Table of Contents

What Is Dividend Reinvestment? Understanding the Basics

- A dividend reinvestment plan (DRIP) is a program of automatic reinvestment of the money paid out to shareholders.

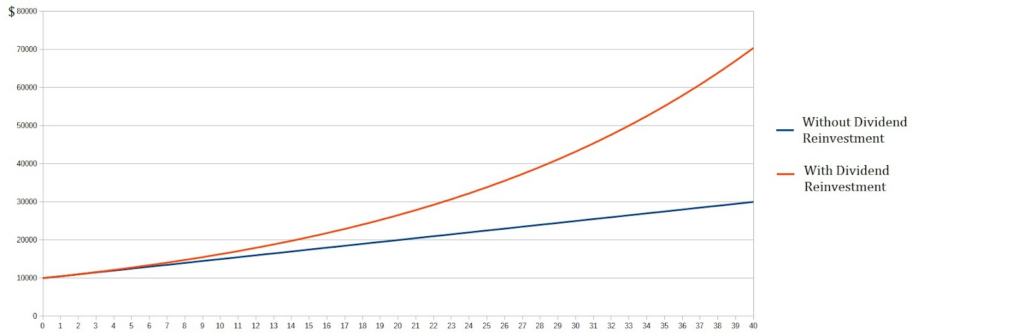

- Reinvestment leads to compounding returns. For instance, with an average annual rate of 3% over 20 years, the total return will increase by around a third. Over a 40-year period, it will almost double.

- The advantages of DRIP include the simplicity of implementing an investment strategy and the elimination of emotional decision-making. Some companies also offer favourable conditions within DRIP, such as the option to purchase stock at a discounted price.

This article will provide a detailed explanation of ‘what is dividend reinvestment plan’ and the benefits it offers.

When a Corporation Allows Investors to Reinvest Cash Dividends

Most companies pay cash dividends and offer automatic reinvestment in additional shares. What’s the dividend reinvestment from the company’s perspective? It is an opportunity to raise additional capital by selling shares directly to investors.

In most cases, a third-party company is involved in setting up a company-sponsored DRIP. For instance, Coca-Cola uses Computershare Trust Company’s services.

Some DRIPs allow the following advantages when purchasing additional shares:

- no commissions on transactions;

- the possibility to purchase fractional shares;

- a discount from the market price.

Why Companies Pay Dividends Instead of Reinvesting Profits

Mature companies that have already gained a significant market share and have limited opportunities for business expansion carry out dividend distribution. A corporate strategy of capital allocation, including dividend payments, helps to increase shareholder value and attract investors.

Types of Dividend Reinvestment Plans

In order to understand ‘how does dividend reinvestment work’, it is necessary to be familiar with the three types of DRIP:

- Company-operated DRIP. A department within the company is responsible for implementing the plan.

- Third-party DRIP. The transfer agent holds the company’s shares and sells them to shareholders as part of the DRIP scheme.

- Broker-operated DRIP. Once dividends have been received by the investor, the broker purchases stocks on the open market in accordance with the strategy established when the plan was activated.

How Dividend Reinvestment Works in Practice

Novice investors often ask, ‘How does dividend reinvestment work?’ Let’s take a look at the dividend payout and reinvestment cycle:

- The amount of the payout is known on the dividend declaration date.

- A list of shareholders is formed on the record date, which coincides with the ex-dividend date.

- The company transfers the money to shareholders on the payment date.

For example, a company might pay $10 per share. If an investor owns 1,000 shares, they will receive $10,000 in dividends. Suppose the investor participates in a 100% DRIP and the stock price is $210 on the payment date. With this money, they can purchase 47 whole shares.

By the next record date, the investor will own 1,047 shares. This means they will receive more dividends and be able to purchase more securities. If the DRIP allows for fractional shares, the investor will receive an additional 47.619 shares.

What Is an Auto Dividend? Automating Your Investment Growth

Another common question among beginner investors is, ‘What is auto dividend?’ An auto dividend refers to a passive investing system that operates on the ‘set-and-forget’ principle. Once the DRIP parameters have been determined, no further decisions are required.

This investment automation eliminates time-consuming tasks. It makes it impossible to deviate from the strategy due to emotions. This is especially important during periods of high volatility. As a result, through regular investments, an individual benefits from advantageous dollar-cost averaging and higher returns.

Types of Dividend Reinvestment Plans Available to Investors

As previously mentioned, there are several DRIP varieties. The choice of the reinvestment option depends on the strategy and the investment vehicles used.

Company-Sponsored DRIPs: Direct Investment Through the Source

Many companies offer dividend reinvestment and direct stock purchase schemes through transfer agents. Investors who choose company-sponsored DRIPs often receive a discount on shares and the option of certificate-free investing. Some companies also allow investors to purchase fractional shares.

One drawback is the need to track accounts with several transfer agents simultaneously, which can make portfolio diversification difficult.

Broker-Operated DRIPs: Convenience Through Your Brokerage Account

What is dividend reinvestment through a brokerage DRIP? It is an opportunity to save time and control your portfolio diversification. Such programmes often allow you to buy fractional shares. Furthermore, online investing through a single broker makes it easier to track capital performance.

In a brokerage DRIP, automatic purchases take place on the stock exchange. Therefore, discounts on shares are not provided. However, the broker may offer commission-free trades.

The Compelling Benefits of Dividend Reinvestment Plans

To answer the question, ‘Is dividend reinvestment a good idea?’, let’s look at the DRIP advantages.

The main advantage is increased investment efficiency. This result is achieved through:

- Compounding growth, which accelerates wealth accumulation.

- Acquiring new shares on favourable terms.

- Dollar-cost averaging.

Is Dividend Reinvestment Good? Examining the Long-Term Impact

What is a dividend reinvestment from the perspective of wealth building? It is a key tool for building capital. To evaluate DRIP performance, a time horizon of several decades must be considered. For instance, historical results demonstrate that, since 1926, reinvesting dividends would have increased investment returns in the S&P 500 index by over a third.

The Power of Compounding: DRIPs as a Wealth Multiplication Tool

The above result is primarily achieved through the ‘magic’ of compound growth. This is based on the time value. Reinvestment effect over a period of 40 years or more yields exponential returns.

For example, an initial investment of $10,000 at an average interest rate of 5%, compounded annually, will grow to $43,000 over 30 years. After 40 years, it will exceed $70,000.

Dollar Cost Averaging through DRIPs

From a strategic perspective, what is dividend reinvestment? It is a decision that helps to accumulate assets and provides a cost basis advantage.

The DCA strategy involves avoiding market timing and making systematic investing decisions as free cash becomes available. This approach does not increase market volatility protection. However, purchasing shares during recession periods enables a more favourable dollar-cost basis to be achieved and increases the portfolio’s dividend yield.

Without enrolling in a DRIP, there is a risk that a person will be influenced by emotions and not invest during bear markets. Consequently, purchases made during bull markets will result in a higher overall dollar-cost basis.

Moreover, the DCA strategy maximizes the time available to benefit from compound growth. Someone who waits for the best moment to buy shares is wasting time.

Potential Drawbacks and Limitations of DRIPs

Automatic purchases can result in excessive concentration of a particular stock. This increases investment risks. Other DRIP disadvantages depend on the format. With a company-sponsored DRIP, for example, investors may have to pay registration fees and commissions on stock sales. Shares purchased through such plans are also less liquid than those held with a broker. Furthermore, having accounts with individual companies can make portfolio management more complicated.

The main disadvantage of a brokerage DRIP is that there is no option to buy shares at a discount. However, investors using this option through a company-sponsored DRIP should consider the additional tax considerations involved.

Tax Implications: What You Need to Know About Reinvested Dividends

From the IRS’s perspective, what is dividend reinvestment? It is the use of received income. DRIP is not a tool for improving tax efficiency. Regardless of whether or not dividends are reinvested, they are still subject to IRS reporting in the year that they are received. The only exception is holding shares in tax-advantaged accounts.

At the same time, the dividend taxation rules remain unchanged. Qualified dividends are taxed at the federal long-term capital gains rate (0% – 20%). Ordinary dividends, however, are taxed at income tax rates (10% – 37%).

DRIP can make cost basis tracking more complicated. Using such programmes results in many small transactions occurring in the account.

If an investor receives a discount through a DRIP, the difference between the stock’s market price and its actual purchase price is also taxable income for the investor.

Setting Up Your Reinvestment Plan

For a plan initiation to purchase additional shares, an investor must contact their brokerage firm or the selected company/authorized transfer agent.

After the DRIP enrollment process, an account setup is required. When it comes to a company-sponsored DRIP, it is essential to ascertain the participation level in the plan.

Sometimes, brokerage DRIPs allow for flexible investment configuration. However, many brokers still offer programmes with no customization options.

Is a DRIP Strategy Right for You? Evaluating Your Investment Goals

To achieve results, it is important to achieve strategy alignment with the investor’s goals. In general, DRIP enrolment is suitable for individuals who:

- are focused on a long investment horizon;

- are not confident in their financial discipline and want to automate the accumulation process;

- do not have enough time or knowledge to regularly seek the most advantageous deals.

Activating a DRIP is likely to be unsuitable for people with a short investment horizon. This includes those who plan to retire soon and intend to use the cash flow to cover their expenses.

The investment suitability of a DRIP in an individual case can be determined by consulting with a financial planning and personal finance specialist.

Strategic Recommendations for DRIP Implementation

A well-designed DRIP implementation strategy will enable the adoption of the best practices for wealth building. Knowing the answer to the question, ‘What is dividend DRIP?’ is not enough. It is also important to remember the criteria for choosing a plan:

- registration fees and other associated costs;

- the possibility to purchase fractional shares;

- the quality of the securities whose positions will increase through reinvestment.

For portfolio optimization, it is advisable to use DRIPs only for high-quality companies with a stable history of dividend growth. It is also important to rebalance at least once a year to avoid excessive concentration of individual stocks.

FAQ

Is dividend reinvestment a good idea?

Yes, reinvestment increases overall profit. Therefore, it is advisable for those who do not need cash.

What are the advantages of a Dividend Reinvestment Plan?

The main advantages are the automation of the process and the simplification of investment strategy implementation. Some companies offer share discounts when you reinvest within a DRIP.

Do you avoid taxes if you reinvest dividends?

No, reinvested dividends are taxed in the year they are received.

What is a Dividend Reinvestment Plan (DRIP)?

When a corporation allows investors to reinvest their cash dividend by purchasing additional shares without additional actions, this program is called a DRIP.

How do dividend reinvestment plans affect portfolio diversification over time?

Dividends that are automatically reinvested can lead to increased concentration in certain stocks. Therefore, investors should regularly rebalance their portfolios.

Why do companies pay dividends instead of reinvesting?

Only mature companies with limited opportunities for further business expansion pay dividends. For these companies, paying dividends is a way of increasing shareholder value.

What’s the difference between automatic dividend reinvestment and manual reinvestment?

To manually reinvest dividends, more time and effort are required. However, this approach offers flexibility. With automatic reinvestment, the process only needs to be set up once. This saves investors time and helps them maintain financial discipline.

Article Sources

- Investing in DRIPs: Using Dividend Reinvestment Plans to Achieve Financial Freedom by Alan Kerrman

- Coca Cola (KO) DRIP

- Overview of Our Dividend Reinvestment Program (DRIP)