In 2023, against a backdrop of increased inflation, many people are deciding to invest in gold. There are 8 main ways to profit from rising gold prices.

But it cannot be considered a one-size-fits-all strategy. Like all investment vehicles, gold has its advantages and disadvantages.

Table of Contents

Is Gold A Good Investment?

Investing in gold and silver is one of the most popular ways to diversify your portfolio with additional assets beyond securities.

Gold is also considered an integral part of a conservative long-term portfolio. The reason for this is that it is perceived as a tool to protect against inflation. Also, it has often been negatively correlated to the broader equity and bond markets in the past.

But gold also has a number of disadvantages. The key one is the lack of passive income. Therefore, it cannot be said that it is a must-have asset that suits every investment strategy.

Why Is Gold Valuable?

Gold has long been a means of payment. Even after the advent of paper banknotes, there was a gold standard for money. The high value of gold as a means of storing capital is therefore a historical fact.

In addition to the gold’s historic importance, the metal’s high value has also contributed to:

- interest from the jewellery industry, which accounts for half of global gold production;

- demand for the chemical and physical properties of the metal in the construction of machinery

- complexity of extraction.

A speculative component also supports the quotation of the precious metal. Approximately 40% of total gold production is converted into investment bars and coins.

The World Gold Council, established in 1987, plays a major role in stimulating demand for the precious metal. The World Gold Council brings together companies that account for around 60% of gold mining and production.

Why Investors Like Gold

The main reason why investing in gold is recommended as part of a long-term strategy is portfolio diversification. This asset is part of popular classic strategies such as Harry Browne’s “permanent portfolio” and Ray Dalio’s “”all weather portfolio”.

In investment theory, gold is perceived as a protective instrument that rises in value in times of crisis and against a backdrop of high inflation.

Also investing in gold has 4 important features for investors:

- High liquidity. This asset is easy to sell compared to antiques, collectible wines, real estate, etc.

- Robust tangible component. Gold, unlike uncertificated stocks and bonds, has a tangible embodiment in the form of bullion and coins, which can be valuable to someone who wants to see more than just “numbers on an account”.

- Returns. Although investing in gold does not yield passive income, it has shown good price appreciation over long time horizons in the past.

- Protection against full depreciation. Thanks to gold’s high demand, you can be sure that its price will not plunge to zero. And when investing in stocks, there is always the risk that the chosen issuer will go bust.

Another advantage of this asset is the variety of ways of investing in gold.

How to start investing in gold

There are 8 main ways to start investing in gold. Gold related assets vary in terms of liquidity, affordability in relation to the entry threshold and simplicity.

1. Investing in gold bars

Investing in gold bullion is a classic way of storing capital in the form of precious metal for the long term. An investment bar contains at least 99.5% pure gold. The front side of the bullion must state:

- manufacturer;

- sample;

- weight information;

- a serial number that can be used to trace the ingot’s path from the place of manufacture to the point of purchase.

There are several disadvantages associated with this form of investing in gold. They all stem from the fact that the asset is in physical form, which means that gold owners must ensure safe storage and insure themselves against theft.

Although “bars” weighing as little as 1g are available, this method of investing in gold is unlikely to be suitable for people with little capital.

2. Gold Coins

This is another option for owning physical gold for investment purposes. The approximate weight of most issued coins is around 1 ounce.

The peculiarity of gold coins is that some of them are of value to coin collectors (e.g. coins such as the American Eagle and the Canadian Maple Leaf). As a result, their price will be higher than the value of the pure gold which they are made of.

3. Investing in gold jewellery

Buying more than $14,000 worth of gold jewellery is considered to be investing in gold.

But this investment option has three key drawbacks:

- When buying jewellery, one pays not only for the gold it is made of, but also for the work of the jeweller.

- Of all types of gold assets, jewellery is the least liquid.

- In the case of jewellery, the likelihood of encountering a fake is the highest.

If it is not collectible or antique jewellery, it is likely that one will have to sell one’s “assets” at scrap prices.

4. Gold ETFs & Mutual Funds

ETF is a way of investing collectively. The management company invests in the underlying asset and issues shares in the fund that are available on the stock exchange. The liquidity of these securities is provided by a market maker.

Each share of a gold ETF corresponds to a certain amount of gold. If gold prices go up, the fund’s net assets also go up, and hence the price of its shares also goes up. This happens in real time, so the spread between the stock exchange price and the fair share price is minimal.

The benefits of gold ETFs:

- no bullion and coin storage costs;

- greater liquidity than actual gold, ETF shares can be bought or sold online in seconds;

- low price per share, low entry threshold for investments.

The disadvantages of gold ETFs are the fund management fees. Equity transactions also incur additional costs. Besides, there are infrastructural risks associated with the management company, the broker who gives access to the exchanges, etc.

Gold mutual funds operate under a similar scheme. But the management company usually charges a higher commission than in the case of ETFs. There may be additional surcharges on the purchase of units and penalties if they are sold before a certain date.

The underlying asset of ETFs and mutual funds is not always gold as a physical asset. Such associations may be investing in shares of gold mining companies, earning on derivatives or combining gold with other exchange-traded commodities.

The largest fund in terms of gold assets is SPDR Gold Shares (GLD). It covers 100% of its shares in bullion.

5. Gold Futures and Options

The above ways of investing in gold focus on a long-term strategy. Futures and options are instruments of speculation and risk hedging.

The advantage of futures is that they allow leverage at virtually no cost. Options differ in that they give the investor the right to make a transaction in the future, which the investor can waive if he/she wishes.

Therefore, the possible losses in option transactions are limited to the premium paid on their purchase. When trading gold futures contracts, losses can be much higher.

And with futures and options having a fixed expiration date, you cannot ‘wait out’ the drawdown, as you can do with spot trading without drawing on credit. That’s why futures and options are not suitable for beginning investors.

Gold futures can be deliverable (on the expiration date, the investor must buy and/or sell 100 ounces at an agreed value) or settled (a variation margin is credited to the investor’s account). The second type is much easier to use.

6. Gold Mining Companies & Stocks

You can indirectly profit from the rising value of precious metals by buying shares in gold mining companies.

Investing in gold stocks is beneficial because it can bring in passive income in the form of dividends. But it also has disadvantages. The value of the stocks is not directly linked to the price of the metal. Due to problems in the individual company, its securities may become cheaper even when gold prices are rising.

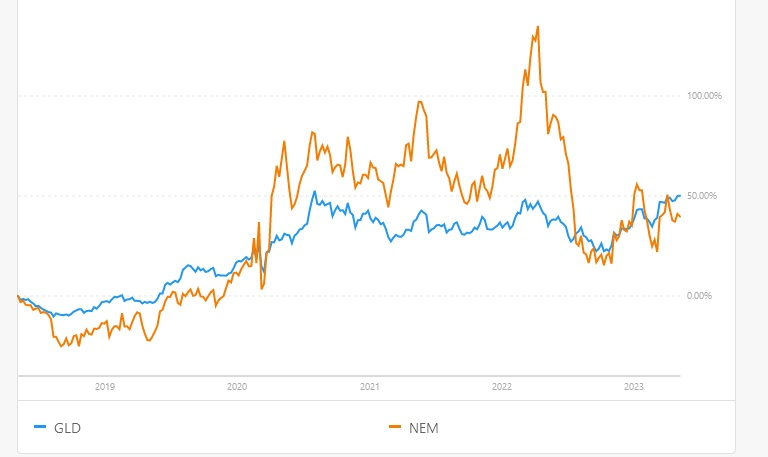

The following picture illustrates the stock returns of a gold ETF and one of the largest U.S. gold miners (taking into account dividends).

7. Streaming & Royalty Companies

This is another type of company whose revenues and dividends depend on the market price of gold. The essence of their activities is that they provide advance financing to gold miners.

In return, they receive the right to purchase a certain amount of precious metals at a reduced price in the future. If a new mine is financed, the company may be entitled to buy back part of the production at a low price as well.

As with mining companies, to properly value gold stocks of royalty and streaming companies and their prospects one must have a good knowledge and understanding of the financial performance and peculiarities of the industry. Therefore, such assets are not recommended for how to start investing in gold and silver for beginners.

Examples of streaming and royalty companies are Wheaton Precious Metals, Franco-Nevada, Royal Gold, Osisko Mining etc.

The advantage of this way of investing in gold is that such a company sponsors several miners. It has a steady, diversified flow of gold.

Both the stocks of miners and the securities of royalty companies are usually more volatile than the quotation of an ounce of gold.

8. Gold certificates

Gold certificates are securities that certify their holder’s rights to a certain amount of gold. It cannot be exchanged for actual gold. But the price of such an asset is directly related to the value of an ounce.

The disadvantage of a gold certificate is that it will be devalued completely if the company that issued it goes bankrupt.

The advantage is that the costs associated with investing are lower, as there is no need to hold physical gold.

How to invest in gold for beginners: quick FAQs

Why should you invest in gold?

Gold is the most liquid of the physical assets. In addition, it often rises in value in times of crisis.

When should you invest in gold?

The best option is to buy small amounts of metal or shares regularly throughout the investment period. This can smooth out the impact of gold price fluctuations and achieve an average value of the position.

How much gold is a good investment?

The most common recommendation is to invest 10% of the value of your investment portfolio in gold. But there are experts who advise allocating up to 25% of investments to this asset.

Investing in physical gold

There are 2 important aspects to consider before you start investing in gold and silver in physical form (bars or coins).

The first is to find a reliable seller so that you can be sure of the authenticity of the item you are buying. You can buy gold bars and coins from a local dealer or online, as well as from private collectors.

Examples of credible physical gold bullion dealers:

- JM Bullion.

- APMEX.

- Provident Metals.

- Westminster Mint.

- Money Metals Exchange.

The second aspect is the storage conditions. The most secure option is to rent a safe deposit box. But it comes with additional costs, which ultimately reduces the return on your investment.

Some people keep their gold in a safe deposit box at home. But in this case, it is recommended to take out insurance, which is also an additional cost. You should also avoid removing the packaging and touching gold bars and coins – the slightest scratch will make it harder to sell and reduce the price of the item.

Gold as a Diversifier

Purchasing gold is considered an excellent diversification move because this asset historically shows low correlation with equities and bonds. The metal also rises as the dollar weakens (DXY index declines).

In spring 2023 the gold price reached an all-time high amid banking system problems and a correction in the US stock market. But that does not mean it will always be so. For example, in 2019 and 2020 the DXY index, the stock market and gold prices moved in the same direction.

Is gold a good investment during a recession?

Gold has been called the best asset to invest in in the event of a recession. The metal has shown positive returns in 5 of the last 7 recessions in the US economy.

The best result (77.3% growth) was achieved during the recession of the 70s. In February-April 2020, gold gained only 6.3% against the background of a falling stock market.

Gold as a “safe haven”

Many gold investors perceive gold as a defensive asset. Therefore, demand for the precious metal increases in times of “fear” in the stock market, on a par with interest in government bonds.

Another useful property of this asset is that it appreciates in periods of high inflation and market volatility on a par with other commodities.

Disadvantages of investing in gold

The different ways of investing in gold have different disadvantages. When it comes to investing in a physical asset, a significant disadvantage will be:

- higher spreads than in securities trading;

- difficulty of holding;

- lack of passive income.

Such assets are always a long-term investment, targeting at least 10-15 years. It makes no sense to buy bullion for speculation.

Another disadvantage of investing in gold at the moment is that it is at a historical peak in value. There is a risk that this will be followed by a long-term drawdown, as was the case after the early 80s. It was only in 2007 that the same level was shown again. The fall and subsequent long recovery in price were also observed after the historical peak reached in 2011.

The main disadvantage of gold mining and royalty stocks is the likely bankruptcy of the issuer. Even ETFs are associated with infrastructure risks. Despite this, buying stocks of mutual or exchange traded funds is considered the best option for investing in gold for beginners.

Conclusion

“Paper” or physical gold remains an excellent asset for portfolio diversification in a long-term strategy. But when planning to buy it, one must be aware of the drawbacks of this instrument.

Investing in ETFs, certificates, coins or bars does not require an investor to have in-depth knowledge. But working with mining or streaming stocks as well as futures and options requires a good understanding of the market.

FAQ

Is there a downside to investing in gold?

The main disadvantage of investing in gold, whether physical or “paper”, is the lack of passive income in the form of dividends and coupon payments. That said, gold miners often pay dividends to their shareholders.

The second most important negative factor is the risk of prolonged stagnation and even a fall in the price per ounce. The physical asset is more suitable for a long-term strategy. This rule does not apply to futures and options.

What is a good amount to invest in gold?

There is no one-size-fits-all amount that every investor should invest in gold. Determine how much money to allocate to this asset as a percentage of the total size in the portfolio, taking into account the aggressiveness of the chosen strategy.

Is it better to buy gold bars or coins?

Coins are considered a more convenient and flexible asset than physical gold bars. In addition, with the right choice of rare coins, you can earn money not only from the rise in gold prices, but also from the interest of collectors.

What is 1 oz of gold worth?

As of 09 May 2023, the value per ounce of gold under the June futures contract was around $2035.

How many ounces of gold can you buy for $1000?

At the time of writing, $1000 can purchase just under half an ounce of gold.

What is the return of gold in the last 20 years?

In early May 2003, an ounce was worth about $357.5. Consequently, at the time of writing, the price of gold has risen almost 5.7 times. This corresponds to an average annual rate of around 9%.

But you can also find less successful 20-year periods on the price chart for this asset.