- The Schwab US Dividend Equity ETF (SCHD) pays quarterly dividends. According to the dividend calendar of the SCHD, the next SCHD ex-dividend date is March 26, 2026.

- The last SCHD dividend payment in 2025 occurred on December 15. When is SCHD next dividend payment? The next SCHD payment date is March 31, 2026.

- The distribution amount for the Schwab Dividend ETF in Q4 of 2025 was $0.2782 per share. The SCHD dividend future forecast for the next quarter is between $0.25 and $0.27.

- The exact amount of the next distribution will not be known before February 17, 2026. In order to receive it, you must be a shareholder on the SCHD record date. This means that the relevant securities must be purchased by March 25, 2026 at the latest.

This article will discuss the SCHD distribution pattern and provide information on SCHD dividend history. It will also answer the question, ‘When does SCHD pay dividends?’

Table of Contents

Understanding SCHD’s Ex-Dividend Schedule

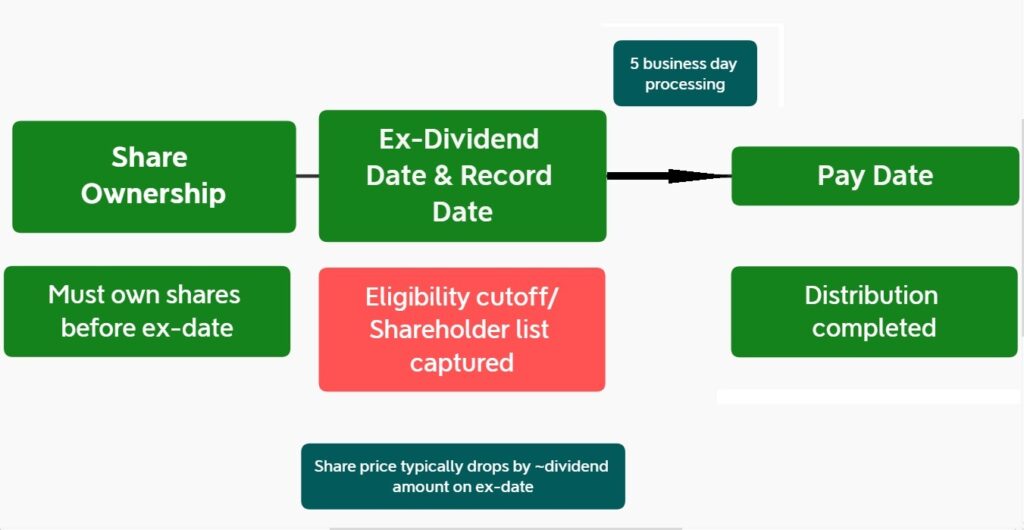

According to the SCHD dividend calendar, the next SCHD ex-dividend date is March 26, 2026. But what is an ex-dividend date, and why is it the most important date for an income investor?

The ex-dividend date (or ex-date) is the first trading day on which buying a share no longer entitles the holder to the upcoming dividend. Therefore, according to SCHD dividend eligibility criteria, in order to receive the next dividend payment, SCHD securities must be purchased by March 25, 2026 (inclusive). This answers the question, ‘When to buy SCHD for dividend?’.

The SCHD record date is the date on which the list of shareholders who will receive the next distribution from the ETF is compiled. As the ETF dividend mechanics operate on a T+1 settlement cycle, the record date coincides with the ex-dividend date.

The first SCHD dividends will be transferred from the fund’s account on March 31, 2026.

Price Impact on Ex-Dividend Date

When the market opens on the ex-date, the price is adjusted because the buyer is no longer eligible for the dividend. The price drops by an amount roughly equivalent to the dividend.

Therefore, the SCHD ex-dividend price adjustment is expected to be within the range of $0.25-$0.27. In Q2 and Q3 of 2025, it took over a week for the SCHD dividend gap to close. However, the duration of the gap closure is heavily influenced by market conditions.

Investors using the dividend capture strategy must consider these nuances of the SCHD share price movement. This strategy involves buying the stock just before the ex-date and selling it shortly afterwards to secure SCHD dividend eligibility.

SCHD Quarterly Distribution Pattern

The SCHD dividend frequency is one payment every three months. According to the SCHD dividend schedule, investors receive money in March, June, September and December. The SCHD ex-dividend date is typically expected to fall around the 20th of the month. However, in December, the record date for the distribution occurs in the first half of the month.

The approximate SCHD distribution schedule and ex-date are as follows:

- March: mid-to-late third decade (in 2025 – March 26).

- June: mid-to-late third decade (in 2025 – June 25).

- September: mid-to-late third decade (in 2025 – September 24).

- December: first decade (in 2025 – December 10).

The SCHD quarterly distribution usually comprises income only. According to data from Schwab Asset Management, the fund has not made any capital gains or return of capital distributions over the last 10 years.

Historical Dividend Performance Analysis

The SCHD dividend history is characterized by stability. The fund’s quarterly payments are a reliable source of passive income. According to BeatMarket, SCHD dividend growth over the last five years is 73%.

In 2025, the SCHD dividend amount was $1.0476 per share. The SCHD dividend yield (TTM) is 3.77%. This is considered above average. The amount of the quarterly payments varies slightly depending on the season.

The table below shows the historical distribution amounts for the last four payment periods.

| Period | Amount | QoQ Dynamics |

| Q4 2025 | $0.2782 | +6.8% QoQ |

| Q3 2025 | $0.2604 | +0.2% QoQ |

| Q2 2025 | $0.2602 | +4.4% QoQ |

| Q1 2025 | $0.2488 | – |

The average quarterly SCHD dividend amount was $0.2619. When does SCHD pay dividends? The company transfers funds on the 5th day after the record date.

Annual Income Projection

One way to calculate the SCHD yearly payout is to multiply the average payment amount by the number of payment periods (i.e. $0.2619 x 4). In 2025, the annual income from SCHD dividends was $1.0476 per share.

To calculate personal income, the number of shares must be multiplied by this figure. For instance, an investor holding 1,000 SCHD shares in 2025 would have earned $1,047.60 ($1.0476 x 1,000) that year.

SCHD’s assets include shares in companies that reliably pay dividends. Consequently, the fund’s distributions are low-volatility. This, coupled with the stability of the SCHD distribution pattern, makes income planning easier.

Future Distribution Forecast

When will SCHD pay next dividend? The next SCHD dividend is scheduled for March 31, 2026. Investors who purchase shares by March 26, 2026 will receive it.

According to SCHD dividend forecasts, the upcoming SCHD dividend will be in the range of $0.25 to $0.27. The exact size of the SCHD quarterly distribution will be confirmed in February 2026.

Knowing the future SCHD ex-dividend dates is important for tax planning purposes. This information is also important for portfolio rebalancing and various investment strategies, such as dividend capture.

When is SCHD next dividend? The table below shows the SCHD distribution schedule for 2026.

| Period | SCHD ex-dividend date | SCHD payment date | Status |

| Q1 2026 | March 26 | March 31 | Forecasted |

| Q2 2026 | June 25 | June 30 | Forecasted |

| Q3 2026 | September 24 | September 30 | Forecasted |

| Q4 2026 | December 10 | December 16 | Forecasted |

According to wallstreethorizon.com

Why Wall Street Horizon’s Forecast Matters

Where to find SCHD dividend dates? One option is the Wall Street Horizon company website. This information resource offers several competitive advantages:

- the company provides a primary-sourced ETF calendar;

- a single page aggregates comprehensive SCHD institutional dividend data;

- data is updated daily.

The platform is designed to provide comprehensive tracking of the entire ETF market. Its purpose is to assist with trade planning.

Critical Tool for Institutional-Grade Trading

Different types of investors use SCHD institutional dividend data in different ways. For instance, options traders use dividend data to predict price changes and mitigate risk.

The table below shows a comparison of usage scenarios by investor type.

| Primary Use Case | Data Requirements | Advance Notice Benefits | Key Calendar Features | |

| Institutional Investors | Cash flow forecasting | Precise timing + advance notice | Quarter-end rebalancing | Full annual schedule |

| Options Traders | Assignment risk calculation | Ex-date precision | Strategy positioning | Strike price adjustments |

| Equity traders SCHD | Dividend capture strategies | Ex-date + price impact | Entry/exit optimization | Daily alerts |

Institutional Investors: Portfolio Management Applications

SCHD institutional investors manage multi-million dollar positions. Portfolio management includes reinvestment, tax-loss harvesting and other activities.

Accurate information is essential for these tasks. It enables cash flow forecasting and liquidity planning.

Options Traders: Assignment Risk Management

Traders using an SCHD options strategy need to calculate the SCHD’s assignment risk. This is important even when selling SCHD covered calls.

For options traders, dividends are one of the factors that influence an option’s pricing model. In order to plan a strategy months in advance, traders need to know the answer to the following question exactly: ‘When is SCHD next dividend?’ Wall Street Horizon provides information up to 250 days in advance.

Equity Traders: Dividend Capture Positioning

Equity traders using the SCHD dividend capture strategy require the SCHD dividend schedule in order to plan trade dates. Access to this schedule enables traders to find out in advance when to buy SCHD for dividends.

Dividend capture timing involves buying shares just before the ex-date and selling them shortly afterwards (usually the following day). Additional data on the SCHD pay date is required for cash flow planning and subsequent trades involving other assets.

Additional Dividend Considerations

SCHD Dividend Yield Context

The SCHD dividend amount is attractive to income investors. The fund pays $1.0476 per share at a price below $27.80. Share price volatility has the greatest impact on yield dynamics. However, the SCHD distribution remains relatively stable.

What is SCHD dividend yield? The current dividend yield (TTM) of SCHD is 3.77%. It is calculated using the following formula:

SCHD Dividend Yield = (Annual Fund Distribution / Current Market Price per Share) x 100%

Now, let’s compare this figure of 3.77% with the average market metrics:

- the S&P 500 index dividend yield is around 1.2%;

- dividend ETFs focusing on company quality offer a dividend yield of about 2.5%;

- broad-market high-dividend ETFs provide shareholders with up to 4%.

Therefore, investors are interested in SCHD quarterly distributions because of the regularity and stability of the payments and their yield.

Tax Considerations for SCHD Distributions

Is SCHD tax efficient? Most of the fund’s distributions can be classified as qualified dividends. The SCHD dividend tax treatment depends on the investor’s holding period.

When to buy SCHD for dividends as part of a tax-efficient investment strategy? In this case, both the purchase and sale dates are important. In order to pay tax implications on dividends at a reduced rate, shares must be held for at least 61 days within a 121-day period.

This period begins 60 days before the SCHD ex-dividend date. If the investor meets the holding period requirement, the applicable tax rate will be 0%, 15% or 20%, depending on their tax bracket.

Tax rates for investors using the SCHD dividend capture strategy who do not meet the holding period requirement range from 10% to 37%.

The SCHD dividend payment for Q4 usually takes place in December. Investors who minimize taxes through tax-loss harvesting should take this into account in their year-end dividend planning.

To optimize your personal tax strategy, it is advisable to consult a tax advisor.

Dividend Reinvestment Options

SCHD dividend reinvestment is possible through a third-party broker. It is also possible via Schwab’s SCHD DRIP program. Most brokers, including Charles Schwab Corporation, allow you to purchase fractional shares, which can increase your overall returns.

The main advantages of the automatic reinvestment of SCHD dividends are saving time and eliminating emotional decision-making. Using DRIP programs helps you to maintain financial discipline.

The SCHD dividend reinvestment program can accelerate your journey to financial independence. Shares purchased using dividends received, in turn, begin to generate dividends. This increases the investor’s cash flow and capital.

SCHD vs Alternative Dividend ETFs

The most common SCHD dividend comparison with other passive income sources is quarterly vs. monthly dividends.

The choice of option depends on investor preference. Quarterly dividends result in fewer events. This enables investors to receive a larger sum at once. Monthly dividends, on the other hand, make it easier to plan income and expenditure.

However, the selection of monthly dividend options among ETFs focused on large U.S. company stocks is limited. Therefore, investors relying on passive income may find it practical to choose assets whose payment dates do not coincide with the SCHD payment date.

Investors may have to choose between the SCHD vs. VYM dividend. Both funds make payments four times a year: in March, June, September, and December. Other comparison criteria are presented in the table below.

| SCHD | VYM | Category | |

| Tracked Index | Dow Jones U.S. Dividend 100 Index. | FTSE High Dividend Yield Index | Various Approaches |

| Dividend Yield | 3.77% | 2.38% | 2-4% |

| Expense Ratio | 0.06% | 0.06% | 0.03-0.10% |

Conclusion

According to the SCHD dividend schedule, the final SCHD payment date in 2025 was December 15. Investors who owned shares on December 10 received this distribution. The next SCHD dividend is scheduled for payment on March 31, 2026, according to the SCHD dividend calendar. To receive it, shares must be purchased by March 25, at the latest.

The Schwab Dividend ETF Calendar enables investors to manage their portfolios more precisely, optimize tax efficiency, and develop trading strategies. The Wall Street Horizon ETF calendar provides information on upcoming ex-dates. Here, data on future payments is presented up to 250 days in advance.

Frequently Asked Questions (FAQs)

Q1: What is SCHD’s record date and how does it relate to the ex-dividend date?

The record date determines dividend eligibility of the SCHD. These are received by all shareholders of the fund on this day. According to the Schwab Dividend ETF Calendar, the record dates for 2026 fall on trading days. Therefore, they coincide with the ex-date.

Q2: How does Wall Street Horizon provide SCHD dividend dates so far in advance?

Wall Street Horizon uses information on SCHD distribution patterns from previous years, as well as institutional dividend data from the company’s main public sources. This information comes from press releases, sections of Schwab’s official website dedicated to investor relations and regulatory reports filed with the SEC.

Q3: Does SCHD’s share price drop on the ex-dividend date?

Yes, when the market opens on the ex-date, the price of SCHD shares falls by a sum similar to the SCHD dividend amount. This phenomenon is known as a ‘dividend gap’. It is a feature of all dividend-paying stocks.

Q4: Can I set up automatic dividend reinvestment for SCHD?

Yes, Schwab supports the automatic reinvestment of dividends received by its clients. This service is also offered by most US brokers.

Q5: How do options traders use SCHD’s ex-dividend calendar?

To calculate assignment risk and adjust the strike price in a timely manner, options traders need access to the SCHD dividend calendar. The key piece of information is the ex-date. On this day, the stock price predictably drops (dividend gap).

Q6: Does my broker automatically credit SCHD dividends to my account?

Yes, if an investor has not set up a DRIP, the broker will credit dividends to the brokerage account by default. In order for the received funds to generate new income, it is necessary to activate an automatic reinvestment program.

Q7: Can SCHD reduce or eliminate its dividend?

The SCHD dividend amount depends on the income received by the fund from its stock holdings. The SCHD comprises 100 companies. The ETF distribution amount could fall sharply if a large proportion of the companies in the Dow Jones U.S. Dividend 100 Index reduce or eliminate their dividends.

In a stable economic environment, the SCHD dividend forecast is positive. Fluctuations in the quarterly distribution amount are usually within a few percentage points.

Q8: What’s the difference between SCHD’s quarterly schedule and monthly dividend ETFs?

SCHD tracks an index comprising the largest dividend payers in the US. Most funds that pay investors monthly invest in other assets. These are most often bonds. There are few equity ETFs in US markets that pay monthly dividends. This distribution frequency is typically offered by funds that employ an active stock option trading strategy.