Introducing the BeatMarket Score – your go-to metric for picking the best stocks for your portfolio.

As the founder and CEO of the BeatMarket (beatmarket.com), I actively use the project’s developments when choosing stocks for investment. In the case of MaxDividends, we use the BeatMarket Score at the final stage of candidate selection, selecting only companies with a score of 80+. Today I would like to talk more about what BeatMarket Score is.

MaxDividends is subscriber’s supported newsletter with community and community member’s tools to start building long-term growing passive income to live off dividends.

If a few more people become paid subscribers, MaxDividends can offer more value, develop better tools for private investors, and help even more through charity. So, if you can swing it, please support this work.

What is the BeatMarket Score?

BeatMarket Score is a rating system based on a company’s fundamental metrics. It ranges from 20 to 99, with higher scores indicating stronger companies.

Stocks rated 80+ are considered high-quality, while those rated 50 or below are seen as weaker investments. This score helps you quickly sift through thousands of stocks to build unique investment strategies that boost your returns.

Global vs. Local Scores

The BeatMarket Score has two components: Global and Local. The Global Score assesses a company’s strength worldwide, while the Local Score focuses on its performance within its country. Both scores use the same metrics but are ranked separately to help you identify local market leaders.

Coverage and Methodology

BeatMarket evaluates over 20,000 companies worldwide, including:

– North America: USA, Canada

– Europe: UK, Finland, Sweden, Norway, Denmark, France, Italy, Spain, Germany, Poland, Netherlands, Belgium, Portugal, Ireland

– Asia and Oceania: Japan, Australia, China, India

We gather financial data daily and analyze the past 11 years of reports to ensure robust evaluations. This long-term perspective helps us assess a company’s resilience during economic downturns.

BeatMarket Score Comprises 3 Key Components

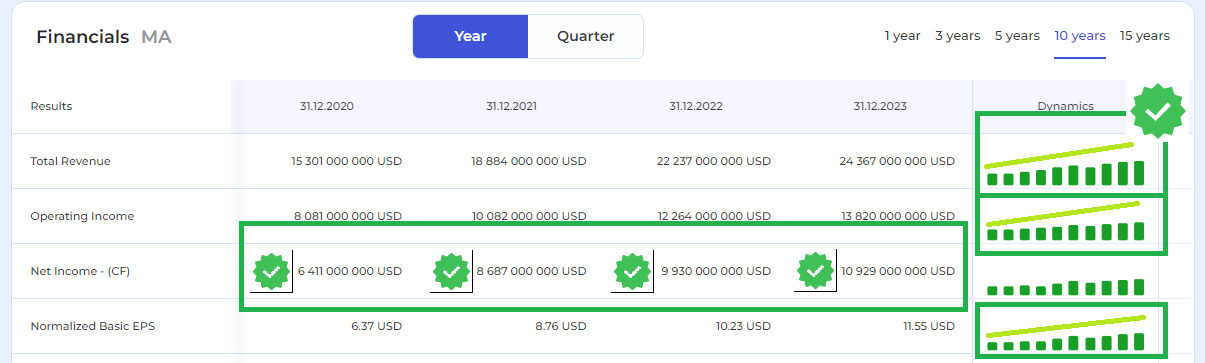

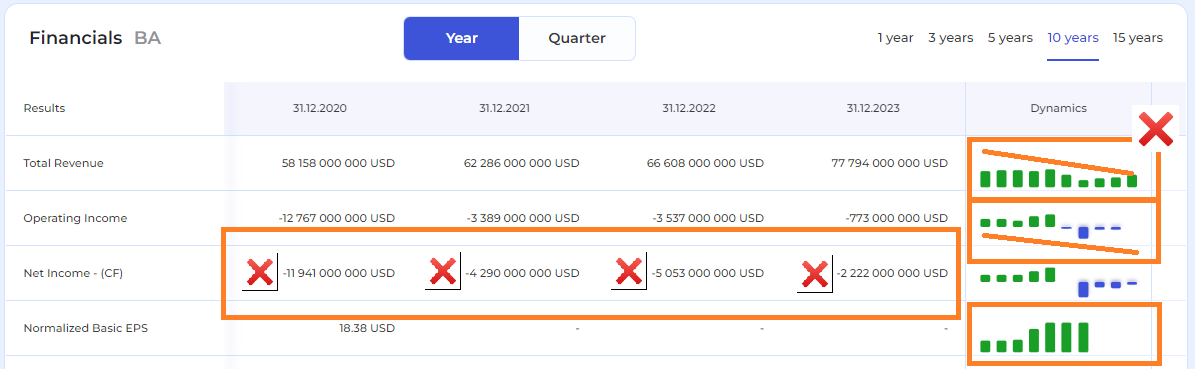

1. Growth Evaluation

We analyze data on sales, operating profit, net income, earnings per share, return on equity, and the trends of these metrics. It’s crucial for us to understand if the company is growing and developing rather than stagnating and incurring losses.

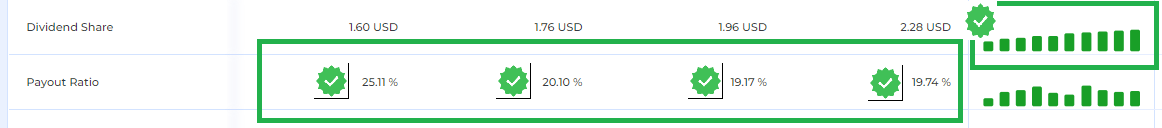

2. Dividend Policy Evaluation

A consistent management approach to investor relations indicates a transparent governance structure and strong management. The dividend policy is a significant aspect of analyzing any public company.

At BeatMarket, we analyze the presence or absence of dividend payments, the overall payment trends, and the frequency of payments. It’s important that dividends are paid from current income, not from past profits or loans. We look at the dividend per share and the percentage of profit allocated for distribution.

When a company consistently pays or does not pay dividends, regularly increases them, or directs all funds towards development, it indicates a well-planned business management and development strategy.

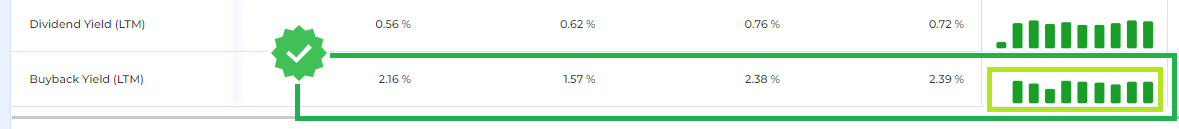

We also pay attention to the presence of share buyback programs. When a company buys back shares, it indicates management’s confidence that the shares are undervalued.

3. Stability Evaluation

In this section, we assess the company’s overall financial health. This includes the ratio of total assets to total liabilities, the ratio of current assets to current liabilities, the debt-to-equity ratio, and growth sustainability. It’s crucial for a company to have a cushion to operate effectively during a market crisis.

Each section (Growth-Dividend-Stability) has a maximum score of 5. If a company meets all the top-tier business criteria, it scores 15 points.

The system then ranks companies and converts the evaluation into the BeatMarket Score. The Global BeatMarket Score considers all evaluated companies worldwide, while the Local BeatMarket Score only considers companies within a specific country.

Why This Matters

Buy Healthy Businesses, Sell Stagnating Ones

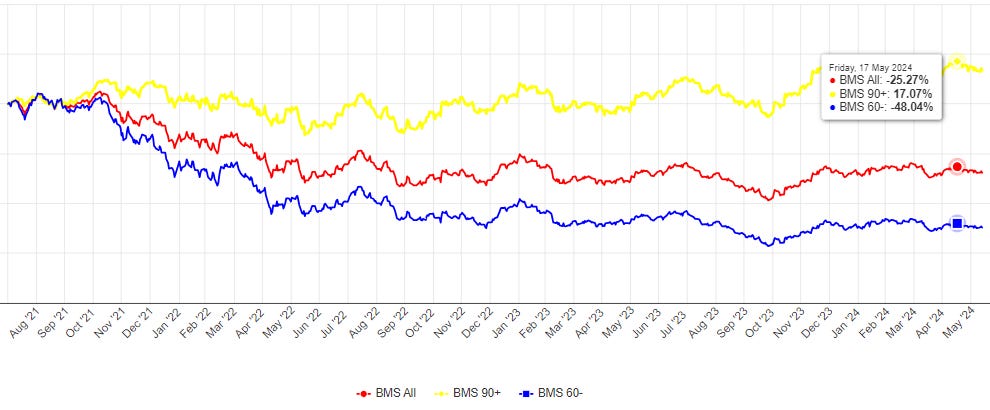

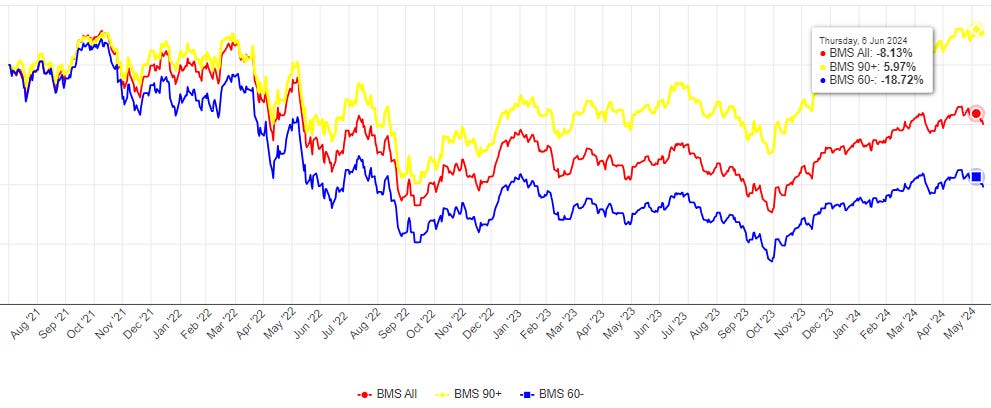

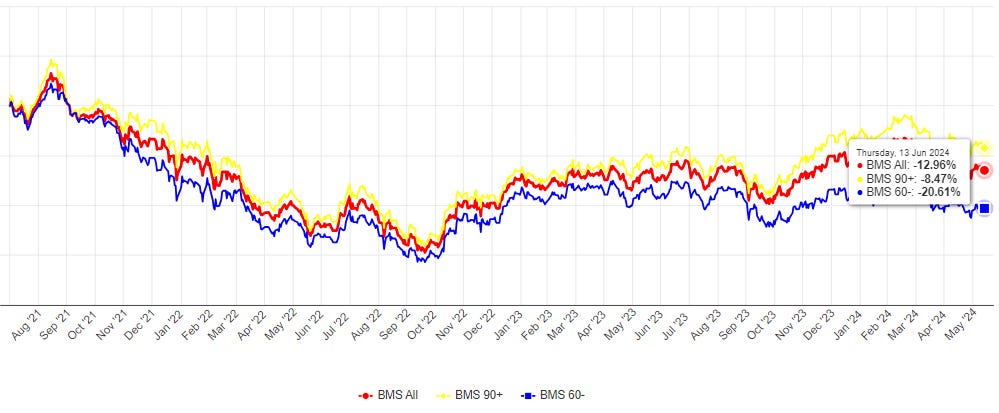

Historically, companies with a rating of 90 and above significantly outperform those with lower ratings. Check out some results comparing the performance of stocks with high ratings (90+) against those with low ratings (60 and below).

USA broad market 4500+ stocks equal weighted. Comparing since BeatMarket launched. 2021-2024

Canada broad market 1000+ stocks equal weighted. Comparing since BeatMarket launched. 2021-2024

Japan broad market 3500+ stocks equal weighted. Comparing since BeatMarket launched. 2021-2024

Choosing stocks based on the analysis of a company’s fundamental metrics is a wise investment of your time to identify the best businesses. The BeatMarket Score helps MaxDividends to quickly identify leaders and laggards in long-term investing.

Sunday Coffee is a column where I share insights on stock investing and the philosophy of long-term investment, discuss intriguing thoughts and ideas that could benefit you.

Did you enjoy the MaxDividends idea and research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Sharing it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research about passive income based on investing in solid high yield dividend stocks: from a small startup team of private investors, followers of F.I.R.E and dividend income, not a fund, bank or so … !

What is inside? Check Out Our 5-Star Deal

- Max Dividends Stocks of the week: Top 10 high-yield, first-class MaxDividends stocks every week

To boost your passive income for living off dividends

- Easy Peasy: Build Your MaxDividends Portfolio to Live Off Dividends with Pre-Selected Stock Sets

Grab ready-made MaxDividends Stock Sets starting at $300, $500, or $1000 each week

- Max Dividends portfolio: Goal $12,000 monthly for 120 weeks

My personal MaxDividends portfolio with all changes and updates weekly

- Sunday coffee

My personal life & business column where I share life moments, insights on stock investing, long-term investment philosophy, and intriguing thoughts to benefit you

- Community chat

Stay in touch with me and other MaxDividends followers

Get 7 day free trial on Substack

Best regards Max Dividends

FAQ

👉 How Do We Choose MaxDividends Stocks?

👉 How well does the MaxDividends strategy work for building a growing passive income?

🙏 A few important notes:

We’re not Wall Street managers or a fund, and our fee for using the product will be the lowest in the world. We’re a startup and a group of individual investors who, like you, want to live off dividends.

Profit isn’t the project’s main goal. Once we cover the costs of maintenance and development, we’ll direct most of our earnings to charity and funds for research and fighting complex diseases.

Did you enjoy the MaxDividends idea and research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Sharing it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research about passive income based on investing in solid high yield dividend stocks: from a small startup team of private investors, followers of F.I.R.E and dividend income, not a fund, bank or so … !

Support us and welcome aboard! Launch your own dividend machine following Max Dividends strategy.