According to statistics from the Motley Fool, only 1% of Americans achieve financial independence between the ages of 40-45. And according to the Employee Benefit Research Institute, 33% of people leave work before age 60. At the same time, an American worker used to have a retirement age of 65.

Key points required for retirement at the age of 40 would be:

- high salary;

- moderate consumption for a high savings rate;

- investment skills.

Table of Contents

Is It Too Late to Save for Retirement at 40?

It’s never too late to start building wealth. 40 years of age is a good age to start if you plan to retire at 67.

For example, to have $1.25 million saved for retirement, you would need to get aside $1,150 per month for 27 years at an average annual return of 8%. This is achievable for the broad US stock market.

At a 4% withdrawal rate, the $1.25 mil in a Roth 401(k) retirement plan will generate about $4,150 per month in additional Social Security benefits.

How Much You Need to Budget to Retire at 40

There is no single amount that will allow someone to retire by 40. It depends on your lifestyle and other factors.

To determine how much do you need, certified financial planners offer the following criteria:

- Retirement savings are 12 times your annual income.

- Annual expenses are no more than 4-5% of available principal (the standard withdrawal rate for retirement at age 65-67).

- Current passive income equals or exceeds expected expenses.

- The $1000 rule of thumb.

The first strategy assumes a standard lifestyle after retirement and a significant reduction in spending, and the second assumes that life span will not exceed 30 years.

The $1000 rule states that every $240,000 saved increases retirement profit by $1000 per month. For example, if a person wants to have $3,000 per month, they only need to set aside $720,000. It is also based on an average lifespan of 67 years.

For the majority of early retirees, the third model seems preferable. However, some of the supporters of the idea of retiring by age 40 calculate the amount of personal capital on the assumption that it will last for 20 years. Then they get:

- Access to employer-sponsored retirement accounts (at age 59.5).

- Social benefits (starting at age 62, but the amount will be much lower). If a person does not claim benefits until age 67, he or she can expect full Social Security payments.

- Eligibility for Medicare (at your 65).

According to investopedia.com, one-third of Americans believe the income for retirement is $1.5 million or more.

Set a Savings Goal

A necessary step in when you’ll need enough money is to create a plan for saving enough money. If the savings goal is early retirement, the following steps should be taken:

- Determine how much you’ll need to spend each year.

- Determine the amount of capital needed based on projected expenses. Keep in mind that living expenses will increase over the years due to inflation.

- Based on your risk tolerance, estimate the portfolio’s expected return.

- Set a timeframe for how long you plan to save enough money for your retirement years.

- Use online trackers to determine the monthly amount you need to put aside for retirement at the age of 40.

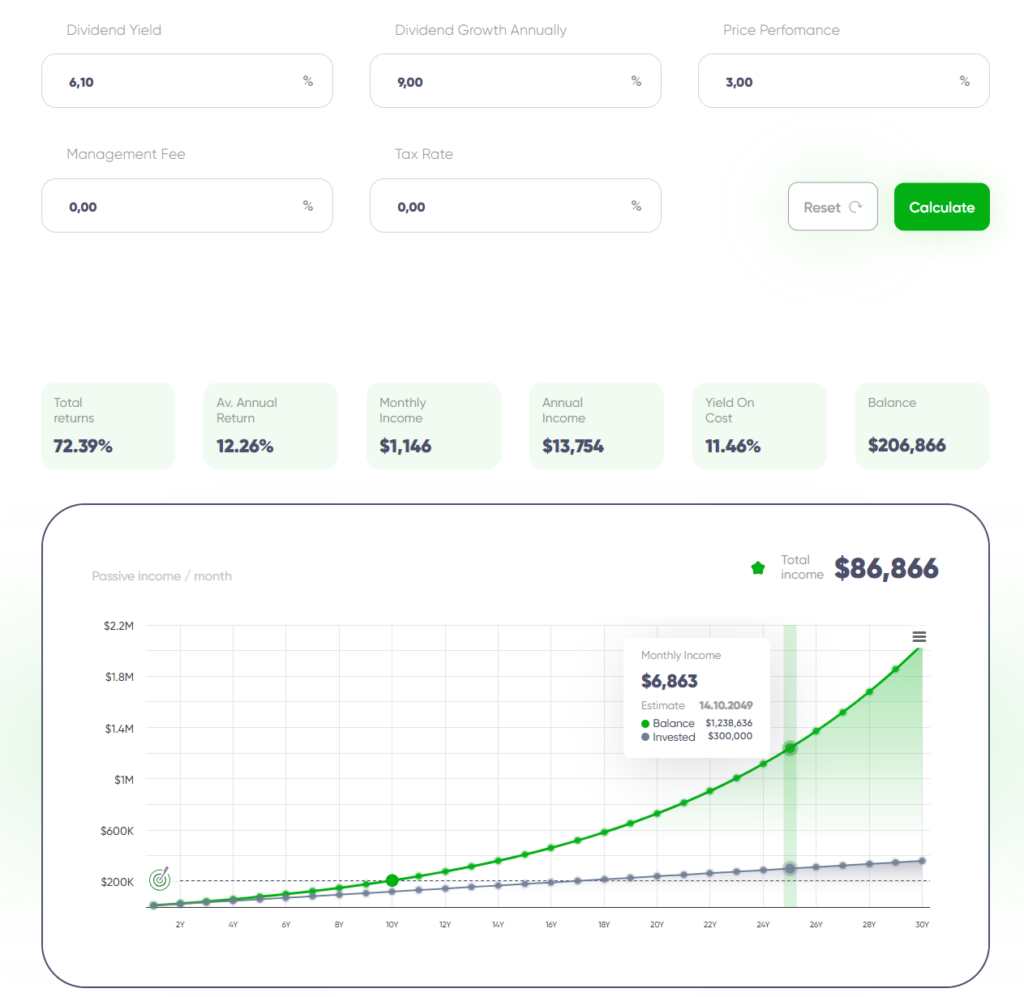

Using an online retirement calculator

You can simplify the calculations by using a special tracker. This service allows you to take into account:

- investor age;

- planned life expectancy;

- current annual revenue and plans to increase it;

- savings policy;

- expected return on investment;

- changes in expenditures throughout your retirement;

- inflation rate;

- additional revenue sources.

Such programs allow you to calculate how much capital is probably needed to support your expected level of retirement spending.

For example: Passive Income Calculator from MaxDividends

They can also help you determine how much you will need in years to reach a specific financial goal at your current savings policy. It is easy to use them to find the amount you would need to have saved per month.

What’s your salary and what’s your expected return on investments?

An important quality for someone who wants to retire early is a willingness to cut costs significantly. The minimum goal for retirees is to save half their salary.

But the reality is that 90% of your ability to save the money you need to give up work depends on your income level during your working years. Therefore, a key component of success is to continually increase your income.

The third influencing factor is the return on investment. At the time of this writing (November 2024), the following facts are relevant:

- The maximum interest rate for High Yield Savings Accounts is 5.0%. However, this is a limited time offer for new customers. Savings Certificates APY reaches 5.50%.

- The current yield on the 20-year U.S. Treasury bond is 4.59% (as of November 11).

- The S&P 500 fund’s return over the past 20 years, including reinvestment of dividends, is 10.52% per year (according to valueinvesting.io).

- The average income on gold investments over the past 20 years is 9.39% per year (according to valueinvesting.io).

For example, an investor in his 20s uses a moderately aggressive strategy and invests only in stocks in a fund based on the S&P 500 index. This individual plans to retire at the age of 40. The savings target is $1.5 million.

If you maintain a 10% rate of return, you should aim to save about $2089 per month ($25,000 per year). This may be difficult in the early years, but as you progress in your career, the income goes up.

With an expected life span of 45 years and a principal of $1.5 million, you can withdraw approximately $2,750 from your retirement account in the first month. The investor also receives regular dividends.

Over time, the portfolio’s dividend yield will increase. But passive income will still be less than the average wage. According to the Bureau of Labor and Statistics, it was $5,000 a month (in the third quarter of 2024).

A person who plans to retire early would be wise to save more than $1.5 million. They may need to put aside $50,000 a year or more.

How to Retire in 5 Years

The point at which retirement is 5 years away is considered the tipping point. Most investors build their wealth with highly volatile assets until they reach retirement age.

It is important that a person could retire and not be faced with having to sell stocks during a bear market phase. Experts can provide legal or tax advice for pre-retirees to rethink their allocations in favor of conservative instruments. The main task is to determine where the money will come from in the early years of retirement.

The following sources of retirement income are recommended by financial advisors to supplement your investment portfolio:

- annuities;

- bonds;

- money market funds;

- stocks of dividend aristocrats.

But some investors think it is wrong to emphasize low-yielding conservative assets. For example, W. Buffett believes that the best allocation of the retirement fund:

- 90% – Equity ETFs;

- 10% – short-term government bonds.

The reason is that the life span in retirement is 30 years or more.

FIRE Update, just hit 200k!

Most FIRE adherents want to make $200,000 a year or more. They want to save $120,000 or more. At an average rate of return of 10%, that would add up to about $2 million in just 10 years.

However, there is another category of people. They are convinced that they only need $200,000 to retire. This idea is based on the assumption that the person will sell a small amount of stock each year. He will take out the amount that the stock grows during the year.

Assume that the value of such an investor’s assets grows at 8% to 12% per year. In this case, the annual income in retirement will be between $16,000 and $24,000.

In some years, the value of the shares may decline. If the investor has no other sources of income, he or she will still have to sell the securities. This means that his capital and future income will be reduced.

A person will have to look for ways to make significant savings, move to a cheaper state, etc. For example, according to statistics, the average cost of living in Nevada is 95.5% of the national average. In addition, there is no local income tax here.

What do people do when they retire at 40?

Most people who seek early financial autonomy plan to live an active lifestyle in retirement. At the top of their to-do lists are:

- travels;

- realization in a new profession, often related to a hobby (writer, artist, musician);

- volunteering, etc.

Planning for your years in retirement will determine how much money do you need to set aside before you give up work.

FAQ

Can you retire at 40 with 1 million?

Whether $1 million to give up work is enough depends on 2 factors. The first is your expected level of spending during your retirement lifestyle. How much you need depends on the number of children you have, your health, etc. The second factor is asset allocation, the availability of passive income in the form of dividends.

Can I retire with $2 million at 40?

Assuming a life span of 85 years, the retiree will have approximately $44,400 per year to spend in retirement. In addition, he will have passive income from this capital. But with inflation, the person will still have to save.

Is $5 million enough to retire at 40?

This is a great amount for retirement at any age. Over 45 years, these savings might allow you to spend more than $9,000 each month.

How much should I retire at age 40?

Most FIRE adherents believe that net income needs in retirement equal to at least 80% of current expenses. They believe that at least $1.5 million is needed to leave work comfortably.

At what age can I retire with 1 million dollars?

How much money you’d need to save depends on your spending level and the dividend yield on your portfolio. For people with good planning and saving skills, $1 million is a sufficient nest egg. It can provide a comfortable retirement at age 50 or earlier.

You Might Also Like

- What Is a Dividend Recap? Understanding This Financial Strategy

- Best MLP ETF: Understanding Dividend Stocks and How to Invest in Them

- What Is a Dividend Yield? Understanding This Key Investment Metric