Updated monthly with top ultra-high yield stocks and a live income portfolio.

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

Max Income Dividend Picks

A selection of ultra-high dividend stocks with over 10% annual yield. This list features the most sustainable ultra-high yield dividend stocks, updated weekly, along with a model portfolio to track real-time performance.

Table of Contents

The Income-Focused Dividend Blueprint

At some point, investing stops being about chasing “what if” and starts being about steady income you can count on.

That’s where ultra-high dividends come in. Imagine your portfolio paying you like a second paycheck — every month, on time, without you having to sell a single share.

The MaxDividends team built an Ultra-High Yield Playbook for exactly that purpose: a way to generate up to 10% in annual cash income, year after year, in any market.

Here’s how we do it, in plain words:

- We look for companies built to pay out — real estate trusts, energy pipelines, business lenders.

- We check the numbers to make sure the cash flow is strong and dependable.

- We focus only on names with a long history of consistent dividends, so the income doesn’t stop.

The result? A short list of companies that can turn your portfolio into a reliable income stream — one that covers bills, pays for the extras, and gives you more freedom to spend time on what really matters.

Because at the end of the day, investing should give you peace of mind — and steady income you can actually live on.

Today’s Income-Boosting Playbook

*How to Build Your Own Income Portfolio (The Easy Way)

Simple to start, steady to trust — a step-by-step strategy built to last.

*Top 3 Dividend Stocks Paying ~10%+ Right Now

These names are on fire — strong payouts, high scores, real income.

*Full Updated Watchlist of the Month: Top 10 Ultra-High Yield Stocks

All the best current picks in one place — refreshed monthly.

🎁 Your First Gift: Top 5 Monthly Dividend Funds Paying ~10% Annually

The easiest way to lock in double-digit cash flow every month.

🎁 Your Second Gift: MaxDividends Modeled Income Portfolios

See exactly what we bought, the yields we’re earning, and how the income stacks up.

🔑 Where the 10% Yields Live

Instead of chasing every flashy payout, we focus on three groups that actually deliver:

1. Income Workhorses

Niche REITs, midstream MLPs, and battle-tested BDCs. These companies exist to pay dividends — and they know it.

2. Opportunity Plays

Small/micro caps and turnaround names. Yes, they’re volatile, but when managed right, they reward investors with premium yields.

3. Global Cash Machines

International dividend legends, often overlooked in the U.S. Many boast 20–30+ years of uninterrupted payouts.

👉 Every month we scan 19,000+ companies worldwide and narrow it down to just 10 names that make the cut.

Max Income Strategy — Plain and Simple

We keep it simple. The companies we choose are the most reliable payers out there — most of them have been sending out dividends not just for 15 years straight, but often closer to 30 years without a single cut.

We check their numbers to be sure the income stream isn’t drying up anytime soon. Only the strongest and safest make the list.

Here’s how it works for you:

- Pick from the list — every stock here is rock-solid: Financial Score 90+ and 15–30 years of dividends without a single cut. Safe, steady, proven.

- Buy when they’re undervalued — the list flags names that are “on sale” so you can spot bargains fast.

- Build your own income portfolio — choose the companies you like, buy the shares through your broker, and track it all in the MaxDividends App. One place, clear and simple.

- Enjoy the cash flow — dividends show up in your bank account like clockwork, covering everyday bills and giving you extra breathing room.

- Replace only on a cut — if a company ever lowers its dividend, just swap it for another reliable payer from the list. That’s it.

That’s it. No complicated rules, no guesswork. Just a portfolio of solid dividend “cash cows” paying you steady income, year after year.

👉 Simple rules, steady income, and peace of mind — this is the Max Income Strategy.

🎯 Spotlight: This Month’s Top 3 Dividend Cash Machines

Highwoods Properties Inc (HIW) — Real Estate | Financial Score: 93

Yield: 6.33% | Consistent Payer: 20 years

👉 A U.S. REIT focused on high-quality office properties. Fairly valued today and delivering a reliable 6%+ yield backed by two decades of steady dividends.

Rubis SCA (RUI) — Energy & Infrastructure | Financial Score: 99

Yield: 6.32% | Consistent Payer: 29 years

👉 European energy and storage group with nearly three decades of dividends. Undervalued right now, making its 6%+ yield especially attractive.

Cogeco Inc. (CGO) — Telecommunications | Financial Score: 92

Yield: 6.15% | Consistent Payer: 33 years

👉 Canadian telecom and media company with over three decades of consistent payouts. Currently undervalued, offering investors a stable income stream above 6%.

Three rock-solid companies, all paying north of 6%, with decades of consistent dividends behind them. A true income spotlight for this month.

And those are just three. The full lineup of High-Income Dividend Payers is right below.

🚀 Full List of High-Income Dividend Payers

When you step inside the Premium circle, the view changes. What looks like scattered tickers from the outside turns into a full performance — ten names on stage, each with decades of dividends behind them and yields that rarely appear together.

These aren’t just stocks. They’re long-time payers — 15, 20, even 30+ years without a single cut — now offering yields north of 6%. It’s a lineup that feels more like a private showing than a market screen.

As a Premium Partner, you’re not guessing in the dark. The curtain is already open — the full cast of today’s High-Income Cash Machines is here, ready for you to explore inside the MaxDividends App.

- Highwoods Properties (HIW) — Yield ~6.3%

Office-focused REIT, two decades of steady payouts and still delivering strong income. - Rubis SCA (RUI) — Yield ~6.3%

European energy & infrastructure group, nearly 30 years of uninterrupted dividends. - Cogeco Inc. (CGO) — Yield ~6.2%

Canadian telecom and media player, over 30 years of consistent income. - Universal Corp (UVV) — Yield ~6%

Century-old tobacco supplier, one of the longest-paying dividend machines with 55 years of raises. - First Bancorp (FNLC) — Yield ~5.9%

Regional U.S. bank with 25 years of dividends and a strong local franchise. - Enghouse Systems (ENGH) — Yield ~5.8%

Canadian software firm, 17 years of dividends and global growth potential. - National Retail Properties (NNN) — Yield ~5.7%

REIT with over 3 decades of dependable dividends, backed by long-term leases. - Ambra SA (AMB) — Yield ~5.6%

Central European wine & beverage group, 16 years of consistent payouts. - Greif Inc (GEF-B) — Yield ~5.4%

Packaging leader, nearly two decades of dividends and steady industrial demand. - Target (TGT) — Yield ~5.0%

Retail giant with 54 years of raises — dependable payouts plus recovery upside.

All companies on this list pay 5%+ dividends and have decades of uninterrupted — never cut — payouts. True dividend cash cows for a passive income portfolio.

🎁 Gift #1: Top 5 Monthly Dividend Funds Paying ~10% Annually

Monthly income, straight to your account — these funds deliver steady double-digit yields and have passed our Financial Score checks.

SCM — Stellus Capital Investment | Yield 10.6% | Undervalued | Score 92

👉 Business development company focused on middle-market lending, paying steady monthly income.

DIV — Diversified Royalty Corp | Yield 7.6% | Fairly valued | Score 96

👉 Canadian royalty firm collecting revenues from multiple brands — simple, diversified cash flow.

PFLT — PennantPark Floating Rate Capital Ltd | Yield 11.9% | Undervalued | Score 88

👉 Specialty finance company investing in floating-rate loans, built to deliver double-digit yields.

AI — Atrium Mortgage Investment Corp | Yield 8.3% | Undervalued | Score 93

👉 Mortgage lender focused on real estate financing, paying investors reliable monthly dividends.

SAR — Saratoga Investment Corp | Yield 12.1% | Undervalued | Score 86

👉 U.S. BDC with a strong lending portfolio, known for some of the highest yields in the sector.

Five simple ways to lock in monthly cash flow — dependable income you can count on.

🎁 Your Gift #2: MaxDividends Modeled Income Portfolios

Here’s a live example of how the strategy works in practice. We build a portfolio with clear rules, track it week by week, and show exactly what kind of income it produces.

#1 Max Income Strategy

The Max Income Model Portfolio is a simple, real-life way to put the strategy into action. Each month, we invest $1,000 into the top high-income dividend stocks from the Max Income list.

These are solid companies with 15–30 years of uninterrupted dividends and strong financial scores. We focus on buying when the stocks are undervalued, and if any company ever cuts its dividend, we simply replace it with another proven payer.

⭐️ $1,000 Max Income Portfolio. Month 13

👉 Link to Max Income Modeled Portfolio 🔐 (for premium only)

- Investment this month: $999.26

- Total Invested: $15,988.98

- Current Value: $17,783.75

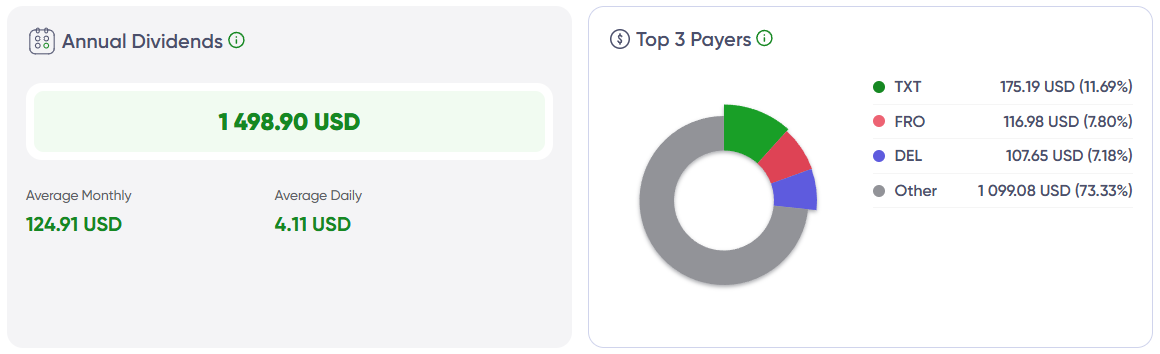

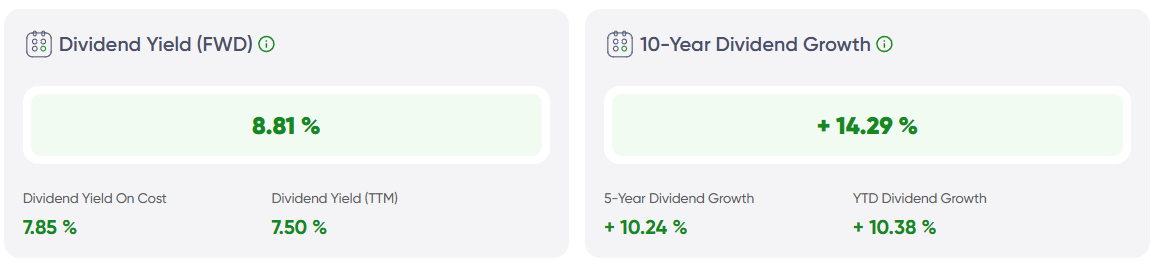

- Yield on Cost (FWD): ~8.81%

- Estimated Annual Dividends: $1,498.90

This month’s additions:

- Universal Corp (UVV) — 5 shares @ $53.40 → $266.98

- One Liberty Properties (OLP) — 1 share @ $20.84 → $20.84

- Ambra SA (AMB) — 54 shares @ 19.70 PLN → ~$290.78

- Greif Inc (GEF-B) — 2 shares @ $61.01 → $122.02

- Rubis SCA (RUI) — 8 shares @ €32.10 → ~$298.64

Income Snapshot

$1,000 Max Income Portfolio – Built with MaxDividends App

Every month we put $1,000 to work using the Max Income Strategy inside the MaxDividends App. Step by step, the portfolio grows — and so does the income. The focus is simple: steady, reliable dividends you can count on.

💡 The MaxDividends App makes it easy to follow the plan, track payouts, and see your income build month after month — a clear path to living off dividends.

#2 Ultra Max Income Strategy

Intro

This strategy is all about turning your savings into steady monthly income. We focus only on funds that have been paying every month for at least 10 years, carry a solid Financial Score above 90, and yield around 10% a year. It’s not about chasing stock gains — it’s about getting cash flow you can count on.

The idea is simple. You buy once, dividends show up every month, and if any fund ever cuts or weakens, we replace it with a stronger one. The goal is reliable income straight to your account, enough to cover bills and enjoy life, while your shares keep working in the background.

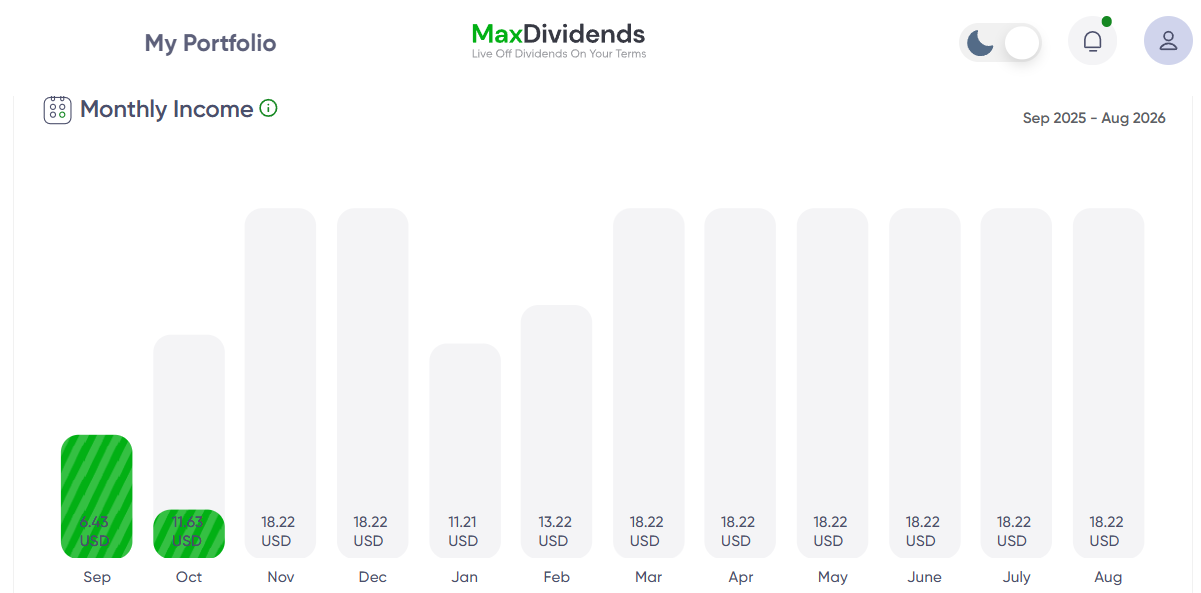

⭐️ Ultra Max Income Portfolio. Month 3

👉 Ultra Max Income Model Portfolio – 10% Annual Yield, Paid Monthly 🔐 (for premium only)

- Today’s investment: ~$539.10

- Total Invested: ~$2,092.11

- Current Market Value: ~$1,972.96

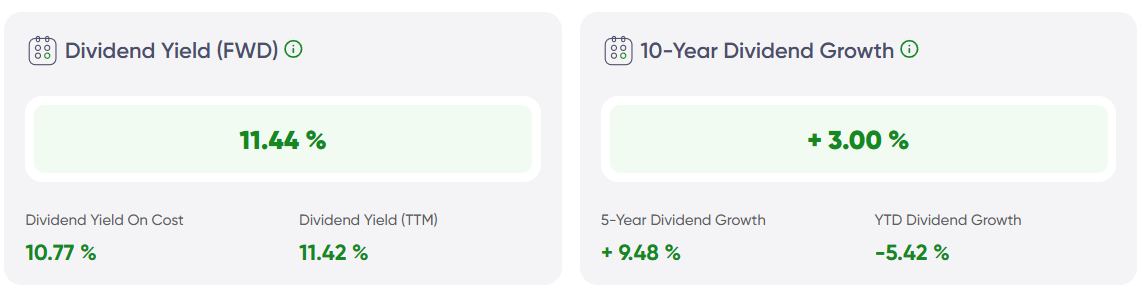

- Portfolio dividend yield on cost: ~10.77%

- Estimated annual dividends: ~$230.71

Added to the portfolio

Latest Additions to the Ultra Max Income Portfolio

Dividends

Income Snapshot – Double-Digit Yield

Monthly Income & Forecast

Annual Dividends & Top Payers

Bottom Line: Max Income Dividend Strategies – Pilot Version

This is the pilot run of our high-dividend strategy. After years of research, we’re now testing it live so you can follow how the income grows month by month.

Roadmap

- 2019–2024 — Research, analysis, and back-testing. Building the foundation for a safe, income-focused strategy.

- 2025 — Pilot launch of live demo portfolios. Real examples, updated in real time, showing how steady dividends work in practice.

- 2027 — Results and review. A clear look at performance, lessons learned, and how dividend income can steadily grow to cover more of life’s bills.