Investing in platinum is different from investing in other precious metals. It is primarily an industrial and jewelry commodity rather than an investment asset. It is essential to consider the smaller volume of the market. This applies to both spot trading and futures transactions.

By its properties, this metal somewhat resembles gold. Due to what it is proper for jewelry manufacturing. Also platinoids are used in industry. However, with a few exceptions, their application is limited to the production of catalytic converters. Therefore, the price of platinum is highly dependent on the car market situation.

Diversification is the main purpose of adding such an asset to your portfolio. It is also proper for betting on a weakening dollar.

Key information on the platinum price outlook is summarized below:

At the moment, metal quotations are on the rise. It can be an excellent asset for short-term investments and speculative deals. The increase in the price is fuelled by news about the reduction of production in South Africa. The region is the world supply leader. Problems in this region are leading to higher shortages.

Further forecast is positive. The movement of quotations depends on several factors. The key one is the state of the global economy. The situation in China is no less important. This country is the main platinum consumer.

To make a platinum price forecast, you can use technical analysis tools. To do so, there are such popular methods as:

Below is a recommendation to buy/sell this asset. It is based on the data of the most popular technical market analysis tools.

On the weekly time frame chart, the quotes reach the upper line of the Bollinger Bands indicator. RSI and MACD oscillators signal to buy. On the lower time frames there are also buy signals.

It allows experts to promise growth of quotations in the nearest months. There are reasons to believe that the upward trend observed since the beginning of February will continue. Platinum's rating is Strong Buy.

If the uptrend breaks, support levels may come at $928.2, $913.00, $901.10.

Below is a recommendation to buy/sell platinum. It is based on the data of the most popular technical market analysis tools.

Buy: 16.67%

Sell: 0%

Neutral: 83.33%

Buy: 100%

Sell: 0%

Neutral: 0%

| Header | Sell | Neutral | Buy | Action |

| Moving Averages |

0% |

0% |

100% |

Strong Buy |

| Oscillators |

0% |

83.33% |

16.67% |

Buy |

| Name | Value | Action |

| RSI(14) |

59.89 |

Neutral |

| Stochastic %K (14, 3, 3) |

23.22 |

Neutral |

| Stochastic RSI Fast (3, 3, 14, 14) |

23.22 |

Neutral |

| Williams Percent Range (14) |

-48.15 |

Buy |

| CCI(20) |

56.43 |

Neutral |

| Ultimate Oscillator (7, 14, 28) |

55.88 |

Neutral |

| Period | Simple | Exponential |

| MA10 |

2171.7 |

2168.37 |

| MA20 |

1876.9 |

1948.55 |

| MA30 |

1708 |

1792.99 |

| MA50 |

1455.48 |

1589.9 |

| MA100 |

1210.19 |

1347.5 |

| MA200 |

1078.93 |

1179.46 |

| Pivot | Classic | Fibonacci | Camarilla | Woodie | Demark |

| Middle | 1837.645 | 1837.645 | 1837.645 | 1890.45625 | 1997.85875 |

| S3 | - | 255.906 | 1702.695775 | - | - |

| S2 | 255.906 | 860.130298 | 1847.6885166667 | 308.71725 | - |

| S1 | 1196.79 | 1233.420702 | 1992.6812583333 | 1302.4125 | 1517.2175 |

| R1 | 2778.529 | 2441.869298 | 2282.6667416667 | 2884.1515 | 3098.9565 |

| R2 | 3419.384 | 2815.159702 | 2427.6594833333 | 3472.19525 | - |

| R3 | 5001.123 | 3419.384 | 2572.652225 | 4465.8905 | - |

There is a table with prices for the main metals below. It allows you to compare the dynamics of platinum quotations with gold etc.

| Price | Day | Month | Year | Date | ||

| Gold | 4818.62 USD | +195.44 | +4.23% | +11.24% | +72.17% | 03.02.2026 |

| Silver | 85.21 USD | +7.35 | +9.44% | +19.06% | +171.86% | 03.02.2026 |

| Palladium | 1751.06 USD | +108.01 | +6.57% | +5.14% | +63.48% | 03.02.2026 |

| Platinum | 2156.13 USD | +128.91 | +6.36% | +0.55% | +109.31% | 03.02.2026 |

| Copper | 5.97 USD | +0.14 | +2.42% | +5.04% | +40.69% | 03.02.2026 |

| Aluminum | 3056.52 USD | -8.66 | -0.28% | +1.36% | +18.33% | 03.02.2026 |

| Zinc | 3330.29 USD | +24.64 | +0.75% | +6.50% | +21.33% | 03.02.2026 |

| Nickel | 16540 USD | -2 210.00 | -11.79% | +4.35% | +8.85% | 02.02.2026 |

The analysts’ promises for 2024 and beyond is positive. Growing scarcity is the main driver of this. The reduction in consumption by industry is unlikely to compensate for it. Despite expectations, on the contrary, the demand for this metal is growing.

The World Platinum Investment Council issued another forecast in January 2024. According to WPIC, the shortage of the metal will soon amount to 12% of annual consumption. That is, it will be higher than last year. This allows us to hope that the current price will not last long.

Experts believe that quotations will start to grow. A steady upward trend is expected in the following years. Forecasts promise to bring the cost closer to the historical maximum. A number of experts are convinced that the potential of this metal has not been fully appreciated by the market.

| Date | Min forecast price | Max forecast price | Change |

| 01.12.2026 | 2680.791 USD | 2746.413 USD | +557.47 USD (20.54%) |

| 01.12.2027 | 2792.265 USD | 2854.139 USD | +109.6 USD (3.88%) |

| 01.12.2028 | 2902.516 USD | 2960.236 USD | +108.17 USD (3.69%) |

| 01.12.2029 | 3015.432 USD | 3078.961 USD | +115.82 USD (3.8%) |

| 01.12.2030 | 3125.632 USD | 3188.401 USD | +109.82 USD (3.48%) |

| 01.01.2031 | 3194.093 USD | 3241.491 USD | +60.78 USD (1.89%) |

Experts think that 2026 will be a favorable year for commodity price. Investments in metals with a view to selling it in 2026 look reasonable.

To a large extent, analysts' optimism is due to expectations of production growth. As a consequence, this will lead to an increase in industrial demand. Another argument is the market's aspiration to return to its "average" values. Now platinum looks oversold. That means that in the medium term growth can be expected.

| Date | Min forecast price | Max forecast price | Change |

| 01.04.2026 | 2673.500 USD | 2697.688 USD | +529.46 USD (19.71%) |

| 01.05.2026 | 2690.963 USD | 2701.980 USD | +10.88 USD (0.4%) |

| 01.06.2026 | 2691.204 USD | 2700.075 USD | -0.83 USD (-0.03%) |

| 01.07.2026 | 2690.333 USD | 2700.720 USD | -0.11 USD (-0%) |

| 01.08.2026 | 2680.600 USD | 2693.262 USD | -8.6 USD (-0.32%) |

| 01.09.2026 | 2672.568 USD | 2693.769 USD | -3.76 USD (-0.14%) |

| 01.10.2026 | 2671.546 USD | 2680.221 USD | -7.28 USD (-0.27%) |

| 01.11.2026 | 2678.541 USD | 2681.092 USD | +3.93 USD (0.15%) |

| 01.12.2026 | 2680.791 USD | 2746.413 USD | +33.79 USD (1.25%) |

Experts predict the price to rise at the end of the five-year cycle. Such expectations are based on the belief in a recovery in the car manufacturers' activity.

The jewelry industry's demand will also be a bullish factor. Investor interest in alternative assets is equally important. In fact, it accounts for a small share of the market. But still this factor is able to push quotations upwards.

| Date | Min forecast price | Max forecast price | Change |

| 01.01.2027 | 2748.141 USD | 2798.884 USD | +617.38 USD (22.26%) |

| 01.02.2027 | 2745.558 USD | 2769.893 USD | -15.79 USD (-0.57%) |

| 01.03.2027 | 2768.579 USD | 2781.827 USD | +17.48 USD (0.63%) |

| 01.04.2027 | 2783.938 USD | 2808.430 USD | +20.98 USD (0.75%) |

| 01.05.2027 | 2802.270 USD | 2813.082 USD | +11.49 USD (0.41%) |

| 01.06.2027 | 2802.467 USD | 2811.427 USD | -0.73 USD (-0.03%) |

| 01.07.2027 | 2801.410 USD | 2811.391 USD | -0.55 USD (-0.02%) |

| 01.08.2027 | 2791.505 USD | 2805.607 USD | -7.84 USD (-0.28%) |

| 01.09.2027 | 2784.058 USD | 2804.776 USD | -4.14 USD (-0.15%) |

| 01.10.2027 | 2782.633 USD | 2791.064 USD | -7.57 USD (-0.27%) |

| 01.11.2027 | 2789.426 USD | 2791.923 USD | +3.83 USD (0.14%) |

| 01.12.2027 | 2792.265 USD | 2854.139 USD | +32.53 USD (1.15%) |

For 2028, both bearish and bullish scenarios are being made. The WPIC predicts a deficit of 500,000 ounces in 2028, which will lead to a reduction in metal reserves and an increase in prices.

Target prices from various analysts include:

Bears anticipate that the growth rate of demand for the metal will slow down. This is expected to result in prices falling below $900. Additionally, bearish models take into account trends from the last decade, which was unfavorable for the market.

| Date | Min forecast price | Max forecast price | Change |

| 01.01.2028 | 2867.061 USD | 2910.118 USD | +732.46 USD (25.36%) |

| 01.02.2028 | 2857.136 USD | 2881.126 USD | -19.46 USD (-0.68%) |

| 01.03.2028 | 2879.819 USD | 2892.368 USD | +16.96 USD (0.59%) |

| 01.04.2028 | 2899.724 USD | 2919.719 USD | +23.63 USD (0.81%) |

| 01.05.2028 | 2913.154 USD | 2924.148 USD | +8.93 USD (0.31%) |

| 01.06.2028 | 2912.576 USD | 2922.554 USD | -1.09 USD (-0.04%) |

| 01.07.2028 | 2912.644 USD | 2922.265 USD | -0.11 USD (-0%) |

| 01.08.2028 | 2902.168 USD | 2916.933 USD | -7.9 USD (-0.27%) |

| 01.09.2028 | 2893.881 USD | 2916.032 USD | -4.59 USD (-0.16%) |

| 01.10.2028 | 2893.904 USD | 2901.896 USD | -7.06 USD (-0.24%) |

| 01.11.2028 | 2900.295 USD | 2904.286 USD | +4.39 USD (0.15%) |

| 01.12.2028 | 2902.516 USD | 2960.236 USD | +29.09 USD (0.99%) |

Experts consider this metal to be an asset proper for the investment portfolio diversification. The long-term price forecast is positive. It is obvious that in 2050 its value will be much higher than the current one. There are several reasons for this:

It is argued that the real commodity is a defense against the depreciation of the US dollar. This metal is generally not recommended as a way to save money during periods of high inflation. But its advantage is that it has intrinsic value. Its price cannot fall to zero.

The global platinum market size is projected to reach USD 11.95 billion by 2031.

During the next 10 years, experts foresee a long-term increase of the asset's quotations. Given its background, local or medium-term corrections are possible. In particular at the beginning of the decade. But eventually the drawdowns will be redeemed.

The consensus forecast for the value in 2033 is about $2000. That's about 140% higher than the current prices. Thus, this metal is unlikely to help boost capital much. The returns expected are not much higher than the broad stock market. And the risks involved are considerably higher.

On the horizon of 10 years, platinum can be considered only as a diversification tool. Nevertheless, some experts believe in the rapid development of green hydrogen energy. Under their predictions, the value of this metal is severely undervalued.

In the year 2030, analysts promise to see the troy ounce in the range of $1500-$1600. This is only 90 per cent higher than the current level. Moreover, it is noticeably lower than the historical maximums.

There are also more optimistic experts. They call figures of $3500-$4000 per ounce. But such a prediction of platinum prices forecast 2030 looks too optimistic.

It is believed that the cost of this metal is determined by the supply and demand ratio. But the year of 2023 has demonstrated other factors to be stronger. Despite the growing deficit, quotations are not going up. Therefore, a moderate expectations look more likely.

The expectations for 2040 are positive. Experts believe that the metal's value will definitely be higher than the current one. The main bullish factors:

A separate question is the growth rates of quotations. Most analysts agree upon the fact that they will remain modest. The consensus forecast is 10-15% per year on average, taking into account local drawdowns. They fail to promise multiple appreciation of platinum like gold.

The situation may change radically when new technologies appear. When demand for the metal increases, its value will rise more than expected.

Experts give an optimistic outlook for 2050. Most analysts believe that the demand for the metal will grow over the long horizon. They also believe that its scarcity will start to have a serious impact on the market.

When such a thing happens, this metal will prove to be a good long-term investment. But the longer the time horizon, the less reliable are the forecasts of futures prices. Therefore, experts find it difficult to give exact figures.

Analysts note that since 2015, the cost has been moving within a narrow range. It is less volatile than gold quotations. Therefore, this investment instrument is recommended for diversification and hedging.

Platinum is the third most popular precious metal. But investing in this asset has a number of peculiarities that need to be taken into account:

More than 40% of mined is used to produce catalytic converters for diesel powered vehicles. The strengthening position of eco-activists has a twofold impact on the consumption of this metal.

On the one hand, electric cars are replacing diesel. On the other hand, the hydrogen economy cannot do without platinum. Therefore, the demand for the metal in the future will depend on the future course of green energy development.

The jewelry industry is the second largest consumer. It accounts for more than a third of the mined volume. China plays the leading role. Global consumption depends, among other things, on the popularity of platinum jewelry.

These factors have a stronger influence on quotations than stock exchange speculation. But one should remember that metal is a good diversification option. It can be used to hedge the risks of investing in other metals. It has a negative correlation with gold (insignificant) and palladium (quite noticeable).

Platinum began to be used as an investment asset only in the second half of the XX century. Nowadays, one can invest in it in a large number of ways. For example, through:

In February 2008, the cost of platinum reached an all-time high of $2150. This year was characterized by a shortage of physical metal. At the same time, there was high market volatility. As a result of the crisis, the price more than halved by September 2008 (to $1000).

In April 2011, the cost of a troy ounce of platinum reached $1875. This is the maximum shown by quotations after 2008. Since then, the metal price has been in a pronounced downtrend, which lasted until 2015.

The bearish cycle in the platinum market has come to an end. Quotes have moved into a prolonged sideways trend. The price of an ounce as of December 2015 practically remained the same as in November 2023.

It is primarily an industrial and jewelry metal. When the market expects a recession and lower production, the value falls. Demand from the jewelry industry is also unstable. Platinum is now cheaper than gold, and items made of it are not considered elite.

When production fails to cover consumption, there is a threat of shortages. Amid fears of a shortage of physical metal, the price rises. But when this is accompanied by expectations of a recession, there is little or no impact on quotations. This was clearly seen in 2008 and 2023.

The problems in South Africa have a direct impact on mining. It can be argued that the price of the metal depends on the well-being of this region. But this only happens when the global economic situation is stable.

Advances in technology are creating new applications for this metal. As a result, its value is increasing. Hence, quotations are also rising. For example, hydrogen energy is one of the newest applications.

As emissions regulations have become stricter, the need for platinum neutralisers has grown. But the growing popularity of electric vehicles is jeopardizing the popularity of this metal.

The cost rises when palladium, gold and oil prices drop. This is due to the fact that platinum consumption by industry increases during such periods.

The expectations for the next week are positive. Instruments related to it are an excellent option for short-term investments. Bearish trend in the market is unlikely. Metal quotations are trending upwards. Investors' increasing interest in alternative assets contributes to this.

On the horizon of 6-12 months, the value of an ounce is expected to grow. Many experts believe that the market will show a bullish trend. They argue that production is declining and consumption of the metal is growing. Technical indicators also point to the advisability of investing in this asset.

The expectations for 2024 and beyond are positive. The market is anticipated to grow. At the moment, the metal is undervalued. Industry specialists expect the price of an ounce to remain above $1000 in the future. Many predict a return to the $1800-$2000 levels.

In the second half of 2023, quotations have been declining. Small regional rises failed to bring the price back to the $1,000 mark. But experts predict a reversal of the trend.

Since 2015, quotations of this metal have been in a sidewall. It brings no profit to long-term investors. But experts believe that asset is now undervalued. The current moment is proper for long-term investments.

This most often happens during economic crises. The value also falls when production exceeds the demand level.

Such a period has already taken place in the past. But it is not likely to happen again. There are no fundamental factors for such a return. It may happen when production levels fall sharply.

For the precious metals market beginners, experts recommend investing in gold. Platinum is proper for those who have positions in other alternative assets. It is used primarily for diversification purposes.

Analysts now promise more modest figures than a few years ago. The average forecast for 2030 is at the level of $1500-$1600. But more optimistic predictions can also be found.

XPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

PlatinumXPT

Platinum

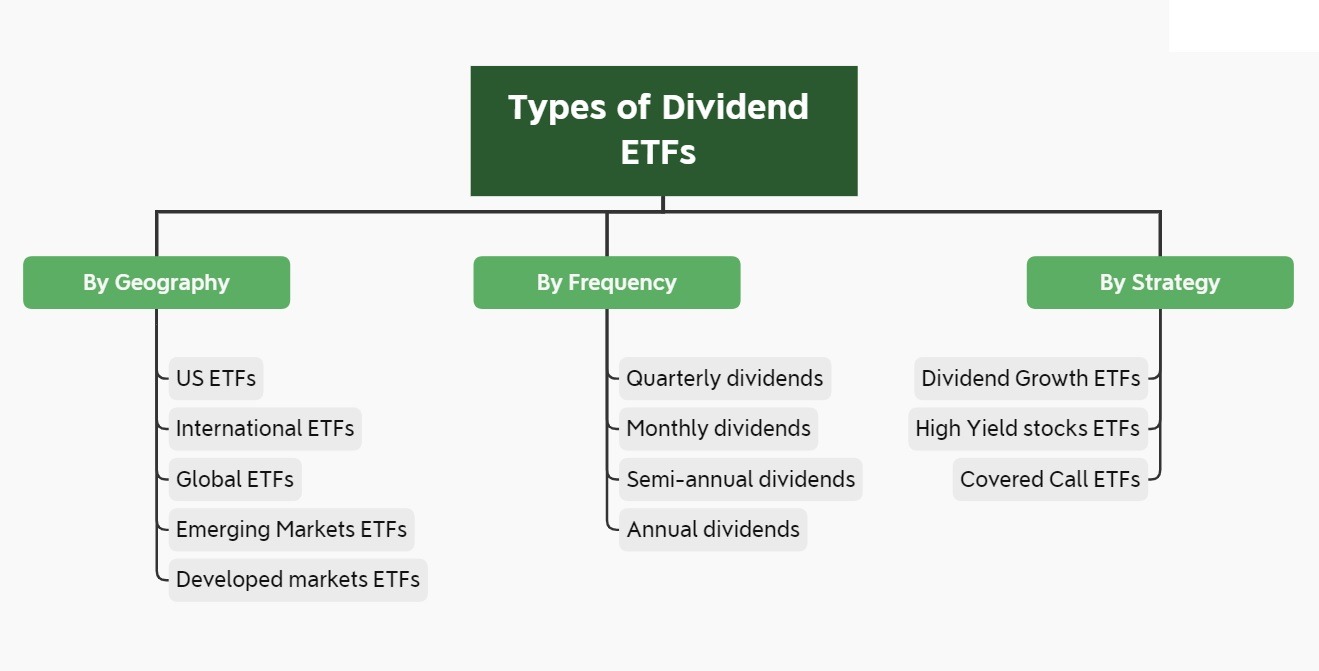

What is a Dividend ETF? Complete Guide to High-Yield Income Investing

Discover what dividend ETFs are, how they generate income through distributions, and why they offer better diversification than individual stocks. Complete 2025 guide.

2025.11.25

Dividend Eagles: October ’25 Edition

Discover the top Dividend Eagles 2025 — stocks with 15+ years of consecutive dividend increases. Build passive income and retire early with elite, financially strong dividend payers.

2025.11.23

The top choice for institutional investors and financial professionals.

All Set