- Dividends are a portion of a company’s profits paid to shareholders as a reward for their investment.

- Dividend yield is the ratio of annual dividends to the current share price. It is expressed as a percentage.

- ‘What is a good dividend yield?’ is one of the key questions in dividend investing. The answer largely depends on an individual’s investment goals.

- This indicator’s main purpose is to allow investors to easily compare the benefits of stock dividends from different companies and other types of assets.

In this article, we will explain what is considered a good dividend yield and what you need to know to invest in dividend-paying stocks.

Table of Contents

How Dividend Yield Works and Calculation Methods

There are two calculation methods for this indicator and many different views on ‘what is a good dividend yield’. The dividend yield formula is as follows:

Dividend yield = (annual dividends per share / stock price) × 100%.

There are two ways to calculate the numerator in this formula. For example, consider a stock that costs $200 and has generated the following income:

- Q1: $0.95.

- Q2: $0.95.

- Q3: $1.

- Q4: $1.

The first method of calculating annual dividends is to sum all dividend payments per share over the last 12 months. In our example, this totals $3.90. The trailing twelve months (TTM) dividend yield is 1.95%.

The second method involves multiplying the latest quarterly dividends by four (or the latest monthly dividends by twelve, if the stock pays dividends monthly). In our example, the annual dividends would amount to $4.00 per share. The forward dividend yield would be 2%.

Both approaches have disadvantages. Therefore, answering the question ‘What is a good dividend yield?’ is not enough. It is also essential to understand how it is calculated, and which method of determining total annual dividends is best for a given situation.

The retrospective approach does not adequately consider the impact of recent changes to dividend policy on future income. For instance, a company may have consistently paid out $1 per share, but then decided to halve investor rewards. In this case, using the trailing twelve-month (TTM) dividend yield value would be inappropriate.

The forward-looking approach cannot be applied to stocks with unstable dividend payments. For instance, a company may initially announce a dividend of $0, but pay more in subsequent periods. Alternatively, there could be small interim dividends, followed by a significant final dividend.

When considering ‘what is a good dividend yield’, it is important to remember that the key factor in its calculation is the denominator. Since share prices fluctuate, dividend yields change daily.

What Is a Good Dividend Yield Range

What is a good dividend yield range? The most popular answer to this question is a dividend yield range of 2 – 6%. However, there are several different views on what should be considered a benchmark yield.

According to the first approach, a good dividend yield is one that exceeds the average S&P 500 dividend yield. The latter is currently around 1.25%.

The second viewpoint involves comparing it with Treasury yields. As of early October 2025, the United States 10-Year Bond Yield was 4.088%.

When answering the question ‘What is a good dividend yield?’, it is important to consider the sector in which the company operates. Each industry has its own average values.

What is a good dividend yield for a technology company, for example? The sector’s average is 0.56%. Therefore, a yield of 3% would be considered excessively high. What is considered to be a good dividend yield for a REIT? The sector average is 4.83%. Conversely, a yield of 3% would be considered low.

These examples are provided for informational purposes only and do not constitute investment advice.

It is important to understand the answer to the question ‘What is a good dividend yield?’ cannot simply be ‘a high yield’. This is because of the inverse relationship between the indicator and the stock price. In most cases, a sharp increase in the dividend yield could indicate investor doubt about the company’s financial stability.

High Dividend Yields: Warning Signs and Payout Ratio Analysis

Let’s consider what is a good dividend yield for a stock. It is the level at which a company can maintain stable dividend payments. However, a high dividend yield is often associated with the risk of dividend cuts in the future.

Knowing the answer to the question ‘What is a good dividend yield ratio?’ does not help you to assess dividend sustainability. Various multiples are used for this purpose. One of these is the payout ratio. This shows what proportion of a company’s earnings per share are paid out as dividends for that stock.

For most industries, a dividend payout ratio above 80% is generally considered to be risky. However, there are several exceptions. REITs, for example, are required to pay out more than 90% of earnings. Consequently, the average dividend yield in this sector is abnormally high compared to the S&P 500 index.

Another metric that can be used to supplement the answer to the question ‘What is a good dividend yield?’ is dividend coverage by cash flow. This shows a company’s ability to fund dividend payments to shareholders using operating cash flow.

As well as dividend-related multiples, it is useful to analyze a company’s financial stability. This could involve examining the level of debt, the interest coverage ratio, and the dynamics of revenue and earnings.

On the subject of quick assessments, a higher dividend yield indicates a higher level of risk. However, this rule only applies when comparing similar companies. Therefore, it is unreasonable to ask, ‘What is a good dividend yield in general?’

A more pertinent question would be: ‘What is considered to be a good dividend yield for a specific company?’ When seeking an answer, however, it is important to remember that stock metrics are influenced not only by the business’s condition, but also by the level of risk-free yield.

Finding and Evaluating Dividend Stocks

The percentages indicated in the ‘What is a good dividend yield range?’ section can be used to screen dividend stocks initially with the help of stock research tools. However, it is also important to consider the industry in which the planned investments are to be made.

The next step is dividend stock screening from the perspective of financial strength. This is achieved by using the payout ratio and the other multiples described above. It is then necessary to study the company’s dividend history and policy.

‘What is a good dividend yield?’ is a question often asked by novice investors. They also frequently ask which stocks provide the most stable dividends. In this context, it is worth paying attention to the companies that make up the S&P 500 Dividend Aristocrats index. This index comprises highly liquid stocks from companies that have increased their dividends for over 25 consecutive years. These companies hold leading positions in their industries and have strong finances.

What is a good dividend yield for a Dividend Aristocrat? As of early October 2025, only five companies on this list pay a dividend that exceeds 5% of their share price. More than 10 companies have a yield of less than 1%. The index’s average dividend yield is around 2%.

Dividend Stocks vs. Dividend Funds and Investment Strategies

There are two approaches to dividend investing. The first involves purchasing individual dividend stocks. The second involves investing in dividend funds and dividend ETFs. This raises the question, ‘What is a good dividend yield for a fund?’ The answer depends on the fund’s area of specialization. The answers to ‘What is a good dividend yield for a growth stock fund?’ and ‘What is a good dividend yield for a REITs fund?’ will differ significantly.

The main advantage of investing through dividend funds is diversification. The size of the fund’s payouts depends on the performance of dozens or even hundreds of companies. Problems in one company have a minimal impact on the overall result. However, sector-specific funds carry the risks inherent to individual companies within that sector.

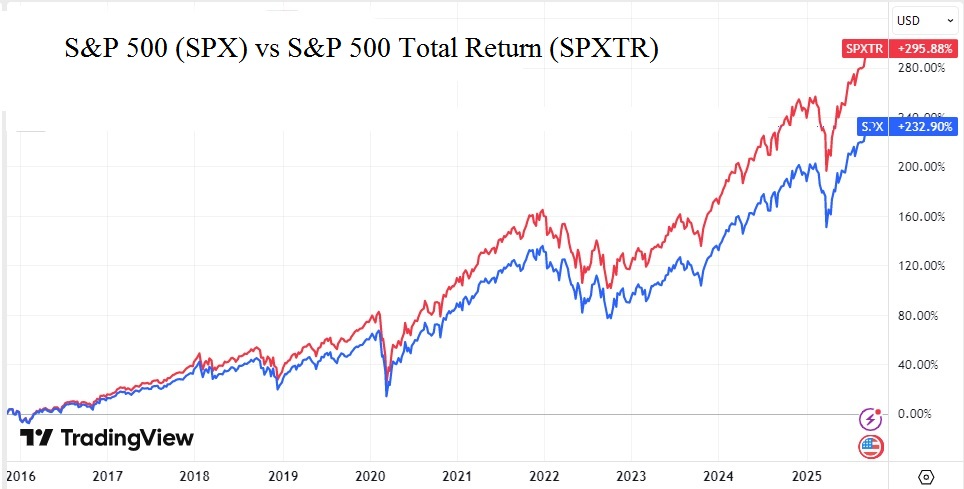

A dividend-based capital growth strategy involves dividend reinvestment. This allows you to achieve the effect of compound growth. According to statistics, dividend reinvestment increases portfolio returns by around one-third over several decades. The 10-year results are shown on the S&P 500 and S&P 500 total return index charts below.

Therefore, it is important to understand that the question ‘What is a good dividend yield?’ is not only about future profits.

DRIP programs offer the chance to reinvest dividends automatically. They typically involve commission-free transactions and the purchase of fractional shares. This makes investing even more efficient.

What is a good dividend yield? When considering this question in relation to reinvestment, it is necessary to take the time value of money into account. In this case, companies that pay high dividends today have the advantage. However, when making such an assessment, it is important to consider the tax implications.

Tax Implications and Special Dividend Investments

The question ‘What is a good dividend yield?’ is inextricably linked to the topic of dividend taxes. According to legislative standards, dividend payments fall into one of two categories:

- Qualified dividends – these dividends are taxed at preferential capital gains rates.

- Ordinary dividends – these are taxed at the same rates as regular income.

Simply answering the question ‘What is a good dividend yield?’ is not enough. One must also consider the net income remaining at the investor’s disposal after tax has been paid.

In order for dividends to be recognized as ‘qualified dividends’, a number of requirements must be met. The tax benefit can be applied if companies pay dividends out of taxable profits.

REITs and BDCs are often mentioned in response to the question, ‘What is a good dividend yield?’ However, these are pass-through entities that do not pay corporate income tax. Consequently, their dividends cannot be categorized as ‘qualified dividends’.

Many investors consider MLPs when looking for answers to the question, ‘What is a good dividend yield?’ Most MLPs’ distributions are considered a return of capital. Consequently, no tax is withheld on these payments in the year they are received. However, if the value of the investment has already been reduced to zero, the distributions received are taxed at ordinary income rates.

In most cases, effective tax optimization is a more efficient approach than seeking a universal answer to the question: ‘What is a good dividend yield?’

One way to reduce tax expenses is to use tax-advantaged accounts. The most popular of these are retirement accounts, such as 401(k)s and IRAs. These accounts offer the opportunity to defer or even eliminate taxes for decades.

Common Dividend Investing Mistakes and Best Practices

There are some common dividend investing mistakes. Many investors make these mistakes as a result of yield chasing, focusing solely on the question, ‘What is a good dividend yield?’

The most common mistake is investing in dividend traps. These are stocks with abnormally high dividend yields, caused by a sharp decline in share price. This usually happens when a business is facing serious issues.

In this case, dividing the total annual dividend paid before the problems arose by the current share price yields an appealing outcome. However, if an investor does not exercise proper due diligence, they risk buying a stock whose future dividends could be significantly lower than those in the past.

Some stocks have shown abnormally high yields for several consecutive years. This reflects the market’s assessment of future risks. For instance, if a company has a high level of debt, investors may be concerned that it will reduce dividends if interest rates rise. Another scenario is a business model characterized by unstable income.

It is not only in cases of abnormally high yields that dividend cuts are possible. There is always a risk, even if the company’s indicators align with the answer to the question, ‘What is a good dividend yield?’ Therefore, it is necessary to analyze the dividend payout ratio and the company’s prospects before buying any stock.

Another common mistake is neglecting portfolio diversification. This is often a consequence of focusing too much on the question, ‘What is a good dividend yield?’ As a result, investors may concentrate on sectors with high payout levels, such as REITs. Consequently, their portfolio becomes vulnerable in the event of an industry-specific crisis.

What is a good dividend yield for a portfolio? It is the highest possible dividend yield that can be achieved while still keeping the level of risk acceptable to the investor.

FAQ – Frequently Asked Questions

Do all companies pay dividends?

Dividend paying companies are established companies that lack the capacity for significant market expansion. Growth companies allocate their profits towards reinvestment and developing their business, or pay minimal dividends. For example, Nvidia shareholders receive a dividend of $0.01 per share quarterly.

The current dividend yield of a stock is not enough to answer the question, ‘What is a good dividend yield?’ A company’s dividend policy must consider the interests of minority shareholders as well as the need for further business development.

Can dividend yields change daily?

What is a good dividend yield? The answer to this question is constantly changing as market conditions evolve. Dividend yield fluctuations are often a consequence of market volatility. Even with dividend stability, stock price changes will cause daily yield changes.

What happens if a company cuts its dividend?

Investors’ reactions to changes in dividend policy depend on whether dividend sustainability was a key factor when purchasing the shares. However, dividend cuts and dividend suspensions usually have a negative stock price impact. Therefore, focusing solely on the question ‘What is a good dividend yield?’ is likely to result in capital loss.

Are dividend yields guaranteed returns?

You should study ways to determine dividend reliability before asking the question, ‘What is a good dividend yield?’ There is no such thing as a 100% dividend guarantee. Investors are not guaranteed to receive the expected annual dividend per share at the time of purchase. There is dividend risk, which is the probability of a reduction in dividends or suspension of dividend payments. However, the potential reward for investment uncertainty is higher returns than those of risk-free assets.

Article Sources

- Fidelity Investments (2025). “Dividend yield: What it is and how to calculate it.” Fidelity Learning Center, comprehensive guide covering dividend yield calculations, investment strategies, and evaluation methods for dividend-paying securities.

- NerdWallet (2025). “Dividend Stocks: How To Invest & 7 High-Yield Options.” NerdWallet Investment Guide, featuring analysis of high-dividend stocks, screening criteria, and investment approaches for dividend-focused portfolios.

- SmartAsset (2025). “What Is a Good Dividend Yield.” SmartAsset Investment Resources, detailed examination of dividend yield benchmarks, comparison methodologies, and evaluation frameworks for income-generating investments.

- Charles Schwab (2025). “Why and How to Invest in Dividend-Paying Stocks.” Schwab Learning Center, investment education resource covering dividend stock strategies, evaluation criteria, and portfolio construction for income-focused investors.

- Standard & Poor’s (2025). “S&P 500 Dividend Yield Data.” S&P Dow Jones Indices, official market benchmark data for dividend yield comparisons and historical market performance analysis.

- Internal Revenue Service (2024). “Publication 550: Investment Income and Expenses.” U.S. Department of Treasury, official guidance on dividend taxation, qualified dividend requirements, and tax treatment of investment income.