There is a popular misconception that investing for beginners with little money is useless. Another mistake is to think of yourself as an investor and buy high-risk assets with high interest debts and without having built up a safety cushion.

With the right approach, investing can produce results that will significantly improve your financial situation relative to your starting point. This article tells you what factors need to be taken into account and what mistakes to avoid. We will also give a list of tools and strategies suitable for beginners.

Table of Contents

First, Invest in Yourself

Investing in yourself is one of the most frequent recommendations given to ambitious young people. Creating serious capital with a small amount of money will also have to start with this step.

If the goal is to improve your personal financial situation through the stock market, investing in yourself should be understood as the following steps:

- Be patient (there is no path that is guaranteed to lead to success in a day/week or even a year);

- Develop financial discipline and stick to it in both good and bad times;

- Learn a systematic approach, create your own investing strategy;

- Learn the laws of the stock market and delve deeply into the business of each company you are considering buying.

Passive investment in an index fund is also a great option and can yield significant returns over the decades. But to replicate the achievements of Buffett and other famous investors of years past, you need a deep dive into the subject.

How to Start Investing Your Money: Develop Your Investing Approach

The following steps are intended to help a beginner with no financial education create his or her own strategy, taking into account his or her expectations, investment horizon and risk tolerance.

Read a Lot About the Stock Market

Many beginners buy a stock just because someone tells them it is a good investment. At its best, it is investment advice from a financial advisor. At its worst, it is the misguided opinion of an amateur.

To be successful in creating a portfolio, it is a good idea to do your own research:

- books on the fundamentals of investing;

- articles on reputable investment portals that help you understand the market situation;

- company reports and news.

Start Looking into Individual Companies

It is not quick to research the situation of more than 500 companies in the SP500 index. A popular recommendation for the beginner is to choose five economic sectors and one attractive company in each of them.

Gradually, the beginner will be able to catch the attention of all the major issuers and understand:

- what makes some companies different from others;

- the outlook for the market in which the chosen issuers operate;

- assessment of the current business situation by the stock market.

It is generally accepted that on an investment horizon of decades, the entry point into a position is not crucial. But this is true for a broad market, such as buying an exchange traded fund on the SP500 or creating a diversified portfolio.

In the case of individual stocks, buying at the value peak may result in losing money if it turns out that the pace of business development has not met investors’ expectations.

Beginners are advised to consider sustainable profitability as a key factor in valuing stocks. Lacking experience, it is difficult to find among the many loss-making start-ups one that will eventually reach world-class levels. It is therefore helpful to focus on the big players.

How to Find Individual Companies Worth Buying

It takes a lot of time to research each company’s prospects on your own. That is why today’s financial industry offers investors a variety of services that help them make quick choices about the best issuers.

One example is the BeatMarket Score subscription. It is a system for ranking companies based on a multitude of parameters. Past performance statistics demonstrate that issuers with a score of more than 90 deliver higher returns than those with a score of 60 or less.

With BeatMarket Score, both the beginner and the experienced investor are able to:

- choose interesting trades from the world’s best trading ideas;

- quickly find and add promising stocks to your investment portfolio;

- monitor the rating of previously selected issuers and promptly get rid of underperforming positions.

The stock scanner allows you to pick securities according to the criteria an investor is interested in. For example, dividend yields, multiples, etc. This makes it possible to obtain information on all SP500 companies and many foreign companies at the same time.

What are the Best Investment Strategies for Beginners

There are many investment strategies that have yielded excellent results for their authors. But there is no one-size-fits-all strategy that will fit every financial situation.

There are several factors that everyone should consider when creating their own strategy.

1. Understand Your Goals and Risk Tolerance Before Doing Anything

Investment can be used to achieve various financial goals. But it is primarily suitable for long-term objectives (e.g. buying a house, creating retirement capital, etc.).

Depending on the objective, the time frame for achieving it is determined, and this influences which stock market instruments an investor should use:

- In the case of short-term investments, high-yield savings accounts and treasuries make the most sense.

- On a medium-term investment horizon, stocks of dividend aristocrats and other companies that have already taken over the market come to the fore.

- Investments in growth stocks are considered the most useful for starting to build up retirement capital. These are the ones that can deliver the highest returns. But these securities are the most volatile on the stock market.

One should take into account not only the investment horizon, but also one’s risk tolerance. If an investor is psychologically unprepared to see a drawdown in the account, inclined not to stick to the original strategy but to sell assets that have slumped, then risky instruments are not recommended.

2. There’s No Such Thing as the Best Investment for Everyone

You can invest with little money not only in securities, but also in real estate, cryptocurrency, etc. That said, there is no one-size-fits-all solution. Some people concentrate on one type of asset, others use all available ones.

The latter option seems preferable, as it ensures maximum portfolio diversification.

3. You Have to Build up to Different Investments

No person can follow one investment strategy all his or her life. They change with the passage of time and changing financial objectives.

While an investor should be steadfast in following the original plan, it is equally important to regularly assess whether the strategy being used is appropriate to the current situation.

4. You Have to be Patient as an Investor

Many people lose money in the stock market because they want to make quick gains. Intraday trading and short-term strategies can bring big profits over a short period of time.

But statistics show that few traders manage to consistently get good financial results year after year. Over decades, the diversified portfolio of the passive investor has proven to be more profitable on average.

What is Diversification?

Diversification is the allocation of funds between different assets in order to reduce the risk of losing money. Thanks to modern financial solutions, even a beginner with little capital can create a well diversified portfolio.

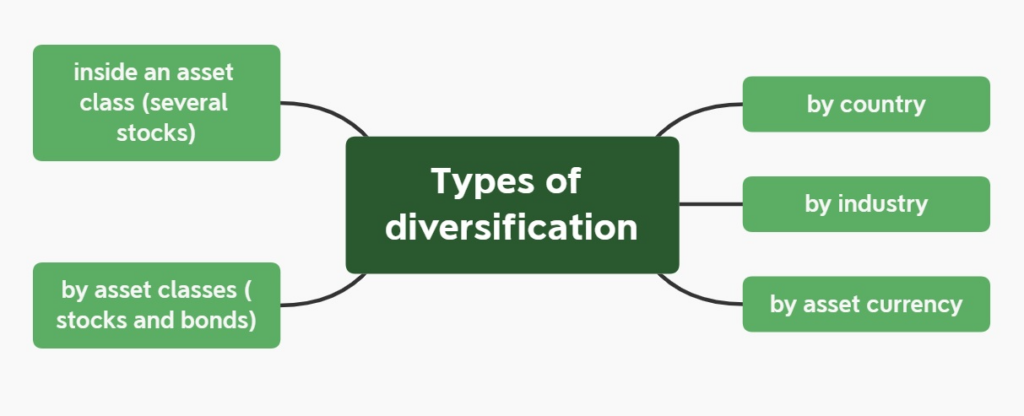

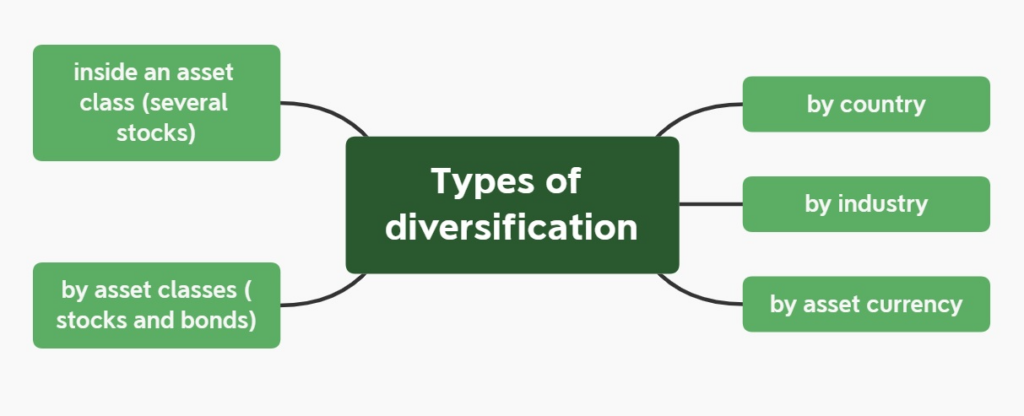

Diversification can be carried out both within a single asset class and across different asset types. By picking instruments with different levels of volatility and, ideally, with negative price correlations, an investor can ensure an ideal risk/return ratio for the portfolio as a whole from his point of view.

As an example, if a person has invested in one company’s stocks and they have halved in value, that person will lose half of his capital. If a person bought 10 companies, it is likely that only 1-2 of them will have problems and the rest will perform positively. This ensures that a drop in one issuer’s price will not cause significant damage to the portfolio.

Step-by-step guide on investing for beginners with little money

The most common mistake made by beginners is thinking that investing with little money is impossible. In fact, anyone with a couple of tens of dollars can buy their first securities.

Therefore, anyone with any income should consider an investment strategy. All experts believe that the best place to start on the way to your long-term financial goal is now. Starting investing early is the only right thing to do. Below are 17 ideas that may be useful to people with little money.

Real Estate Crowdfunding

Traditionally, it is thought that it takes substantial sums of money to invest money in real estate. But with modern solutions, investing in real square meters is becoming affordable even for people with low incomes. The minimum amount at which you can start earning in this way is just $500.

By participating in real estate crowdfunding, one becomes the owner of a small share in some room. This enables him or her to earn a steady, passive income by renting out the property. If the property is sold, the value of the property is divided among all owners in proportion to their initial contribution.

Crowdfunding can be done through specialized platforms:

- CrowdStreet;

- EquityMultiple;

- PeerStreet;

- RealtyMogul.

The advantage of this method of earning money is that one does not have to spend time managing the property, finding tenants, etc. In addition, one can create a diversified portfolio of properties for different purposes. However, it should also be remembered that any investment involves risk.

High Yield Savings Accounts

The minimum investment amount for a high yield savings account is just $1. But to get the highest possible rate, large deposits may be required.

In spring 2023, the best offer for high yield savings accounts is 5.07% per annum. But a minimum of $1,000 must be invested. The best option available to people with small capital is 5% per annum.

A high yield savings account is the easiest answer to the question of how to start investing with little money. This financial instrument allows money to grow slowly but steadily. It is ideal for people with a minimal risk tolerance, as well as for storing a “safety cushion” and money that is planned to be used in the coming year.

The main condition is not to keep more than $250,000 in one bank. This is the maximum amount covered by the FDIC.

Invest in Fractional Shares

More and more brokers are offering so-called fractional shares to their clients as an answer to the question of how to start investing in stocks with little money. Robinhood, Fidelity or Public.com offer such a service.

If a stock is worth more than $200, investors have the option of buying only a “fraction” of it, such as 1/2 or 1/20. Usually the minimum investment amount is set at a few dollars ($10 or even $1 depending on the broker’s policy).

Fractional investing allows beginners with little money to create a diversified portfolio and even include high value assets.

The disadvantages of this method of investing in equities:

- difficulties in transferring to another broker;

- complications with voting at shareholders’ meetings;

- potential additional commissions;

- transactions not being executed in real time;

- challenges in completing tax returns.

Each broker draws up his or her own list of companies and exchange traded funds whose stocks can be bought in shares. This should be taken into account when choosing a trading intermediary.

Robo Advisors

Most people prefer not to spend all their free time studying the stock market, but rather invest their money using the advice of an expert. But the services of a professional financial advisor are expensive.

For a person with little money, it may not be advisable to contact an expert. In addition, there are minimum investment requirements. Some experts will not work with a client who is not prepared to invest more than a certain amount.

The problem can be solved by using computer programmes called robo advisors. Relying on the basic information specified by the investor, they draw up a recommended asset allocation which a person only has to copy.

There are many such programmes to help you start investing with little money. They range from those charging a small annual subscription fee to those that are completely free. Examples are Betterment, M1 Finance and others. Many brokers also provide clients with their own programmes.

The minimum amount at which it makes sense to start a robo advisor is $100.

Get A Free Stock From Webull

Some brokers give away free stocks to attract clients for opening an account or performing other simple actions. These securities can be a beginner’s first asset and the answer to the question of how to start investing with no money.

Certificates Of Deposit (CDs)

This option of depositing money in a bank generates a higher income than savings accounts. But if a person wants to take the money out before the due date, he or she will lose the interest income and have to pay a penalty.

The minimum amount for which a certificate of deposit can be purchased depends on the bank. This tool is one of the best answers to the question of how to start investing with $500. Higher thresholds are rare.

Invest With the Stash App

Apps like these are designed to help beginners develop the habit of saving money and make it easier to build a diversified portfolio when investing with little money.

Apps for beginners in the stock market:

- allows buying assets online on the basis of personal advice;

- support automatic reinvestment;

- allow setting up automatic deposits from your bank account, etc.

Examples of applications suitable for micro investing are Stash, Plynk, Fidelity® Youth Account, etc.

Ally Invest: For Banking and Investing

Ally Bank is one of the market leaders in the US for savings accounts. The company also offers the Ally Invest app, aimed at investors with little money.

The main advantages are that there are no minimum deposit requirements, rich market research and the opportunity to test trading ideas before investing money in a real account.

Peer to Peer Lending

One innovative way of generating passive income is through P2P lending on online platforms. Such activity generates noticeably more income than buying debt from the government or major companies.

But P2P lending are riskier investments than those listed above. They come with much greater risks of defaulting on the loans. You can get familiar with this type of investment on platforms such as Prosper and Lending Club.

To start earning from peer-to-peer lending, it is advisable to have a minimum of $1000.

U.S. Treasury Securities

This type of investing with little money is suitable for people who are looking for reliable ideas. The main disadvantage is the low yield compared to the potential returns that other securities can generate.

To invest in bonds, you must have a minimum of $100. Such investments yield regular coupon payments. Also, an investor can make money on the increase in the value of bonds if interest rates go down.

Government bonds have maturities that range from 30 days to 30 years, depending on the bond issue. The investor can sell them at any time without losing the coupon income.

Employer-Sponsored Retirement Plan

An Employer-Sponsored Retirement Plan is in most cases the best investment decision for a beginner with little money who wants to build up a retirement portfolio. There are several reasons for this:

- part of the salary paid into a classic 401(k) account is exempt from tax;

- the employer, in turn, tops up the employee’s account with a similar amount (within a certain limit);

- contributions are made by the employer, no effort is required by the investor to fund the account.

With a 401(k), you can start investing with a small amount of money. For example, it is sufficient to contribute 1% of your salary for the first year, then increase your contributions over time.

The disadvantage may come from the limitations of the employer’s chosen plan in terms of the investment instruments available. Some 401(k) plans only allow you to work with mutual funds.

Gold and Other Precious Metals

It is a rather risky investment given that precious metals do not pay dividends and there are long periods when their prices do not rise.

Buying gold is usually considered a way to diversify portfolio and protect against inflation. Investments in physical metals, in the form of bars and coins, are virtually inaccessible to people who are starting their investing with little money. A great solution for them would be gold ETFs.

Stock Options

By purchasing an option, a person does not become the owner of a stock. Instead, he or she gets the right to buy or sell it at a certain price in the future. For this, they must pay a so-called premium. This cannot be paid back, even if the investor decides not to exercise the acquired right.

Options, along with futures, are said to be tools for experienced traders. They are not suitable for someone who wants to invest money for a long term. But the free leverage they have built in allows a person who is well-versed in the subject to multiply their capital quickly.

Target-Date Mutual Funds

This investment instrument is designed for people who pursue a maximally passive long-term strategy. By purchasing a target-date mutual fund, a person gets a stake in a well-diversified set of assets. As the target date approaches, the fund manager changes strategy, shifting the portfolio towards more reliable instruments.

The minimum amount at which it makes sense to start such funds is $1,000. A disadvantage compared to index funds is the higher management fees.

Try the Cookie Jar Approach

This is a strategy for those who do not have any savings. Its purpose is to create a habit of saving and build up a financial cushion in case of an emergency.

The essence of it comes down to spending a little less than you have been spending up to this point. For example, putting aside $10 a week. It is suggested that you put it away in a box or biscuit jar until you have enough money left over for the person to realize the effectiveness of the approach. But then the savings will lose their purchasing power.

That’s why it’s better to start depositing into your savings account right away, separate from your debit card account. This denies a person instant access to money and protects them from impulsive spending. Plus, the investor gets interest to at least partially cover inflation.

Open IRA as Well

Not everyone has a retirement plan from their employer. An alternative to it is to decide on investing money in your own retirement account. The advantages of this solution are greater freedom in terms of the choice of assets.

Tax benefits are still available. Putting money into an IRA allows you to reduce your current tax base. And with a Roth IRA, you don’t have to pay taxes on the earnings.

But any retirement plan is only suitable for building capital that a person plans to use after age 59.5.

Put Your Money in Low-Initial-Investment Mutual Funds

Mutual funds are associated with high entry thresholds, initial exposure and high management fees. But in the US financial market, there are plenty of options aimed at people with little money.

There are mutual funds that do not have a minimum investment threshold and do not charge initial fees. ETFs are also suitable to start investing with little money.

The entry threshold, in the case of an ETF, is equal to the value of one stock. Another advantage is that the fiscal burden with respect to capital gains taxes is optimized.

The advantage of mutual funds is that they allow you to set up automatic investments.

Active vs. Passive Investing (and Which One’s Right for You)

There are 2 fundamentally different approaches to trading. They are the passive strategy and the active one. The first involves a person choosing assets that suit their investment objectives and time horizon, buying and holding them for years.

Passive investors make transactions once a month or even once a quarter in order to increase the size of the portfolio and average the value of the positions. Some are even limited to rebalancing once a year.

Active investing is a constant search for stocks whose price changes can help you make a quick profit. It may be intraday trading or holding a position for several days/weeks.

Passive investors focus on fundamentals – multiples dynamics, pace of company development, etc. Active traders work with technical and wave analysis tools.

The advantage of passive investing in the broad market is that it does not require much time and in-depth knowledge. In addition, the risk of losing much money in active trading, especially with leverage, is much higher.

Statistics prove that while passive investing does not yield dizzying results over a short time horizon, it is much more effective than trading over a long time horizon.

When Should I Start Investing in the Stock Market?

Step 1: Investing in Stocks is Long-Term; Focus First on Today’s Needs

Starting to invest with little money and as early as possible is the most popular advice. But you shouldn’t forget about:

- closing consumer debts with high interest rates and credit card debts;

- establishing an emergency fund;

- housing and other basic needs.

Before one starts investing (buying stocks and other risky instruments), one must make sure that one does not have to sell them during a fall in order to pay the bills. To do this, one should create a financial safety cushion equal to at least 6 months’ expenses.

It may also be more efficient to pay off a high interest rate debt ahead of time than to invest in low-yielding assets.

Step 2: Invest Early, Invest Often (and Diversify)

Once debts have been paid off and an emergency fund has been set up, you should not put off investing for too long. Another financial tip is to go beyond the popular recommendation to save 10% of your income and use as much free money as possible.

The investment procedure should look as follows:

- 401(k) or another employer’s programme;

- IRA;

- taxable brokerage account.

Step 3: Rinse and Repeat (and Repeat

Micro investing is good for the initial steps, but you should not limit yourself to doing so. You need to continually transfer part of your income to your investment account, building up the amounts you save. This is the only approach that will bring results leading to a decent retirement and financial independence.

Where Should I Keep Money Outside of the Stock Market for Short-Term Needs?

The best option for keeping funds that you plan to use in the near future is a high-yield savings account insured under the FDIC.

It not only secures capital but also generates passive income.

Is it worth it to invest in such small increments?

Many people think there is no point in saving small amounts of money. But the truth is that even a small amount of money saved will have a noticeable effect over a considerable period of time.

For example, if you save $10 every week for 30 years, you can make a profit of:

- $15,600 if you just keep it in the biscuit jar;

- $26,245 if held in a deposit with a 3% interest rate;

- $67,162 if you invest and get an average annual return of 8% at the end of 30 years (this figure approximates the average annual return of the SP500 over the last 20 years).

Certainly, the above amounts will not be enough for retirement. That is why it is a good idea not to limit yourself to $10, but to increase this figure as your financial situation improves.

Mistakes to Avoid when Investing with Little Money

There are a few mistakes to avoid in any financial situation:

- Trying to find a better entry point into the market and constantly waiting for a crisis in the hope of buying assets cheaper.

- Refusing to diversify.

- Getting carried away with pyramid schemes and HYIPs promising quick riches.

- Selling assets when stocks drop due to panic.

- Choosing investment instruments on the advice of unauthorised experts without understanding where you intend to invest your money.

Such actions can lead to the loss of most capital and the wrong belief that investing is similar to gambling in a casino. But the most important mistake one can make in the initial stage of capital formation is to avoid investing altogether.

By postponing the first step, one deprives oneself of the opportunity to take advantage of compound interest. By starting to invest early, one can get the most out of this mechanism.

Conclusion

Today’s financial industry provides many opportunities for someone with little capital to begin investing. Fractional stock-buying apps, $10-15 ETFs and index funds, and other tools can help build a diversified portfolio from almost any starting position.

The main goal for the beginner is to create his or her own strategy and stick to it. It is equally important to regularly replenish your investment account, even with a modest amount.

FAQ

how to start investing with 100 dollars

With this amount, you can open a high-yield savings account, buy ETFs and stocks of some companies. The best option for building a long-term portfolio is to put money into a 401(k) to get extra funds from your employer. But first, you need to make sure that all high interest credit cards are closed and student loans are paid off.

how to start investing with 1000 dollars

The principle will be the same as for an investor with $100. The advantages are a wider range of assets that can be used to create the most diversified portfolio possible.

Can I start investing with 5000

This amount is enough to create a balanced set of assets of different classes in any type of investment account. A financial advisor or robo advisor can help you create an optimal portfolio.

How should I start investing with 10000

The best option is still depositing into a 401(k) to maximize employer matching. Remaining funds can be deposited into an IRA or taxable brokerage account if you have medium-term financial goals.