For the majority of people, long-term investments are the most affordable option for creating personal capital. The stock market offers a variety of different types of securities, from which one can build a portfolio suitable for any level of risk tolerance.

In order to succeed, a combination of multiple factors is required. The main ones are — the ability to strictly follow the investment strategy and competent risk management.

Table of Contents

What are Long-Term Investments?

Long-term investments — are such investments which are made with the expectation of gaining profit after 2 years or more. Though, more commonly, when being referred to, a time horizon which encompasses tens of years is assumed.

Long-term investments primarily include retirement plans 401(k) offered by employers, or personal retirement savings. But this term can be applied to any investments in stocks, bonds, mutual funds, and so on. The point is that it refers to the money investors won’t need in the near future.

If a person is prepared from the beginning not to be able to use the invested money in the coming years, he will pay less attention to fluctuations of the portfolio’s value. Plus, the possibility of quickly selling it becomes less significant.

Consequently, unlike short-term investments, investments with a long time horizon allow:

● to use high volatility assets;

● to invest in instruments with low liquidity;

● to choose more profitable, but charging redemption fees, mutual funds.

At the same time, size of the annual management fee paid by the investor becomes very important. Even a difference of tenths of one percent becomes critical on the 30-40 years horizon.

Types of Long-Term Investments

Below is the list comprising 12 the most popular types of assets which can be used for long-term investments.

1. Stocks

Stocks are securities that give to an investor the right to have a stake in a company’s business. This means that the investor who owns them can take part in voting on key issues, expect to receive a share of profits, etc.

There are two ways to derive income from investing in stocks. The first one is to own a security for a long period of time and wait for its value to grow. If it is a long-term investment with the purpose of creating retirement capital, then, after leaving a job, a person can gradually sell the stocks and live on the obtained revenues.

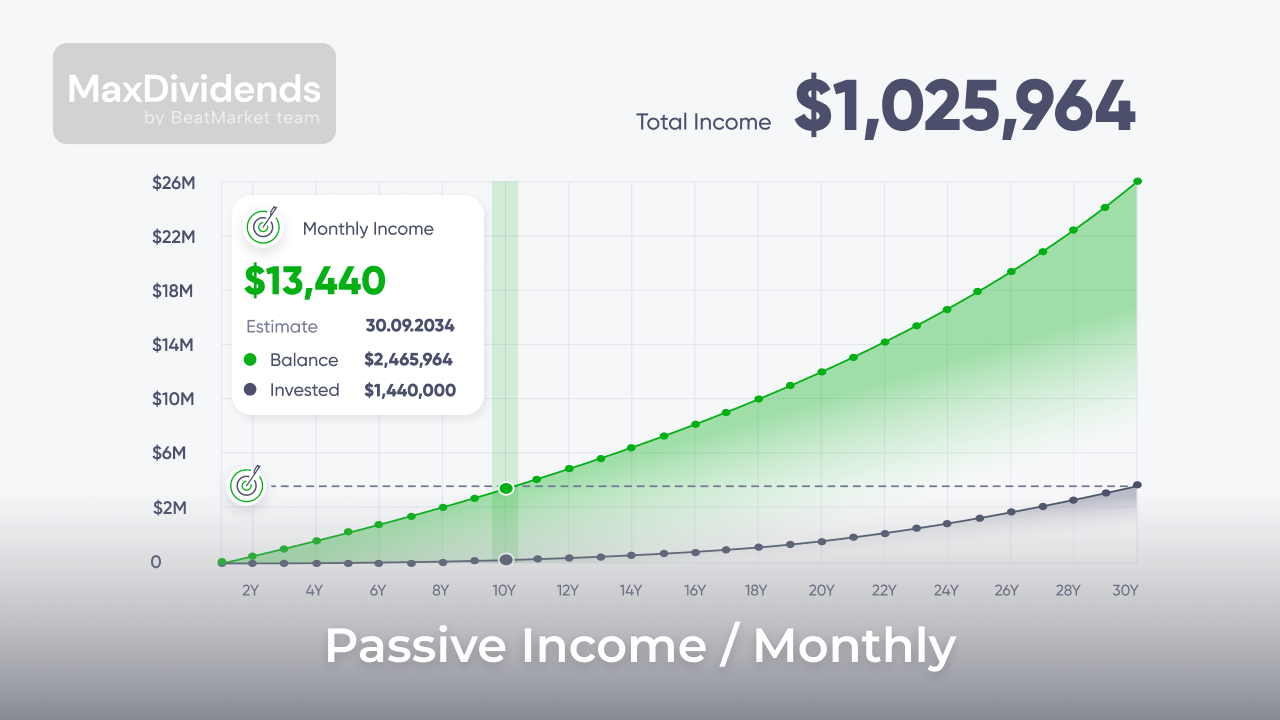

The second way to derive income is through dividends. The advantage of dividend strategy is receiving money on a regular basis. They can be reinvested; or, if the financial goal is achieved, they can be spent. In this case, one does not have to decrease base capital in order to cover living expenses. However, not all stocks yield dividends.

Dividends, however, have some drawbacks:

- Receiving dividends in most cases will result in having to pay the tax.

- Stocks with high dividends are less likely to rise in value.

- Reinvesting involves additional commissions.

There are many ways to classify stocks, which are aimed to help in choosing the most appropriate securities for a long-term investment. The most popular classification divides them into growth stocks and value stocks.

- Growth stocks are securities of a company that is in the process of active development and whose quotes can perform exponential growth. Such issuers typically do not distribute profit among shareholders, spending it on business expansion instead.

- Value stocks are securities of a company that has already acquired a large share of the market. It has almost no room for growth, so it distributes profit among its shareholders in the form of dividends. But in times of crisis and rising interest rates, many value stocks’ quotes show better dynamics than those of growth stocks.

For those whose investment strategy involves receiving passive income, it is preferable to take into consideration dividend aristocrats. This is the name given to value stocks whose issuers have been consistently paying dividends for 25 and more years, regularly increasing their amount.

Past performance is not a guarantee of income in the future. Yet companies cherish their aristocratic status, which is why even in tough periods for business they strive to maintain the same size of payouts.

Also, when choosing stocks, one can look at the capitalization of a company. The bigger it is, the more stable a business is considered. Buying stocks of a small-cap company (less than $2 billion) can result in complete loss of the invested sum as a result of the issuer’s bankruptcy.

| nano cap | 0-$50 mln |

| micro cap | $50 mln – $300 mln |

| small cap | $ 300 mln – $ 2 mlrd |

| mid cap | $ 2 mlrd – $10 mlrd |

| large cap | $ 10 mlrd – $200 mlrd |

| mega cap | more than $200 mlrd |

Any stocks are considered to be quite risky investments, since their price can drop even on the decades’ horizon.

2. Bonds

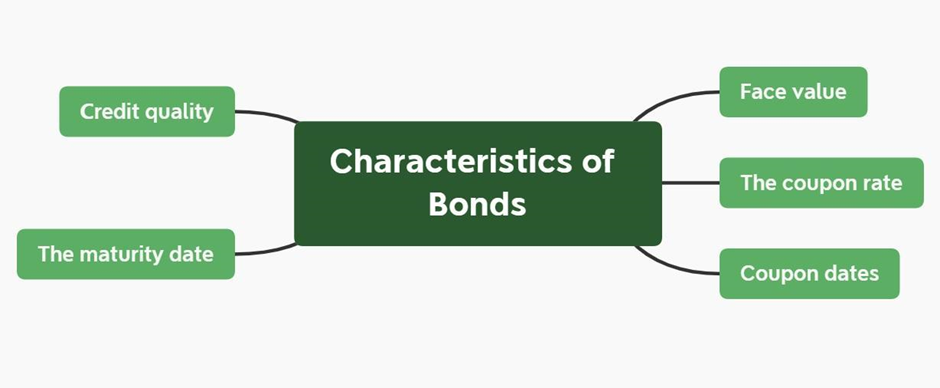

Bonds are debt obligations of a company that issued them. Most of such securities assume that the investor regularly receives interest payments on them — coupons. And at a certain date, a sum equal to the bond’s face value is paid back to the investor.

This type of asset is considered to be a low-risk investment. But in fact, much depends on the issuer of security itself. Really reliable bonds are the ones issued by a federal government or the largest companies.

Investing in bonds with a low credit rating involves high risks. There is a possibility that the issuer would go bankrupt and will not be able to fulfill its obligations. Nonetheless, unreliable issuers borrow money at high interest rates.

In addition to the risk level, bonds differ in terms of maturity. For investing in the long-term, the appropriate type of bond is the one with long-term duration (5, 10, or more years).

But when purchasing this kind of securities, one should evaluate the probability of an increase in interest rates. If this happens, the investor who owns a long maturity bond will miss the opportunity to invest money at a more lucrative interest rate.

During periods when anticipating an increase in interest rates, it is prudent to favor short-term investments in bonds with a short maturity period, or to choose securities with protection against inflation (TIPS).

Bonds are usually included in retirement portfolios to reduce their overall volatility. Plus, in times of stock market crises, debt securities can have better returns than stocks.

3. Mutual Funds

One of the main objectives in long-term investing is proper diversification of the portfolio. It is common to combine several strategies:

● according to the types of investment tools;

● issuers;

● currencies;

● economic industries;

● countries.

This means that it would require a large capital (hundreds of thousands of dollars) to create a well-diversified set of assets. Such investments are beyond the means of the majority of private investors.

Mutual funds are the solution to this problem. They usually have an entry threshold of several thousand (or even several hundred) dollars. All investors’ capital is invested by the manager of such a fund in securities according to the initially provided fund’s strategy.

Through purchasing a share in such a fund, an investor acquires a stake in a well-diversified set of assets.

There are many such funds. They are classified by:

● the type of assets (stock funds, bond funds);

● management strategy (active or passive);

● the industries of economy to which the companies whose shares are included in the fund’s assets belong, etc.

The main disadvantage of long-term investment in mutual funds – is the management fee which reduces the overall profitability.

The advantage – is the possibility of ridding yourself of the necessity to look through the companies’ reports on your own in an effort to select the best one.

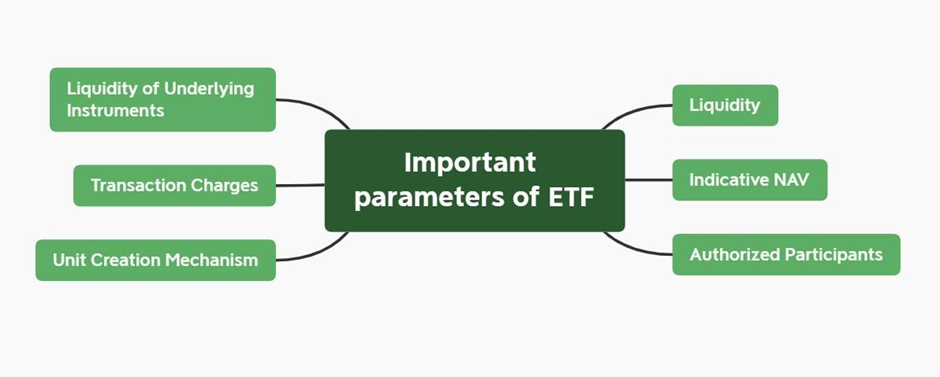

4. Exchange Traded Funds

Exchange-traded funds operate on the same principle as mutual funds. But their securities can be purchased on the stock market. This provides two key advantages:

● the investor acquires assets at a maximally fair price;

● the ETFs have no initial load and no redemption fee.

In 99% of cases, ETFs follow a passive strategy, i.e., they repeat one of the indices. This makes their management fee noticeably lower than that of mutual funds.

Nearly all ETFs available in the U.S. stock market regularly pay dividends to their holders. Like mutual funds, ETFs are divided into stock funds and bond funds. Also, their net assets may include gold, other precious metals, exchange-traded commodities and many other things. These funds are also the easiest and cheapest option for investing in foreign markets.

5. Target-Date Funds

Target-date funds are a type of collective long-term investments. They operate on the same principles as ETFs and mutual funds:

- The manager selects investment tools in accordance with the strategy set out in the fund’s documents.

- By investing in such a fund, the investor receives a share in a diversified set of assets.

- Management expenses are covered by a commission, which is deducted from the net asset value, reducing the final return.

The key difference of a target-date fund lies in its net asset structure. ETFs and mutual funds in most cases use only one type of investment tools, for example, growth stocks or bonds.

A target-date fund manager, on the other hand, uses several asset classes at once. At the beginning of the fund operation, priority is placed on investments with higher risk. The closer the return date, the larger the share of bonds and other reliable assets becomes.

Applying to such a fund completely relieves investors of the need to think independently about rebalancing the investment portfolio and updating the strategy.

An important disadvantage is that such funds offer one-size-fits-all programs that do not match risk tolerance of an individual investor.

6. Real Estate

Real estate remains a popular tool for long-term investing due to a number of advantages:

- Low volatility of value. This asset is suitable for people with minimal risk tolerance.

- Possession of an asset with “physical value”. Stocks are just figures on an investor’s account, which turn to zeros if the company that issued them goes bankrupt. It is more difficult to lose investment in real estate.

- The possibility to avoid investing personal cash by using the bank’s money instead. Brokers also offer the possibility to buy stocks on credit. Yet such a strategy is not suitable for long-term investments.

Real estate objects yield profit in two ways:

● they can be rented out and bring in a regular passive income;

● over the years, the price of an apartment/house/commercial space is likely to rise significantly.

But direct investments in real estate hold a variety of downsides. The main ones are:

● low profitability compared to growth stocks and other risky investments;

● expenses for utilities, repairs, plus property taxes;

● risk of physical destruction of the property;

● high cost and, as a consequence, unaffordability to many investors.

7. Real Estate Investment Trusts

To earn on real estate and avoid the drawbacks related to direct investments in this class of assets helps a form of collective investment funds – REITs.

A company that manages a REIT makes money on investments in real estate. The operations involving it must generate at least 75% of the income. It can be the rental of residential and commercial premises, warehouses, hospital buildings, timberlands, etc. Another type of REIT buys mortgages from banks and earns interest income.

A REIT can be either a publicly traded company or a private fund. Stocks of many such issuers are publicly listed just like ETFs. But there are also those that are not publicly listed.

When incorporating REITs into long-term investing strategy, one needs to take into account particular characteristics of this asset:

- According to U.S. Law, a REIT has to distribute at least 90% of its profits to shareholders. This means its dividend yield is noticeably higher than that of value stocks.

- REIT stock prices barely increase over the years due to the fact that the number of assets they own is not getting bigger.

- This type of investment can be viewed as protection against inflation, as with the growth of rents received by the funds, their dividends will rise as well.

An important disadvantage of REITs lies in the fact that their stock prices fall heavily in times of crisis. And with the tendency moving to online funds which specialize in commercial real estate (as well as retail and office spaces), REITs may lose their appeal in terms of long-term investments.

8. Tax-Sheltered Retirement Savings Plans

A retirement plan by itself is not an investment tool. It is a way to rationalize your tax burden compared to a standard investment account, not designed for long-term investments.

There are eight types of retirement plans. The most popular ones are 401(k) and IRAs. They allow money to be deposited into an account before income tax is deducted. As a result, the taxable amount gets lower. After retirement, however, a person has to pay taxes on the earnings withdrawn.

The most popular alternative is the Roth IRA. This retirement plan does not reduce tax burden in the present. But it does exempt from tax the profits earned during the years of investing.

In case of using a pension plan ahead of time (because of arised necessity to spend the invested money early), the investor will face penalties.

9. Life Insurance

Some types of life insurance policies have an investment side. This type of asset also provides tax benefits.

In addition, the holder of such a policy can pledge it to take loans (for example, to buy real estate or pay for education). In this way, he does not completely lose access to the money allocated for long-term investments.

Also, there are so-called accelerated benefits (also known as “living benefits”). For example, it allows you to get part of insurance coverage during your lifetime in order to pay for medical expenses, etc.

But in general, life insurance is thought to be beneficial only to people with high incomes. Many investors can find cheaper instruments for obtaining tax benefits.

10. Annuities

Annuities are suitable for an investment strategy which involves a large number of low-risk securities.

Many types of annuities give a fixed interest income. At the same time, their value does not fall, which means that the investor is guaranteed not to lose the invested money.

The downside of annuities, which sharply reduces their popularity – high commissions and low yield profitability.

This instrument cannot be considered as an adequate substitute for dividend stocks. It can be used by people who want to live on passive income right now (for example, when they are already retired). But it is poorly suited for capital appreciation over the long term.

11. Alternative Assets

Alternative assets comprise precious metals, oil, grain, gas and many other exchange-traded commodities.

For passive earnings on this kind of instrument within the frames of long-term investment strategies, it is common to use exchange-traded funds. Sure, gold and silver can be purchased in the form of physical bars or coins. But this kind of purchase is not available to all newcomers, besides, their storage requires additional expenses.

Alternative investments are regarded as a way of protection against inflation, since commodities’ values rise together with the world’s prices.

12. Cryptocurrencies

Cryptocurrency is a new investment instrument with extremely high volatility. For example, in 2022-2023 the price of Bitcoin alone dropped three-fold in less than 12 months.

Therefore, this class of assets can be used for long-term investments only by people with a high level of risk tolerance. It takes a certain mindset not to start selling “coins” at such a slump in an attempt to save at least part of the investments.

Even bearing in mind the horizon of 30-40 years, it is dangerous to invest all money in cryptocurrencies. They should constitute an insignificant part of the portfolio, capable of increasing profitability greatly in case of success.

Tips for Long-Term Investors

When building a long-term investment strategy, the following tips may be helpful.

1. Determine Your Time Horizon

Identifying the time horizon is the first step in building an investment strategy. Although both investments with the goal of saving for retirement within 30-40 years and achieving a less global goal in 5-10 years are equally called ‘long-term investments’, using the same investment decisions for each of them wouldn’t be a good idea.

A clear knowledge of the time horizon helps to determine the level of risk tolerance on which the portfolio diversification strategy is founded.

2. Be Attentive to Risks

Investing involves risk. Neither a well-diversified portfolio, nor consulting the best financial advisors provide 100% protection against drawdowns.

Therefore, an investor must maintain a proportion of high-risk and low-risk assets. The closer the target date for reaching a financial goal, the higher the proportion of low-risk assets should be; such as high-yield savings accounts or bonds with a maturity date that coincides with the target date for returning the invested funds.

In addition, the investor should have an emergency fund that would allow him not to sell investment assets/not to withdraw money from the retirement account in case of a job loss, health problems, etc.

Apart from investment horizon and psychological resilience, the advisability of using high-risk assets is influenced by the amount of investor’s capital.

A person with a few spare millions can put some of the funds into small-cap stocks or even into venture capital funds, participate in IEOs and use other alternative investments.

A person with a modest capital has to choose more secure assets, such as dividend stocks, large-cap stocks, etc. The reason for this is that with small incomes it is much more challenging to lay up for a decent retirement. Losing even part of the investments will have a negative impact on a person’s financial future.

In that case, it may be more prudent to increase returns by avoiding any unnecessary commissions for advisory or brokerage services. Say, invest in individual bonds rather than bond funds, and use online brokers that do not charge transaction fees.

3. Do Not Forget to Diversify

The main goal of creating a diversified portfolio is to find a balance between risk and return that is acceptable to the investor.

There are two ways to diversify investments – in asset classes and within the same class of assets.

In the first case, an investor adds to his portfolio different types of securities (growth stocks, value stocks, bonds), gold, real estate, etc.

In the second, he buys many assets of the same type, i. e., shares of companies whose businesses span different economic industries, focus on different countries, etc.

Usually these two options are combined in a long-term investing strategy.

But purchasing a diversified set of individual stocks and bonds may not be affordable to an investor due to the lack of capital. Moreover, this approach requires a lot of time for asset selection and rebalancing. Investments in stock funds and bond funds can help to solve this problem.

4. Follow the “Buy and Hold” Approach

The stock market is constantly shifting up and down. That is why an investor might want to urgently add some fast-growing stocks to his portfolio or to get rid of the falling securities. But such fussy actions only lead to depreciation of the deposit.

For a person who is not ready to devote all his time to the quotes’ analysis, active trading is unlikely to be a way of making money. Besides, it is associated with expenses on commissions and taxes.

As statistics show, long-term investments with a correct strategy on a long time horizon are profitable in most cases. While more than a half of traders end up with complete loss of the deposit.

5. Pay Attention to Commissions

Diversification of the portfolio by means of funds entails additional expenses related with the commission charged by the management company. These expenditures are stated in fund sheets as a percentage of the net asset value per year.

The amount of commission depends on a number of factors:

- Strategy. Actively managed funds have higher costs than index funds.

- The type of net assets. A bond fund will have lower commission than a fund investing in exchange-traded commodities.

- Size. Large companies typically charge lower commission than small companies.

When it comes to mutual funds or the purchase of an annuity, there may be additional costs incurred such as initial load and redemption fees.

When investing in individual stocks and bonds, a person also faces the expenses associated with brokerage services, depository of securities, etc.

A separate item of expenditure are the services of financial advisors, used by many novice investors.

The estimates tell us that a commission expense of 0.5% of capital per year results in a loss of nearly 20% of investment income over a 45-year horizon. (The calculations are based on an average annual return of 5%).

At the same time, an expert who gives investment advice does not guarantee that the expressed opinion will result in a profit for the investor.

6. Do Not Forget to Rebalance

The value of different assets changes at different rates. Therefore, the initial proportions of the portfolio change quickly. For instance, an investor has invested 60% of his money in stocks and 40% in bonds. A year later he may find that stocks make up 70% of his capital and bonds only 30%. This means that his investment risk has become higher.

Rebalancing means bringing proportions of the portfolio to the initially chosen values. It can be done in two ways:

● sell some stocks and buy bonds;

● top up the account and use the money mainly to buy bonds.

An essential component of a long-term investor’s strategy is a clear answer to the question of how often rebalancing should take place. Some would do it once a quarter/year, some would do it when a certain level of deviation from a given stocks and bonds ratio is reached.

Is the Current Moment Suitable to Buy Stocks for Long-Term Investments?

According to statistical analysis of the S&P 500 index changes, the best results are obtained by investors who invest money immediately when it becomes available, rather than waiting for the “perfect” moment.

But past performance is not a guarantee that this will also be true in the future. In any case, the strategy of constant averaging is the easiest one for novice investors.

Why Is Investing in the Long-Term a Good Idea?

Long-term investing is a good idea because it allows you to ignore short-term ups and downs of the quotes. An investor spends much less time than a trader who makes dozens of trades each day. Thanks to this, this method of investment is accessible not to professionals only.

In addition, when following a long-term strategy, chances of making profit become much higher. According to theory, the market is steadily growing on a decades’ horizon. This is true not for individual stocks, but for indices, primarily for the S&P 500.

Conclusion

Although long-term investing is believed to be the best way to save up money, some people fail and quickly leave the stock market. The reason for this is often a misjudgment of one’s own psychology, unreadiness to tolerate short-term drawdowns, while using a strategy that is too risky.

Therefore, the first steps of a novice investor should be aimed at preserving capital and low-risk assets, rather than chasing a multiplication of the deposit.

You Might Also Like

- What Is a Dividend Recap? Understanding This Financial Strategy

- Best MLP ETF: Understanding Dividend Stocks and How to Invest in Them

- What Is a Dividend Yield? Understanding This Key Investment Metric