Table of Contents

As we get older, we also get wiser. But one thing remains true: we’re not getting any younger.

No one wants to work forever, and the question of financial security becomes more pressing. Can we really count on enjoying life after retiring, without having to find another job just to make ends meet?

MaxDividends is subscriber’s supported newsletter with community and community member’s tools to start building long-term growing passive income to live off dividends.

If a few more people become paid subscribers, MaxDividends can offer more value, develop better tools for private investors, and help even more through charity. So, if you can swing it, please support this work.

Get 7 day free trial on Substack

Early retirement?

The idea of growing passive income typically dawns on us when we realize we’re no longer in our twenties. For me, this realization hit around age 35. I don’t plan to run a business my entire life—I have big plans for other areas of my life too. I enjoy writing, blogging, and sharing my experiences.

🙏 To focus on what I love, I needed to stop worrying about daily expenses. For me, the solution was creating a growing passive income stream through dividend stocks.

Ten years ago, I started investing in growth stocks. By now, the capital from those investments and my past savings have allowed me to start implementing my planned strategy. In the early years, I focused primarily on growth stocks, but over the past few years and especially in recent months, I’ve shifted more towards high-yield, growing dividend stocks.

At this stage in my life, predictable passive income is more important than the long-term price appreciation of stocks, because I plan to live off the dividends.

To understand how to move from point A to point B, my team and I developed a simple calculator to determine when I can transition from active work to a growing passive income stream, allowing me to step back from my day-to-day responsibilities.

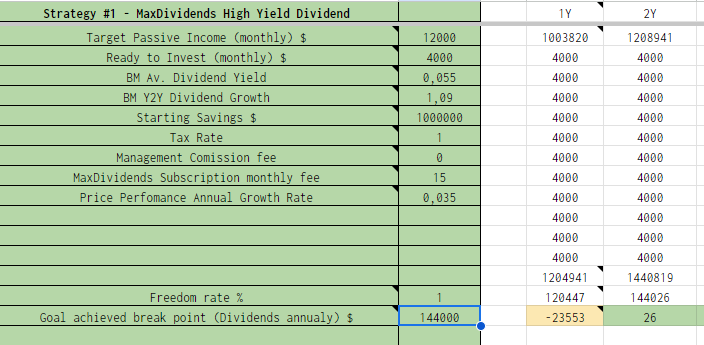

My First Goal: $12,000 Per Month in Dividends

I have initial savings of around $1,000,000 and a current business income that I can invest in stocks. I reinvest the dividends I receive.

Based on MaxDividends stocks with a dividend yield of 5.5% and annual dividend growth of 8-9%, I will reach my goal in about one year.

✅ Year 1: 84% of my goal

✅ Year 2: 100% of my goal

By the end of the second year, I will have enough passive income to live off dividends. This is achieved by following the MaxDividends strategy and using the MaxDividends app throughout the journey.

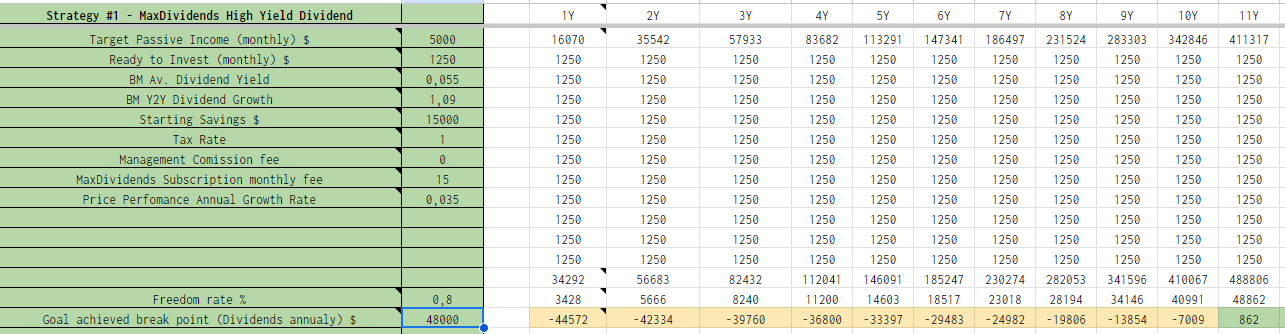

Applying the Strategy to Your Goals

Simple calculations suggest that you can achieve the same income you have now within 10 years, but through dividend stocks. Each subsequent year, this income will grow even if you stop investing and don’t reinvest dividends.

Here’s what you need:

- Start with capital equal to three months of your current income or save it during the first year of investing.

- Invest 25% of your monthly income into MaxDividends stocks according to the MaxDividends strategy.

- Reinvest the dividends you receive.

Your stocks, dividends, time, and the power of reinvestment will do the rest. In 10 years, you’ll have a passive, growing income very close to your current salary. In 15 years, this amount will have grown by another 30%. You’ve stopped investing, you’re living off dividends, and your income continues to grow.

That’s how the MaxDividends app strategy works.

Get 7 day free trial on Substack

P.S.

For myself, once I reach my passive income goal, I plan to allocate 10% of that amount to buying growth stocks and 5% to buying new MaxDividends stocks.

This way, I’ll safely invest in growth stocks, accelerating my capital growth, while my passive income from dividends continues to rise. Not only will I benefit from dividend increases, but I’ll also purchase new high-dividend stocks, generating even more payouts.

Sunday Coffee is a column where I share insights on stock investing and the philosophy of long-term investment, discuss intriguing thoughts and ideas that could benefit you.

Did you enjoy the MaxDividends idea and research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Sharing it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research about passive income based on investing in solid high yield dividend stocks: from a small startup team of private investors, followers of F.I.R.E and dividend income, not a fund, bank or so … !

What is inside? Check Out Our 5-Star Deal

- Max Dividends Stocks of the week: Top 10 high-yield, first-class MaxDividends stocks every week

To boost your passive income for living off dividends

- Easy Peasy: Build Your MaxDividends Portfolio to Live Off Dividends with Pre-Selected Stock Sets

Grab ready-made MaxDividends Stock Sets starting at $300, $500, or $1000 each week

- Max Dividends portfolio: Goal $12,000 monthly for 120 weeks

My personal MaxDividends portfolio with all changes and updates weekly

- Sunday coffee

My personal life & business column where I share life moments, insights on stock investing, long-term investment philosophy, and intriguing thoughts to benefit you

- Community chat

Stay in touch with me and other MaxDividends followers

Get 7 day free trial on Substack

FAQ

👉 How Do We Choose MaxDividends Stocks?

👉 How well does the MaxDividends strategy work for building a growing passive income?

👉 One more secret sauce of MaxDividends strategy

🙏 A few important notes:

We’re not Wall Street managers or a fund, and our fee for using the product will be the lowest in the world. We’re a startup and a group of individual investors who, like you, want to live off dividends.

Profit isn’t the project’s main goal. Once we cover the costs of maintenance and development, we’ll direct most of our earnings to charity and funds for research and fighting complex diseases.

Did you enjoy the MaxDividends idea and research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Sharing it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research about passive income based on investing in solid high yield dividend stocks: from a small startup team of private investors, followers of F.I.R.E and dividend income, not a fund, bank or so … !