333333 | 62.659033333333 | 8.8025 | - |

| S1 | 39.519666666667 | 40.468657333333 | 67.739016666667 | 44.684 | 50.579 |

| R1 | 94.937666666667 | 82.808009333333 | 77.898983333333 | 100.102 | 105.997 |

| R2 | 117.05633333333 | 95.886657333333 | 82.978966666667 | 119.6385 | - |

| R3 | 172.47433333333 | 117.05633333333 | 88.05895 | 155.52 | - |

The forecast for silver prices is positive. A strong uptrend is expected in the coming week. This is due to investors' optimism about real assets. The expectation of weakening of the dollar exchange rate also has a significant impact on the quotations.

| Date | Min forecast price | Max forecast price | Change |

| 04.02.2026 | 75.32 USD | 83.24 USD | -5.93 USD (-7.49%) |

| 05.02.2026 | 71.55 USD | 79.09 USD | -3.96 USD (-5.26%) |

| 06.02.2026 | 71.13 USD | 78.61 USD | -0.45 USD (-0.6%) |

| 09.02.2026 | 73.41 USD | 81.13 USD | +2.4 USD (3.11%) |

| 10.02.2026 | 77.07 USD | 85.19 USD | +3.86 USD (4.76%) |

| 11.02.2026 | 77.48 USD | 85.64 USD | +0.43 USD (0.53%) |

| 12.02.2026 | 81.36 USD | 89.92 USD | +4.08 USD (4.76%) |

| 13.02.2026 | 84.25 USD | 93.11 USD | +3.04 USD (3.43%) |

| 16.02.2026 | 83.04 USD | 91.78 USD | -1.27 USD (-1.45%) |

| 17.02.2026 | 83.21 USD | 91.97 USD | +0.18 USD (0.21%) |

| 18.02.2026 | 87.29 USD | 96.47 USD | +4.29 USD (4.67%) |

| 19.02.2026 | 85.16 USD | 94.12 USD | -2.24 USD (-2.5%) |

| 20.02.2026 | 84.60 USD | 93.50 USD | -0.59 USD (-0.66%) |

| 23.02.2026 | 88.83 USD | 98.18 USD | +4.46 USD (4.76%) |

| 24.02.2026 | 91.03 USD | 100.61 USD | +2.32 USD (2.42%) |

| 25.02.2026 | 95.58 USD | 105.64 USD | +4.79 USD (4.76%) |

| 26.02.2026 | 99.58 USD | 110.06 USD | +4.21 USD (4.02%) |

| 27.02.2026 | 97.91 USD | 108.21 USD | -1.76 USD (-1.71%) |

| 02.03.2026 | 93.93 USD | 103.81 USD | -4.19 USD (-4.24%) |

| 03.03.2026 | 98.62 USD | 109.00 USD | +4.94 USD (4.76%) |

| 04.03.2026 | 103.55 USD | 114.45 USD | +5.19 USD (4.76%) |

| 05.03.2026 | 105.83 USD | 116.97 USD | +2.4 USD (2.15%) |

| 06.03.2026 | 105.61 USD | 116.73 USD | -0.23 USD (-0.21%) |

| 09.03.2026 | 100.33 USD | 110.89 USD | -5.56 USD (-5.26%) |

The silver price outlook for the next 5 years is positive. All analysts share this opinion. Financial consultants recommend investors to increase their position in the metal to diversify their portfolio.

Analysts' positive expectations for silver have several fundamental reasons:

Silver is expensive right now when based on historical data over the past decade. Despite this, experts are predicting a positive 5-year outcome. Although there is a probability that in some years quotations will decrease.

| Date | Min forecast price | Max forecast price | Change |

| 01.12.2026 | 118.648 USD | 119.909 USD | +34.06 USD (28.56%) |

| 01.12.2027 | 125.940 USD | 127.122 USD | +7.25 USD (5.73%) |

| 01.12.2028 | 133.162 USD | 134.281 USD | +7.19 USD (5.38%) |

| 01.12.2029 | 140.609 USD | 141.783 USD | +7.47 USD (5.29%) |

| 01.12.2030 | 147.805 USD | 149.029 USD | +7.22 USD (4.87%) |

| 01.01.2031 | 149.170 USD | 150.823 USD | +1.58 USD (1.05%) |

The most optimistic forecast for silver in 2026 predicts a rise in prices to $50-$68, as projected by Gov Capital. Other experts are much more pessimistic. A "golden middle" can be considered the range of $41.68 - $45.92, according to analysts from Coin Price Forecast.

The lowest estimate is provided by Wallet Investor. Their experts expect a decrease in prices to $25. This viewpoint is based on the fact that silver has been in a sideways trend for a long time. Analysts from the platform see no reasons for a break in this trend. BeatMarket experts agree with this view. Our forecast for silver in 2026 is a price below $30.

| Date | Min forecast price | Max forecast price | Change |

| 01.04.2026 | 113.792 USD | 114.395 USD | +28.88 USD (25.31%) |

| 01.05.2026 | 114.029 USD | 114.499 USD | +0.17 USD (0.15%) |

| 01.06.2026 | 114.625 USD | 114.911 USD | +0.5 USD (0.44%) |

| 01.07.2026 | 114.672 USD | 115.914 USD | +0.53 USD (0.46%) |

| 01.08.2026 | 115.787 USD | 116.915 USD | +1.06 USD (0.91%) |

| 01.09.2026 | 116.960 USD | 117.200 USD | +0.73 USD (0.62%) |

| 01.10.2026 | 116.987 USD | 117.840 USD | +0.33 USD (0.28%) |

| 01.11.2026 | 117.836 USD | 118.585 USD | +0.8 USD (0.67%) |

| 01.12.2026 | 118.648 USD | 119.909 USD | +1.07 USD (0.9%) |

The maximum price forecast for the end of 2027 is $94.9, as suggested by Gov Capital. BeatMarket experts consider this estimate to be inflated. In our view, there are no fundamental reasons for a more than fourfold increase in prices over four years.

We believe that the global silver market will continue to move sideways. It is unlikely that prices will stabilize above $30 for long. Previous historical highs were the result of speculation. In our opinion, the current valuation of an ounce of metal is fair.

| Date | Min forecast price | Max forecast price | Change |

| 01.01.2027 | 119.976 USD | 121.767 USD | +35.66 USD (29.5%) |

| 01.02.2027 | 119.392 USD | 120.537 USD | -0.91 USD (-0.76%) |

| 01.03.2027 | 120.405 USD | 121.016 USD | +0.75 USD (0.62%) |

| 01.04.2027 | 120.999 USD | 121.679 USD | +0.63 USD (0.52%) |

| 01.05.2027 | 121.310 USD | 121.878 USD | +0.25 USD (0.21%) |

| 01.06.2027 | 121.913 USD | 122.173 USD | +0.45 USD (0.37%) |

| 01.07.2027 | 121.917 USD | 123.180 USD | +0.51 USD (0.41%) |

| 01.08.2027 | 123.061 USD | 124.175 USD | +1.07 USD (0.87%) |

| 01.09.2027 | 124.237 USD | 124.462 USD | +0.73 USD (0.59%) |

| 01.10.2027 | 124.249 USD | 125.083 USD | +0.32 USD (0.25%) |

| 01.11.2027 | 125.106 USD | 125.841 USD | +0.81 USD (0.64%) |

| 01.12.2027 | 125.940 USD | 127.122 USD | +1.06 USD (0.84%) |

Long-term forecasts are even more variable than short-term ones. Experts name the following ranges:

BeatMarket experts see factors that indicate a likely increase in the price of silver. First and foremost is the growth in demand from the green energy sector. The second was the lagging of gold, which was the earliest the market wagged out.

We therefore disagree with the negative outlook. At the same time, we consider the $100 bar to be overstated. In our view, the maximum probability is a moderate projection. We expect the price per ounce not to exceed $30 by the end of 2028.

| Date | Min forecast price | Max forecast price | Change |

| 01.01.2028 | 127.510 USD | 129.050 USD | +43.07 USD (33.57%) |

| 01.02.2028 | 126.705 USD | 127.844 USD | -1.01 USD (-0.79%) |

| 01.03.2028 | 127.763 USD | 128.229 USD | +0.72 USD (0.56%) |

| 01.04.2028 | 128.450 USD | 128.961 USD | +0.71 USD (0.55%) |

| 01.05.2028 | 128.580 USD | 129.216 USD | +0.19 USD (0.15%) |

| 01.06.2028 | 129.171 USD | 129.458 USD | +0.42 USD (0.32%) |

| 01.07.2028 | 129.297 USD | 130.438 USD | +0.55 USD (0.43%) |

| 01.08.2028 | 130.338 USD | 131.473 USD | +1.04 USD (0.79%) |

| 01.09.2028 | 131.465 USD | 131.741 USD | +0.7 USD (0.53%) |

| 01.10.2028 | 131.604 USD | 132.409 USD | +0.4 USD (0.31%) |

| 01.11.2028 | 132.373 USD | 133.136 USD | +0.75 USD (0.56%) |

| 01.12.2028 | 133.162 USD | 134.281 USD | +0.97 USD (0.72%) |

The future outlook for silver is optimistic. The answer to the question of whether silver prices are expected to rise is affirmative. The average price of the metal in the next decades will be higher than in the previous decades. There are several reasons for this:

Contrary to gold, however, silver is still not predicted to experience crazy rallies. The historic highs of 1980 and 2011 were the result of speculation. And the peak price was short-lived.

According to most forecasts, silver prices can be expected to reach triple digits closer to 2050. Few analysts are convinced that silver will cross $100 in the next 10 years.

The main reasons for this:

According to the Silver Institute, Since 2020, industrial demand for silver has been growing. In 2023, it increased by a total of 11%.

For the next 10 years, silver price forecasts are generally optimistic. Experts predict no decrease in quotations. Yet the best result, which is promised by analysts, is about $100. Это оценка Coin Price Forecast.

But most experts expect only approaching the historical maximum. BeatMarket specialists agree with this view. Silver does not have the same investment demand as gold and is not considered a traditional safe-haven asset. The price increase in 2020 was driven by a unique situation, and a repeat of such a scenario is unlikely. It is doubtful that silver will turn out to be the most favorable asset on the horizon for a decade.

Long-term forecasts are even more variable than short-term ones. Experts mention the following ranges:

BeatMarket experts see factors indicating a likely increase in the price of silver. Firstly, this is the growth in demand from green energy. Secondly, lagging behind gold, which used to be played out by the market.

Therefore, we disagree with the negative forecast. At the same time, we consider the $100 mark to be overestimated. In our opinion, the moderate forecast has the highest probability. We expect that by the end of 2028, the price per ounce will not exceed $45.

Some experts believe silver will reach a price of $75-$80 by 2030. But the average forecast value is $50-$55. For example, this level is considered achievable by experts of the Red Cloud Financial Services platform. This result gives a growth of more than x2 relative to the 2023 level. However, there are also those analysts who expect $27-$30 per ounce.

The most popular scenario forecasts an increase in silver prices to $75-$85 by 2030. Forecasts within this range can be seen on many platforms, such as Coin Price Forecast. However, BeatMarket experts hold a less optimistic view. Our target price is $55-$60. Currently, there are no fundamental factors that would lead to a higher increase in value. Prices above $60 could be the result of one of two reasons:

It is difficult to predict the long-term price of silver. Its level is influenced by many factors. Experts' assessments differ greatly. The following figures can be used as benchmarks:

This valuation is provided by the experts at Investing Cube. The minimum threshold is calculated based on fundamental factors. The range of $78-$138 is derived using technical analysis tools.

The most optimistic estimate is $289.59, suggested by analysts at Bit Screener. However, BeatMarket experts consider the most likely range to be $50-$75 per ounce. This threshold aligns with the current pace of demand growth for silver. An increase in demand could be driven by the active development of green energy, particularly the expansion of solar panel technology.

Solar power is predicted to require 500 million ounces of silver per year by 2050. This represents almost half of the total current demand. Solar panel production is one of the most important applications of silver. It is predicted that all reserves will be used for green energy by 2050. This is one of the reasons why quotations are predicted to rise above $100.

The Gold/silver ratio remains quite stable over long periods. Deviations from the average values occur frequently. But in the end, the quotation ratio is leveling out. This is the second reason why experts are confident in the growth of the value of silver.

But there is an opposite point of view. It says that the industry will find an alternative to silver. This will lead to a decrease in interest in the metal. That, in turn, will not allow quotations to rise above the level of $50. In addition, silver has not established itself as a profitable asset in recent decades. Although there has been an increase in demand from manufacturing during this time.

Silver, as with most commodities, is considered a defense against inflation. But this is true when rapid price growth is accompanied by positive expectations. Precious metal prices often fall when a recession is anticipated.

US dollar fluctuations have a significant impact on silver prices. The stronger the dollar, the more pressure on the price. A weak dollar relative to other world currencies favors its growth.

Another important factor is fluctuations in the exchange rate of the most popular metal. Silver quotes quite often follow the dynamics of gold. But sometimes it happens with a noticeable time lag.

Half of the demand for silver is formed by industry. Accordingly, the price of the metal is growing on expectations of lower production levels. This can also happen in case of political conflicts.

But more often the deterioration of the geopolitical situation affects first of all the price of gold. And then, silver quotations are only indirectly affected.

The value of a troy ounce is inversely proportional to the Federal Reserve rate. The higher the rate, the more profitable risk-free assets - deposits and bonds. Therefore, investors are less interested in risky investments. In addition, there is a lower probability that the final profit will justify the risks.

As the pandemic demonstrated, lower production levels lead to higher prices. Many experts note that the industry is already experiencing a shortage of the metal. But there is no reason to believe that there will be an acute shortage of silver in the coming years.

The silver price chart is steadily going upwards. In the coming days and weeks this trend is expected to continue. The current moment is proper for short-term trading of the asset.

The silver price forecast for the next 6-12 months is positive. Experts believe that quotations will go up under the influence of several factors at once. It is unlikely that the bears will be able to reverse the positive mood of the market.

Silver price forecasts for the long-term outlook are positive. Experts hope to see quotations continue to grow. On the horizon of 10 years, a renewal of the historical maximum is predicted.

Experts say that in the future silver prices will be higher than the current ones. Many analysts believe that in 10 years, quotations will approach the $70-$80 threshold.

The average price quoted in the forecasts is $55. But the exact figure will depend on the inflation rate. The industry's demands for increased production will also have an impact.

Such a scenario is unlikely to happen. Few analysts predict a multiple of silver's value even on a decades-long horizon.

Silver quotes have exceeded this mark several times. There are reasons to assume that it will happen again.

This is very unlikely. Manufacturing accounts for half of the demand for silver. In recessionary periods, production declines. So demand for the metal will fall.

It is matter of time. This is likely to happen after a few decades due to inflation. There are also experts who claim that silver is now severely undervalued. They predict a rise in quotations above $100 already in the coming years.

No. He bought the metal in 1997 and held it until 2006, but then sold all the bullion. Since then, Buffett has not returned to investing in silver.

Such forecasts are out there. They are based on expectations of rapid industrial growth. However, this opinion is not shared by all experts.

XAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

SilverXAG

Silver

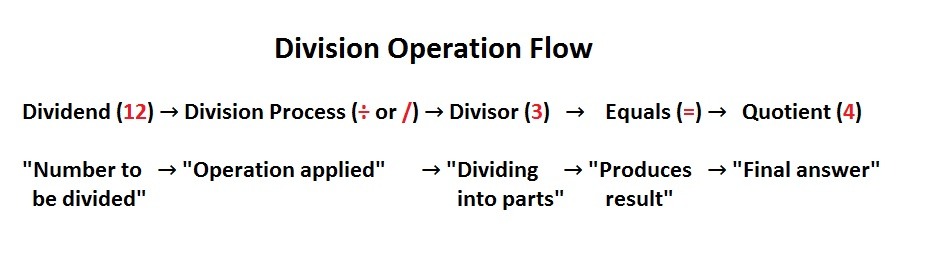

What is a Dividend in Math? Essential Division Concepts for Financial Professionals

Learn what dividends mean in mathematics and why mastering division concepts is crucial for financial analysis and investment careers

2026.01.09

What Is Dividend Income? The Complete Guide to Building Passive Investment Returns

Learn what dividend income is, how corporations distribute profits to shareholders, tax implications for qualified vs ordinary dividends, and proven strategies for building passive returns through compounding and reinvestment.

2025.12.15

Your interview request has been received. We will follow up with additional information via email

The top choice for institutional investors and financial professionals.

All Set