Publicly traded stock options are stock market derivatives that are linked to an underlying asset. It is a contract between a buyer and a seller which stipulates all the terms and conditions of the transaction on which the underlying asset will be transferred. There is also a variation of such contracts called employee stock options. This is a form of equity compensation that employers use to reward employees.

Table of Contents

What Are Stocks Options?

Stock option is a financial instrument, the possession of which gives an investor the right to make a transaction in a stock at a predetermined time at a predetermined price.

Stocks are the most popular underlying asset. But options on other investment instruments can also be found on the stock exchange.

By purchasing stock options, the investor pays a so-called premium. Each contract has a precise expiry date. A person owns it until that date, or until he or she exercises his or her right.

Importantly, options, unlike futures, are not an obligation to make a trade. They only give the right to do so. But if an investor does not exercise an option, he or she loses the premium paid to buy it.

Stock options are derivative financial instruments. Their price is directly related to the underlying stock price.

How Do Stock Options Work?

Stock options work according to the following scheme:

- An investor buys an option that gives him the right to buy shares, let’s say at $100.

- If the value of that security rises above $100 in the stock market before the option expires, the investor will exercise his option and make a profit.

- If the price of the underlying asset remains below $100, the investor simply does not exercise this right.

The same thing happens in the opposite direction. Suppose an option is bought giving you the opportunity to sell the stock for $100. If the market price is above this threshold, the investor will not exercise the right. If the price falls below it, the investor will be able to exercise it and make a profit.

Equity Vs. Stock Options

Trading options increases the potential profit/risk ratio. In addition, such contracts provide an opportunity to hedge investment risks.

But in a stock option transaction, an investor does not become the owner of a share in the company. Therefore, he cannot vote at shareholder meetings or receive dividends.

Stock Option Types

There are two types of stock options on the stock exchange:

- A stock call option. In fact, it is a bet that the stock price will rise. By purchasing it, the investor receives the right to buy the securities himself later at a fixed price.

- A stock put option. This is a bet on a fall in the stock price. It gives the right to sell a stock at a set price.

Benefits of Stock Options

Many investors prefer to trade stock options rather than the stocks themselves due to the fact that:

- Free leverage is available. At the moment of purchasing the option, the investor only pays a premium. If he were to buy 100 stocks directly, he would have to pay much more.

- The risk is limited by the size of the premium. If an investor buys a stock in the hope that it will rise and the price starts to fall, he may lose more.

- The system of risk management is simplified from a psychological point of view. Some investors find it hard to lock in a loss if the price has gone down after purchasing a stock. As a result, they remain in a futile position for years.

An option gives you the opportunity to avoid restrictions on ownership of an asset because ownership does not transfer when purchasing an option. Later on, an investor may not exercise his stock option, but sell it to another market participant at a higher price and thereby make a profit, even without the transaction of the underlying asset.

Options can also be used to hedge risks on already open positions in stocks.

Drawbacks of Stock Options

There are disadvantages to option trading as well. The key one is that such a contract has a limited duration and afterwards its value drops to zero. Having bought a stock, an investor can hold it indefinitely. In the case of a long-term strategy with direct ownership of a stock, one can wait out a market decline without taking a loss.

Furthermore, the market stock price falls to zero quite rarely, only in the case of bankruptcy of the company. And if one refuses to exercise an option, one loses the entire premium paid.

Another notable disadvantage of options is the higher securities and stock exchange commission per transaction as compared to trading directly in stocks.

If it is more about selling than buying an option, however, there is no limit to the potential losses.

Stock Options Features

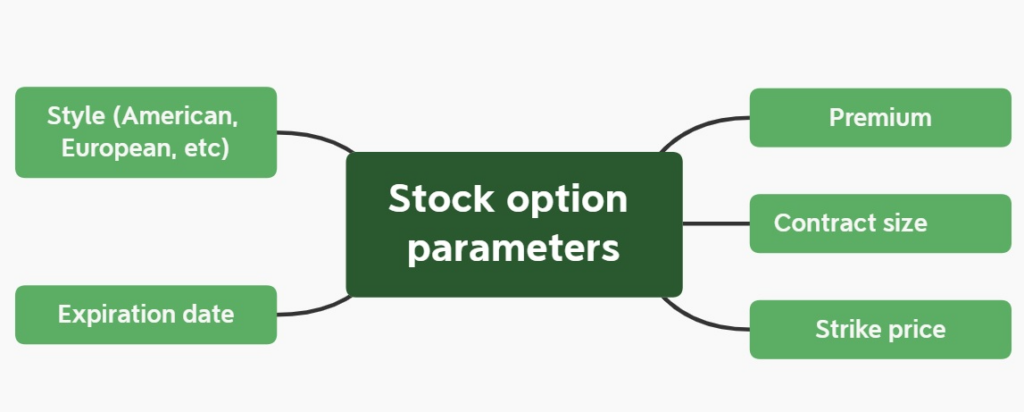

When deciding whether or not to buy an option, there are several characteristics of the contract to consider.

American vs. European Styles

The difference between these types of contracts comes down to the time of execution.

The European style limits the investor in terms of timing. The decision to use an option can only be made on the day of expiry.

The American option is more common. Such options allow the holder to exercise his right to buy/sell stocks at any time before the expiry date of the contract.

Expiration Date

The expiry date is the expiration date of the contract, i.e. the day on which the option is no longer valid. It is set according to the schedule (cycle) of the options. A contract can be valid for a day, a week, a month, a year or more.

The longer the time until expiration day, the more valuable the option is considered to be. After all, the more time there is to spare, the better the chance that the price of the underlying stock will reach the right value and the option will be worth exercising.

It is essential to know that the stock exchange may support the auto-exercise function, i.e. the automatic exercise of an option on its expiry date.

Strike Price

The exercise price, or strike price, is the price at which the option will be exercised. For example, an investor buys a US call option on a stock with a strike price of $200 and an expiration date in January.

If the stock price rises above that level before then, the person will benefit from exercising the option. A person will receive the stocks at exactly $200, even if they are worth much more on the market at that point.

Contract Size

The size of the contract refers to the number of shares it covers. One option gives the right to buy or sell 100 underlying shares. If an investor buys 5 put options, he gets the right to sell 500 shares at a fixed price.

Premium

A premium is the cost of purchasing an option. This is the amount paid by a buyer to a seller. It is not refundable if the option is not exercised.

Therefore, if one buys an option, the potential loss is only limited to the premium paid at the time of the transaction and the possible gain can actually be infinite and only depends on market conditions.

If the investor becomes the seller of a stock option, however, his profit is fixed by the premium paid to him by the buyer. The loss, in this case, is unlimited. The seller must honour the buyer’s claim to exercise the option, no matter how much the current market price of the underlying stock differs from the strike price.

To calculate the amount to be paid when buying an option, multiply the number of contacts acquired by the value of the underlying asset and by the premium for the right to deal in one stock.

Suppose an investor wants to buy 5 options, each option entitles the investor to deal in 100 stocks and the premium for each option is $1. In this case he would have to pay $500.

The amount of the premium depends on the expiry date of the option and the stock price volatility of the underlying asset. The higher the volatility, the higher the premium.

There are also so-called margin options. These do not involve a one-off transfer of premium from the buyer to the seller. Instead, a variation margin is calculated, as in futures transactions.

What Are Stock Options Used For?

Private investors and investment companies most often use stock options to hedge the risk of open positions.

The essence of hedging is as follows:

- An investor holds stocks of a certain company in a brokerage account, but is concerned about the price falling.

- He buys a put stock option, i.e. he fixes the price at which he will sell the stock if the price does fall.

- With no hedging, the investor’s risk was equal to the amount he had invested in the stocks. By using an option, he reduces this loss to the amount of the premium (in case his expectations are not met) or to the difference between the price at which the stock was bought and the strike price.

The second way to use options is to make money on high-value assets with little capital. It takes much less money to buy a call option on a stock than it does to buy the stock itself.

If the investor’s bet on a stock rise justifies itself and the stock price goes up, the option price will increase proportionately.

A popular strategy is spread trading. The investor uses a combination of put and call options with different expiration dates and strike prices.

In terms of business, options are useful for stimulating interest in the stocks of a fledgling company. Investors are more willing to buy a call option than the stocks of a start-up that is just going public. That is why investment companies use them to raise capital.

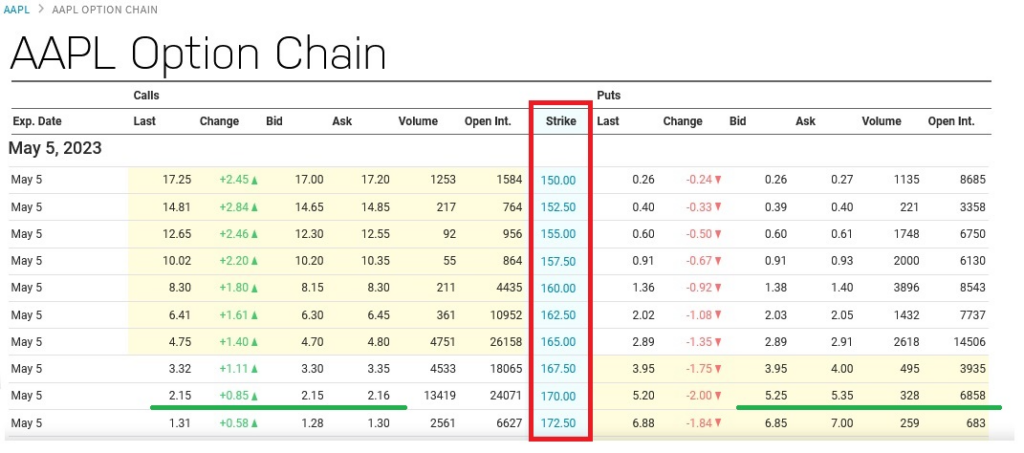

The following picture illustrates a screenshot of Apple stock options information, with an expiry date of 5 May 2023.

Stock Options Example

The central column, highlighted in red rectangle, is the strike price. If an investor wants to buy a call option he should look to the left, a put option is to the right. The Bid and Ask columns are essentially the same glass as the trader sees when buying a stock.

Let’s say a person is interested in an exercise price of $170. In this case, when buying a call option, he would have to pay $2.16 as a premium for the right to buy 1 Apple stock until May 05, 2023. That is, to buy 1 option with 100 stocks, he would have to pay $216 for it.

If it is a put option, the premium per stock is $5.35. And the price per option is $535.

Employee Stock Options

There is another type of option that cannot be found on a stock exchange. Such contracts are issued by the issuing company. These are so-called employee stock options. These are call options and are used for financial incentives for employees.

The way this option works is identical to a stock option – the person who receives it has the right to buy his employer’s stocks at a fixed price by a certain date. This price can either be roughly equal to the current fair market value of the stocks, or much lower.

How Do Stock Options Vest?

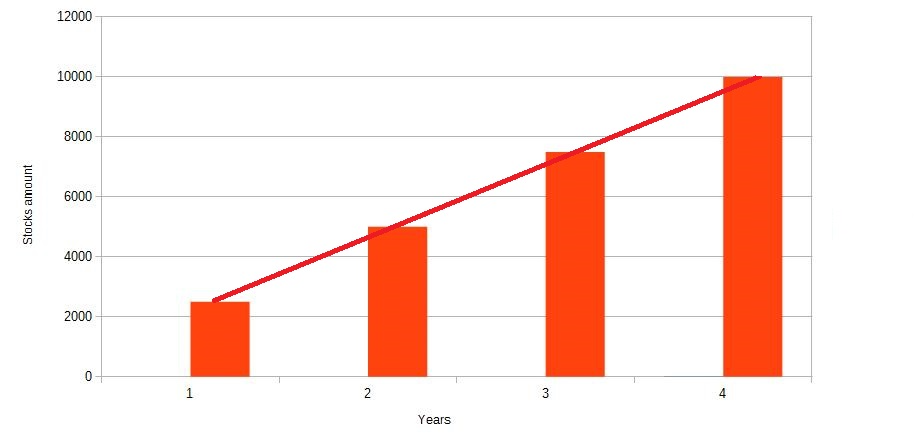

A company that practices the issuance of employee stock options draws up an option agreement that specifies the timetable for the vesting of the contracts.

For example, a company might give each of its employees options for 10,000 stocks at the time of hiring. But there is such a thing as vesting. This is a period during which a person gradually becomes entitled to exercise the options.

Most of the time, it takes four years to vest. The first 2,500 stocks must be exercised for one year in order to be entitled to exercise the first stock option. In the second year, the employee receives options for another 2,500 stocks, and so on.

Employee compensation in the form of equity shares is used to encourage employees to stay with the company longer and invest in its growth. Employees who own stocks are given an additional incentive to contribute to the development of the company.

But employee stock options also have disadvantages. First and foremost, they are negative for other investors. When an employee exercises his or her option, the company sells him or her new stocks, which are not previously traded on the stock exchange. This means that there is a dilution of capital.

Types of Stock Option Plans

Depending on company policy, stock option grants to employees usually follow the schemes in the table below.

| Fixed Value Plan | Fixed Number Plan | |

| Structure | Each year, employees receive options for a certain amount of money | Each year, employees receive options on a certain number of stocks |

| Benefits | It is easier for the company to keep employee remuneration at a competitive level, which reduces the risk of specialists leaving | There is a strong link between performance and remuneration, which motivates employees |

| Drawbacks | Low correlation between the level of remuneration and the quality of work | Future payouts could be lower if the company’s share price falls |

There is also a third option for a stock option grant. This is a one-off grant in which a large number of options are granted. This form of compensation in the form of an equity share is usually applied when hiring a highly competent employee for a leading position.

Another type of employee reward is the so-called phantom stock. The employees do not acquire ownership of the shares. They are paid a cash award, the amount of which depends on the company’s current stock price.

How Do Stock Options Work After Termination?

Employer stock options are a reward for employees and a way to reduce employee turnover. By quitting one’s job, a person can completely lose the right to exercise the stock options they already hold.

But most companies leave it up to the former employee to repurchase the shares for a few months. There may also be a link to the time working for the company.

Information on this should be specified in each individual company’s employee stock purchase plan.

How to Calculate the Value of Stock Options

The easiest way to do this is in the case of a public company whose stocks are traded on a stock exchange. Therefore, the employee needs to compare the amount he/she would pay to buy the stocks under his/her option with the amount he/she would spend to buy the company’s stock on the stock exchange.

For example, a person owns call options on 20,000 stocks in a company for $2. However, the stock in that company is listed at $1. In this case, it makes no sense to exercise the stock option. It is worthless, at least if the situation on the exchange does not change before the contract expires.

If the stock exchange price is $3, then the value of the option will be $20,000 ($60,000 when bought on the exchange minus $40,000 when bought at the option).

If it is a private company and its securities are not publicly traded, calculating the value of a stock option received from it is much more difficult. For example, this can be done on the basis of a business valuation, data on the number of options issued and the total number of employee stocks.

When You Should Exercise Stock Options

There are several factors that determine whether an employee should exercise his or her stock options or wait for a more favourable time:

- the company’s publicity;

- current price quotations;

- taxation issues;

- dividends;

- the time factor.

Financial advisors agree that only public companies’ options should be exercised. Otherwise, one risks being left with an illiquid asset in one’s hands.

It makes no sense to exercise an option if its strike price is higher than the current stock price on the stock exchange.

Even if the quotes are above the strike price, it may be advisable to keep the stock option, waiting for the level at which the person wants to sell the shares. This will avoid keeping one’s money invested in the asset for a long period of time.

But this approach deprives the possibility of receiving dividends and also prevents optimisation of the tax burden. It should also be remembered that options have a limited expiration date. Therefore, it may make sense to exercise your options as soon as the exchange value exceeds the strike price.

How to Exercise Stock Options

An investor or employee of the company becomes the full owner of the stocks at the time he or she exercises the call option. But it must be realized that the latter may not execute the transaction immediately upon stock option granting, but only after vesting.

When an option is exercised, the investor can either pay the strike price with his own money or use a margin loan if it is approved by his broker.

Investors often resort to selling a portion of the stock immediately upon exercise of an option. This provides the amount of money needed to cover the strike price, transaction fees and taxes. But in order to implement this scheme, it is necessary to contact a broker.

Yet another option is to sell immediately. The investor has the right to sell all the stocks included in the option at once and lock in a profit, receiving cash in the account.

If it was an employee stock option, the employer’s company stock option agreement may require the employee to give notice that he or she has sold some of the stocks received under the option.

Stock Options and Taxes

For the majority of cases, taxable income arises at the time the option is exercised. In the case of an employee stock option, the gain is calculated as the difference between the strike price and the current fair market value of the stock. In the case of an option purchase, the profit is reduced by the premium paid for it and the broker’s commission.

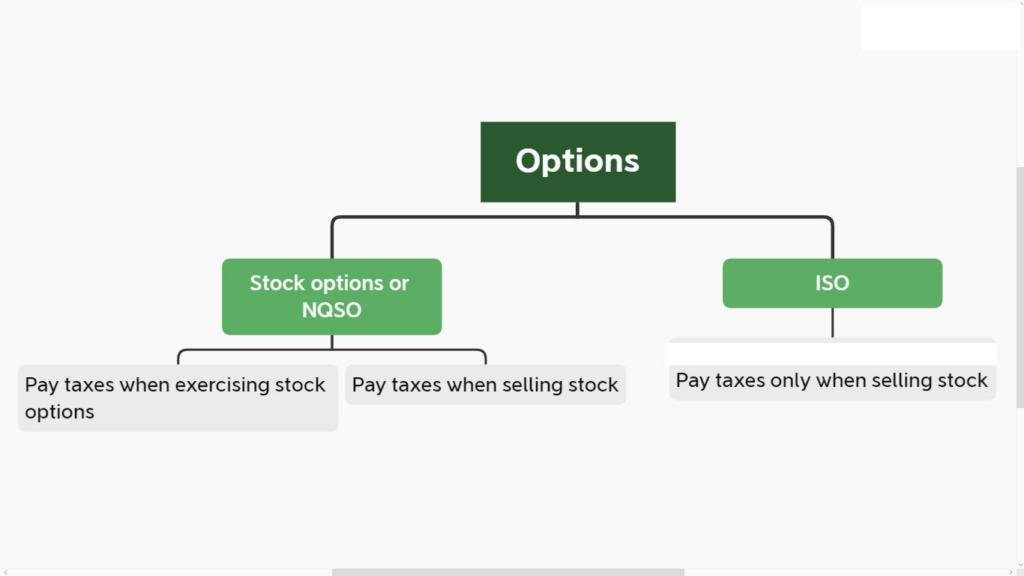

There are two types of employee stock options. The first one is employee incentive stock options. The ISO exempts its holder from tax at the time of exercise. But the profit made is taken into account in the total annual income and can lead to an alternative minimum tax at the end of the year.

The second type is non qualified stock options (NQSOs). These are the ones most often granted by employers. And these must be taxed at the time of exercise (i.e. when the stocks are purchased) at the rates applicable to ordinary income.

There are also non-standard options. Tax is withheld at the time of receipt rather than at the time of exercise. But these are rare.

If the investor decides to sell the shares received by exercising the call option, he or she will have to pay tax again. If he has owned them for less than a year, it is a short-term capital gain. If the person has owned the securities for more than a year, the tax will be paid at the reduced rate applicable to long-term capital gains.

FAQ

What are examples of stock options?

Let’s say a stock is worth $1,000. An investor hopes its price will continue to rise, but realises that investing involves risk and there is a possibility of a fall in the price. For $100 he buys an option that gives him the right to buy the asset at $1200.

If the stock price exceeds $1200 by the time the option expires, the investor will exercise the option and make a profit. If, on the other hand, the price falls, the person will not exercise the option and will only lose $100.

What are stock options for dummies?

An option is a type of contract. The buyer of an option acquires the right at a certain time to demand a transaction on specified terms. The seller of the option assumes the obligation to fulfill the buyer’s demand.

The buyer can choose not to exercise the right. But he or she will not get back the money he or she paid when buying the option.

Is a stock option a good benefit?

For the well-versed trader, options offer significant advantages. They allow traders to use their leverage for free and deal in amounts of assets for which they have insufficient spare cash.

In addition, by using stock options, one can reduce investment risks and get a kind of insurance in case of a fall in the quotation of investor-owned securities.

Can you really make money with stock options?

Many experienced traders make money from options trading. But to take advantage of this tool, one needs to have a good understanding of how it works and a clear strategy. For beginners, this asset is considered more dangerous than buying stocks and bonds.

Can I sell my employee stock options?

This depends on the rules laid down by the employer. But even if this is allowed, there may be difficulties in assessing the value of the stock option if it is a non-public company.

The bottom line

Since options have a limited expiration date, buying them is a speculative transaction that involves the risk of losing money. When dealing with options, an investor will not always be able to wait out a negative market situation without taking a loss.

So even buying options requires in-depth knowledge. And selling such contracts, with the potential loss becoming virtually unlimited, is more suitable for institutional investors than for people who want to build up retirement capital or save for their children’s education.