- Dividend investing is a popular choice for those seeking passive income. Investors may aim to generate retirement income or create a stable cash flow for further reinvestment.

- A popular asset for income generation is the Low Expense Ratio Dividend ETF (Exchange Traded Fund). These allow for portfolio diversification even with minimal capital.

- All dividend ETFs can be divided into two broad categories. The first type is high-dividend ETFs. The second type is dividend growth ETFs.

This article will explain how to select a low volatility dividend ETF. It will also outline the risks associated with investing in this asset class.

Table of Contents

H2: Understanding Dividend ETF Investment Strategies

There are two main methods of building a dividend portfolio. The first is the dividend yield approach. According to this approach, when selecting stocks, the focus is on the yield of the nearest payments, regardless of the company’s fundamental indicators.

When it comes to a low beta high dividend ETF, this approach is not found in its pure form. Funds targeting high dividends still filter out potential traps.

The second method is the dividend growth strategy. In this case, the portfolio comprises companies that have consistently increased their dividends for at least 10 consecutive years. Investors receive relatively low-yield payments with high stability and growth potential.

A low volatility dividend ETF can be categorized by its investment methodology. Passively managed funds aim to replicate the results of a chosen index as closely as possible. They do this by forming a portfolio and holding stocks for the long term.

Unlike passive funds, actively managed funds are not strictly tied to an index. As well as holding stocks, these ETFs use options and other methods to increase returns. When choosing between active vs passive management, investors must consider that, in the former case, the potential return and risks are both higher.

H2: Market Cap and Geographic Considerations

Large-cap dividend stocks are considered a core asset for income investors. However, to increase portfolio yield, mid-cap dividend ETFs can be used. Even more profitable can be small-cap dividend investing. Such stocks can yield up to 7% annually.

International dividend ETFs are usually employed to achieve geographical and currency diversification. These assets help to stabilize a portfolio during periods of dollar weakness.

H2: Dividend Payment Frequency Analysis

There are advantages to monthly dividends over quarterly dividends. Primarily, there is the advantage of being able to plan the ratio of income to expenses more easily. There is also the benefit of more frequent reinvestment.

However, the most common dividend frequency is four times a year. Monthly dividend ETFs can be found on the exchange. But the selection is limited. These payment schedules are predominantly offered by bond funds and actively-managed ETFs.

H2: Top 14 High-Dividend ETFs for 2025

When it comes to dividend ETF recommendations, the list of Morningstar Gold rated ETFs is a good place to start. These are funds that Morningstar analysts believe are capable of outperforming their competitors throughout the entire market cycle.

This rating is a forward-looking indicator which takes into account the potential of the strategy, as well as its associated fees and risks. The listed funds include high-yield ETFs and dividend growth funds.

The best dividend ETFs of 2025 (those that received Morningstar’s Gold and Silver ratings) are listed below:

- Capital Group Dividend Value ETF (CGDV).

- Fidelity High Dividend ETF (FDVV).

- Schwab International Dividend Equity ETF (SCHY).

- Schwab U.S. Dividend Equity ETF (SCHD).

- SPDR S&P Dividend ETF (SDY).

- Vanguard Dividend Appreciation ETF (VIG).

- Vanguard High Dividend Yield ETF (VYM).

- Vanguard International Dividend Appreciation ETF (VIGI).

- Vanguard International High Dividend Yield Index ETF (VYMI).

- WisdomTree U.S. LargeCap Dividend ETF (DLN).

- WisdomTree U.S. MidCap Dividend ETF (DON).

- WisdomTree U.S. SmallCap Dividend ETF (DES).

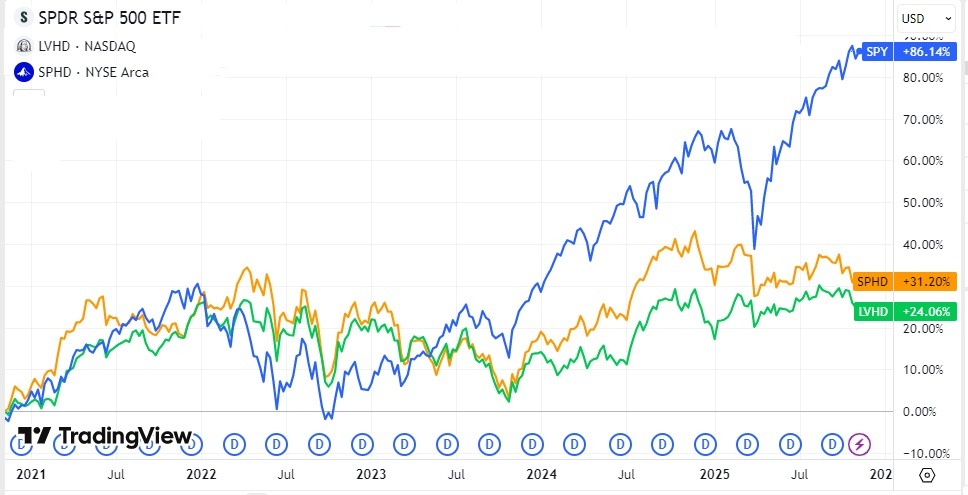

BeatMarket experts suggest adding two low beta dividend ETFs to this list: The Franklin Low Volatility High Dividend ETF (LVHD) and the Invesco S&P 500® High Dividend Low Volatility ETF (SPHD). These funds have the lowest price volatility of all those reviewed.

The chart below shows how the share price of these funds has performed over the past five years, compared with the SPY.

H2: US Large-Cap Dividend ETF Leaders

The following three funds can be used as a foundation for large-cap dividend investing.

The Capital Group Dividend Value ETF is the only actively managed fund on this list of low risk high dividend ETF. The predominant sectors are technology, industry and healthcare. CGDV invests in the stocks of companies with a long history of dividend payments. One of the selection criteria is the dividend amount. This must exceed the S&P 500 average by at least 30%.

- Dividend yield – 1.3%;

- Expense ratio – 0.33%;

- Beta – 0.84.

The Schwab U.S. Dividend Equity ETF is a passive fund which aims to replicate the performance of the Dow Jones U.S. Dividend 100 Index. The key sectors are consumer defensive goods, energy, and healthcare. The ETF’s holdings consist of highly liquid stocks with stable dividends and a payout ratio of less than 60%.

- Dividend yield – 3.9%;

- Expense ratio – 0.06%;

- Beta – 0.56.

Based on its yield and beta coefficient, SCHD can be considered the best low volatility high dividend ETF.

The Vanguard High Dividend Yield ETF is a low volatility dividend ETF that tracks the FTSE High Dividend Yield Index. The key sectors are financial services, technology and healthcare. VYM invests in high-yielding stocks, excluding REITs.

- Dividend yield – 2.52%;

- Expense ratio – 0.06%;

- Beta – 0.77.

The Vanguard Dividend Appreciation ETF focuses on companies with a long dividend growth streak. It includes companies that have increased their dividends for at least 10 consecutive years. As the tracked index is market-cap weighted, around 50% of the assets are in the technology and financial sectors.

- Dividend yield – 1.65%;

- Expense ratio – 0.05%;

- Beta – 0.78.

H2: High-Yield and Low-Volatility Strategies

The Franklin Low Volatility High Dividend ETF is a passive fund which tracks the US market as a whole. It holds 121 stocks. The key sectors are utilities, consumer defensive stocks, and real estate.

The fund’s primary objective is a low volatility investing strategy. It can also be used for portfolio yield optimization.

- Dividend yield – 3.43%;

- Expense ratio – 0.27%;

- Beta – 0.29.

The Invesco S&P 500 High Dividend Low Volatility ETF tracks the S&P 500 Low Volatility High Dividend Index. It comprises 50 low volatility high dividend stocks. The main sectors are real estate, consumer staples and utilities.

- Dividend yield – 1.8%;

- Expense ratio – 0.3%;

- Beta – 0.33.

The Fidelity High Dividend ETF is a passively managed fund with a Morningstar Silver rating. Its main sectors are technology, financial services and consumer defensive stocks. The fund focuses on large- and mid-cap stocks that pay above-average dividends and regularly increase them.

- Dividend yield – 3.1%;

- Expense ratio – 0.16%;

- Beta – 0.73.

H2: International Dividend Opportunities

International dividend ETFs offer the chance to diversify your portfolio through global dividend investing. This solution can help to boost cash flow by offering higher payouts from companies in emerging markets.

The Schwab International Dividend Equity ETF is a passive fund which tracks the Dow Jones International Dividend 100 Index. Key sectors include financial services, defensive consumer goods, and communication services. The fund invests in large- and mid-cap stocks from around the world, excluding the US. No single stock accounts for more than 4% of the net assets.

- Dividend yield – 3.6%;

- Expense ratio – 0.08;

- Beta – 0.73.

The Vanguard International Dividend Appreciation fund comprises large- and mid-cap companies that have increased their shareholder payouts for at least seven consecutive years. The top three sectors are financial services, industrials and healthcare.

- Dividend yield – 1.9%;

- Expense ratio – 0.10;

- Beta – 1.13.

The Vanguard International High Dividend Yield Index ETF is another international, low volatility dividend ETF. Its strategy differs from that of VIGI in that it focuses on a higher current yield rather than on the length of the dividend growth streak.

- Dividend yield – 3.9%;

- Expense ratio – 0.17;

- Beta – 0.78.

H2: Mid-Cap and Small-Cap Dividend Strategies

The following funds focus on mid-cap dividend investing.

The SPDR S&P Dividend ETF tracks the S&P High Yield Dividend Aristocrats Index. The index comprises stocks of companies that have increased their dividends for at least 20 consecutive years. Additional selection criteria include risk factors for dividend reduction. Notably, this index is yield-weighted rather than capitalization-weighted.

- Dividend yield – 2.68%;

- Expense ratio – 0.35;

- Beta – 0.54.

The main advantage of the WisdomTree MidCap Dividend ETF is that it pays monthly dividends. The stocks in the tracked index are weighted based on the aggregate dividends expected to be paid over the next 12 months. The fund’s assets comprise over 300 companies. The key sectors are financial services, industrials, and consumer cyclicals.

- Dividend yield – 2.4%;

- Expense ratio – 0.38;

- Beta – 0.98.

The WisdomTree SmallCap Dividend ETF also pays monthly dividends. The top three sectors for DES are the same as for DON. However, this fund comprises over 550 companies.

- Dividend yield – 2.7%;

- Expense ratio – 0.38;

- Beta – 1.10.

H2: Monthly Dividend ETF Options

A monthly income is the most attractive option for a retirement portfolio. It also enhances the efficiency of dividend reinvestment by allowing for greater compounding. Furthermore, more frequent reinvestment can lead to more favourable dollar-cost averaging for the position.

Another monthly dividend ETF is the WisdomTree LargeCap Dividend ETF. It comprises approximately 300 of the largest dividend-paying companies in the US market.

- Dividend yield – 1.89%;

- Expense ratio – 0.28;

- Beta – 0.71.

H2: Specialized High-Income Strategies

Among high-income ETFs, some funds may utilize alternative income approaches. These are primarily covered call ETFs, which combine stock ownership with options strategies.

Selling options enables the fund to increase its income, consequently increasing the amount of distributions to shareholders. Furthermore, this strategy enables the fund to pay monthly dividends.

The JPMorgan Equity Premium Income ETF (JEPI) is an example of a low volatility dividend ETF with an alternative strategy. This is an actively managed fund. It is benchmarked against the S&P 500 Index and focuses on US low volatility dividend stocks. Additional income is generated by selling options and receiving premiums.

- Dividend yield – 8.39%;

- Expense ratio – 0.35;

- Beta – 0.56.

Despite JEPI’s low beta coefficient, such funds are generally not recommended for conservative investors. Their distributions can be less stable than those of traditional ETFs.

H2: Risk Management and Volatility Control

Investing in dividend-paying stocks carries two main risks. The first is the risk of dividend cuts, and the second is the possibility of losing part of the invested capital due to a decline in the share price.

The low volatility dividend investing strategy using ETFs involves prudent risk management. This is achieved through specific stock selection criteria. These criteria primarily aim to avoid value traps.

Additionally, the selection criteria include factors that reflect dividend sustainability. These include dividend history and payout ratio, among others. There are also limitations on the weighting of individual stocks and sectors within the fund’s portfolio. This enhances diversification and reduces share price volatility.

Tax Considerations for Dividend ETFs

The first step in building an investment strategy is selecting a low cost high dividend ETF. The second important factor is optimizing dividend taxation.

The simplest way to increase tax efficiency is to receive qualified dividends. These are taxed at long-term capital gains rates. Depending on the investor’s tax bracket, these rates are 0%, 15% or 20%. In contrast, ordinary dividends are taxed at rates ranging from 10% to 37%.

In order to receive qualified dividends, an investor must hold the ETF share for at least 61 days during the 121-day period. This period begins 60 days before the ex-date. Furthermore, in order to distribute qualified dividends, a fund must itself receive qualified dividends.

Using tax-advantaged accounts is particularly advisable for those in the higher tax brackets. High-income investors should bear in mind the additional net investment income tax. This tax is charged at a rate of 3.8%.

Another important point to note is foreign withholding tax. This is levied in most countries. Investors using geographical diversification and international ETFs must complete the relevant section of their tax return.

Portfolio Construction and ETF Selection

A low volatility dividend ETF is a good tool for portfolio diversification. However, it should only be one component of a portfolio. Investors seeking passive income should have sources of guaranteed cash flow. Examples include bonds and annuities. Other possible components of a portfolio include growth stocks, gold and real estate.

The following ETF selection criteria are used when building a portfolio:

- type of management (active/passive);

- the fund’s investment strategy (dividend growth/maximizing current yield);

- geographical focus;

- expense ratio;

- past performance;

- Morningstar rating.

When selecting a dividend ETF allocation, it is important to bear in mind that the funds’ holdings may overlap. It is therefore important to monitor the key sectors and the top 10 holdings of the chosen ETFs.

Performance Analysis and Benchmarking

In order to evaluate a dividend ETF performance, it is not enough to consider its dividend income alone. It is also necessary to conduct the following:

- Benchmarking. It is important to compare the tracking error of your fund with that of competing funds.

- Total Return Analysis. Total return is the sum of the distributions received and the capital appreciation.

- This is an assessment of risk-adjusted returns. This shows the profit margin for each unit of risk, enabling assets with different risk profiles to be compared.

The price of stocks that pay the highest-yielding dividends often declines. This is because the market has a negative outlook on the company’s future. A low volatility high dividend ETF should track an index that excludes such ‘dividend traps’.

Various metrics are used to assess risk-adjusted returns. The two most common are the beta coefficient and the Sharpe ratio. A higher Sharpe ratio indicates a greater return per unit of risk (i.e. a better investment). A lower beta coefficient indicates lower price volatility.

Advanced Dividend ETF Strategies

Experienced investors often use advanced dividend strategies:

- Dividend Laddering. In this approach, exchange-traded fund (ETF) shares are selected based on their payment schedules to ensure a regular income.

- Sector rotation. This strategy involves investors regularly shifting capital from one sector to another in response to changes in the economic cycle.

- Tactical allocation. This is an active management strategy involving regular changes to the asset allocation within a portfolio, based on macroeconomic conditions.

FAQ Section

A dividend ETF FAQ section can serve as investor guidance. It provides answers to common questions asked by beginners.

What’s the difference between dividend yield and dividend growth ETFs?

Dividend yield vs growth strategy comparison is one of the ETF selection criteria. In the first case, stocks are selected based on the forward yield for the upcoming year. In the latter, stocks are selected based on the length of the consecutive dividend growth streak.

How do monthly dividend ETFs work and are they better than quarterly payers?

Investors prefer monthly dividend payments to quarterly distributions. The main payment frequency benefits are higher reinvestment efficiency and simpler expense planning.

Are international dividend ETFs worth the additional complexity?

International dividend investing using global ETFs carries currency risk and withholding tax. However, it can enhance portfolio diversification and increase dividend yield.

How much should I allocate to dividend ETFs in my retirement portfolio?

Portfolio allocation and dividend ETF percentage depend on factors such as age, risk tolerance and income needs. Consequently, the asset allocation for retirement investing will differ between a young investor and someone who is approaching retirement in the coming years.

What are the main risks to consider with high-dividend ETF investing?

Investment risks associated with dividend stocks include value traps, the likelihood of dividend cuts and potential capital loss. Additional dividend ETF risks include issues of sector concentration within the fund.

Finding Additional Dividend Investment Opportunities

When conducting dividend ETF research, it is useful to employ screening tools. Most brokers allow clients the option of investment discovery by yield, dividend payout ratio and other criteria. However, additional resources are important for deeper analysis. These can include Morningstar research and various popular ETF screeners, such as ETFdb.com, as well as services offered by the BeatMarket platform.

Article Sources

- Morningstar, Inc. (2025). “The Top High-Dividend ETFs for Passive Income in 2025.” Morningstar Investment Research, comprehensive analysis of 13 top-rated dividend ETFs with Gold and Silver Medalist Ratings and 100% analyst coverage.

- Invesco Ltd. (2025). “S&P 500 High Dividend Low Volatility ETF (SPHD) – Fund Overview.” Invesco Asset Management, official fund documentation detailing investment methodology, index construction, and performance characteristics.

- Zacks Investment Research (2025). “Should Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) Be on Your Investing Radar?” Finviz Financial Visualization, independent analysis of SPHD performance, sector exposure, and risk metrics.

- 24/7 Wall Street (2025). “3 Dividend ETFs to Buy for An Incredible Passive Income Stream in Retirement.” Investment analysis covering high-yield dividend ETF strategies for retirement income planning.

- U.S. News & World Report (2025). “7 Best Monthly Dividend ETFs to Buy Today.” Money section investment guidance on monthly dividend distribution strategies and covered call ETF approaches.

- Fidelity Investments (2024). “Do ETFs Pay Dividends? Understanding ETF Dividend Taxation.” Fidelity Learning Center, educational resource explaining qualified vs. non-qualified dividend taxation and reporting requirements.

- ETF Database (2025). “Top 100 Highest Dividend Yield ETFs.” VettaFi comprehensive screening data and dividend yield analysis across exchange-traded fund universe.

- Dividend.com (2025). “Top Monthly Dividend Stocks, ETFs, Funds.” Investment research platform providing monthly dividend screening criteria and performance analytics.