Exchange Traded Funds (ETFs) are an instrument designed for typically passive investment in a ‘buy and hold’ format. This article reviews the features of this asset class, its types, advantages and disadvantages. A step-by-step plan on how to invest in your first ETF is given for beginner investors.

Table of Contents

What are etfs in investing

An exchange traded fund, or ETF, is a collective investment instrument that makes it possible to build a well-balanced portfolio of securities with little capital.

An ETF management company issues stocks that are traded on a stock exchange, similar to Apple or Microsoft. The performance of these securities is affected by changes in a fund’s net asset value. The latter may be a collection of stocks, bonds, precious metal bullion, etc., depending on the fund’s investment strategy.

By purchasing a stock in an ETF for the SP500 index, for example, an investor gets a stake in a balanced basket of securities that includes shares of 500 companies. To build such a diversified portfolio on one’s own would require capital worth hundreds of times the value of the ETF stock.

Differences between ETFs and mutual funds

At first glance, ETFs are similar to mutual funds. These types of investor alliances do share many similarities. They are balanced baskets of securities assembled within a particular strategy. A mutual fund, like an ETF, can replicate an index. But among them, actively managed funds are much more common.

The key differences between mutual funds and ETFs are described in the table.

| ETF | Mutual fund | |

| Trading method | ETFs are traded on the stock exchange. They can only be bought online if you have a brokerage account | Mutual fund stocks can only be purchased from a dealer |

| Pricing | The price of a stock changes every second, depending on investor demand. The market maker ensures that it strives for a fair value | The price of mutual fund stocks changes once a day after the close of the stock exchange according to how the net asset value has changed |

| Additional expenses | Only the brokerage commission may be deducted from the buy/sell of an ETF | Many mutual funds use a so-called initial charge (surcharge) on the value of a unit, which is deducted on purchase. A penalty may be imposed on the sale if the investor has been a member of the fund for less than a set period of time |

| Expense ratio | Typically below 1%, can be as low as hundredths of a percent | Always noticeably higher than ETFs, can be as high as a few per cent |

Understanding ETF basics

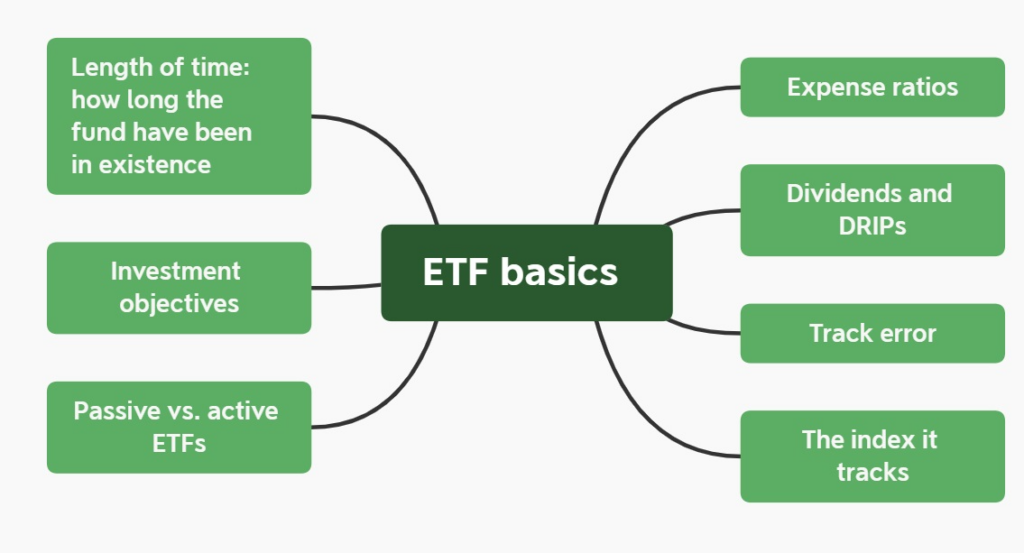

There are several parameters that are essential to know before investing in an ETF:

- form of management;

- basic asset;

- dividend availability;

- track error;

- expense ratio;

- fair value of the stock.

An important feature of ETFs is that 99% of them are passive management funds. This means that the manager does not develop an investment strategy himself, but copies a particular index.

The basic asset of an ETF is the investment instruments in which the money of the fund’s stockholders is invested. The principle of making money from ETFs is that an investor purchases a stock in a fund, just as he or she would buy a stock in any company. If the net asset value of a fund increases, so does the value of the stock it issues. Then the investor can sell the securities and make a profit.

Investing in exchange traded funds can also generate passive income. Some ETFs pay monthly dividends. The money received from the issuers of the securities, which are part of the net assets, is used for this purpose. Therefore, gold ETFs and other commodity funds do not offer regular payouts.

One of the key parameters of an ETF is the track error. It indicates how much the real composition of a fund’s net assets may deviate from the benchmark. The lower it is, the more efficient the fund is considered to be.

The expense ratio is the fee that the management company withholds from investors to cover its costs. It is expressed as a percentage of the net asset value per year. But it is actually deducted evenly from the fund’s assets throughout the year.

An ETF’s fair stock price is defined as the fund’s net asset value divided by the total number of stocks it issues. The exchange price usually deviates slightly from the fair price. Each management company is required to cooperate with a market maker, whose job is to keep this deviation within acceptable limits. To do this, it places large orders to buy and sell stocks in the fund at a price that is as close to fair as possible.

Understanding ETF taxes

ETF transactions are taxed depending on the type of account used by the investor:

- In a standard brokerage account, taxes must be paid on dividends and capital gains if the ETF stocks are sold at a profit.

- With an IRA, tax only needs to be paid when the account is closed (it is charged on all profits received – both from dividends and from securities transactions).

- With a Roth IRA, taxes are generally not withheld on any kind of investor’s profits.

In the case of a regular brokerage account, the rate at which an investor has to pay tax depends on many factors. Among them are one’s total annual income, the length of time one has held the asset and the structure of the ETF chosen.

An important advantage is that the ETF has tax benefits. Transactions in securities that the fund manager makes to achieve an exact index match do not result in the need to pay tax.

How to start investing in etfs

The answer to the question of how to invest in ETFs comes down to a four-step guide. It involves selecting a broker and choosing the most suitable ETFs for the investment strategy you are using.

Step 1. Open an investment account

ETFs trade is necessary to have a brokerage account. It is advisable for beginner investors to choose a company to open one with the following factors taking into account:

- Convenience. The US and European market has both online brokers and traditional companies. The former provides the client with an opportunity to monitor the status of the portfolio 24 hours a day. The latter may not have such an option.

- Service charges. A broker may charge a commission for every transaction as a percentage of the transaction amount or a fixed amount, for the account maintenance, custody of securities etc. Although these amounts are not large separately, over the decades they add up to impressive figures for an active investor.

- Minimum deposit requirements. Some brokers cut off clients with little capital by setting minimum account requirements. Others charge additional fees to investors with less than a certain amount of capital.

It is also necessary to find out which stock exchanges and instruments the broker gives access to, whether s/he offers to work with fractional stocks, etc.

Step 2. Research ETFs to buy

Financial advisers recommend adding up to 10 ETFs to your investment portfolio to create the most diversified set of assets possible. When selecting them, the following indicators should be taken into account:

- the base asset (must be consistent with long-term investment objectives and risk tolerance);

- the fund’s costs (the lower, the better);

- net asset value (the bigger the fund, the more resilient it is during a crisis);

- the volume of transactions per day (reflects the fund’s liquidity and investor demand for the fund).

The US ETF market is the world’s richest one. There are almost 3,000 funds with a variety of basic assets on US exchanges.

Beginners don’t have to manage their capital themselves. They can turn to a financial adviser for investment advice or use automated robo-advisors. But these services have to be paid for.

Types of ETFs

All existing ETFs can be divided into several types.The basic asset classification is as follows

- Broad market funds. These are stock ETFs that replicate the largest US and global indices, such as the SP500.

- Sector ETFs, or specialty funds. These are also equity funds. They replicate industry indices, such as IT, biotechnology, etc.

- Thematic ETFs. They put investors’ money into companies’ stocks that profit from a particular theme. For example, artificial intelligence, cloud computing, etc. Thus, these funds are even more narrowly focused than sector ones.

- Bond ETFs. These ETFs only include among the net assets of bonds that have been selected according to an index. With the underlying asset being fairly conservative and stable, the stock price of such funds is the least volatile. Plus, they generate fixed income from coupon payments.

- “Sustainable”, or ECG ETFs. These are funds that invest in companies that are environmentally and socially responsible.

- Factor ETFs. Unlike ETFs that try to perfectly replicate the SP500 or MSCI USA, these funds select companies’ stocks included in the index based on a specific factor. For example, capitalization levels, growth rates, etc.

- Commodity ETFs. Like ETFs investing in gold, silver, gas, etc. The net assets in this case may be bullion precious metals directly, commodity futures or mining company stocks.

- Currency ETFs. The value of these stocks fluctuates according to the price dynamics of the chosen currency relative to the US dollar or a multi currency basket.

- Money market ETFs. They are a separate class, but these funds typically invest in debt securities. What sets them apart is that they invest in securities with short maturities. Most commonly, these are treasury bills.

The basic assets of an Exchange Traded Fund are defined by the index it is set up to replicate. These are not always tangible items or securities. There are also ETFs that trade in futures.

There may be two objectives. The first is to make money on the appreciation of gas, oil and other commodities, which are difficult to store. The second is to use leverage to increase investors’ income. Leverage funds, or leveraged ETFs, use futures, options and lending to make large returns on even small movements in the price of the underlying asset. Investing in them is considered quite risky compared to buying traditional ETFs.

There are also so-called inverse ETFs. They allow you to profit from a drop in the chosen index. But such companies are few and risky and only suitable for bear market periods, not for the long term.

Best-performing large-cap ETFs

The list of funds investing in America’s large-cap companies is shown below. It showcases the best ETFs with the highest returns over the past 12 months (according to money.usnews.com).

But past performance cannot be considered a guarantee of future income.

Step 3. Purchase your chosen ETFs

Once the specific funds have been selected, the amount of money to be invested in each of them must be determined.

The next step is to apply to buy ETFs. To understand how to invest in ETF funds, you need to know how to work the trading terminal for your computer or mobile phone.

As with individual company stocks, in order to purchase an ETF, the following is required:

- go to the application form section;

- enter the ticker symbol of the selected ETF;

- specify the desired number of stocks;

- specify the purchase price (this can be set “at the market” or enter the exact amount at which the transaction is to take place);

- сonfirm your actions by clicking on the “Buy” button.

ETFs can be bought and sold using this method at any time when the exchange is open.

Step 4. Set up a regular investing schedule

Buying a few ETF shares once is not enough to build capital. It requires regular investment over many years. An investor should determine:

- Frequency of funding (weekly, monthly, quarterly);

- the amount to be deposited (and how this will increase as your income increases);

- investment rules (how newly deposited money will be allocated among the assets).

Regular investing of a fixed amount helps to average the value of securities owned by a person by purchasing them both during bull market periods and during periods of falling prices. It also helps to remove doubts about the right entry point.

Invest in ETFs with a diverse and defensive strategy

Investing in ETFs is the easiest and most convenient way for someone with little capital to build a diverse set of assets.

According to investment theory, proper diversification is one of the main factors for success in the stock market. Proper asset allocation can reduce overall risk while maintaining a sufficient level of return.

Most ETFs are already a diversified set of assets based on issuers. The challenge for the investor is to select them in a way that provides sufficient diversity across sectors and, most importantly, types of investment vehicles. As an example, pick US and foreign equity ETFs from various sectors and add commodity funds and bond ETFs to them.

This would reduce the risk of loss in the event of problems in one industry. And investing in gold and silver ETFs is considered a good way to hedge inflation.

Who can buy ETFs?

Anyone with a standard brokerage account or IRA can buy an ETF. Before opening one, make sure that the chosen company provides access to trading in exchange traded funds.

ETFs can also be purchased as part of a corporate pension plan if the employer’s plan allows investment in this asset class.

How to evaluate an ETF

To assess whether investing in a particular Exchange Traded Fund is worthwhile, the following factors need to be taken into consideration:

- the underlying index that the fund tracks;

- the history of both the index and the management company that created the fund;

- the expense ratio of the fund;

- The taxation features, depending on the fund’s structure (the tax rate conditions for an ETF investing in stocks, precious metals bullion or trading futures will be different);

- The investment strategy (an inverse ETF or a leveraged ETF is not suitable for beginners).

A fund’s strategy and the underlying index it follows should be consistent with the investor’s risk tolerance and fit within the framework of its comprehensive financial planning.

It is equally important to research an ETF in terms of the management company’s experience, its reliability and the conditions under which the market maker ensures the liquidity of the fund’s stocks.

ETFs and your portfolio

The first step to begin investing in ETFs is to evaluate your existing portfolio. You need to review it in terms of diversification, identify the missing sectors and then select exchange traded funds to help fill the gaps.

How much money do you need to be able to invest in ETFs?

Unlike mutual funds, ETFs do not set a minimum entry threshold. An investor only needs to buy one stock. There are funds on US exchanges with securities priced around $10.

In addition, some brokers support the so-called fractional stock option. They give their clients the choice of owning a fraction of a high-value security. This can be useful for investors with small capital who want to invest in a fund with stocks worth several hundred dollars.

Pros and Cons of ETFs

Each investment asset has advantages and disadvantages. ETFs are no exception.

Advantages to investing in ETFs:

Investing in exchange traded funds has the following advantages

- possibility of investing in a wide range of stock, bond and commodity markets with minimal cost and effort;

- high liquidity, convenient online transactions with low commissions;

- savings on expense ratios compared to mutual funds;

- ease of creating a diversified and balanced set of assets (in fact, it is sufficient to have an ETF portfolio consisting of 3-5 funds).

Potential drawbacks of ETFs:

Compared to picking stocks and bonds on their own, investing in ETFs has a number of drawbacks that will be particularly significant to the experienced investor:

- A management fee is payable. A person who has independently assembled a package of individual stocks/bonds does not pay it.

- Low performance. Most ETFs blindly copy an index. An experienced investor, trading on his own, will remove a stock from his portfolio as soon as the company’s business has gone bad. A fund manager won’t be able to do that. He sells securities only after they have been excluded from the copied index.

- A bonus or discount relative to the fair price, which makes ETFs ill-suited for short-term speculation. Although there is a market maker in the market, transactions in ETF stocks may occur between two private investors. This means that the prices of these securities are influenced by the supply/demand ratio.

- The risk of liquidating an ETF, for example, if the fund does not prove popular with investors.

FAQ

How much to invest in etf per month?

The size of the monthly investment depends on a person’s income. It is suggested that at least 10% of one’s earnings should be kept aside. This amount should be allocated according to one’s strategy to various instruments, including ETFs.

How to invest in copper etf

Funds such as the United States Copper Index ETF (CPER) and Ipath Series B Bloomberg Copper Subindex Total Return ETN (JJC) can help capitalize on rising copper prices.

How to invest in gold etf

Gold ETFs can be bought directly from an exchange (e.g. GLD or IAU tickers). There are also mutual funds that invest investors’ money in this type of exchange traded asset.

How to invest in lithium etf

Global X Lithium & Battery Tech ETF and Amplify Lithium & Battery Technology ETF are examples of ETFs that make money on lithium.

How to invest in wheat etf

Teucrium Wheat Fund’s net assets consist of wheat futures. By choosing contracts with different maturities, the impact on the fund’s returns of the difference between the futures price and the spot price is minimized.

How to invest in bitcoin etf

A Bitcoin Strategy ETF is available on the New York Stock Exchange. It is linked to bitcoin futures, which can be found on the Chicago Stock Exchange.

How to invest in natural gas etf

There are more than 10 funds available to profit from gas. These include ProShares Ultra DJ-UBS Natural Gas ETF, UltraShort DJ-UBS Natural Gas ETF, etc.

How to invest in nickel etf

The iPath Series B Bloomberg Nickel Subindex Total Return ETN, which tracks the price of nickel using futures, is available on the New York Stock Exchange. Another option is the SPDR S&P Metals & Mining ETF. This fund holds metals and mining stocks.

How to invest in carbon credits etf

There are six such ETFs available in the US. Examples of their tickers are KRBN and KCCA.

How to invest in commodities etf

Many commodity ETFs invest not in a specific single commodity, but in several units at once or even in a broad commodity market. The Abrdn Bloomberg Bloomberg All Commodity ETF (BCD) and iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT) are examples of such funds.