The proper asset allocation is one of the key components necessary for building up personal capital. There is a lot of advice on retirement planning on how to determine the proportion of stocks and bonds in your portfolio.

Let’s take a look at the main asset allocation models and see how well the average investor’s portfolios conform to the experts’ recommendations.

Table of Contents

What Is Asset Allocation?

Asset allocation refers to the ratio between different types of investment instruments in an investor’s portfolio.

There is no single right asset allocation that is universal to all people. Everyone should choose the best option for themselves based on 3 factors:

- risk tolerance;

- time horizon;

- the profitability required to achieve the financial goal.

There are many asset allocation models. The simplest of these is to buy 2 types of investment instruments ( stocks and bonds) in predetermined proportions. More complex ones involve diversification not only across asset classes but also within each class.

Classical portfolio theory assumes that the asset allocation by and within classes must be chosen in such a way that the portfolio yields the maximum return at the risk level set by the investor. Past performance data and lengthy mathematical calculations are used to determine the ideal proportions.

Why Is Asset Allocation Important?

The main asset classes behave differently in each phase of the market cycle. During bullish market periods, stocks offer the highest returns. In times of recession, fixed-income bonds look preferable.

Therefore, if an investor wants to ensure that the total value of his portfolio is not too volatile, he must have a set of assets for each of the phases of the economy.

When choosing the proper asset allocation, the correlation between the assets is taken into account. If two investment instruments have high correlation, it means that their quotations behave roughly the same. Negative correlation is said to occur when the price of one asset rises while the price of the other falls.

Portfolio investment theory is based on the theory of using assets with low or negative correlation. This reduces the risk of drawdown of the total value of the portfolio.

Most experts believe that achieving the final financial result depends by more than 80% on the proper asset allocation of an investor’s portfolio. This means that selecting the optimal proportion between stocks and bonds is more important than selecting individual issuers.

But the downside should not be forgotten:

- correlation between different types of assets can change over time;

- alternative assets and gold, which are seen as a way of protecting against periods of higher inflation, may not generate income for a long time;

- broad diversification can reduce returns over a short period of time.

It is important not only to determine once what proportion of personal finances should be allocated to a particular investment asset. The chosen asset allocation must be maintained at all times through rebalancing.

Note that rebalancing by selling some of the higher-priced securities could lead to an increase in the tax burden. For this reason, it is better to either use tax-deferred retirement plans or to rebalance only by funding the account and buying sagging assets.

In addition, in the case of long-term goals, such as retirement capital formation, it is advisable to review the asset allocation strategy as you get closer to your investment goal.

Asset Allocation Examples

Here are some asset allocation examples that are considered benchmarks and can be recommended by financial advisors.

60/40

This is the simplest portfolio that includes only stocks and bonds. This ratio has long been considered very profitable. By adding 60% stocks of US companies to the portfolio, the investor ensures sufficient growth. And 40% of US bonds provide resistance to drawdowns.

But in 2022, this strategy showed a failed annual result. The loss was 16%, the worst result since 2008. The reason for this is that the collapse in stock prices coincided with the Fed’s rate hike.

In the first quarter of 2023, though, the most popular asset allocation started generating income again.

Portfolio Size By Age

Classical theory holds that the proper asset allocation in retirement savings depends on the age of the investor. Several formulas are suggested for the calculation:

- The proportion of stocks in the portfolio is defined as 100 minus the age of the investor. At age 20, stocks and bonds should be 80% and 20%, whereas at age 70 they should be 30% and 70%. There are also recommendations where the constant coefficient rises to 110 and even 120.

- The bond share is calculated as the investor’s age minus 20. At the age of 20, an investor puts all the money into stocks, and at the age of 70, it comes to a 50/50 ratio.

- The bond share is calculated using the formula 2x(age of investor minus 40). Until the age of 40, a person invests only in stocks. At age 70, an individual should already have 60% of the total capital in bonds.

The first strategy is the most conservative. The third one is the riskiest. Its advantage is that it should provide maximum returns for the younger investors and, as a consequence, significant capital appreciation through compound interest.

Buffett’s strategy

This asset allocation also involves investing only in stocks and bonds. It is based on Warren Buffett’s will. He determined that the estate to be inherited by his wife should be 90% invested in US stocks and only 10% in short-term US government bonds.

This idea contradicts the classic asset allocation strategy, which prescribes that the share of risky investment instruments must decrease as the retirement age approaches.

But calculations based on past performance have shown that such a model is more profitable than a conservative one. And the retirement savings are sufficient for 30 years if you withdraw 4% a year with a 98% probability.

Ray Dalio’s all-weather portfolio

This is a more complex asset allocation system in which, in addition to stocks and bonds, other types of investment instruments are added to the portfolio. Its author Ray Dalio recommended the following ratio:

- 40% — long-term bonds;

- 30% — stocks;

- 15% — medium-term bonds;

- 7.5% — gold;

- 7.5% — commodities.

Harry Browne’s eternal portfolio

In such a case, the proper asset allocation is the purchase of 4 types of investment instruments (stocks, bonds, gold and cash) in equal shares of 25% of capital each.

The author considered such a portfolio to be universal and capable of generating income during any of the four economic cycles (upturn, inflation, deflation and recession).

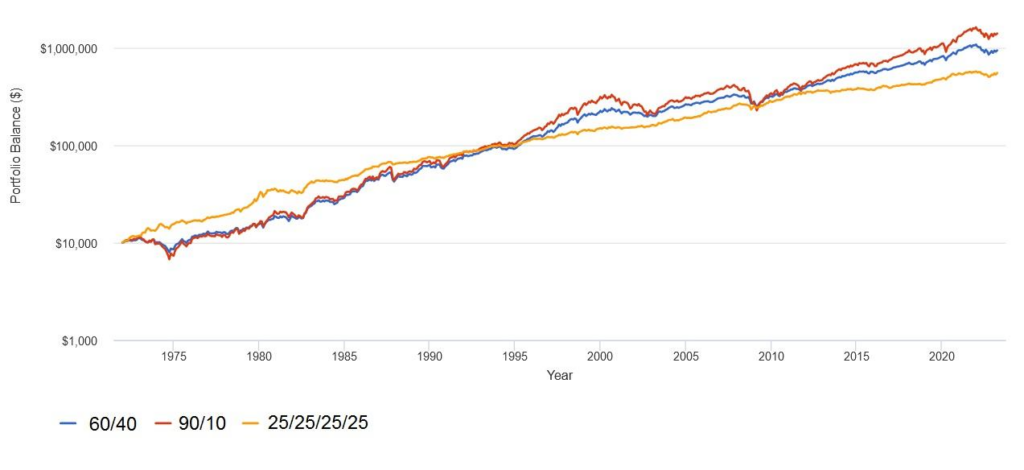

The chart below shows how 3 of the portfolios listed behave without further replenishment, but subject to annual rebalancing.

Portfolio size and cash share by age

In terms of asset allocation to stocks and bonds, many investors from the same age group have different strategies. But there is a clear pattern in terms of portfolio size and cash share.

The main one is that for most investors, the value of capital increases with age until retirement. After 60 years, this indicator begins to gradually decrease.

In terms of the value of cash share, they are more inclined to keep it:

- People over the age of 90 – cash accounts for about 31% of their capital.

- Retired people aged 80-90 – 29.4%.

- Younger people (in their early 20s) – 28.4%.

The third place looks rather unexpected. This result is due to the inexperience of young people and their unwillingness to take the risks of investing due to the small size of their capital.

Stock Allocations By Age

Statistical research from the Empower platform shows that the majority of Americans do not adhere to the recommendations described above on the asset allocation by age.

The proportion of stocks in the portfolio of 20-year-old investors is very slightly higher than the proportion of stocks in the portfolios of people who have reached retirement age.

| Investor’s age | Share of capital in US stocks, % | The share of capital in shares of companies of other countries, % |

| 20-49 | 43 | 11-12 |

| 50-69 | 39-42 | 10 |

| 70 or more | 37-39 | 6-9 |

Home Country Bias By Age

Most people are patriotic in their financial lives and prefer to hold stocks of domestic companies in their investment accounts. This is true for both Americans and residents of other countries.

But you can see fluctuations of a few percent depending on the age of the investor:

- Older Americans are the most conservative and US companies’ securities account for about 88.5% of all stocks they own.

- The younger investors follow, holding around 85.2% of the capital allocated to this asset type in US companies.

- People aged 30-49 and 60-69 are the most likely to diversify their portfolios by country. More than 18 per cent of the stocks they own are issued by non-US companies.

Bond and Alternative Asset Allocations By Age

According to the same statistical studies, the proportion of bonds in the portfolio increases as the US investor ages, but remains well below the recommended proportion in most strategies for choosing the proper asset allocation.

People from 20 to 40 years old allocate no more than 5% of their capital to the share of bonds. After the age of 50, the figure rises to 9%. After 60 — almost to 14%.

When retirement age is reached, the share of bonds begins to fall again. This is due to the fact that many investors choose issues with a maturity that coincides with the retirement date.

As far as alternative assets are concerned, their share in the portfolio of US investors is virtually unchanged. The lowest value is for people aged 30-39. They have a 3.3 per cent share of such instruments.

The maximum share of capital (4.3%) in alternative assets is held by people aged 70-79. This is largely because gold has long been regarded as the safest way to protect against inflation and an indispensable component of a conservative portfolio. In the current reality, many younger investors are rejecting this belief.

Tips For Improving Your Portfolio Mix

Following a few well-known investment advice can help improve your bottom line.

Adjust Your Asset Allocation According To Your Age

This is the most frequent advice given by financial planners. It is based on the fact that stocks can lose a lot in the short term.

It is therefore safer for someone approaching their investment horizon to increase the proportion of assets that guarantee capital preservation, even at the expense of returns.

It is not just about the time of retirement. Investing involves risk. Therefore, the best investment strategy is to save yourself from having to sell stocks and bonds when their value is depressed.

To do so, 2 conditions must be met:

- Always have some amount in cash for emergencies;

- Keep the money you plan to spend in the next 5 years in savings accounts or short-term bonds.

Consider Your Innate Risk Tolerance, Not Just Your Age

The proper asset allocation is the mix of stocks and bonds that gives an investor peace of mind at any phase of the market cycle.

It is therefore worth stepping back from the recommended asset allocation tied solely to age, and taking your own personality traits into account. If a younger investor follows the advice to invest 80% of capital or more in stocks, but sells them at every market drawdown, it will not lead to financial success.

Don’t Let Stock Market Conditions Dictate Your Allocation Strategy

In times of a rising market, it seems that the positive momentum will continue for a long time, and there is a desire to increase stock holdings in order to maximise profits.

But in reality, no one can accurately predict when a correction and a bear market will start. Therefore, the recognised proper allocation of assets should be adhered to. It is a mistake to build up a stake in a stock during a bull market and sell it off during a correction.

Diversify Your Holdings Within Each Asset Class

Proper asset allocation involves diversification not only across different investment instruments, but also within each asset class.

Stocks

Experts recommend including shares in an investment portfolio of at least 20 companies to reduce the likelihood of capital loss from market risk. The companies chosen should come from different sectors and preferably from different countries.

Another way to reduce the investment risk associated with stocks holding is to purchase index funds rather than individual companies. However, a company’s weight in a particular index must be taken into account.

For example, investments in a fund following the SP500 and a technology company fund cannot be considered diversified. The reason for this is that Apple and a number of other issuers hold a significant stake in each of these funds.

An example of a more proper asset allocation is to invest in a US equity fund and an international equity fund.

Bonds

Diversification in the bond market involves the purchase of debentures with different maturities issued by different issuers.

There are also bond index funds, which allow you to avoid wasting time selecting individual issues.

Cash

If an investor prefers to hold a significant percentage of his/her financial portfolio in cash, he/she should also consider diversifying the storage locations. It should be remembered that the maximum amount of insurance is $250,000 per depositor at each bank cooperating with the FDIC. The amount exceeding the specified amount must be distributed to different banks.

In addition, there are different types of deposits. It is a good idea to keep some cash in a savings account that can be closed at any time without loss. The use of savings certificates can increase returns. But if a person wants to return the money before the specified date, he or she must pay a fine.

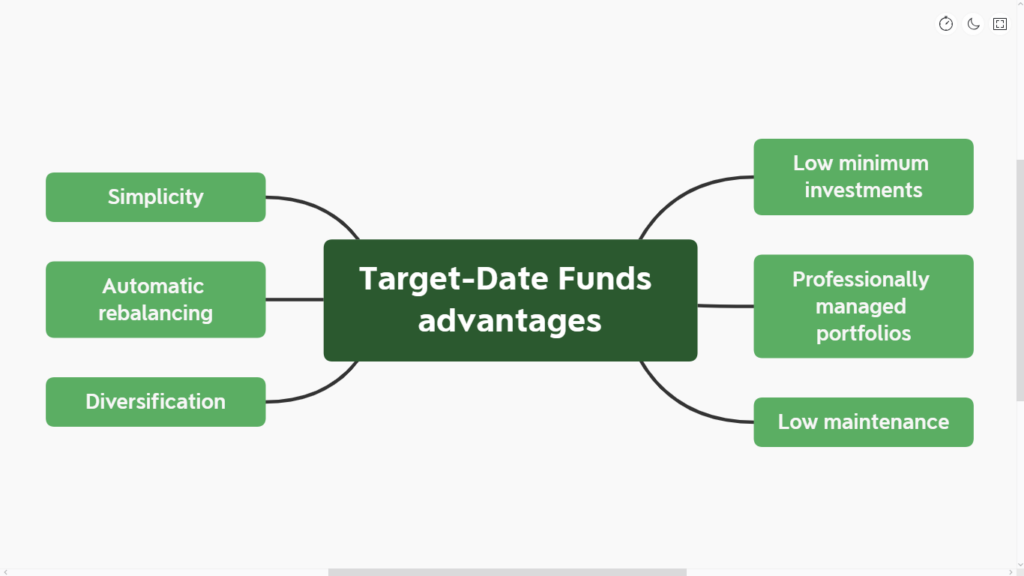

Invest in a Target-Date Fund That Manages Asset Allocation For You

Target date funds are a type of mutual fund. Their peculiarity is that, over the years, the manager changes the fund’s asset allocation from aggressive to conservative. Therefore, they are best suited for the role of retirement funds.

You should select such a fund on the basis of several criteria:

- planned refund date;

- the amount of the management fee;

- compliance with the strategy of personal risk tolerance.

The target date is indicated in the name of the fund. It should be as close as possible to the year of planned retirement. Maximum compliance is unlikely to be achieved, the funds usually set the target date in 5-year increments. For example, 2050, 2055, etc.

FAQ

How much should a 70 year old have in stocks?

The classic answer to this question is 30%. Some experts suggest increasing this amount to 50%.

But it all depends on the individual approach to the asset allocation strategy.

What is the ideal portfolio mix by age?

If only one criterion (age of investor) is taken into account, a younger investor should have as many stocks and other asset classes with high volatility as possible. Over the years, he/she should increasingly build up the share of conservative instruments.

But you can never stop at one criterion. Risk tolerance, not age, should play a key role in selecting the proper asset allocation.

How big should your stock portfolio be?

Financial advisors often recommend holding at least 20 different stocks in a portfolio. But in reality, the distribution of stocks is much more important than the number of them.

In one phase of the economic cycle some companies benefit, in another phase others do. The investment portfolio should therefore cover all sectors of the economy.

How much should a 50 year old have in stocks?

The classic approach to asset allocation is to have 50-70% of stocks in your investment portfolio at age 50.

Can I retire at 70 with 500k?

The short answer is yes. But much depends on individual consumption and the availability of other sources of retirement income, such as social security.

It is considered sufficient for a person to have private capital of 12 times their annual income in order to retire. Hence, $500k is a sufficient amount for someone who earns up to $41,500 a year.

Asset allocation should also be taken into account. For example, capital may be invested in dividend stocks and bonds with coupon payments or held in a bank deposit. This situation is preferable to being in instruments that do not generate passive income.

The bottom line

The best way to achieve financial independence and maximize your retirement income is through long-term investment. Holding assets for decades without regard to changing market data is at the heart of W. Buffett’s strategy.

With the proper asset allocation, an averaging strategy (buying assets of a certain amount at regular intervals) and compound interest, much better results can be achieved with long-term passive investing than with active trading and daily transactions. But because not every investor can devote as much time to stock and bond selection as Buffett did, a sound investment strategy is to invest in broad market index funds.