Recently, the analysts at Hartford Funds, in collaboration with Ned Davis Research, updated their extensive study on dividend stocks (“The Power of Dividends: Past, Present, and Future”).

This study compared the performance and volatility of dividend-paying stocks to non-payers over 50 years (1973-2023).

Here’s what they found:

- Non-dividend paying stocks: Averaged a 4.27% annual return and were 18% more volatile than the S&P 500.

- Dividend-paying stocks: Delivered a 9.17% average annual return and were 6% less volatile than the S&P 500.

Table of Contents

Why Dividends Matter

Companies that regularly pay dividends tend to be profitable and transparent, offering a reliable growth outlook. These businesses are expected to increase in value over time, enriching their patient shareholders.

Before diving into investments, my team and I did thorough research on the best ways to invest in reliable, high-dividend stocks. Here’s what we concluded:

1. Predictable Income: Dividends are profits you will definitely receive. They provide a predictable, tangible income stream that goes straight into your pocket every month or quarter.

2. Reinvest for Growth: Reinvesting your dividends can create a snowball effect. As you buy more shares, you earn more dividends, which increases your total income.

3. Stability Over Speculation: Investing in stocks that don’t pay dividends means you’re banking on price growth, which can be unpredictable. High-dividend stocks offer clear, regular payouts, providing stability regardless of market conditions.

“Anybody who invested in growth stocks last year, for instance, would have watched their investment go up, up , up, then come crashing back down in January. But dividends can’t be clawed back, once they’re paid out, that gain is permanent.”

Unknown but experienced investor on Reddit

The Numbers Speak

What can you expect from the MaxDividends strategy? Let’s look at the research:

Fact #1: Stability of Dividend Payments:

- 91% of MaxDividends companies continue paying dividends without interruption 15+ years after purchase.

- 84% continue paying dividends without interruption 20+ years after purchase.

We analyzed 25 years of US and global stock markets, focusing on the stability of dividend payments from companies selected using the MaxDividends strategy. Here are the results:

Holding Period | Stopped Paying Dividends (%)

2 years - 3.35%

5 years - 4.26%

7 years - 7.69%

10+ years - 8.47%

15+ years - 10.14%

20+ years - 17.35%Fact #2: Growing Dividend Payments:

- 99% of portfolios based on MaxDividends stocks pay more dividends the following year compared to the purchase year, without additional investments.

We selected 50 random 1-year time periods, starting in 1999 and ending in 2024. For each selected year, we formed the Top 10 stocks according to the MaxDividends strategy.

Next, we calculated the amount of dividends that these companies paid at the time of purchase and compared them with the amount of dividends they paid after 1 year.

In all 50 cases, the dividend amount for the following year was higher than the dividend amount at the time of purchase without reinvestment of dividends.

In each case, the dividend amount increased by an average of 9.63% year-over-year. That is, if at the beginning of the period you had $100 in dividends, then next year you will have $109.63.

Timeline of U.S. Stock Market Crashes

2008 Recession: 159 companies suite to parameters of MaxDividends stocks

- 147 increased dividends that year

- 11 kept the same payments

- 1 cut dividends ~15%

- 0 canceled dividend payouts

2015 Stock Market Selloff: 137 companies suite to parameters of MaxDividends stocks

- 125 increased dividends that year

- 10 kept the same payments

- 2 cut average ~17%

- 0 canceled dividend payouts

2020 Coronavirus Crash: 129 companies suite to parameters of MaxDividends stocks

- 117 increased dividends that year

- 12 kept the same payments

- 0 cut the dividend payments

- 0 canceled dividend payouts

Fact #3: Long-term performance:

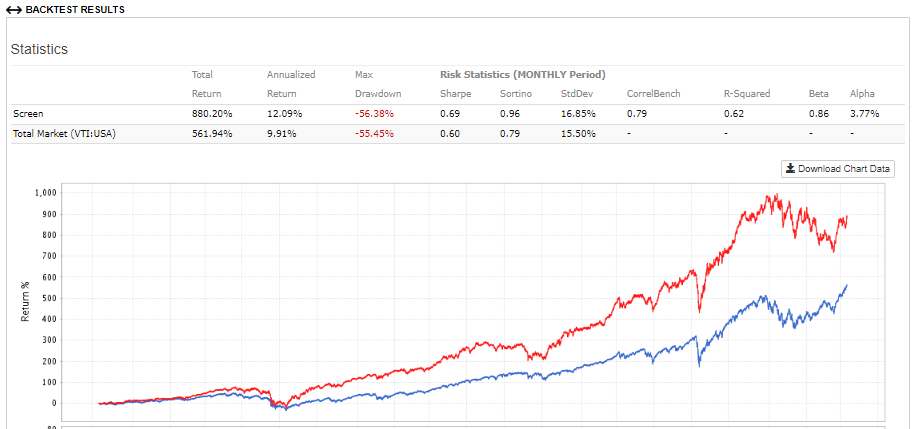

- MaxDividends stock outperforms the broader market over the long term 11.32% vs. 9.91% for the broad market

We ran 100+ multiple-period single tests and 250+ rolling tests

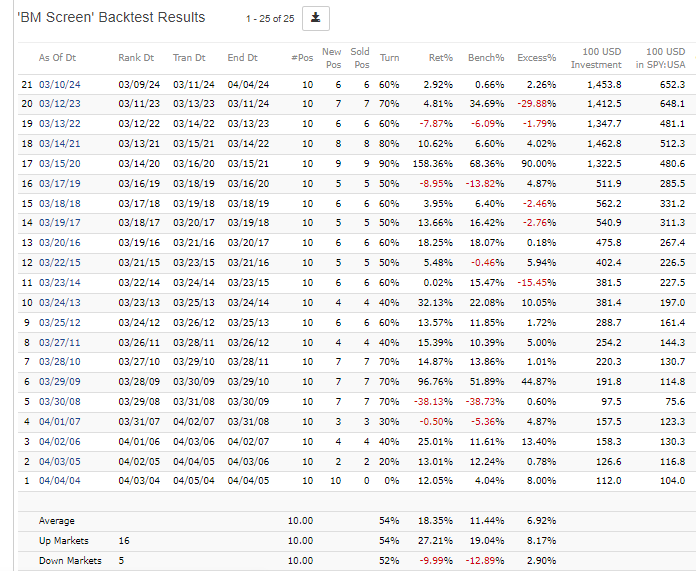

- Buying the Top 10 MaxDividends stocks and selling them after a year, reinvesting the dividends. Here’s what we found:

An example of one such test is shown in the screenshot below. MaxDividends reinvestment-adjusted return: +12.09% per annum over 20 years, which is 2.18% higher than the broad market’s return.

- In another case, we used the MaxDividends app strategy, buying the Top 10 MaxDividends shares and selling companies only if they:A) stopped paying/raising dividendsB) became unprofitable, did not develop any longer

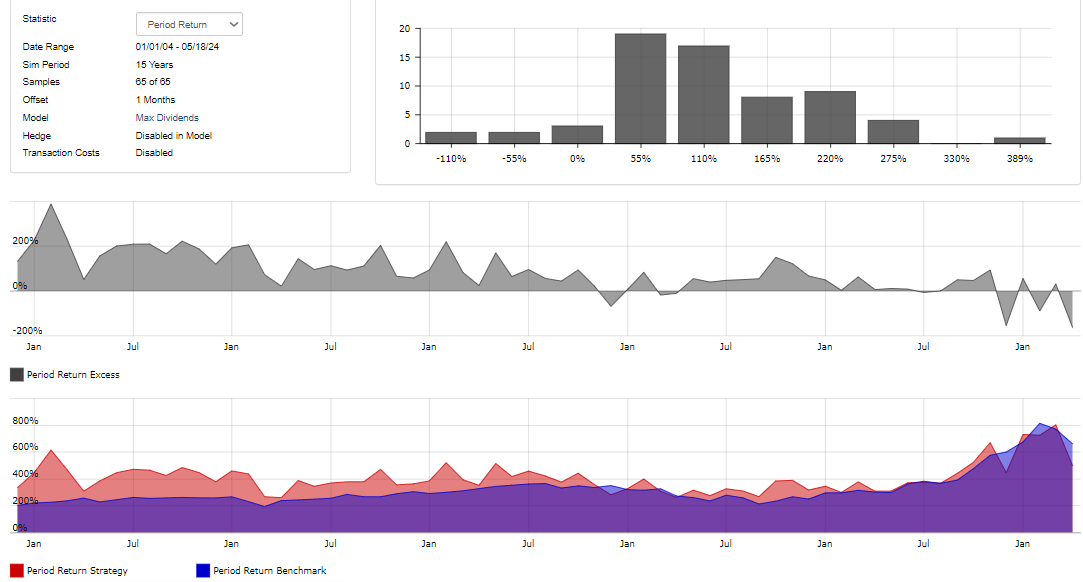

Rolling tests results. 65 scenarios.

- Average annual return: 11.32% vs. 9.91% for the broad market.

- Average MaxDrawdown: -46.02% vs. -51.90% for the broad market.

- Portfolio average deviation: 14.82% vs. 14.99% for the broad market.

Conclusion

Our extensive tests demonstrate that choosing reliable, high-dividend stocks can provide a solid foundation for capital growth and passive income. With the MaxDividends strategy, you can enjoy predictable, growing dividends and long-term stability.

Sunday Coffee is a column where I share insights on stock investing and the philosophy of long-term investment, discuss intriguing thoughts and ideas that could benefit you.

Did you enjoy the MaxDividends idea and research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Sharing it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research about passive income based on investing in solid high yield dividend stocks: from a small startup team of private investors, followers of F.I.R.E and dividend income, not a fund, bank or so … !

FAQ

👉 How Do We Choose MaxDividends Stocks?

👉 MaxDividends Roadmap to Early Retirement with Living Off Dividends

🙏 A few important notes:

We’re not Wall Street managers or a fund, and our fee for using the product will be the lowest in the world. We’re a startup and a group of individual investors who, like you, want to live off dividends.

Profit isn’t the project’s main goal. Once we cover the costs of maintenance and development, we’ll direct most of our earnings to charity and funds for research and fighting complex diseases.

Did you enjoy the MaxDividends idea and research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Sharing it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research about passive income based on investing in solid high yield dividend stocks: from a small startup team of private investors, followers of F.I.R.E and dividend income, not a fund, bank or so … !

Support us and welcome aboard! Launch your own dividend machine following Max Dividends strategy.