Table of Contents

High Dividend Stocks 2025: What Makes a Dividend “High” in Today’s Market

- The average dividend yield of the S&P 500 Index is usually around 1.5%. Therefore, when evaluating high dividend stocks 2025 offers, securities with a yield of 4% or more are generally considered high dividend stocks.

- Another popular dividend benchmark is Treasury yields. In August 2025, investors received a yield of over 4.25% on ten-year Treasury bonds. Therefore, during periods of tight monetary policy, it is reasonable to classify securities with a dividend yield of 6% or more as high yield dividend stocks.

- Some sectors of the stock market tend to offer above-average dividends. Examples include utility providers and real estate funds.

- The highest dividend available on American stock exchanges is over 20% of the stock price per year. However, such payments are unreliable.

In this article, we will discuss which industries to consider when looking for high yield dividend stocks 2025, as well as the factors that should be taken into account when building a dividend stock portfolio.

Why and How Companies Pay Dividends

Mature companies that lack significant opportunities for further business expansion use dividend payments to stimulate investor interest. By paying quarterly dividends, the board of directors demonstrates its confidence in stable cash flows and its commitment to the interests of minority shareholders.

The key document is the company’s dividend policy. Based on this, the board of directors makes recommendations regarding the dividend payout amount. The amount of the next dividend is announced on the declaration date. In order to receive dividends, an investor must own the relevant securities on the record date. To do this, they must buy shares before the ex-dividend date.

As companies pay dividends out of net profit, these are not guaranteed payments. In the event of an economic downturn, the board of directors may reduce or cancel them.

Dividends come in three forms:

- cash;

- stock;

- property.

Sometimes, companies issue hybrid dividends. For example, part of the payout may be in cash and part in stock.

Another way to classify dividends is into regular and special dividends. Regular dividends are paid at equal intervals; most high dividend yield US stocks 2025 pay shareholders quarterly dividends. These payments are sourced from profit made through core operations. Special dividends, on the other hand, are distributed in the event of one-off profits, such as when a company sells part of its assets.

Why Invest in High Dividend Stocks 2025?

Various strategic objectives can be served by the best high dividend stocks:

- Generating passive income in retirement.

- Contributing to portfolio protection against inflation. Some companies listed on U.S. stock exchanges have had a continuous dividend growth streak of 50 years or more. These are known as ‘dividend kings’. Several of these companies offer a dividend yield of over 4%.

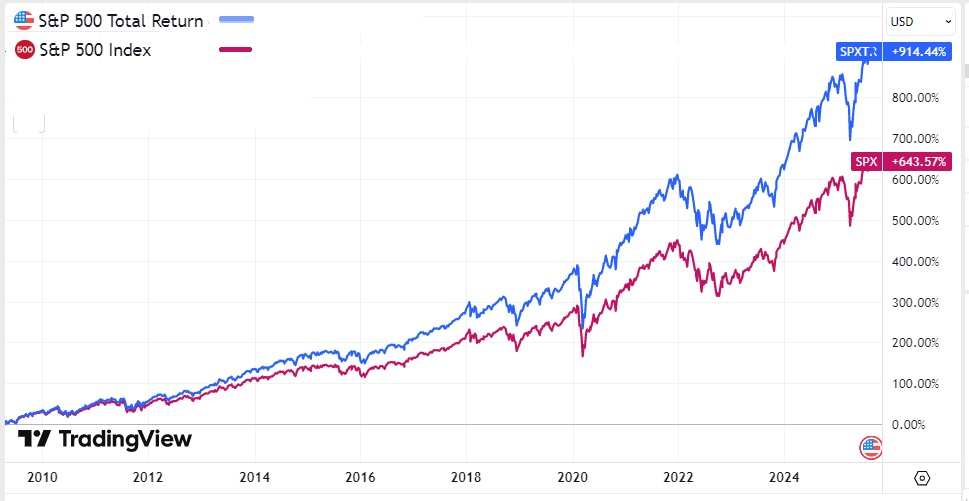

- Functioning as a financial resource for expanding holdings and attaining a more advantageous dollar amount. According to statistics, reinvesting dividends over several decades can boost overall returns by a third or more.

- Reducing portfolio volatility. It is believed that dividend stocks experience less severe price declines during periods of crisis.

- Offering psychological advantages. If a portfolio generates a stable income, it becomes easier for an individual to continue investing. Quarterly and monthly dividends are particularly valuable in a bear market.

However, it is important to note that these goals can only be achieved if stocks that pay stable dividends are selected, rather than just high ones.

The Hidden Risks of High-Yield Dividend Stocks

High dividend stocks can turn out to be dividend traps. This term refers to securities whose yield has increased sharply as a result of a decline in market value rather than an increase in the annual dividend. Such a price drop is most often caused by financial problems within the company. A logical consequence of this is dividend cuts.

In order to distinguish a good investment opportunity in a solid company from a dividend trap, a fundamental analysis must be conducted. There are several signs that are highly likely to indicate a risk of dividend cuts:

- a payout ratio exceeding 100%, particularly in sectors where low payout ratios are the norm;

- a decline in earnings and free cash flow for several consecutive quarters;

- an increase in debt or debt servicing costs.

If dividends are reduced, it is highly likely that the share price will fall. Consequently, investors may not receive the expected level of return and could lose some of their capital when selling the asset.

Essential Financial Metrics Beyond Yield

The following metrics are important to examine when purchasing high dividend stocks:

- payout ratio;

- free cash flow coverage;

- earnings per share (EPS) trend.

The payout ratio indicates the proportion of a company’s profits that are distributed to shareholders in the form of dividends. A level of up to 80% is considered safe. However, higher values are acceptable for some sectors.

For example, utility providers have a regulated and predictable income. Therefore, they can afford to make higher dividend payments. REITs (real estate investment trusts) are required to distribute at least 90% of their earnings to shareholders. In this sector, the FFO (funds from operations) indicator is also more important than net profit.

By contrast, the technology sector usually has low payout ratios. A company that allocates a large proportion of its profits to shareholders may find that its growth rate lags behind that of its competitors.

The optimal dividend coverage ratio based on free cash flow is 1.5. A lower figure indicates that the company may struggle if expenses increase or income falls.

Earnings per share (EPS) is one of the key performance indicators. It enables more accurate tracking of an asset’s profitability dynamics and helps to estimate future dividend amounts. Total profit is considered a less informative indicator because an investor does not account for possible changes in the number of shares outstanding when tracking it alone.

Building a Diversified Dividend Portfolio

A key aspect of constructing a portfolio is determining the optimal sector allocation and yield tiers. This can be achieved by applying Markowitz’s portfolio theory. The objective is to identify the asset mix that offers the lowest possible risk for a given level of return, or the highest possible return for a specified risk level.

However, calculations based on Markowitz’s theory can be quite complex, so beginner investors may wish to seek the advice of a financial advisor. An example of dividend portfolio allocation is shown below. This is not personalized investment advice:

- 30% – high-yield dividend stocks and ETFs (such as REITs and BDCs);

- 50% – reliable companies with moderate yields and high dividend growth potential (such as consumer goods manufacturers and healthcare sector companies);

- 20% – international stocks necessary for geographic and currency diversification.

ETFs and mutual funds enable you to invest in many companies simultaneously, even with a small amount of capital. The downside to this approach is the management fees, which reduce the overall return on investment.

Simply selecting an asset allocation once is not enough; rebalancing is essential. The rules for this should also be predetermined. For instance, you could sell assets that have increased in value and use the proceeds to buy cheaper stocks. Alternatively, you could use dividends and income from active investments to restore the initial portfolio balance.

Taxation can have a significant impact on an investor’s overall return. Therefore, it is important to allocate capital among assets and choose the right account types for them.

Many high dividend stocks, for instance, are issued by REITs or other pass-through entities. Dividends from these cannot be considered ‘qualified dividends’. Consequently, it is most advantageous to buy and hold such assets in tax-advantaged accounts, such as a 401(k) or an IRA. Taxable accounts, on the other hand, are better suited to purchasing stocks that pay qualified dividends and MLPs.

Conclusion – 2025 Dividend Outlook

Investing involves risks, including the risk of loss of principal. When selecting high dividend stocks 2025 offers, it is crucial to consider the fundamental qualities of the company. Inflation and high interest rates can lead to reduced profits and increased expenses. During such periods, companies with strong brands and a low Debt/Equity ratio are at an advantage.

In times of crisis and recession, actionable strategies for investing in high-dividend stocks include achieving broad diversification and focusing on companies with a stable dividend history.

The most profitable sectors, such as real estate and energy, tend to have highly volatile dividend payments. Focusing solely on maximising dividend yield at the expense of stock quality can lead to losses.

Companies with the most stable dividends tend to operate in sectors that are resistant to recessions, such as consumer staples and utilities. Financial analysts also see growth potential in industries that benefit from aging populations.

FAQ

Which stock gives the highest dividend?

In 2025, the majority of ultra high-yield monthly dividend stocks are in the mortgage REIT category.

What are the risks of chasing the highest dividend yields?

Many high dividend stocks carry risks such as reduced payout ratios and a decline in the market value of the security. Such companies often have unstable profits.

What industries typically offer the highest dividend yields?

Many high paying dividend stocks, especially REITs, offer high yields. Companies operating in the financial and energy sectors most often issue shares with high dividend stocks. These primarily include BDCs and MLPs.

How do you screen high-yield stocks?

There are numerous services that allow investors to search for stocks based on various parameters, such as dividend yield and payout ratio. One example is the screener offered by BeatMarket.

How does a dividend payment work?

On the declaration date, the company’s board of directors announces the amount of the upcoming payout and the record date for determining which shareholders are eligible to receive it. To be eligible, investors must purchase the stock before the ex-date. If they do this, they will receive the dividend on the payment date, even if they sell the stock before then.

What are high-dividend ETFs?

These are ETFs whose net assets consist of high-dividend stocks. Examples include the VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF and the iShares STOXX Global Select Dividend 100 UCITS ETF. ETFs focused on cryptocurrencies, options trading and other areas can also pay high dividends; however, their yield is often unstable.

What are dividend aristocrats and why are they important?

The term ‘dividend aristocrats’ refers to companies that have increased their payouts to shareholders for at least 25 years. These are well-established businesses that dominate their industries. Investing in such stocks reduces portfolio volatility and makes cash flow more stable.

How are dividends taxed on high-yield stocks?

Many high-dividend stocks, primarily REITs, pay ordinary dividends that cannot be considered qualified dividends. This means that the tax rate ranges from 10% to 37%, depending on the investor’s tax bracket. However, some companies pay corporate taxes and distribute qualified dividends with yields exceeding 4%.

Article Sources

- The Best Dividend Stocks for 2025: How to Create a Cashflow Machine Paying You Every Month by Henry Broadwater.

- Shareholder Yield: A Better Approach to Dividend Investing by Meb Faber.

- Dividend Stocks: How To Invest & 7 High-Yield Options for August