In this article, I’ll break down the approach to selecting stocks for MaxDividends top 10 list and app strategy.

As a father of three with a loving family, stability and a clear outlook on the future are paramount. We need a strategy that keeps us secure even in uncertain times.

I’m not yet a billionaire who can afford to throw money around or rely solely on ultra-conservative instruments without worrying about returns. I’m no longer in my twenties, and the desire to work less is growing. So, I really enjoy seeing notifications about my new dividends coming in.

I’m a systematic person and love certainty, especially when it comes to my savings and finances. I don’t want to work until I’m 65. I want to enjoy life and my hobbies sooner, without stressing about a government-dependent retirement income. I want to control my destiny.

After extensive research, I decided the stock market was the best, most flexible investment avenue. Why? Low entry threshold, freedom of choice, high liquidity, and the ability to align investments with my personal goals.

To secure a sustainable, growing passive income from dividends, several key parameters are crucial:

- Predictability of income

- Regularity of payments

- Growth of payments

- Safety and transparency of the investment path

Based on these parameters and my extensive experience in market research and company analysis, I’ve developed essential rules for selecting dividend-paying stocks.

How the MaxDividends Strategy Works: 7 Steps to Predictable Success

1. Daily Market Scan: We scan over 5,000 U.S. stocks daily for companies that meet the high-dividend criteria of MaxDividends.

Every week, twice a week, my team and I conduct extensive market scans. We review about 5,000 companies listed on NYSE and Nasdaq. These are U.S. companies traded publicly. On other days, we update financial data, aggregating all available public reports for subsequent analysis.

Market conditions change daily. Companies rise and fall in value, new financial reports are released, and news emerges. Our task is to find the best opportunities amid these changes.

Manually analyzing such a vast amount of information is impossible for a small team, let alone one person. Even with all necessary tools, it takes 4-5 minutes to study one company’s financial report. For 5,000 companies, that’s 25,000 minutes or 17 days.

Thus, we created MaxDividends to automate the search and analysis of financial data, quickly identifying top dividend-paying companies.

Once data is gathered and updated, we analyze each company’s information. We thoroughly review the public financial reports of the past 12 years to ensure we select strong businesses. Here’s what we prioritize:

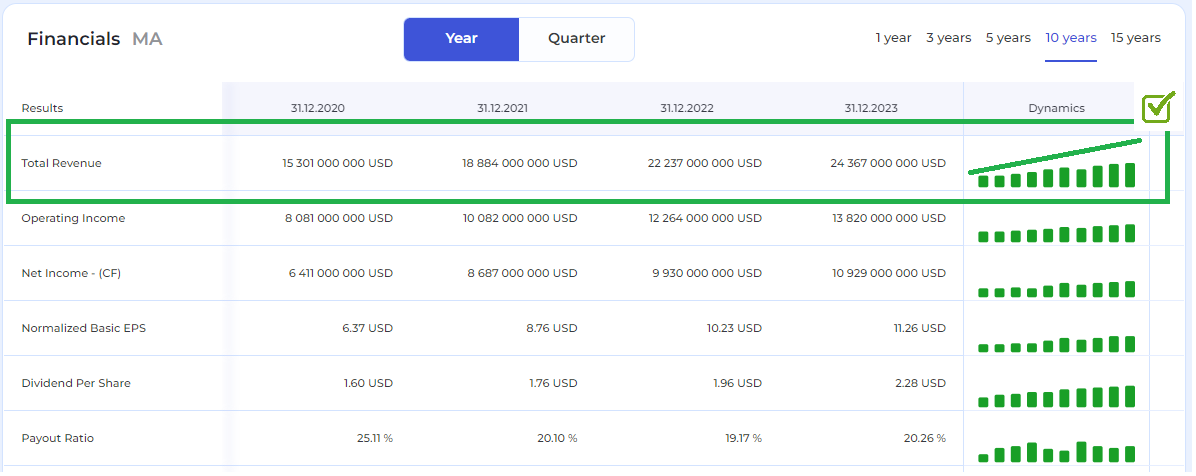

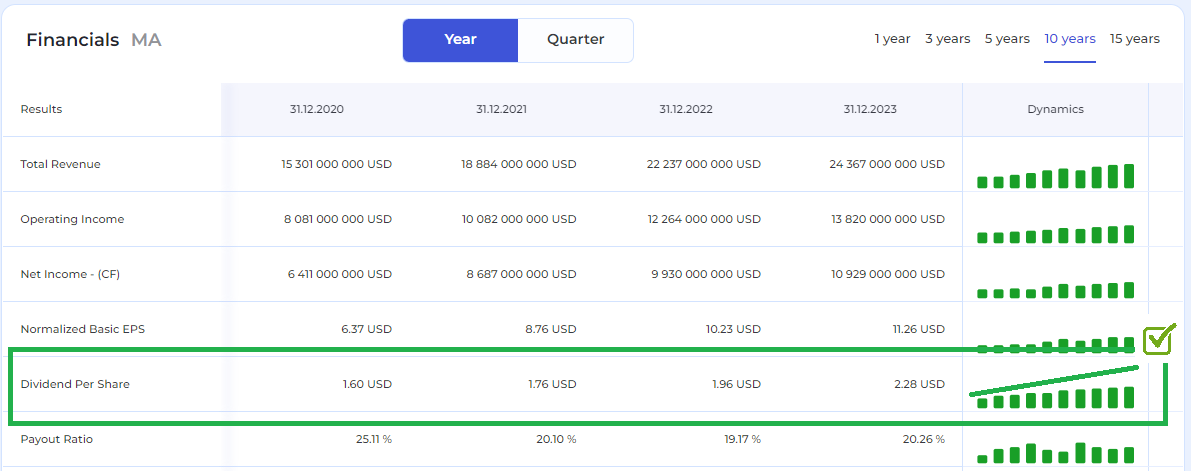

2. Sales Growth: Priority is given to companies showing long-term positive sales trends, indicating business growth.

Sales trends are crucial. If sales are declining or stagnant, the business is dying. Any business thrives on sales growth. With growing sales, other issues can be resolved. MaxDividends screener selects companies with historically positive sales trends, indicating a developing business.

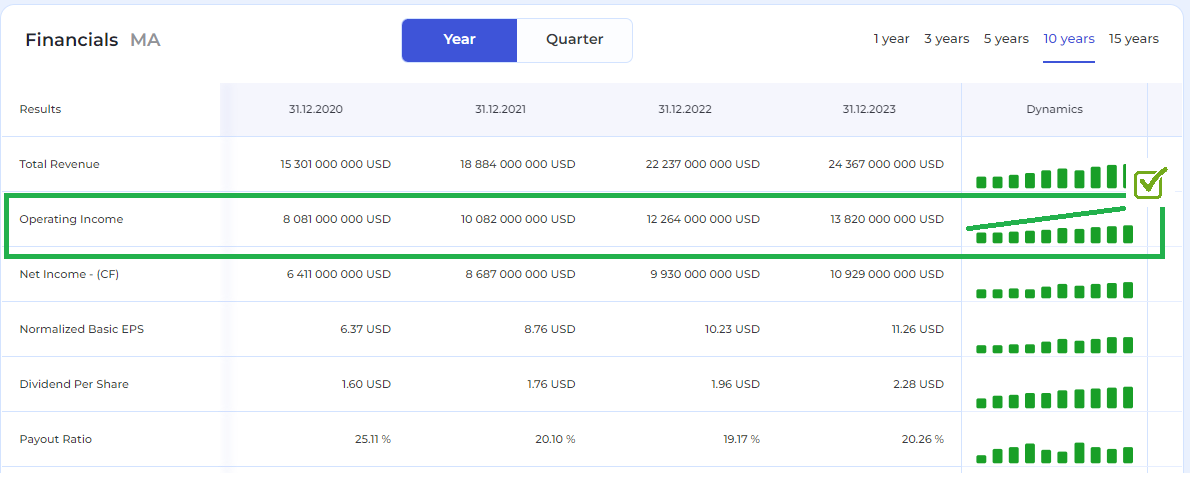

3. Profitability Check: We select only companies that have been profitable for the last 10+ years.

Profitability is another critical metric. While startups may initially spend heavily to establish themselves, no company can survive long-term without profitability. We select companies that have been profitable for over 10 years.

This period usually includes two 4-year economic cycles and one 7-year cycle, encompassing significant market events and local crises. Companies that remain profitable through these periods have proven their business model’s reliability.

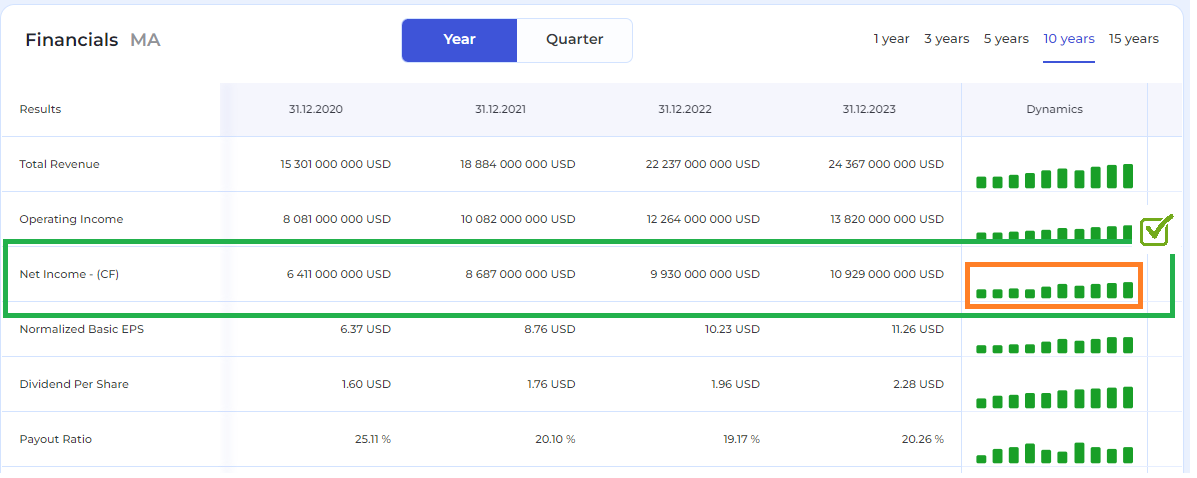

4. Dividend Consistency: Companies must have paid dividends consistently for at least 10 years.

As dividend investors, we seek companies that provide stable, predictable income. MaxDividends ensures companies have consistently paid dividends for 10+ years, increasing payouts over time. This reliability helps us confidently predict future dividends, supporting a growing passive income.

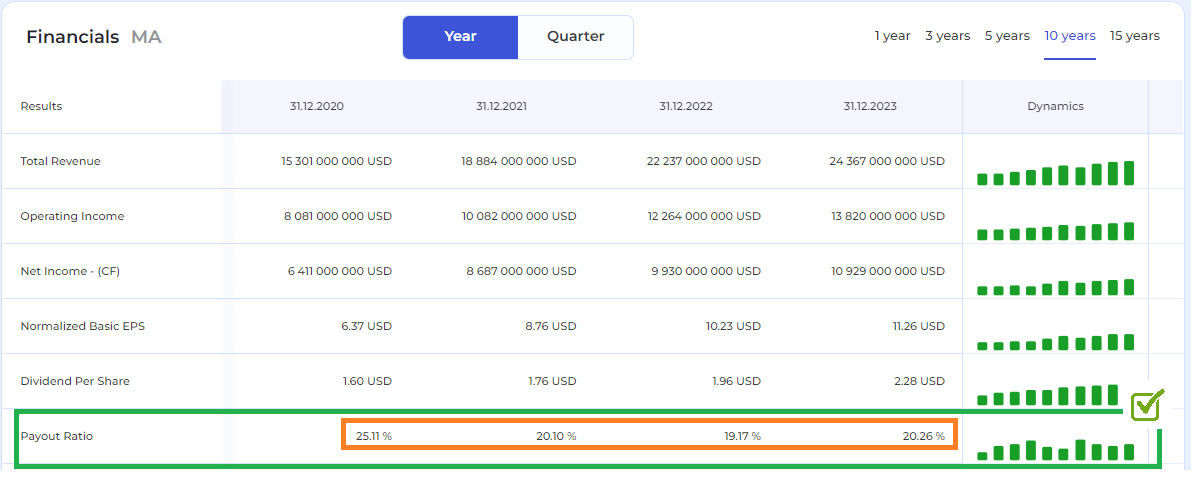

5. Dividend Coverage: We ensure dividends are paid from profit with sufficient surplus.

Stable dividend payments and growth require dividends to be paid from current profits, not past earnings or loans. MaxDividends verifies that dividends are covered by profits, indicating competent management and sound financial planning.

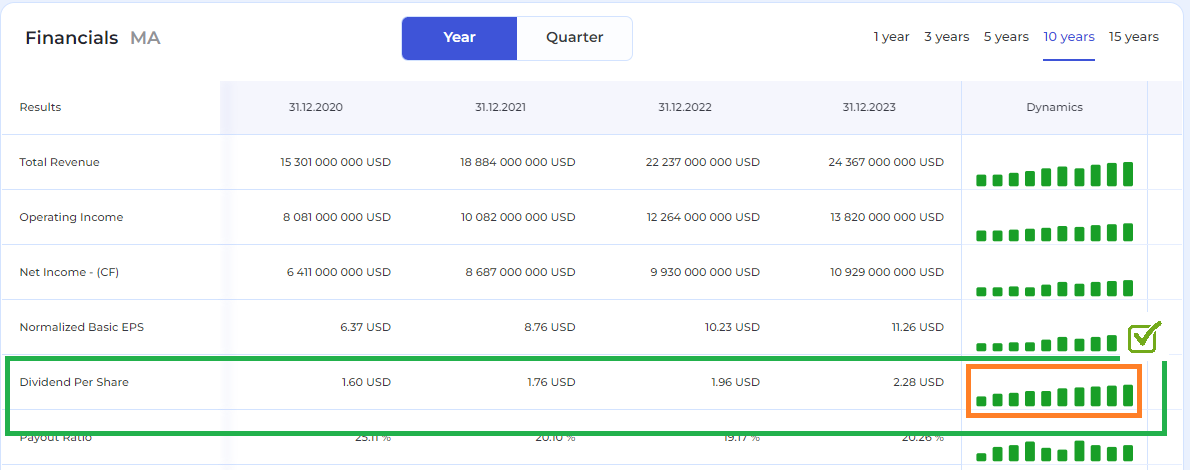

6. Dividend Growth: We focus on companies that increase or keep the same level of dividends, with a track record for at least 3+ years.

The next crucial step is ensuring dividend growth. Companies that grow sales and profits should also increase dividends. We select companies that consistently raise or keep stable level of dividends, providing a predictable rise in passive income regardless of market conditions.

7. High BeatMarket Score: Only companies with a strong rating make it into our balanced portfolio of growing dividend-yielding stocks.

Finally, we ensure our selected companies are top performers using the BeatMarket Score. This rating system evaluates companies on 130 criteria, ensuring we invest in the strongest businesses. Companies with high scores are more reliable, grow faster, and manage debt better.

After this thorough process, we’re left with about 120 companies. We sort them by current dividend yield, selecting undervalued stocks with the highest yields.

This forms the Top 10 MaxDividends stocks with ~6%+ dividend yield and base for MaxDividend app strategy, ready to provide a robust and growing passive income.

So, this is the way how we break down the approach to selecting stocks for MaxDividends top 10 list and MaxDividends app strategy.

Sunday Coffee is a column where I share insights on stock investing and the philosophy of long-term investment, discuss intriguing thoughts and ideas that could benefit you.

Did you enjoy the MaxDividends idea and research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Sharing it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research about passive income based on investing in solid high yield dividend stocks: from a small startup team of private investors, followers of F.I.R.E and dividend income, not a fund, bank or so … !

Best regards Max Dividends

From Max Dividends’s subscriber chat

Ask me about MaxDividends. Any questions about the way we do. Would be happy to hear ideas and your questions!

FAQ

👉 How well does the MaxDividends strategy work for building a growing passive income?

🙏 A few important notes:

We’re not Wall Street managers or a fund, and our fee for using the product will be the lowest in the world. We’re a startup and a group of individual investors who, like you, want to live off dividends.

Profit isn’t the project’s main goal. Once we cover the costs of maintenance and development, we’ll direct most of our earnings to charity and funds for research and fighting complex diseases.

Did you enjoy the MaxDividends idea and research by finding it interesting, saving you time & getting valuable insights? What would be appreciated?

Sharing it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research about passive income based on investing in solid high yield dividend stocks: from a small startup team of private investors, followers of F.I.R.E and dividend income, not a fund, bank or so … !

Launch your own dividend machine following Max Dividends strategy.