Gold — is the oldest financial asset. Over the millennia, it has lost neither its popularity nor its purchasing power. The price of an ounce covers the same set of goods as before Christ.

Gold was originally valued for its beauty and chemical properties. Nowadays, investors are interested in buying the precious metal because of its reputation. It is considered an instrument that can protect money from inflation.

The second reason for gold's popularity is its low correlation with stocks. Physical gold is one of the safe haven assets. This makes it an important component of a conservative portfolio. However, this factor is gradually receding into the background. Recently, the correlation has been growing compared to the indicators of the XX century.

Metals have several differences from other investment instruments:

The future price of gold largely depends on the expectations of market participants. Traders are more active in gold trading during periods of banking crises, etc. Demand grows as people believe that the metal will retain the purchasing power of money.

Most of the deals take place involving derivatives and "paper" gold. The latter are funds' stocks, which make money on the growth of the price of an ounce. Direct investments in bars and coins are used only by long-term investors.

The price of gold is largely determined by the balance of supply and demand. But market expectations of a recession are making serious adjustments. The best time to invest in this metal is during periods of economic growth.

Financial crises are accompanied by falling asset values as investors need liquidity. Over 7 months the gold price fell by 29.5%. Only in November 2008 the global economy adapted to the situation and the demand for metal increased. In just 3 months quotations returned to the level of early January 2008.

+2.8%Gold prices remained in a strong uptrend. In many respects, monetary policy contributed to the achievement of the historical maximum. It was aimed at overcoming the economic crisis. Most central banks reduced the rate to historic lows.

+44.3%Against the backdrop of the political crisis, the quotations of most assets collapsed. For more than half a year, the price declined, eventually losing more than 15%. Yet, the recovery to the previous values was even more rapid.

+24.6%The quotations of the asset are now growing. The situation in the domestic and global market pushes the gold price upwards. Investors are inclined to buy the precious metal as they see it as a safe haven asset against a weaker dollar.

As long as the expectations of market participants do not change, the gold price predictions will remain positive for a long period of time. Therefore, at the present moment it looks like a strong asset. All indicators prove that it is reasonable to buy.

For predicting gold prices using technical analysis, traders look at the following factors and tools:

For gold in May 2024, technical analysis tools are providing a bullish forecast. If the upward trend breaks, the support levels will be at the thresholds of $2145 and $2070.

However, technical analysis is not always accurate. A signal is considered more reliable if it is confirmed by multiple indicators.

Below is an overview of these most popular technical analysis tools. The recommendations to buy or sell gold are based on them.

Buy: 16.67%

Sell: 16.67%

Neutral: 66.66%

Buy: 100%

Sell: 0%

Neutral: 0%

| Header | Sell | Neutral | Buy | Action |

| Moving Averages |

0% |

0% |

100% |

Strong Buy |

| Oscillators |

16.67% |

66.67% |

16.67% |

Neutral |

| Name | Value | Action |

| RSI(14) |

74.22 |

Neutral |

| Stochastic %K (14, 3, 3) |

70.1 |

Neutral |

| Stochastic RSI Fast (3, 3, 14, 14) |

70.1 |

Neutral |

| Williams Percent Range (14) |

-41.27 |

Buy |

| CCI(20) |

120 |

Sell |

| Ultimate Oscillator (7, 14, 28) |

59.71 |

Neutral |

| Period | Simple | Exponential |

| MA10 |

4554.53 |

4596.33 |

| MA20 |

4297.32 |

4325.88 |

| MA30 |

4015.65 |

4117.48 |

| MA50 |

3694.86 |

3800.26 |

| MA100 |

3109.64 |

3291.71 |

| MA200 |

2500.39 |

2763.36 |

| Pivot | Classic | Fibonacci | Camarilla | Woodie | Demark |

| Middle | 3830.87 | 3830.87 | 3830.87 | 3951.685 | 4010.6175 |

| S3 | - | 1895.33 | 3796.1565 | 1417.97 | - |

| S2 | 1895.33 | 2634.70628 | 3973.581 | 2016.145 | - |

| S1 | 3111.88 | 3091.49372 | 4151.0055 | 3353.51 | 3471.375 |

| R1 | 5047.42 | 4570.24628 | 4505.8545 | 5289.05 | 5406.915 |

| R2 | 5766.41 | 5027.03372 | 4683.279 | 5887.225 | - |

| R3 | 7701.95 | 5766.41 | 4860.7035 | 7224.59 | - |

Expectations for gold prices for the next week are positive. On some days there may be slight drawdowns of quotations. But the general trend according to all forecasts will be upward. Weaker dollar makes gold attractive. Investors' desire to buy is growing due to the inflow of liquidity.

| Date | Min forecast price | Max forecast price | Change |

| 04.02.2026 | 4536 USD | 5014 USD | -43.62 USD (-0.91%) |

| 05.02.2026 | 4309 USD | 4763 USD | -239 USD (-5.27%) |

| 06.02.2026 | 4305 USD | 4759 USD | -4 USD (-0.09%) |

| 09.02.2026 | 4476 USD | 4948 USD | +180 USD (3.82%) |

| 10.02.2026 | 4638 USD | 5126 USD | +170 USD (3.48%) |

| 11.02.2026 | 4661 USD | 5151 USD | +24 USD (0.49%) |

| 12.02.2026 | 4700 USD | 5194 USD | +41 USD (0.83%) |

| 13.02.2026 | 4797 USD | 5301 USD | +102 USD (2.02%) |

| 16.02.2026 | 4871 USD | 5383 USD | +78 USD (1.52%) |

| 17.02.2026 | 4966 USD | 5488 USD | +100 USD (1.91%) |

| 18.02.2026 | 5049 USD | 5581 USD | +88 USD (1.66%) |

| 19.02.2026 | 5027 USD | 5557 USD | -23 USD (-0.43%) |

| 20.02.2026 | 5018 USD | 5546 USD | -10 USD (-0.19%) |

| 23.02.2026 | 5054 USD | 5586 USD | +38 USD (0.71%) |

| 24.02.2026 | 5048 USD | 5580 USD | -6 USD (-0.11%) |

| 25.02.2026 | 5140 USD | 5681 USD | +96.5 USD (1.78%) |

| 26.02.2026 | 5177 USD | 5721 USD | +38.5 USD (0.71%) |

| 27.02.2026 | 5202 USD | 5750 USD | +27 USD (0.49%) |

| 02.03.2026 | 5153 USD | 5695 USD | -52 USD (-0.96%) |

| 03.03.2026 | 5210 USD | 5758 USD | +60 USD (1.09%) |

| 04.03.2026 | 5351 USD | 5915 USD | +149 USD (2.65%) |

| 05.03.2026 | 5350 USD | 5914 USD | -1 USD (-0.02%) |

| 06.03.2026 | 5366 USD | 5930 USD | +16 USD (0.28%) |

| 09.03.2026 | 5325 USD | 5885 USD | -43 USD (-0.77%) |

According to gold price predictions for next 5 years, a decline in quotations is possible. This forecast is due to a number of negative factors. Among them is a drop in gold demand. Investors can be provoked to cool down by the desire for more predictable results.

An important role is played by the growth of key rates. Many Central Banks have made such a decision. This makes the yield on government bonds much higher than in 2020-2022. Investors can lock in the profits made during the rally of recent years. And allocate the free money into debt securities.

Another argument for the negative outlook for the future of gold is the growth of the DXY index. Strengthening of the dollar always leads to a decrease in the quotations of precious metals.

Most analysts do not recommend building up positions in gold. In any case, investors with an investment horizon of 3-5 years.

| Date | Min forecast price | Max forecast price | Change |

| 01.12.2026 | 5689.255 USD | 5736.916 USD | +894.47 USD (15.66%) |

| 01.12.2027 | 6291.757 USD | 6337.420 USD | +601.5 USD (9.53%) |

| 01.12.2028 | 6893.629 USD | 6935.167 USD | +599.81 USD (8.67%) |

| 01.12.2029 | 7499.147 USD | 7543.155 USD | +606.75 USD (8.07%) |

| 01.12.2030 | 8098.620 USD | 8144.350 USD | +600.33 USD (7.39%) |

| 01.01.2031 | 8149.099 USD | 8215.719 USD | +60.92 USD (0.74%) |

Goldman Sachs predicts gold prices at $1,971 per ounce. However, most analysts give a more optimistic forecast:

The first two forecasts for gold in 2026 are made using mathematical models based on data from past years. The third takes into account fundamental factors but is made with the assumption that inflation and the Federal Reserve rate will return to the 2-3% level.

BeatMarket experts consider forecasts below $2000 overly pessimistic. In our view, bullish factors are affecting gold. Even in a negative scenario, prices will not fall below $2400.

| Date | Min forecast price | Max forecast price | Change |

| 01.04.2026 | 5294.200 USD | 5347.343 USD | +502.15 USD (9.44%) |

| 01.05.2026 | 5347.061 USD | 5384.046 USD | +44.78 USD (0.83%) |

| 01.06.2026 | 5389.759 USD | 5416.886 USD | +37.77 USD (0.7%) |

| 01.07.2026 | 5418.388 USD | 5483.771 USD | +47.76 USD (0.88%) |

| 01.08.2026 | 5490.410 USD | 5553.378 USD | +70.81 USD (1.28%) |

| 01.09.2026 | 5555.764 USD | 5595.147 USD | +53.56 USD (0.96%) |

| 01.10.2026 | 5596.146 USD | 5649.457 USD | +47.35 USD (0.84%) |

| 01.11.2026 | 5649.782 USD | 5686.935 USD | +45.56 USD (0.8%) |

| 01.12.2026 | 5689.255 USD | 5736.916 USD | +44.73 USD (0.78%) |

At the end of the five-year cycle, experts forecast a wave of growth in gold quotations. Such optimism is due to:

Quotes will be supported by the build-up of the U.S. government debt and related concerns.

Expert target prices range from $2,328 to $3,291. The lower levels are forecasted in the event of prolonged high interest rates and economic recession. The higher figures will be achievable in the event of a bull market and a relaxation of monetary policy.

| Date | Min forecast price | Max forecast price | Change |

| 01.01.2027 | 5740.013 USD | 5806.754 USD | +954.77 USD (16.54%) |

| 01.02.2027 | 5788.583 USD | 5821.225 USD | +31.52 USD (0.54%) |

| 01.03.2027 | 5830.126 USD | 5892.216 USD | +56.27 USD (0.96%) |

| 01.04.2027 | 5894.247 USD | 5948.430 USD | +60.17 USD (1.02%) |

| 01.05.2027 | 5950.353 USD | 5989.361 USD | +48.52 USD (0.81%) |

| 01.06.2027 | 5991.382 USD | 6019.765 USD | +35.72 USD (0.59%) |

| 01.07.2027 | 6019.334 USD | 6082.788 USD | +45.49 USD (0.75%) |

| 01.08.2027 | 6089.688 USD | 6154.893 USD | +71.23 USD (1.16%) |

| 01.09.2027 | 6158.251 USD | 6195.477 USD | +54.57 USD (0.88%) |

| 01.10.2027 | 6196.995 USD | 6250.589 USD | +46.93 USD (0.75%) |

| 01.11.2027 | 6251.384 USD | 6288.470 USD | +46.14 USD (0.74%) |

| 01.12.2027 | 6291.757 USD | 6337.420 USD | +44.66 USD (0.71%) |

Experts differ widely in their predictions for gold prices in 2028:

BeatMarket authors are moderately optimistic in gold price predictions for next 5 years. We believe that the cycle of interest rate reductions will shortly begin. In case of dollar weakening, gold will get strong support. Improving the macroeconomic situation will also have a positive impact on the market.

There is not a single reputable forecast of a sharp fall in the price of gold. On the 5-year horizon, the asset can be used to maintain and increase capital.

| Date | Min forecast price | Max forecast price | Change |

| 01.01.2028 | 6348.872 USD | 6409.077 USD | +1560.36 USD (24.46%) |

| 01.02.2028 | 6390.114 USD | 6431.512 USD | +31.84 USD (0.5%) |

| 01.03.2028 | 6435.376 USD | 6494.844 USD | +54.3 USD (0.84%) |

| 01.04.2028 | 6504.484 USD | 6549.495 USD | +61.88 USD (0.95%) |

| 01.05.2028 | 6551.376 USD | 6593.952 USD | +45.67 USD (0.69%) |

| 01.06.2028 | 6594.710 USD | 6620.997 USD | +35.19 USD (0.53%) |

| 01.07.2028 | 6623.248 USD | 6688.867 USD | +48.2 USD (0.72%) |

| 01.08.2028 | 6691.233 USD | 6758.532 USD | +68.82 USD (1.02%) |

| 01.09.2028 | 6760.166 USD | 6796.361 USD | +53.38 USD (0.79%) |

| 01.10.2028 | 6802.901 USD | 6853.398 USD | +49.89 USD (0.73%) |

| 01.11.2028 | 6853.615 USD | 6892.054 USD | +44.69 USD (0.65%) |

| 01.12.2028 | 6893.629 USD | 6935.167 USD | +41.56 USD (0.6%) |

The answer to the question of whether gold prices are expected to rise is positive. In the long term, all analysts predict a renewal of historical highs. Some experts assure that the cost of an ounce will reach five-digit values by 2050.

The main stimulating factors will be inflation and the increase in the money supply. The metal is not being mined at the same rate as cash.

Falling industrial gold demand may curb growth slightly. But on a long time horizon it will not appear to be crucial.

The World Gold Council could limit supply in case of strong pressure on quotations. But, most likely, this will not be necessary. The key factor will be purchases by Central Banks and institutional investors. No long-term falling interest can be expected from this side. Investing in gold is the way to de dollarisation and preserving the purchasing power of capital.

Ten years is a sufficient period of time to expect an unconditional growth of quotations. During this period, there may be intervals when gold will become cheaper. But these losses will be noticeable only at a certain moment. At the end of the decade, a positive result is expected.

There are forecasts that gold production will begin to decline from 2028. This will be an important factor for the quotations growth in the second half of the decade. But the main driver, which cannot be doubted, is the increase in money supply.

There is no reason to believe that the leading countries will reconsider their approach to issuance. Besides, constant inflation is an integral part of a functioning financial system. As long as gold is seen as a defense against it, the quotations of the asset are growing.

Experts give different forecasts for the price of gold in 2030. The most optimistic of them - a level close to $7000 per ounce. This prediction is posted on LBMA website. Others are more cautious and cite less impressive figures.

But all factors point to the fact that in 2030 quotes will be significantly higher than the current ones. As already mentioned, the expected reduction in production will have a strong effect. Other factors will also push prices upwards:

There is a probability that another crisis will occur in 2030. It will collapse quotations of all assets. But it is unlikely to affect gold in such a way that it will be cheaper than the current levels.

One of the most popular gold prices forecasts is in the range of $4,197 to $4,381 by 2030. This estimate is based on the current growth rate of the value of the yellow metal. If bullish factors weaken, the prices in 2030 could fall below $4,000.

By 2040, experts predict even greater growth in quotations. The main drivers are all the same reasons:

On such long horizons, it's hard to predict exact numbers. But analysts agree the long-term trend will be upward. The only difference is the forecasts on the rate of increase in quotations.

The price in such forecasts is at the level of:

Among the most authoritative sources are the World Gold Council. Its experts forecast a level around $3,000 per ounce. BeatMarket analysts take a more optimistic view. We estimate the cost to be above $4,500.

The question is not whether gold prices are expected to grow. It is whether this growth will be strong enough. Or, despite the increase in quotations, there will be more profitable assets.

The minimum forecast is based on the scenario of the second half of the 20th century. After the historical highs of the 1980s, prices remained in a sideways trend for a long time. However, BeatMarket experts believe that such a situation will not repeat. The current value of gold has fundamental justifications; it is not the result of speculative actions.

In our view, five-figure sums seem overly optimistic. Such a scenario is only possible in a situation of high inflation over several decades.

In the long term, all analysts expect gold prices to rise. Even the most modest forecasts promise five-digit sums. More optimistic ones promise a 10+ fold price hike. The maximum figure, mentioned by experts, is $52,000.

The most pessimistic outlook is posted on linkedin. The price is expected to reach $6,000 by 2050. BeatMarket analysts consider these numbers to be under-reported. We expect the quotes to at least exceed the $10000 threshold.

A long period of quotation stagnation is possible on the metals market. Despite this, the results on a long horizon are impressive:

Past performance cannot be a guarantee of future returns. But the factors that pushed prices up earlier are still significant.

Based on the results presented above, five-figure forecasts for gold appear justified. Prices may once again enter a sideways trend. However, several decades is a sufficient period. There is a high probability that during this time, the market will experience several bullish cycles.

Buying gold to preserve capital is popular investment advice. But in the long run, the correlation between inflation and the price of an ounce is weak. Quotes rise when high inflation is combined with distrust in the market. During economic upturns, gold is an unattractive investment. Even when these times are accompanied by high inflation.

There is a long-term inverse correlation between gold prices and the DXY index. When the dollar falls relative to the rest of the world's currencies, US domestic prices rise. This is true for both consumer goods and exchange traded goods.

With a strong dollar, there is pressure on the quotations of the yellow metal. In such periods, investors are less interested in buying it.

Many traders perceive gold as a protective asset. During periods of aggravation of the geopolitical situation, there is an increasing interest in it. Investors seek to shift capital from paper assets to real ones.

When bond yields rise, gold prices will be in a downtrend. At best, a sideways trend is possible. This is due to the fact that the metal does not bring passive income. At high interest rates, risk-free investments ( treasuries) are preferable. During the period of low interest rates, investment demand for gold increases. This means its price is also increasing.

The gold production level is a fairly constant value. It is not possible to increase it quickly. Demand can change almost instantly.

The main influence is exerted by the Central Banks of different countries, IMF, large mutual funds. Many countries are striving for dedollarization and building up gold reserves. This will push the price of an ounce upwards in the coming years.

Technical indicators and market sentiment are on the bullish side. The August forecast for gold prices in 2023 is positive. The ounce value is expected to rise steadily in the near term. This is a proper period to capitalize on the rally. Though usually this asset is recommended mainly to long-term investors.

On the horizon of 6-12 months the growth of the ounce value is expected. It is caused by investors' fears and actions of the Central Banks of the leading countries. According to the gold price forecast, the moment is proper for building up positions. But it is required to observe risk management. The situation in the markets is constantly changing at a rapid pace.

Gold is always considered a proper asset for long-term investments. The longer the investment period, the higher the final return. Currently, the price has decreased relative to the historical maximum. This makes it a proper time to build up positions. Fundamental factors indicate that strengthening of bulls is expected.

Such an investment will be reasonable if the rising rate cycle is quickly completed. Experts believe that the price will increase by 1.5-4 times. The most negative forecasts promise to keep quotations at the current level. Therefore, there is no reason to believe that investing in gold will be unprofitable. But it can bring less income than some other stocks.

In the second half of 2023, quotations will move sideways. They are under the pressure of negative factors. If bond yields continue to rise, a bearish trend may be formed. The rate's growth is counteracted by the demand for gold from institutional investors. If geopolitical tension intensifies, a bullish reversal is expected. It can lead to the renewal of historical highs.

Experts differ greatly in their forecasts. In a negative scenario, investors will earn 5-10% at the end of 5 years. The most optimistic options guarantee a profit of 700-800%. The most probable scenario is a moderate one with a return of 20-25% per annum. One should also be aware of volatility. There is a high chance that quotations will peak in 2026-2027. This will be followed by a bearish market phase.

It all depends on the investment horizon. When it comes to decades, the best option is the dollar averaging strategy. It does not involve any attempts to guess the best entry point. You should make purchases at regular intervals. With short horizons, it is advisable to consider the technical indicators. Investors' expectations about the stock market also play an important role.

The probability of such an event happening is negligible. There is industrial demand for gold. It is also in demand by jewelers. For this metal to cease to be valued, a complete restructuring of human society is necessary. It is possible that the price will remain at the same level for a long time. For example, from 2012 to 2022, quotations did not update the historical maximum.

XAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

GoldXAU

Gold

SCHD Dividend Calendar 2025-2026: Next Ex-Dividend Date, Payment Schedule & Quarterly Distribution History

SCHD's next ex-dividend date is 12/10/2025 with payment on 12/15/2025. View complete quarterly distribution schedule, historical amounts, and institutional-grade forecast data.

2026.01.13

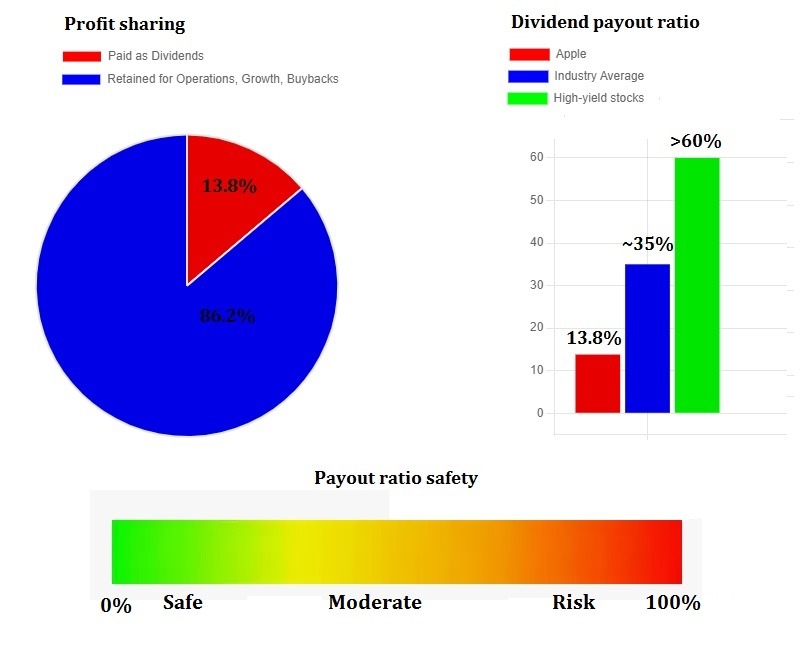

Does Apple Pay a Dividend? Complete 2026 Analysis of AAPL Dividend Yield, Safety, and Investment Strategy

Yes, Apple pays quarterly dividends. Current yield 0.44%, $1.04 annual per share, 14-year growth streak. Complete analysis of AAPL dividend safety and strategy

2026.01.12

The top choice for institutional investors and financial professionals.

All Set