Investing in mutual funds for beginners is the easiest step to building capital. Even so, it requires understanding both what features mutual funds have and how to choose the best one. It is also up to the beginner to decide which purchase method will be most convenient for him or her.

In addition, there are many narrowly focused mutual funds. They will prove useful to the experienced investor who wants to bet on the growth of a particular industry or theme.

But most commonly, people are interested in investing in funds for the purpose of building a retirement portfolio. This is the most popular instrument available in all the schemes offered by employers.

Table of Contents

Mutual funds definition

Mutual funds are companies that bring investors together and invest their capital in a diverse set of assets. The advantage of investing through such structures is that one gets access to a diversified portfolio of securities (stocks, bonds, etc.) with far less capital than one would need to buy these instruments themselves.

A mutual fund participant does not possess its net assets directly, but benefits from their rising value (as well as a loss in the case of falling prices).

Mutual fund types

A mutual fund is a broad term. It refers to a multitude of collective investment instruments, differing in terms of the form of management (active or passive), financial objectives, etc.

A mutual fund may be open-end (continuously issuing new stocks as new investors are attracted) and closed-end (the number of securities in the fund is fixed at the moment of creation). But the main classification is based on the type of net assets.

Stock (equity) funds

Stock funds, or equity funds, are the most popular type of mutual fund. They invest a minimum of 75 per cent of their net assets in companies selected according to a certain criteria.

Equity funds, in turn, are divided into many sub-types:

- sectoral (invest in companies in one industry, e.g. pharmaceuticals);

- topical (make money on specific topics, e.g. cloud storage);

- broad US equity market;

- foreign market;

- selecting companies based on their capitalisation, etc.

There are also different mutual funds whose investment strategy combines assets according to other characteristics. For example, income funds, growth funds, etc.

Stock (value) funds

This type of mutual fund invests in stocks of companies that are considered undervalued in the hope that they will soon approach fair value.

These mutual funds’ strategy is actually based on the writings of B. Graham.

Balanced funds

Balanced mutual funds are fully diversified portfolios across asset classes. They include stocks, bonds and other investments (in gold, money market, etc.). Typically, this result is achieved through the fact that money is not invested directly in stocks/bonds, but in securities of other mutual funds.

The main disadvantage of such funds is the higher commissions.

A separate class of balanced funds are mutual funds with a target return date. The essence of the strategy is that the fund manager changes the proportions of asset allocation towards a more conservative one as the end date of investment approaches.

In fact, by purchasing stocks in one fund, a person receives a portfolio assembled according to the rules of a classic asset allocation strategy. In doing so, he does not have to spend time rebalancing.

Blended funds

Blended funds are mutual funds of equities that use 2 strategies at the same time. This means that the fund’s investments include both growth and value stocks at the same time.

Bond (fixed-income) funds

The net assets of such a mutual fund consist mainly of bonds. In most cases, these are debt obligations of the government and large companies.

These assets are considered the least volatile. They also generate stable interest payments. That said, the potential returns of such funds are noticeably lower than those of funds that invest in equities.

Money market funds

Money market mutual funds invest in short-term bonds, treasury bills, etc. Investing in them involves the least risk. Due to their extremely short life, the assets they hold almost never fall in value.

The downside of such a mutual fund is minimal returns. The return on investment is close to the interest rate of a bank deposit.

Commodity funds

These mutual funds profit from the growth of commodities and raw materials. They can make money from a variety of commodities as well as from one type of commodity. For example, companies investing in gold bullion are popular.

How do mutual fund profits work?

Investments in mutual funds generate 3 types of income.

1. Dividend payments

Mutual funds receive dividends and coupons from the issuers of stocks and bonds as part of their net assets. This money is in turn paid out to investors.

A person can, however, choose whether to receive this money in a cash account or to have it automatically reinvested in stocks in the same mutual fund.

But dividends are optional. They are not paid by mutual funds which in turn do not receive a constant cash flow from existing net assets (e.g. in the case of investments in companies’ growth stocks, gold bullion, etc.).

2. Capital gains

Mutual funds make profits from securities transactions. Most of them distribute the capital gains received during the year to stockholders.

Like dividends, these distributions can lead to an increase in the tax rate.

3. Net asset value

A mutual fund’s stock price is directly related to its net asset value. It is updated once a day after the stock exchange closes. If a mutual fund’s securities rise in value, the value of its stocks increases as well.

Selling stocks at a higher price than they were bought is one way of earning money from mutual fund investments.

Tax consequences arise if one records the income. Until the moment of sale, the paper gain does not result in the need to pay tax.

Guide on investing in mutual funds for beginners

Here is a step-by-step guide on how to invest in mutual funds for beginners. It will help you avoid mistakes and get the most out of your mutual funds.

1. Decide on Your Mutual Fund Investment Goals

The first step is to determine your financial goal and the horizon for achieving it. This determines whether it is worth investing in mutual funds and what type of underlying asset is best chosen.

For example, it may be a long-term goal – retirement, children’s education, etc. In this case, it is advisable to choose assets with a high potential return, albeit at a higher risk.

If it is a short-term goal (e.g. buying a car in 1-2 years), however, investing in stock mutual funds can be a mistake. If the economic situation deteriorates, stock prices go down. In such a case, the investor will be forced either to sell his assets at a loss or to postpone realizing his objective.

It is equally important to consider one’s risk tolerance and willingness to see a drawdown in one’s account during bear market periods.

2. Pick the Right Mutual Fund Strategy

Which strategy is the right one depends directly on the investor’s financial objective:

- When it comes to the long term and decades, growth mutual funds are considered the best solution. They invest in fund companies that are likely to show a rise in stock prices. This is the riskiest option among securities. But it can also maximize your returns and help you raise real capital, not just compensate for inflation. Mutual funds with a set return period are another option. During the first few years, the manager wants to maximize profits; in the last few years, he wants to preserve the capital he has accumulated.

- For medium-term investments (5-10 years), it becomes risky to work exclusively with growth stocks. In such cases, financial advisers recommend allocating capital to mutual funds which invest in value stocks, large-cap companies or mixed funds. Balanced funds, which have both equities and bonds in their composition, are a good option.

- If the horizon is less than 5 years, experts advise giving preference to bond funds. They should account for at least 70% of capital.

- If it is a question of a short-term horizon (one year or less) or keeping a safety cushion, high-yield savings accounts are recommended.

The investor also needs to decide which type of fund is preferable for him/her – with active or passive management. The first option is more suitable for an experienced person who is prepared to carefully study the investment philosophy of the selected funds and the qualifications of their managers.

For beginners making their first investment, low-cost mutual funds that replicate the SP500 index are considered more suitable.

3. Research Potential Mutual Funds

Once you have decided on the desired strategy and the underlying asset, you need to select a particular mutual fund from several similar ones.

There are many investor services that provide detailed information on mutual funds to choose the most suitable one.

The key parameters to look out for:

- Past performance. Although they cannot be a guarantee of success in the future, they do give an indication of the professionalism of fund managers. They should be compared with the performance of similar funds. For passive funds, compare them to the benchmark market index.

- Expense Ratio. This is the amount deducted from a fund’s net assets. It goes to compensate for the costs of the fund’s management. It is expressed as a percentage of the net asset value per year. It largely depends on the strategy of the fund, its size, etc.

- A loading fee, or initial charge. Many mutual funds still charge an investor a fee for buying their securities. This is a fee to the dealer and the management company. But due to the highly competitive financial market, it is possible to find a mutual fund that does not make such a mark-up and sells its stocks at a fair price.

- Selling commission. This is the amount that will be deducted from an investor’s capital when selling their stocks. Generally, its amount decreases with each year of holding the asset. There are also no load mutual funds which have waived this fee, as well as the mark-up on purchases.

- The existence of other fees such as 12b-1 fees, etc.

Financial advisers recommend picking up several mutual funds, even if they are mixed funds and target date funds. This will help diversify counterparty risk.

It is also a good idea to study the fund’s prospectus before buying its securities. They should provide information on the asset structure, a detailed expense report, etc.

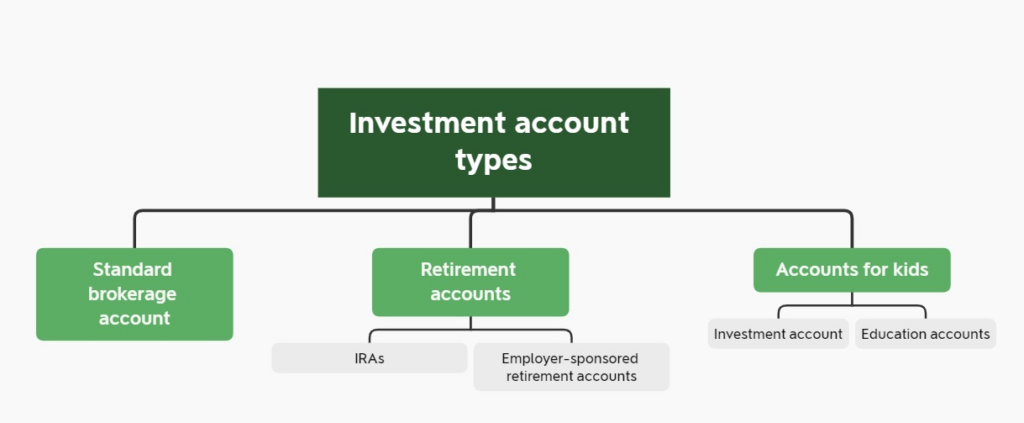

4. Open an Investment Account

There are several types of account that can be used to invest in mutual funds:

- Employer Sponsored Retirement Account – 401(k) or 403(b);

- Individual retirement account – IRA;

- Children’s education savings account;

- Taxable brokerage account – can be closed at any time without penalty, so it is suitable for any non-retirement purpose.

5. Purchase Shares of Mutual Funds

Some mutual funds set a minimum amount that an investor must contribute to become a member. This threshold may be set at $3,000 or more.

To purchase stocks in the selected fund, you can contact the fund management company directly, a financial advisor or an online broker that gives you access to this type of asset.

6. Set Up a Plan to Keep Investing Regularly

The best strategy is to buy securities regularly once a month or once a quarter. Regular, multi-year investments in mutual funds allow you to average the value of your assets. If you accumulate cash over a long period of time and then invest it in securities overnight, there is a risk that the purchase will be made at the peak of value.

Portfolio rebalancing is no less important. If a person uses several mutual funds with different underlying assets, he or she needs to ensure that the right balance is maintained between them. An investor can both maintain the proportions initially chosen and shift them towards more conservative funds as they get closer to their financial goal.

Proper asset class allocation is considered one of the key success factors over the long-term horizon. It is recommended to perform rebalancing once a year.

Rebalancing can be done either through new deposits or by selling the most appreciated securities and buying the ones that have fallen in value. In both cases, you must have a strategy in place and stick to it. This avoids the financial losses that can arise from buying impulsively in the pursuit of higher profits.

7. Consider Your Exit Strategy

The sale of mutual fund stocks can result in expenses of 2 types:

- Dealer’s commission (final load);

- Capital gains tax (if no Roth IRA or Roth 401(k) accounts were used for the investment).

To avoid the first of them, it is advisable to choose mutual funds that have completely waived this type of commission, or those that reduce it to zero over time. A competent financial adviser can help minimize taxes.

Mutual fund examples

The picture below provides information on a few of the largest mutual funds available to investors in the US.

How to choose a mutual fund

To choose the right mutual fund, you need to follow the first 3 steps outlined in the investment guide above.

It is also useful to pay attention to additional factors:

- Dividends (some investors may be keen to receive dividends, while others may prefer to avoid an excessive tax burden);

- fund size (the larger the fund, the more sustainable it is perceived to be but there is an opinion that very large mutual funds work less efficiently);

- total costs compared to similar investment vehicles (quite often it turns out that investing in ETFs is more profitable than purchasing mutual fund stocks due to lower fees).

How to buy mutual funds

The easiest way to invest in mutual funds is to buy their stocks online. This can be done in several ways:

- On the website of the managing company controlling the selected mutual fund. The advantage of this solution is minimal fees. The disadvantage is that the investor only has access to the funds of that company.

- On the website of the company managing the investor’s pension account. In this case a person is usually limited in the list of funds available for investment by the rules set by the chosen pension plan.

- By using an online broker. In this way, the investor has access to a much larger number of funds, but often has to pay additional transaction fees in addition to the fees of the fund itself.

To make a purchase online, you have to register as a customer of the selected company, provide your personal details and wait for your account to be activated. Once you have done this, you can fund your account and make your first trades.

In many ways, buying mutual funds online is similar to buying stocks, bonds or ETFs through a standard trading platform. The investor will also need to know the ticker to find the securities of interest.

The important difference is that an investor may not be required to specify the number of stocks desired, but rather the amount that the investor is ready to invest. The managing company also has the right to set a minimum entry threshold.

The next difference is that the transaction will not be executed instantly, unlike the purchase of exchange traded assets at the market price. The transaction will remain incomplete until the trading session at the exchange closes and the mutual fund’s stock price is calculated. This occurs by 6 p.m. ET.

It will also take time for the calculation to take place. The investor will become a stockholder in 1-3 business days, depending on the rules of the chosen broker.

It is also possible to buy mutual funds offline with the help of dealers and financial advisers.

How to sell mutual funds

The scheme for selling mutual fund stocks is identical to that for buying them. The investor bids online or offline in exactly the same way. The final price he will receive cannot be known at the time of placing the order, but only after the stock exchange closes.

A commission (final load) may still be deducted from this amount if the fund’s rules stipulate this.

Who should invest in a mutual fund?

Investments in mutual funds can benefit most investors. It is a broad asset class that offers a wealth of opportunities:

- for beginners it is the easiest investment option;

- for experienced investors, mutual funds provide a convenient way to invest in what they see as a promising industry that they are not used to investing in directly.

The first question a person should ask is not about how to start investing in index funds, but which type of investment instrument suits his or her goals and risk tolerance. And only after that one should choose how to invest in that asset – directly, through ETFs or mutual funds.

But because of the particular characteristics of mutual funds, one must remember that they are not suitable for speculation and intraday trading. Therefore, only people with a long-term strategy should consider them as an investment.

How are mutual funds taxed?

Investing in mutual funds can be more expensive when compared to using exchange traded instruments in terms of tax payments.

Similar to individual company stocks and ETFs, an investor must pay tax on dividends and gains from the sale of securities if he or she does not use tax-advantaged accounts.

In addition, a person may face tax obligations even if he or she has not sold mutual fund stocks. This happens if capital gains are distributed to investors.

In such a case, the tax rate depends on how long the mutual fund itself has held the asset that generated the gain on sale. The period for a mutual fund’s stock to be held by an investor is irrelevant.

Mutual funds vs. ETFs vs. stocks

The following chart compares mutual funds with ETFs and individual stocks to help every investor decide on the best investment option for his or her situation.

| Mutual funds | Exchange traded funds (ETF) | Individual stocks | |

| Average expense ratio, % | 0,47 | 0,16 | No |

| Additional fees (initial and final loads) | Can be as high as 8%, but many mutual funds refuse to do so | No | |

| Trading | At the end of the day after markets close | During normal market hours and extended hours | |

| Minimum investment | Frequently they amount to several thousand dollars. But some funds do not have this threshold | The value per stock (if the investor’s broker allows fractional lot trading, the minimum investment threshold is even lower) | |

It is a myth that mutual funds are, by default, a more expensive investment than ETFs. The expense ratio depends on management style and the underlying asset, not company status.

Therefore, a passively managed mutual fund tracking the SP 500 index is very likely to have a lower expense ratio than an ETF investing in a narrow industry or overseas markets.

Active vs. passive mutual funds

All available mutual funds are divided into 2 large subtypes – actively managed and passively managed. This determines the investment strategy followed by the fund, its expenses and the resulting returns.

Active mutual funds

The investment objective of an actively managed mutual fund is to outperform the growth of a benchmark index (e.g. SP500 when dealing with the broad equity market, US10Y when the underlying asset is bonds, etc.).

Such a fund is managed by a professional investor who selects the best securities according to his point of view. But they must be in line with the investment strategy defined in the mutual fund’s founding documents.

The advantage of this style of management is potentially higher returns.

But in practice, few managers are able to do this. Statistics on the US stock market do not show that actively managed mutual funds consistently outperform passive funds in terms of returns.

Many actively managed funds can do better than the market average in some years. But it is difficult to find a fund that will do so for decades.

Another disadvantage of an active strategy is higher fees. These are made up of higher professional team fees and trading commissions for more frequent trades.

Passive mutual funds

Passive mutual funds do not strive to find the best investment solutions to maximize returns. Therefore, they do not need a highly skilled team of professional investors.

In this case, the manager’s job is to create a set of assets that will replicate the benchmark index as closely as possible (within the margin of error). This allows transactions to be made much less frequently than is necessary with active management.

Due to these 2 factors, the expense ratio of passively managed mutual funds is noticeably lower.

While investing in index funds for beginners may seem like a failure at first glance, this strategy has consistently outperformed most actively managed funds on the horizon for decades.

Conclusion

A mutual fund is a convenient investment vehicle for people who have a long-term strategy and don’t want to spend a lot of time picking individual stocks and bonds.

To choose the right mutual fund, you must first decide on your investment time horizon and risk tolerance. This is the basis for deciding on your preferred underlying asset or combination of assets. Once you’ve done this, the decision will be made whether to invest in a particular fund based on its expense and the credibility of the fund’s management company.

However, investing in mutual funds involves additional expense and may result in a higher tax burden. It is therefore essential to carefully consider this side of the issue before you buy your first stocks.

FAQ

Is a mutual fund good for beginners?

A mutual fund (primarily an index fund that replicates the SP500, or a balanced mutual fund) is considered a good investment option for beginners because it obviates the need to build a diversified portfolio on its own.

But specific, narrowly focused funds can be dangerous for a beginner who doesn’t understand all the risks involved in the industry. Furthermore, whether investing in a fund is a good idea depends largely on the capital and investment horizon.

Can I invest $1,000 per month in mutual funds?

Yes. Most mutual funds define only a minimum entry threshold. An investor who already holds stocks in the fund can buy additional ones for a smaller amount.

How much should you initially invest in mutual funds?

The most popular minimum entry threshold for a mutual fund is $3000. But a beginner investor may also find himself interested in a mutual fund that requires a deposit of $5000 or more. However, there is a fairly large selection of funds that have no minimum investment limit.

Can I start a mutual fund with $500?

Yes, this amount may be enough to start investing. But the choice of mutual funds available will be limited.

What if I invest $5,000 in mutual funds for 5 years?

The result depends entirely on the underlying asset of the selected mutual fund and the stock market situation.

For example, the average annual return of the SP500 over the years 2000-2022 is about 8%. If the next 5 years show the same result, the initial $5,000 invested in a mutual fund replicating this index will turn into $7,346 (not including fees and reinvestment of dividends received over that time).

What if I invest $10,000 in mutual funds for 5 years?

If we take the same mutual fund on the SP500 as in the previous example, the $10k would turn into $14,693 excluding expenses and reinvestments if the annual average is maintained.

But investing involves risk. You have to understand that the figure of 8% is taken as an average over many years. In the years ahead, returns can vary radically upwards or downwards from this figure.

What is the downside of mutual funds?

Mutual funds have 2 key downsides – high fees and inefficient taxation. There are also risks of mismanagement, poor management, causing a lower return than the benchmark index and similar companies show.