How much money do I need to start investing depends on the chosen starting asset allocation. A few tens of dollars are enough to buy the first stock in an exchange traded fund or an individual company. But for such an action to be meaningful, it is important to choose the right broker and consider your financial goals and investment horizon.

Table of Contents

How can I invest a small amount?

Regardless of the amount, you need to open a brokerage account to start investing on the stock market. Many financial institutions provide brokerage services in the stock market. This may be a bank, a traditional independent brokerage company, an online-only broker, etc.

When choosing, you should pay attention to the minimum deposit requirement. This limit will be the answer to the question of how much money I should have to start investing. A person with little money should give preference to a broker who does not set high limits and allows them to start with a few dollars. Examples include Fidelity, TD Ameritrade, SoFi and others.

Other important criteria for choosing a broker:

- Transaction fees (many online brokers do not charge transaction fees when trading stocks);

- stock exchanges and the range of assets to which access is provided;

- opportunity to trade in fractional stocks.

Some companies’ stocks are valued in the hundreds or even thousands of dollars. Without fractional stock trading rights, an investor with little money will be limited in the number of assets available.

It is up to each broker to determine which securities will be available for fractional stock trading and what the minimum investment amount in a fractional stock should be. Among the largest brokers in the US, you can find companies that have set this threshold at $1.

If a broker that does not provide access to fractional stocks is chosen, the answer to the question of how much should I start investing with is $10-15. For this amount, one can already buy some ETFs and even individual stocks of several SP500 companies.

What is the right amount to invest?

A general rule of thumb is to put aside 10-15% of your income for the long term. There is no exact figure that is a one-size-fits-all answer. Each person decides for themselves how much do you need to start investing and how often to top up their account, based on their current situation. Before investing in the stock market, there are a few simple steps to take:

- Put your personal finances in order and pay off your current debts. Although you should start investing as early as possible, it is wise and more profitable for a beginner to pay off high-interest loans first.

- Set up an emergency fund in case of illness, job loss, etc. A popular recommendation is to save an amount that covers at least 6 months of expenses. But it’s up to each person to determine how much money should I have before I start investing.

- Put aside in high-yield savings accounts funds accumulated for financial goals that you plan to realize in the near future.

Long-term investments should only be made once the above-mentioned tasks have been completed. A monthly budget should also be drawn up. It should take into account all basic expenses so that a person does not have to sell their assets urgently in order to pay the bills.

The amount that remains over the budget should be allocated to investments every month. And the regularity of funding the brokerage account is more important than how much the person will save. Even $50 a month will yield positive results.

Getting started

There are a few universal steps that every beginner should follow in order to get the most out of an investment.

Start investing as early as possible

The best way to increase profit, even with a small amount of money, is to start investing as early as possible. There is what is known as compound interest.

This term means that the income earned by an investor starts to pay out on its own. As a result, the amount of money saved grows non-linearly. The earlier you start to build your capital, the stronger the compounding effect will be.

For example, if one invests $100 every month for 20 years, one will have over $46,000 in his/her account. And the income will be $22.6 thousand, and the equity will be $24,000 (the calculation is provided for an average annual return of 6%).

Under the same conditions, the total would reach $200,000 over 40 years.

Decide how much to invest

How much do I need to start investing and how much I need to deposit regularly depend on 3 factors:

- personal financial situation;

- investment horizon;

- investment goals.

If it is a 401(k) retirement plan, it is advisable to contribute at least the amount that will allow you to get the maximum employer match each year.

Define Your Tolerance for Risk

This factor determines how volatile assets an investor can use. The broad market is said to grow steadily over a long period of time.

But this does not change the fact that drawdowns occur in certain periods. An investment portfolio composed exclusively of high-risk securities can lose 50% or more.

If it is a passive “buy and hold” strategy without leverage, it is a paper loss. If an investor doesn’t sell the stock, they won’t lock it in and lose money. But many beginners cannot remain calm in such a situation and sell off assets in a panic.

It is therefore important for an investor to honestly answer himself what level of drawdown he is ready to see and build his portfolio keeping this factor in mind.

Decide on Your Investment Goals

The investment goal can be buying a car, real estate, building up retirement capital, etc.

Depending on the goal, the investment term is determined. The amount of money that needs to be regularly deposited in the account to achieve the objective is determined by this and the potential rate of return.

Determine Your Investing Style

There are two styles of investing – passive and active. In the former, an investor builds a diversified portfolio of securities that they hold for years. In the second, they buy and sell stocks all the time in the hope of maximizing profits.

A beginner who is not prepared to spend time on learning how to trade and constantly monitoring the market is better suited to the first style.

It is also necessary to decide whether a person will choose assets independently or needs prompting. In the latter case, one can turn to a certified financial planner. But the services of an expert are expensive, and using them with little money may not be advisable.

In this case, robo advisors come to the rescue. These are specialized programmes that select a set of assets based on the investor’s preferences.

Learn to Diversify and Reduce Risk

Portfolio diversification is the allocation of capital to different assets of the same type as well as to different asset classes.

The main objective of diversification is to reduce the impact of a single bad investment on the size of the portfolio. This can be achieved by creating a set of securities and other instruments with minimal correlation.

This can be done either independently or with the help of various funds.

Diversify within asset classes.

There are several asset classes that can be combined with each other. The following picture shows the main ones.

Within each asset class, a diversified portfolio can also be created. For example, equity investments can be divided into large-cap and small-cap companies. Investments in bonds can include both reliable government securities and higher-yielding (but less reliable) debt of smaller companies.

Diversify within sectors.

When building a stock portfolio, it is useful to choose issuers from different sectors. For example, combine popular bio and IT technologies with classic solutions (retail, telecoms, etc.).

The reason for this is that the economy develops cyclically, and at each phase one or the other sector takes precedence. Creating a diversified set of stocks helps to maintain the overall return of the portfolio regardless of the situation.

Open an investment account

There are many types of investment accounts. The type of account you use depends on your chosen goal. They can be combined if the financial situation allows it.

The main types of brokerage accounts:

- 401 (k), Roth 401 (k) and other equivalents offered by employers;

- IRA, Roth IRA – individual retirement accounts;

- standard brokerage account without tax advantages.

The first 2 types are suitable for building up capital to be used after age 59.5. The latter is for more immediate purposes. A traditional retirement account is credited with pre-tax dollars. In a Roth 401(k) and Roth IRA the investor is exempt from paying tax on capital gains.

If the employer of a beginning investor offers a retirement plan, it is wise to opt for it and transfer the remaining free money into an individual account. The reason for this is that under a 401(k) scheme, companies credit their employees’ accounts with amounts equal to their contribution (up to a set limit). This substantially increases profitability.

Pick an investment strategy

Investing strategy is determined by investment horizon and risk tolerance. The longer the time horizon to reach a financial goal, the more risky assets an investor can afford.

On an investment horizon of 20 years or more, it makes more sense to use growth stocks as the most profitable asset in the long term, capable of outperforming inflation by a wide margin.

If, on the other hand, a time horizon of 2-3 years is involved, the risk capacity is significantly reduced. In order not to jeopardize your financial goal, preference should be given to bonds and certificates of deposit. When investing in equities, especially growth companies, there is a risk of a drawdown in the value of assets by the time the investment is scheduled to expire.

how much money to start investing in different options

Investing involves risk. Every asset has its downside. It is important to understand how it works, how much risk is involved in investing in this instrument, and whether it suits the investor’s goals and financial capabilities.

To answer the question of how much money to begin investing in an asset, it is useful to study the theory of Markowitz and his followers about building a portfolio with an optimal risk/return ratio.

Stocks

By buying a stock, an investor gets a stake in the business and therefore shares all its risks. Depending on the company, the value of a stock can range from a few dollars, to a few thousand dollars.

Bonds

Bonds are debt obligations of the state or companies. Most issues:

- generate constant interest income (but there are also zero-coupon bonds);

- guarantee their holder a certain amount (the face value of the bond) at maturity.

It is a much less risky instrument than equities. It has lower quote volatility plus there is a fixed passive income. But there is still the risk of losing money altogether if the issuer goes bankrupt.

There are bonds with a face value of $100. But they are often sold in large lots of 100 pieces. An investor with little money may use an exchange traded bond fund. He or she can also buy US savings bonds through TreasuryDirect for any amount starting at $25.

Mutual funds

Mutual funds bring investors together and invest their capital within a defined strategy. By purchasing mutual fund securities, a person gets a stake in a diversified set of assets.

There are many types of mutual funds:

- actively managed and index funds;

- equity funds, money market funds and other asset types, as well as commingled funds;

- funds with target date of return, etc.

The minimum investment amount depends on the policy of the fund management company. It may be $3,000 or more. But there are many funds that are aimed at people with little money and do not set a lower investment threshold.

Exchange-traded funds

ETFs are a form of collective investment. Most of them, like mutual funds, are a diversified set of assets.

The difference between mutual funds comes down to the method of investment, the valuation of the stock, the amount of management fees, etc.

The minimum amount needed to buy an ETF is equal to the price of one stock. There are options available on US exchanges, ranging in price from $10 to several hundred dollars.

Is it really worth investing such a small amount?

Even little but regular effort can produce meaningful results, if we are talking about decades. Of course, you cannot become a millionaire by saving $5 a day. But this action, repeated over 40 years, will create a five-figure sum in an account.

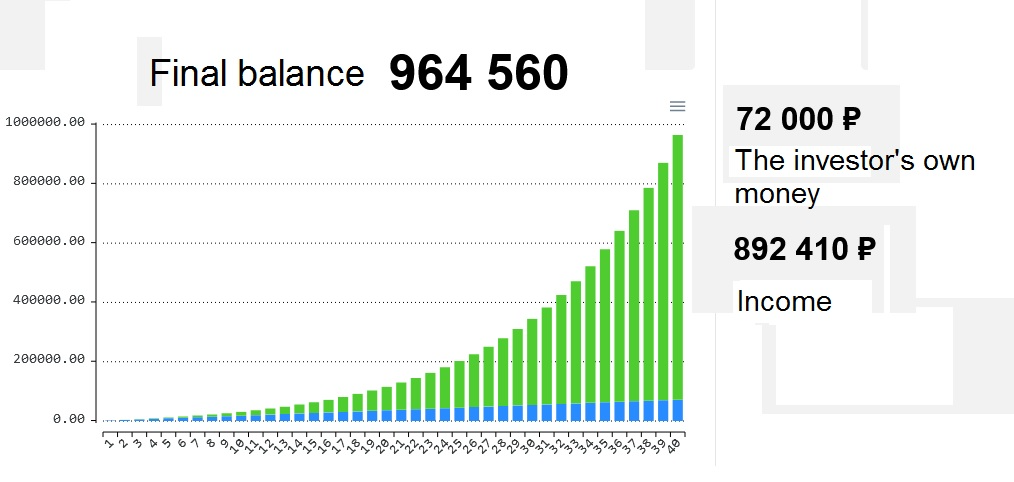

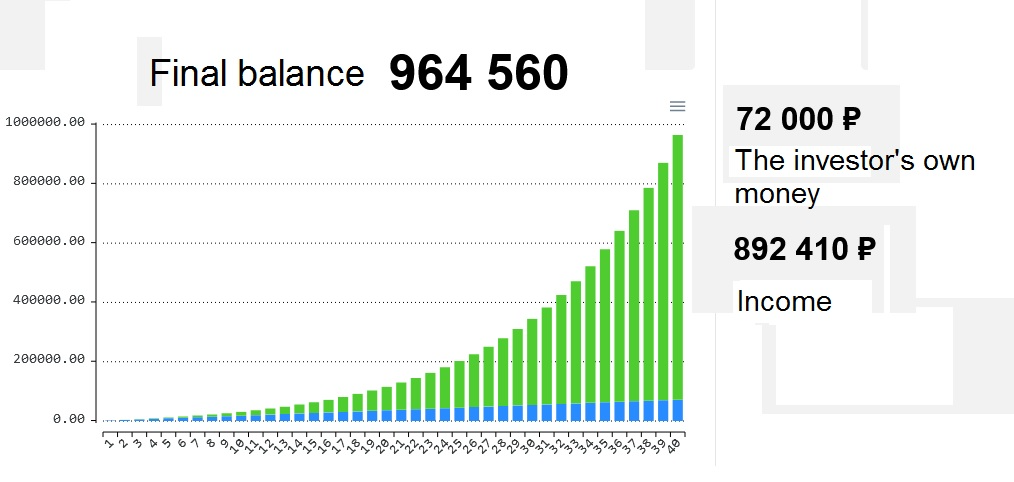

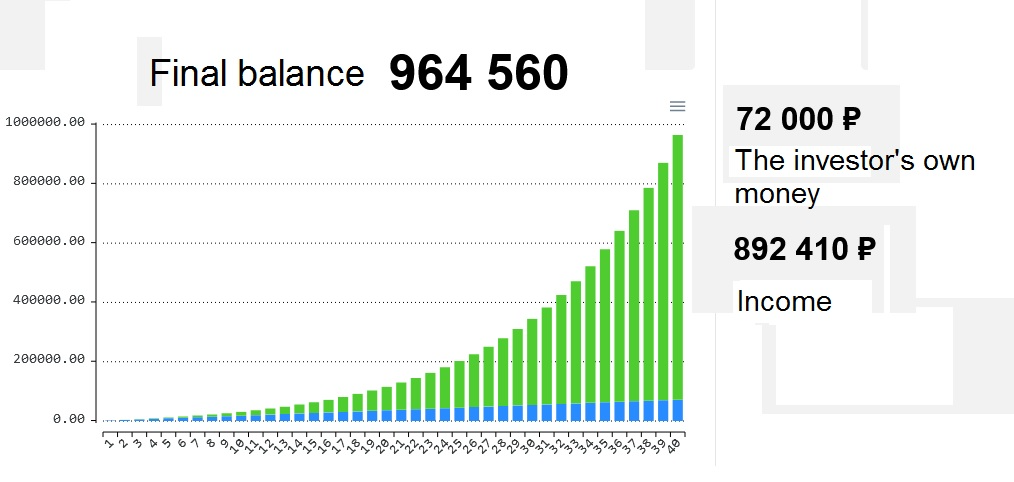

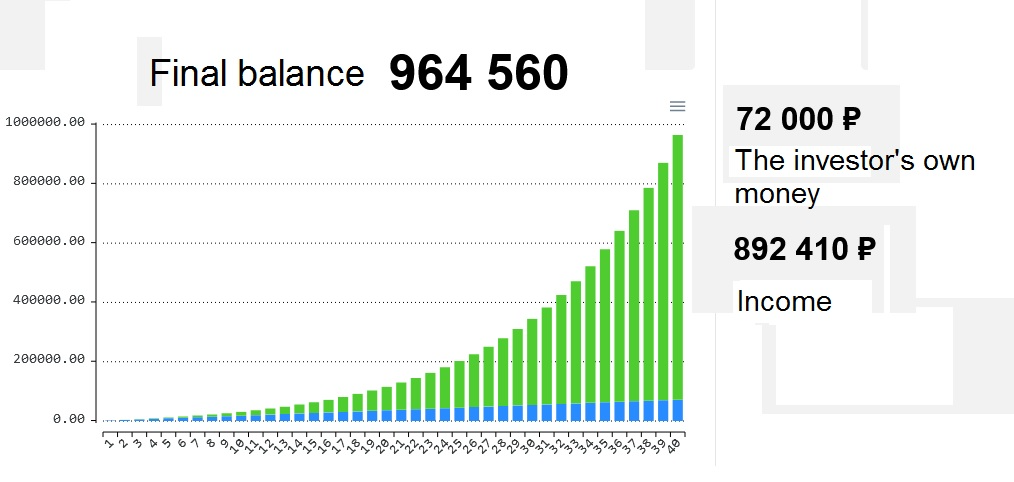

For example, at an average annual return of 6%, the investor will end up with $300,000. If you manage to get 10% a year on average, then investing just $150 every month, after 40 years you can see almost $964 thousand in your account.

What is dollar-cost averaging?

Cost averaging is a strategy in which an investor buys the same amount of assets at equal intervals. That is, s/he builds up his/her position both at times of price drawdown (buying more stocks for the same amount) and at local highs (albeit by buying fewer stocks during those periods).

What are the advantages of dollar-cost averaging?

Experts argue that this investment strategy yields greater returns than continually staying out of the stock market and waiting for it to fall to buy securities at the best possible value.

Statistics demonstrate that this statement is true even when compared to investors who have actually managed to avoid missing the bottom. Most beginners, on the other hand, are unlikely to be able to catch the best price moment in times of crisis.

In addition, the dollar-cost averaging strategy:

- allows you to start investing as early as possible, without having to wait for a large sum to emerge;

- eliminates doubts about choosing the ideal entry point into the market;

- saves time on constant monitoring of the situation, because the investor knows exactly when to buy an asset;

- simplifies the investment process from a psychological point of view, especially in times of crisis.

Many retirement plans and mutual funds allow you to set up automatic crediting of part of your income into an investment account. It is also advisable to increase the amounts you save as your financial situation improves.

What else can I do to maximize how much I invest?

Another common recommendation of financial advisors, aimed at maximizing the result of long-term investing, is to direct all unexpected cash proceeds into one’s investment account (bonuses, birthday cash, etc.).

By doing so, one increases the size of the investment and therefore the bottom line. In this case, it is not advisable to strive for averaging and split a large amount into several investments.

Statistics show that the best financial results in the past have come from people who have invested money in the broad market as it becomes available, rather than accumulating funds in a bank account waiting for the best time.

It is important for an investor with little money not only to strive to maximize the amount deposited into a brokerage account, but also to improve returns. For example, you can improve your financial results by optimizing capital gains taxes, using tax-advantaged accounts, etc.

Another smart move is to avoid mutual funds with high management fees and initial exposure.

Conclusion

The financial industry is offering more and more opportunities every year for people with little money to start investing. Even $100 is enough to buy stocks in a few ETFs or mutual fund securities and get a well-diversified portfolio of assets. Even with such a modest amount, as long as you fund your account regularly, you can get a decent return.

Many brokers allow you to start investing with a few dollars and do not charge transaction fees. Numerous expert robots will help beginners to find the right asset allocation for free or for a minimal subscription fee.

It’s important to have patience for the long haul before investing. High returns are promised only by assets involving a high risk of total loss of invested capital, which is unacceptable at low returns.

FAQ

Can I start investing with $100?

Yes. That’s enough money to create an account in micro investment apps. And with ETFs and a fractional stock system, it’s enough to create a balanced portfolio.

Is $500 enough to start investing?

Yes. With this amount, you can both buy stocks in some mutual funds and create a diversified set of exchange-traded assets on your own.

Have $100 a month to invest?

Saving $100 a month will not fully cover your retirement. But that doesn’t mean you have to give up investing altogether. Even such small savings can significantly improve your financial situation over the decades.

Is investing $50 a week good?

Investing $50 a week is far better than not investing at all. Over 30 years, the total investment will amount to $78,000. And the resulting return will be more than the equity already at an average annual rate of return of 5%. This figure is considered realistic even with a conservative strategy.

Is $5 000 enough to start investing?

Yes. This amount is enough to join any mutual fund or to build up a securities portfolio on your own.

How do I start investing in the poor?

For someone with a minimum income, the best solution is to close all high-interest credits. The interest saved on this can be considered risk-free income. If this task is accomplished and an emergency fund has been accumulated, you can start building a portfolio of securities by using micro investment apps.

Is it hard to start investing?

The hardest thing for someone with a small income is to overcome the psychological barrier, the fear of losing money, and begin to understand the subject of investing. It is equally difficult to break the habit of spending your entire salary. From a technical point of view, it is easy enough to buy your first securities. There are many ways to do it online.