The Tree That Keeps Paying Me Back

💡 MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

Every Friday, I share what I’m buying — real moves, no fluff. The plan is simple: mix high yield with dividend growth to build income that grows year after year.

My goal is $12,000/month in 10 years. This journey is open to anyone — it’s about creating a legacy, taking care of loved ones, and leaving behind a stream of income that outlives you.

⭐️ Your Premium Hub | 🎬 MaxDividends App: 2-Minute Video

Table of Contents

From Rome, With Dividends

Hey friends — Max here.

Some weeks feel slow on the surface… but underneath, compounding keeps working like a machine. No fireworks, no headlines — just quiet progress that turns ordinary Fridays into milestones.

This week marks the 79th Friday in a row since the start of my $12K journey — and the rhythm hasn’t changed:

$3,000 invested every week, $12,000/month as the long-term goal, and one simple mission — build lasting income, not fleeting excitement.

While the market jumps between fear and euphoria, I’m just planting more seeds.

Those seeds — my dividend shares — keep growing quietly, sending a little more cash every month.

🌇 A Special Week — and a Personal Note

This one’s a special week, no doubt. And I’m happy I get to share it with you.

By the time you read this, we’re probably strolling through Rome — and honestly, I couldn’t care less what the market’s doing right now. It’s the weekend, and we’re in the Eternal City. 🇮🇹

Yesterday I turned 40 — a milestone of its own.

It feels like the brightest moments are already behind me… and yet, somehow, all the most interesting ones are still ahead 😂

What truly matters? My family is with me. My wife, my kids — all close. Life is good, and I’m grateful for it. Especially because this trip — every espresso, every museum ticket, every evening walk — is paid for by dividends.

That’s what makes this journey so real. It’s not theory anymore — it’s experience. Dividends are paying for our memories.

And now, back to the portfolio. I made this week’s buys early — on Monday — just so I wouldn’t have to think about markets while we’re away. So if prices look a little different today, that’s why. The plan, though, stays the same.

Let’s roll.

— Max

$12K Journey — Month 18, Week 3: The Calm Weeks That Change Everything

Building Income, One Calm Week at a Time

Each week, I invest $3,000 toward a single goal: reach $12,000/month in dividends in 120 months.

The best part is seeing which positions keep compounding inside the portfolio—and which names sit on the watchlist until the setup is right.

That’s the snowball. No need to time it perfectly—just steady adds, dividend checks, and repeatable moves that compound.

Simple, live, and step by step—the MaxDividends plan, one quiet week at a time.

My Latest Dividend Milestone

✅ $100/month – hit at Month 3

✅ $250/month – hit at Month 5

✅ $500/month – hit at Month 10

✅ $750/month – hit at Month 16

🎯 $1,000/month – now 80.1% complete

💵 A New Record — and a Quiet Victory

This week marks another milestone — I’ve officially crossed $800 per month in dividend income. Another quiet win on the road to my next target: $1,000 a month.

Step by step, week by week, the flywheel keeps spinning faster — every reinvested dollar adds new momentum, every raise lifts the baseline higher. Another milestone reached, another proof that patience pays.

What a great mile to cross!

Now, let’s get to the buys. Grab a seat, pour yourself some coffee (or whatever you love most), and let’s dive in! ☕🚀

💰 $12K in 120 Months — My Portfolio Update (Month 18, Week 3)

Buys This Week

Another $3,190 quietly put to work — same rhythm, same plan. No rush, no drama. Just steady moves that keep the income snowball rolling faster every week.

Here’s what joined the portfolio this time:

🔧 Snap-on (SNA) — 3 shares

The gold standard of craftsmanship — not just in tools, but in business discipline. Over 80 years of dividend payments, 14 years of consecutive increases, and margins that show what consistency really looks like.

🏠 Lowe’s (LOW) — 5 shares

A Dividend King with 62 years of uninterrupted raises. Solid management, strong buybacks, and a balance sheet built for long-term compounding. One of my all-time favorite “quiet builders” of wealth.

📊 T. Rowe Price (TROW) — 10 shares

Still undervalued, still debt-free, and still raising dividends after nearly four decades straight. Yielding around 4.4% with one of the cleanest payout records in finance — a patient investor’s kind of stock.

➡️ Total invested: $3,190 — right on schedule.

Another calm week, another quiet step toward $1,000 a month in dividends. Steady hands, strong names, and the power of time — that’s the MaxDividends way.

🔗 View the live portfolio: MaxDividends $12K in 120 Months Strategy Portfolio

Portfolio Snapshot

- Total Invested: ~$258,618

- Current Value: ~$250,057

- Annual Dividends: ~$9,602 (+$168 vs. last week)

- Yield on Cost (FWD): ~4.33%

The snowball keeps rolling — heavier every week.

🔔 Dividend Raises — Year to Date (2025)

- Greif Inc +3.7%

- OZK Bank +2.3%

- Texas Instruments +4.4%

- FedEx +5%

- Johnson & Johnson +4.8%

- Nexstar Media +10%

- Chevron +4.9%

- Robert Half +11%

- PepsiCo +5%

…and many more.

Each raise locks in more lifetime income and lifts my yield on cost. Quiet, steady, automatic.

Portfolio Progress

Here’s a look inside my portfolio this week:

- Annual Dividends: $9,602/year → about $800/month or ~$27/day passive income

- Top Payers Right Now: a few lead, but 80%+ of income comes from a broad, diversified base

- Based on recent raises, the portfolio is expected to pay about a 4.4% yield over the next year — and those dividends have been growing around 16% a year over the past decade.

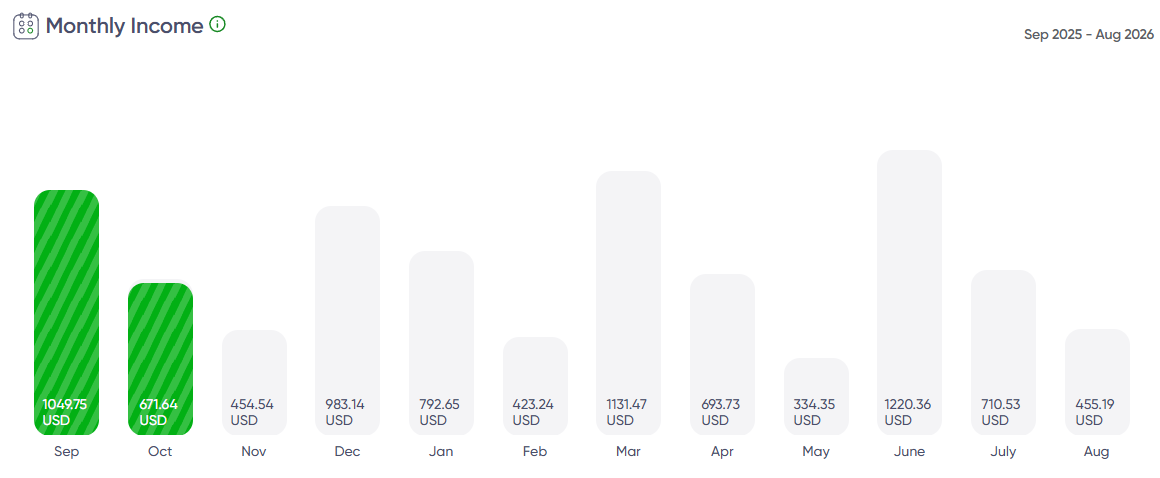

- Monthly Income Trend: some months already cracking $1,000 — September crossed four digits

- Passive Income Goal: 6.46% of the way to $12,000/month. The snowball is rolling stronger every week.

The MaxDividends App

All of this is tracked inside the MaxDividends App — my roadmap and compass. It shows payouts, raises, and exact progress toward the $12K finish line.

If you’re not using it yet, you’re leaving a serious edge on the table.

My Word Here

11/07 Update — email me anytime: max@maxdividends.app

Everything’s right on schedule — October dividends have been fully reinvested, and the snowball keeps rolling. I’m moving forward, reaching new milestones in passive income, step by step, in real time.

My portfolio is well-balanced — a mix of strong, reliable dividend companies — and I’m enjoying every chance to add more shares while the market still offers discounts.

Next week, I’ll tell you about a new company I’ve been watching closely and plan to add soon. But for now, we’ve officially crossed the $800/month mark in dividend income — time to lock it in and keep climbing.

December is right around the corner — a new month of reports, raises, and those beautiful little payout notifications that make this journey so rewarding.

Long live dividends! 💪💰

MaxDividends App

We’re also moving full-speed ahead behind the scenes. The MaxDividends App is getting its own dedicated domain — maxdividends.app — with a new homepage, social login options, and soon, public registration and open access.

Step by step, we’re building the world’s most complete platform for dividend investors — designed by people who actually live and breathe this strategy.

No detail will go unnoticed. No data point left behind.

We’re building something that will serve investors for decades to come — and you’re here early to watch it grow.

The MaxDividends Way

This isn’t gambling or chasing hype. It’s a proven system:

- Invest consistently, every week.

- Stick with dividend growth stocks.

- Reinvest every payout.

- Rotate only if growth stalls.

That’s why the income snowball keeps rolling — heavier each month, stronger each year.

Chapter #2: Kid’s Portfolios

New quarter, new milestone. Every quarter I put $300 into each of my three kids’ portfolios — building generational wealth one brick at a time.

Kids’ Portfolios:

- Focused on capital growth, built around Capital Growth-Focused Dividend Eagles

- Powered by weekly dividend growth stock picks with the help of the MaxDividends Assistant

- $300 each, every quarter

This quarter I added WestPharma and ResMed. Next quarter I’ll likely swap Johnson Outdoors (its Financial Score dropped below 80).

Chapter #3: Core Family Portfolio – Bigger Picture

This is where the long game plays out. Beyond the weekly $3,000 experiment, my family’s core portfolio is the real backbone — built for high-yield dividend growth, steady compounding, and financial security for years to come.

Here I’ll break down where things stand today, how the plan for this quarter looks, and why this portfolio is designed to cover every family expense while still growing stronger over time.

I’ve spent the past 20 years building businesses. That’s where most of my capital came from. But now, at 40 and with three kids, I want to stay involved in business and investing on my terms.

The Big Idea

My goal? More time with family, freedom to focus on what matters, and a portfolio that pays me whether I’m working or not. That’s why in 2025, I’ve started transitioning to fully living off dividends.

The mission hasn’t changed: build a high-yield, dividend-growing portfolio that delivers steady cash flow and strong long-term returns.

With the MaxDividends Concept, my team and I scan markets across the U.S., Europe, and Asia to find financially strong companies with a track record of raising dividends. This way, I’m not just chasing price growth — I’m building a paycheck that grows by itself.

Core Family Portfolio Snapshot

- Total Invested: ~$1,333,736

- Current Value: ~$1,610,642

- Current Yearly Dividends: ~$71,910*

- Yield on Cost: ~5.41%

(*Dividend totals vary slightly due to exchange rates.)

This portfolio alone now pays over ~$6,000/month in dividends. Every dollar is reinvested, fueling even faster growth.

Companies Purchased This Week

No new buys or sells this week — just a calm pause before the next move. I plan to reinvest my October dividends next week, most likely adding a few more shares of Shoe Carnival (SCVL).

Sometimes the best move is to simply let the income build and compound.

Core Family Portfolio Breakdown

✅ 90% High-Yield Dividend Growth Stocks – These names pay me consistently and raise dividends year after year.

✅ 10% Capital Growth Stocks – A smaller bucket for faster-growing companies. When I sell, half the profits go into new growth stocks and half into high-yield dividend payers.

Current Top Holdings

Capital Growth (10%)

- Nexstar Media Group (NXST)

- Tractor Supply (TSCO)

- Lam Research (LRCX)

- Nike (NKE)

High-Yield Dividend Growth (90%)

- Asseco Business Solutions (Poland)

- Rubis SCA (France)

- Hornbach Holding (Germany)

- Melexis (Belgium)

- Rubis SCA (France)

- Ambra SA (Poland)

- Bank OZK (USA)

- Teleperformance (France)

Recent Standouts

🏆 United Parcel Service, Inc – has shown solid momentum over the past week, with a gain of +8.07%

- Nexstar Media Group, Inc – has delivered a solid gain of +21.11%

- Bank OZK – has delivered a solid gain of +14.26%

Dividend Hikes in Q3

- +Yokogawa Bridge +9.09%

- Lam Research Corp +13%

- OZK Bank +2.3% (fourth increase this year)

- Universal Corp +1.25%

- SkyWorks +1.43%

- Texas Instruments +4.4%

More Raises This Year

- Asseco Business Solutions — +25%

- T. Rowe Price — +2.5%

- Fuchs Petrolub — +5%

- BestBuy — +1.1%

- Zoetis — +15.7%

- Tractor Supply — +4.5%

- Applied Materials — +15%

- Teleperformance — +9%

- Nexstar Broadcasting — +10%

- UPS — +0.6%

- Nomura Real Estate — +16%

- Sun Wa Corp — +15%

- Archer Daniels Midland — +2%

Each hike locks in more income for life — steady raises with zero extra work.

📅 This Quarter’s Plan (Q4)

For the fourth quarter, my focus is simple: put more savings to work in the core family portfolio and keep aggressively reinvesting every dividend. The target is clear — push monthly dividends past $7,000 by year-end.

The strategy doesn’t change. I’m looking for stable, undervalued Dividend Eagles that start with solid yields and have the strength to keep paying and raising over time. Dividends are my lever — I collect them, reinvest them, and let compounding do the heavy lifting.

I won’t lock in specific tickers right now — opportunities shift as the quarter unfolds. What matters is scanning the best markets worldwide: the U.S., Canada, Japan, Australia, the U.K., and Europe, and picking financially strong companies that fit the MaxDividends secret formula.

And for my kids? The playbook stays the same: $300 each, every quarter. Three kids, three portfolios, one steady strategy to build generational wealth.

The structure is unchanged — 90% high-yield dividend growth stocks, 10% capital growth stocks. The mission stays the same too: steady income, steady growth, and the freedom that comes from reinvesting.

Right now, it’s all about speeding up the cycle — dividends keep rising, capital keeps compounding, and every reinvested payout brings us closer to true financial freedom.

The Long Game

By 2033–2035, I expect my Core Portfolio alone to generate $16K–$18K/month in dividends. Combine that with my $12K-in-120-months experiment, and the total passive income goal is $30,000/month.

That’s full financial independence: family expenses covered, reinvestment rolling, and freedom secured.

***

That’s all for today’s update.

🎁 Bonus!

Your exclusive gift — a treasure trove of fresh ideas, unlocked because you’re already on the partner side.

- Dividend Radar by MaxDividends — built on the timeless CCC method first introduced by David Fish.

- Weekly Dividend Hikes by MaxDividends — the world’s #1 source for accurate, global dividend raise updates from top dividend-paying companies.

Wishing you steady growth and financial peace,

Max

💌 Questions or thoughts? Reach me anytime at max@maxdividends.app

📚 Knowledge Base & Premium Guides

Start Here

- Your Premium Hub

- What is the MaxDividends Strategy

- 📖 What is the MaxDividends Idea & Concept | E-Book

- 🎥 Quick Video | What MaxDividends App Is All About

Guides & Step-by-Step

Deep Insights

- 📖 I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | E-Book

- How Effective is the MaxDividends Strategy for Building Growing Passive Income

- One More Secret Ingredient for the MaxDividends Strategy

Help & Support

- Got a question about dividends? Ask Max, your AI Dividend Assistant!

- Didn’t get the answer you need? Reach out: max@maxdividends.app or team@maxdividends.app — we’ll help you out.

MaxDividends Mission

Helping people build growing passive income, retire early, and live off dividends.

Someone’s sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.