The 401k retirement plan is one of the best ways to take care of your old age. Most people in the US do not have a traditional pension, which is widespread in some other countries. Creating equity is therefore a must for almost everyone. This can be done through investment. Most often mutual funds, ETFs or individual stocks are used for this purpose.

It is useful not only to learn about the properties of the different asset classes, but also to learn about some of the features of the 401k that will maximize the profits of this programme.

Table of Contents

Types of 401 (k) Investments

There are several varieties of the standard 401k retirement plan. Depending on which one is offered by the employer, various combinations of 4 asset classes may be available to create retirement savings.

High-risk instruments, such as investment options, are not usually used to preserve retirement savings.

Mutual funds

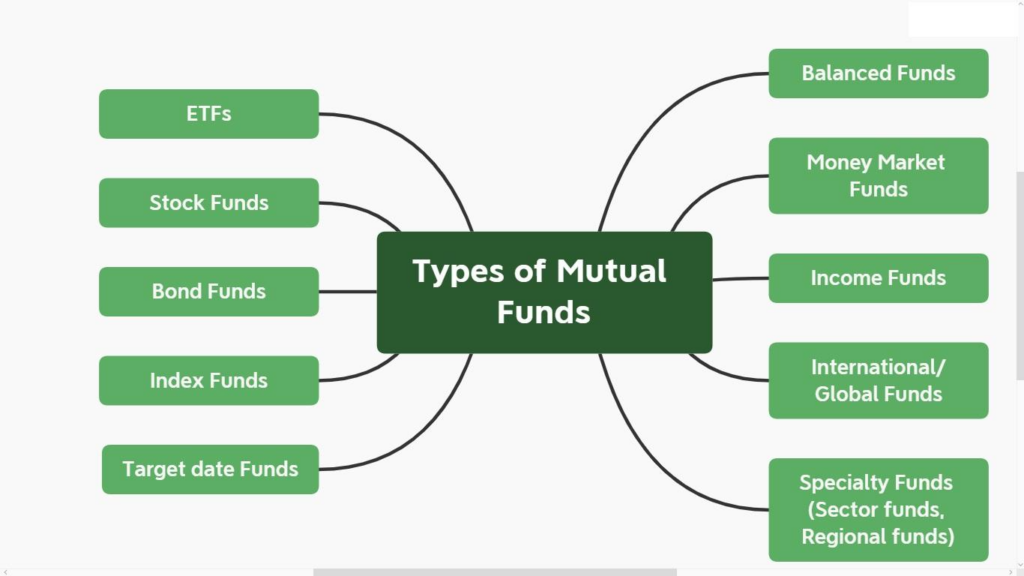

By becoming a mutual fund shareholder, an investor receives a stake in a well-balanced set of securities managed by an experienced manager. Such associations may adhere to various investment strategies.

All types of mutual funds have several disadvantages:

- management fee, which is charged regardless of the financial result and can greatly reduce the final profitability;

- inefficiency in terms of tax optimization;

- possible misuse by managers;

- commissions on the purchase and sale of fund securities.

However, investing in a mutual fund does not guarantee that an investor will not lose money.

For a retirement account, target date funds are considered most appropriate. Their essence is that the manager must return investors’ money within a precisely defined timeframe.

At the beginning of the capital accumulation period, predominantly risk involved investment instruments are added to the fund’s net assets. The closer the return date is, the higher the share of assets with guaranteed returns.

In fact, investing in a target date fund is the most convenient way to invest passively.

Another type of mutual fund, usually available for investment on the retirement plan, is balanced funds. Their set of net assets consists of stocks and bonds. Their ratio is maintained in predetermined proportions, e.g. 70% and 30%.

Employer’s shares

Many of the publicly traded companies allow their employees to purchase their shares in a 401k account. Moreover, employers sometimes push their employees to do so in every way possible.

For instance, 2 incentives are popular:

- opportunity to buy shares cheaper than the market value;

- increase in the contribution to the employee’s retirement account, subject to the purchase of the employer’s shares.

Sometimes an alternative is used. Employees are invited to buy not the company’s shares themselves, but the securities of a fund that invests only in this issuer.

Although there are advantages to investing in your employer’s shares, you should never forget the rules of diversification and invest in only one asset.

Individual securities

A certain type of 401k plan gives the right to buy shares of individual companies and exchange traded funds (ETFs), as well as bonds.

Thanks to this, a person gets the opportunity to independently build an investment strategy to achieve their financial goals. It also allows you to save on mutual fund fees. But such a decision does involve extra time spent studying market data and business news.

Variable annuities

The 401k account may also allow hybrid products from insurance companies. Like mutual fund stocks, this asset class may have additional purchase fees.

In addition, in case of early sale, a fine is withheld. However, this type of asset does not have the advantages of fixed annuities – the security of the amount originally invested and a clearly predictable return. This is offset by a higher potential profit.

Can I Invest My 401k in Stocks

In order for a 401k account to be able to buy shares in individual companies and index funds, the employer must offer a 401k brokerage window programme.

It is an option to a 401k plan that allows a person to trade in it under the same rules as a regular brokerage account. Only minor restrictions remain, such as no access to margin borrowing and derivatives.

With this approach, the investor:

- retains the tax breaks that a 401k plan provides;

- can choose the most optimal strategy for the risk tolerance;

- saves on mutual fund fees.

With a 401k brokerage window, the investor does not pay tax on securities gains in the year in which they are received. All the payments to the tax office are postponed until retirement and the withdrawal of the money from the account.

It is also important to bear in mind the additional costs – broker’s fees, transaction fees, etc.

What to Consider Before 401(k) Investing

Before you start buying assets in your retirement account, you need to determine how the money will be spread over them.

Several criteria are taken into account:

- risk tolerance;

- investor’s age, which determines the investment horizon;

- desired profit.

Any investment involves risk. The lower one’s willingness to see a loss in a brokerage account, the more tools there must be to guarantee a full return on the investment. But the higher the risk of an asset, the higher its potential return.

Your Age

Many certified financial planners advise calculating the percentage of capital that should fall on risky assets according to the formula 100 minus the age of the investor. But increasingly there are recommendations to raise the permanent ratio to 120.

On this basis, it is recommended that a person who is 30 years old should keep 70% of their capital in shares. After 30 years, shares must no longer hold more than 40% of the capital. With an aggressive strategy, these figures increase to 90% (120-30) and 60% respectively.

Total amount

The distribution of assets is also affected by how much an investor wants to see in the account at the time of retirement.

There are 2 ways to determine what amount should be considered as a retirement goal.

The easiest way is to multiply the current annual income by 12. That is, a person who receives $50 thousand a year should have at least 600 thousand in the retirement fund by the time of career completion.

The other way is that the retired person’s monthly income should be 80% of his or her former salary.

Calculations can be simplified with the help of calculators from companies offering professional retirement capital management.

Other sources of income should also be taken into account when calculating. Certified financial advisors recommend not limiting yourself to a 401k plan.

When forecasting your future capital, it is recommended to use a conservative assumption of an average annual return of 5-6%.

How Much Should I Invest in 401(k)?

Most 401k plans imply that an employee must contribute at least 3% of his salary to a future retirement. The most popular recommendation is to save 10% of current income for retirement.

But in the case of a 401k, it is advisable to additionally take account of the employer’s matching contributions. The most common rule is that the company transfers to the retirement fund a certain percentage of the amount transferred by the employee, but above a certain threshold. For example, 50 cents for every dollar, but no more than $ 10 thousand per year.

For maximum benefit, it is advisable to transfer the amount that will allow for the employer’s maximum contribution.

Another factor to keep in mind is tax breaks. The amount credited to the 401k reduces the base on which federal income tax is calculated. But there is a limitation here. In 2023, it amounts to $22,500 for young taxpayers. People over the age of 50 can contribute another $7,500 over.

Therefore, it is impractical to transfer all free money to a 401k plan. If a person is determined to save more than the amount required to meet the employer’s maximum contribution, it makes sense to consider an alternative in the form of an Individual Retirement Account (IRA).

A traditional (IRA), like a traditional 401k, makes it possible to receive a tax deduction from the amount deposited. With a Roth IRA, investors pay taxes on the money they deposit in their account, and money withdrawal can already be made tax-free.

How To Invest Your 401k

In a 401k plan with a brokerage window option, investments are available in selected company stocks, bonds and ETFs.

A person who decides to manage his/her retirement plan independently without consulting a financial adviser should learn the principles of compiling a diversified portfolio.

Market risk can be reduced by allocating funds by:

- shares of companies from different sectors of the economy;

- types of assets (stocks, bonds, etc.);

- investment instruments linked to different currencies.

The easiest way to create a diversified portfolio is to buy several index funds. These may include:

- funds for SP500;

- funds for small-cap companies;

- international funds, bond funds and those that make money from commodities.

ETFs have several advantages over mutual funds. For example, lower management fees and no buying or selling commissions.

When choosing investment options, it is useful to take into account your other assets. For example, a person keeps a significant amount in a high-yield savings account. In this case, it is worth considering the idea of investing 401k more money in the stock market to the detriment of bonds.

Strategies to Maximize Your 401(k)

Here are 10 tips you can use to maximize the benefits of your 401k.

Don’t Accept the Default Savings Rate

When a person joins a new employer’s retirement plan, 3% is deducted by default towards their future retirement benefits. But it is advisable to revise this figure according to your own situation.

Financial advisors recommend that young professionals who started at 3% increase contributions by 1% annually until they reach 20% and maintain this figure.

Get a 401(k) Match

As mentioned above, employers are willing to credit their employees’ 401k plans with a percentage of their contributions.

The easiest way to increase the amount in your retirement account is to use the possibility of replenishment by the employer to the maximum.

Stay Until You Are Vested

If an employee has worked in the company for less than the prescribed period, then upon dismissal, he may be required to return all or at least part of the employer’s contributions credited to the 401k. The result could be several hundred thousand dollars.

In order not to face such a problem, it is usually required to work in the company for at least 5-6 years. This should be taken into account when planning a change of employer.

Maximize Your Tax Break

As already mentioned, up to a certain threshold, funds deposited into a 401k account are tax free.

In addition to this, low-income workers can receive a depositor’s tax credit. To do so, their annual remuneration in 2023 must not exceed $36,500 for a single person or $73,000 for a married couple in which both spouses have an income.

Diversify With a Roth 401(k)

This is a type of retirement program that is also sponsored by the employer. The difference is that the employee deposits the money after paying taxes. Withdrawals are tax free.

This type of retirement account is subject to the same annual top-up limits as a traditional 401k.

It is believed that it is more expedient to choose investments in this type of retirement plan for people who pay taxes at a low rate due to low incomes, but expect to improve their financial situation in the future.

Don’t Cash Out Early

You can withdraw money from a 401k before retirement. But if a person under 59.5 years of age does so, they must pay a 10% penalty.

In addition, premature closing of a 401k does not allow you to earn at the expense of compound interest.

Rollover Without Fees

When you change employers, it is possible to make a match with your previous employer to transfer the money to the new 401k account directly. This will help save on fees.

Minimize Fees

Often, the investment options available on a 401k are limited to mutual funds with high fees. The investor’s task is to choose the ones that will:

- match his risk tolerance as much as possible;

- have the lowest possible fee.

The federal government and the Department of Labour require brokerage firms that administer 401k plans to provide their clients with full information about the fees of each of the mutual funds offered.

If the returns on eligible investment assets in the retirement plan are low and the fees are excessive, employees can ask their employer to review the 401k’s terms and conditions.

Diversify Your Assets

To avoid losing money credited to your retirement account, you should create a well-diversified portfolio in it and rebalance it regularly.

It is a mistake to accumulate all funds in 1-2 mutual funds or shares in an employing company.

However, do not rush to the other extreme and change your investment strategy because of the news. This will only lead to loss of money due to emotions and unnecessary transaction fees.

Remember Required Minimum Distributions

After 72 years, a person is obliged to withdraw an amount of at least the established threshold from his retirement account annually. If he fails to do so, he receives a hefty fine.

So you need to make sure that the investment strategy you choose will allow you to withdraw money in cash at the right time.

Potential Risks in 401(k) Investments

There are 3 key factors that can make a 401k’s financial results unsatisfactory:

- excessive conservatism;

- excessive costs;

- investment losses.

In an effort to minimize the risk of losing money, a person may choose the most conservative strategy possible and invest mainly in bonds.

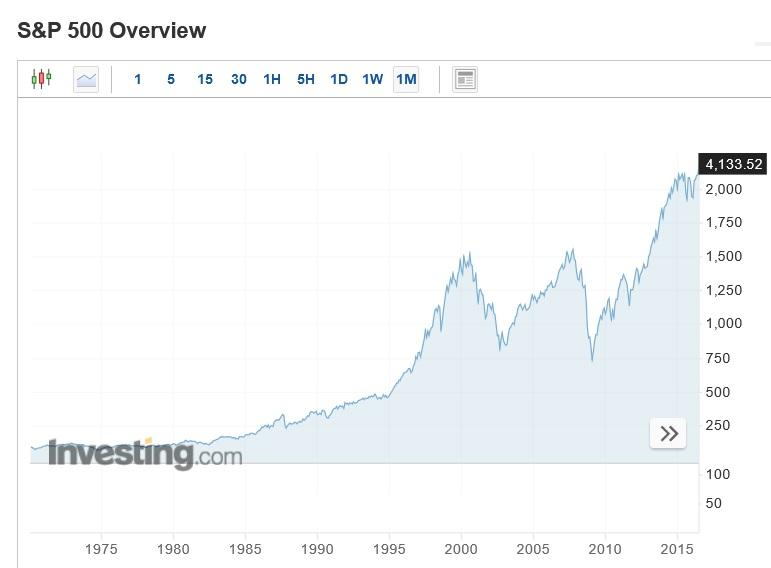

But on the horizon of decades, such an approach is highly likely not to even overtake inflation. Statistics show that investing in the broad stock market yields much higher returns over the long term than debt securities.

And while past performance is no guarantee of future returns, there is no reason to believe that an overly conservative strategy will become more effective.

Excessive investment costs as a result of choosing mutual funds with high management fees are another trap when saving for retirement. A difference of a few tenths of a percent seems small at the moment. But at the end of 30-50 years, it will reduce the final yield by tens of percent.

Therefore, index funds with a management fee of no more than 0.5% are considered the best solutions.

Investment losses are the most obvious risk. The market price of stocks and even bonds can fall. Moreover, the issuing company may become bankrupt. No matter how carefully one selects assets, it cannot be guaranteed that this will not happen.

The best way to reduce the risk of a total capital loss is to diversify. By investing in a broad market, different countries and different types of assets, one will be able to ensure that drawdowns in some positions are compensated for by growth in others.

FAQ

What is the best strategy for 401k?

In a 401k, an investor is limited in terms of the choice of assets available. If the employer does not allow a brokerage window option, there are often only a few mutual funds available to a person.

Since every company has different restrictions, it is not possible to name one best strategy. But in any case, an investor should aim for maximum diversification and keep management fee costs as low as possible.

What is the best investment allocation for 401k?

There is no universal asset allocation that every investor needs to support. The proportions between government bonds, relatively safe stocks of dividend nobility and high-risk assets should be chosen according to each investor’s individual situation.

The first thing to consider when allocating capital to asset types is risk tolerance. But the older one is, the higher the proportion of investment instruments with low volatility should be.

Is 401k a good investment strategy?

An employer retirement plan is definitely a great strategy, especially for someone who has only recently become interested in the subject of personal finance.

With a 401k, as with an individual retirement account, you can save on taxes. And extra employer contributions, not available in an IRA, significantly improve the bottom line.

How much of my 401k should I invest?

It is most beneficial to put exactly the amount you need into your 401k each year in order to receive the maximum employer contribution possible.

If a retirement plan is well set up in terms of the selection of assets available, including mutual funds that give high returns with low fees, it will be advisable to deposit the maximum amount that can have tax free withdrawals by this means. Every year this figure increases.

But the current financial situation must also be taken into account. It is not a good idea to supplement your retirement account to the detriment of your current needs.

How much should I invest in a 401k by age?

There are 2 points of view on this issue. Many people believe that as a person gets older, they deal with key financial issues, start earning more and are able to build up their contribution to their retirement fund.

But some experts remind us of the magic of compound interest. With it, the amount contributed to a 401k at age 22-25 will give a much more noticeable result than the money a person puts aside at age 45-50.

Conclusion

A 401k is a great way to save for retirement. Its main advantage is the employer’s participation in the replenishment of the account. The disadvantage may be the limited number of assets available for investment. But even then, an optimal strategy can be found.

You need to start investing to create retirement capital as early as possible. Due to the compound interest, even a moderately risky strategy will bring good profits over the years.

You Might Also Like

- What Is a Dividend Recap? Understanding This Financial Strategy

- Best MLP ETF: Understanding Dividend Stocks and How to Invest in Them

- What Is a Dividend Yield? Understanding This Key Investment Metric