Investing in assets that have potential for growth or that can save your earned money is a complicated process. To allocate your money across multiple options, it is important to get to know all the types of asset classes, their benefits and risks.

There are hundreds of investment strategies, but every investor chooses own way corresponding to current needs. Whether you invest for long-term goals using growth assets or pursue defensive strategies avoiding volatility, you should be conscious of main asset classes.

Table of Contents

Key Points

Historically, there are three main categories of assets: equities, fixed income investments and cash with its equivalents. However, some other asset classes have already firmly come into use:

- Equities (stocks) — shares issued by a company. Shares can be otherwise called stocks. Their value rises and falls over time according to company development, results and performance. Some companies pay dividends which are also a constituent part of equities.

- Cash — money used to purchase goods and pay bills or debts. Cash equivalents — assets which can be converted into cash (certificates of deposit, treasury bills, etc.).

- Fixed income investments (bonds) — loans with fixed rate of return in the form of interest. Investors get these interest payments on their principal provided to the company.

- Real estate or other tangible assets — an asset class protecting against inflation. Real estate contains more “real” physical assets than derivatives and other forms of financial instruments.

- Alternative investments — an asset class including precious metals, commodities, futures, forwards, cryptocurrency, P2P loans and option trading contracts.

The variety of asset classes with different characteristics nowadays leads to diversification of investors’ portfolios that allows them to reduce risk.

What is an Asset Class?

An asset class is an asset category with similar investments being a subject to similar regulations. Equities with their specific traits, fixed income (debt securities), real estate and commodities — all these are asset classes helping diversification.

Understanding asset classes lets you be aware of what you own at a high level.

Types of Asset Classes

Cash and Cash Equivalents

Cash essentially means your money in the bank whether holding a checking, savings or money market account or invested in CDs. Cash is an asset class which possesses a low risk with low return. Except cash itself, cash equivalents like U.S. T-bills, bank CDs, money market funds, commercial papers and bankers ‘acceptances also provide low risk and guarantee a possibility to sell or buy your securities quickly. Liquidity of cash is one of the highest among all the current assets on a balance sheet.

Any asset that is denominated in cash is potentially vulnerable to inflationary risk therefore it should be protected. Besides, across multiple options it would be better to invest in assets possessing less risk of inflation in current circumstances.

Fixed Income Assets

Within fixed income securities you can find two main types of assets — asset-backed securities (ABS) and mortgage-backed securities (MBS). ABS refers to securities, mostly bonds, that are backed by collaterals in the form of home loans, auto loans, student loans, etc. and are created from the pooling of various assets. MBS in turn represent a pool of mortgages.

As you know, bonds are loans to companies and governments as well as municipalities (munis). The enumerated entities issue bonds instead of taking bank loans. When you buy a bond you usually earn a return from interest payments and also receive an investment principle back at maturity date. Price fluctuation of the principle is not so high as stocks change in prices. However, fixed-income securities including bonds generate predictable income.

Bonds can offer medium risk and medium return potential. Investing in debt securities is comparatively less risky than investing in equities or other asset classes. But be mindful of perceived default risk (i.e. the risk that a borrower won’t be able to repay loan to a lender) of fixed-income investments which should have been assessed in advance. To do this, you can consult credit rating agencies which analyze a company’s financial condition and ability to repay its debt.

High-yield bonds or junk bonds that have lower credit ratings than investment-grade bonds offer higher interest rates for risk carried by investors.

Examples of fixed-income securities are represented by the following assets: bonds, treasury bills, Guaranteed Investment Certificates and mortgages.

Equities

Equities are mostly shares placed on stock markets. These shares are issued by companies and represent a portion of the company’s capital. Depending on your share number, you get a part of the company’s profit.

Purchasing shares investors await an increase in value of the principal amount. Besides, except capital gains shares generate dividends improving portfolio’s performance and investor’s wealth. The crucial benefit of equities is their small initial investment amount and possibility of broad diversification e.g. if you buy shares of an equity fund. Moreover, with equity strategies you may get returns above the benchmark and achieve your financial goals much faster than with some other asset classes.

Investment Funds

Investment fund is a well-spread type of assets implying cooperative ownership by shares of the fund. Numerous investors pool their money and purchase securities, while professional managers select, check and allocate investments for the benefits of all the parties involved. Traditionally there are 4 main types of investment funds:

- mutual funds pooling investor’s money and allocating them in various securities according to prescript rules;

- exchange-traded funds also pooling money from investors and pursuing to get maximum benefits, but in contrast to mutual funds traded intra-day;

- money market funds investing in high-quality debt instruments and cash equivalents;

- hedge funds using risk management techniques for the purpose of maximizing returns.

Commodities

Commodities are highly volatile products, but they can also be used to get returns on your funds. Commodities are the most basic resources like wheat, grains, beef, natural gas or gold. Raw materials like corn, oil or uranium are commodities as well.

With the help of called items people produce enhanced goods or use commodities for direct consumption. Besides, sophisticated investors hedge their risks buying derivatives of commodities such as ETPs or futures.

Commodities are risky enough as price on them fluctuates under the influence of many factors from weather to global policy. To invest in commodities, you can either buy natural resources, precious metals, livestock and physical raw commodities or invest in futures, exchange-traded funds and hedge funds.

Alternative Asset Classes

Alternative investments can include any assets that do not fit into one of the other categories like real estate, hedge funds, cryptocurrencies, artwork and collectibles, private equity or venture capital.

But some experts debate over classification of the real estate asset class, which offers different features to traditional investments (stocks, bonds and cash) and their mainstream strategies.

Alternatives typically are associated with:

- illiquidity;

- limited investment history;

- performance characteristics that are not similar to traditional assets;

- specialized skills for asset management.

Despite the fact that alternatives are considered as less liquid asset classes in comparison with conventional assets, their returns can vary depending on the exact asset type.

Derivatives that are also included into alternative investments are based on an underlying asset and can be highly liquid. For instance, oil futures are derivatives of the price of crude oil, whereas stock options are derived from stocks. Transaction costs for alternative assets can be pretty high.

Choosing the Right Asset Allocation

Asset allocation models help to determine best performing assets and create a strong portfolio for future goals taking into account investor’s risk tolerance and investment timeline.

Jack Bogle, the founder of Vanguard, once said: “The most fundamental decision of investing is the allocation of your assets: How much should you own in stocks? How much should you own in bonds? How much should you own in cash reserves?”.

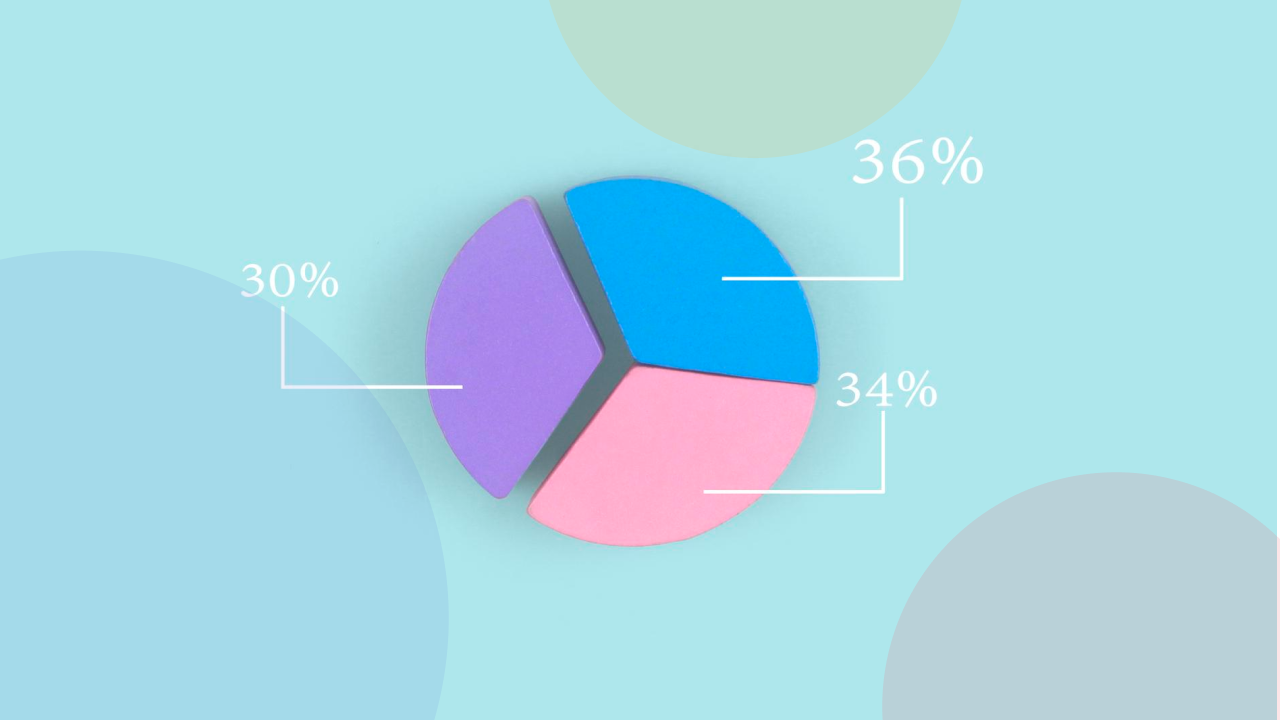

Asset allocation models analyze all the set of factors: your age, time horizon, wealth goals, capacity for risk and risk tolerance. Referring to these parameters the following models can be built:

- Aggressive or growth model. The model emphasizes the importance of long-term growth rather than regular income or funds preservation. To use the model investors should be tolerant to high risk and short-term price fluctuations. According to this model at least 70% of your capital should be kept in stocks.

- Moderate, balanced or income model. It is the best choice for investors trying to reduce potential volatility by focusing on coupon-yielding bonds and dividend paying stocks. The risk level corresponds to the name of the model, it is moderate. Using this model, investors add to their investments at least 40% bonds.

- Conservative or very conservative model focuses on modest capital and income growth. The model usually consists of fixed-income securities and a small number of equities.

A choice of a right investment model allows you to make more conscious decisions and grow or save your portfolio in a secured way.

Comparative Risks and Returns

Various asset classes are associated with different risks and returns. To get maximum benefit, investors should know key points of every asset type.

When you use equities, there is no guarantee that dividends will be paid. In addition to it, the share price can fall below the level you invested. It means that your initial amount of money invested is also under threat of price movements. Accordingly, investments in equities are risky, but highly profitable.

Bond investments or so called fixed income assets have their own risks as well and their returns are more modest in comparison with equities. The value of fixed assets is connected with interest rates, consequently your principal amount varies over time. Besides, sometimes due to multiple reasons the borrowers are not able to repay.

Cash is typically a lower risk investment tool with lower return in comparison with bonds or equities. Cash and cash equivalents are suitable for risk-averse investors. Rates of return of cash are usually modest. Cash is not the best choice for investors willing to get long-term capital growth.

Commodities are recommended to sophisticated investors due to multiple forms of risks under threat of which they are traded. Climate change affects supply and demand correlation, political issues have an impact on the economy of different countries and all this matters while trading commodities and changes their prices and returns.

Alternatives tend to be sensitive to restrictions on transfer and they have no secondary trading market. Thus, risk exposure of alternatives is high. However, despite the speculative and volatile nature of alternative investments, their returns are usually higher than returns of traditional assets that makes them attractive for investors.

FAQs

H3: What are the most popular asset classes?

The most popular asset classes are equities, fixed income, cash and its equivalents. There is also a class of alternatives which comprises all the other not mentioned assets (real estate, commodities, futures, cryptocurrency etc.).

Which of the asset classes is generally considered to be the least liquid?

Real assets like commodities, real estate, land tend to be the least liquid while cash is typically the most liquid asset of all.

After allocating assets, what’s the next level of diversifying you should do within asset classes?

After you have allocated your assets (i.e. decided which portion of your portfolio and in which asset you invest), you should periodically rebalance your portfolio in order to make its values more corresponding to your investment plan levels.

What alternative asset classes are well suited for the current market environment?

What alternative asset classes are well suited now, will depend on a cycle segment we are currently in. If we see continuing decline in business activity, raising interest rates and even looming recession according to some predictions then it is possible to consider business loans (merchant debt/factoring), private equity, real estate or artificial intelligence and maintain growth/protection balance.

However, all the provided information here is not investment or financial advice and you should consult with a licensed professional on your own situation.