- Airbnb investment properties can be an opportunity for income diversification.

- The service offers vacation rentals while traveling. Additionally, many of our clients are business people.

- Airbnb property offers a significant advantage in terms of potential income compared to long-term rentals.

- The investor’s main disadvantage is wasting time on hosting. However, delegation can solve this problem.

- Lease arbitrage allows entrepreneurs to start a business without owning property, which is a significant advantage.

Our guide explains how to invest in Airbnb and lists the most promising cities according to rental companies.

Table of Contents

How Airbnb Real Estate Investments Work

Investing in Airbnb involves purchasing a property to rent out.

On the Airbnb platform, an entire property can be offered, as well as individual rooms. The main aspect of this service is timing, as it is designed for short-term rentals. It is commonly used by people on vacation or business trips. When visiting a real estate agency, the rentals offered are typically for long-term stays.

To earn money through Airbnb short term rentals, conduct market research:

- Find areas where many people visit for a short time;

- Ensure that short-term rentals are allowed by county law;

- Select and buy/rent investment properties for the long term.

It is possible to use Airbnb properties as a primary residence. By renting out a spare room, Airbnb hosts can earn passive income.

Comparing Profitability: Airbnb vs Traditional Rentals

Profit comparison by average rates shows that short-term rentals are more profitable. For instance, consider the Airbnb income generated from a one-bedroom apartment through short-term rentals compared to the profit from long-term rentals.

Monthly rents in Los Angeles range from $1500 to over $3000. According to Apartments.com, the average monthly rent is $2092. Over the course of a year, the property will generate more than $25000 in revenue.

According to globalcitizensolutions.com, the average cost of short-term rentals on Airbnb is approximately $190 per day. The price may vary depending on the location and other conditions, ranging from below $150 to over $600.

Occupying the apartment 365 days a year would generate over $69,000. But that’s unlikely. However, even with less demand, the higher profit margins are undeniable. Renting out an Airbnb property for just 132 days a year can generate over $25,000 in revenue.

If the average result is rented for 220 days per year, the investor will receive approximately $41,800. The Airbnb business is more profitable than conventional rental property, even when considering additional costs. The difference is approximately $16,000.

This is a rough calculation. For each property, the benefits must be determined individually. The profit will depend on the demand and prices of the tenants.

Expenses of an Airbnb Rental Investment

Investing in Airbnb incurs additional costs, including:

- Decorating and furnishing a home;

- Buy a variety of bathroom items;

- Facility maintenance and minor repairs;

- Payment for television, internet, and other basic amenities;

- insurance.

To avoid extra expenses, consider real estate investing through a REIT.

Pros and Cons of Airbnb Investments

Airbnb investing has advantages and disadvantages. One of the first considerations is the profitability of investments. A property owner can earn more with traditional rentals. The flexibility of timing and high-quality marketing of the site are also advantages.

The Airbnb business has key disadvantages, including additional financial and time costs. On the other hand, indirect investment property does not have these problems.

Pros of Airbnb Investments

Real estate investors choose Airbnb for its potential for higher profits. The flexibility of rental terms allows owners to use the rented accommodation themselves if necessary. Additionally, the platform’s marketing system ensures that the property is in demand.

Cons of Airbnb Investments

Investing in Airbnb comes with a time requirement:

- placing ads, communicating with clients;

- servicing Airbnb properties;

- meet guests.

Responsibilities can be delegated, but this can lead to higher costs.

Additionally, Airbnb businesses have lower security since property owners cannot thoroughly vet tenants.

| Pros | Cons |

| Airbnb investing returns are higher than other real estate investment tools | Expenses that decrease earnings. Higher upfront costs compared to conventional rental properties |

| Flexible lease terms | Property damage risk |

| The property can be advertised on Airbnb | Time costs. Conventional investment rental properties require very little time |

Choosing an Airbnb Investment Property Type

The location of the Airbnb rental property is crucial. It doesn’t have to be limited to coastal and resort cities. Investors should analyze the seasonality of demand, the cost of rent, and its relationship to the price of housing to determine the most profitable properties in terms of return on investment.

Not all vacation rental properties meet the needs of clients. Business travelers are often tenants, making central districts the most desirable locations.

Property types are important. For business centers, it is more profitable to buy or rent one-room apartments. For popular family vacation spots, investing in larger premises is more advisable.

If you are going to start an Airbnb, it is advisable to consult a real estate agent. This will help you avoid common mistakes made by beginners.

Living Near Your Airbnb Property

Airbnb investments are linked to the need for constant guest greetings. However, personal greetings are not always necessary. A property manager can be hired to handle this task, as well as online communications and reservations.

Hired employees can serve as property managers. Delegating tasks allows for flexibility in choosing neighborhoods in which to invest, and allows Airbnb to choose which neighborhoods to invest in.

This solution is suitable for Airbnb hosts who have limited free time. Confirming reservations and meeting guests can be a second job, rather than passive income.

Paying property managers is a disadvantage as it reduces the net profit. This solution allows for owning multiple properties in different locations at once, but it reduces the net profit from the Airbnb business. With this approach, it is possible to have a diversified portfolio of properties.

Best US Cities for Airbnb Investments

The table below summarizes the top cities for Airbnb investment. The data is based on gross revenue growth, occupancy rates, and other factors from globalcitizensolutions.com and getchalet.com.

| City | State | Number of objects |

| Palm Springs | California | 2154 |

| La Quinta | California | 1323 |

| Sevierville | Tennessee | 3064 |

| South Lake Tahoe | California | 2057 |

| South Bend | Indiana | 1048 |

| South Haven | Michigan | 1070 |

| Cleveland | Ohio | 2146 |

However, do not hastily decide to start an Airbnb in the cities listed. The cities listed in the table are only averages. Properties in other areas may have higher occupancy rates.

Presenting the home in advertising and communicating with customers are both critical. The diagram below summarizes the objective criteria to be considered.

H2Top International Airbnb Investment Markets

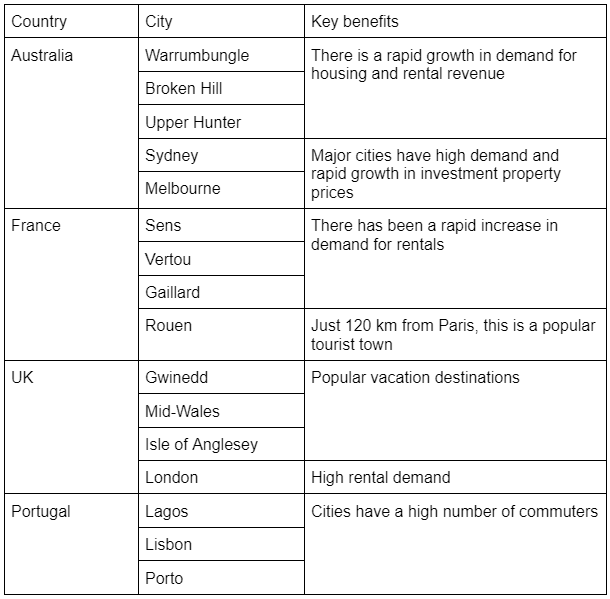

Delegating property management opens doors to investing in Airbnb in other countries. European and Australian markets are equally lucrative as properties in the United States.

Examples of places outside the Americas where one can start an Airbnb include Maui, which has a high occupancy rate for vacation rentals. Airbnb investments are profitable and quickly pay off due to the high occupancy rate, which reached 73% in 2023.

Darwin, Australia is in second place. Insidermonkey.com reports that it will take about 6.5 years to recoup the investment. The city’s location is a key advantage, making it an important connection point between Asia and Australia. The region’s largest industries include tourism.

Investment property in Dublin, Ireland can pay for itself in less than 7 years. Milan, Italy is also a notable economic and financial center, with an approximate payback period of 8.5 years. To ensure a relatively even income throughout the year, the property is oriented towards business people. However, demand in resort areas experiences significant seasonal fluctuations.

The Airbnb investment market is rapidly growing in France. Small cities, such as Montrichard, are leading the way with a 150% increase in new bookings.

The table below shows countries and cities suitable for purchasing Airbnb properties.

Consider India and Japan for long-term Airbnb investments due to projected market shortages. India currently has only 2.6 million hotel rooms, but is expected to receive 30 million tourists by 2030, according to Colliers Hong Kong.

Analyzing Potential Airbnb Investment Markets

When choosing a location for an Airbnb, several metrics are considered. One crucial factor is the level of competition in the neighborhood area. Areas with high occupancy rates are preferred. This shows that the real estate market is not yet saturated. Also, consider the cost of rent, the growth dynamics, and the region’s development plans.

Researching Market Factors

When buying or renting an Airbnb property, market research should consider two key factors. The first factor is the supply/demand ratio. It is important to consider not only the current situation but also future projections.

Seasonality is the next factor to consider. Airbnb rental properties that are in demand throughout the year can generate revenue more quickly.

Comparing Airbnb Markets

The following metrics are used to compare potential property locations for Airbnb investments:

- rental income;

- occupancy rate;

- Airbnb market growth rate;

- most popular property types;

- local property taxes;

- the value of the property and monthly mortgage payments when a purchase is planned.

Assessing the prospects for rising rents and home prices is helpful. Buying an Airbnb investment property can yield more than just rental income. An increase in the property’s value can also contribute to the return on investment.

Maximizing Airbnb Investment Income

A flexible pricing strategy can increase the return on your Airbnb investment. It should consider booking performance, seasonal demand, and competitors’ rates. The daily rate can vary depending on the season and days of the week, as well as the neighborhood.

Monthly rental income cannot be predicted with complete accuracy, but there are calculators available that can provide an estimate. These calculators are based on the experiences of other Airbnb hosts.

After placing an advertisement on the site, the investor’s main task is to find the optimal ratio of price to occupancy rate for a specific location.

To ensure profitability when buying investment property, it is recommended to take your time. One way to test the profitability of investments is through Airbnb arbitrage, which involves renting out long-term rental properties on Airbnb to generate a positive cash flow in that location.

Conclusion

Investing involves risks. Active management of investments can pose additional challenges. In the Airbnb business, these challenges may include low occupancy rates, conflicts with tenants, and property damage.

To assess your readiness to invest in Airbnb, start by experimenting with your primary residence. Rent it for the duration of your vacation.

Many investors prefer the Airbnb business model due to its fast return on investment. However, not everyone knows how to invest in Airbnb to maximize profits. There are several small issues to consider. To avoid mistakes when choosing a property, it is advisable to consult a real estate agent. Additionally, a property management company can assist with tenant management.

FAQs

Are airbnb’s a good investment?

On the Airbnb rental market, housing yields 5-15% of its value per year, with some properties yielding up to 40% annually. However, these investments are risky and require thorough study of the property market.

How much money do you need to start investing in Airbnb?

An idea to start an Airbnb rental business involves several initial costs, such as business start-up fees and preparing the premises. On average, it costs between $3000 and $6000. If an individual does not have a suitable investment property, they will need to factor in mortgage payments.

How do I become an investor on Airbnb?

To become an investor, research Airbnb laws and regulations. Select a suitable property and purchase it. Arbitrage rentals are also possible. Next, open a legal entity to run a short term rental business. Finally, place your ad on the service and wait for your first clients.

How do I stock up on Airbnb?

As an Airbnb property owner, it is essential to provide guests with basic household items such as linens, towels, soap, bathroom supplies, and toilet paper. Additionally, the apartment should be equipped with a hair dryer and charging station. Failure to provide these items may result in a negative review from the guest.