- The only option that leads to a death benefit increase is paid up additions to life insurance.

- With this option, the insurance company uses dividends to purchase extra, fully paid up insurance coverage.

- This increases the tax free death benefit and the policy’s cash value continuously, with no additional out-of-pocket costs.

- Paid up additions are the best dividend option for maximizing legacy. Using them results in tax-free capital growth and does not require a re-evaluation of health status.

This article will answer the following question, ‘Which dividend option will increase the death benefit?’ It will also look at the advantages of other life insurance dividend options.

Table of Contents

Understanding Death Benefits in Life Insurance

The death benefit in life insurance is a beneficiary payout. This is made by the insurance company upon the death of the insured.

There are two types of payouts:

- A basic death benefit. This is the amount of money that will be paid out under the terms of the insurance policy or annuity. In the case of an annuity, interest may be included.

- An enhanced death benefit. This feature provides a payout that exceeds the current account value. It is not available with all insurance contracts.

The life insurance death benefit is usually not subject to tax. However, exceptions apply to large sums and payouts to a trust.

Understanding Life Insurance Dividend Options

In the context of life insurance, dividends refer to the distribution of a mutual insurance company’s surplus profits to policyholders. There are five life insurance dividend options:

- Paid up additions.

- Interest accumulation.

- Cash payment.

- Premium reduction.

- Extended term insurance.

Policy dividends are not guaranteed. They are only available through participating whole life insurance.

How Participating Policies Generate Dividends

Participating whole life insurance is a type of permanent life insurance that provides coverage based on premium payments. As well as a guaranteed cash value, policyholders have the potential to receive mutual insurance company dividends.

It is the responsibility of the board of directors to determine how dividends are paid, and whether they are declared at all. Distribution to holders of participating policies only occurs if the company has earned more than is necessary to cover claims and operating expenses. Potential sources of funds include:

- lower-than-expected claims payouts;

- operational efficiency reducing company costs;

- investment income exceeding assumptions.

How is a life insurance policy dividend legally defined? These payments constitute a return of premiums, rather than interest or other income. They are considered a non-guaranteed refund of excess premiums.

The operations of mutual insurance companies are overseen by the state insurance department. This protects clients’ rights and ensures that they have sufficient financial reserves.

When choosing a mutual insurance company, it is advisable to consider the dividend payout ratio. This ratio shows the proportion of the company’s total surplus that is distributed to participating policyholders.

Which Policies Qualify for Dividend Options

In order to receive whole life insurance dividends, the policy must fulfil participating policy requirements. These policies must be from participating mutual insurance companies. Dividends are not distributed for term life and universal life insurance or non-participating policies.

For you to have a policy eligibility for dividends, the policy must be active. Regular insurance premiums must be paid on time. Furthermore, most mutual insurance companies only pay dividends on policies issued more than a year before the dividend declaration date.

How Paid-Up Additions Directly Increase Your Death Benefit

With the paid up additions life insurance option, the dividends distributed by the mutual insurance company will be used to purchase extra insurance coverage.

These purchases will increase the amount of the death benefit. They also increase the cash value, which can be used to access living benefits.

Paid up additions are the only death benefit increase option. Other life insurance dividend options do not offer this advantage.

Do paid up additions require medical underwriting? A key difference between this dividend option and purchasing new policies is that there is no need to reassess the health of the insured person.

Another advantage of using dividends to purchase paid up additions is that it avoids the need for new life insurance.

Below, we will examine in detail how paid up additions work.

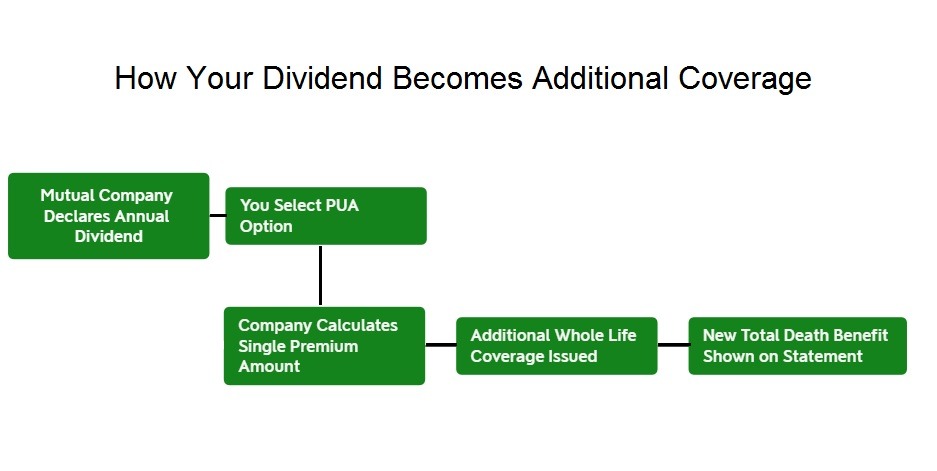

What Happens After You Select the PUA Option

After selecting dividend options, the paid up additions process involves the following steps:

- The board of directors of the mutual insurance company evaluates its financial position and declares a dividend.

- The insurer then calculates the single premium amount based on the client’s age under the insurance policy administration.

- Any additions to the policy are purchased automatically using the declared dividends.

- The death benefit calculation takes the paid up additions into account.

- The client’s personal account is updated to show the current cash value and death benefit amount.

No Medical Underwriting Required

Paid up additions underwriting involves the addition of new life insurance regulations. Do paid up additions require medical underwriting? No, this program involves no medical exam. This is beneficial for people whose health has deteriorated since the initial contract was signed.

Although these additions are modest, over the years the compounding effect means they have a significant impact on the final sum. This is an advantage over guaranteed issue life insurance. Such programs also do not require medical examinations, but offer a lower payout amount.

The Mathematical Mechanics of PUA Death Benefit Growth

How to calculate the death benefit with paid up additions? Let’s examine how paid up additions work. The formula for calculating death benefit increase is as follows:

PUA Amount = Dividend ÷ Net Single Premium Rate

The net single premium rate depends on the age of the insured person. It is also influenced by the health rating obtained when the policy was first issued. For an accurate calculation, this specific rate must be confirmed with the insurance company.

For example, an annual dividend of $1,500 could increase the death benefit by around $12,500 for someone aged 45.

Importantly, this involves compound dividend growth. Money spent on purchasing additional insurance coverage will generate new dividends in the future.

Calculating Your Death Benefit Increase with PUA

How to calculate death benefit with paid up additions? The total insurance coverage amount is the sum of the value of the original policy and all additional policies.

The death benefit calculation follows the paid up additions formula:

Total Death Benefit = Base Death Benefit + Accumulated PUA Death Benefit

This formula suggests that the death benefit amount will increase each year. For example, consider a policy with a base amount of $250,000 and an annual dividend of $1,500.

| Years | Cumulative PUA Death Benefit Growth | Total Death Benefit |

| 0 | 0 | $250,000 |

| 10 | ~$18,750 | ~$268,750 |

| 20 | ~$49,000 | ~$299,000 |

| 30 | ~$105,000 | ~$355,000 |

Over 30-40 years, the growth chart will become exponential. However, the final result is not guaranteed. The death benefit calculation is provided as an example only. The actual increase will depend on the size and stability of the dividends paid.

The Compound Growth Advantage

Let’s look at how paid up additions work in terms of wealth accumulation. Compound dividend growth accelerates this process. The snowball effect then comes into play. In subsequent years, the policyholder receives dividends not only on the original policy, but also dividends on dividends.

However, it’s important to understand that this is not guaranteed income, but rather the result of mathematical modeling. In reality, a mutual insurance company may not pay dividends. If this happens, the cumulative effect will not be realized.

Complete Comparison: How Each Dividend Option Affects Your Death Benefit

Let’s provide a dividend options comparison to help you make the best possible life insurance dividend choices.

| Option | Effect on Death Benefit | Effect on Cash Value | Liquidity | Compound Dividend Growth | Best for |

| Paid up additions | Increases permanently | Immediate increase | Surrender available | Yes – Generates own dividends | Legacy maximization |

| Interest accumulation | No | Grows at 3-5% | Available | No – Interest only | Conservative growth |

| Cash payment | No | No | Immediate | No | Immediate income |

| Premium reduction | No | No | Applied to premium | No | Cost management |

| Extended term insurance | Minimal | Minimal | Rarely used | No | Rarely selected |

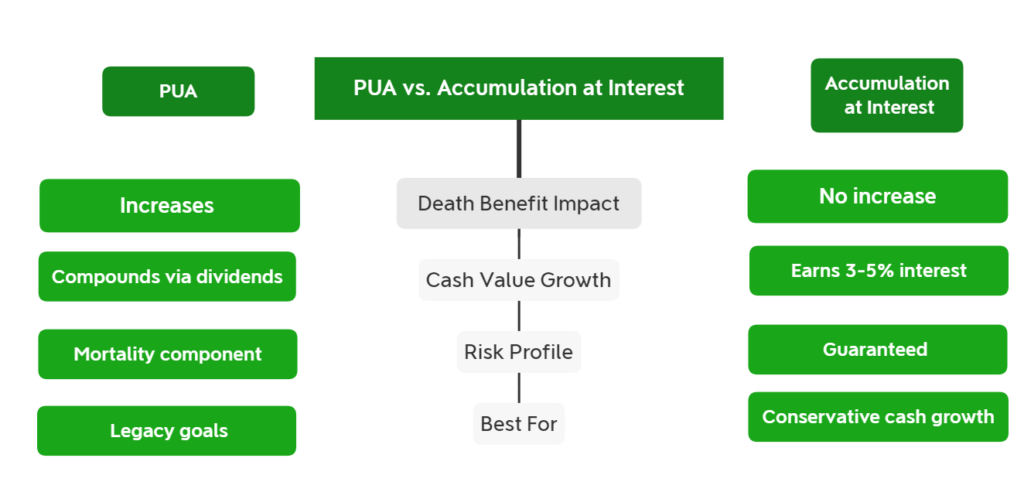

The most common dilemma for participating policyholders is the choice between paid up additions vs. interest accumulation.

PUA vs. Accumulation at Interest: Key Differences

The choice between paid up additions vs. interest accumulation is determined by your financial goals. The accumulation at interest option is advisable for:

- obtaining guaranteed profit;

- achieving a lower level of risk;

- ensuring access to liquidity.

Paid up additions are advisable if the participating policyholder is looking for death benefit increase options. They are also suitable for people who want to:

- purchase additional insurance policies;

- increase not only the death benefit but also the policy’s cash value;

- utilize the potential for compound growth.

Which dividend option would an insurer invest in? Dividends are placed in interest accumulation. The insurance company uses the funds received for investment purposes. In return, the client receives a guaranteed income.

A cash value growth comparison between paid up additions vs. interest accumulation shows the advantage of the former. It is also the best dividend option for maximizing legacy.

Furthermore, this option has the potential to deliver higher returns thanks to compound growth. However, the accumulation at interest option is better for guaranteed returns.

Cash Value Benefits of Paid-Up Additions

The cash value of a life insurance policy can function as a policy loan collateral. Therefore, the paid up additions cash value increases the amount of loan available to the policyholder. At the same time, the amount that the policyholder would receive if they surrendered the policy increases.

Why PUA Outperforms Other Dividend Options for Legacy Planning

Paid up additions to life insurance provide the answer to the question: ‘Which dividend option will increase the death benefit?’ It is the best dividend option for those who want to:

- ensure legacy wealth transfer through a tax-free death benefit;

- maximize the death benefit without needing a re-evaluation of health status;

- achieve compound dividend growth and increase the cash value life insurance.

Choosing the Right Dividend Option for Your Goals

Selecting a dividend option depends on the policyholder’s dividend strategy goals:

- the dividend option cash payment is preferable for generating retirement income or for quickly obtaining liquidity;

- premium reduction is for cases of limited cash flow to lessen financial burden;

- the accumulation at interest option is for conservative growth and preserving future liquidity.

When to choose paid up additions? This option is chosen when it is necessary to achieve several goals at once. Firstly, it is one of the death benefit increase options. An alternative in this regard is the guaranteed issue, which also does not require medical exams.

Secondly, it increases the cash value of life insurance. This enhances policy loan collateral, thereby increasing the amount that can be borrowed.

Flexibility to Change Dividend Options

The policy flexibility and ability to change dividend options depend on the chosen company. Most insurers allow annual dividend election changes. These changes are made upon written request and are not subject to penalties.

Paid up additions to life insurance policies are most beneficial when taken out at a young age. If a person has already retired, mutual insurance company dividends may be necessary to cover current expenses. Experts recommend reviewing your chosen strategy every three to five years.

Tax Considerations for Each Dividend Option

Life insurance tax treatment depends on the choice of life insurance dividend options:

- Using the death benefit increase options and the cash value allows for tax-free growth.

- Interest accumulation provides tax deferral until funds are withdrawn.

- Cash payments are usually only taxable once they exceed the original premium amount.

- Premium reduction has no dividend tax implications.

According to Section 101(a) of the U.S. Tax Code, life insurance death benefits are generally not subject to income tax. There are rare exceptions for exceptionally large benefit amounts, but most people do not reach this threshold, meaning that beneficiaries receive a tax-free death benefit.

Conclusion: Paid-Up Additions Offer the Only Direct Path to Death Benefit Growth

The choice of dividend option depends on your goals. The question, ‘Which dividend option will increase the death benefit?’ has only one answer. It is paid up additions to life insurance.

This option ensures the maximizing death benefit. The first key advantage is that additional coverage can be purchased under the terms of the original policy, without the insured undergoing further underwriting or health reassessment.

A second key benefit is tax-free legacy wealth transfer. Paid up additions also allow for the tax-free compound growth of the cash value.

In order to enter into a participating whole life insurance contract, it is essential to carefully select a mutual insurance company. Ratings from A.M. Best and Moody’s, as well as an evaluation of the company’s payment history and dividend payout ratio, can help with this.

It is also helpful to consult a financial advisor. They can help you choose a reliable insurer and devise an optimal dividend utilization strategy.

Frequently Asked Questions (FAQs)

Q1: Can you split dividends between multiple options?

In the United States, there are companies that allow you to combine multiple options. For example, under the dividend option cash payment, half of the dividend amount can be taken as cash. The other half of the funds received can be used to purchase paid-up additions.

Q2: How often are life insurance dividends paid?

Mutual insurance company dividends are typically paid out on an annual basis. However, a company may also choose to declare no dividends. This depends on the company’s financial performance.

Q3: What determines dividend amount in life insurance?

The total dividend amount depends on investment returns, operational efficiency and the ratio of actual to expected claims. The amount received by the participating policyholder is also affected by the terms and cost of the policy.

Q4: Does premium reduction option affect death benefit?

Using dividends to reduce the insurance premium does not decrease the death benefit provided by the original policy. However, selecting this option means that the participating policyholder will not benefit from compound dividend growth.

Q5: What is extended term insurance dividend option?

The essence of this option is to purchase a term life insurance policy using the accumulated dividends from a permanent life insurance policy. This maintains the death benefit amount. This method preserves insurance coverage for a set period without the need to pay regular premiums.

Q6: How do mutual insurance companies declare dividends?

The board of directors evaluates the company’s financial results. The amount to be distributed among participating whole life insurance policyholders is then determined. The amount received by each individual depends on the premiums paid and the policy’s cash value.

Q7: What is the minimum policy age to receive dividends?

There is no universal age regulation. However, most companies offer policies to people aged between 18 and 65-75. One of the conditions for receiving dividends is that the original policy was issued more than a year before the distribution.

Q8: Can beneficiaries access paid-up additions before death?

No, beneficiaries cannot access the paid up additions before the death of the policyholder. Only the policyholder can access cash from their paid up additions, either through a policy loan or by making a withdrawal.